|

市場調查報告書

商品編碼

1406121

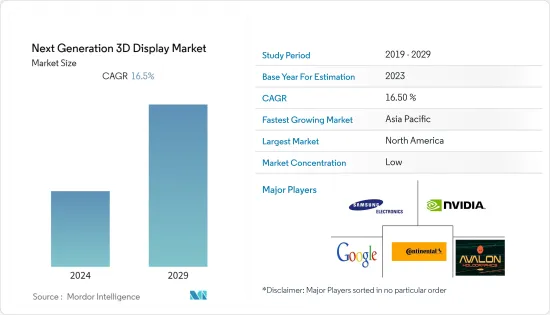

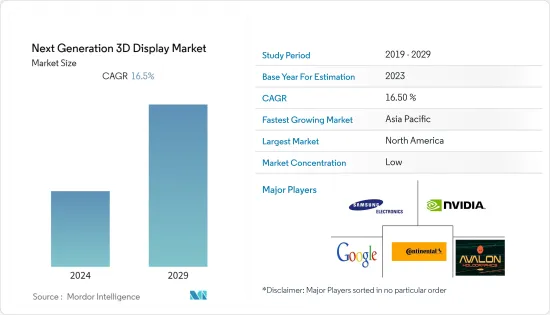

下一代 3D 顯示 -市場佔有率分析、行業趨勢/統計、2024 年至 2029 年成長預測Next Generation 3D Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

下一代3D顯示器市場上年度估值為982.2億美元,預計未來五年將以16.5%的複合年成長率成長至5,722.5億美元。

此外,三星電子、英偉達和微軟等大多數公司專注於開發多用戶顯示器,特別是採用屈光光學方法,也推動了市場成長。

主要亮點

- 面板製造的持續開拓、8K 電視的推出以及對視覺舒適度的日益重視是推動市場成長的一些因素。全球智慧電視的使用量不斷增加正在推動市場成長。根據 Ofcom 的數據,去年 67% 的英國家庭擁有智慧型電視。

- 一些公司已經將裸眼 3D 技術融入其產品中,以獲得市場競爭優勢。例如,2023 年 3 月,中國科技公司中興發布了最新創新產品 Nubia pad 3D,可提供裸眼 3D 視覺效果。這款平板電腦配備 12.4 吋 LCD 螢幕,原始解析度為 2560x1600px,刷新率為 120Hz,長寬比為 16:10。此外,宏碁、華碩等品牌已經發表了配備裸眼3D技術的筆記型電腦。

- 此外,作為工業自動化的一部分,5G 在工業中的日益普及也有助於連網型生態系統的發展,其中 3D 顯示智慧型手機和電腦發揮關鍵作用。根據HMS Networks預測,2021年工業自動化網路市場將成長6%,工廠熱切期盼5G無線。

- 電腦遊戲已成為千禧世代遊戲玩家的熱門選擇。這種變化主要是由於多種因素造成的,包括遊戲品質、高階軟體和硬體的可得性以及網路頻寬的改進。現在出現了更令人興奮和要求更高的新技術,例如 VR 和 3D 顯示器。因此,PC遊戲玩家預計會相應升級他們的設備,這是推動專用遊戲PC和遊戲螢幕等配件銷售的因素之一。

- 此外,3D顯示設備的高組裝成本也限制了市場的成長。由於這一步驟涉及新技術的生產和建設,因此對中小企業來說可能會造成經濟負擔。此外,對於低度開發國家的消費者來說,價格可能顯得昂貴,限制了市場擴張。

- 在新冠疫情第一階段,由於消費者對產品的支出延遲,對智慧型手機、電視和類似配套家電的需求下降,從而影響了3·19顯示器市場。同時,隨著網路培訓和在家工作的限制解除,對家用電器的需求成長。

下一代3D顯示市場趨勢

家電提供成長機會

- 隨著VR的積極發展,AR(擴增實境)也逐漸興起。與基於雙眼和光場顯示的VR/AR類比,預測基於全像顯示的VR/AR技術的未來,為消費電子產業的下一代3D顯示器創造成長機會。例如,2023 年 6 月,蘋果宣布推出首款混合實境頭戴裝置 Vision Pro。這款耳機主要定位為擴增實境設備,但您可以使用轉盤輕鬆在 AR 和 VR 之間切換。

- 由於技術不斷進步,下一代3D顯示市場的消費性電子領域預計將實現高速成長。

- 此外,由於擴大安裝在顯示器、電視、智慧型手機、數位相框和筆記型電腦等各種家用電器中,預計該市場在預測期內將穩定成長。消費性電子產品中的無玻璃 3D 顯示器允許觀看者調整影像的觀看深度,從而更好地控制自己的觀看體驗。

- 愛立信預計,到 2026 年,全球智慧型手機用戶量預計將達到 75.16 億支。因此,隨著高階智慧型手機變得越來越普及,智慧型手機製造商正在引入先進的智慧型手機功能,以區別於競爭對手,這有助於市場成長,並且在研究期間預計這一趨勢將持續下去。

- 此外,一些主要製造商正在專注於新產品開發,以滿足不斷成長的需求。例如,2023 年 4 月,Sony Corporation發布了一款新型 3D 顯示器 ELF-SR2。此顯示器顯示觀看者無需特殊眼鏡即可看到的立體影像。

亞太地區將實現市場最大成長

- 由於存在台灣等在家用電子電器領域取得長足進步的新興經濟體和國家,亞太地區對於全像顯示市場來說是一個非常有利的市場。台灣、中國、韓國。儘管印度市場正處於非常發展的階段,但在零售業支持的新興經濟體、廣告支出增加以及公共和私人基礎設施改善的推動下,對下一代顯示器的需求預計將在預測期內成長。 。

- 幾家領先公司正致力於為該地區帶來新技術和先進技術,進一步推動市場成長。例如,2022 年 4 月,印度行銷傳播集團 Laqshya Media Group 宣布將為印度 Tanishq 的 Season of Bloom 系列《Live a Dream》帶來身臨其境型3D 顯示器。該顯示器將安裝在孟買班德拉的 Bandstand Promenade。這個 3D 裝置是一個夢幻般的夢幻世界體驗,將優雅、複雜和藝術性的組合帶入生活。

- 此外,2023年5月,全球智慧型手機品牌摩托羅拉宣布將在印度發布一款配備3D曲面顯示器的新智慧型手機「Edge 40」。這款新型智慧型手機完美融合了最尖端科技、無可挑剔的設計和滿足不斷變化的消費者需求的軟體體驗。每家公司的這些推出預計將支持市場成長。

- 此外,由於消費性電子產品製造能力不斷擴大,對鄰近東南亞國家的出口增加,以及各種顯示技術(如4K、LCD、LED、和OLED,預計將在中南部地區成長。

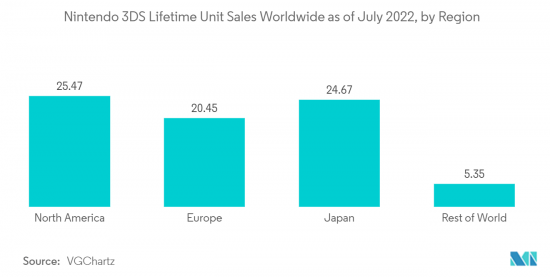

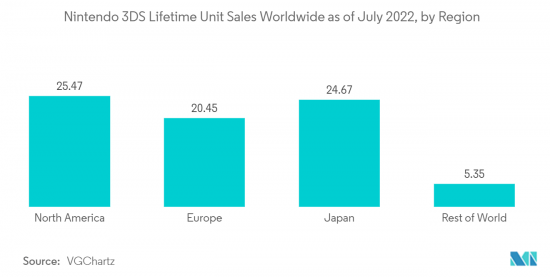

- 該地區比其他地區更具競爭力,因為任天堂等大多數主要供應商都位於該地區。

下一代3D顯示產業概況

由於大量公司的存在,下一代 3D 顯示市場高度分散。主要企業專注於技術進步,採取了收購、聯盟、合資等多種策略。

- 2023 年 2 月 - 大陸集團宣布將透過 5K 自然 3D 顯示器擴展其 3D 顯示器解決方案產品組合,這是一種可實現3D沉浸式用戶體驗的創新顯示解決方案。此顯示器採用矩陣背光,配備 3,000 個 LED,可提供具有高對比度的卓越影像質量,同時還有助於節省功耗並提高可讀性。

- 2023 年 1 月 - 三星電子宣布推出全新 Neo QLED、MICRO LED 和三星 OLED 系列,以及生活風格產品和配件。三星的 3D 地圖視圖讓消費者能夠一目了然地看到家中和 SmartThings 裝置中的所有內容。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 汽車和家電市場的擴大成長

- 數位相框和頭戴式顯示器的採用率增加

- 市場抑制因素

- 缺乏3D內容的開發

- 昂貴的 3D 顯示器

- 評估 COVID-19 對產業的影響

第6章市場區隔

- 產品

- 3D全像顯示

- 頭戴式顯示器 (HMD)

- 靜態音量顯示

- 立體

- 掃頻音量顯示

- 音量顯示

- 科技

- 數位光處理背投電視(DLP RPTV)

- 發光二極體(LED)

- 有機發光二極體二極體(OLED)

- 等離子顯示面板 (PDP)

- 液晶顯示器(LCD)

- 存取方式

- 微顯示

- 傳統/基於螢幕的顯示

- 最終用戶產業

- 消費性電子產品

- 汽車/交通

- 醫療保健

- 航太/國防

- 產業

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Avalon Holographics Inc.

- Avegant Corp.

- Robert Bosch GmbH

- Continental AG

- Fovi 3D

- Samsung Electronics

- Nvidia

- Coretronic Corporation

- Creal 3D

- SHARP Corporation

- LG Electronics

- AU Optronics Corp.

- Panasonic Corporation

第8章投資分析

第9章 市場機會及未來趨勢

The next-generation 3D display market was valued at 98.22 billion in the previous year and is expected to grow at a CAGR of 16.5 % during the forecast period to become USD 572.25 billion by the next five years. The emphasis on developing multi-user displays and, in particular, using the refractive optics approach by the majority of companies, such as Samsung Electronics, Nvidia, Microsoft, etc., is also boosting the growth of the market.

Key Highlights

- The continuous development in panel manufacturing, the introduction of 8K television, and the increasing emphasis on visual comfort are some of the factors driving the growth of the market. The increase in smart TV use throughout the globe drives market growth. According to Ofcom, in the last year, 67% of homes in the UK owned a Smart TV.

- For the purpose of gaining an competitive advantage on the market, some companies have already incorporated glassless 3D into their products. For instance, in March 2023, ZTE, a China-based tech company, announced introducing of its latest innovation, the Nubia pad 3D, which offers glass-free 3D visuals. This tablet features a 12.4-inch LCD screen with a native resolution of 2560x1600px with a 120Hz refresh rate and 16:10 aspect ratio. Furthermore, brands like Acer and Asus have already announced laptops with glass-less 3D technology.

- Moreover, the growth in the 5G deployment in industries as part of industrial automation also contributes to developing a connected ecosystem where 3D-displayed smartphones and computers play a vital role. According to HMS Networks, the industrial automation networking market grew by 6% in 2021, with wireless waiting for 5G in factories.

- PC gaming has become a favorite choice among millennial gaming enthusiasts. This shift is primarily due to multiple factors, such as the quality of gameplay, availability of high-end software and hardware, and improved internet bandwidth. Newer exciting, and demanding technology, such as VR and 3D displays, are available today. As a result, PC gamers are expected to upgrade their equipment accordingly, which is also one of the reasons for helping to drive the sales of gaming-specific PCs and accessories such as gaming screens.

- Moreover, the high cost of assembling 3D display devices is restraining the market growth. The procedure entails the production and construction of novel technologies, which could prove to be financially burdensome for smaller enterprises. Moreover, the pricing may appear expensive for consumers in less developed countries, constraining the expansion of the market.

- Demand for smartphones, televisions and similar ancillary consumer electronics declined during the first phase of COVID as a consequence of consumers' delays in spending on products which had affected the 3 19 display market. Demand for consumer electronics products, on the other hand, had grown following the lifting of restrictions as a result of Internet training and working from home.

Next Generation 3D Display Market Trends

Consumer Electronics to Provide Growth Opportunities

- With the vigorous development of VR, augmented reality (AR) is also gradually emerging. The future of VR/AR technology based on holographic display is predicted by analogy with the VR/AR based on binocular vision display and light field display, thus creating growth opportunities for next-generation 3D display in the consumer electronics industry. For instance, in June 2023, Apple Inc. announced the introduction of its first-ever mixed-reality headset, ' Vision Pro.' The headset is primarily positioned as an Augmented Reality device but switches between AR and VR effortlessly using a dial.

- The consumer electronics segment in the next-generation 3D display market will witness high growth due to rising technological advancement, and the industry stands to gain significantly if glassless 3D technology gains wider acceptance.

- In addition, the market will grow steadily over the forecast period due to an increasing uptake of these screens in various consumer electronic devices such as monitors, TVs, smartphones, digital photo frames and notebook computers. The glassless 3D display in consumer electronics allows viewers to adjust the image's viewing depth, giving them greater control over their viewing experience.

- According to Ericsson, worldwide smartphone subscription is expected to reach 7,516.0 million units by 2026. Thus, the increasing adoption of high-end smartphones has led smartphone manufacturers to introduce advanced smartphone features to stay ahead of the competitors, which in turn has contributed to the market growth and is expected to do so over the study period.

- Furthermore, several leading manufacturers are focusing on developing new products to meet the growing demand. For instance, in April 2023, Sony Corporation announced to introduce new 3D display, the ELF-SR2, which displays a stereoscopic image where viewers can see without needing special glasses.

Asia Pacific to Witness Largest Growth in The Market

- Asia Pacific presents a very lucrative market for the holographic display market owing to the presence of developing economies as well as Countries like Taiwan have made great strides in the area of consumer electronics. Taiwan, China, , and South Korea. While the market in India is at a very nascent stage, however with a developing economy buoyed by a retail sector, increasing advertising expenditures, and improving public and private infrastructure in India, the demand for next-generation displays is expected to grow over the forecast period.

- Several leading players are focusing on bringing new and advanced technologies to the region, further supporting the market growth. For instance, in April 2022, Laqshya Media Group, a marketing communication group in India, announced to bring the immersive 3D display to India for Tanishq's season of bloom collection, Live a Dream. The display is installed at Bandstand Promenade, Bandra, in Mumbai. This 3D installation is a senatorial experience of fantastical realm of dreams and brings to life the elegance, complexity, and artistry of the assortment.

- Moreover, in May 2023, Motorola, a global smartphone brand, announced to launch of a new smartphone, "Edge 40," with a 3D curved display in India. The new smartphone is the perfect blend of cutting-edge technology, impeccable design, and software experiences that cater to the ever-evolving demands of consumers. Such introduction by the players will support the market growth.

- Further, the expansion of consumer electronics manufacturing capacities, The adoption of holographic displays is projected to grow especially in China's South Central Region due to the increasing exports into neighbouring Southeast Asian countries and lower average selling prices for various display technologies such as 4K, LCD, LED or OLED. among the different 3D display devices in the region.

- The easy availability of 3D gaming hardware and software in the region will boost the growth opportunities for next-generation 3D displays, as most of the prime vendors like Nintendo are based in the region, providing the region with a competitive edge over others.

Next Generation 3D Display Industry Overview

The next generation 3D display market is highly fragmented because of the presence of large number of players in the market. The major market players are focusing on technological advancements and the players are adopting different strategies namely acquisitions, partnerships, joint ventures, by which only top players are gaining the market share.

- February 2023- Continental AG announced to expand its 3D display solutions portfolio with 5K natural 3D display, an innovative display solution for a three-dimensional and immersive user experience. The display is illuminated through a matrix backlight with 3,000 LEDs, which results in excellent picture quality with high contrast, further helping to save power and improve readability.

- January 2023- Samsung Electronics announced to introduce its new Neo QLED, MICRO LED, and Samsung OLED lineups alongside lifestyle products and accessories. It features a 3D map view, designed for users to conveniently control and monitor connected devices; Samsung's 3D Map View provides users a bird's eye view of consumers' homes and all of their SmartThings devices at-a-glance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Growth of Automotive and Consumer Electronics Market

- 5.1.2 Rising Adoption of Digital Photo Frames and Head-mount Displays

- 5.2 Market Restraints

- 5.2.1 Lack of 3D Content Development

- 5.2.2 Cost-Intensive 3D Displays

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 Product

- 6.1.1 3D Holographic Display

- 6.1.2 Head Mounted Displays (HMD)

- 6.1.3 Static Volume Displays

- 6.1.4 Stereoscopy

- 6.1.5 Swept Volume Displays

- 6.1.6 Volumetric Displays

- 6.2 Technology

- 6.2.1 Digital Light Processing Rear-Projection Television (DLP RPTV)

- 6.2.2 Light Emitting Diode (LED)

- 6.2.3 Organic Light Emitting Diode (OLED)

- 6.2.4 Plasma Display Panel (PDP)

- 6.2.5 Liquid Crystal Display (LCD)

- 6.3 Access Method

- 6.3.1 Micro Display

- 6.3.2 Conventional/Screen Based Display

- 6.4 End User Industry

- 6.4.1 Consumer Electronics

- 6.4.2 Automotive and Transportation

- 6.4.3 Medical

- 6.4.4 Aerospace & Defense

- 6.4.5 Industrial

- 6.4.6 Others

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avalon Holographics Inc.

- 7.1.2 Avegant Corp.

- 7.1.3 Robert Bosch GmbH

- 7.1.4 Continental AG

- 7.1.5 Fovi 3D

- 7.1.6 Samsung Electronics

- 7.1.7 Nvidia

- 7.1.8 Google

- 7.1.9 Coretronic Corporation

- 7.1.10 Creal 3D

- 7.1.11 SHARP Corporation

- 7.1.12 LG Electronics

- 7.1.13 AU Optronics Corp.

- 7.1.14 Panasonic Corporation