|

市場調查報告書

商品編碼

1334485

光波長服務市場規模和份額分析 - 增長趨勢和預測(2023-2028)Optical Wavelength Services Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

光波長服務市場規模預計將從2023年的43.3億美元增長到2028年的75.4億美元,預測期內(2023-2028年)複合年增長率為11.71%。

主要亮點

- 預計到 2025 年,全球數據量將翻一番,因此更加需要關注每比特成本和功耗。長距離擴展大波長可以為最終用戶提供更具成本效益和更高效的服務。波長擴展還可以顯著增加網絡帶寬,這對於高清內容、5G 蜂窩網絡、物聯網、遠程工作和其他應用至關重要。

- 對光纖到戶(FTTH)系統的需求不斷增加,不僅在城市地區,而且在農村和偏遠地區加速了網絡連接的部署。這些投資正在加劇有線電視公司之間的競爭,以提供更密集、更高性能的無線網絡和更高波長的服務。

- 2023 年 2 月,Fujitsu發布了 1FINITY,這是一款超可靠的光傳輸平台,可實現每波長 1.2 太比特每秒 (Tbps) 的數據速率。該平台有助於降低功耗,並將全網二氧化碳排放量減少60%。

- 儘管跨網絡更廣泛部署 FTTH 具有諸多好處,但運營商對安裝額外光纖或最終用戶光調製解調器的成本仍猶豫不決。隨著行業轉向更大的帶寬(例如 50G 和 100G),這一成本問題可能會變得更加嚴重,這需要調製解調器中的相干技術。

- 即使在 COVID-19 大流行之後,網絡運營商仍在繼續增加設備和容量,以支持遠程工作、基於雲的服務、流媒體視頻、物聯網和 5G 無線技術。數據和高速網絡日益增長的需求和供應中斷正在推動網絡解決方案提供商開發高波長網絡,該網絡可以快速擴展容量以解決流量瓶頸並降低數據傳輸速率,並推動招聘。

光波長業務市場趨勢

10Gbps以下的帶寬推動了市場

- 相干WDM技術是一種先進的光傳輸技術,具有更高的比特率、更大的靈活性、更簡單的DWDM線路系統以及更好的光學性能等眾多優點。該技術使得DWDM網絡中經濟高效且可靠的光傳輸得以發展,波長速度從前相干時代的10Gb/s到100Gb/s、200Gb/s,以及現在現代相干光設備中的波長速度。已提高到400Gb/s和800Gb/s。

- CWDM 和 DWDM 是適應信息傳輸所需的增加帶寬的兩種不同方法。DWDM 使用更窄的波長帶或通道,而 CWDM 每個通道使用更寬的波長帶。

- 英國廣播、通信和郵政行業的官方監管機構和競爭機構——通信辦公室 (Ofcom) 表示。平均每個人每月使用大約 2.9GB 的數據,並且隨著數字化的進步,這一需求只會不斷增加。但我們發現10Gb/s對於普通手機用戶來說已經足夠了。

- 2023 年 2 月,新加坡電信公司 StarHub 推出了超高速寬帶,其速度和帶寬比新加坡標準寬帶服務快 10 倍。這種高速寬帶服務顯著改善了家庭連接,為在線遊戲和光速內容流提供最佳響應能力。

- 2022年6月,視頻傳輸服務MASV採用了具有10Gbps性能的下一代光纖互聯網服務。通過此次升級,MASV 現在可以通過雲安全高效地傳輸 PB 級視頻,讓任何人都可以更快、更經濟高效地傳輸大量視頻數據。

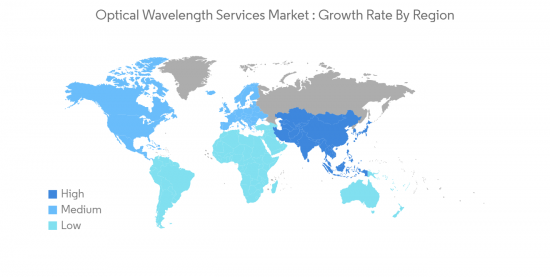

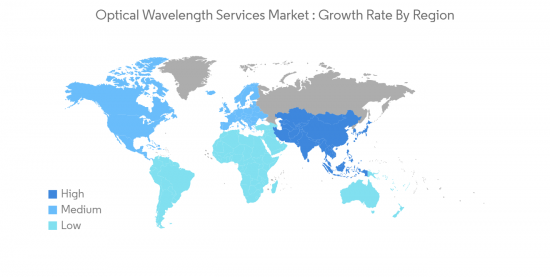

亞太地區佔據壓倒性的市場份額

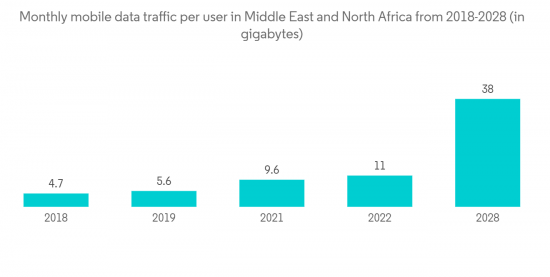

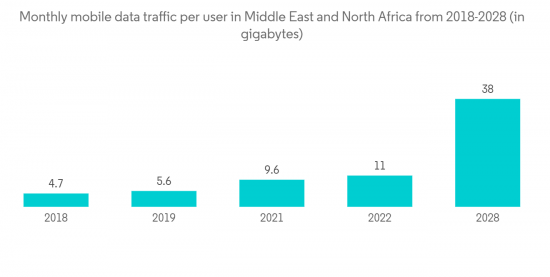

- 印度和中國這兩個國家佔據了全球移動數據流量的近一半,而北美和歐洲合計僅佔全球移動數據服務的四分之一。印度尤其成為移動數據服務市場的主要參與者,其每月移動數據消耗量為全球最高,為每用戶 12GB。

- 此外,印度每季度新增 2500 萬智能手機用戶,使其成為移動數據服務的重要市場。由於智能手機用戶的快速增長,預計到 2022 年,每個用戶的平均每月數據消耗量將達到 19.5 GB,這表明對數據驅動的應用程序和服務的需求正在增加。這一發展凸顯了印度作為全球移動數據市場主要參與者的地位,具有進一步增長和創新的巨大潛力。

- 移動數據服務的強勁增長也刺激了對 5G 設備的需求,而私營部門在 5G 網絡上的支出導致這些設備在印度的出貨量強勁。據估計,印度5G設備出貨量已超過7000萬台,到2027年,民用無線網絡投資預計將達到約2.5億美元。這將鼓勵運營商提供更強的網絡連接速度,進而推動光波長服務的增長。

- 新興國家政府正在採取舉措,促進本國電信基礎設施的發展。尤其是亞太地區,由於其廉價勞動力和工業 4.0 的高滲透率,正在成為受歡迎的製造中心。亞洲各國政府正在通過“中國製造2025”等計劃積極促進新公司的發展,旨在廣泛支持中國製造業和工業4.0的採用。

光波長服務行業概況

光波長服務市場目前競爭適中,但隨著供應商計劃推出新產品、建立合作夥伴關係和收購,該領域預計將增長。該領域的市場領導者包括 Zayo Group、Nokia、Century Link、Verizon Wireless、Century Link、Windstream Communications。與其他網絡設置相比,光波長網絡提供了可擴展的解決方案,可以快速增加容量以應對數據傳輸速率下降或處理流量瓶頸。

2022年3月,電信網絡提供商E-Net與EXA基礎設施簽署協議,在都柏林與其歐洲和北大西洋數據中心之間建立新的高速數據中心間光纖網絡連接。該 International Wave 項目旨在在數據中心之間提供具有價格競爭力、安全、快速和透明的連接。

同月,光纖通信解決方案提供商 Zayo Group Holdings 與網絡解決方案提供商 Infinera 合作,開發了全球最長的地面 800G 光波長,商用網絡覆蓋 1,044.51 公裡。Infinera硬件解決方案的集成使該項目能夠滿足更高線速下更多帶寬的需求。Zayo 擁有的光纖線路從猶他州斯普林維爾延伸至內華達州裡諾,並將由 Infinera 的 ICE6 800G 相干技術提供照明和供電。這一發展展示了光波長服務滿足高速數據傳輸和網絡連接不斷增長的需求的潛力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 調查範圍

第二章研究方法論

第三章執行摘要

第四章市場洞察

- 市場概況

- 行業價值鏈分析

- 行業吸引力——波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對行業的影響

第五章市場動態

- 市場驅動力

- 互聯網需求增加

- 加速帶寬密集型應用程序

- 市場製約因素

- 增加帶寬可用性限制

- 對虛擬連接的需求增加

第六章市場細分

- 按帶寬

- 小於 10Gbps

- 40Gbps

- 100Gbps

- 100Gbps 或更多

- 按地區

- 北美

- 歐洲

- 亞太地區

- 世界其他地區

第七章 競爭格局

- 公司簡介

- Nokia Corporation

- Zayo Group Holdings, Inc.

- Verizon Communications Inc.

- GTT Communications, Inc.

- AT&T Inc.

- Lumen Technologies Inc.

- T-Mobile US Inc.

- Crown Castle Inc.

- Comcast Corporation

- Charter Communications

- Windstream Holdings, Inc.

- Colt Technology Services Group Limited

- Cox Communications

- Jaguar Network SAS

- CarrierBid Communications

- EUnetworks Group

- Telia Carrier

- Exascale Limited

第八章投資分析

第 9 章 市場期貨

The Optical Wavelength Services Market size is expected to grow from USD 4.33 billion in 2023 to USD 7.54 billion by 2028, at a CAGR of 11.71% during the forecast period (2023-2028).

Key Highlights

- With global data volumes projected to double by 2025, there is a growing need to focus on cost and power consumption per bit. Extending large wavelengths across longer distances can make services more cost-effective and efficient for end-users. Larger wavelengths also provide significant network bandwidth expansion, essential to power high-definition content, 5G cell networks, IoT, remote work, and other applications.

- The demand for fiber-to-home (FTTH) systems is increasing, accelerating the deployment of network connections not just in urban areas but also in rural and remote locations. These investments lead to more robust competition among cable companies to create a denser, higher-performance wireless network and high wavelength services.

- In February 2023, Fujitsu launched the Ultra Optical System called 1FINITY, a hyper-reliable optical transport platform delivering extreme performance and scalability with data rates of 1.2 terabits per second (Tbps) on a single wavelength. This platform helps to reduce power consumption and achieve a 60% reduction of CO2 emissions throughout networks.

- Despite the benefits of implementing FTTH more extensively across networks, carriers are still discouraged by the cost of installing additional fiber and the end-users' optical modems. As the industry transitions to larger bandwidths, such as 50G and 100G, which require coherent technology in the modems, this cost issue will worsen.

- Even after the Covid-19 pandemic, network operators continue to add more gear and capacity to support remote work, cloud-based services, streaming video, IoT, and 5G wireless technology. This increasing demand for data and high-speed networks with uninterrupted supply drives Network Solution providers to adopt high wavelengths that can quickly scale up capacity to address traffic bottlenecks or combat slower data transfer speeds.

Optical Wavelength Services Market Trends

Less than 10 Gbps Bandwidth has Been Driving the Market

- Coherent WDM technology is a highly advanced optical transmission technology that offers numerous benefits, including higher bit rates, greater flexibility, simpler DWDM line systems, and better optical performance. This technology has enabled the development of cost-effective and highly reliable optical transport in DWDM networks, with wavelength speeds increasing from 10 Gb/s in the pre-coherent era to 100 Gb/s, 200 Gb/s, and now even 400 or 800 Gb/s with the latest coherent optical equipment.

- CWDM and DWDM are two different methods for addressing the increasing bandwidth requirements for information transmission. DWDM employs a larger number of narrower wavelength bands or channels, while CWDM uses broader wavelength bands per channel.

- According to the of Communications (Ofcom), the government-approved regulatory and competition authority for the broadcasting, telecommunications, and postal industries of the United Kingdom. The average person uses around 2.9GB of data per month, and this demand is continuously increasing with the evolution of digitalization. However, this confirms that 10Gb/s is more than enough for the average phone user.

- In February 2023, StarHub, the Singaporean telco, introduced ultra-speed broadband with up to 10 times the speed and bandwidth of standard broadband services in Singapore. This high-speed broadband service will significantly enhance household connectivity, providing optimal responsiveness for online gaming and lightning-fast content streaming.

- In June 2022, MASV, the video transfer service, adopted next-generation fiber-optic internet services with 10Gbps performance. This upgrade enables MASV to move Petabytes of video securely and efficiently through the cloud, making it faster, better, and more cost-effective for anyone to transfer large amounts of video data.

Asia Pacific to Hold Dominant Share of the Market

- India and China are the two countries that account for nearly half of the world's mobile traffic, while North America and Europe together only account for a quarter of the global mobile data services. India, in particular, has emerged as a major player in the mobile data services market, with the highest mobile data consumption rate of 12 GB/user a month globally.

- Moreover, India witnesses a remarkable increase of 25 million new smartphone users every quarter, making it a crucial market for mobile data services. This surge in smartphone usage has led to an average data consumption rate of 19.5 GB per user per month in 2022, indicating a growing demand for data-driven applications and services. This trend highlights India's position as a key player in the global mobile data market, with enormous potential for further growth and innovation in the future.

- The strong growth of mobile data services has also fueled demand for 5G devices, with private enterprise spending on 5G networks leading to robust shipments of these devices in India. It is estimated that over 70 million 5G devices have been shipped to India, and the country's investment in private wireless networks is expected to reach approximately USD 250 million by 2027. This will encourage telecom providers to offer more powerful network connection speeds, which, in turn, will promote the growth of Optical Wavelength Services.

- Governments in developing nations are taking initiatives to encourage the development of communication infrastructure in their countries. The Asia-Pacific region, in particular, is becoming increasingly popular as a hub for manufacturing due to its cheap labor and high adoption rate of the Industry 4.0 movement. Governments in Asian countries are aggressively promoting the growth of new firms, with programs like "Made in China 2025" designed to broadly support Chinese manufacturing and the implementation of Industry 4.0.

Optical Wavelength Services Industry Overview

The Optical Wavelength Services Market currently experiences moderate competition, but this sector is expected to grow as vendors plan new product launches, partnerships, and acquisitions. Some of the market leaders in this segment include Zayo Group, Nokia, Century Link, Verizon Wireless, Century Link, and Windstream Communications. Compared to other network setups, optical wavelength networks offer a scalable solution that can quickly increase capacity to combat slower data transfer speeds or address traffic bottlenecks.

In March 2022, Enet, a telecom network provider, signed a contract with EXA Infrastructure to establish new high-speed datacentre-to-datacentre optical network connections between Dublin and data centers in Europe and the North Atlantic. This International Wave project aims to provide price-competitive, secure, high-speed, and transparent inter-datacentre connectivity.

In the same month, Zayo Group Holdings, a provider of fiber-based communications solutions, collaborated with Infinera, a networking solutions provider, to jointly develop the world's longest-known terrestrial 800G optical wavelength in a commercial network that covers 1,044.51 km. With the integration of Infinera's hardware solutions, the project was able to fulfill the demand for more bandwidth at higher line rates. The Zayo-owned fiber route spans from Springville, Utah, to Reno, Nevada, and is lit and powered by Infinera's ICE6 800G coherent technology. This development showcases the potential of optical wavelength services to meet the growing demand for high-speed data transfer and network connectivity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assesment of Covid-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for the Internet

- 5.1.2 Accelerated Bandwidth-intensive Applications

- 5.2 Market Restraints

- 5.2.1 Limited Availability of Incremental Bandwidth

- 5.2.2 Increasing Demand for Virtual Connectivity

6 MARKET SEGMENTATION

- 6.1 By Bandwidth

- 6.1.1 Less than 10 Gbps

- 6.1.2 40 Gbps

- 6.1.3 100 Gbps

- 6.1.4 More Than 100 Gbps

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Nokia Corporation

- 7.1.2 Zayo Group Holdings, Inc.

- 7.1.3 Verizon Communications Inc.

- 7.1.4 GTT Communications, Inc.

- 7.1.5 AT&T Inc.

- 7.1.6 Lumen Technologies Inc.

- 7.1.7 T-Mobile US Inc.

- 7.1.8 Crown Castle Inc.

- 7.1.9 Comcast Corporation

- 7.1.10 Charter Communications

- 7.1.11 Windstream Holdings, Inc.

- 7.1.12 Colt Technology Services Group Limited

- 7.1.13 Cox Communications

- 7.1.14 Jaguar Network SAS

- 7.1.15 CarrierBid Communications

- 7.1.16 EUnetworks Group

- 7.1.17 Telia Carrier

- 7.1.18 Exascale Limited