|

市場調查報告書

商品編碼

1406282

嵌入式SIM (eSIM) -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Embedded SIM (eSIM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

本會計年度嵌入式SIM(eSIM)市場規模預估為77.1億美元,複合年成長率為7.05%,預估五年內將達117.1億美元。

eSIM 是一種小型可編程晶片,直接嵌入到智慧型手機、平板電腦、穿戴式裝置和其他物聯網裝置等裝置中,無需實體 SIM 卡即可進行遠端 SIM 配置。

主要亮點

- 物聯網 (IoT) 是 eSIM 採用的關鍵驅動力之一。 eSIM 為全球部署和管理物聯網設備提供了可擴展的解決方案。

- 連網型和 M2M(機器對機器)生態系統的進步是市場成長的關鍵驅動力。 5G 網路的發展也為 eSIM 的採用創造了新的機會。企業已採用 eSIM 進行 M2M 部署,例如資產追蹤、智慧計量、工業監控和供應鏈管理。

- 對智慧型設備不斷成長的需求是增加 eSIM 技術採用的關鍵促進因素之一。智慧型設備,包括智慧型手機、平板電腦、穿戴式裝置、聯網汽車和各種物聯網 (IoT) 設備,在消費和工業應用中變得越來越普及。

- 安全和互通性標準化問題正在限制市場成長。傳統的 SIM 卡需要實體存取才能竄改或更換 SIM 卡,這使得惡意行為者更難破壞連線。然而,由於 eSIM 直接焊接到設備的電路上,因此未授權存取和克隆的可能性可能會帶來重大的安全風險。

- COVID-19 大流行迫使組織迅速適應遠距工作和數位解決方案。這導致人們越來越依賴連網型設備和物聯網技術,而 eSIM 已成為實現安全、無縫連接的關鍵。

嵌入式SIM (eSIM) 市場趨勢

智慧型手機應用領域預計將佔據主要市場佔有率

- eSIM不需要實體SIM卡,使用戶更容易啟動和切換行動電話。 eSIM 允許用戶遠端為設備配置新的營運商配置文件,而無需獲取或等待實體 SIM 卡的麻煩。

- eSIM 技術使得雙 SIM 卡功能在智慧型手機中得以採用。結合eSIM實體卡插槽,使用者可以在同一裝置上擁有兩個有效的電話號碼,這對於旅客、商務人士和擁有多個行動電話合約的人尤其有用。

- 對於行動網路營運商來說,eSIM 技術在獲取新客戶方面提供了更大的彈性。行動網路業者無需透過零售通路分發實體 SIM 卡,而是可以遠端配置 eSIM,從而簡化啟動過程並降低分發成本。

- eSIM 在實現物聯網設備連接方面發揮關鍵作用。智慧型手機是各種物聯網應用的閘道器,而 eSIM 技術提供了一種安全且高效的方式將物聯網設備連接到蜂巢式網路。

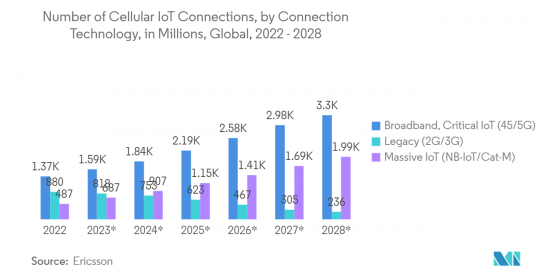

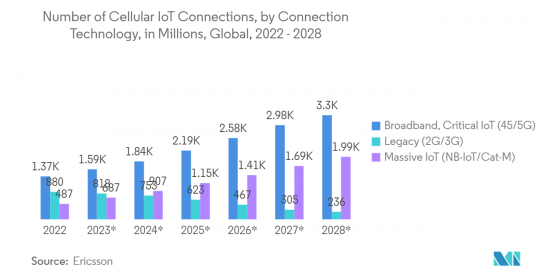

- 5G 網路的持續發展和物聯網設備的普及預計將進一步增加 eSIM 與智慧型手機和其他連網裝置的整合。根據愛立信預測,到 2022 年,全球重要的物聯網和寬頻蜂巢式物聯網連接數量將約為 15 億。五年內,此類蜂巢式物聯網連接數量將每年持續穩定成長,達到33億。

預計北美將佔據較大市場佔有率

- 在北美,物聯網設備在各個行業的採用正在迅速增加,包括醫療保健、汽車、智慧家庭和工業應用。 eSIM 技術在為這些設備提供無縫連接方面發揮關鍵作用,並正在推動 eSIM 市場的成長。

- 製造商正在將 eSIM 技術整合到許多設備中,包括智慧型手機、平板電腦、穿戴式裝置和物聯網設備。隨著越來越多的設備相容於 eSIM,對 eSIM 服務的需求預計將會增加。

- 隨著北美 5G 網路部署的加速,eSIM 技術透過提供無縫連接並允許消費者輕鬆切換通訊業者和套餐來補充 5G 網路功能。據Cisco稱,到 2022 年,穿戴式裝置將成為北美擁有最多 5G 連接的裝置。北美地區的 4.39 億連線數比 2017 年 4G 網路連線數多了 2.22 億。

- eSIM 在該地區將變得更加便宜,與安全國際漫遊解決方案相關的計劃將顯著促進該地區 eSIM 的採用。支援eSIM的行動電話允許用戶從多個國家或漫遊計劃中進行選擇,而多國營運商的行動解決方案往往比美國的行動解決方案貴得多。用戶出國旅行時,可以選擇電信商的漫遊套餐。 eSIM 允許用戶掃描2D碼或從設備選單中選擇新的通訊業者,從而更輕鬆地更改通訊業者和漫遊。

- 2022 年 12 月,頂級消費科技訂閱供應商之一 Grover 宣布推出 Grover Connect,這是一家針對美國科技租賃客戶的 MVNO。該國的客戶可以使用 Grover Connect 快速啟動其支援 eSIM 的技術設備。 Grover 也與全球領先的電信即服務平台之一 Giggs 合作,推出了這項創新服務,使任何公司或品牌都可以成為 MVNO。客戶可以在美國結帳時購買 Grover eSIM,很快就會在歐洲上市。

嵌入式SIM (eSIM) 產業概述

嵌入式SIM (eSIM) 市場較為分散,主要企業包括 Gemalto NV(泰雷茲集團)、Giesecke+Devrient GmbH、STMicroElectronics NV、Infineon Technologies AG 和 Valid SA。市場參與者正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

>2023 年 6 月,國際商業分析研究所宣佈了 ChatGPT 學習之旅,這是一系列生成式人工智慧課程中的第一門,旨在為組織和工人提供高效和合乎道德地使用技術所需的技能。 在此之前,Skillsoft 一直在努力幫助組織瞭解和利用人工智慧的潛力來推動業務增長,並對 AI 平台進行了改進

2022 年 11 月,義法半導體與泰雷茲合作,為 Google Pixel 7 提供安全、非接觸式體驗。 ST54K 單晶片 NFC 控制器和安全元件與泰雷茲安全作業系統結合,可在嵌入式SIM、交通票務和數位汽車鑰匙應用中提供卓越的效能。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業相關人員分析營運商、OEM、系統整合商

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對連結產業的影響

- e-SIM 相容設備的全球出貨覆蓋範圍

第5章市場動態

第6章 市場促進因素

- 連網型與M2M生態系領域的進展

- 智慧型設備需求不斷成長

- 與傳統替代方案相比,eSIM 更易於使用和訪問

第7章 市場問題 市場問題

- 安全性、互通性標準化問題

第8章市場機會

- 對 M2M普及的極為正面的預測

第9章 全球SIM卡形勢分析(出貨貨量/地區分佈)

第10章市場區隔

- 依用途

- 智慧型手機

- 平板電腦和筆記型電腦

- 穿戴式的

- M2M(工業、汽車等)

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 韓國

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第11章競爭形勢

- 公司簡介

- Gemalto NV(Thales Group)

- Giesecke+Devrient GmbH

- STMicroelectronics NV

- Infineon Technologies AG

- Valid SA

- Idemia(Advent International Corp)

- Workz Group

- Truphone Limited

- Gigsky, Inc.

- ARM Limited

第12章供應商定位分析

第13章市場展望 市場展望

The Embedded SIM (eSIM) Market was valued at USD 7.71 billion in the current year and is expected to register a CAGR of 7.05%, reaching USD 11.71 billion in five years. An eSIM is a small, programmable chip embedded directly into devices, such as smartphones, tablets, wearable devices, and other IoT devices, allowing remote SIM provisioning without needing a physical SIM card.

Key Highlights

- The Internet of Things (IoT) was one of the key drivers for eSIM adoption. As the number of connected devices increased, managing physical SIM cards for each device became impartial. eSIM provided a scalable solution for deploying and managing IoT devices globally.

- Advancements in the connected and M2M (machine-to-machine) ecosystem were key drivers in the market's growth. The growth of the 5G network also creates new opportunities for eSIM adoption. Enterprises embraced eSIM for their M2M deployments, such as asset tracking, smart meters, industrial monitoring, and supply chain management.

- The growing demand for smart devices was one of the key drivers that increased the adoption of eSIM technology. Smart devices, including smartphones, tablets, wearables, connected cars, and various Internet of Things (IoT) devices, have become more prevalent in consumer and industrial applications.

- Security and interoperability standardization issues are restraining the market growth. With traditional SIM cards, physical access is required to tamper with or replace the SIM, making it more difficult for malicious actors to compromise the connection. However, as eSIM is soldered directly onto the device's circuitry, the potential for unauthorized access or cloning could be a significant security risk.

- The COVID-19 pandemic forced organizations to adapt rapidly to remote work and digital solutions. This increased reliance on connected devices and IoT technologies, where eSIM is vital in enabling secure and seamless connectivity.

Embedded SIM (eSIM) Market Trends

Smartphones Application Segment is Expected to Hold Significant Market Share

- eSIM technology has been increasingly integrated into smartphones, bringing numerous benefits to consumers and mobile network operators (MNOs). eSIM eliminates the need for physical SIM cards, allowing users to activate and switch between mobile carriers more easily. With eSIMs, users can remotely provision their devices with a new carrier's profile without the hassle of acquiring a physical SIM card and waiting for it to be delivered.

- eSIM technology has enabled the adoption of dual-SIM functionality in smartphones. With a combination of eSIM physical card slots, users can have two active phone numbers on the same devices, which is especially useful for travelers, business professionals, or people with multiple cellular subscriptions.

- For mobile network operators, eSIM technology offers greater flexibility in onboarding new customers. Instead of distributing physical SIM cards through retail channels, MNOs can remotely provision eSIMs, simplifying the activation process and reducing distribution costs.

- eSIM plays a significant role in enabling connectivity for IoT devices. Smartphones are a gateway for various IoT applications, and eSIM technology provides a secure and efficient way to connect IoT devices to cellular networks.

- The ongoing development of 5G networks and the proliferation of IoT devices are expected to further the integration of eSIM in smartphones and other connected devices. According to Ericsson, the number of cellular IoT connections with critical IoT and broadband globally in 2022 was approximately 1.5 billion. In five years, the forecast is that the number of cellular IoT connections with the same connection type will continue to rise steadily each year, up to 3.3 billion.

North America is Expected to Hold Significant Market Share

- North America has witnessed a rapid rise in the adoption of IoT devices across various industries, including healthcare, automotive, smart home, and industrial applications. eSIM technology plays a crucial role in providing seamless connectivity for these devices, driving the growth of the eSIM market.

- Manufacturers have incorporated eSIM technology into many devices, including smartphones, tablets, wearables, and IoT devices. As more devices become eSIM-enabled, the demand for eSIM services is expected to rise.

- The deployment of 5G networks in North America has been gaining momentum. eSIM technology complements the capabilities of the 5G network by providing seamless connectivity and making it easier for consumers to switch between carriers and plans. According to Cisco Systems, North America will have the most 5G connections made using wearable devices in 2022. The 439 million connections in North America would be 222 million more than those made to 4G networks in 2017.

- The plans related to eSIM becoming significantly cheap in the region and a secure international roaming solution considerably drive the adoption of eSIM in the region. On phones with eSIM support, the user can select from several individual countries or roaming plans, where the multi-country operators tend to be significantly more expensive than US Mobile's solution. If the user is traveling abroad, he can select the carrier's roaming plan. The user can also buy a local SIM card or a multi-country travel SIM card like KnowRoaming, which is the most expensive. eSIM lets the user scan a QR code or pick a new carrier from an on-device menu, making it much easier to switch carriers or roam.

- In December 2022, Grover, one of the top subscription providers for consumer technology, unveiled Grover Connect, an MVNO for clients renting technology in the United States. The country clients can quickly activate any eSIM-enabled technology gadget using Grover Connect. Also, Grover partnered with Gigs, one of the global leaders in telecom-as-a-service platforms in the world that enables any business or brand to become an MVNO, to introduce this innovative new offering. Customers can purchase a Grover eSIM at checkout in the United States, which will soon be available in its European regions.

Embedded SIM (eSIM) Industry Overview

The embedded SIM (eSIM) market is fragmented, with the presence of major players like Gemalto N.V. (Thales Group), Giesecke+Devrient GmbH, STMicroelectronics N.V., Infineon Technologies AG, and Valid S.A. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In February 2023, Giesecke+Devrient (G+D) and its partner NetLync launched AirOn360 ES, enabling Mobile Network Operators to deploy Entitlements, including the seamless SIM transfer on iPhone from physical SIM card or eSIM, allowing mobile operators to offer convenient services such as simplified and digital activation processes, synchronization of all devices, or (e)SIM transfers. For users, eSIM allows them to easily connect or quickly transfer their existing plans digitally and provides for multiple cellular plans on a single device.

In November 2022, STMicroelectronics collaborated with Thales, which powers secure, contactless convenience in Google Pixel 7. The ST54K single-chip NFC controller and secure element combine with Thales secure OS for superior performance in embedded SIM, transit ticketing, and digital car-key applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis Operator, OEM & System Integrators

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Connectivity Landscape

- 4.5 Coverage on e-SIM Enabled Device Shipments Globally

5 MARKET DYNAMICS

6 Market Drivers

- 6.1 Advancements in the Field of Connected & M2M Ecosystem

- 6.2 Growing Demand for Smart Devices

- 6.3 Ease of Use and Access Provided by eSIM over Traditional Substitutes

7 Market Challenges

- 7.1 Security, Interoperability Standardization Issues

8 Market Opportunities

- 8.1 Highly Positive Forecasts for M2M Adoption

9 GLOBAL SIM CARD LANDSCAPE ANALYSIS (SHIPMENTS & REGIONAL BREAKDOWN)

10 MARKET SEGMENTATION

- 10.1 By Application

- 10.1.1 Smartphones

- 10.1.2 Tablets & Laptops

- 10.1.3 Wearables

- 10.1.4 M2M (Industrial, Automotive, etc.)

- 10.2 By Geography

- 10.2.1 North America

- 10.2.1.1 United States

- 10.2.1.2 Canada

- 10.2.2 Europe

- 10.2.2.1 United Kingdom

- 10.2.2.2 Germany

- 10.2.2.3 France

- 10.2.2.4 Rest of Europe

- 10.2.3 Asia-Pacific

- 10.2.3.1 China

- 10.2.3.2 South Korea

- 10.2.3.3 Japan

- 10.2.3.4 Rest of Asia-Pacific

- 10.2.4 Latin America

- 10.2.5 Middle East and Africa

- 10.2.1 North America

11 COMPETITIVE LANDSCAPE

- 11.1 Company Profiles*

- 11.1.1 Gemalto N.V. (Thales Group)

- 11.1.2 Giesecke+Devrient GmbH

- 11.1.3 STMicroelectronics N.V.

- 11.1.4 Infineon Technologies AG

- 11.1.5 Valid S.A.

- 11.1.6 Idemia (Advent International Corp)

- 11.1.7 Workz Group

- 11.1.8 Truphone Limited

- 11.1.9 Gigsky, Inc.

- 11.1.10 ARM Limited