|

市場調查報告書

商品編碼

1273500

摩托車潤滑油市場 - 增長、趨勢、COVID-19 的影響和預測 (2023-2028)Two-Wheeler Lubricants Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

摩托車潤滑油市場預計在預測期內以超過 4% 的複合年增長率增長。

COVID-19 對 2020 年的市場產生了負面影響。 但目前估計已達到疫情前水平,市場有望穩步增長。

主要亮點

- 新興國家/地區對機油的需求不斷增長推動了市場增長

- 摩托車在印度和中國等國家/地區的銷量增加預計將推動市場增長。

- 另一方面,電動汽車的普及可能會阻礙市場增長。

- 亞太地區主導著全球市場,其中中國、印度和日本等國家/地區的消費量最高。

摩托車潤滑油市場趨勢

機油用量增加

- 機油廣泛用作摩托車內燃機的潤滑劑。 它一般由基礎油和添加劑組成。

- 基礎油是使用石油、合成化學品或兩者混合製成的。 基礎油負責潤滑發動機的運動部件並帶走多餘的熱量。

- 添加到機油中的各種添加劑包括抗氧化添加劑、分散添加劑、清淨添加劑、消泡添加劑、粘度指數調節劑、抗磨添加劑、腐蝕抑製劑、防凍添加劑、防凍添加劑等。 它控製油的粘度和潤滑性,並保護髮動機零件免受磨損和損壞。

- 摩托車機油的主要功能是抗腐蝕和抗磨損。 延長發動機壽命和提高性能,減少摩擦,提高發動機性能,降低油耗,去除雜質和實現發動機清潔,優化發動機效率,通過優化冷卻防止能量損失等。它會實現。

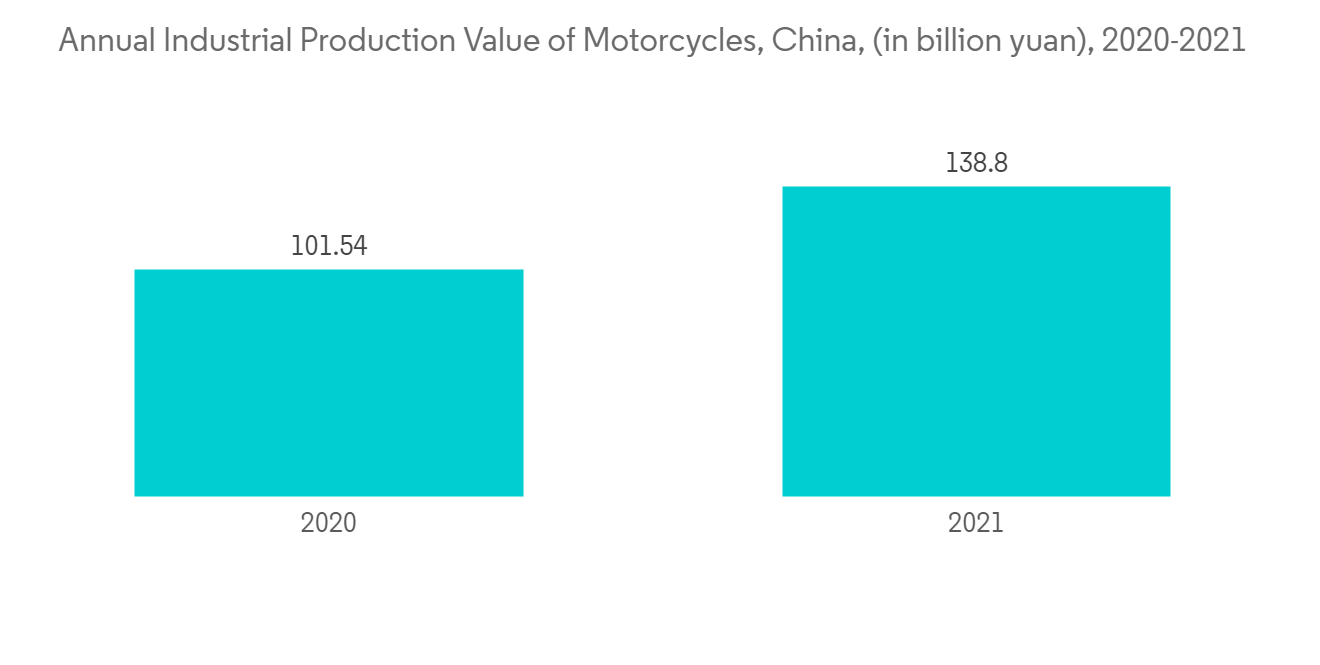

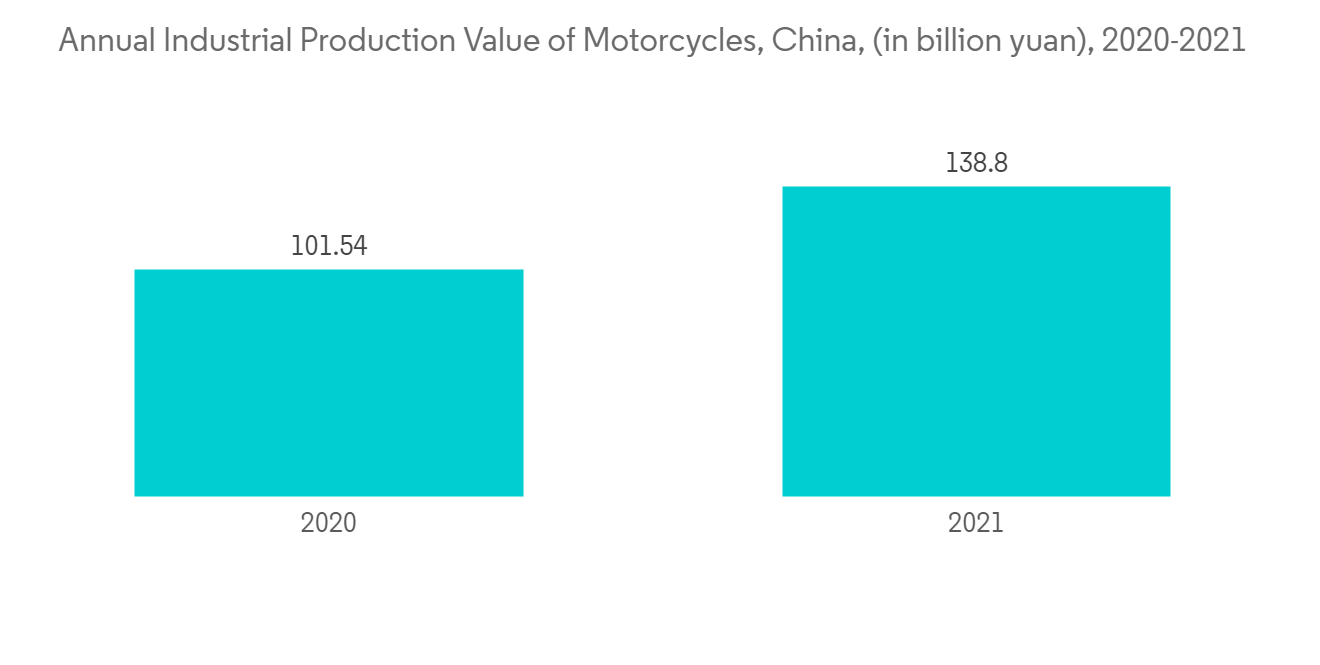

- 隨著消費者可支配收入的增加,中國的兩輪車行業正在顯著擴張。 2021 年摩托車產值將達到約 1380 億元人民幣(201.2 億美元),比 2020 年增長約 36%。 因此,我們積極支持市場的發展。

- 此外,中國的摩托車銷量大幅增長。 例如,2021 年摩托車銷售額將達到 1379.8 億元人民幣(201.2 億美元),比 2020 年增長 36%。 因此,我們正在積極推動市場的增長。

- 因此,由於上述所有因素,預計機油使用量的增加將推動預測期內的市場增長。

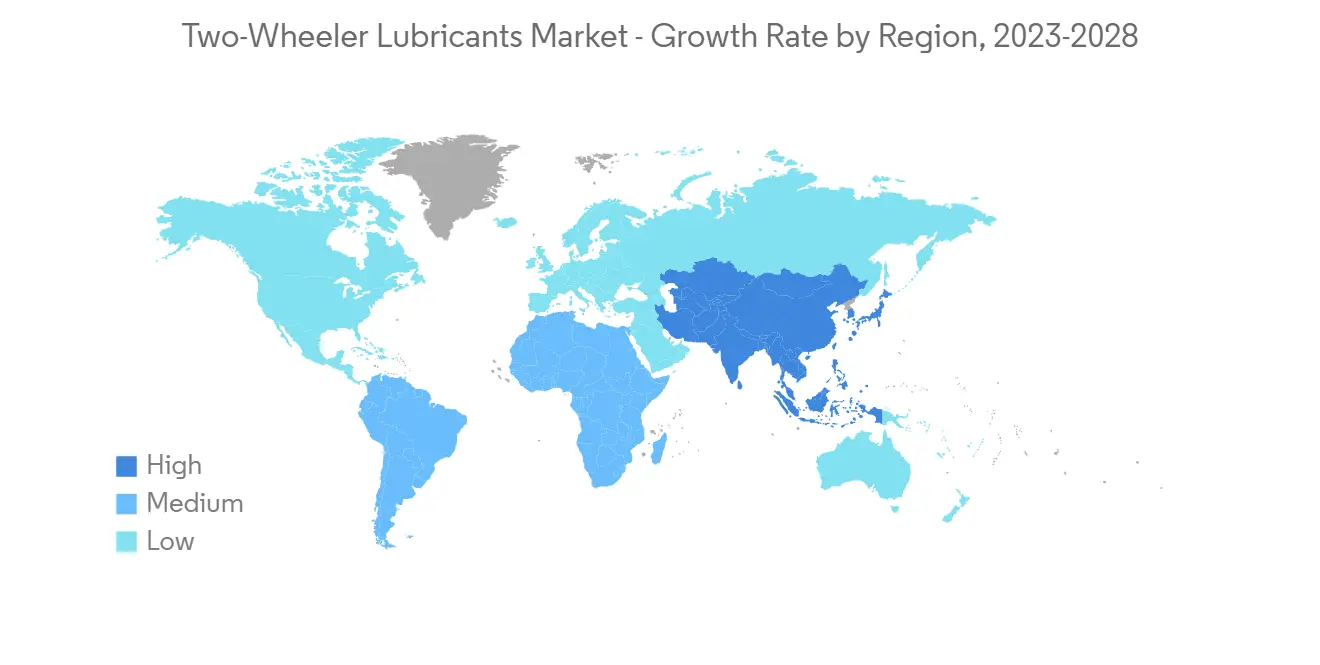

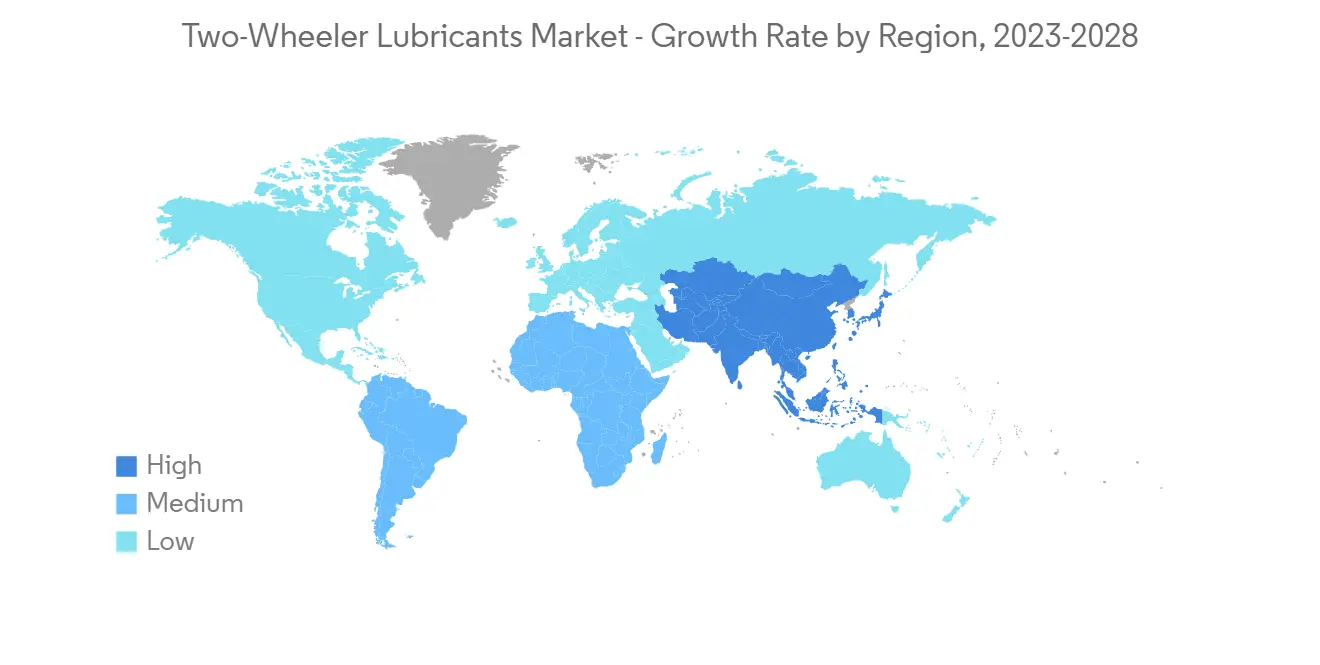

亞太地區主導市場

- 在新興國家/地區,對摩托車的需求正在顯著增長。 亞太地區最近成為摩托車潤滑油消費增長最快的地區。

- 城市化進程的加快、收入的增加、人口的增長以及摩托車製造商之間日益激烈的競爭正在為各個區域群體提供價格更優惠的車輛。

- 此外,孟加拉國、巴基斯坦、斯裡蘭卡和菲律賓等國家/地區對二手自行車的需求非常高。 然而,由於當地汽車組裝的增加,預計未來十年新車銷量將增加。

- 印度、馬來西亞、新加坡、越南、孟加拉國和菲律賓等一些新興國家/地區的摩托車潤滑油消費量最近出現了正增長。

- 例如,2021 年,菲律賓的摩托車和踏板車銷量將達到 1,435,677 輛,比 2020 年增長 19%。 在新加坡,摩托車和踏板車的銷量在 2021 年增長了 8% 至 11,428 輛。 因此,它將積極支持市場的增長。

- 此外,馬來西亞和菲律賓等國家/地區的摩托車和踏板車產量大幅增加。 例如,菲律賓2021年將生產867,453輛摩托車和踏板車,比2020年增長32%。 因此,我們正在積極推動市場的增長。

- 因此,由於上述發展,亞太地區有望在預測期內主導摩托車潤滑油市場。

摩托車潤滑油行業概況

- 摩托車潤滑油市場本質上是分散的。 市場參與者包括 BP p.l.c.、Shell plc、PT Pertamina (Persero)、TotalEnergies 和 Idemitsu Kosan(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 新興國家/地區對機油的需求不斷擴大

- 其他司機

- 約束因素

- 電動汽車的推廣

- 其他抑製劑

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分

- 產品類型

- 機油

- 液壓油

- 剎車油

- 鏈條油

- 最終用戶行業

- 摩托車

- 滑板車

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 俄羅斯

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)/排名分析

- 主要公司採用的策略

- 公司簡介

- BP p.l.c.

- Chevron Corporation

- Exxon Mobil Corporation

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co., Ltd

- PT Pertamina(Persero)

- Petroliam Nasional Berhad(PETRONAS)

- Shell plc

- China Petrochemical Corporation

- TotalEnergies

第七章市場機會與未來趨勢

簡介目錄

Product Code: 70901

The Two-Wheeler Lubricants Market is projected to register a CAGR of more than 4% during the forecast period. COVID-19 negatively impacted the market in 2020. However, the market is now estimated to have reached pre-pandemic levels and is expected to grow steadily.

Key Highlights

- Increasing demand for engine oils from developing countries is fuelling market growth.

- Increasing sales of motorcycles in countries such as India, China, etc., are expected to fuel the market's growth.

- On the other hand, the increasing penetration of electric vehicles is likely to hamper the market growth.

- The Asia-Pacific region dominated the global market, with the largest consumption from countries such as China, India, and Japan.

Two-Wheeler Lubricants Market Trends

Increasing Usage of Engine Oils

- Engine oils are widely used for lubricating internal combustion engines in two-wheelers. They are generally composed of base oils and additives.

- The base stock is made using petroleum, synthetic chemicals, or both. The base stock is responsible for lubricating the engine's moving parts and removing the excess built-up heat.

- Various additives added in engine oils include oxidation inhibitor additives, dispersant additives, detergent additives, anti-foaming additives, viscosity index modifiers, anti-wear additives, corrosion inhibitor additives, and anti-freeze additives. It controls the oil viscosity and lubricity and protects the engine parts against wear and tear.

- Some major functions of engine oils in two-wheelers are resistance against corrosion and wear and tear. It is to ensure increased engine life and better performance, reduction of friction, increase engine performance, reduction of fuel consumption, removal of impurities and achieve engine cleanliness, optimize engine efficiency, and prevent energy loss by providing optimum cooling.

- China's motorcycle sector is expanding significantly due to increasing consumer disposable income. Motorcycle production value totaled roughly CNY 138 billion (USD 20.12 billion) in 2021, representing an increase of around 36% compared to 2020. Hence, supporting the market growth positively.

- Moreover, the sales value of motorbikes in China also increased considerably. For instance, in 2021, the sales of motorcycles increased by 36%, amounting to CNY 137.98 billion (USD 20.12 billion) compared to 2020. As a result, positively boosts market growth.

- Thus, owing to all the factors above, increasing the use of engine oils is expected to fuel the market growth throughout the forecast period.

Asia-Pacific Region Dominates the Market

- The demand for two-wheelers in developing countries is growing vastly. Asia-Pacific recently became the fastest-growing region in the consumption of two-wheeler lubricants.

- Increasing urbanization, rising incomes, growing population, and progressive competition between two-wheeler manufacturers offer a better price on vehicles that various regional groups can afford.

- Moreover, Bangladesh, Pakistan, Sri Lanka, the Philippines, and other countries highly demand used bikes. However, the sale of new motor vehicles is expected to rise in the next ten years, owing to the increasing local assembly of motor vehicles.

- Some developing countries such as India, Malaysia, Singapore, Vietnam, Bangladesh, and the Philippines have recently witnessed positive growth in the consumption of two-wheeler lubricants.

- For instance, in 2021, the sales of motorcycles and scooters in the Philippines reached 1,435,677, representing a 19% increase compared to 2020. Also, in Singapore, sales of motorcycles and scooters increased by 8%, reaching 11,428 in 2021. Hence, supporting the market growth positively.

- Furthermore, in countries such as Malaysia, the Philippines, and others, the production of motorcycles and scooters increased significantly. For instance, the Philippines produced 867,453 motorcycles and scooters in 2021, up 32% compared to 2020. As a result, positively boosting the market growth.

- Thus, owing to the trends above, the Asia-Pacific region is expected to dominate the two-wheeler lubricants market during the forecast period.

Two-Wheeler Lubricants Industry Overview

- The two-wheeler lubricant market is fragmented in nature. Some of the major players in the market include BP p.l.c., Shell plc, PT Pertamina(Persero), TotalEnergies, and Idemitsu Kosan Co., Ltd., among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Engine Oils from Developing Countries

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Penetration of Electric Vehicles

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Engine Oil

- 5.1.2 Hydraulic Oil

- 5.1.3 Brake Oil

- 5.1.4 Chain Oil

- 5.2 End-user Industry

- 5.2.1 Motorcycles

- 5.2.2 Scooters

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BP p.l.c.

- 6.4.2 Chevron Corporation

- 6.4.3 Exxon Mobil Corporation

- 6.4.4 Hindustan Petroleum Corporation Limited

- 6.4.5 Idemitsu Kosan Co., Ltd

- 6.4.6 PT Pertamina(Persero)

- 6.4.7 Petroliam Nasional Berhad (PETRONAS)

- 6.4.8 Shell plc

- 6.4.9 China Petrochemical Corporation

- 6.4.10 TotalEnergies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219