|

市場調查報告書

商品編碼

1334414

採購分析市場規模和份額分析 - 增長趨勢和預測(2023-2028)Procurement Analytics Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

採購分析市場規模預計將從 2023 年的 33.2 億美元增長到 2028 年的 104.1 億美元,預測期內(2023-2028 年)複合年增長率為 25.67%。

採購分析利用大量採購數據生成一組有價值的見解,幫助推動價值和增強運營。

市場擴張的主要驅動力是公司越來越注重提高采購渠道的運營效率以及管理合同和合規政策的迫切需要。

支出分析的好處也在不斷擴大,通過數據可視化提供更深入的見解、實現降低成本的流程的能力以及更輕鬆地訪問大型文件。例如,它可以提供實時更新和整理的數據。 利用率和消耗的增加提高了系統的可擴展性並降低了組織的投資成本。

此外,在整個預測期內,由於軟件與人工智能(AI)的集成,預計採購軟件市場將具有巨大的開發潛力。 技術開發可能會加速市場進入者的收入增長。 相反,需要更多的熟練人員來確保市場增長。

此外,隨著數據業務複雜性的增加,決策也隨之增加。 中小型企業需要更多資源來優化周圍的數據,這可能會阻礙市場擴張。

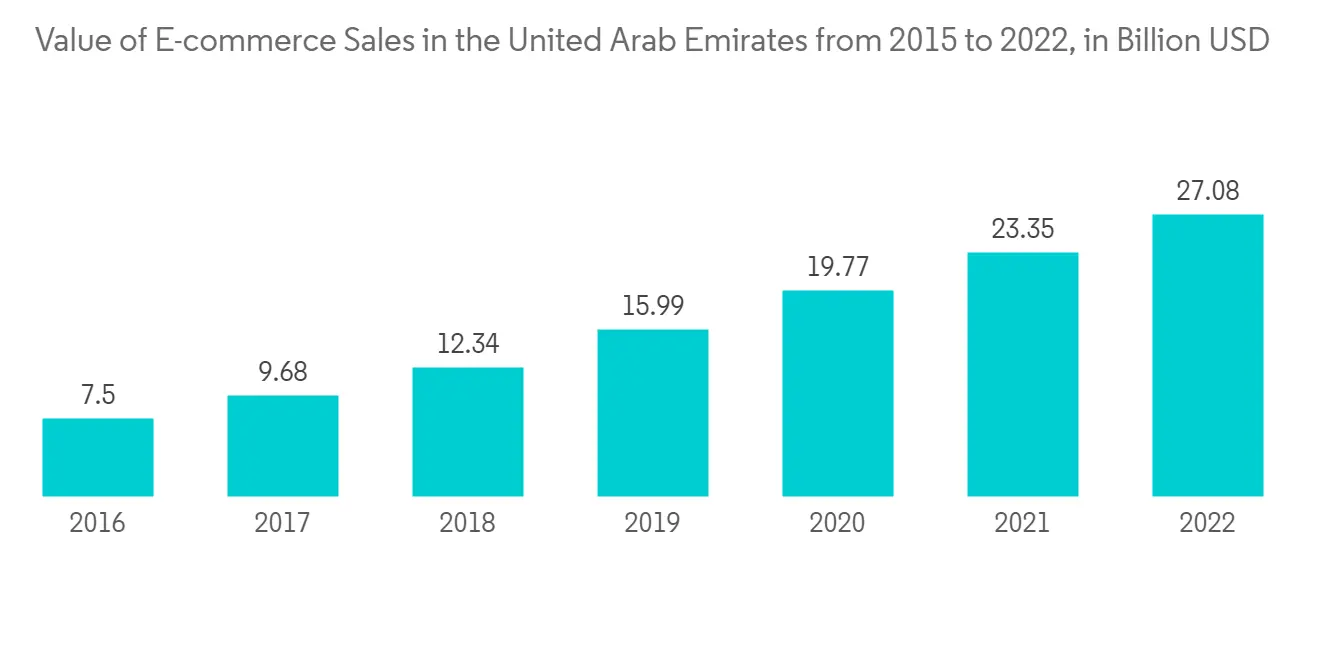

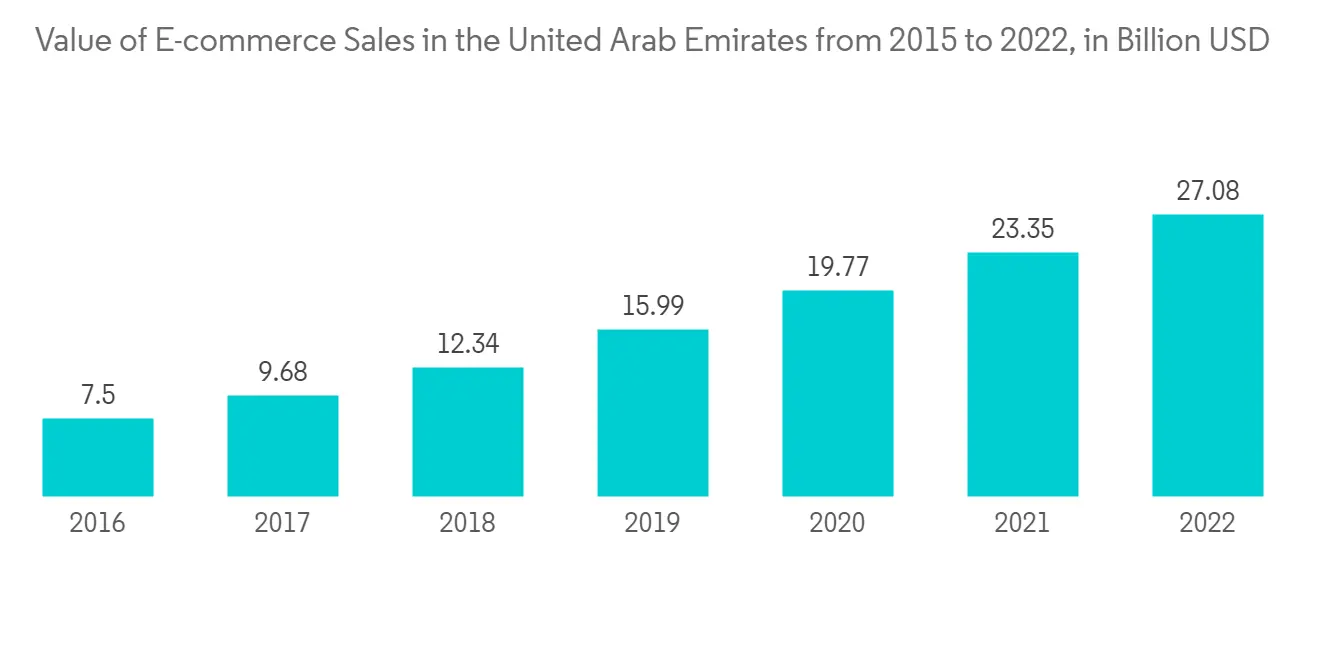

COVID-19 的爆發對採購分析市場的發展產生了重大影響。 智能手機的日益普及、聯網設備的普及率不斷提高以及電子商務行業的蓬勃發展為市場創造了廣闊的增長機會。

採購分析市場趨勢

零售和電子商務行業預計將增長

採購分析可能會在不斷擴張的零售和電子商務行業中迅速採用。 企業使用電子商務分析來研究用戶行為並確定最有可能吸引訪問者並轉化為銷售的產品登陸頁面的佈局和內容。

電子商務是一個術語,用於描述商品和服務的買家和賣家使用計算機、平板電腦、智能手機和其他智能設備訪問互聯網上的網站、應用程序和其他內容的方式。 大型電子商務公司和有組織的零售商經常使用採購分析,因為它提供了對消費者支出和行為的數據驅動分析。

隨著藍牙和 Wi-Fi 在所有家用電器和設備中的引入,數據生成的質量和速度得到了顯著提高。

例如,IIM加爾各答將於2022年6月推出供應鏈管理高級課程(APSCM),幫助相關領域專業人士和供應鏈從業者建立有彈性且具有成本效益的供應網絡。 本課程側重於供應鏈分析和物流,可提高您的決策技能並提高整體業務盈利能力。

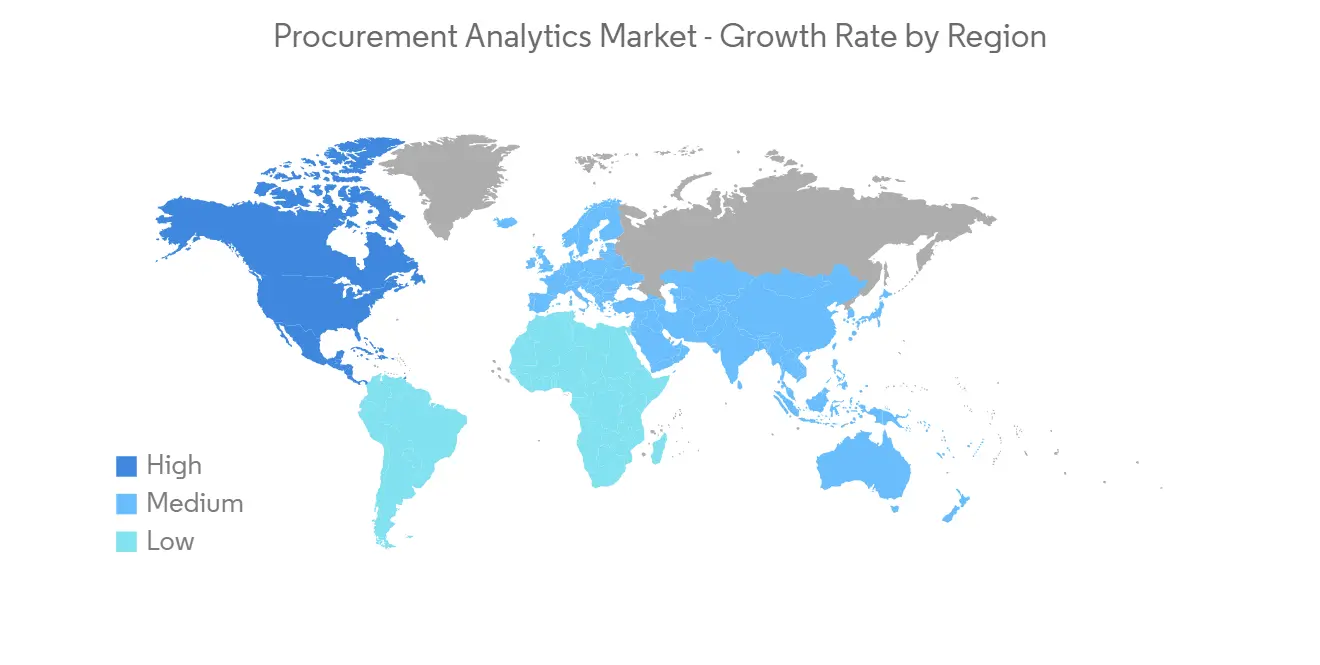

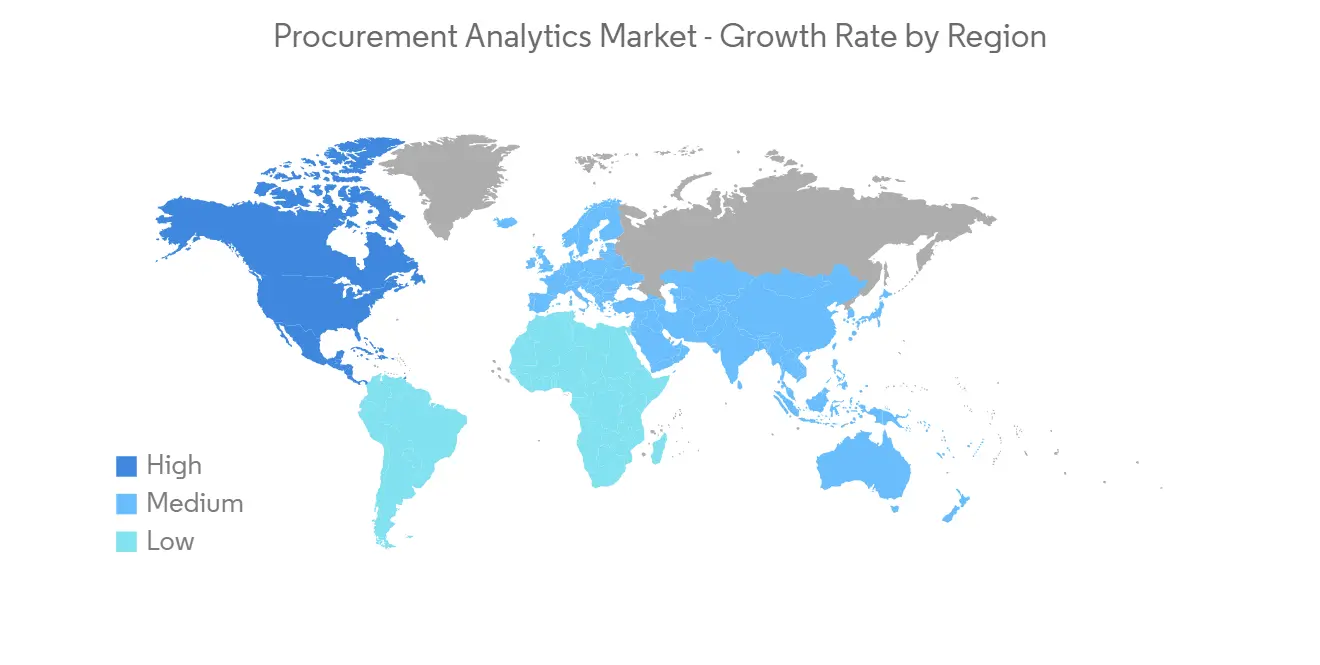

北美將經歷最高的增長

由於對採購流程集中化的需求不斷增長,北美目前在全球市場上佔據主導地位。 此外,預計該地區成立的公司的整合將推動未來幾年的市場擴張。

美國還擁有龐大的工業基礎、支持創新的政府計劃以及公民的高購買力。 增長的中心是美國。 關鍵數據軟件用戶經常使用打印管理解決方案來降低成本、改善行業垂直並提高員工生產力。

早期採用技術,包括流程數字化和分析。 該地區的增長可能是由風險管理、供應鏈分析和供應商分析解決方案支出的增加推動的。

美國正在努力振興製造業,重點關注提高工業部門的生產率和改善供應鏈運營。

北美採購分析市場的主要市場參與者也在不斷更新和創新其產品陣容。 例如,2022 年 6 月,PartsSource 推出了可視化處方管理和供應鏈風險監控,幫助客戶提高設備正常運行時間和供應鏈彈性。

採購分析行業概述

採購分析市場競爭非常激烈。 市場參與者不斷採取產品創新、合作和收購等策略來擴大市場佔有率。

2022 年 11 月,SAS Institute Inc. 和再生醫學發展組織 (ReMDO) 正在北卡羅來納州合作開展一項新的再生醫學試驗,即 ReMDO RegeneratorOR 測試床。 該合資企業將成為經濟發展的驅動力,通過提供最先進的生物製造設備、行業專業知識、人力資源和培訓計劃,將創新技術推向市場,以支持新的原型設計和商業產品開發。加快新興企業成長,支持大中型企業擴張。

2022 年 7 月,Zycus 和 NSE 宣布合作變革採購到付款流程。 與供應商的獨家聯盟是手動的。 Zycus eproc 解決方案提高了目錄、發票和採購訂單管理操作的效率和有效性。 此外,電子發票系統支持非接觸式應付賬款處理,使所有供應商都能開具數字發票。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 研究假設和市場定義

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場洞察

- 市場概覽

- 行業吸引力 - 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 新冠肺炎 (COVID-19) 影響評估

第五章市場動態

- 市場驅動因素

- 工業採購流程中的採用率有所提高

- 對基於雲的分析解決方案的需求不斷增加

- 市場製約因素

- 缺乏訓練有素、技術精湛的分析專業人員

- 數據洩露案例增加

第六章市場細分

- 按類型

- 軟件

- 服務

- 按部署類型

- 本地

- 雲

- 按用途

- 供應鏈分析

- 風險分析

- 費用分析

- 需求預測

- 合同管理

- 按最終用戶

- 製造業

- 交通/物流

- 零售/電子商務

- BFSI

- IT/通信

- 其他最終用戶(教育、醫療保健)

- 按地區

- 北美

- 歐洲

- 亞太地區

- 世界其他地區

第7章競爭態勢

- 公司簡介

- SAP SE

- Oracle Corporation

- SAS Institute Inc.

- IBM Corporation

- Zycus Inc.

- BRIDGEi2i Analytics Solutions Pvt. Ltd.

- JAGGAER Inc.

- Genpact Limited

- Rosslyn Data Technologies PLC

- Simfoni Analytics

第8章 投資分析

第9章 市場機會與今後動向

The Procurement Analytics Market size is expected to grow from USD 3.32 billion in 2023 to USD 10.41 billion by 2028, at a CAGR of 25.67% during the forecast period (2023-2028).

To create a set of valuable insights that will help drive value and enhance operations, procurement analytics involves drawing on the vast pool of procurement data.

The primary drivers of the market's expansion are the organizations' growing emphasis on improving their operational efficiencies in their procurement channels and their impending need to manage contracts and compliance policies.

The advantages of spend analytics are also expanding, including the ability to get deeper insights through data visualization, enable the implementation of processes that save costs, make it simple to access enormous files, and provide data that is updated and located in real time. Improved use and consumption increase the system's scalability and lower the organization's investment.

Furthermore, throughout the projection period, the market for procurement software is projected to have significant development potential due to the software's integration with artificial intelligence (AI). Technological developments will likely hasten market participants' revenue growth. On the contrary, more skilled personnel is needed to ensure market growth.

Additionally, as business complexity related to data has grown, making decisions has become more complex. Small and medium-sized businesses need more resources to optimize the data around them, which could impede market expansion.

The COVID-19 outbreak significantly impacted the development of the procurement analytics market. The rising popularity of smartphones, the increasing uptake of connected devices, and the booming e-commerce industry presented the market with promising opportunities for growth.

Procurement Analytics Market Trends

Retail and E-commerce Sector to Witness the Growth

Procurement analytics are likely to be adopted by the expanding retail and e-commerce industries at a rapid rate. E-commerce analytics are used by businesses to examine user behavior and determine the layout and content of product landing pages that are most likely to engage visitors and result in sales.

E-commerce is the term used to describe a means by which buyers and sellers of goods and services use computers, tablets, smartphones, and other smart devices to access websites, applications, and other content on the Internet. Large e-commerce companies and organized retail outlets frequently use procurement analytics because it provides a data-driven analysis of consumer spending and behavior.

The inclusion of Bluetooth and Wi-Fi in every consumer electronic product and piece of equipment has exponentially enhanced data generation quality and speed, which is also expected to drive demand for spending analytics, particularly in the retail industry.

For instance, IIM Calcutta created the Advanced Programme in Supply Chain Management (APSCM) in June 2022 to help professionals in related fields and supply chain practitioners create resilient, cost-effective supply networks. The emphasis on supply chain analytics and logistics in this curriculum will help sharpen decision-making skills and increase overall business profitability.

North America to Witness Highest Growth

Due to the growing demand for centralized procurement processes, North America currently controls the global market. Additionally, it is anticipated that the consolidation of companies founded in the area will spur market expansion in the future.

Also, the U.S. has a significant industrial base, there are government programs to support innovation, and the population has a high purchasing power. The U.S. is where the growth is mainly centered. Significant data software users frequently use print management solutions to save costs, improve industry verticals, and increase worker productivity.

Early technology adoption, including process digitalization and analytics. Regional growth will likely be fueled by increased spending on risk management, supply chain analytics, and vendor analytical solutions.

The United States is assiduously working to boost its manufacturing sector by increasing productivity and emphasizing better supply chain operations within its industrial sector.

Major market participants in North America's procurement analytics market are also constantly updating and innovating their product lineup. For instance, in June 2022, PartsSource introduced a visual formulary control and supply chain risk monitor to assist clients in increasing equipment uptime and supply chain resilience.

Procurement Analytics Industry Overview

The procurement analytics market is highly competitive. Players in the market are continuously adopting strategies like innovations in their products, partnerships, acquisitions, and others to increase their market presence.

In November 2022, SAS Institute Inc and Regenerative Medicine Development Organization (ReMDO) were collaborating on the ReMDO RegeneratOR Test Bed, a novel regenerative medicine endeavor in North Carolina. The joint enterprise will serve as an economic development driver, helping to accelerate the growth of startups and scale up mid-to-large-sized companies with innovative and emerging technologies through access to state-of-the-art biomanufacturing equipment, industry expertise, talent, and training programs to support novel prototyping and commercial product development.

In July 2022, Zycus Inc and NSE announced the collaboration to transform its procure-to-pay process. The exclusive partnership with its suppliers is manual. Zycus eproc solution will increase efficiency and effectiveness across catalog, requisition, and purchase order administration tasks. Additionally, the e-invoicing system will provide touchless A/P processing and allow all vendors to issue digital invoices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption in Procurement Process in Industries

- 5.1.2 Rising Demand for Cloud Based Analytical Solutions

- 5.2 Market Restraints

- 5.2.1 Lack of Trained and Skilled Analytical Professionals

- 5.2.2 Growing Data Breaches Cases

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment Type

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By Application

- 6.3.1 Supply Chain Analytics

- 6.3.2 Risk Analytics

- 6.3.3 Spend Analytics

- 6.3.4 Demand Forecasting

- 6.3.5 Contract Management

- 6.4 By End-User

- 6.4.1 Manufacturing

- 6.4.2 Transportation & Logistic

- 6.4.3 Retail and E-commerce

- 6.4.4 BFSI

- 6.4.5 IT & Telecommunication

- 6.4.6 Other End-Users (Education, Healthcare)

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 SAP SE

- 7.1.2 Oracle Corporation

- 7.1.3 SAS Institute Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Zycus Inc.

- 7.1.6 BRIDGEi2i Analytics Solutions Pvt. Ltd.

- 7.1.7 JAGGAER Inc.

- 7.1.8 Genpact Limited

- 7.1.9 Rosslyn Data Technologies PLC

- 7.1.10 Simfoni Analytics