|

市場調查報告書

商品編碼

1273463

智能燈塔市場-增長、趨勢、COVID-19 影響和預測 (2023-2028)Smart Beacon Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,智能信標市場預計將以 54.05% 的複合年增長率增長。

信標技術允許智能手機和平板電腦等設備在信標附近執行操作。 由於與傳統營銷相比具有更高的銷售成功率、改善的客戶關係、增強的定制體驗、實時和實惠的價格等特點,近距離營銷的投資正在增加。 此外,移動普及正在推動鄰近營銷的擴展。

主要亮點

- 對可用於分析當前人口統計數據的空間數據的需求不斷增長,正在推動正在研究的各種應用市場的增長。 信標技術在高等教育中最廣泛的用途之一是加快管理任務,例如考勤監控。 使用信標進行考勤監控既高效又省時。 此外,您可以使用空間自動檢測的考勤信息來代替實體考勤卡。

- 日益全球化和汽車行業的需求將成為市場驅動力。 強調商業智能以增強競爭力、增加空間數據在分析中的利用率、對室內導航智能信標的需求增加以及工業化程度的提高預計將有助於市場的增長。

- 此外,通過在現實生活中的地理區域周圍創建虛擬邊界並與該區域的用戶交流,玩家可以擴大他們的受眾範圍並覆蓋數十萬。它專注於先進的地理圍欄技術和空間數據創新,以捕獲點周圍的遠程信息處理。

- 缺乏信息和技術技能阻礙了市場擴張。 藍牙和低功耗技術的技術障礙、互操作性問題以及有限的傳感能力可能會進一步減緩市場發展的步伐。 新興市場廣泛的技術限制以及日益增長的安全和隱私問題可能使市場擴張更加困難。

- 在 COVID-19 大流行期間,市場將受到許多零售店關閉和各種最終用戶行業關閉的阻礙。 大流行後,由於商店重新開張和各種終端用戶活動的恢復,市場正在蓬勃發展。 隨著手機的普及,市場進一步擴大。

智能信標市場趨勢

零售終端用戶細分市場有望佔據較大的市場份額

- 隨著零售額的增加,智能手機徹底改變了人們的購物方式。 零售商現在正在利用稱為 Beacon 技術的基於位置的鄰近營銷解決方案來改善客戶體驗、增加收入和提高運營效率。

- 信標技術(藍牙低功耗 (BLE) 信標)在打造一致的線上和店內體驗方面非常有效。 通過跟蹤顧客在店內的動向,我們可以根據顧客正在查看的產品提供有針對性的折扣信息。

- Proximity beacons 跟蹤您的位置,以便它們可以及時傳遞相關消息。 例如,當顧客進入零售店時會受到歡迎,或者如果顧客在特定的百貨商店區域,藍牙信標可以觸發與該區域相匹配的活動。

- 在零售業中使用智能信標可以讓企業更多地了解他們的客戶。 零售商店信標可以記錄消費者何時購物、他們在商店停留多長時間以及他們通常購買什麼等信息。 企業可以使用這些數據來改進他們的信標營銷工作和店內改進。

- 大型商店很難走動,但如果您有信標,就可以引導他們找到所需的產品。 例如,蓋特威克機場使用數百個信標提供機場導航和增強現實引導服務,將旅客引導至機場航站樓內的指定位置。 同樣,Target 利用鄰近信標來映射並幫助購物者在他們的應用程序內購物清單上找到商品。

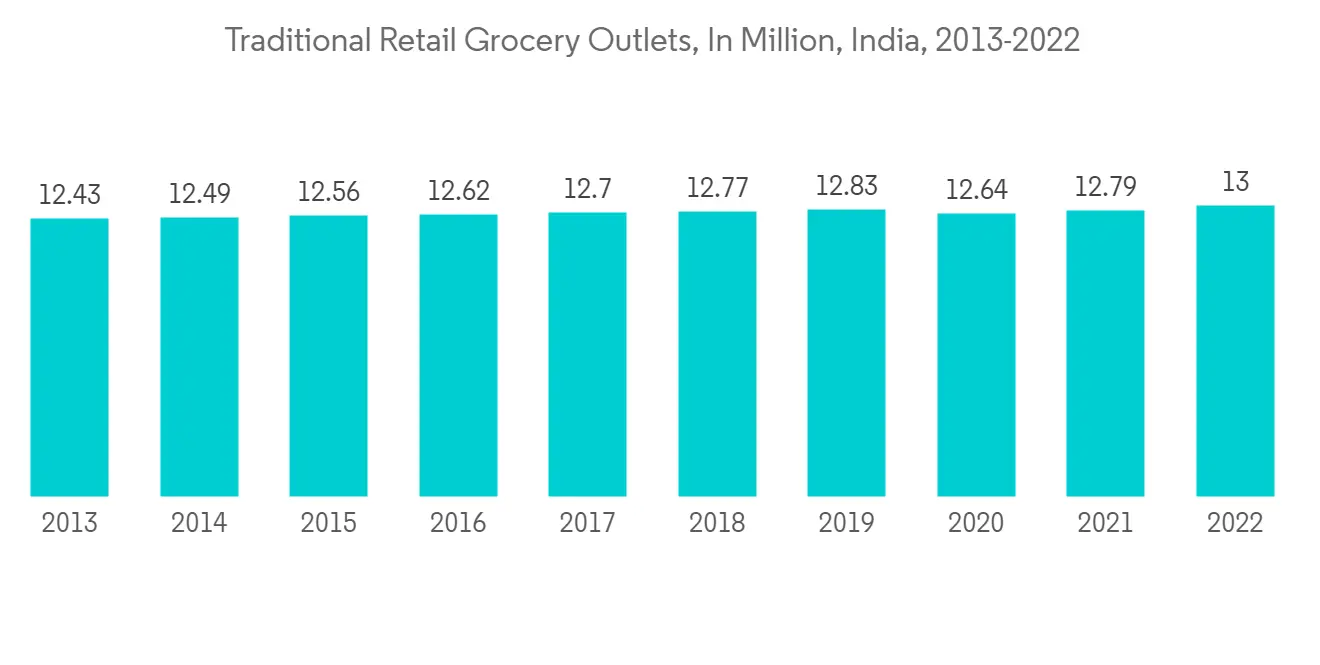

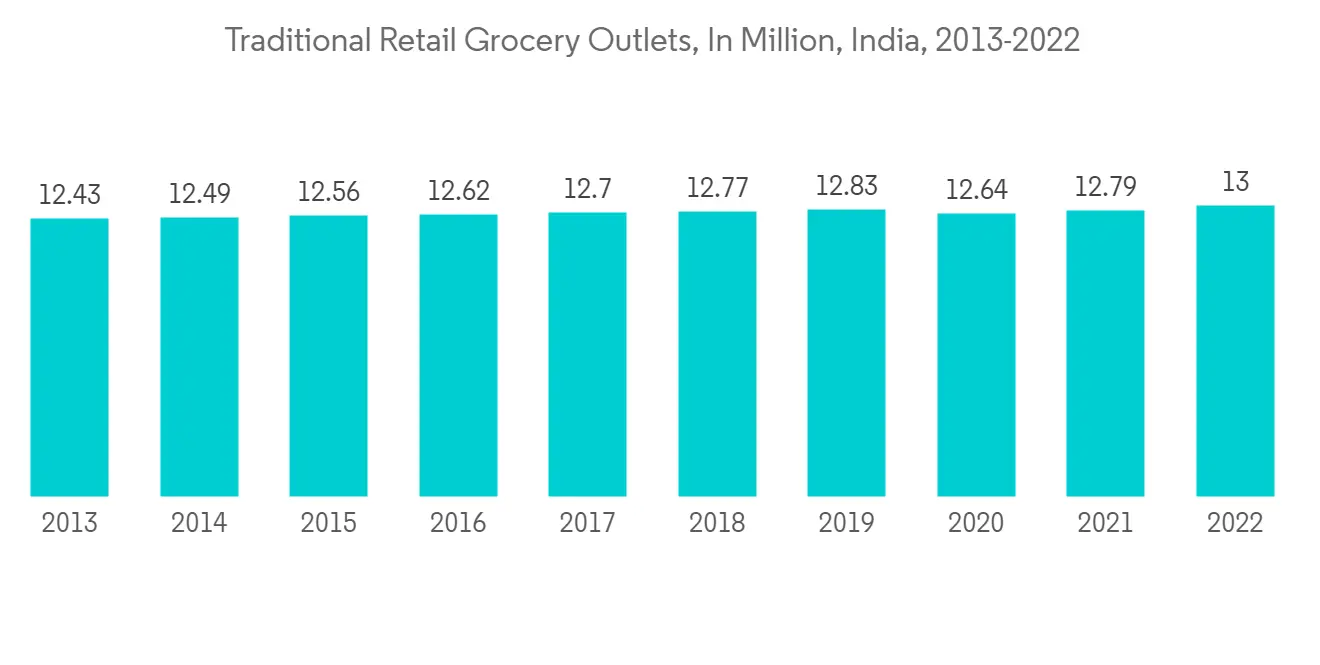

- 隨著全球零售店數量的增加,智能信標的使用也會增加。 據美國農業部對外農業服務局稱,到 2022 年,印度將有約 1300 萬家傳統零售雜貨店。 自 2013 年以來,這種零售模式得到了 Kirana 和 Corner Shop 等強勁且持續的發展。 此外,這種超市店面設計在雜貨零售業務中佔有很大份額。 相比之下,該行業的現代商家同期在全國開設了約 8,400 家門店。

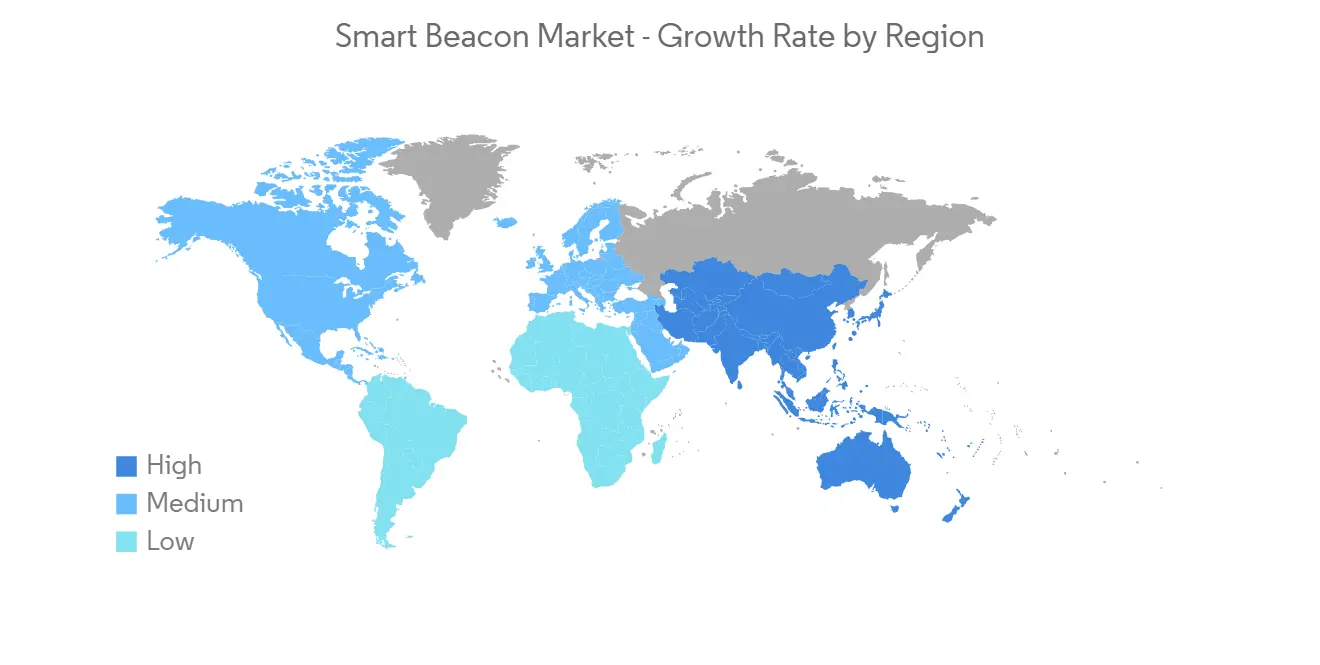

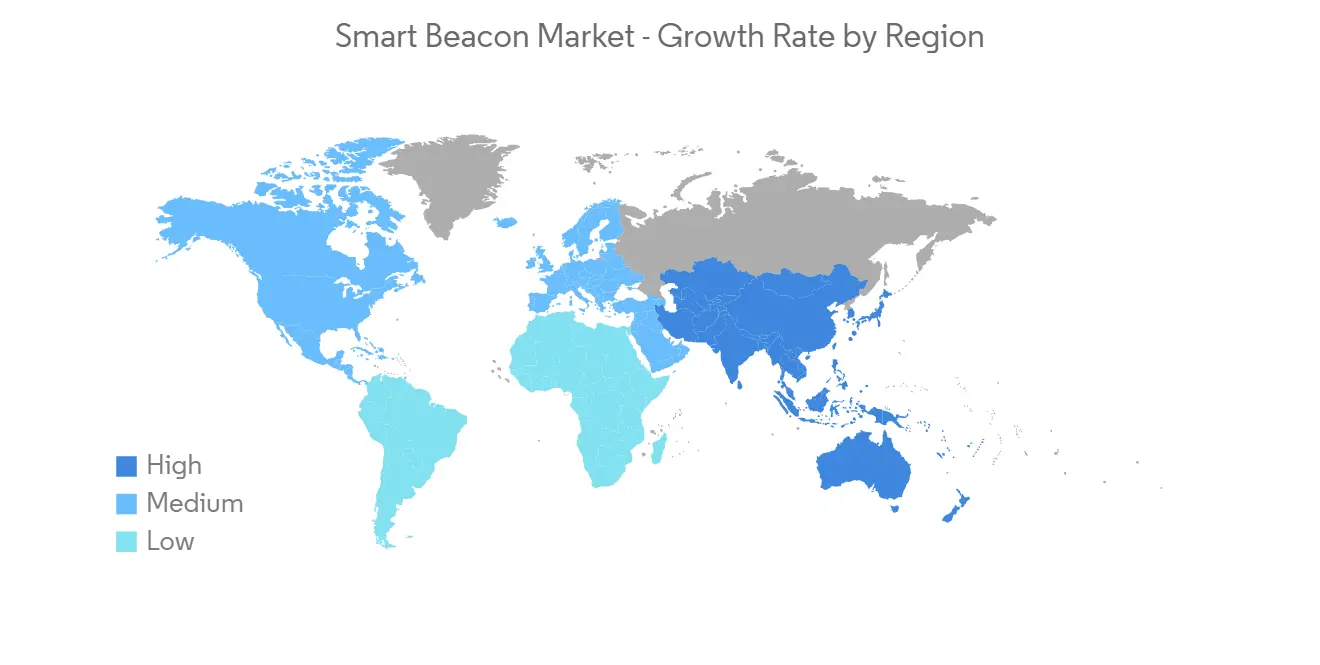

亞太地區有望成為增長最快的市場

- 隨著信標技術在印度和澳大利亞的各種應用中得到廣泛應用,亞太地區有望實現顯著增長。 該地區仍是一個發展中市場,潛力巨大。

- 該地區有組織的零售業的增長預計將為智能信標業務帶來新的可能性。 可支配收入的增加、生活水平的提高、消費主義的興起、技術影響以及國際商人的出現正在推動該地區有組織的零售業的擴張。

- 此外,該地區的超市、百貨公司、大賣場和折扣店對信標技術的需求將會增長,因為信標技術使有組織的零售店變得更加智能。

- 信標正在成為公司技術創新和數字營銷戰略不可或缺的一部分,使公司能夠在為客戶服務的同時進行業務分析。 信標有助於收集上下文相關的客戶數據,這可以提高促銷優惠和營銷準確性。 信標可以被場館所有者和運動隊用於鄰近倡議,以從衝動購買和讚助合作夥伴關係中產生新的收入。

- 印度等國家/地區在亞太地區的體育場舉辦了許多板球比賽。 信標可以放置在體育場內結構和區域的不同位置,通過自己的藍牙信號覆蓋最遠 75 米的特定區域,並與參與球迷的智能手機和可穿戴設備通信,以便您識別您的座位。

- 印度購物中心開發商也找到了合適的技術解決方案,購物中心內的多家零售連鎖店已成功實施了信標等技術。

智能燈塔行業概覽

智能信標市場高度分散,由 Aruba Networks(惠普企業開發有限責任公司)、HID Global Corporation、Leantegra Inc.、Cisco Systems Inc.、Kontakt.io Inc. 等大公司組成。 市場參與者正在採用合作夥伴關係、競爭和收購等戰略來加強他們的產品供應並獲得持續的競爭優勢。

- 2022 年 8 月 - HID Global 是可信身份和 RFID 跟蹤解決方案的全球領導者之一,宣布比利時國家鐵路公司的 NMBS/SNCB 宣布 HID BEEKs 藍牙低功耗 (BLE) 信標供電實時定位服務平台成功部署,宣布將精準監控列車位置,確保列車準時發車。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查結果

- 本次調查的假設

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 市場驅動因素

- 越來越需要空間數據來分析人口統計數據

- 智能信標在物流和運輸中的採用率提高

- 市場製約因素

- 構建信標解決方案需要高超的技能

- 在零售業務中,線下商店越來越傾向於選擇在線平台

- 工業價值鏈分析

- 行業吸引力 - 波特五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 評估 COVID-19 對行業的影響

第 5 章市場細分

- 按標準類型

- iBeacon

- 埃迪·斯通

- 其他標準類型

- 通過連接

- 低功耗藍牙

- 無線網絡

- 其他連接

- 最終用戶

- 零售

- 運動

- 運輸/物流

- 建築

- 航空

- 醫療保健

- 汽車

- 其他最終用戶

- 按地區

- 北美

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 澳大利亞

- 韓國

- 其他亞太地區

- 世界其他地區

- 北美

第六章競爭格局

- 公司簡介

- Aruba Networks(Hewlett Packard Enterprise Development LP)

- HID Global Corporation

- Leantegra Inc.

- Cisco Systems Inc.

- Kontakt.io Inc.

- Gimbal Inc.

- Accent Systems

- Sensoro Co. Ltd

- Jaalee Technology

- Fujitsu Components Asia Pte Ltd

第七章投資分析

第八章市場機會與未來趨勢

The smart beacon market is expected to register a CAGR of 54.05 % during the forecast period. Beacon technology enables smartphones, tablets, and other devices to perform actions close to a beacon. Because of characteristics such as the increased probability of successful sales, improved customer relationships, enhanced tailored experience, and real-time & affordable nature when compared to traditional marketing, proximity marketing has seen increased investment. Furthermore, increased mobile penetration promotes the expansion of proximity marketing.

Key Highlights

- The increasing need for spatial data, which can be used to analyze the current demographic trend, is driving the growth of the market studied in various applications. One of the most widespread usages of beacon technology in higher education is the expedition of administrative tasks, such as attendance monitoring. Attendance monitoring via beacons increases efficiency and saves time. It also replaces a physical attendance sheet with spatially and automatically detected attendance information.

- Increasing globalization and demand from the automobile sector will emerge as key market development drivers. Increasing emphasis on business intelligence to achieve a competitive edge, increased usage of spatial data in analytics, rising demand for smart beacons for indoor navigation, and expanding industrialization would contribute to the market's growth.

- Moreover, by creating virtual perimeters around real-world geographic areas to communicate with users in those areas, players are focused on innovating advanced geofence technology and spatial data for increasing the audience reach and capturing telematics around hundreds of thousands of points of interest in the smart connect platform.

- The lack of information and technological skills will hamper the market's expansion. Technical obstacles, interoperability concerns, and bluetooth low energy technology's restricted sensing capabilities may slow the market's development pace even more. Large-scale technology restrictions in developing nations, and increased security and privacy concerns, may further challenge market expansion.

- During the COVID-19 Pandemic, the market is hampered due to the closure of many retail stores and the close of various end-user industries. Post-pandemic, the market is growing rapidly with the reopening of stores and resuming of various end user activities. With the increased mobile penetration, the market is propelling further.

Smart Beacon Market Trends

Retail End-User Segment is Expected to Hold Significant Market Share

- Owing to the increasing growth in retail sales, smartphones have entirely revolutionized how people shop. Retailers are now utilizing the location-based proximity marketing solution called Beacon technology to improve the customer's experience, drive revenue, and increase operational efficiency.

- Beacon technology (Bluetooth low energy (BLE) beacons) is incredibly effective for creating a cohesive online and in-store experience. By tracking a customer's in-store movement, retailers can deliver targeted information and discounts depending on which products the customer is perusing.

- Since proximity beacons track client positions, merchants may deliver highly relevant and tailored messages at approximately the appropriate time. For example, greeting a customer as they enter the retail store, or if a consumer is in a specific department store section, the bluetooth beacon can activate offers matched with that area.

- Using smart beacons in retail allows companies to learn more about their customers. Retail beacons can record information such as when consumers shop, how long they stay in the store, and what they generally purchase. This data may be used by businesses to improve their beacon marketing efforts and make in-store improvements.

- Large stores might be difficult to navigate, but retail beacons can help by directing shoppers to their desired items. For example, Gatwick Airport uses hundreds of beacons to provide interior navigation and augmented reality wayfinding service that directs travelers to specified places across the airport terminal. Similarly, Target leverages proximity beacons to assist shoppers in finding products on their in-app shopping lists by mapping paths for them.

- The increase in the number of retail stores across the globe increases the usage of smart beacons. According to USDA Foreign Agricultural Service, In 2022, around 13 million traditional retail grocery stores in India. Since 2013, this retail model has had strong and continuous development, including kiranas or corner shops. Additionally, this supermarket store design accounts for a sizable percentage of the retail grocery business. In comparison, modern merchants in this sector have around 8.4 thousand stores across the country over the same period.

Asia Pacific is Expected to be the Fastest Growing Market

- The Asia Pacific region is expected to witness significant growth due to the increasing traction of the beacon technology in India and Australia for various applications. The market is still developing and has much potential in this region.

- The growth of the organized retailing industry across the region is expected to create new potential for the smart beacon business. An increase in disposable income, a higher living standard, the rise of consumerism, technological influence, and the arrival of international merchants fuel the expansion of the organized retail business across the region.

- Additionally, as beacon technology makes organized retail outlets smarter, demand for beacon technology would likely expand in the region's supermarkets, department stores, hypermarkets, and discounters.

- Beacons are becoming vital to enterprises' technical innovation and digital marketing strategy, allowing industries to create corporate analytics while serving customers. They aid in collecting contextually relevant customer data, improving the accuracy of promotional offers and marketing. Beacons can be utilized by venue owners and sports teams in proximity-based initiatives to generate new income through impulsive purchases and sponsor integrations.

- Countries like India conduct much cricket matches in the Asia Pacific region in the stadium. Beacons can be placed at various locations within a structure or an area within a stadium to cover specific zones extending up to 75 meters with unique Bluetooth signals, allowing a participating fan's smartphone or wearable device to communicate with it and thereby identify their seat.

- Moreover, mall developers in India have found appropriate technology solutions, and several retail chains in malls have successfully implemented technologies, such as beacons.

Smart Beacon Industry Overview

The smart beacon market is highly fragmented with the precence of major players like Aruba Networks (Hewlett Packard Enterprise Development LP), HID Global Corporation, Leantegra Inc., Cisco Systems Inc., and Kontakt.io Inc. Players in the market are adopting strategies such as partnerships, megers and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- August 2022 - HID Global, one of the global leaders in trusted identity and RFID tracking solutions, announced that the Belgian national railway company, NMBS/SNCB, has successfully deployed a real-time location service platform with HID BEEKs Bluetooth Low-Energy (BLE) beacons to accurately monitor train location and ensure on-time departures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need for Spatial Data to Analyze Demographic Trend

- 4.2.2 Rising Adoption of Smart Beacons in Logistics and Transportation

- 4.3 Market Restraints

- 4.3.1 Requirement of High Skill for the Creation of Beacon Solution

- 4.3.2 Increasing Trend toward Offline Stores for Opting Online Platforms in Retail Sector

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Standard Type

- 5.1.1 iBeacon

- 5.1.2 Eddystone

- 5.1.3 Other Standard Types

- 5.2 By Connectivity

- 5.2.1 Bluetooth Low Energy

- 5.2.2 Wi-Fi

- 5.2.3 Other Connectivity

- 5.3 By End-User

- 5.3.1 Retail

- 5.3.2 Sports

- 5.3.3 Transportation and Logistics

- 5.3.4 Construction

- 5.3.5 Aviation

- 5.3.6 Healthcare

- 5.3.7 Automotive

- 5.3.8 Other End-Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Australia

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia Pacific

- 5.4.4 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Aruba Networks (Hewlett Packard Enterprise Development LP)

- 6.1.2 HID Global Corporation

- 6.1.3 Leantegra Inc.

- 6.1.4 Cisco Systems Inc.

- 6.1.5 Kontakt.io Inc.

- 6.1.6 Gimbal Inc.

- 6.1.7 Accent Systems

- 6.1.8 Sensoro Co. Ltd

- 6.1.9 Jaalee Technology

- 6.1.10 Fujitsu Components Asia Pte Ltd