|

市場調查報告書

商品編碼

1435962

資料恢復力:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Data Resiliency - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

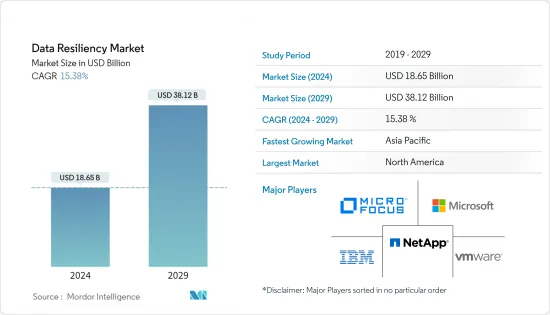

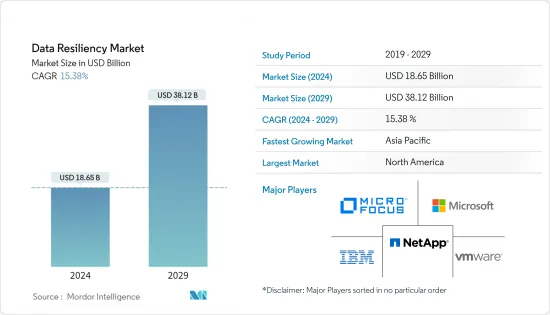

資料恢復力市場規模預計到 2024 年為 186.5 億美元,預計到 2029 年將達到 381.2 億美元,預測期內(2024-2029 年)複合年成長率為 15.38%。

隨著已開發國家和新興國家的網路普及迅速提高,資料漏洞不斷增加,這主要是由於所有行動裝置無線網路的擴展。因此,資料恢復力有望成為世界上每個組織的重要組成部分。

主要亮點

- 去年,網路攻擊的數量激增。這迫使企業將安全放在首位。服務供應商現在正在竭盡全力保護客戶的服務基礎設施。重要的是,該解決方案不僅實現了安全解決方案,而且還具有防禦所有類型攻擊並快速恢復的能力。

- 世界各地的企業和政府機構正在從測試環境轉向將許多業務關鍵型工作負載和運算實例放置在雲端。此外,作為數位轉型策略的關鍵部分,物聯網、雲端和巨量資料分析在多個組織中的迅速採用也增加了資料中心的壓力,從而促使市場成長。

- 根據 Datrium Inc. 的報告《2019 年企業資料恢復力與災難災害復原狀況》,超過 50% 的受訪者表示他們的組織曾回答經歷過災難復原事件。此外,89% 的 IT 領導者表示勒索軟體是其組織資料安全的主要威脅。 IT 領導者也表示,他們對此最大的擔憂是生產力下降 (74%) 以及在這種情況下無法經營業務 (65%)。

- 無論是本地、公有、私有或混合模式,轉向多重雲端架構都變得越來越普遍。 Teradici Corporation 的一項研究表明,目前超過一半的 IT 專業人員在多重雲端環境中業務,近十分之一的人在其組織內使用五個或更多雲。

- 世界各地的許多公司現在都專注於管理冠狀病毒大流行的影響,並正在尋找更新、更強大的做法,以確保在當前和未來發生破壞性事件時的業務彈性。 主動的業務連續性和彈性戰略已成為實現數位業務的關鍵。 這主要涉及在基礎架構中構建強大的彈性,同時減少停機時間和相關成本。

資料恢復力市場趨勢

BFSI 區隔市場預計將大幅成長

- 由於龐大的客戶群和金融資訊受到威脅,金融業是遭受多次資料外洩和網路攻擊的重要產業之一。

- 資料外洩會導致成本飆升和有價值的客戶資訊遺失。根據 Verizon 發布的 2019 年資料外洩調查報告,金融服務和保險領域的所有網路事件中有 88% 是出於經濟動機。網路攻擊者尋求以最簡單的方式獲取經濟利益,攻擊金融服務業。

- 為了保護IT流程和系統、保護客戶的關鍵數據並遵守政府法規,私人和公共銀行機構都專注於部署最新技術來防止這些攻擊並更快地恢復。 此外,不斷提高的客戶期望、不斷提高的技術能力和監管要求迫使銀行採取積極主動的安全方法。

- 此外,最近的冠狀病毒爆發影響了世界各地的金融市場和機構。在這樣的時期,BFSI 部門需要製定緊急時應對計畫來應對這場流行病帶來的所有威脅,這預計將增加該行業對資料復原解決方案的需求。

預計北美將佔據重要市場佔有率

- 北美地區已成為全球所有主要組織的主要樞紐。多個行業的擴張和連網型設備的快速成長正在推動該地區對彈性解決方案的需求。

- 此類攻擊的風險增加,可能影響從個人到企業再到政府的市場。因此,保護敏感資料在該地區變得非常重要。據白宮經濟顧問委員會稱,有害網路活動每年給美國經濟造成約 570 億美元至 1,090 億美元的損失。

- 就在 2019 年 10 月,該國 DCH Health Systems 營運的三家醫療服務提供者遭到名為 Ryuk 的勒索軟體攻擊。所有這些醫療中心都已實施緊急程序以確保患者安全,該公司正在努力診斷攻擊。預計該國所有行業的此類網路攻擊都會增加,這可能會增加市場對彈性解決方案的需求。

- 此外,2020 年 3 月,為彈性企業提供安全多重雲端資料平台的供應商 Datrium 宣佈在資料恢復力和耐用性、伺服器重複資料刪除、增強儲存效能、加密方面取得進步,並宣布已獲得五項新的美國專利為了安全。壓縮和資料路徑監控提高了網路彈性。

資料恢復力產業概述

資料恢復力市場競爭非常激烈,因為市場上有多家供應商為國內和國際市場提供服務。該市場似乎適度集中,參與者採取產品創新、併購和策略合作夥伴關係等策略來擴大影響力並保持市場競爭力。市場參與者包括 IBM 公司、微軟公司和 NetApp 公司。

- 2020 年 6 月 - 全球領先的跨雲端和本地環境資料管理企業軟體供應商 Commvault 宣布與 Microsoft 達成一項多年協議,以整合上市、工程和服務。使用 Microsoft Azure 銷售該公司的 Metallic 軟體即服務 (SaaS)資料保護產品組合。它主要透過簡單的 SaaS 管理提供規模和可靠的安全性。

- 2020 年 6 月 - 網路保護公司 Acronis 宣布與亞太地區領先的網路安全經銷商之一 ACE Pacific Group 建立多年合作夥伴關係。此次合作主要是透過 ACE Pacific Group 廣泛的銷售管道提供對 Acronis 網路保護解決方案的全面存取。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 多個來源產生的資料快速成長

- 日益成長的隱私問題和日益成長的資料安全需求

- 市場限制因素

- 開放原始碼方案的可用性

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

第5章市場區隔

- 依發展

- 本地

- 雲

- 依最終用戶/行業

- BFSI

- 資訊科技和通訊

- 政府

- 製造業

- 衛生保健

- 其他最終用戶

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- Acronis International GmbH

- Asigra Inc.

- Carbonite, Inc.(OpenText Corporation)

- CenturyLink, Inc.

- Commvault Systems, Inc.

- IBM Corporation

- Microsoft Corporation

- NetApp, Inc.

- Veritas Technologies LLC

- VMware, Inc.(Dell Technologies Inc.)

- Micro Focus International plc

第7章 投資分析

第8章市場機會及未來趨勢

The Data Resiliency Market size is estimated at USD 18.65 billion in 2024, and is expected to reach USD 38.12 billion by 2029, growing at a CAGR of 15.38% during the forecast period (2024-2029).

With the rapidly increasing penetration of the internet among developed and developing countries, also the expanding wireless network for all the mobile devices has primarily increased the vulnerability of data, which is expected to make data resiliency an essential and integral part of every single organization across the globe.

Key Highlights

- The previous year has seen a rapid increase in the number of cyberattacks. This has forced companies to adopt security-first thinking. The service providers are now putting much more effort in order to secure the service infrastructure of their clients. The solutions are not only about having a security solution in place but also the ability to defend and recover fast against any type of attack.

- Enterprises and government organizations across the globe are moving from test environments to placing more of their work-critical workloads and compute instances into the cloud. Further, owing to the rapidly increasing adoption of IoT, cloud, and big data analytics across multiple organizations as a major part of their digital transformation strategy, the burden on the data centers is also increasing leading to the growth of the market.

- According to Datrium Inc. report, 'The State of Enterprise Data Resiliency and Disaster Recovery 2019, more than 50% of the respondents indicated that their organization experienced a DR event in the past 24 months. Moroever, 89% of the IT leaders reported that ransomware is the major threat to organizations' data security. The IT leaders also expressed that their top concerns regarding this was the loss of productivity (74%) and the inability to operate their businesses (65%) under these circumstances.

- Whether on-premise, public, private, or a hybrid model, the move towards a multi-cloud architecture is increasingly becoming popular. A research from Teradici Corporation has revealed that more than half of the IT professionals are currently operating in a multi-cloud environment, with almost one in every ten using five or more clouds within their organizations.

- Various enterprises across the globe are currently focused on managing the impact of the coronavirus pandemic and are looking at newer and robust practices in order to help ensure their business resiliency now and during any other future disruptive events. A proactive business continuity and resiliency strategy is becoming very crucial to enable digital businesses, which primarily requires building a robust resiliency into the infrastructure, while reducing downtime and associated costs.

Data Resiliency Market Trends

BFSI Segment is Expected to Witness Significant Growth

- The financial industry has been one of the critical sectors that suffer several data breaches and cyber-attacks, owing to the large customer base that the industry serves and the financial information that is at stake.

- Data breaches lead to an exponential rise in costs and loss of valuable customer information. According to the data breach investigations report, 2019, released by Verizon, 88 percent of all cyber incidents in the financial services and insurance sector were done with financial motivation. Cyber attackers in pursuit of the easiest path possible to financial gain attack the financial services industry.

- With an aim to secure their IT processes and systems, secure customer critical data, and comply with government regulations, both private and public banking institutes are focused on implementing the latest technology to prevent these attacks and recover faster. Additionally, with greater customer expectation, growing technological capabilities, and regulatory requirements, banking institutions are pushed to adopt a proactive approach to security.

- Moreover, the recent coronavirus outbreak has affected the financial markets and institutions across the globe. In these times, the BFSI sector's must have contingency plans put in place in order to meet all the threats that is being posed posed by this pandemic, which is expected to drive the demand for data resiliency solutions in the industry.

North America is Expected to Hold a Significant Market Share

- The North American region has been a primary hub for all the major organizations across the globe. The expansion of the multiple industries and the rapid growth of connected devices is driving the demand for resiliency solutions in the region.

- The rising risks of such attacks that can impact the market vary from individuals to corporates to the governments. Thus, securing crucial data has become very crucial in the region. According to the White House Council of Economic Advisers, the United States economy loses approximately USD 57 billion to USD 109 billion per year to harmful cyber activity.

- Recently in October 2019, the three healthcare providers operated by DCH Health Systems in the country were attacked by ransomware strain known as Ryuk. All these healthcare centers have implemented emergency procedures to ensure the safety of their patients, and the company is working on the attack diagnosis. Such cyber-attacks are expected to increase in the country across the domains, which may fuel the demand for resiliency solutions in the market.

- Moreover, in Mar 2020, Datrium, a provider of the secure multicloud data platform for the resilient enterprise, announced it has been awarded with five new US patents for data resiliency and durability, advancements in server-powered deduplication, enhanced storage performance, encryption and compression, and data path monitoring for improved network resilience.

Data Resiliency Industry Overview

The Data Resiliency Market is highly competitive owing to the presence of multiple vendors in the market providing services to domestic and international markets. The market appears to be moderately concentrated with players adopting strategies such as product innovation, mergers, and acquisitions, strategic partnerships in order to expand their reach and stay competitive in the market. Some of the players in the market are IBM Corporation, Microsoft Corporation, NetApp, Inc., among others.

- Jun 2020 - Commvault, a prominent global enterprise software provider in the management of data across the cloud and on-premise environments, announced that it has entered into a multi-year agreement with Microsoft that will integrate the go-to-market, engineering and sales of the company's Metallic Software-as-a-Service (SaaS) data protection portfolio with Microsoft Azure, primarily delivering scale and trusted security with simple SaaS management.

- Jun 2020 - Acronis, a player in the cyber protection domain, announced the signing of a multiyear partnership with ACE Pacific Group, which is one of the APAC region's cybersecurity distributors. The partnership will primarily enable the full access to Acronis' cyber protection solutions across the ACE Pacific Group's wide distribution channels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Growth in Data being Generated from Multiple Sources

- 4.2.2 Increasing Privacy Concerns and Rising Need for Data Security

- 4.3 Market Restraints

- 4.3.1 Availability of open-source alternatives

- 4.4 Porters 5 Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By End-user Vertical

- 5.2.1 BFSI

- 5.2.2 IT & Telecommunication

- 5.2.3 Government

- 5.2.4 Manufacturing

- 5.2.5 Healthcare

- 5.2.6 Other End-user Vertical

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Acronis International GmbH

- 6.1.2 Asigra Inc.

- 6.1.3 Carbonite, Inc. (OpenText Corporation)

- 6.1.4 CenturyLink, Inc.

- 6.1.5 Commvault Systems, Inc.

- 6.1.6 IBM Corporation

- 6.1.7 Microsoft Corporation

- 6.1.8 NetApp, Inc.

- 6.1.9 Veritas Technologies LLC

- 6.1.10 VMware, Inc. (Dell Technologies Inc.)

- 6.1.11 Micro Focus International plc