|

市場調查報告書

商品編碼

1406261

主動網路管理 -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Active Network Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

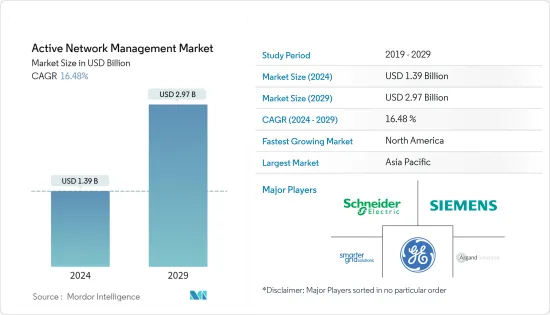

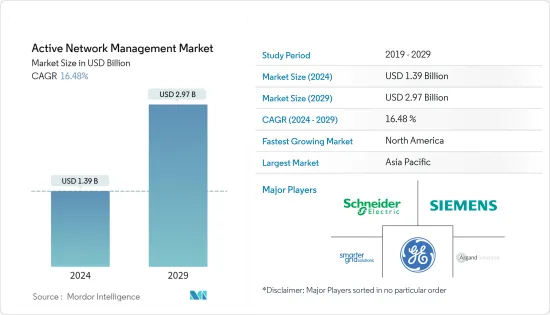

主動網路管理市場規模預計到 2024 年為 13.9 億美元,預計到 2029 年將達到 29.7 億美元,在預測期內(2024-2029 年)複合年成長率為 16.48%。

主要亮點

- 由於擴充性、遠端存取以及經濟高效的資料儲存和處理能力,公用事業公司正在轉向針對主動網路管理市場和電網資產監控的雲端基礎的解決方案。此外,公共產業公司正在利用人工智慧 (AI) 和資料分析來最佳化電網營運。主動網路管理系統利用預測分析來預測電網行為並採取主動措施。電網資產監控也利用人工智慧來預測維護需求並檢測異常情況,從而促進市場成長。

- 新興的智慧電網技術將促進向低碳經濟的轉型,並且需要ANM系統來進行潮流和電壓管理。 2030年實現淨零目標每年需要約6000億美元的投資。然而,新興市場和新興經濟體的快速投資進程要求電網獲得這種必要的認可並抑制ANM市場的成長。

- 根據國際能源總署 (IEA) 的數據,2022 年至 2025 年間,全球發電量將增加 2,493 太瓦時,促使可再生能源發電增加以滿足這一需求。德國的目標是到2035年100%的電力來自可再生能源,而全球整體可再生能源預計在未來三年內成為最重要的電力源。主動網路管理系統將在連接更多分散式可再生發電方面發揮關鍵作用。

- 交通運輸、電動車 (EV) 的電氣化需要主動的網路管理來管理充電基礎設施和電網資產監控,以評估對電網資產的影響。這一步是市場擴張的原動力。印度工業聯合會 (CII) 2023 年 7 月表示,到 2030 年,印度可能需要至少 132 萬個電動車充電站,以促進電動車的快速普及。政府對電動車的大力支持增加了消費者的選擇和意識,促使與前一年同期比較電動車普及大幅增加,年增兩倍。

- 主動網路管理 (ANM) 系統收集和傳輸有關網路操作的敏感資訊。確保這些資料的機密性和安全性至關重要。對資料外洩和詐欺的日益擔憂可能會阻礙主動網路管理(ANM)系統的部署。此外,在某些地形崎嶇和極端天氣條件的地區,實施主動網路管理基礎設施可能很困難且成本高昂,這可能會阻礙市場成長。

- 由於供應鏈中斷、勞動力限制以及在 COVID-19 大流行的關鍵階段對現場存取和安裝的限制,主動網路管理 (ANM)計劃面臨延誤。這些因素影響了正在進行的項目和新計畫。隨後,COVID-19 大流行凸顯了對電網彈性的需求,而主動網路管理在監測和響應電網中斷方面的作用對於提供可靠的電力供應至關重要,特別是在意外停電期間。更重要。

主動網路管理市場趨勢

電網資產監控佔主要市場佔有率

- 由於人們對環境問題的興趣日益濃厚,對智慧電網的需求正在迅速增加。近年來,能源消耗大幅成長,2022年1月至2022年9月期間,全球約有250億美元分配給能源儲存和智慧電網。這些投資預計將繼續成長,能源儲存公司在從石化燃料到清潔能源來源的轉型中發揮著至關重要的作用。

- 電力需求的增加將導致電網中的可再生能源數量超過設計目標。故障或過時的變壓器佔停機時間和服務成本的 70% 以上,因此變壓器監控至關重要。資產效能管理 (APM) 和主動網路管理 (ANM) 是實現這項變革的重要工具。

- 根據美國能源局(DoE) 的數據,到 2026 年,美國公用事業公司對 IT 和 OT 數位技術的資本投資總額將達到 245 億美元。其中,164億美元將用於智慧電網技術和系統。

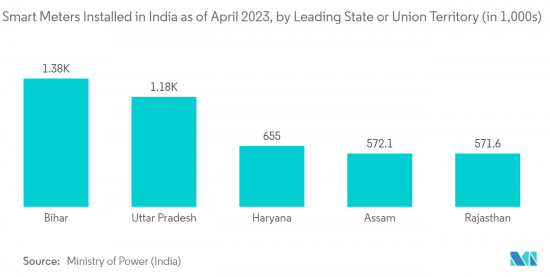

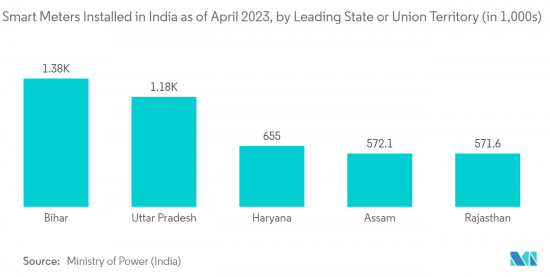

- 在許多地區,投資電網現代化措施以提高電網的可靠性、生產力和彈性變得越來越重要。 2023年4月,印度比哈爾邦安裝了137萬台智慧電錶,數量位居全國第一。北方邦則位居第二,哈里亞納邦緊追在後,位居第三。資產監控已成為此流程的關鍵要素,因為它對於管理和最佳化這些現代化網路至關重要。例如,在亞太地區,中國國家電網等國家於2023年1月宣布2023年電網投資770億美元。

- Ubiquia 等公司正在開發基於人工智慧的解決方案,以幫助電力公司遠端監控和維護變電站。 UbiHub 變電站監控解決方案採用尖端攝影機技術和工業人工智慧來偵測電弧等安全風險、監控野生動物入侵並發現犯罪分子侵入。這使公用事業公司能夠全面了解所有變電站並主動監控威脅。

亞太地區實現顯著成長

- 亞洲國家希望所有產業快速實現電氣化。綠色社區電網正在獲得巨大的吸引力,特別是在中國、印度和尼泊爾等國家。根據國際能源總署(IEA)預測,全球新增電力需求的70%將來自亞洲國家,主要是中國、印度和東南亞。未來兩年,中國將佔再生能源成長的45%以上。

- 智慧城市的出現有望進一步增強該地區的市場競爭力。借助技術,智慧城市可以減少對環境的負面影響。例如,智慧電力系統可以管理尖峰需求。智慧水系統可確保高效的水分配,並且可使用基於證據的決策工具更有效、更透明地規劃有限的基礎設施投資。智慧城市運作的基本要素之一是智慧型能源系統。物聯網(IoT)、人工智慧(AI)和巨量資料等先進技術有望解決當前和未來的各種課題。

- 物聯網設備和感測器的引入極大地促進了主動網路管理產業的擴張。這些技術可以即時監控電網狀況和資產性能,從而更快地回應問題並做出更明智的決策。例如,2023年9月,印度電力基礎設施系統將進入重大變革時期期。智慧電網和物聯網的整合正在實現配電效率和可靠性的革命性結合,並推動更具彈性和永續能源系統的發展。

- 能源產業的公司正在投資人工智慧技術。例如,智慧電動車 (EV) 充電器可以在需求最低且電力最便宜時自動充電,從而減輕網路壓力。印度ReNew Power公司宣布與12家外國金融機構建立合作夥伴關係,提供11億美元的外部商業借款計劃融資貸款。這筆資金將支持 ReNew 的混合電池供電、24可再生運作計劃,包括太陽能發電工程、風電場和儲能設施。

主動網路管理產業概述

由於有許多大大小小的公司,主動網路管理市場競爭非常激烈。領先企業正在積極努力將溫室氣體排放減少到接近零或在特定時間範圍內實現淨零排放。這一勢在必行,推動了對主動網路管理解決方案的需求。西門子股份公司、通用電氣公司和 Argand Solutions 公司等主要行業參與者正在即時監控分散式發電 (DG) 高普及帶來的問題,並實施創新以增加配電網內的 DG 容量。創新解決方案開發的前沿。

2023年2月,西門子與EnergyHub建立策略夥伴關係,共同建構全面且可擴展的下一代DER管理系統(分散式能源)。西門子軟體透過考慮所有分散式能源來源,在加強網路規劃、營運和維護方面發揮著至關重要的作用。西門子和 EnergyHub 的合作使公用事業公司能夠利用西門子的網路專業知識和 EnergyHub 的電網領先能力,從而為下一代分散式能源管理解決方案提供全面的產品組合元素。這項發展使公用事業公司能夠利用分散式能源作為替代的無線解決方案並減少對硬體投資的需求,從而實現淨零排放。

2023年1月,該公司將與著名的公共和專用行動網路供應商波特蘭通用電氣(PGE)合作,加速電網現代化進程和再生能源來源的整合。 Expeto 的專用無線網路由波特蘭通用電氣公司提供支持,可簡化自動化電網彈性,透過智慧型感測器和設備追蹤現場狀況,提高員工安全性,整合員工以提高生產力,並提供電動車充電站以使用公共電網。這項合作將加速可再生能源的部署和電網基礎設施的現代化。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 對主動網路管理市場的影響

第5章市場動態

- 市場促進因素

- 可再生能源商業化的成長

- 智慧城市計劃增加

- 市場課題

- 引進ANM維修成本高

第6章市場區隔

- 依類型

- 軟體

- 依服務

- 依用途

- 自動化

- 電網資產監控

- 即時監控

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章 競爭形勢

- 公司簡介

- Schneider Electric SE

- Siemens AG

- Smarter Grid Solutions Ltd.

- General Electric Company

- Argand Solutions

- Camlin Ltd

- Chemtrols Industries Pvt. Ltd

- ABB Group

- Itron Inc

- SolarWinds

- Landis+Gyr

第8章投資分析

第9章 市場的未來

The Active Network Management Market size is estimated at USD 1.39 billion in 2024, and is expected to reach USD 2.97 billion by 2029, growing at a CAGR of 16.48% during the forecast period (2024-2029).

Key Highlights

- Utilities are increasingly transitioning to cloud-based solutions for active network management market and grid asset monitoring due to the scalability, remote accessibility, and cost-efficient data storage and processing capabilities. Furthermore, utilities use artificial intelligence (AI) and data analytics to optimize grid operations. Active network management systems leverage predictive analytics to anticipate grid behavior and implement proactive measures. Grid asset monitoring also utilizes AI to predict maintenance needs and detect anomalies, thus contributing to the market's growth.

- The emerging Smart Grid technology will facilitate the shift to a low-carbon economy, and ANM systems will be required for power flow and voltage management. Huge investments need to be made toward electricity grids; around USD 600 billion in annual investment is required to achieve a net zero target by 2030. However, the investment process can be fast in emerging markets and developing economies, so electricity grids need to receive this necessary recognition and restrain the growth of the ANM market.

- According to the International Energy Agency (IEA), global electricity generation will rise by 2,493TWh between 2022 and 2025, leading to the growth in renewable generation that will cater to this demand. While Germany aims for 100% power generation from renewable resources by 2035, renewables are expected to be the most significant source of electricity within the next three years globally. Active network management systems will play a vital role in linking more distributed, renewable generation.

- The electrification of transportation, electric vehicles (EVs), necessitates active network management for the management of the charging infrastructure, as well as grid asset monitoring to evaluate the effect on grid assets. This step has been a driving factor in the expansion of the market. According to the Confederation of Indian Industry (CII), in July 2023, India may require at least 1.32 million EV charging stations by 2030 to facilitate the rapid uptake of electric vehicles. The government's strong support for electric vehicles has increased consumer choice and awareness, resulting in an exponential growth in EV adoption during 2022, with a threefold increase from the previous year.

- Active network management (ANM) systems collect and transfer sensitive information about network operations. It is essential to ensure the confidentiality and safety of this data. Rising concerns of data breaches or misappropriation may impede the adoption of Active network management (ANM) systems. Furthermore, in certain regions with rugged terrain or extreme weather conditions, implementing an Active network management infrastructure may be challenging and expensive, thus impeding the market's growth.

- Active network management (ANM) projects faced delays in the primary stages of the COVID-19 pandemic due to supply chain disruptions, labor constraints, and restrictions on-site visits and installation. These factors affected both ongoing and new projects. Subsequently, the COVID-19 pandemic highlighted the need for grid resilience, and the role of active network management in monitoring and responding to grid disruptions has become increasingly important in providing a dependable power supply, particularly during unexpected outages.

Active Network Management Market Trends

Grid Asset Monitoring to Hold the Significant Market Share

- The smart grids are experiencing a surge in demand due to increasing environmental concerns. Over the years, energy consumption has grown significantly, and approximately USD 25 billion was allocated to energy storage and smart grids worldwide between January 2022 and September 2022. These investments are expected to expand, with energy storage companies playing a pivotal role in transitioning from fossil fuels to clean energy sources.

- Due to increasing electricity demand, grids receive more renewable energy sources input than they were designed for. Transformer monitoring is essential since broken or old transformers account for more than 70% of downtime and service costs. Asset performance management (APM) and active network management (ANM) are essential tools to effect this change.

- According to The US Department of Energy (DoE), total capital spending on IT and OT digital technologies by US electric utilities will reach 24.5 billion USD by 2026. Of this, 16.4 billion USD will be used for smart grid technologies and systems.

- It is becoming increasingly important for many regions to invest in grid modernization initiatives to enhance the electrical networks' dependability, productivity, and resilience. In April 2023, India's state of Bihar had the most installed smart meters across the country, with a total of 1.37 million. Uttar Pradesh followed in second place, followed by Haryana. Asset monitoring is a crucial component of this process, as it is essential for managing and optimizing these modernized networks. For instance, in the Asia Pacific, countries like the Chinese State Grid announced in January 2023 a USD 77 billion investment in the power grid for the year 2023.

- Companies like Ubicquia are developing AI-based solutions to help utility companies maintain their substations with remote monitoring. The UbiHub substation monitoring solution uses cutting-edge camera technology with industrial AI to detect safety risks like arc flashes, watch for wildlife intrusions, and spot trespassing criminals. This way, utilities have complete insight into every substation and can actively monitor threats.

Asia-Pacific to Witness a Significant Growth

- Asian nations want to electrify quickly across all industries. Green community grids are gaining significant traction, notably in nations like China, India, and Nepal. According to the International Energy Agency (IEA), 70% of global electricity demand growth will come from Asian countries, comprising China, India, and Southeast Asia. China will account for over 45% of renewables growth in the next two years.

- The emergence of smart cities is expected to add to the region's competencies in the market. With the help of technology, smart cities can lessen their adverse environmental effects. For instance, smart power systems can manage peak demand. Smart water systems can ensure efficient water distribution and evidence-based decision-making tools can be used to plan limited infrastructure investments more efficiently and transparently. One of the essential elements of any functioning smart city is a smart energy system. Advanced technologies like the Internet of Things (IoT), artificial intelligence (AI), and big data are expected to address various current and future difficulties.

- Implementing IoT devices and sensors has been a significant contributor to the expansion of the active network management industry. These technologies enable real-time monitoring of grid conditions and the performance of assets, allowing for faster responses to problems and more informed decisions. For instance, in September 2023, India's power infrastructure system is undergoing a significant transformation, as the integration of smart grids and the IoT has enabled a revolutionary combination of efficiency and reliability in power distribution, as well as the development of a more resilient and sustainable energy system.

- Energy sector players are investing in AI technologies. For instance, smart electric vehicle (EV) chargers can automatically enable charging when demand is lowest and electricity cheapest, thus reducing the burden on the network. India-based ReNew Power announced a collaboration with twelve foreign lenders for external commercial borrowings for project finance loans of 1.1 billion USD. The funds will be utilized for ReNew's hybrid, battery-powered, round-the-clock renewable energy project, including solar projects, wind farms, and battery storage facilities.

Active Network Management Industry Overview

The active network management market is highly competitive due to the presence of numerous small and large players. Major organizations are actively working towards reducing greenhouse gas emissions to nearly zero or achieving Net Zero emissions within a specific timeframe. This imperative has driven the demand for Active Network Management solutions. Key industry players such as Siemens AG, General Electric Company, and Argand Solutions are at the forefront of developing innovative solutions to monitor real-time issues stemming from high distributed generation (DG) penetration, consequently increasing DG capacity within distribution networks.

In February 2023, Siemens entered into a strategic partnership with EnergyHub to create a holistic and scalable next-generation DER management system (Distributed Energy Resources). Siemens' software will play a pivotal role in enhancing the planning, operation, and maintenance of networks by considering all the distributed energy sources. This collaboration between Siemens and EnergyHub empowers utilities to leverage Siemens' network expertise and EnergyHub's grid-leading capabilities, resulting in a comprehensive portfolio element for a next-generation distributed energy resource management solution. This development is poised to enable utilities to achieve net zero emissions by harnessing distributed energy resources as a non-wiring alternative solution, reducing the need for investments in hardware.

In January 2023, Expeto, Inc. joined forces with Portland General Electric (PGE), a prominent provider of public and private mobile networks, to accelerate the grid modernization process and the integration of renewable energy sources. Expeto's private wireless network, facilitated by Portland General Electric, will streamline automated grid resilience, track field conditions through intelligent sensors and equipment, integrate workers for enhanced employee safety, and provide electric vehicle charging stations for public grid use. This collaborative effort is set to advance the adoption of renewable energy and modernize the grid infrastructure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Active Network Management Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Renewable Energy Commercialization

- 5.1.2 Rising Number of Smart City Projects

- 5.2 Market Challenges

- 5.2.1 High Cost of Upgrading for ANM Technology Deployment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Application

- 6.2.1 Automation

- 6.2.2 Grid-Asset Monitoring

- 6.2.3 Real-Time Monitoring

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Schneider Electric SE

- 7.1.2 Siemens AG

- 7.1.3 Smarter Grid Solutions Ltd.

- 7.1.4 General Electric Company

- 7.1.5 Argand Solutions

- 7.1.6 Camlin Ltd

- 7.1.7 Chemtrols Industries Pvt. Ltd

- 7.1.8 ABB Group

- 7.1.9 Itron Inc

- 7.1.10 SolarWinds

- 7.1.11 Landis+Gyr