|

市場調查報告書

商品編碼

1406279

美術館/博物館照明:市場佔有率分析、行業趨勢和統計、2024-2029 年成長預測Art & Museum Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

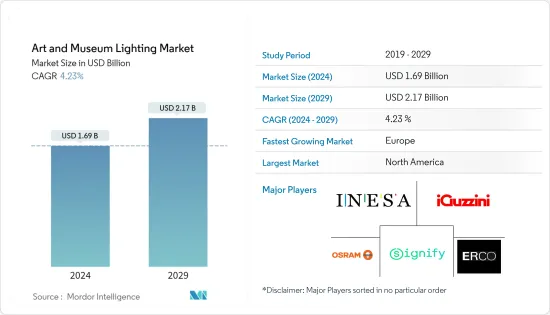

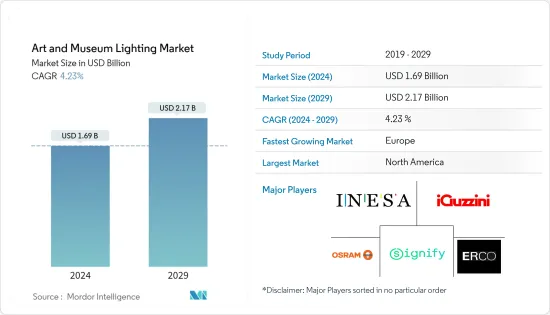

預計2024年美術館/博物館照明市場規模為16.9億美元,2029年達到21.7億美元,在市場預測期間(2024-2029年)複合年成長率為4.23%,預計將會成長。

在博物館照明設計中,環境、任務、焦點和裝飾都是有助於空間整體美感的層次。環境層是指房間內的一般照明。這種類型的照明允許人們在空間中移動,並且明顯低於工作燈的水平。世界各地不斷成長的城市人口正在引起人們對負擔得起的能源供應的安全、溫室氣體排放、氣候變遷和生物多樣性喪失等環境影響的擔憂,促使高效照明不僅在住宅中而且在城市商業中越來越多被採用建築物。

主要亮點

- 美術館和博物館內對電氣照明系統的改造和維修的投資不斷增加,以在節能和持續降低維護成本方面實現顯著的成本節省,並增加佔用率和用戶需求。對具有智慧控制的照明系統的需求不斷增加能夠回應偏好的系統是推動美術館/博物館照明市場成長的主要因素。

- 博物館和美術館消耗大量能源來維持保護和保存其收藏的內部環境。根據Arup的報告,展覽室和後台照明可佔能源消費量的20%,為了降低成本,大多數博物館都在使用高效的照明設備。

- 在博物館照明系統中使用LED燈LED燈的另一個優點是,它們投射的光包含很少的紅外線輻射,幾乎不含紫外線輻射。它無需使用過濾器來保護易碎藝術品免受紅外線和紫外線的影響,從而改善參觀者的視覺體驗。

- 曼徹斯特博物館進行的一項研究也顯示,博物館的照明系統佔能源消耗總成本的 50%。博物館用LED燈取代了螢光管,並在博物館的照明燈具中安裝了運動感測器,減少了約 89% 的功耗。

- 此外,藝廊和博物館面臨的最重要課題之一是在節能與藝術家期望的展覽照明品質之間取得平衡。在大多數情況下,顯著節能的誘惑有時是以較差的照明品質為代價的。這就是為什麼大多數新興市場供應商提供全面的照明設計服務,從最初的策略建議和概念開拓到施工文件和現場支援。

- 此外,俄羅斯和烏克蘭之間的衝突可能會造成額外的干擾並影響半導體供應鏈,導致電子設備價格進一步上漲。總體而言,衝突對電子產業的影響預計將是重大的。這將阻礙智慧照明產品的生產。

美術館/博物館照明市場趨勢

LED 領域可望推動市場成長

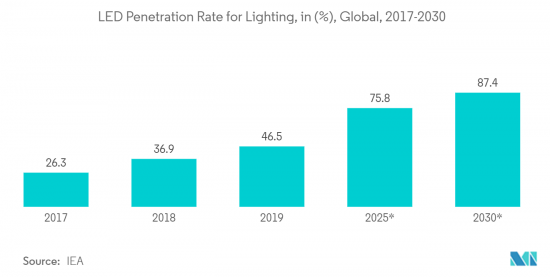

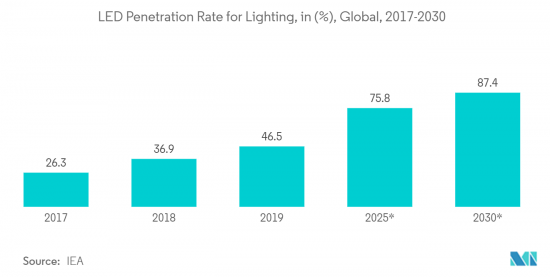

- 博物館和美術館的照明非常重要。光線可以吸引人們對作品的注意力,同時防止對作品本身的損壞。這兩個要求經常發生衝突,因為將藝術品暴露在強光源下通常會影響其品質。 IEA 表示,隨著越來越多的國家逐步淘汰傳統燈泡,LED 正成為市場的主導。 LED在全球照明市場的普及預計在2025年達到76%,並在2030年進一步達到87.4%。

- 因此,需要一種能夠最佳化藝術品視覺欣賞且不損害其特性的照明解決方案。因此,LED照明燈具已成為美術館和博物館的首選照明解決方案。發光二極體(LED) 燈正在取代美術館和博物館使用了數十年的白熾燈和螢光。在LED的優點中,其持續時間是最大的。與傳統LED相比,LED的使用壽命超過25,000小時,相當於約10年的博物館參觀時間。

- 消費者對環境和電燈耐用性的認知不斷提高,以及政府對能源效率的要求,正在推動 LED 的採用。現代 LED 照明解決方案正在迅速發展,因為它們具有巨大的節能潛力。提高效率、最佳化燈具設計和靈活的照明控制可以在各種照明和交通條件下以更低的成本提高效能。

- 美術館和博物館的內部人造光源包括白熾燈、鹵素燈、光纖、螢光、冷陰極管和 LED。白熾燈通常用於軌道照明燈具中的環境照明和重點照明。然而,透過消除大多數鹵素光源,大多數藝廊都用新的 LED 燈具取代了當前的畫廊照明庫存,而無需改變現有的電氣基礎設施或照明控制。 LED照明燈具也顯著降低了電力成本。

- 此外,LED 照明技術具有很高的能源效率,可能對美國照明的未來產生巨大影響。 LED 照明的普及可能會對美國的節能產生重大影響。預計到 2035 年,大多數照明裝置將採用 LED。根據美國能源部預測,到 2035 年,LED 照明每年可節省 569 太瓦時的能源,相當於發電廠每年超過 921,000 兆瓦的發電量。

歐洲預計將出現顯著成長

- 由於人們對環境問題的日益關注以及各行業對發光二極體(LED) 照明系統的採用,預計歐盟市場將在 LED 照明市場中佔據主要佔有率。這是因為與傳統照明技術相比,基於 LED 的照明更加節能、使用壽命更長,並且運行所需的電力更少。隨著照明產業向固體照明和 LED 光源發展,歐洲成為世界上最具創意的照明市場之一。

- 地方政府也提供補貼和激勵措施,鼓勵消費者採用 LED 產品並逐步淘汰舊的、效率較低的技術。這將提高整個歐洲照明產業的效率。例如,2022年10月,歐盟綠燈向義大利橄欖廠提供了1億歐元的補助。據義大利農業、食品和林業部稱,新的補貼將資助那些使用較少能源和對環境影響較小的措施。

- 在COP26上,歐盟承諾在2030年排放至少55%,並在2050年成為第一個實現氣候中和的地區。因此,逐步淘汰螢光的運動變得越來越重要,並且可以帶來直接的社會效益。根據聯合國關於汞的水俁公約,這項決定將有助於歐盟加速轉向節能和清潔的 LED 照明。

- LED 照明可以最佳化操作,而不會犧牲觀看樂趣或藝術保存。歐洲有 17 個世界上最大的博物館:7 個在倫敦,3 個在巴黎、馬德里和巴塞隆納,2 個在羅馬,1 個在佛羅倫薩和羅馬。這些因素可能會創造美術館和博物館等公共場所對 LED 照明的需求。

- 由於 LED 使用量的增加以及船舶行業安全燈法規的嚴格化,對節能照明的需求不斷成長將推動市場的發展。例如,2022 年 11 月,歐盟委員會宣布額外撥款 1,000 萬歐元,用於 COP27 後減少國際航運溫室氣體 (GHG)排放的計劃。

- 此外,有關歐洲銷售的幾乎所有燈具的燈泡壽命和預熱時間等能源效率要求的法規變化預計將刺激市場。根據最新規定,大多數鹵素燈和傳統螢光管照明將從2023年9月起逐步淘汰。

美術館/博物館照明產業概況

美術館/博物館照明市場競爭激烈,Signify NV、Osram Licht AG、ERCO GmbH、Inesa Lighting (Pty) Ltd 和 iGuzzini Illuminazione SpA 等主要廠商佔據市場主導地位。這些公司利用策略合作計劃來增加市場佔有率和盈利。

2022 年 11 月,Nanoleaf 宣佈在其 Essential 智慧照明產品線中新增四款支援 Matter 的新型智慧燈泡和照明燈具。在這些新產品中,2023年第一季推出的支援Thread的LED照明包括燈條和A 19、BR 30、GU 10燈泡,是首款無需橋接即可直接相容Matter的產品,已成為其中的一部分。

2022 年 6 月,Cree LED 推出了 XlampElement G (XE-G) LED。 XE-G LED 具有無與倫比的光輸出和效率,且外型小巧,提供了全新的效能。 XE-G LED 系列被 EdisonReportas 評為“LightFair 十大必看產品”,Cree LED 的 3007 號展位上展示了全面的 XE-G LED 系列中的全部 17 種產品。令人驚嘆的 8 英尺元素週期表展示顏色和3 種白色選項。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 宏觀經濟趨勢的影響

第5章市場動態

- 市場促進因素

- 博物館和藝術畫廊更多地採用 LED 照明設備

- 對具有智慧控制系統的照明系統的需求不斷成長

- 市場抑制因素

- 對 LED 照明的好處缺乏認知

第6章市場區隔

- 依類型

- LED

- 非LED

- 依用途

- 室內的

- 戶外的

- 依地區

- 北美洲

- 亞太地區

- 歐洲

- 中東/非洲

第7章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Signify NV

- OSRAM Licht AG

- ERCO GmbH

- Inesa Lighting(Pty)Ltd.

- iGuzzini illuminazione SpA

- BEGA Gantenbrink-Leuchten

- Lumenpulse Group

- Acuity Brands Inc.

- Targetti Sankey SpA

- Feilo Sylvania Group

第8章投資分析

第9章市場的未來

The Art & Museum Lighting Market size is estimated at USD 1.69 billion in 2024, and is expected to reach USD 2.17 billion by 2029, growing at a CAGR of 4.23% during the forecast period (2024-2029).

In museum lighting design, the ambient, task, focal, and decorative are all layers that contribute to the overall aesthetic of a space. Ambient layering is the general lighting of a room. This type of lighting allows one to move through space and is significantly lower than task light levels. The growing urban population across the globe has heightened concerns about the secure, reliable supply of affordable energy, environmental impacts such as greenhouse gas emissions, climate change, and loss of biodiversity, which in turn has driven the adoption of efficient sources of lighting in residential as well as in commercial buildings in cities, which is further propelling the studied market growth.

Key Highlights

- The increasing investment to refurbish or upgrade the electric lighting systems within museums and art galleries to attain significant cost savings, both in terms of energy reduction and reducing ongoing maintenance costs and growing demand for electing lighting systems with a smart control system that can respond to occupancy or user preference are the major factors driving the growth of the art & museum lighting market.

- Museums and galleries consume significant energy to maintain an internal environment to protect and preserve their collections. As per the Arup report, lighting within both exhibitions and back-of-house areas can account for 20% of the energy consumption, and to reduce the cost, most museums are using efficient luminaires.

- Furthermore, the light cast by LED lamps contains very few infrared rays and almost no ultraviolet rays, which is another advantage of using LED lamps for the museum's lighting system. The fragile artwork no longer requires filters to preserve it from damaging infrared or ultraviolet beams, which enhances the visitor's visual experience.

- Also, a survey conducted at the Manchester Museum revealed that 50% of the total cost of energy consumption was attributable to the museum's lighting system. When the museum decided to replace its fluorescent tubes with LED lamps and affix motion sensors to the luminaires throughout its establishment, it reduced its consumption by around 89%.

- Moreover, the museums and art galleries' most significant challenge is to balance the energy savings and lighting quality of the displays as expected by the artist. Most of the time, the lure of substantial energy savings can sometimes lead to compromised lighting quality. Hence, most market vendors provide comprehensive lighting design services, from initial strategic advice and concept development to construction documents and on-site support.

- Additionally, the Russia-Ukraine conflict might cause extra disruptions and affect the supply chains of semiconductors, leading to further increases in the prices of electronics. Overall, the impact of the conflict on the electronics industry is expected to be significant. This would hamper the production of smart lighting products.

Art & Museum Lighting Market Trends

LED Segment is Expected to Drive the Growth of the Market

- Lighting up museums and art galleries well is crucial. Light helps draw attention to artwork while preventing damage to the work itself. These two imperatives often conflict, as exposing artwork to a source of intense light can periodically affect its quality. According to IEA, as more and more countries are getting close to phasing out conventional bulbs, LEDs are continuing their march to the top of the Market. The penetration rate of LEDs into the global lighting market is expected to reach a penetration of 76% in 2025 and a further 87.4% in 2030.

- Consequently, there is a need for a lighting solution that enables optimal visual appreciation of the art and ensures that its characteristics are not tainted. As a result, LED luminaires have emerged as the preferred lighting solution in museums and art galleries. Light-emitting diode (LED) lamps are increasingly replacing the incandescent and fluorescent lamps used by museums and art galleries for decades. Of all the advantages of the LED, its duration is the most significant. LEDs can have a 25,000+ hours lifetime compared to their traditional counterparts, translating to approximately ten years of museum and art gallery visiting hours.

- The growing consumer awareness about the environment and the durability of electric lights, along with the government mandates for energy efficiency, are the drivers for the increasing adoption of LEDs. Modern LED lighting solutions are advancing rapidly as they deliver significant energy-saving potential. Increasing efficacy, optimized luminaire design, and flexible lighting control enable enhanced performance at a lower cost for different lighting and traffic conditions.

- The interior artificial light sources of the museum and art galleries include incandescent, halogen, fiber optics, fluorescent, cold cathode, and LEDs. Incandescent lamps are generally used for ambient and accent lighting with track luminaires. However, by discontinuing most halogen light sources, most art galleries replaced their current stock of gallery luminaires with new LED luminaires without the need to change their existing electrical infrastructure and lighting controls. LED luminaires have also reduced electric costs significantly.

- Moreover, LED lighting technology is very energy-efficient and can drastically impact the future of lighting in the United States. The widespread adoption of LED lighting has a significant potential impact on American energy savings. By 2035, it's predicted that most lighting installations will be LED-based. According to US DOE, Energy savings from LED lighting might reach 569 TWh annually by 2035, equivalent to the yearly energy production of over 921,000-megawatt power plants.

Europe is Expected to Experience Significant Growth

- Due to growing environmental concerns and the adoption of light-emitting diode (LED) lighting systems across industries, the EU market is anticipated to dominate the LED lighting market with a sizeable share. LED-based lights are preferable to conventional lighting technologies because they are more energy-efficient, have a longer lifespan, and require less electricity to operate. Europe is one of the world's most inventive lighting marketplaces as the lighting industry transitions to solid-state lighting and LED sources.

- In order to boost consumer adoption of LED products and phase out older, less efficient technologies, the regional governments are also offering subsidies and incentives. This will enhance the overall efficiency of the European lighting industry. For instance, EU Green Lights funded a EUR100M Subsidy for Italian Olive Millers in October 2022. According to the Italian Ministry of Agriculture, Food, and Forestry, the new subsidies will fund initiatives that use less energy and have a minor environmental impact.

- At COP 26, the EU committed to reducing emissions by at least 55% by 2030 to become the first area to achieve climate neutrality by 2050. As a result, the move to phase out fluorescent lamps is growing in importance and can be done for a direct societal benefit. With the United Nations Minamata Convention on Mercury, such decisions will assist the EU in accelerating the switch to energy-efficient, clean LED lighting.

- LED illumination enables operating optimization without sacrificing viewing pleasure or art preservation. Since Europe is home to seventeen of the largest museums in the world-seven of them are in London, three are in Paris, Madrid, and Barcelona, two are in Rome, and one in each in Florence and Rome-it presents a substantial growth opportunity for the LED market. Such factors can create a demand for LED lighting in public places such as Art and Museums.

- With The rise in the usage of LEDs and the stricter rules for the marine industry concerning safety lights, the growing demand for energy-efficient lighting will drive the Market. For instance, in November 2022, the European Commission recently announced an additional EUR 10 million for a project to lower the greenhouse gas (GHG) emissions from international shipping in the margins of COP27.

- Additionally, the changing regulations for energy efficiency requirements and other factors for almost all lamps sold in Europe, such as bulb lifetime and warm-up time, are anticipated to fuel the Market. According to the latest regulation, most halogen lamps and traditional fluorescent tube lighting will be phased out from September 2023 onwards.

Art & Museum Lighting Industry Overview

The art and museum lighting market is competitive and is dominated by a few significant players like Signify NV, Osram Licht AG, ERCO GmbH, Inesa Lighting (Pty) Ltd, and iGuzzini illuminazione S.p.A. These significant players, with a prominent share in the market, are concentrating on expanding their customer base across foreign countries. These corporations leverage strategic collaborative initiatives to increase their market share and profitability.

In November 2022, Nanoleaf announced the addition of four new Matter-compatible smart bulbs and light strips under its Essential Smart Lighting line product range. Among these new products, the Thread-enabled LED lights launched in Q1 of 2023 and include a light strip and A 19, BR 30, and GU 10 bulbs, making them some of the first to support Matter directly without a bridge.

In June 2022, Cree LED launched XlampElement G (XE-G) LEDs that deliver a new performance class with unpaired light output and efficiency in a small form factor. The XE-G LED family of products has been recognized by EdisonReportas a "LightFair Top 10 MUST SEE" product on display at Cree LED's booth 3007 is a stunning, 8-foot periodic table showcasing all 17 colors and three white options available in the comprehensive XE-G LED family.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of LED Luminaires in Museum and Art Galleries

- 5.1.2 Growing Demand for Electing Lighting System with a Smart Control System

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness about the Advantages of the LED Lights

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 LED

- 6.1.2 Non-LED

- 6.2 By Application

- 6.2.1 Indoor

- 6.2.2 Outdoor

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Asia Pacific

- 6.3.3 Europe

- 6.3.4 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share

- 7.2 Company Profiles

- 7.2.1 Signify NV

- 7.2.2 OSRAM Licht AG

- 7.2.3 ERCO GmbH

- 7.2.4 Inesa Lighting (Pty) Ltd.

- 7.2.5 iGuzzini illuminazione S.p.A

- 7.2.6 BEGA Gantenbrink-Leuchten

- 7.2.7 Lumenpulse Group

- 7.2.8 Acuity Brands Inc.

- 7.2.9 Targetti Sankey S.p.A.

- 7.2.10 Feilo Sylvania Group