|

市場調查報告書

商品編碼

1406245

全球溶劑:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Global Solvents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

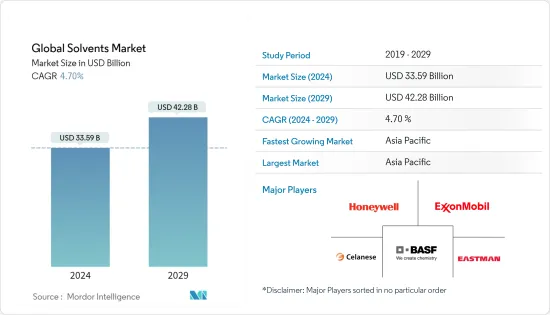

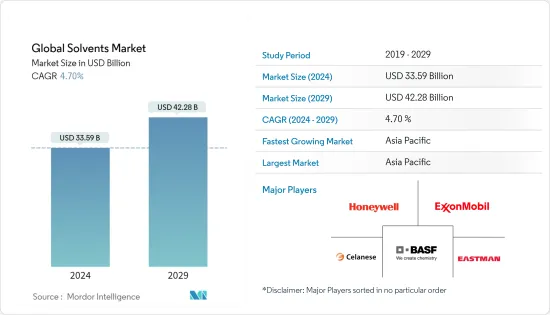

預計2024年全球溶劑市場規模為335.9億美元,預計2029年將達到422.8億美元,在市場估算與預測期間(2024-2029年)複合年成長率為4.70%。

溶劑市場受到 COVID-19 大流行的影響,由於遏制措施和經濟中斷,油漆和塗料以及聚合物和黏劑等行業被迫推遲生產,導致生產和運輸放緩。目前市場正從疫情中恢復。預計2022年市場將達到疫情前水準並持續穩定成長。

由於建築化學品的強勁需求和汽車行業的成長,預計油漆和塗料行業將在此期間在全球溶劑市場的應用領域佔據主導佔有率。

另一方面,化學溶劑會以多種方式對人類健康產生負面影響。它們不僅影響人類健康,而且對環境和動物健康產生嚴重影響,從而阻礙市場成長。

氧基工業溶劑的開拓預計將為市場成長創造新的機會。

亞太地區是最大的市場,由於中國和印度等國家的消費,預計在預測期內將成為成長最快的市場。

溶劑市場趨勢

建築和汽車行業的巨大需求

- 溶劑用於各種建築和汽車材料,包括油漆、被覆劑和黏劑。隨著對節能建築和車輛的需求增加,這些產業對溶劑的需求可能會增加。

- 酮由於其低黏度特性和高固態含量而廣泛用於油漆和被覆劑。酯類溶劑主要用於油漆作為硬化劑,也用作工業清洗劑。

- 生物基溶劑用於油漆和被覆劑中,以溶解黏合劑和顏色並提供一致性。裝飾漆和噴漆中添加乙二醇醚酯等溶劑,以防止它們在空氣中乾燥。

- 溶劑用於許多建築產品,例如油漆、稀釋劑和黏劑。中國、印度、美國和巴西等國家建設活動的增加預計將推動油漆和塗料應用領域的成長。

- 根據美國總承包商協會的數據,到 2023 年,美國建設產業將蓬勃發展,每年建造的建築價值估計將達到 2.1 兆美元。

- 印度國家投資促進和便利化管理局的數據顯示,印度的建築業也不斷成長,約佔該國GDP的9%。不斷成長的建築業正在推動對油漆和塗料的需求,而油漆和塗料是溶劑的重要應用產業。

- 溶劑在汽車工業中也有多種應用。汽油中的添加劑有助於將水從汽油中分離出來。此外,該溶劑有助於燃料更清潔地燃燒,並有助於減少廢氣排放氣體。溶劑可以幫助冰凍門鎖除冰、清洗化油器、冷卻引擎以及保持內裝衛生和地毯衛生。

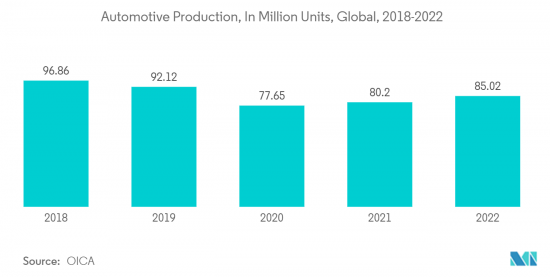

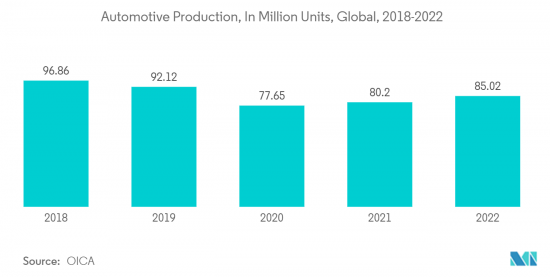

- 根據國際汽車工業協會(OICA)預測,2022年全球汽車產業較2021年成長6%。全球已開發國家和開發中國家的汽車產量均增加,包括中國、德國、韓國、英國、英國和義大利。 2022年,汽車產量超過8,500萬輛。

- 因此,汽車行業的強勁需求為油漆和塗料售後市場的創新創造了有利可圖的機會,並迅速增加了溶劑市場的需求。

亞太地區主導市場

- 中國和印度等國家建築支出的增加以及這些國家工業化的擴張預計將推動該地區溶劑市場的成長。

- 中國、印度、印尼、泰國、越南和韓國等國家擁有蓬勃發展的油漆、被覆劑和黏劑等終端用戶產業。預計這些國家將刺激該地區產品的需求。

- 根據中國國家統計局的數據,建築業產值將從2021年的29.31兆元(4.2兆美元)增加至2022年的31.2兆元(4.5兆美元)。此外,根據住宅及城鄉建設部的預測,2025年後中國建築業預計將維持GDP的6%。

- 在2023-2024年預算中,印度財政部長宣布撥款27億印度盧比(33.9億美元)來促進住宅建設。這一分配比前上年度增加了近10%。預計這將為住宅建設提供重要動力。

- 此外,該地區石油探明蘊藏量佔全球的3%,天然氣探明蘊藏量佔全球的10%,其中中國持有全部區域的28%。預計這將促進石化產品的生產,進而促進溶劑市場的成長。

- 此外,建設活動的快速成長以及對汽車的強勁需求預計將增加油漆和塗料應用中對溶劑的需求。此外,該地區的個人護理市場正在蓬勃發展,刺激了溶劑市場的成長。

- 根據OICA統計,亞太地區汽車產量為5,002萬輛,比去年的4,677萬輛成長7%。

- 由於上述因素,預計該地區對溶劑的需求在預測期內將會增加。

溶劑產業概況

溶劑市場本質上是部分一體化的。主要企業(排名不分先後)包括伊士曼化學公司、BASF公司、埃克森美孚公司、霍尼韋爾國際公司和塞拉尼斯公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 油漆塗料領域需求快速成長

- 嚴格法規以盡量減少揮發性有機化合物的排放

- 其他司機

- 抑制因素

- 高製造成本和溶劑性能問題

- 化學溶劑的有害影響

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 來源

- 生物基溶劑

- 石化溶劑

- 類型

- 氧溶劑

- 烴類溶劑

- 鹵素溶劑

- 目的

- 黏劑

- 畫

- 個人護理

- 藥品

- 聚合物製造

- 其他用途(印刷油墨、農藥、金屬清洗)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太地區其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- ADM

- Arkema

- Ashland

- BASF SE

- Bharat Petroleum Corporation Limited

- Celanese Corporation

- Dow

- Eastman Chemical Company

- Exxon Mobil Corporation

- Gandhar Oil Refinery(India)Limited

- GROUPE BERKEM

- Honeywell International Inc

- Huntsman International LLC

- INEOS

- LyondellBasell Industries Holdings BV

- Shell plc

- Sasol Limited

- Solvay

第7章 市場機會及未來趨勢

- 氧系工業溶劑的開發

- 對生物基產品的需求不斷增加

The Global Solvents Market size is estimated at USD 33.59 billion in 2024, and is expected to reach USD 42.28 billion by 2029, growing at a CAGR of 4.70% during the forecast period (2024-2029).

The solvents market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility wherein industries such as paints and coatings, polymers and adhesives, etc., were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily.

The paints and coatings industry is expected to dominate the application segment of the global solvents market over the period due to significant demand for construction chemicals and the growing automotive industry.

On the flip side, chemical-based solvents can negatively affect human health in different ways. They not only affect human health but also severely affect the environment and the health of animals, and this can hinder the growth of the market.

The development of oxygenated-based industrial solvents is expected to create new opportunities for the market to grow.

Asia-Pacific region represents the largest market and is expected to be the fastest-growing market over the forecast period owing to the consumption from countries such as China and India.

Solvents Market Trends

Significant Demand from Construction and Automotive Industry

- Solvents are used in various construction and automotive materials, such as paints, coatings, and adhesives. As the demand for energy-efficient buildings and vehicles increases, solvents demand is likely to increase from these industries.

- Ketones are widely employed in paints and coatings owing to their ability to acquire low-viscosity properties and high solid content. Ester solvents are primarily used in paints as a hardener and find their usage as an industrial cleaner.

- Bio-based solvents are employed in paints and coatings to dissolve binders and colors and offer consistency. Solvents like glycol ether esters are added to some decorative paints and spray paints to prevent them from drying in mid-air.

- Solvents are used in many construction products, such as paints, thinners, and glues. Increasing construction activities in countries such as China, India, the United States, and Brazil are expected to boost the growth of the paints and coatings application segment.

- In 2023, the United States construction industry is booming, with an estimated USD 2.1 trillion worth of structures built each year, according to the Associated General Contractors of America.

- The construction industry in India is also increasing, accounting for around 9% of the country's GDP, according to the National Investment Promotion & Facilitation Agency. This ever-increasing construction industry is driving demand for paints and coatings, a significant application industry for solvents.

- Solvents find various applications in the automotive industry. Additives in gasoline help keep the water separate from the gasoline. Furthermore, solvents assist the fuel burn cleaner, which can help reduce tailpipe emissions. Solvents aid in de-ice frozen door locks, cleaning carburetors, keeping the engine cool, and hygienic upholstery and carpet.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), the global automotive industry grew by 6% in 2022 compared to 2021. Automotive production increased in developed and developing countries worldwide, including China, Germany, South Korea, Canada, the United Kingdom, and Italy. Over 85 million motor vehicles were manufactured in 2022.

- Thus, significant demand in the automotive sector is generating lucrative opportunities for innovation in the paints & coatings aftermarket, surging the need for the solvents market.

Asia-Pacific Region to Dominate the Market

- Increasing construction spending in countries like China and India, along with expanding industrialization in these countries, is anticipated to boost the solvents market growth in the region.

- End-user industries such as paints, coatings, and adhesives flourish in countries such as China, India, Indonesia, Thailand, Vietnam, and South Korea. They are expected to fuel product demand in the region over the period.

- According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.31 trillion (USD 4.2 trillion) in 2021. Moreover, as per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025.

- In the budget 2023-2024, the Indian finance minister announced an allocation of INR 2.7 lakh crore (USD 3.39 billion) for boosting housing construction. This allocation increased by nearly 10% as compared to the previous year. This will provide a significant boost to housing construction.

- Additionally, the region accounts for 3% of the world's proven oil reserves and 10% of the world's proven gas reserves, of which China holds 28% of the regional total. This is driving the production of petrochemicals, which, in turn, is expected to fuel the growth of the solvents market.

- Moreover, rapid growth in building & construction activities and strong demand for automobiles are expected to drive the need for solvents in the paints & coatings application. Also, the personal care market is booming in the region and, in turn, fueling the growth of the solvents market.

- According to OICA, the total automotive production in the Asia-Pacific region accounted for 50.02 million units, registering an increase of 7% compared to 46.77 million units produced last year.

- Due to the factors above, the demand for solvents is expected to increase in the region during the forecast period.

Solvents Industry Overview

The solvents market is partially consolidated in nature. The major players (not in any particular order) include Eastman Chemical Company, BASF SE, Exxon Mobil Corporation, Honeywell International Inc., and Celanese Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand from the Paints & Coatings Sector

- 4.1.2 Stringent Regulations in Place to Minimize VOC Emissions

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Manufacturing Costs and Performance Issues of Solvents

- 4.2.2 Detrimental Effects of Chemical Solvents

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Source

- 5.1.1 Bio-Based Solvents

- 5.1.2 Petrochemical-based Solvents

- 5.2 Type

- 5.2.1 Oxygenated Solvents

- 5.2.2 Hydrocarbon Solvents

- 5.2.3 Halogenated Solvents

- 5.3 Application

- 5.3.1 Adhesives

- 5.3.2 Paints and Coatings

- 5.3.3 Personal Care

- 5.3.4 Pharmaceuticals

- 5.3.5 Polymer Production

- 5.3.6 Other Applications (Printing Inks, Agricultural Chemicals, Metal Cleaning)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 BASF SE

- 6.4.5 Bharat Petroleum Corporation Limited

- 6.4.6 Celanese Corporation

- 6.4.7 Dow

- 6.4.8 Eastman Chemical Company

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Gandhar Oil Refinery (India) Limited

- 6.4.11 GROUPE BERKEM

- 6.4.12 Honeywell International Inc

- 6.4.13 Huntsman International LLC

- 6.4.14 INEOS

- 6.4.15 LyondellBasell Industries Holdings B.V.

- 6.4.16 Shell plc

- 6.4.17 Sasol Limited

- 6.4.18 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Oxygenated Based Industrial Solvents

- 7.2 Increasing Demand for Bio-Based Products