|

市場調查報告書

商品編碼

1333770

協作機器人市場規模和份額分析-增長趨勢和預測(2023-2028)Collaborative Robots Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計 2023 年協作機器人市場規模為 9.5 億美元,預計到 2028 年將達到 24.1 億美元,預測期內(2023-2028 年)複合年增長率為 20.50%

結合人工智能、自動化、物聯網、計算能力和機器人等技術,將實現新一代智能工廠。 機器人和自動化在過去幾年中發生了巨大變化。 對先進自動化的投資不斷增加,為電子、汽車、食品、金屬加工和物料搬運等不斷增長的行業中的協作機器人創造了充足的機會。

主要亮點

- 隨著機器人與人類的合作更加密切,它們必須對用戶做出反應並調整自己的行為。 在接下來的幾年中,預計研究人員將能夠識別人類的基本行為並相應地調整機器人的行為。 在接下來的幾年裡,這將演變成一個更複雜的程序,可以適應複雜任務的需求。

- 邊緣計算是一種令人興奮的網絡架構新方法,突破了傳統基於雲的網絡的限制。 隨著自主機器人和醫療傳感器等創新機器變得司空見慣,邊緣計算將對社會產生重大影響。 人工智能 (AI) 的快速發展使得任務能夠在不斷變化的環境中準確執行。 集成人工智能的協作機器人可幫助各種應用的製造商保持高效、平穩和高效的運營。 由人工智能控制的協作機器人可以確定材料面向哪個方向以及是否存在。 您還可以測試和檢查材料、在現場拾取和放置它們、讀取檢查結果並根據這些結果做出決策。

- 汽車行業使用的工業機器人提高了速度、準確度、精密度、靈活性和敏捷性,使其使用起來更加高效且更具成本效益。 過去十年來,乘用車製造的複雜性不斷增加。 因此,機器人等自動化解決方案現在被用於製造過程的重要部分。

- 集成先進技術的機器人比傳統機器人成本更高。 機器人系統的成本與強大的硬件和高效的軟件有關。 自動化設備需要採用先進的自動化技術,需要較高的資金投入。 例如,自動化系統的設計、製造和安裝可能花費數百萬美元。

- 醫療保健行業在疫情期間目睹了醫療服務提供商的短缺,並意識到自動化和機器人的重要性。 此外,藥品和疫苗需求的快速增長也強調了藥品和製造過程的自動化。 在大多數醫院,拆包和分類血液樣本是一項繁瑣且耗時的手動任務。

- 在後新冠肺炎 (COVID-19) 疫情背景下,協作機器人因其強大的功能和節省的成本而在所有行業中獲得了巨大的需求。 例如,一些快餐連鎖店和醫院正在使用這些機器人進行體溫檢查和分發消毒劑。 雜貨店、食品服務企業和餐館越來越多地使用機器人來準備食物和送外賣。 此外,倉儲物流行業也正在轉向協作機器人,以提高分揀、包裝和運輸效率。 所有這些行業的公司都越來越多地考慮在工作場所實施自動化,以遵守流行病協議、降低感染風險並保護員工的健康。

協作機器人市場趨勢

各種工業流程對自動化的需求不斷增長,推動了市場

- 新冠肺炎 (COVID-19) 疫情導致組織轉向自動化和數字化,預計這將推動各行業對協作機器人的需求。 自動化解決方案可以顯著降低運輸成本。 這得到了機器人技術創新的支持,機器人技術使各行業的公司能夠增強人類的能力和自主操作的能力。

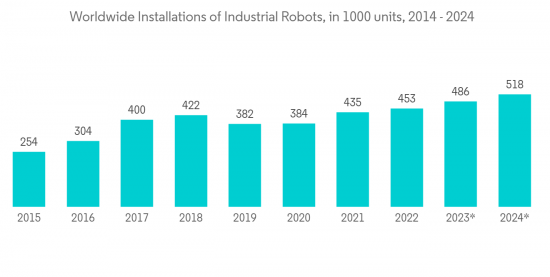

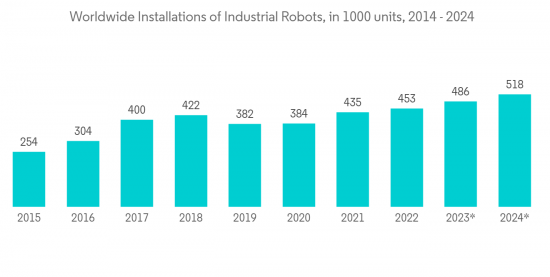

- 更長的培訓和入職時間、更高的福利和薪酬以及勞動力短缺是推動部署的關鍵因素。 越來越多的倉庫、配送和履行設施正在投資自動化解決方案。 隨著技術的進步和應用變得更加廣泛和靈活,機器人技術正在被全球許多製造業務所採用。

- 例如,2022年1月,ABB與中國汽車零部件供應商華域汽車合作組建合資企業,加速中國汽車行業的智能製造。 通過此次合作,兩家公司旨在推動人工智能和智能技術在汽車行業的普及。

- 同樣,2022 年 1 月,協作機器人供應商 Fanuc 將其密歇根園區的操作空間增加了近一倍,以滿足自動化需求。 機器人在工業自動化中發揮著重要作用,工業中的許多核心任務都是由機器人來管理的。 即使在危險環境中,機器人也可以精確地執行複雜、重複的任務。 由於這些原因,大多數行業的製造設備中都採用了機器人。 根據 UiPath 的一項研究,超過 88% 的組織認為自動化可以通過加速和補充人類成就而發揮作用。

- 由於速度、準確度、精密度、靈活性和敏捷性達到新水平,汽車行業使用的工業機器人得到了更高效、更經濟的利用。 過去十年來,乘用車製造的複雜性不斷增加。 因此,機器人越來越多地用於製造過程的重要部分的自動化解決方案。

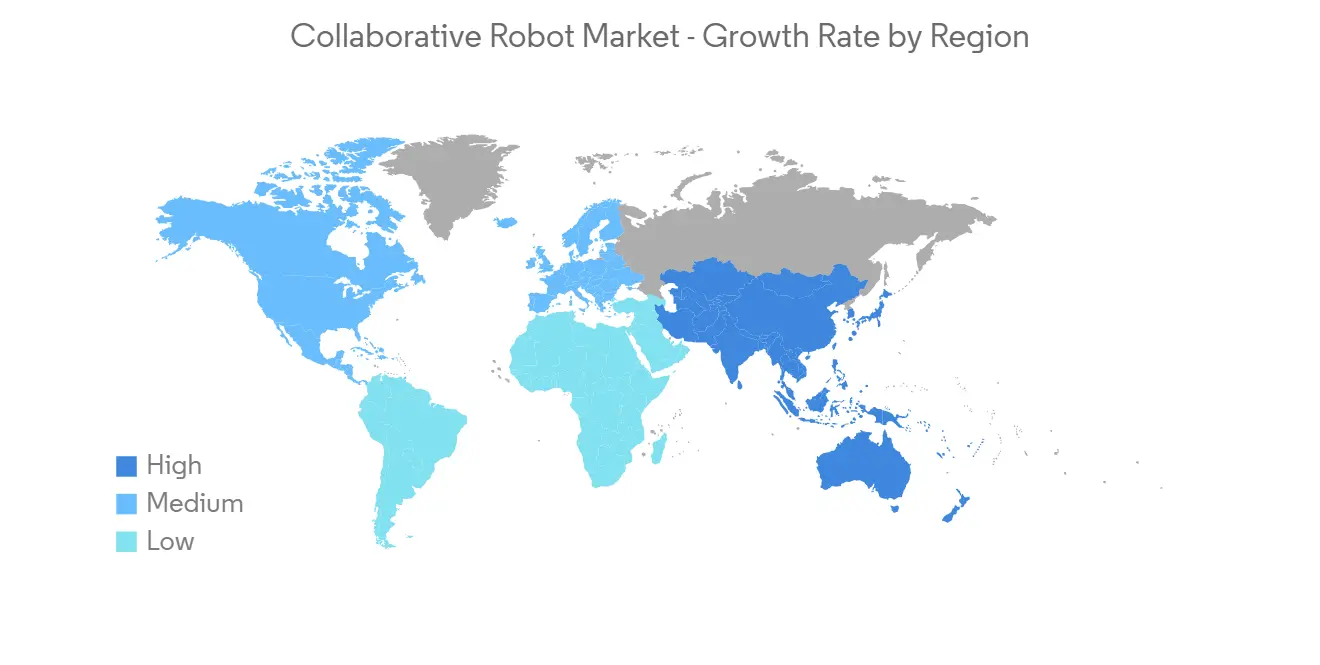

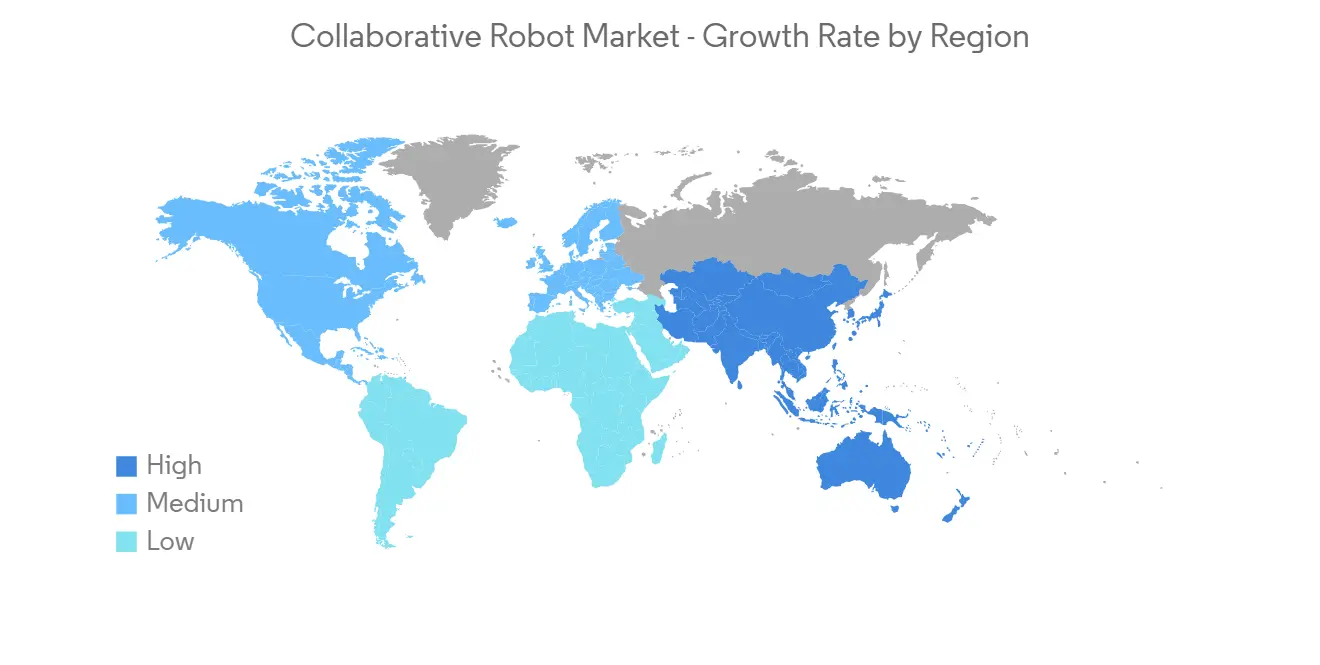

亞太地區預計將成為快速增長的市場

- 由於該地區工業數量的不斷增加以及與自動化的集成以提高投資回報率,亞太地區的協作機器人市場正在顯著擴張。 隨著中國製造、銷售和交易的協作機器人數量不斷增加,中國有望成為亞太協作機器人市場的最大參與者。

- 例如,北京工業和信息化部 (MIIT) 公佈了機器人產業發展“十四五”規劃,並將機器人技術納入未來五年八個重點行業。致力於推動創新,使中國成為機器人技術和產業發展的世界領先者。 由此,2022年4月23日,國家重點研發計劃啟動了一項重要而獨特的項目“智能機器人”,資助金額為4350萬美元。

- 印度的協作機器人市場正在穩步增長。 這是因為印度市場的許多流程沒有明確標準化,許多公司繼續以非結構化方式開展工作,數字化水平低於其他發達市場。 儘管印度在採用機器人和協作機器人技術方面進展緩慢,但 IFR 表示,印度是這些技術最有前途的市場之一。

- 由於製造業的擴張、有組織的零售業的增長、食品和飲料製造業的擴張以及柔性和無菌包裝趨勢的日益增長,日本的包裝行業已蓄勢待發。 例如,日本正在根據其塑料新經濟計劃擴大塑料生產。 因此,不斷增長的包裝行業預計將為協作機器人市場帶來顯著的增長機會。 協作機器人可以完成所有包裝和碼垛任務,無需人工干預。

- 亞太地區的其他國家包括韓國、澳大利亞和東南亞國家等,這些國家已發展成為多個行業的重要製造中心。 例如,根據IFR的數據,韓國在汽車、電子、半導體、機械和化工等所有初級製造業領域均名列“前五”製造強國,這一強大製造業基礎的需求帶動了韓國機器人技術的崛起但它已成為一個主要參與者,在機器人密度方面始終排名前兩名,使其成為對全球機器人公司極具吸引力的國家。

協作機器人行業概況

儘管存在Universal Robots AS、Fanuc Corp.、TechMan Robotics Inc.、Rethink Robotics GmbH 和AUBO Robotics USA 等主要參與者,但協作機器人市場仍高度分散。 市場參與者正在利用合作夥伴關係、合併、創新、投資和收購來改進他們的產品並可持續地提高他們的競爭力。2023 年 2 月,Rapid Robotics 宣布與優傲機器人 (UR) 建立新的合作夥伴關係,UR 將向 Rapid Robotics 位於北美的協作機器人工作單元提供協作機器人手臂。 該交易允許製造商填補機器人無法填補的職位,從而進一步消除自動化障礙。

2022年11月,達明機器人有限公司發布了協作機器人TM AI Cobot系列,該系列結合了強大而精準的機械臂、原生AI推理引擎和智能視覺系統。 是智能機械臂系列,附帶TM AI+Training Server、TM AI+AOI Edge、TM Image Manager、TM 3DVisionTM等全套AI軟件,幫助企業訓練訓練其係統,完美支持他們的應用,我們支持定制。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 研究假設和市場定義

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 行業吸引力 - 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 競爭公司之間的對抗關係

- 替代品的威脅

- 行業價值鏈分析

- 新冠肺炎 (COVID-19) 對市場的影響

- 價格分析

第五章市場動態

- 市場驅動因素

- 邊緣計算和人工智能的進步使實施變得容易

- 各種工業流程對自動化的需求增加

- 市場製約因素

- 初始投資高且需要熟練勞動力

第六章市場細分

- 有效負載

- 小於5公斤

- 5~9Kg

- 10~20Kg

- 20公斤以上

- 最終用戶行業

- 電子產品

- 汽車

- 製造業

- 食品和飲料

- 化學/製藥

- 其他最終用戶行業

- 應用

- 物料搬運

- 拾取和放置

- 組裝

- 碼垛和卸垛

- 其他用途

- 地區

- 北美

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美

第七章競爭格局

- 公司簡介

- Universal Robots AS

- Fanuc Corp.

- TechMan Robot Inc.

- Rethink Robotics GmbH

- AUBO Robotics USA

- ABB Ltd.

- Kawasaki Heavy Industries Ltd.

- Precise Automation Inc.

- Siasun Robot & Automation co. Ltd.

- Staubli International AG

- Omron Corporation

- Festo Group

- Epson Robots(Seiko Epson)

- KUKA AG

第8章 投資分析

第9章 今後的市場

The Collaborative Robot Market size is estimated at USD 0.95 billion in 2023, and is expected to reach USD 2.41 billion by 2028, growing at a CAGR of 20.50% during the forecast period (2023-2028).

Combining technologies such as artificial intelligence, automation, the Internet of Things, computing power, and robotics enables a new generation of smart factories. Robotics and automation have changed significantly over the past few years. Increasing investment in advanced automation creates ample opportunities for cobots in a continuously growing range of industries such as electronics, automotive, food and metalworking, and material handling.

Key Highlights

- As robots work even more closely with humans, they must respond to the users and adapt their behaviors. Over the next few years, researchers are expected to recognize basic human behaviors and adapt these robots' actions to respond to them. Over the next few years, this would develop into much more advanced programs that could adapt to the needs of complex tasks.

- Edge computing is an interesting new approach to network architecture that helps businesses break beyond the limitations of traditional cloud-based networks. As innovative machines like autonomous robots and medical sensors become more common, edge computing will significantly impact society. Rapid advancements in artificial intelligence (AI) enable them to execute tasks accurately in a continuously changing environment. AI-integrated cobots help manufacturers in various applications that make operations run efficiently, smoothly, and productively. Cobots that are controlled by AI can tell which way materials are facing and if they are there. They can also test and inspect materials, pick and place tasks on the fly, read inspection results, and make decisions based on what they find.

- Industrial robots used in the automotive industry are more efficient and utilized cost-effectively owing to their increased speed, accuracy, precision, flexibility, and agility levels. The complexity of manufacturing passenger cars has increased over the past ten years. This has resulted in the use of robots in automation solutions for a significant portion of the manufacturing processes.

- The robots integrated with advanced technologies cost more than traditional robots. The costs of robotic systems are associated with robust hardware and efficient software. Automation equipment involves using advanced automation technologies that require a high capital investment. For instance, an automated system may cost millions of dollars for design, fabrication, and installation.

- The healthcare industry significantly realized the importance of automation and robots during the pandemic as the world witnessed a shortage in healthcare service providers. Moreover, the sudden surge in demand for medicines and vaccines also emphasized automation in pharmaceutical and manufacturing processes. In most hospitals, unpacking and sorting blood samples is a boring and time-consuming task that is done by hand.

- In the post-COVID-19 scenario, collaborative robots gained significant demand across all industries due to their capabilities and reduced cost. For instance, some fast-food chains and hospitals use these robots to conduct temperature tests and distribute sanitizers; groceries, food services, and restaurants have shifted to robots for food preparation and takeaway deliveries. Further, the warehousing and logistics industry is also shifting to collaborative robots to improve sorting, packaging, and shipping efficacy. Companies across all of these industries are increasingly looking into introducing automation at the workplace to comply with pandemic measures, reduce the risk of infection, and safeguard staff health.

Collaborative Robots Market Trends

Increasing Demand for Automation in Various Industrial Processes Drives the Market

- Due to the COVID-19 outbreak, organizations shifted towards automation and digitalization, which was expected to drive the demand for collaborative robots across various industries. Automation solutions can drive down the cost of deliveries dramatically. Supported by this are the robot innovations that are taking place, allowing enterprises in multiple industries to operate autonomously with augmented human capability and capacity.

- Longer training and onboarding, increasing benefits and compensation rates, and labor shortages are significant factors driving the deployment. More and more warehousing, distribution, and fulfillment facilities are investing in automated solutions. As technology improves and the applications become broader and more flexible, robotics is being adopted by many manufacturing operations across regions.

- For instance, in January 2022, ABB and a China-based automotive parts supplier, HASCO, partnered to build a joint venture to accelerate smart manufacturing in China's automotive industry. Through this partnership, the companies want to make AI and smart technologies more common in the automotive industry.

- Similarly, in January 2022, Fanuc, a collaborative robot supplier, expanded the operational space by almost double at the Michigan Campus to accommodate the demand for automation. Robots play a crucial role in industrial automation, with many core operations in industries being managed by them. Robots can take on complicated, repetitive tasks with accuracy, even in hazardous environments. For this very reason, they have been employed in manufacturing units across most industries. According to a study by UiPath, over 88% of organizations believe that automation will accelerate human achievement and be effective when it complements humans.

- Industrial robots used in the automotive industry are more efficient and utilized cost-effectively owing to their new levels of speed, accuracy, precision, flexibility, and agility. The complexity of manufacturing passenger cars has increased over the past ten years. As a result, robots are now used in automation solutions for a significant portion of manufacturing processes.

Asia Pacific is Expected to be the Fastest Growing Market

- The market for collaborative robots in Asia Pacific is expanding significantly due to the growing number of industries in the region and their integration with automation to increase ROI. With the number of cobots being made, sold, and traded in China going up, it is expected that China will be the biggest player in the Asia-Pacific collaborative robot market.

- As long as China keeps putting a high priority on industrial automation, its market for collaborative robots is bigger than those in EMEA and the Americas.For instance, the Ministry of Industry and Information Technology (MIIT) in Beijing released the "14th Five-Year Plan" for Robot Industry Development, focusing on promoting innovations to make China a global leader in robot technology and industrial advancement by including it in 8 critical industries for the next five years. As a result, on April 23, 2022, the vital, one-of-a-kind program "Intelligent Robots" was launched under the National Key R&D Plan with a funding of USD 43.5 million.

- India's collaborative robot market is growing steadily because many processes in the Indian market are not clearly standardized and a large number of businesses continue to work in an unstructured way with lower levels of digitization than in other developed markets.Even though India is slow to adopt robots and collaborative robot technology, the IFR has said that it is one of the most promising markets for these technologies.

- With the expanding manufacturing sector, growing organized retail, expanding food and beverage production, and increasing trends in flexible and aseptic packaging, the packaging sector in Japan is well poised. For instance, Japan is expanding its plastic production in accordance with the New Plastics Economy Initiative. As a result, the growing packing industry is expected to create great growth opportunities for the collaborative robot market. This is because collaborative robots can do all the work of packaging and palletizing without any human help.

- The rest of the Asia-Pacific region includes nations such as South Korea, Australia, and all the Southeast Asian countries that are evolving as significant manufacturing hubs for multiple industries. For instance, considering South Korea is a "Top 5" manufacturing powerhouse in all primary manufacturing sectors, including automotive, electronics, semiconductors, machinery, and chemicals, as per IFR, demand from this solid manufacturing foundation has led the country to become a leading player in robotics as well, consistently ranking among the top 2 in robot density and making it very attractive to global robotics companies.

Collaborative Robots Industry Overview

The collaborative robot market is highly fragmented, despite the presence of major players like Universal Robots AS, Fanuc Corp., TechMan Robotics Inc., Rethink Robotics GmbH, and AUBO Robotics USA. Players in the market use partnerships, mergers, innovations, investments, and acquisitions to improve their products and gain a competitive edge that will last.

In February 2023, Rapid Robotics announced a new collaboration with Universal Robots (UR), in which UR would supply collaborative robot arms for Rapid Robotics' deployment of cobot work cells across North America. Through this agreement, the company would be able to remove more barriers to automation by filling positions that manufacturers can't fill with robots.

In November 2022, TechMan Robot Inc. introduced its TM AI Cobot series of collaborative robots, which combines a powerful and precise robot arm with a native AI inferencing engine and smart vision system. It is a series of intelligent robotic arms that come with a full set of AI software, such as TM AI+ Training Server, TM AI+ AOI Edge, TM Image Manager, and TM 3DVisionTM, which helps companies train and customize their systems to work perfectly with their applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Pricing Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advancements in Edge Computing & AI Leading to Easier Implementation

- 5.1.2 Increasing Demand for Automation in Various Industrial Processes

- 5.2 Market Restraints

- 5.2.1 High Initial Investment and the Requirement of Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 Payload

- 6.1.1 Less Than 5Kg

- 6.1.2 5-9 Kg

- 6.1.3 10-20 Kg

- 6.1.4 More Than 20 KG

- 6.2 End-user Industry

- 6.2.1 Electronics

- 6.2.2 Automotive

- 6.2.3 Manufacturing

- 6.2.4 Food and Beverage

- 6.2.5 Chemicals and Pharmaceutical

- 6.2.6 Other End-user Industries

- 6.3 Application

- 6.3.1 Material Handling

- 6.3.2 Pick and Place

- 6.3.3 Assembly

- 6.3.4 Palletizing and De-palletizing

- 6.3.5 Other Applications

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Universal Robots AS

- 7.1.2 Fanuc Corp.

- 7.1.3 TechMan Robot Inc.

- 7.1.4 Rethink Robotics GmbH

- 7.1.5 AUBO Robotics USA

- 7.1.6 ABB Ltd.

- 7.1.7 Kawasaki Heavy Industries Ltd.

- 7.1.8 Precise Automation Inc.

- 7.1.9 Siasun Robot & Automation co. Ltd.

- 7.1.10 Staubli International AG

- 7.1.11 Omron Corporation

- 7.1.12 Festo Group

- 7.1.13 Epson Robots(Seiko Epson)

- 7.1.14 KUKA AG