|

市場調查報告書

商品編碼

1445673

雲端通訊平台:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Cloud Communication Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

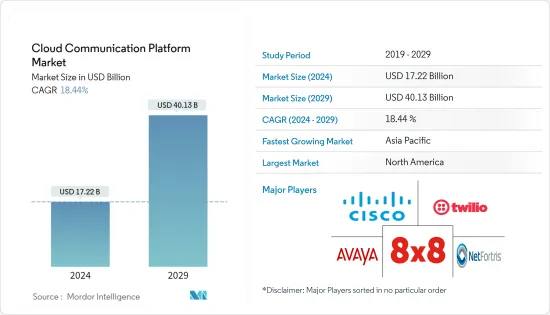

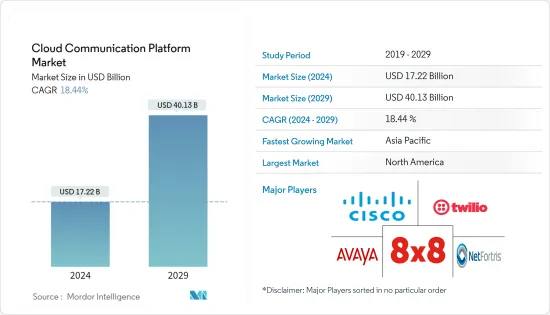

雲端通訊平台市場規模預計到2024年為172.2億美元,預計到2029年將達到401.3億美元,在預測期內(2024-2029年)成長18.44%,以年複合成長率成長。

如今,企業發現採用雲端通訊平台解決方案極為重要,以跟上通訊市場的技術進步。

主要亮點

- 連網型設備的普及、物聯網的普及以及雲端基礎的服務的普及是推動市場成長的關鍵因素。據思科系統公司稱,預計到 2022 年,全球消費者 IP 流量將達到每月 333Exabyte,年複合成長率為 27%,預計將推動所研究市場的成長。

- 根據《富比士》報道,到 2025 年,全球物聯網 (IoT) 連接設備的總裝置量預計將達到 754.4 億台,在 10 年內成長五倍。此外,據 Finch Capital 稱,到年終,全球物聯網終端用戶解決方案市場預計將成長至 2,120 億美元,這為雲端通訊服務供應商提供了開拓全球未開發市場的有利機會。這是一個機會。

- 此外,BYOD政策和付費使用制服務的成長趨勢也是進一步推動雲端通訊平台市場成長的因素。近年來,企業紛紛採用自帶裝置 (BYOD) 措施。由於 87% 的組織現在依賴員工使用行動應用程式的能力,企業辦公室和遠距工作之間的界線變得越來越模糊。

- 提高生產力和降低成本等因素使企業能夠採用雲端協作解決方案以獲得更好的結果。這使得服務供應商能夠專注於雲端基礎的通訊和協作解決方案,並長期推動該市場的發展。多家公司已宣布增強的雲端協作平台,預計將推動市場發展。例如,去年 11 月,全球技術供應商和專業經銷商 Westcon-Comstor 宣布創建一個名為「雲端與協作」的新業務部門。

- 雲端服務通常是基於網際網路。因此,網路連線速度可能會影響雲端通訊平台市場。此外,有關敏感資料的隱私和安全問題進一步阻礙了市場的成長。根據身分盜竊資源中心的數據,去年上半年美國資料外洩事件達到 817 起。

雲端通訊平台市場趨勢

BFSI 引領市場

- 雲端通訊平台解決方案使投資銀行、私募股權、創業投資、資產管理公司和保險公司能夠與合作夥伴、客戶和顧客安全地交換業務資訊。金融科技 (FinTech) 的發展和 BFSI 產業的數位轉型正在推動該產業的成長。

- 金融業正在經歷一場巨大的變革,變得更加敏捷、創新、協作和以客戶為中心是時代的需要。 Box、HighQ 和 Jive Software 等雲端協作供應商使 BFSI 產業能夠提供高階客戶體驗、降低營運成本並滿足監管和合規義務。

- 在 COVID-19感染疾病期間,對雲端基礎的BPO 服務的需求增加,使機構能夠在面臨挑戰的情況下繼續運作。此外,BPO 服務解決方案使銀行能夠將資源用於核心人力資源和關鍵業務營運,對於銀行、企業和金融機構的高效營運至關重要。雲端通訊透過遠端存取、數位資料交換、自動報告和即時工作場所管理,幫助金融機構最大限度地提高生產力。根據《富比士》報道,超過 77% 的銀行使用雲端運算將部分業務外包給其他組織。

- 此外,雲端技術(包括雲端通訊)使金融科技公司能夠快速開發和建立應用程式,使其業務與競爭對手區分開來並改善消費者體驗。此外,借助雲端通訊,金融科技公司可能會透過與金融品牌通訊的眾多線上管道向客戶提供這些體驗。這些管道包括行動應用程式、機器人聊天機器人、影片、通訊服務等。

- 該行業的各個公司正在製定多種策略來適應 BFSI 行業,以提高其競爭力。例如,去年1月,Route Mobile與馬哈拉斯特拉邦銀行和印度國家銀行合作,利用雲端通訊平台功能在WhatsApp上提供金融服務。

北美市場佔據主導地位

- 就收益而言,北美在雲端通訊平台市場佔據主導地位,預計在預測期內將保持其主導地位。這一成長歸因於雲端基礎的服務的日益普及以及該地區多個雲端基礎的服務供應商的可用性。

- 該地區取得優異發展速度的主要原因是服務供應商之間對整合通訊和產品分離的需求不斷成長。在北美,UCaaS 解決方案細分正在推動市場向 IVR 領域發展。預計該地區 IVR 領域的成長速度將快於視訊會議領域。

- 此外,該地區的雲端通訊平台市場預計將受益於物聯網在通訊業的日益普及。美國電信業者正在利用基於物聯網的技術來加快流程並提高效率。據電信諮詢服務公司稱,今年美國網路流量預計將增至每月 9,864 萬Exabyte。

- 一些零售商還將雲端基礎的通訊平台與其 CRM 介面整合,以增強客戶互動。幫助解讀消費者的詢問並將他們引導到正確的地方進行澄清。

- 此外,一些公司轉向雲端通訊平台視訊解決方案,為客戶提供高清品質的視訊並流暢地訪問,特別是透過視訊聊天展示產品特性和功能。我正在使用。為了留住更多顧客,Croma(英菲尼迪零售有限公司)等組織在疫情期間在班加羅爾創建了第一家試點商店進行線上展示。

雲端通訊平台產業概況

雲端通訊平台市場競爭激烈,許多供應商提供全面的雲端通訊解決方案。市場相關人員正在積極致力於擴大其產品範圍和服務領域。為了向整個產業提供特定應用服務,企業強調創新和研發。雲端通訊平台市場的主要企業包括 Cisco System Inc.、Twilio Inc.、8x8 Inc.、Avaya Inc. 和 NetFortris Inc.。

2022 年 2 月,全球開放電信解決方案 (EDP) 供應商 Radisys Corporation 推出了 Radisys Engage 數位平台。它是一個開放的雲端通訊平台,將迎來新一代可編程通訊,包括基於視訊的顧客關懷、對話式人工智慧應用、工業5.0應用以及實現人機協作的超個性化社交參與。該平台使服務供應商能夠輕鬆且盈利設計滿足各個企業和消費者領域的需求和期望的產品。

2022 年 4 月,服務供應商Lumen 選擇 Alianza 的雲端通訊技術為其電話服務提供支援。 Alianza 平台是為服務供應商設計的,可以與通訊業者整合。 Lumen 相信該平台補充了其核心語音服務和客戶需求,並為傳統電話服務客戶提供了有吸引力的新遷移替代方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 通訊市場的重大變化

- 越來越多的組織正在引入靈活的工作機會

- BYOD 需求不斷成長

- 市場限制因素

- 安全和隱私問題

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 按成分

- 解決方案

- 服務

- 依部署類型

- 公共雲端服務

- 私有雲端服務

- 混合雲端服務

- 按行業分類

- BFSI

- 衛生保健

- 資訊科技/通訊

- 零售

- 政府

- 其他(製造、旅遊/酒店、教育)

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭形勢

- 公司簡介

- Cisco System Inc.

- Twilio Inc.

- 8x8 Inc.

- Avaya Inc.

- NetFortris Inc.

- West IP Communications Inc.

- Telestax Inc.

- Plivo Inc.

- Nexmo Inc.

- Vonage Holdings Corp.

- Masergy Communications

- Mitel Networks Corporation

- Vonage API Developer

- CallFire Inc.

- Ozonetel Communication Pvt. Ltd

- RingCentral Inc.

第7章 投資分析

第8章市場機會與未來趨勢

The Cloud Communication Platform Market size is estimated at USD 17.22 billion in 2024, and is expected to reach USD 40.13 billion by 2029, growing at a CAGR of 18.44% during the forecast period (2024-2029).

Nowadays, companies are experiencing a vital necessity for adopting cloud communication platform solutions to keep themselves updated with the technological advancements in the communication market.

Key Highlights

- Increasing adoption of connected devices, increasing penetration of the internet of things, and rising adoption of cloud-based services are major factors driving the market growth. According to Cisco Systems, in 2022, global consumer IP traffic was expected to reach 333 exabytes per month at a 27% compound annual growth rate, which is anticipated to fuel the growth of the market studied.

- According to Forbes, the total installed base of the Internet of Things (IoT) connected devices is projected to amount to 75.44 billion worldwide by 2025, a fivefold increase in 10 years. Also, as per Finch Capital, the global market for IoT end-user solutions was expected to grow to USD 212 billion in size by the end of 2019, presenting lucrative opportunities for cloud communication service providers to tap the untapped market globally.

- Besides, the growing trend of BYOD policies and pay-as-you-use services are other factors further fueling the growth of the cloud communication platform market. Companies have adopted Bring-Your-Own-Device (BYOD) efforts in recent years. The capacity of employees to use mobile apps is currently relied on by 87% of organizations, and the border between the corporate office and working remotely is becoming increasingly blurred.

- Factors such as enhanced productivity and decreased costs have enabled enterprises to adopt cloud collaboration solutions for better outcomes. This has allowed the service providers to focus on cloud-based communication and collaboration solutions and drive this market in the long run. Various companies are launching an enhanced cloud collaboration platform, which is expected to drive the market. For instance, in November last year, Westcon-Comstor, a worldwide technology supplier and specialized distributor, announced the formation of a new business segment called Cloud & Collaboration.

- Cloud services are usually internet-based; therefore, internet connection speed would affect the cloud communication platform market. Also, privacy and security concerns regarding confidential data further hamper the market's growth. According to Identity Theft Resource Center, The number of data breaches in the United States reached 817 in the first half of the last year.

Cloud Communication Platform Market Trends

BFSI to Drive the Market

- The Cloud Communication Platform solutions allow investment banks, private equity, venture capital, asset managers, and insurance firms to securely exchange business information with partners, clients, and customers. The evolution of financial technology (fintech) and digital transformation in the BFSI sector drive the segment's growth.

- The financial sector is undergoing a massive transformation, and it has become the need of the hour to be more agile, innovative, collaborative, and customer-centric. The cloud collaboration vendors such as Box, HighQ, Jive Software, and others enable the BFSI industry to deliver high-end customer experience, decrease operating costs, and meet regulatory and compliance obligations.

- During the COVID-19 pandemic, demand for cloud-based BPO services increased, allowing institutions to continue active despite setbacks. Furthermore, the BPO services solution was critical to the efficient operation of banks, enterprises, and financial institutions by allowing banks to employ their resources for core talents and vital business operations. Cloud communication helps financial organizations maximize productivity through remote access, digital data exchange, automated reporting, and real-time work floor management. According to Forbes, over 77% of banks utilize cloud computing to outsource a few of their operations to other organizations.

- Moreover, cloud technology, including cloud communication, allows Fintech firms to develop quickly and build apps that differentiate their businesses from the competition and improve consumer experiences. Additionally, FinTech companies may offer these experiences to customers across the numerous online channels they use to communicate with financial brands due to cloud communications. Such channels include mobile applications, robotic chatbots, video, and Messaging Services.

- Various companies in the industry are involved in several strategies to cater to the BFSI industry to gain a competitive edge. For instance, in January last year, Route Mobile teamed with the Bank of Maharashtra and the State Bank of India to provide financial services over WhatsApp utilizing cloud communication platform capabilities.

North America to Dominate the Market

- North America dominates the cloud communication platform market in terms of revenue and is expected to maintain its dominance during the forecast period. This growth is attributed to the increasing adoption of cloud-based services and the availability of several cloud-based service providers in this region.

- The main reason for this region's excellent development rate is the growing demand for unified communications and product segregation among the service providers. In North America, the UCaaS segment by solutions drives the market to the IVR segment. IVR segment is expected to increase at a greater rate than the video conferencing segment in this region.

- Additionally, the region's cloud communication platform market is expected to profit from the expanding adoption of IoT in the telecommunications industry. American telecom companies are making use of the capabilities of IoT-based technology to speed up procedures and increase efficacy. According to Telecom Advisory Services, the United States is expected to climb to 98.64 million exabytes of internet traffic per month in the current year.

- Several retailers are also integrating cloud-based communication platforms with their CRM interfaces, boosting customer interaction. It aids in deciphering consumer inquiries and directs them to the right locations for the explanation.

- Furthermore, some firms use cloud communication platform video solutions to give high HD quality video and smooth access to clients, particularly for showcasing product features and functioning via video chatting. In order to retain more customers, organizations such as Croma (Infiniti Retail Limited) created their initial pilot store for an online demonstration in Bengaluru during the pandemic.

Cloud Communication Platform Industry Overview

The Cloud Communication Platform Market is highly competitive and is characterized by a number of vendors offering comprehensive cloud communication solutions. Market players are actively concentrating on extending their product range and service area. In order to deliver application-specific services across industries, companies emphasize innovation and R&D. Major players in the cloud communication platform market include Cisco System Inc., Twilio Inc., 8x8 Inc., Avaya Inc., and NetFortris Inc.

In February 2022, the Radisys Engage Digital Platform was made available by Radisys Corporation, a global supplier of open telecom solutions (EDP). It is an open cloud communication platform that helps usher in a new generation of programmable communications, including video-based customer care, conversational AI applications, Industry 5.0 applications, and hyper-personalized social engagements that enable human-machine cooperation. The platform enables service providers to easily and profitably design products to meet the needs and expectations of diverse corporate and consumer sectors.

In April 2022, Lumen, a service provider, selected Alianza's cloud communication technology to enhance its phone services. The Alianza platform is designed for service providers and can be integrated with telecom operators. Lumen believes the platform complements its core voice offerings and client demands and will provide an attractive new migration alternative for legacy phone service customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tremendous Shifts in the Communication Market

- 4.2.2 The Growing Trend of Organizations Implementing Flexible Work Opportunities

- 4.2.3 Growing Demand for BYOD

- 4.3 Market Restraints

- 4.3.1 Security and Privacy Concerns

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 By Deployment Type

- 5.2.1 Public Cloud Services

- 5.2.2 Private Cloud Services

- 5.2.3 Hybrid Cloud Services

- 5.3 By Industry Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 IT and Telecommunication

- 5.3.4 Retail

- 5.3.5 Government

- 5.3.6 Other Industry Verticals (Manufacturing, Travel and Hospitality, and Education)

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Cisco System Inc.

- 6.1.2 Twilio Inc.

- 6.1.3 8x8 Inc.

- 6.1.4 Avaya Inc.

- 6.1.5 NetFortris Inc.

- 6.1.6 West IP Communications Inc.

- 6.1.7 Telestax Inc.

- 6.1.8 Plivo Inc.

- 6.1.9 Nexmo Inc.

- 6.1.10 Vonage Holdings Corp.

- 6.1.11 Masergy Communications

- 6.1.12 Mitel Networks Corporation

- 6.1.13 Vonage API Developer

- 6.1.14 CallFire Inc.

- 6.1.15 Ozonetel Communication Pvt. Ltd

- 6.1.16 RingCentral Inc.