|

市場調查報告書

商品編碼

1435945

一次性塑膠包裝:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Global Single Use Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

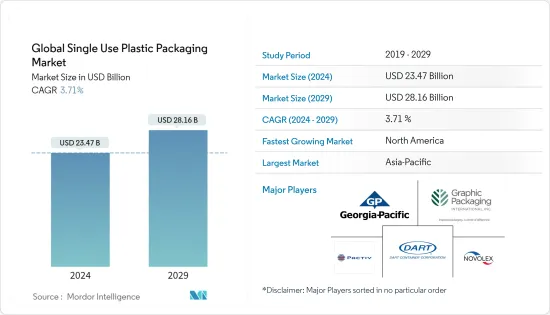

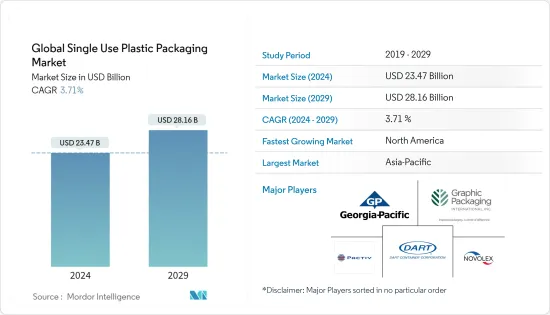

預計2024年全球一次性塑膠包裝市場規模為234.7億美元,預計到2029年將達到281.6億美元,在預測期(2024-2029年)將成長37.1億美元,複合年成長率為% 。

COVID-19 大流行為一次性塑膠包裝供應商帶來了極大的緩解。儘管許多國家已逐漸禁止此類包裝並推廣可重複使用的包裝,但疫情改變了消費者和政府對包裝的行為。

由於COVID-19的爆發,對能量飲料和保健食品的需求急劇增加。這些產品大部分採用一次性塑膠包裝。全球範圍內的訂單規模如此之大,以至於該行業的製造商和包裝公司甚至擴大了設施,這也得到了大多數政府的支持。

主要亮點

- 推動市場成長的因素包括對線上食品配送服務的需求不斷成長以及一次性包裝的使用帶來了更多的便利性和實用性。儘管一次性塑膠對環境產生重大影響,但由於與其他材料相比,它們重量輕且耐用,因此仍然被大量使用。然而,隨著一次性塑膠替代品普及顯著的市場滲透,這種推動的有效性將逐漸減弱。

- 根據 Business Insider 報導,美國線上包裝食品銷售額預計將從 2012 年的 60 億美元增至 2021 年的 1,660 億美元。由於最終用戶行業消費的增加,對一次性塑膠包裝的需求也在增加。由於一次性包裝成本低且可用性高,大多數最終用戶都採用一次性包裝。這也影響著世界各地的回收業。

- 隨著一些國家禁止使用一次性塑膠,一些公司正在將其生產線從塑膠轉向天然纖維。例如,BFG Eco Packaging 採用聚苯乙烯和聚丙烯製造盒子、盤子和托盤,並使用甘蔗纖維(一種來自砂糖過程的產品)來生產其產品。英國包裝製造商 Vegwear 也關注基於紡織品的宏觀趨勢。該公司使用可再生植物性材料,因為天然纖維可提供經濟耐用的外帶盒。

- 歐盟到 2021 年對各種一次性塑膠產品的禁令正面臨威脅,因為消費者和餐廳因為擔心傳染病而越來越依賴它們。與可重複使用的塑膠產品相比,消費者和供應商更喜歡一次性塑膠。例如,鑑於新冠疫情,星巴克宣佈在全球所有門市暫停使用可重複使用的杯子。

一次性塑膠包裝市場趨勢

PET預計將顯著成長

- 在原料樹脂中,PET是一種主要材料,佔據了80%以上的市場佔有率,因為它成本低廉,並且可以輕鬆改變其物理性能,以滿足廣泛的客戶需求。

- 聚對聚對苯二甲酸乙二酯(PET) 由於其高抗衝擊性以及改進的防潮和氣體阻隔性而用於碳酸飲料包裝。它具有堅固的結構和高強度。此外,與高密度聚苯乙烯(HDPE)包裝相比,具有紫外線阻隔性的寶特瓶的光澤外觀往往對於延長產品保存期限非常突出,並且玻璃般的透明度已成為各種包裝的標準。

- 例如,2021年2月,可口可樂推出了13.2盎司的可口可樂、健怡可樂、零糖可樂和可口可樂口味等商標品牌。由 100% 再生 PET (rPET) 塑膠製成的瓶子在加州、佛羅裡達州和東北部的一些州推出,今年夏天其他發泡飲料品牌也紛紛效仿。

- PET 包裝的回收率高度依賴回收基礎設施的可用性和可近性,因此這是影響特定地區市場成長的關鍵因素。例如,如今,居住在人口 125,000 人或以上的社區的美國居住者中有 94% 使用回收計劃。

- 市場上的供應商致力於提高PET一次性塑膠包裝的可回收性,以符合法規並在回收方面形成封閉回路型循環。隨著人們越來越重視回收這些材料,預計 PET 一次性塑膠包裝將會成長。

北美實現溫和成長

- 食品服務業是重要的最終用戶產業之一,在杯子和蓋子市場中佔據主要佔有率。線上食品配送服務的成長增加了對食品杯的需求。依地區分類,美國是世界第二大食品市場。用於食品包裝的塑膠用量約佔塑膠總量的 40%。此外,根據美國人口普查局的數據,美國外食服務總銷售額達到 602 萬美元。

- 政府的打擊也對市場產生負面影響。然而,由於疫情持續,紐約州一次性塑膠袋禁令於2020年3月1日生效,並延至2020年5月15日。塑膠需求的激增可能只是暫時的改變。向循環經濟轉型的短期努力和目標。除此之外,塑膠製造鏈也可能面臨壓力。

- 此外,2020 年 10 月,美國能源局(DOE) 宣佈為 12 個計劃提供超過 2,700 萬美元的資金,以支持先進塑膠回收再利用技術和可回收設計的新型塑膠的開發。

- 作為能源部塑膠創新課題的一部分,這些計劃還將幫助改進現有的回收工藝,將塑膠分解成可用於製造新產品的化學成分。此類舉措可支持一次性塑膠包裝市場

- 儘管該地區多年來一直在考慮採取監管措施,但 COVID-19感染疾病減緩了此類法律的實施,並為市場帶來了急需的緩解。此次疫情實際上推遲了歐盟將歐盟一次性塑膠指令(SUPD)轉化為國家法律的立法程序。例如,義大利的塑膠稅已從2020年延後到2021年,該國海洋保護機構Malevivo正在鼓勵全面禁止塑膠杯。

一次性塑膠包裝行業概況

全球一次性塑膠包裝市場高度整合。一次性塑膠包裝市場各公司之間的競爭由於 Dart Container Corporation、Georgia-Pacific LLC 和 Graphic Packaging International, Inc. 等幾家主要企業的存在,公司之間的競爭加劇。收購使這些公司在市場上佔據了更強大的地位。

- 2021 年 5 月 - Novolex 旗下歐洲熱成型包裝專家 Waddington Europe 透過添加開創性的熱填充選項升級了其 TamperVisible 系列保護性包裝產品。 TamperVisible 產品系列讓最終用戶放心,因為裡面的食品就像準備時一樣安全。

- 2021 年 5 月 - Interfor Corporation 與 Georgia-Pacific Wood Products LLC 和 GPGP Wood Products LLC 達成協議,收購位於密西根州 Bay Springs、阿拉巴馬州費耶特、路易斯安那州德昆西和奧勒岡州Philomath 的四家鋸木廠業務。收購價格為3.75億美元,包括營運資金,將全部由庫存現金提供資金。

- 2021 年 7 月 - Graphic Packaging Holding Company 推出 OptiCycle,這是一系列非聚乙烯 (PE) 塗層一次性食品包裝產品,可取代傳統 PE 和聚乳酸 (PLA) 塗層產品。該解決方案將由當地供應商在北美進行商業化,其設計目的是透過使液體隔離層與紙張順利分離來實現輕鬆回收。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵意強度

- 市場促進因素

- 市場課題

- 市場機會

第5章 評估 COVID-19 對產業的影響

第6章食品服務業形勢

- 依地區分類的食品服務市場需求

- 食品服務市場需求(依類別)

第7章 一次性塑膠包裝的管理規定

第8章一次性塑膠包裝的生命週期

第9章市場區隔

- 依材質

- 聚乳酸(PLA)

- 聚對苯二甲酸乙二酯(PET)

- 聚乙烯(PE)

- 其他類型的材料

- 依產品類型

- 瓶子

- 翻蓋式

- 托盤、杯子、蓋子

- 其他產品類型

- 依最終用戶

- 快速服務餐廳

- 全方位服務餐廳

- 設施

- 零售

- 其他最終用戶

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第10章競爭形勢

- 公司簡介

- Georgia-Pacific LLC

- Graphic Packaging International, Inc.

- Novolex

- Pactiv LLC

- Ardagh Group SA

第11章 市場未來前景

The Global Single Use Plastic Packaging Market size is estimated at USD 23.47 billion in 2024, and is expected to reach USD 28.16 billion by 2029, growing at a CAGR of 3.71% during the forecast period (2024-2029).

The COVID-19 pandemic provided significant relief to the single-use packaging vendors. Although many countries were slowly banning such packaging and promoting reusable packaging, the outbreak changed the consumers' and governments' behavior toward them.

Due to the COVID-19 outbreak, the demand for nutritional drinks and healthy food increased exponentially. The majority of these products are packaged with single-use plastic. The orders were so huge on a global level that the manufacturers and packaging companies in the field even expanded their facilities, which was also supported by most of the governments.

Key Highlights

- Factors driving the market's growth include the growing demand for online food delivery services and the use of single-use packaging that offers increased convenience and utility. Single-use plastics are still being considerably used due to their lightweight and durable properties compared to other materials, despite having significant effects on the environment. However, the effect of the driver will gradually decrease once alternatives to single-use plastics gain significant traction in the market.

- According to Business Insider, online packaged food sales in the United States are expected to reach USD 166 billion in 2021 from USD 6 billion in 2012. The growth in end-user industry consumption is also increasing the demand for single-use packaging. Most of these end-users are adopting single-use packaging due to their low cost and easy availability. This has also affected the recycling industry across the world.

- Several companies are switching their production lines from plastic to natural fiber-based options due to the ban on single-use plastics in several countries. For instance, BFG Eco Packaging, which makes boxes, plates, and trays from polystyrene and polypropylene, makes products using sugarcane fiber, a sub-product obtained during the sugar manufacturing process. Also, banking on the fiber-based macro trend is Vegware, a UK packaging manufacturer, which uses renewable plant-based materials as the natural fibers provide an economical, sturdy takeaway box.

- The EU's ban on a range of single-use plastic items by 2021 came under threat as more consumers and restaurants became more dependent on disposable plastic products due to contagion fears. Consumers and vendors prefer single-use plastic to reusable plastic products. For instance, given the pandemic, Starbucks announced a temporary pause on reusable cups across its global outlets.

Single Use Packaging Market Trends

PET is Expected to Witness Significant Growth

- PET, among the raw material resin, is the dominant material capturing a market segment of more than 80% due to the easiness with which the physical property is altered to suit a wide variety of customer's needs while maintaining low costs.

- Polyethylene terephthalate (PET) is used for carbonated drinks packaging due to its high impact-resistant nature and improved moisture and gas barrier properties. They have a rigid structure with high strength. Moreover, compared to high-density polyethylene (HDPE) packaging, the glossy appearance of PET bottles with ultraviolet barriers often stand out for extending the shelf life of products, making the glass-like transparency a standard for a variety of packaging.

- For instance, in February 2021, Coca-Cola's trademark brands, which include Coke, Diet Coke, Coke Zero Sugar, and Coca-Cola Flavors, introduced a 13.2-oz. bottle made from 100% recycled PET (rPET) plastic in California, Florida, and select states in the Northeast, with other sparkling beverage brands following this summer.

- The rate of recycling of PET packaging highly depends on the availability and accessibility of recycling infrastructure and therefore serves as a significant factor impacting the growth of the market in a particular region. For instance, currently, 94 percent of U.S. residents living in communities with a population of more than 125,000 have recycling programs available to them.

- The vendors in the market are focusing on increasing the recyclability of PET single use packaging in order to adhere to the regulations as well as create a closed loop cycle in terms of recycling. The increasing emphasis on recycling of these materials is expected to provide growth prospects to PET single use packaging.

North America to Witness Moderate Growth

- The food service industry is one of the prominent end-user industries that hold a significant share in the cups and lids market. The growth of online food delivery services augmented the demand for food cups. Among regions, the United States is the second-largest food market across the world. The volume of plastic allocated to food packaging amounts to approximately 40% of plastics. Moreover, according to the US Census Bureau, the total foodservice sales in the United States amounted to USD 6.02 million.

- The government enforcements also harm the market. However, due to the ongoing pandemic New York State's ban on single-use plastic bags, which went into effect on March 1, 2020, it was postponed to May 15, 2020. Such a spike in plastic demand would likely lead to a temporary change in the short-term initiatives and goals of transitioning to a circular economy. Apart from this, it is likely to put pressure on the plastic manufacturing chain.

- Moreover, in October 2020, the US Department of Energy (DOE) announced over USD 27 million in funding for 12 projects that will support the development of advanced plastics recycling technologies and new plastics that are recyclable-by-design.

- As part of DOE's Plastics Innovation Challenge, these projects will also help improve existing recycling processes that break plastics into chemical building blocks, which can then be used to make new products. Such initiatives might support the single-use plastic packaging market

- In spite ofthe regulatory measures that have been on the table for the last few years in the region, the COVID-19 pandemic has stalled the imposition of such legislation and has provided the market with a much-needed lifer for the time. The pandemic has effectively postponed the legislative process of the European Union for the transposition of the EU Single-Use Plastic Directive (SUPD) into domestic law. For instance, Italy's Plastic tax has been postponed from 2020 to 2021, with Marevivo, the maritime protection agency of the country, encouraging a complete ban on plastic cups.

Single Use Packaging Industry Overview

The Global Single-Use Plastic Packaging Market is Highly Consolidated . The competitive rivalry amongst the players in the single-use packaging market is high owing to the presence of some key players such as Dart Container Corporation, Georgia-Pacific LLC, Graphic Packaging International, Inc., etc. Through strategic partnerships, mergers, and acquisitions, these players have been able to gain a stronger footprint in the market.

- May 2021- European thermoforming packaging specialist Waddington Europe, a division of Novolex, upgraded its TamperVisible range of protective packaging products by adding a pioneered Hot Fill option. The TamperVisible range of products reassures the end-user that the food inside is as safe as the day it was prepared.

- May 2021 -Interfor Corporation signed an agreement with Georgia-Pacific Wood Products LLC and GP Wood Products LLC to acquire four sawmill operations located in Bay Springs, Miss., Fayette, Ala., DeQuincy, La., and Philomath, Ore. The total purchase price of USD 375 million, including working capital, will be funded entirely from cash on hand.

- July 2021 - Graphic Packaging Holding Company launched OptiCycle, a line of non-polyethylene (PE) coated, single-use foodservice packaging, which is an alternative to classic PE and polylactic acid (PLA) coated products. The solution is to be commercialized in North America by a local supplier and designed to be easily recyclable by allowing the smooth separation of the liquid barrier layer from the paper.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.5 Market Challenges

- 4.6 Market Opportunities

5 ASSESMENT OF COVID-19 IMPACT ON THE INDUSTRY

6 FOODSERVICE INDUSTRY LANDSCAPE

- 6.1 Foodservice Market Demand by Region

- 6.2 Foodservice Market Demand by Category

7 SINGLE-USE PLASTIC PACKAGING REGULATIONS

8 LIFECYCLE of SINGLE-USE PLASTIC PACKAGING

- 8.1 (Collection, Sorting, Recycling. End Of Life)

9 MARKET SEGMENTATION

- 9.1 By Material

- 9.1.1 Polylactic Acid (PLA)

- 9.1.2 Polyethylene Terephthalate (PET)

- 9.1.3 Polyethylene (PE)

- 9.1.4 Other Types of Materials

- 9.2 By Product Type

- 9.2.1 Bottles

- 9.2.2 Clamshells

- 9.2.3 Trays, Cups & Lids

- 9.2.4 Other Product Types

- 9.3 By End-User

- 9.3.1 Quick Service Restaurants

- 9.3.2 Full Service Restaurants

- 9.3.3 Institutional

- 9.3.4 Retail

- 9.3.5 Other End-users

- 9.4 By Geography

- 9.4.1 North America

- 9.4.2 Europe

- 9.4.3 Asia-Pacific

- 9.4.4 Latin America

- 9.4.5 Middle East & Africa

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles*

- 10.1.1 Georgia-Pacific LLC

- 10.1.2 Graphic Packaging International, Inc.

- 10.1.3 Novolex

- 10.1.4 Pactiv LLC

- 10.1.5 Ardagh Group S.A.