|

市場調查報告書

商品編碼

1273505

垂直升降模塊 (VLM) 市場——增長、趨勢、COVID-19 的影響和預測 (2023-2028)Vertical Lift Module (VLM) Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

垂直升降模塊 (VLM) 市場預計在預測期內以 8% 的複合年增長率增長。

工業 4.0 正在推動自動化解決方案在工廠和倉庫中的應用。

主要亮點

- 隨著向智能內部物流的轉變,垂直升降模塊成為解決方案的關鍵部分。 由於終端市場的變化,內部物流在過去十年中經歷了巨大的動盪。 這是因為偏好已經從將 VLM 簡單地用作空間管理工具演變為從連接的解決方案中獲得運營收益。 這是推動市場的關鍵因素之一。

- 此外,收緊政府法規以改善工作場所安全也是推動市場發展的主要因素。 《職業安全與健康法》在其更新的標準中規定,無論墜落距離如何,都必須為員工提供安全墜落保護。 因此,涉及預防所有傷害和事故的工作場所安全變得很重要,垂直升降模塊 (VLM) 的採用也在增加。

- 此外,越來越多的零售商在人口稠密地區使用較小的配送中心。 換句話說,由於空間有限和成本高,對能夠在小空間內處理大量包裹的靈活、可擴展和自動化的 VLM 的需求有望推動零售市場。

- 但另一方面,垂直升降模塊 (VLM) 的高成本和相關的大量維護將限制預測期內的市場增長。

- COVID-19 有望促進未來的市場增長。 這是因為出於社會距離和工人安全的考慮,汽車、食品和飲料以及物流等行業都專注於自動化。

垂直升降模塊 (VLM) 市場趨勢

食品和飲料部門有望顯著增長

許多食品和飲料公司都在使用過時的轉盤來方便揀選,現在這些轉盤正在被垂直升降模塊 (VLM) 所取代。 該系統使空間受限的企業能夠無縫運營,並顯著提高了設施的立方體利用率。

- 由於行業內存有大量庫存,VLM 採用符合人體工程學的設計,每台托盤能夠支撐超過 1,000 磅的重量。 VLM 的總高度範圍從 15 英尺到 75 英尺。

- 垂直升降模塊 (VLM) 的使用方式還必須能防止工人受傷,這對工人安全至關重要。 由於“中國製造 2025”戰略,到 2025 年,中國使用自動化的工廠將顯著增加。 它促進了該國的垂直升降模塊(VLM)業務。 公司在物流領域的持續投資對垂直升降模塊市場的增長產生了重大影響。

- 大流行病正在造成世界上最嚴重的勞動力短缺。 嚴格的法規和要遵循的 COVID-19 指南和協議在食品和飲料行業造成了巨大的勞動力供需缺口。 因此,許多組織也在考慮全球情景,並尋找降低成本的方法,例如減薪和裁員。 這就是為什麼許多組織希望通過 VLM 等解決方案升級他們的倉庫並提高效率。 然而,解決方案的高成本、全球經濟波動和業務不確定性目前阻礙了這些解決方案的採用。

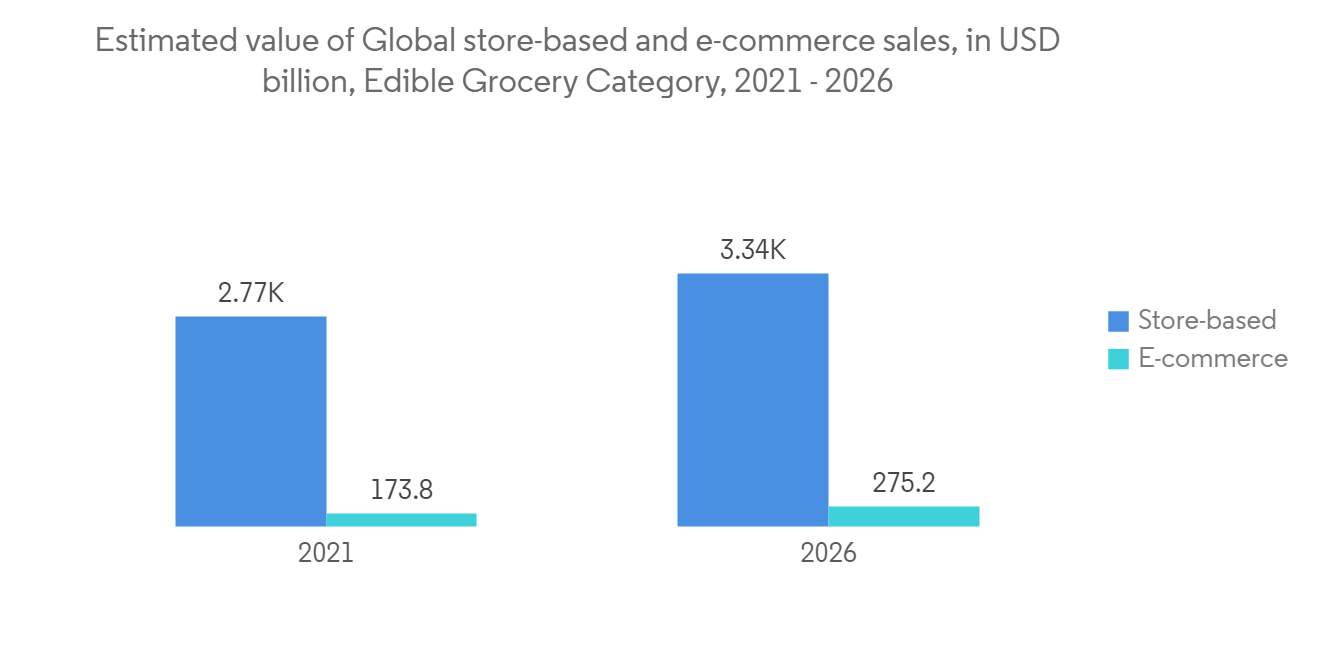

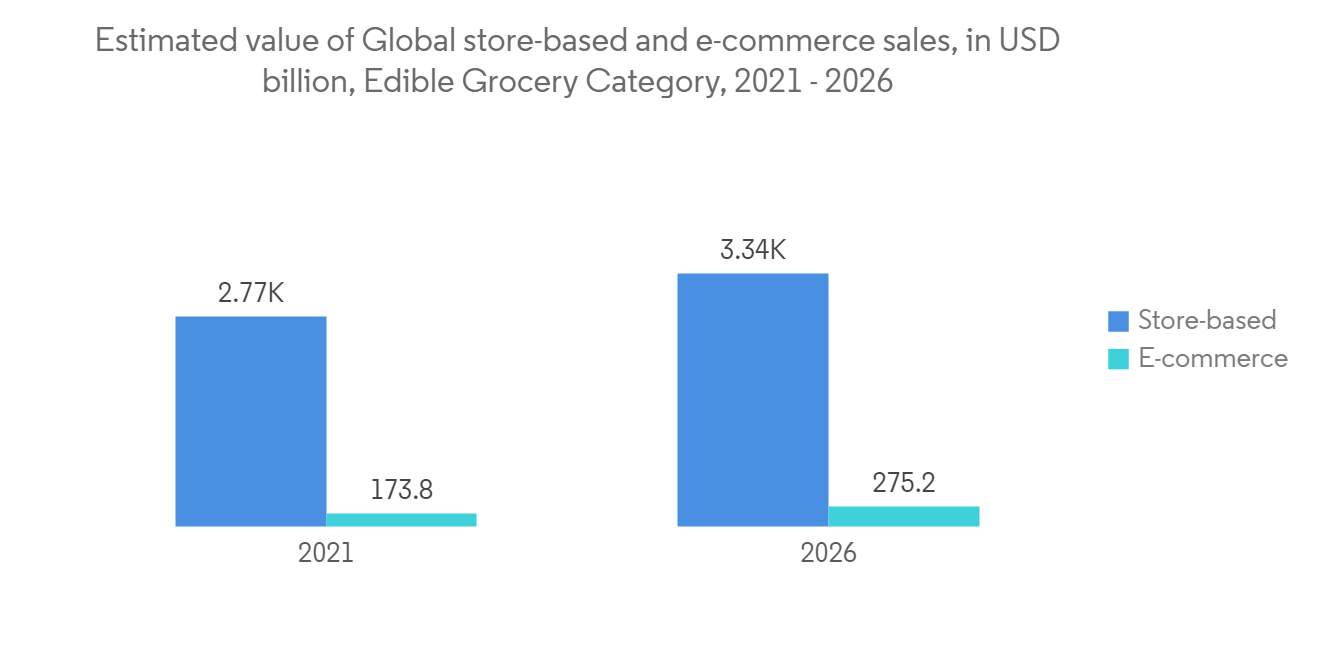

- 據領先的電子商務服務提供商 Edge by Ascential 稱,儘管實體店仍然是食品銷售的主要方式,但數字行業在未來幾年內可能會增長。...顯然 ... 該細分市場的在線銷售額預計將從 2021 年的 1740 億美元增長到 2026 年的 2750 億美元以上。 預計電子商務將佔當年全球食品雜貨總銷售額的 7.6% 左右。

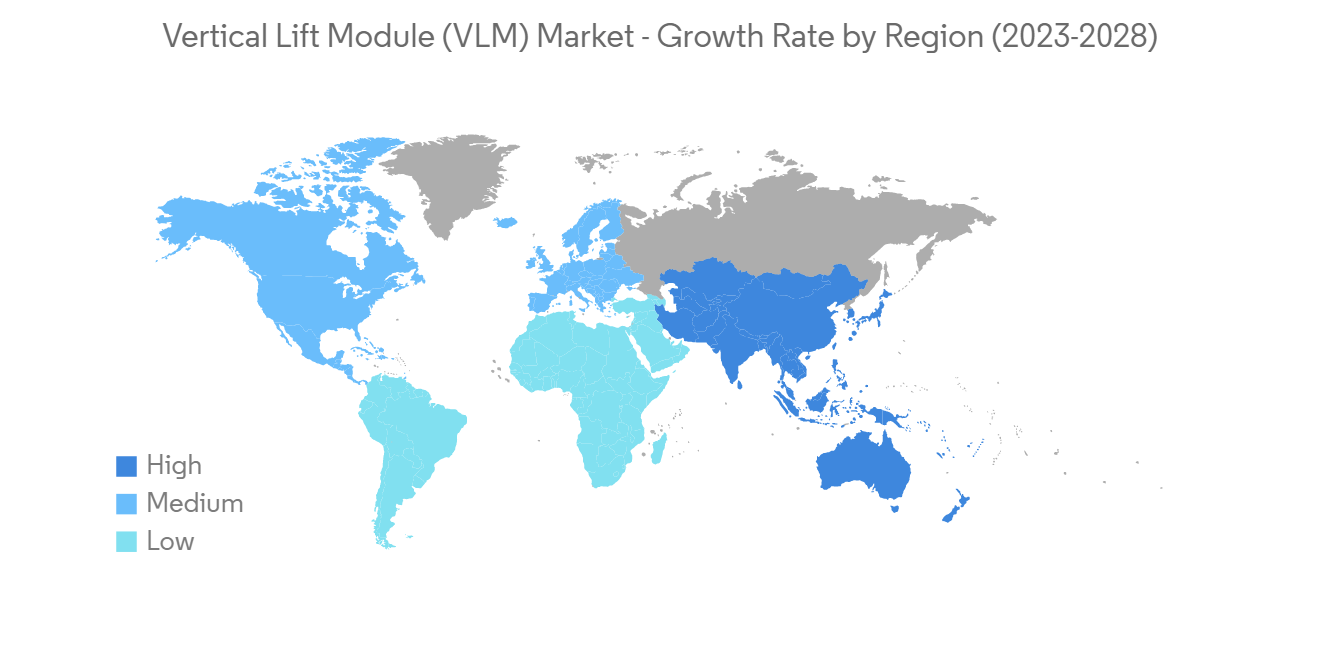

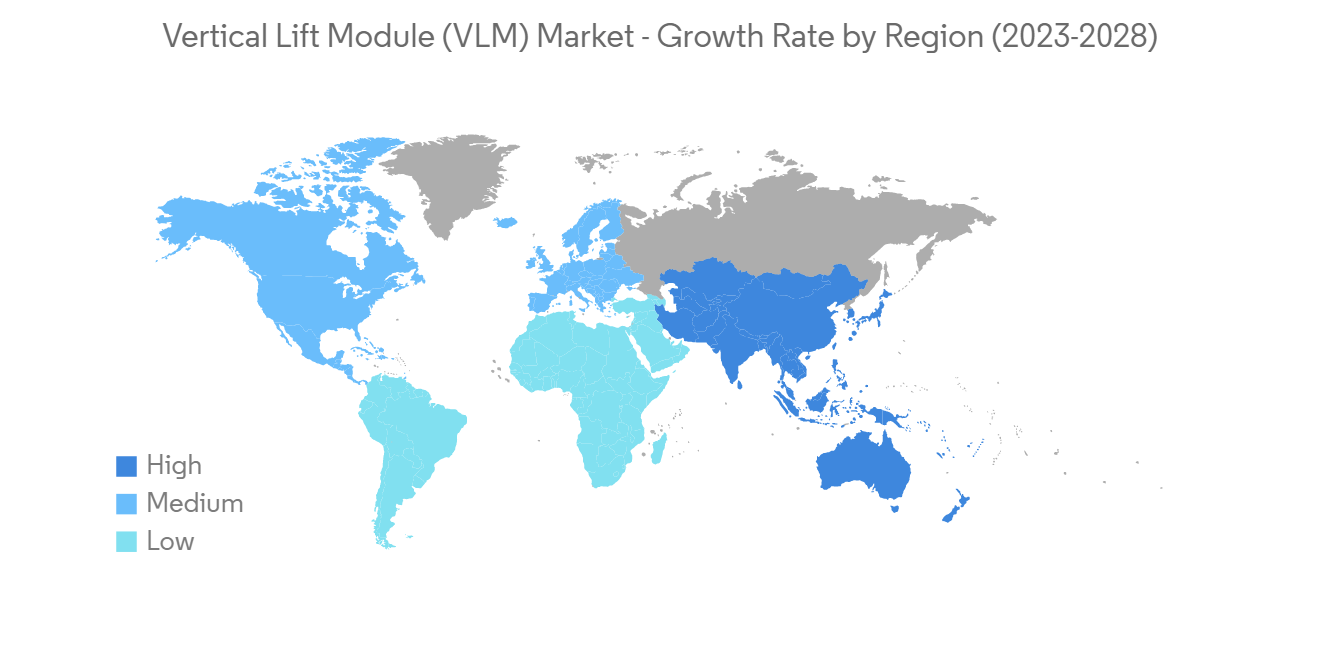

亞太地區有望顯著增長

- 亞太地區預計增長最快,因為它是世界上最大的製造基地和最大的出口國中國的所在地。 在中國,到 2025 年,自動化預計將降低 30% 的成本,而“中國製造 2025”計劃預計將增加中國製造基地的數量。 這一因素推動了該國的垂直升降模塊 (VLM) 市場。

- 此外,世界上另一個增長最快的經濟體是印度。 印度雄心勃勃的“印度製造”計劃有望為製造業以及相關的分銷和物流活動帶來巨大增長。

- 根據聯合國的最新數據,印度人口為 1,423,061,201,2023 年 7 月 1 日的估計人口為 1,428,627,663。 此外,根據 2023 年印度經濟調查,印度預計 2024 年將增長 6-6.8%。

- 印度擁有先進的物流和倉儲,有很多專門從事電子商務、物流和倉儲的項目,例如DDF(Delivery Dedicated Corridor)Sagar Mala項目。 印度共有11個主要港口和168個中小型港口。 正因為如此,大量貨物才有可能從這些島嶼運往印度海岸。 這也需要一個龐大的倉庫和金庫網絡,使得這個地區和研究期間研究的市場成為一個巨大的市場。

- 換句話說,由於上述因素,亞太地區的垂直升降模塊 (VLM) 預計在預測期內表現良好。

此外,為了阻止 COVID-19 冠狀病毒的傳播,幾乎每家公司都實施了社交距離、安全標準和規程,以確保倉庫和工廠工人的安全。 這引起了很多關注。 這導致該組織重新評估勞動力較少的設施的運營。 預計疫情將對博覽會和交易會的舉辦產生負面影響,並影響市場現有企業中該地區小企業的營銷和銷售規範。

垂直升降模塊 (VLM) 行業概覽

Kardex Group、Hanel Storage Systems、Ferretto Group S.p.A.、Modula Inc. 和 Schaefer Systems International 等公司主導著垂直升降模塊 (VLM) 市場。 這些市場份額巨大的巨頭專注於擴大其在其他國家/地區的客戶群,並利用戰略合作計劃來提高市場份額和盈利能力。 然而,隨著技術進步和產品創新,中小企業通過獲得新合同和開發新市場的方式增加了市場佔有率。

貿澤電子是一家行業領先的新產品導入 (NPI) 分銷商,提供多種半導體和電子元件,宣布將於 2022 年 2 月在全球各地的配送中心採用最先進的自動化技術世界。繼續投資。 這樣做是為了幫助加快訂單處理速度、提高準確性並縮短客戶的上市時間。 該技術歷史上最大的 VLM 安裝將在 Mouser 進行,將安裝 120 個垂直升降模塊 (VLM)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 產業吸引力 - 波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 工業價值鏈分析

- COVID-19 對垂直升降模塊市場影響的評估

第 5 章市場動態

- 市場驅動因素

- 隨著佔地面積的縮小,增加了對倉庫所有者的僱用

- 與傳統存儲和檢索系統相比具有巨大優勢

- 市場挑戰

- 對能源消耗和巨額基礎設施成本的擔憂日益增加

第 6 章市場細分

- 按最終用戶行業

- 金屬/機械

- 汽車

- 電氣/電子

- 零售/倉庫/配送中心/物流中心

- 生命科學

- 食物和飲料

- 其他最終用戶行業

- 區域信息

- 北美

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美

第七章競爭格局

- 公司簡介

- Kardex Group

- Hanel Storage Systems

- Ferretto Group S.p.a

- AutoCrib, Inc.

- Modula Inc.(System Logistics)

- Weland Lagersystem AB

- Schaefer Systems International Inc.

- Automha SPA

- Green Automated Solutions, Inc

- Stanley Black & Decker Storage Solutions

第八章投資分析

第九章市場機會與未來趨勢

The vertical lift module (VLM) market is expected to register a CAGR of 8% over the forecast period. Because of Industry 4.0, factories and warehouses are now more likely to use automated solutions.

Key Highlights

- Vertical lift modules form a significant part of the solution due to the shifted focus on smart intralogistics. Intralogistics experienced significant disruption over the past decade due to changes in end markets as preferences evolved from using VLMs as a mere space management tool to deriving operational benefits from connected solutions. This is one of the significant factors that is driving the market.

- Further, another major factor that is driving the market is the stringent government regulations for increasing workplace safety. The Occupational Safety and Health Act, in its updated standards, has also mandated safety fall protection for employees, regardless of the fall distance. Hence, the safety of the workplace, which deals with the prevention of any injury or incident, becomes critical, thereby increasing the adoption of a vertical lift module (VLM).

- Also, more retailers are using small-format distribution centers in areas with a lot of people. This means that square footage is limited and expensive, and the need for flexible, scalable, automated VLMs that can handle high volumes in small spaces is expected to grow and drive the retail market.

- However, on the flip side, the high cost of the vertical lift module (VLM) and the high maintenance associated with them are a few factors that are restraining the market's growth in the forecasted period.

- COVID-19 was expected to contribute to market growth in the future. This was due to the focus on automation in industries such as automotive, food and beverage, and logistics, so as to maintain social distancing and stress worker safety.

Vertical Lift Module (VLM) Market Trends

Food and Beverage Sector is Expected to Grow Significantly

A significant number of food and beverage companies are tormented by older carousels to facilitate picking, which are now being replaced with vertical lift modules (VLMs). These systems have greatly increased the cube utilization of facilities by allowing these companies to run seamlessly within space constraints.

- Since the industry has huge inventories, the VLMs are made with ergonomic designs and trays that can hold more than 1,000 pounds each. The overall heights of the VLMs range from 15 feet to 75 feet.

- Also, vertical lift modules (VLMs) must be used to keep workers from getting hurt, which is important for worker safety.As a result of the "Made in China 2025" strategy, China is likely to have a lot more factories that use automation by 2025.It fuels the nation's vertical lift module (VLM) business. Continuous investments made by businesses in their logistics divisions have a significant impact on the growth of the vertical lift module market.

- Due to the pandemic, there has been the worst labor shortage globally. Strict regulations and COVID-19 guidelines and protocols to follow have created a huge gap in supply and demand for labor in the food and beverage industry. Therefore, many organizations are also looking for cost-cutting methods, such as lower wages and layoffs, considering the global scenario. Many organizations are thus looking to upgrade their warehouses with solutions like VLM to be more efficient; however, the high cost of solutions, fluctuating global economies, and uncertainty in the business hamper the application of such solutions.

- Edge by Ascential, a top provider of e-commerce services, says that over the next few years, the digital sector is likely to grow, even though physical stores are still the most common way to sell food. It is expected that online sales in this sector will grow from 174 billion US dollars in 2021 to more than 275 billion US dollars in 2026. E-commerce is anticipated to represent around 7.6% of total grocery sales globally that year.

Asia-Pacific is Expected to Experience Significant Growth

- Asia-Pacific is expected to grow the most quickly because it is home to China, the world's biggest manufacturing hub and biggest exporter. Automation in China is expected to cut costs by 30% by 2025, and also, by virtue of the 'Made in China 2025' initiative, manufacturing units are expected to increase rapidly in the country. This factor drives the market for the vertical lift module (VLM) in the country.

- Additionally, another fastest-growing economy in the world is India. With India's ambitious plan of 'Make in India," manufacturing and its consequential distribution and logistics activities are expected to witness exponential growth.

- India is also the second-most populous nation in the world, and consumption dominates its economy.Based on the most recent data from the United Nations, India has a population of 1,423,061,201 people.The UN estimates the July 1, 2023 population at 1,428,627,663. Additionally, according to the Economic Survey 2023, India, the nation will grow at a rapid rate of 6 to 6.8% in FY 2024.

- India is also making strides in its logistics and warehouse capabilities, and there are a number of projects, such as the DDF (Dedicated Freight Corridor) Sagar Mala Project, dedicated to e-commerce, logistics, and warehouse operations. India has a total of 11 major ports and 168 smaller or intermediate ports. This makes it possible for a lot of cargo to move along the Indian coast from the islands. This will also require a huge network of warehouses and storage units, making the studied market in the region and during the studied time period a huge market.

- So, the above factors should make the vertical lift module (VLM) in the Asia-Pacific region look good during the forecast period.

Also, to stop the COVID-19 coronavirus from spreading, almost every company was putting in place social distance, safety standards, and protocols to make sure warehouse and factory workers were safe. This got a lot of attention. Thus, organizations were reevaluating their operations in facilities with a lower workforce. The outbreak negatively impacted the hosting of expos and trade shows and was expected to affect the marketing and sales specifics of smaller regional players amid the market incumbents.

Vertical Lift Module (VLM) Industry Overview

Companies like Kardex Group, Hanel Storage Systems, Ferretto Group S.p.A., Modula Inc., and Schaefer Systems International dominate the vertical lift module (VLM) market.With a big share of the market, these big players are focusing on growing their customer base in other countries.These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, midsize to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Mouser Electronics, Inc., which has the largest selection of semiconductors and electronic components and is the top distributor for new product introductions (NPIs) in the industry, continued to invest in cutting-edge automation in its global distribution center in February 2022. This was done to speed up order processing, improve accuracy, and help clients shorten their time-to-market. The largest VLM installation in the history of the technology will be at Mouser, where 120 vertical lift modules (VLMs) will be placed.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Vertical Lift Module Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption among Warehouse Owners due to Reduced Floor Space

- 5.1.2 Significant Advantage over Traditional Storage and Retrieval Systems

- 5.2 Market Challenges

- 5.2.1 Increasing Energy Consumption Concerns and Huge Infrastructural Costs

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Metal and Machinery

- 6.1.2 Automotive

- 6.1.3 Electrical and Electronics

- 6.1.4 Retail/Warehousing/DistributionCenter/Logistics Center

- 6.1.5 Life Sciences

- 6.1.6 Food and Beverage

- 6.1.7 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 South Korea

- 6.2.3.4 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kardex Group

- 7.1.2 Hanel Storage Systems

- 7.1.3 Ferretto Group S.p.a

- 7.1.4 AutoCrib, Inc.

- 7.1.5 Modula Inc.(System Logistics)

- 7.1.6 Weland Lagersystem AB

- 7.1.7 Schaefer Systems International Inc.

- 7.1.8 Automha SPA

- 7.1.9 Green Automated Solutions, Inc

- 7.1.10 Stanley Black & Decker Storage Solutions