|

市場調查報告書

商品編碼

1406100

汽車外飾化學品-市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Automotive Appearance Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

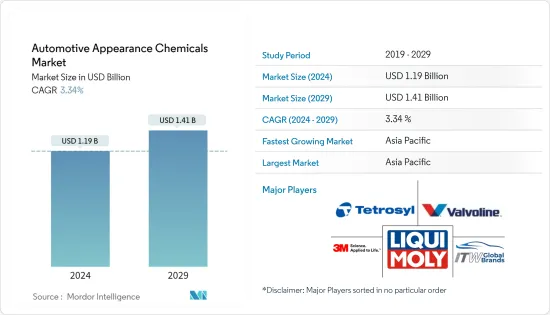

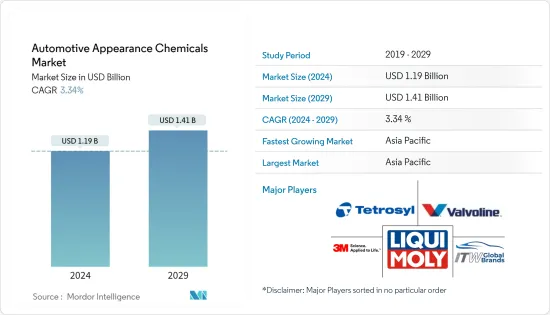

預計2024年汽車外飾化學品市場規模為11.9億美元,2029年達14.1億美元,預測期間(2024-2029年)複合年成長率為3.34%。

COVID-19 的爆發影響了全球汽車外觀化學品市場。由於全球汽車產量在此期間放緩,2020 年市場成長溫和。然而,市場已經從大流行中恢復並正在顯著成長。

主要亮點

- 短期內,電動車(EV)產量的增加和消費者對汽車維護的意識是推動所研究市場成長的關鍵因素。

- 然而,政府對蠟和被覆劑等石油產品的嚴格監管可能會限制所研究市場的成長。

- 然而,專業汽車保養服務和專業應用中擴大採用現代技術可能會為全球市場提供利潤豐厚的成長機會。

- 亞太地區是最大的市場。由於中國、印度和日本等國家的消費量不斷增加,預計該市場也將成為預測期內成長最快的市場。

汽車外觀化學品市場趨勢

電動車產量增加

- 由於電動車(EV) 的需求,汽車外觀化學品市場不斷成長。

- 由於環保意識和滿足未來能源需求的需要,電動車市場正在經歷顯著成長。實現永續交通的需求在推動電動車需求方面發揮關鍵作用。

- 此外,電動車產量的增加可能會增加所研究市場的需求。例如,根據 CleanTechnica 的數據,2022 年 7 月的國際插電式汽車註冊量較 2021 年 7 月增加了 61%,達到 778,000 輛。

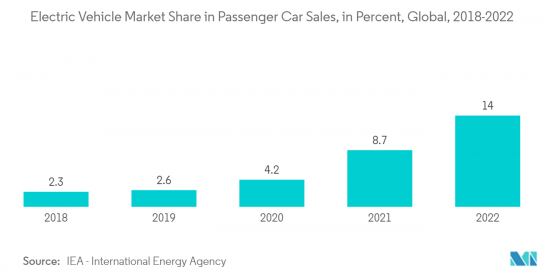

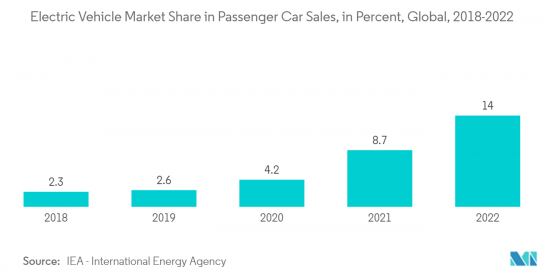

- 根據國際能源總署(IEA)預測,2022年電動車將佔全球小客車銷量的約14%,與前一年同期比較增加5.3個百分點。

- 根據世界經濟論壇 (WEF) 的數據,2022 年上半年全球售出約 430 萬輛新型純電動車 (BEV) 和插電式混合動力汽車(PHEV)。此外,純電動車銷量每年成長約75%,插電式混合動力車銷量成長37%。此外,2022年1月至8月全球電動車銷量突破570萬輛大關,插電式電動車市場佔有率上升至近15%。

- 各國政府對電動車的採用和電動車製造基礎設施的擴張採取了優惠政策。能源成本上升和新興能源效率技術之間的競爭預計也將推動市場成長。

- 近年來,汽車製造商宣布了許多普及電動車的計劃和時間表。豐田計劃在 2025 年之前其一半銷量來自電動車。該公司將於 2021 年與中國電池製造商比亞迪合作生產電動車。大眾汽車宣布,2023年將斥資超過300億美元開發電動車。此外,到 2030 年,我們的目標是讓全球 40% 的持有為電動車。

- 目前,電動的焦點集中在小客車上,但這種趨勢預計很快就會改變並蔓延到其他類別的車輛。

- 所有上述因素預計將在預測期內增加汽車外裝化學品的需求。

亞太地區主導市場

- 預計在預測期內,亞太地區將成為汽車外部保護劑的最大市場。

- 亞太地區是世界上一些最有價值的汽車製造商的所在地。中國、印度、日本和韓國等新興國家正在努力加強製造基礎並建立高效的供應鏈以提高盈利。

- 根據中國工業協會統計,中國是全球最大的汽車生產基地,預計2022年汽車產量將達到2,700萬輛,比去年的2,600萬輛成長3.4%。

- 根據SIAM India統計,2022年印度汽車總產量約2,290萬輛,較前上年度成長。

- 此外,據印度品牌股權基金會 (IBEF) 稱,到 2025 年,印度電動車(EV) 市場規模預計將達到 5,000 億印度盧比(70.9 億美元)。

- 根據日本經濟產業省、日本小客車製造商協會的數據,2022 年日本乘用車產量約 657 萬輛,低於前一年的約 662 萬輛。此外,包括小客車、客車和卡車在內的國內生產總值約為784萬輛。

- 因此,上述因素可能會在預測期內影響市場。

汽車外觀化學品產業概況

汽車外觀化學品市場較為分散。主要參與者(排名不分先後)包括 3M、LIQUI MOLY GmbH、ITW Global Brands、Valvoline 和 Tetrosyl Ltd。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 電動車(EV) 產量增加

- 提高消費者車輛保養意識

- 其他司機

- 抑制因素

- 政府對蠟和被覆劑等石油產品實施嚴格的法規

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 產品類別

- 蠟

- 拋光

- 保護劑

- 車輪/輪胎清潔劑

- 窗戶清洗液

- 皮革護理產品

- 其他

- 目的

- 小客車

- 輕型商用車

- 大型商用車

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率分析(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- SONAX GmbH

- Dow

- General Chemical Corp.

- ITW Global Brands

- Guangzhou Biaobang Car Care Industry Co. Ltd

- LIQUI MOLY GmbH

- Niteo Products, Inc.

- Nuvite Chemical Compounds

- Tetrosyl Ltd

- Turtle Wax, Inc.

- Valvoline Chemicals

第7章 市場機會及未來趨勢

- 更多採用專業汽車護理服務

- 在特殊應用中更多採用尖端技術

The Automotive Appearance Chemicals Market size is estimated at USD 1.19 billion in 2024, and is expected to reach USD 1.41 billion by 2029, growing at a CAGR of 3.34% during the forecast period (2024-2029).

The COVID-19 pandemic affected the global automotive appearance chemicals market. The slowdown in global automobile production during the period resulted in minimal market growth in 2020. However, the market recovered from the pandemic and is growing significantly.

Key Highlights

- Over the short term, the increase in the production of electric vehicles (EV) and consumer awareness toward vehicle maintenance are major factors driving the growth of the market studied.

- However, stringent government regulations on petroleum products such as waxes and coatings are likely to restrain the growth of the studied market.

- Nevertheless, the increasing adoption of professional auto care services and modern technology in specialized applications will likely create lucrative growth opportunities for the global market.

- The Asia-Pacific region represents the largest market. It is also expected to be the fastest-growing market over the forecast period, owing to the increasing consumption in countries such as China, India, and Japan.

Automotive Appearance Chemicals Market Trends

Increase in the Production of Electric Vehicles

- The automotive appearance chemical market is growing due to the demand for electric vehicles (EVs).

- The EV market witnessed significant growth due to environmental awareness and the need to address future energy requirements. The need to attain sustainable transportation plays a significant role in driving the demand for EVs.

- Furthermore, the rising production of electric vehicles will likely enhance the market demand for the studied market. For instance, according to CleanTechnica, international plug-in vehicle registrations increased by 61% in July 2022 compared to July 2021, reaching 778,000 units.

- As per the International Energy Agency (IEA), in 2022, electric vehicles accounted for around 14% of worldwide passenger car sales, a 5.3% point increase year on year.

- As per the World Economic Forum (WEF), nearly 4.3 million new battery-powered EVs (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold globally in the first half of 2022. Additionally, BEV sales grew by around 75% yearly and PHEVs by 37%. Moreover, global electric car sales crossed the 5.7 million units mark in the first eight months of 2022, and the market share of plug-in electric cars increased to nearly 15%.

- The governments of various countries adopted favorable policies toward adopting electric vehicles and expanding the manufacturing infrastructure of electric vehicles. Rising energy costs and competition among emerging energy efficiency technologies are also expected to fuel market growth.

- In recent years, automotive manufacturers announced many plans and timelines for bringing more EVs. Toyota plans to generate half of its sales from electrified vehicles by 2025. The company partnered with Chinese battery manufacturer BYD in 2021 to manufacture electric cars. Volkswagen said it will spend more than USD 30 billion developing EVs by 2023. The manufacturer also aims for EVs to make up 40% of its global fleet by 2030.

- Currently, much attention is being given to passenger vehicles for electrification, but this trend is expected to change soon and spread to other classes of vehicles.

- All the factors above are expected to enhance the demand for automotive appearance chemicals during the forecast period.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to account for the largest market for automotive appearance chemicals during the forecast period.

- The Asia-Pacific region is home to some of the world's most valuable vehicle manufacturers. Developing countries such as China, India, Japan, and South Korea are working hard to strengthen the manufacturing base and develop efficient supply chains for greater profitability.

- According to the China Association of Automobile Manufacturers (CAAM), China includes the largest automotive production base in the world, with a total vehicle production of 27 million units in 2022, registering an increase of 3.4 % compared to 26 million units produced last year.

- According to SIAM India, in the financial year 2022, the total production volume of vehicles in India was around 22.9 million units, an increase from the previous year.

- Additionally, according to the Indian Brand Equity Foundation (IBEF), the electric vehicle (EV) market is estimated to reach INR 50,000 crore (USD 7.09 billion) in India by 2025.

- In 2022, according to METI (Japan); JAMA, approximately 6.57 million passenger cars were produced in Japan, down from about 6.62 million units in the previous year. The total domestic production volume reached approximately 7.84 million units, which includes buses and trucks next to passenger cars.

- Therefore, the above factors will likely impact the market in the forecasted period.

Automotive Appearance Chemicals Industry Overview

The automotive appearance market is fragmented in nature. The major players (not in any particular order) include 3M, LIQUI MOLY GmbH, ITW Global Brands, Valvoline, and Tetrosyl Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Drivers

- 4.1.1 Increase in the Production of Electric Vehicles (EV)

- 4.1.2 Increase in Consumer Awareness Toward Vehicle Maintenance

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations on Petroleum Products like Waxes and Coatings

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Waxes

- 5.1.2 Polishes

- 5.1.3 Protectants

- 5.1.4 Wheel and Tire Cleaners

- 5.1.5 Windshield Washer Fluids

- 5.1.6 Leather Care Products

- 5.1.7 Others

- 5.2 Application

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Heavy Commercial Vehicles

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 SONAX GmbH

- 6.4.3 Dow

- 6.4.4 General Chemical Corp.

- 6.4.5 ITW Global Brands

- 6.4.6 Guangzhou Biaobang Car Care Industry Co. Ltd

- 6.4.7 LIQUI MOLY GmbH

- 6.4.8 Niteo Products, Inc.

- 6.4.9 Nuvite Chemical Compounds

- 6.4.10 Tetrosyl Ltd

- 6.4.11 Turtle Wax, Inc.

- 6.4.12 Valvoline Chemicals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Adoption of Professional Auto Care Services

- 7.2 Increasing Adoption of Modern Technology in Specialized Application