|

市場調查報告書

商品編碼

1435947

無線基礎設施監控 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Wireless Infrastructure Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

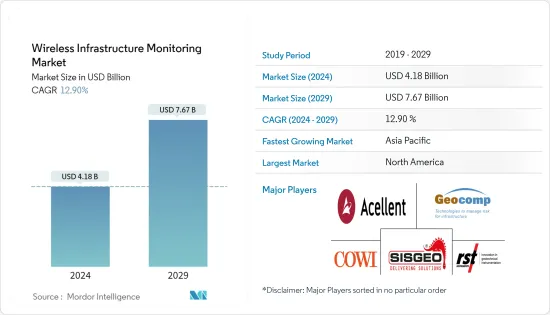

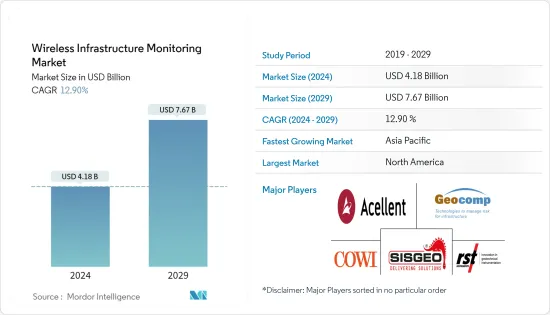

無線基礎設施監控市場規模預計到2024年為 41.8 億美元,預計到2029年將達到 76.7 億美元,在預測期內(2024-2029年)CAGR為 12.90%。

感測器技術、無線技術和物聯網等技術的快速進步提供了有關結構狀況和基礎設施健康狀況的即時訊息,推動市場發展。

主要亮點

- 由於經濟走強,大多數國家都受到工業化的正面影響,並見證了道路、高速公路、橋樑、工業倉庫、能源工廠和礦區等民用基礎設施的蓬勃發展,預計這將推動無線基礎設施監控市場的發展。

- 例如,2019年,中國高鐵網路建設投資超過1,250億美元。中國鐵路總公司計劃新開線6800公里,其中高鐵4100公里,比2018年投產總里程增加45%。截至2018年底,中國鐵路總公司營運高鐵里程2.9萬公里。線路覆蓋全球三分之二,2018年增加了4000 多公里線路。這減少了中國主要城市之間的旅行時間,當局尋求將新線路延伸到該國的一些偏遠角落。

- 此外,越來越多的基礎設施因惡化而倒塌,推動了基礎設施監控市場的發展,以便即時檢查其健康狀況,以避免任何持續的基礎設施故障。2017年,美國基礎設施被一家工程協會評為接近不及格的D+,反映出其基礎設施品質不斷下降。 ASCE估計,到2025年,美國需要投資4.59兆美元,使其基礎設施達到足夠的B級水準,這一數字比目前的資金水準高出約2兆美元。基礎設施資金的增加預計也將推動無線基礎設施監控市場的發展。

無線基礎設施監控市場趨勢

結構監測領域預計將顯著成長

- 結構監測設備用於對基礎設施的健康狀況進行連續、即時的監測,並檢測任何可能未注意地發展並隨著時間的推移而惡化的裂縫。根據 IOGP 的《2019年全球產量報告》,石油和天然氣的需求正處於高峰,比以往任何時候都更大,非洲、亞太地區、中東和美洲的需求急劇成長。這刺激了石油探勘和生產的投資,以滿足需求和供應。許多中型企業結成策略聯盟來開發非常規資源。

- 例如,2019年,Ecopetrol和西方石油公司同意成立一家合資企業,開發德州二疊紀盆地約97,000英畝的非常規油藏,該盆地是美國最大、最活躍的石油盆地之一州,約占美國石油總產量的30%。預計將增加石油和天然氣產業對結構監測設備的需求。

- 此外,由於智慧城市的持續大趨勢,基礎設施監控系統市場的成長推動。越來越多的人湧入城市,刺激了這些城市中心對資源和服務的需求激增。到2025年,全球將有35個城市人口超過1000萬。城市已經消耗了世界2/3的能源和大部分其他資源,如水、住房設施、能源和電力的可靠性、空氣品質和交通流量,這將影響生活品質。因此,大多數城市滿足不斷成長的需求,並尋求物聯網(IoT)技術來獲取必要的尖端智慧和靈活性,以幫助城市更有效地利用資源。

- 例如,英特爾和加州聖荷西市合作開展了一個公私合作計畫,該計畫實施英特爾的物聯網智慧城市展示平台,透過使用物聯網技術來測量空氣中的顆粒物、噪音污染和環境污染等特徵,創造環境永續性。交通流量並提供空氣品質、噪音、運輸效率、健康和能源效率。

北美將經歷顯著成長並推動市場

- 最終用戶產業的快速擴張為無線基礎設施監控系統的應用提供了重大機會,導致了市場的擴張。例如,美國在30個州有98座運作的核反應堆,自2001年以來,這些核電廠的平均容量係數超過90%,每年發電量高達807太瓦時,約佔總發電量的20%。平均產能係數已從 1970年代初期的 50%上升到 1991年的 70%,2002年超過 90%。該行業每年在工廠維護和升級方面的投資約為 75 億美元,預計2020年將增加。未來幾年,預計將推動市場。

- 在該地區營運的企業正致力於新產品開發,以提高生產能力。例如,2019年 10月,美國探地雷達(GPR)設備製造商 GSSI 推出了新型200 MHz(200 HS)天線,這是專為應用而設計的下一代高性能 GS 系列中的首款天線需要更深的深度滲透。它非常適合在具有挑戰性的測量條件下需要高可靠性的地球物理、岩土或環境應用。

- 然而,預計市場將受到最近爆發的 COVID-19 大流行的影響。經濟放緩預計將減少基礎設施支出,降低後電暈經濟中市場的成長資料。不過,預計這些公司將投資其IT系統來開發遠端監控功能,以避免未來出現類似情況。預計這將在中長期對市場產生較大刺激。

無線基礎設施監控產業概述

無線基礎設施監控市場競爭激烈,由 Acellent Technologies, Inc.、Geocomp Corporation、COWI A/S、Sisgeo Srl 和 RST Instruments Ltd(Vance Street Capital)等幾家主要參與者組成。這些在市場上佔有顯著佔有率的主要參與者正致力於擴大其在國外的客戶群。這些公司利用策略合作計劃來增加市場佔有率並提高盈利能力。然而,隨著技術進步和產品創新,中小型公司透過獲得新合約和開拓新市場來增加其市場佔有率。

- 2020年 6月 - COWI A/S 贏得了挪威最大廢水處理廠 VEAS 的兩項框架協議。一類涵蓋建築業,包括建築技術、消防安全、機械安裝、室外環境、水、廢水、雨水、規劃、環境、建築和HSE。另一個是涵蓋電氣裝置和自動化的單獨框架協議。

- 2020年 5月 - Sisgeo。 Srl 與 Worldsensing 領先的岩土監測無線解決方案合作,以便其客戶在將 Sisgeo 的第3 版數位協議感測器與 Worldsensing 的 Loadsensing 結合使用時可以享受自動讀數。它保證了與Sisgeo 鑽孔剖面就地測斜儀、傾斜計、軌道變形系統、引伸計探頭、引伸測斜儀探頭、液體沉降系統、稱重感測器和多點鑽孔引伸計等的互通性。

附加優惠:

- Excel 格式的市場估算(ME)表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 研究範圍

第2章 研究方法

第3章 執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

- 產業價值鏈分析

- COVID-19 對全球基礎設施監控市場的影響評估

第5章 市場動態

- 市場促進因素

- 有關結構永續性的嚴格政府法規

- 資訊取得的成本效益和靈活性,提高維護效率和安全性

- 市場挑戰

- 發展中國家缺乏安裝和校準系統的熟練技術人員

第6章 市場細分

- 依類型

- 硬體

- 軟體和服務

- 依應用

- 岩土監測

- 結構監測

- 環境監測

- 其他應用(空間監控、交通流量監控等)

- 依最終用戶產業

- 民用基礎設施

- 石油和煉油廠

- 運輸

- 礦業

- 其他

- 按地理

- 北美洲

- 歐洲

- 亞太

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Acellent Technologies, Inc.

- Geocomp Corporation

- COWI A/S

- Sisgeo Srl

- RST Instruments Ltd.(Vance Street Capital)

- Campbell Scientific, Inc.

- Geokon, Inc.

- Nova Metrix LLC

- WorldSensing SL

- Ackcio Pte Ltd.

第8章 投資分析

第9章 市場機會與未來趨勢

The Wireless Infrastructure Monitoring Market size is estimated at USD 4.18 billion in 2024, and is expected to reach USD 7.67 billion by 2029, growing at a CAGR of 12.90% during the forecast period (2024-2029).

The rapid advancements in technologies such as sensor technology, wireless technology, and IoT, which provide real-time information on structural conditions and health of infrastructures is driving the market.

Key Highlights

- Owing to the strengthening economy, most of the countries are experiencing positive influence of industrialization and witnessing exuberant growth in their convoy of civil infrastructures such as roadways, highways, bridges, industrial warehouses, energy plants, and mining areas which are expected to boost the wireless infrastructure monitoring market.

- For instance, in 2019, China invested more than USD 125 billion for the construction of a high-speed rail network. China Railway Corporation is set to open 6,800 km of new lines, including 4,100 km of high-speed infrastructure, which is 45% more than the total mileage commissioned in 2018. By the end of 2018, it was operating 29,000 km of high-speed lines, two-thirds of the world, and had added more than 4000 route-km in 2018. It has reduced the travel time between major Chinese cities, and authorities are looking to extend new lines into some of the remote corners of the country.

- Moreocer, an increasing number of collapsing infrastructures due to deterioration has fueled the infrastructure monitoring market in order to check its health in real-time to avoid any situations of persistent infrastructure breakdown. In 2017, the United States infrastructure was given a near-failing grade of D+ by an engineering association, that reflects light on the degrading quality of its infrastructure. The ASCE estimated that the United States needed to invest USD 4.59 trillion by 2025 to bring its infrastructure to an adequate B- grade, a figure about USD 2 trillion higher than current funding levels. This increasing funding on its infrastructure is also expected to boost the wireless infrastructure monitoring market.

Wireless Infrastructure Monitoring Market Trends

Structural Monitoring Segment is Expected To Grow Significantly

- Structural monitoring equipment is employed to provides continuous, real-time monitoring of the health of the infrastructure and detects any cracks that can develop unnoticed and worsen over time. As per the IOGP's Global Production Report 2019, demand for oil and gas is at the peak, greater than ever before, with dramatic growth in Africa, Asia Pacific, the Middle East, and the Americas. This has fueled the investment in exploration and production of oil to meet the demand and supply. Many mid-sized players are forming a strategic alliance for the development of unconventional resources.

- For instance, In 2019, Ecopetrol and Occidental Petroleum Corp agreed to form a joint venture for the development of unconventional reservoirs in approximately 97,000 acres of the Permian Basin in the State of Texas which is one of the largest and most active oil basins in the United States, accounting for approximately 30 percent of the total U.S. oil production. It is expected to boost the demand for structural monitoring equipment in the oil and gas sector.

- Moreover, the growth of infrastructure monitoring system market is boosting due to the ongoing mega-trend of smart cities. An increasing number of people are moving to cities, spurring skyrocketing demand for resources and services in these urban centers. By 2025, 35 cities across the world will have a population of greater than 10 million people. Cities already consume 2/3 of the world's energy and the majority of other resources such as water, housing facilities, reliability of energy and power, the quality of the air, and the flow of traffic, which will impact the quality of living. So, most of the urban cities are addressing the escalating demands and are looking over the Internet of Things (IoT) technology for the cutting-edge intelligence and flexibility necessary to help cities use resources more efficiently.

- For instance, Intel and The City of San Jose, CA collaborated on a public-private partnership project which implements Intel's IoT Smart City Demonstration Platform to create environmental sustainability by using IoT technology to measure characteristics such as particulates in the air, noise pollution, and traffic flow and offer air quality, noise, transportation efficiency, health, and energy efficiency.

North America Will Experience Significant Growth and Drive the Market

- The rapid expansion of the end-user industries that offer a major opportunity for the application of wireless infrastructure monitoring systems is leading to the expansion of the market. For instance, United States has 98 operating nuclear power reactors in 30 states, and since 2001 these plants have achieved an average capacity factor of over 90%, generating up to 807 TWh per year and accounting for about 20% of the total electricity generated. The average capacity factor had risen from 50% in the early 1970s to 70% in 1991, and it passed 90% in 2002. The industry invests about USD 7.5 billion per year in maintenance and upgrades of the plants, which is expected to increase in upcoming years and is expected to drive the market.

- The players operating in the region are focusing on new product developments to increase their production capabilities. For instance, in October 2019, GSSI, United States-based ground penetrating radar (GPR) equipment manufacturer has introduced the new 200 MHz (200 HS) antenna, the first of the next-generation high-performance GS Series that is designed for applications that require deeper depth penetration. It is ideal for geophysical, geotechnical, or environmental applications that require high reliability under challenging survey conditions.

- However, the market is expected to be affected by the recent outbreak of the COVID-19 pandemic. The slowing down of the economy is expected to reduce expenditure on infrastructure and thereby to reduce growth figures for the market in a post-corona economy. However, the companies are expected to invest in their IT systems to develop remote monitoring capabilities in order to avoid a similar situation in the future. This is expected to act as a big stimulus for the market in the medium to long run.

Wireless Infrastructure Monitoring Industry Overview

The wireless infrastructure monitoring market is highly competitive and consists of a few major players such as Acellent Technologies, Inc., Geocomp Corporation, COWI A/S, Sisgeo S.r.l. and RST Instruments Ltd (Vance Street Capital). These major players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets.

- June 2020 - COWI A/S won two framework agreements for VEAS, Norway's largest wastewater treatment plant. One covers building trades, including construction technology, fire safety, mechanical installations, outdoor environment, water, wastewater, stormwater, planning, environment, architecture, and HSE. The other is a separate framework agreement covering electrical installations and automation.

- May 2020 - Sisgeo. S.r.l. collaborated with Worldsensing leading wireless solution for geotechnical monitoring, so that its customers can enjoy automated readings when using Sisgeo's version 3 digital protocol sensors in combination with Worldsensing's, Loadsensing. It guarantees interoperability with Sisgeo borehole-profile in-place inclinometers, tiltmeters, rail deformation systems, extensometer probes, extenso-inclinometer probes, liquid settlement systems, load cells, and multipoint borehole extensometers, amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Global Infrastructure Monitoring Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Government Regulations Pertaining to Sustainability of Structures

- 5.1.2 Cost-effective and Flexible Nature for Information Acquisition and Improving Maintenance Efficiency and Safety

- 5.2 Market Challenges

- 5.2.1 Shortage of Skilled Technicians for Installation and Calibration of Systems across Developing countries

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.2 Software and Services

- 6.2 By Application

- 6.2.1 Geotechnical Monitoring

- 6.2.2 Structural Monitoring

- 6.2.3 Environmental Monitoring

- 6.2.4 Other Applications (Spatial Monitoring, Traffic Flow Monitoring, etc.)

- 6.3 By End-user Industry

- 6.3.1 Civil Infrastructure

- 6.3.2 Oil and Refineries

- 6.3.3 Transportation

- 6.3.4 Mining

- 6.3.5 Others

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Acellent Technologies, Inc.

- 7.1.2 Geocomp Corporation

- 7.1.3 COWI A/S

- 7.1.4 Sisgeo S.r.l.

- 7.1.5 RST Instruments Ltd.(Vance Street Capital)

- 7.1.6 Campbell Scientific, Inc.

- 7.1.7 Geokon, Inc.

- 7.1.8 Nova Metrix LLC

- 7.1.9 WorldSensing SL

- 7.1.10 Ackcio Pte Ltd.