|

市場調查報告書

商品編碼

1406263

石油和天然氣工程服務:市場佔有率分析、行業趨勢和統計、2024-2029 年成長預測Oil & Gas Engineering Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

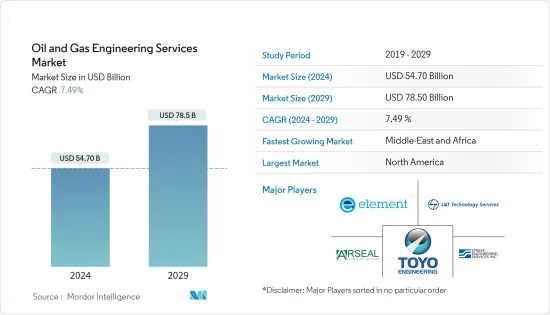

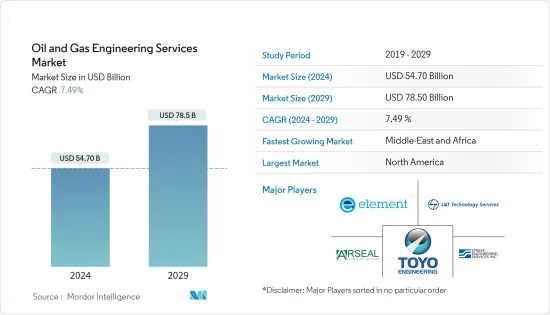

預計2024年石油和天然氣工程服務市場規模為547億美元,預計到2029年將達到785億美元,在預測期內(2024-2029年)複合年成長率為7.49%。

石油和天然氣領域擴大採用各種自動化技術是推動工程服務市場呈指數級擴張的關鍵因素。

主要亮點

- 該行業的動態本質推動了提高生產力和效率、運作和收益的需求。同時,最大限度地降低成本預計將推動工程服務在行業中的採用。此外,石油和天然氣產業還面臨可再生能源普及提高、更嚴格的碳足跡法規、電動車和各種新碳氫化合物來源等課題。因此,企業正在採取各種工業 4.0 策略來克服這些課題。

- 機器學習、分析和許多其他技術的高級應用預計將幫助和協助石油和天然氣公司分析巨量資料集並提供有意義的見解。因此,預計在預測期內,產業內工程服務的採用將會增加。

- 此外,市場上公司之間的各種策略聯盟也是擴張的有利途徑。例如,2023年4月,能源公司BlueNord(也稱為Noreco Oil丹麥AS或Noreco)與工程和承包公司Semco Maritime AS共同識別、探索和開發石油和天然氣領域的商機,並簽署了戰略合作夥伴關係同意調查。

- 然而,與營運和合規性相關的日益嚴峻的課題、石油和天然氣價格的波動以及行業內的其他宏觀經濟波動可能會成為限制預測期內整體市場成長的重大問題。

- COVID-19大流行及其經濟影響引起了各國政府的強烈關注,並轉移了人們對能源轉型的注意力。這場危機的短期和長期影響對該行業產生了重大影響。然而,在後 COVID-19 時期,自動化的採用將激增,尤其是在石油和天然氣行業,這將有助於設計和工程服務的整體成長,以及擴增實境等工業 4.0 實踐的興起和BIM 4D,市場預計將見證巨大的成長機會。

石油和天然氣工程服務市場趨勢

下游板塊成長顯著

- 石油和天然氣行業的下游部門主要包括從建設階段到銷售階段的業務。它包括石油產品的加工、精製、運輸和銷售等下游過程。對安全可靠營運和降低整體成本的需求不斷成長預計將推動整個產業採用石油和天然氣下游服務。

- 石油和天然氣下游服務在提高整體精製製程方面發揮關鍵作用,同時也影響最終產品的適銷性和需求性。下游供應鏈包括顯著的業務,例如特定產品的行銷、有效的資料庫管理和有效的分銷管理。

- 此外,關鍵的下游石油和天然氣服務包括資產完整性管理、石油測試、工業工程檢驗、精製和分銷、危險場所設備測試和資料庫軟體解決方案。它還包括用於核心資產資訊管理的企業資產管理(EAM)解決方案以及與工廠資產維護管理相關的應用程式。

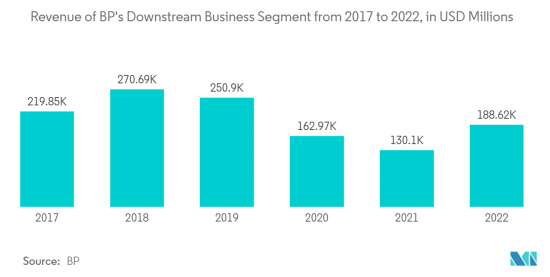

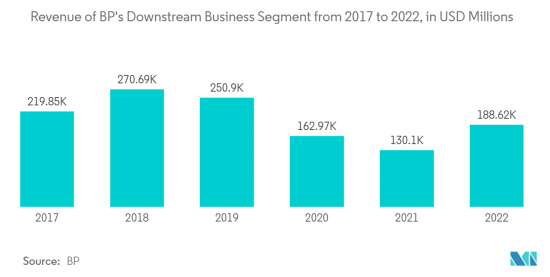

- 根據BP國際有限公司統計,2022年BP下游業務部門總收入約1,886億美元。去年的銷售額是同期最低的。 2020年,由於COVID-19大流行顯著減少了運輸燃料的需求,特別是航空業的需求,BP的下游收益較前一年下降了約35%。

預計北美將主導市場

- 由於石油和天然氣計劃數量不斷增加,預計北美將主導石油和天然氣工程服務市場,特別是在加拿大和美國等國家。根據美國能源情報署2023年1月短期能源展望,2023年美國原油總產量平均為1240萬桶/日,2024年為1280萬桶/日,高於2019年的12.3億桶/日。預計日產量將超過10,000桶。

- 該地區也認為建立一些戰略聯盟是抓住石油和天然氣產業機會的有利途徑。例如,2023年3月,美國能源局(DOE)向由Project Innerspace、國際石油工程師協會和Geo Thermal Rising組成的聯盟授予約1.65億美元的“石油·示範工程”津貼來自天然氣的地熱能。”聯盟形成的跨產業合作將吸引石油和天然氣專家、地熱Start-Ups和其他相關人員參與,就地熱創新策略和機會達成共識。

- 去年10月,印度和美國宣布成立新能源工作小組,專門促進支持向清潔能源過渡所需的可再生能源的廣泛整合。該聲明是在石油和天然氣部長哈迪普·辛格·普里與美國能源部長詹妮弗·格蘭霍姆進行雙邊會談後發表的。 該聲明是在石油和天然氣部長Gland·普裡與美國能源部長詹妮弗·格蘭霍姆進行雙邊會談後發表的。將夥伴關係提升到一個全新的水平。

- 加拿大也是世界領先的石油和天然氣生產國之一,該產業在加拿大整體經濟中發揮重要作用。根據加拿大石油和天然氣生產商協會的數據,上游石油和天然氣生產的投資預計到 2023 年將達到約 400 億加元(297.3 億美元),超過新冠疫情之前的投資。這意味著加拿大經濟的額外支出將約為 40 億加元(29.7 億美元),比前一年成長 11%。

- 2022 年 10 月,福陸公司為帝國學院提供可償還前端工程以及詳細工程、設計和採購,以在其位於加拿大亞伯達埃德蒙頓附近的 Strathcona 煉油廠建造世界一流的可再生柴油綜合體,服務已訂單。新綜合設施預計將成為加拿大最重要的可再生柴油生產設施,每天利用當地原料等生產約 20,000 桶可再生柴油。

石油天然氣工程服務業概況

石油和天然氣工程服務市場預計將成為半固體市場,這主要是由於多個全球參與者的存在以及新市場參與企業的出現。 Toyo Engineering、Stress Engineering Services 和 Element Materials Technology 等市場參與企業已與全球各個石油和天然氣公司建立了各種戰略聯盟和合作夥伴關係,以加強工程服務在行業中的整體採用。目標是建立合作夥伴關係。

2023 年 6 月,科萊恩石油服務推出 PHASETREAT WET,為石油和天然氣產業的去乳化需求提供更有效率、更永續的解決方案。這種新穎的解決方案旨在克服傳統石油生產過程中固有的課題,特別是滿足更嚴格的油水分離環境要求,簡化了物流,最大限度地降低了營業成本並降低了安全風險。協助和支援營運商緩解風險

2023年1月,利比亞國家石油公司(NOC)執行長( Farhat Bengdalla)與埃尼執行長克勞迪奧·德斯卡爾齊(Claudio Descalzi)宣布啟動策略計劃“Structural A&E”,並就開發達成協議。這主要是為了最大限度地提高天然氣產量,特別是確保利比亞國內市場的供應和對歐洲的出口。 「結構 A&E」是該國自 2000 年代初以來的第一個重大計劃。它包括開發兩個天然氣田,即結構“E”和“A”,位於利比亞近海D合約區。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 石油和天然氣行業自動化程度的提高推動了設計和工程服務的成長

- 持續努力提高石油和天然氣產業的成本和業務效率

- 透過擴增實境和 BIM 4D 等工業 4.0 實踐縮短 TTM

- 市場抑制因素

- 市場容易受到石油和天然氣價格波動以及其他宏觀經濟波動的影響

- 營運和合規課題

- 產業相關人員和經營模式分析

- 工程服務業內部與外包的比較分析

- 成本明區隔析

- 石油和天然氣與其他關鍵製程產業的採用趨勢比較分析

- COVID-19 對工程服務業的影響

第6章市場區隔

- 依類型

- 下游

- 中產階級

- 上游

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Stress Engineering Services Inc.

- Toyo Engineering Corporation

- Element Materials Technology

- L&T Technology Services Limited

- Arseal Technologies

- Citec Group Oy Ab

- WSP Global Inc.

- Wood PLC

- Tetra Tech Inc.

- Mannvit Consulting Engineers

- QuEST Global Services Pte. Ltd

- M&H

- Hatch Ltd

- Lloyd's Register Group Services Limited

第8章投資分析

第9章 市場機會及未來趨勢

The Oil & Gas Engineering Services Market size is estimated at USD 54.70 billion in 2024, and is expected to reach USD 78.5 billion by 2029, growing at a CAGR of 7.49% during the forecast period (2024-2029).

The rise in the adoption of various automation technologies in the Oil and Gas sector is the prime factor enhancing the engineering services market exponentially.

Key Highlights

- Due to the industry's dynamic nature, the need to increase productivity and efficiency, uptime, and return on assets is rising. At the same time, minimizing costs is estimated to drive the adoption of engineering services in the industry. Moreover, the oil and gas industry faces challenges like rising penetration of renewable energy, strict carbon footprint regulations, electric vehicles, and various new hydrocarbon sources. Hence, the companies are adopting various strategic Industry 4.0 strategies to overcome these challenges.

- Advanced application of technologies, such as machine learning, analytics, and many others, is expected to help and assist oil and gas companies in analyzing big data sets and provide meaningful insights. Hence, the engineering services adoption within the industry is anticipated to rise during the forecast period.

- Also, the market is witnessing various strategic collaborations amongst the players, acting as a lucrative path toward expansion. For instance, in April 2023, Energy company BlueNord, also known as Noreco Oil Denmark AS or Noreco, and engineering and contracting company Semco Maritime AS entered into a strategic partnership agreement to jointly identify, explore, and investigate opportunities in the oil and gas space.

- However, the growing operational and compliance-related challenges and the fluctuations in the oil and gas prices, as well as other macroeconomic changes within the industry, could be a significant concern limiting the overall market's growth throughout the forecast period.

- The COVID-19 pandemic and its economic implications have received intense government attention, which diverted attention from the energy transition. The crisis's short and long-term effects significantly impacted the sector. However, during the post-COVID-19 period, the market is expected to witness significant growth opportunities, especially due to the surge in the adoption of automation in the oil and gas industry to aid the overall growth of design and engineering services as well as the rise in the Industry 4.0 Practices Such as Extended Reality & BIM 4D.

Oil & Gas Engineering Services Market Trends

Downstream Segment to Exhibit Significant Growth

- The Downstream section of the Oil and Gas Industry involves the operations that primarily occur after the construction phase until the point of sale. Certain downstream operations comprise processing, refining, transportation, and selling petroleum products. The rising demand for safe and reliable operations while reducing the total cost of operations is anticipated to drive the industry's overall adoption of downstream oil and gas services.

- Downstream oil and gas services play a very significant role in enhancing the total refining process while impacting the marketability and desirability of the finished product. The downstream supply chain includes noteworthy operations such as marketing by-products, effective database management, and effective management of distribution.

- Moreover, key downstream oil and gas services comprise asset integrity management, petroleum testing, industrial technical inspection, refining and distribution, hazardous location equipment testing, and database software solutions. It also includes Enterprise Asset Management (EAM) solutions that address core Asset Information Management as well as applications involving Plant Asset Maintenance Management.

- According to BP International Limited, BP's downstream business segment has generated a total revenue of around USD 188.6 billion in 2022. The previous year recorded the lowest revenue in the period in consideration. In 2020, BP's downstream revenue was reduced by around 35% from the previous year, as the COVID-19 pandemic severely minimized the transportation fuel demand, especially within the aviation industry.

North America Expected to Dominate the Market

- North America is anticipated to dominate the Oil and Gas Engineering Services Market, especially due to the rising number of oil and gas projects in countries such as Canada and the United States. According to the January 2023 Short-Term Energy Outlook by the US Energy Information Administration, it is forecasted that the overall crude oil creation in the United States would average 12.4 million barrels per day (b/d) in 2023 and 12.8 million b/d in 2024, thereby surpassing the earlier record of 12.3 million b/d set in 2019.

- The region is also seeing a large number of strategic collaborations as a lucrative way to grab the opportunities offered by the oil and gas industry within the region. For instance, in March 2023, the US Department of Energy (DOE) awarded a sum of around USD 165 million "Geothermal Energy from Oil and Gas Demonstrated Engineering" grant to a consortium formed by Project Innerspace, Society of Petroleum Engineers International, and Geothermal Rising. The cross-industry collaboration that is formed by the consortium would engage with oil and gas professionals, geothermal startups, and other stakeholders to create consensus around strategies and opportunities for geothermal innovation.

- In October last year, India and the US declared the creation of a new energy task force, especially to facilitate the extensive integration of renewable energy, which is mainly required to support the transition to clean energy. The declaration would elevate the India-US partnership's strength in the vital energy sector to a whole new level, which came following a bilateral meeting between the Union Minister of Petroleum and Natural Gas Hardeep Singh Puri and US Energy Secretary Jennifer Granholm.

- Also, Canada is one of the significant oil and gas producers worldwide, as the industry plays a crucial role in the country's overall economy. According to the Canadian Association of Petroleum Producers, it is forecasted that the oil and natural gas investment in upstream production will hit a sum of around CAD 40.0 billion (USD 29.73 billion) in 2023, surpassing the pre-COVID investment levels. That represents around CAD 4.0 billion (USD 2.97 Billion), or 11%, more in the additional spending across Canada's economy than the prior year.

- In October 2022, Fluor Corporation was given a reimbursable front-end engineering and detailed engineering, design, and procurement services contract for Imperial as the company progresses and intends to build a world-class renewable diesel complex at its Strathcona refinery near Edmonton, Alberta, Canada. The new complex is anticipated to be the most significant renewable diesel production facility in Canada and would produce around 20,000 barrels of renewable diesel per day, especially from locally sourced feedstocks.

Oil & Gas Engineering Services Industry Overview

The Oil and Gas Engineering Services Market is anticipated to be semi-consolidated, primarily due to the presence of several worldwide players, along with the emergence of new market participants. The market players, such as Toyo Engineering Corporation, Stress Engineering Services Inc., and Element Materials Technology, are targeting to form various strategic collaborations and partnerships with various oil and gas companies globally to enhance the overall adoption of engineering services within the industry.

In June 2023, Clariant Oil Services introduced PHASETREAT WET to provide more efficient and sustainable solutions for the oil and gas industry's demulsification needs. Designed to overcome challenges inherent in traditional oil production processes - most notably, meeting stricter environmental requirements for oil and water separation - the novel solution would help and assist operators in simplifying logistics, minimizing operational costs, and mitigating safety risks.

In January 2023, the CEO of the National Oil Corporation of Libya (NOC), Farhat Bengdara, and Eni CEO Claudio Descalzi agreed on the development of "Structures A&E," a strategic project. It is mainly aimed at maximizing gas production, especially to supply the Libyan domestic market and to ensure export to Europe. "Structures A&E" is primarily the first major project in the country since early 2000. It comprises the development of two gas fields, namely Structures "E" and "A," located in the contractual area D, offshore Libya.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Automation in the Oil and Gas Industry to Aid Growth of Design and Engineering Services

- 5.1.2 Ongoing Efforts to Enhance Cost and Operational Efficiency in the Oil and Gas Industry

- 5.1.3 Industry 4.0 Practices Such as Extended Reality and BIM 4D to Reduce TTM

- 5.2 Market Restraints

- 5.2.1 The Market is Susceptible to Fluctuations in the Oil and Gas Prices as Well as Other Macroeconomic Changes

- 5.2.2 Operational and Compliance-related Challenges

- 5.3 Industry Stakeholder and Business Model Analysis

- 5.4 Comparative Analysis of In-house and Outsourced Engineering Services Industry

- 5.5 Cost Breakdown Analysis

- 5.6 Comparative Analysis of the Adoption Trends Between Oil and Gas and Other Major Process Industries

- 5.7 Impact of COVID-19 on the Engineering Services Industry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Downstream

- 6.1.2 Midstream

- 6.1.3 Upstream

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Stress Engineering Services Inc.

- 7.1.2 Toyo Engineering Corporation

- 7.1.3 Element Materials Technology

- 7.1.4 L&T Technology Services Limited

- 7.1.5 Arseal Technologies

- 7.1.6 Citec Group Oy Ab

- 7.1.7 WSP Global Inc.

- 7.1.8 Wood PLC

- 7.1.9 Tetra Tech Inc.

- 7.1.10 Mannvit Consulting Engineers

- 7.1.11 QuEST Global Services Pte. Ltd

- 7.1.12 M&H

- 7.1.13 Hatch Ltd

- 7.1.14 Lloyd's Register Group Services Limited