|

市場調查報告書

商品編碼

1272676

Alpha烯烴市場 - 增長、趨勢和預測 (2023-2028)Alpha Olefins Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

在預測期內,全球Alpha烯烴市場預計將以超過 5% 的複合年增長率增長。

主要亮點

- COVID-19 對 2020 年的市場產生了負面影響。 但市場將在2022年達到疫情前水平,有望繼續穩步增長。

- 推動市場發展的主要因素是造紙和紙漿行業不斷增長的需求。 另一方面,由於聚乙烯的不可生物降解性,嚴格的環境法規阻礙了α-烯烴市場的增長。

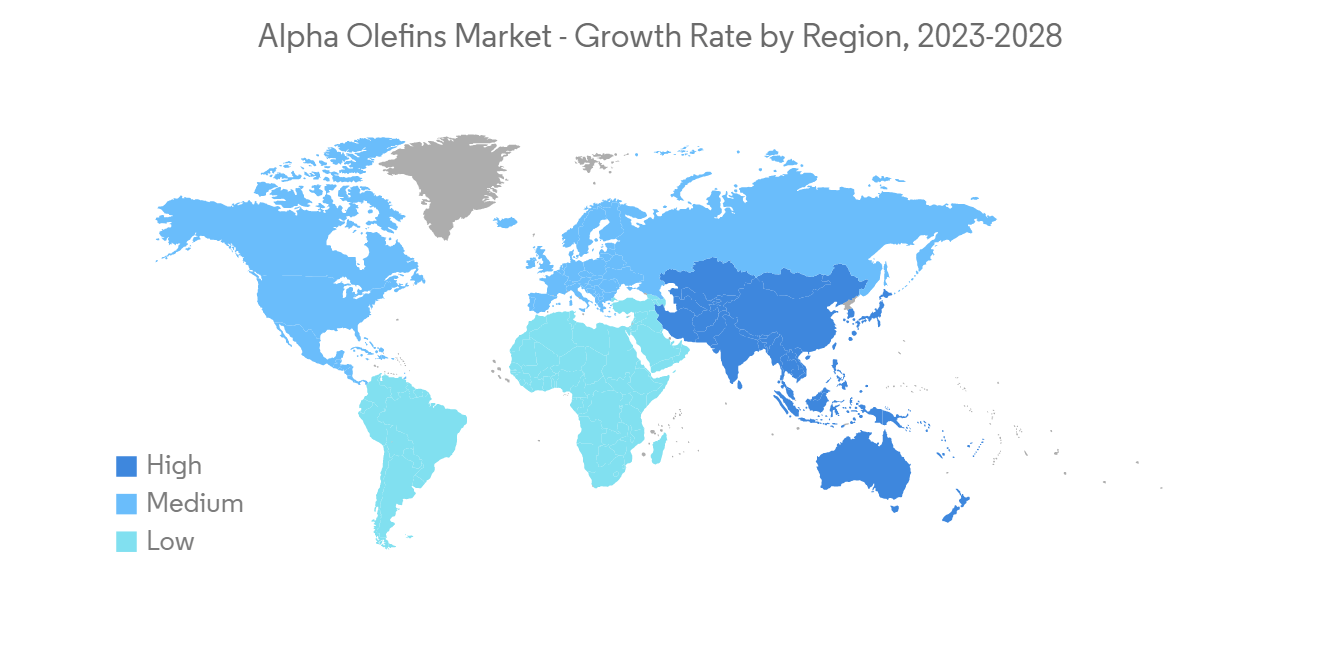

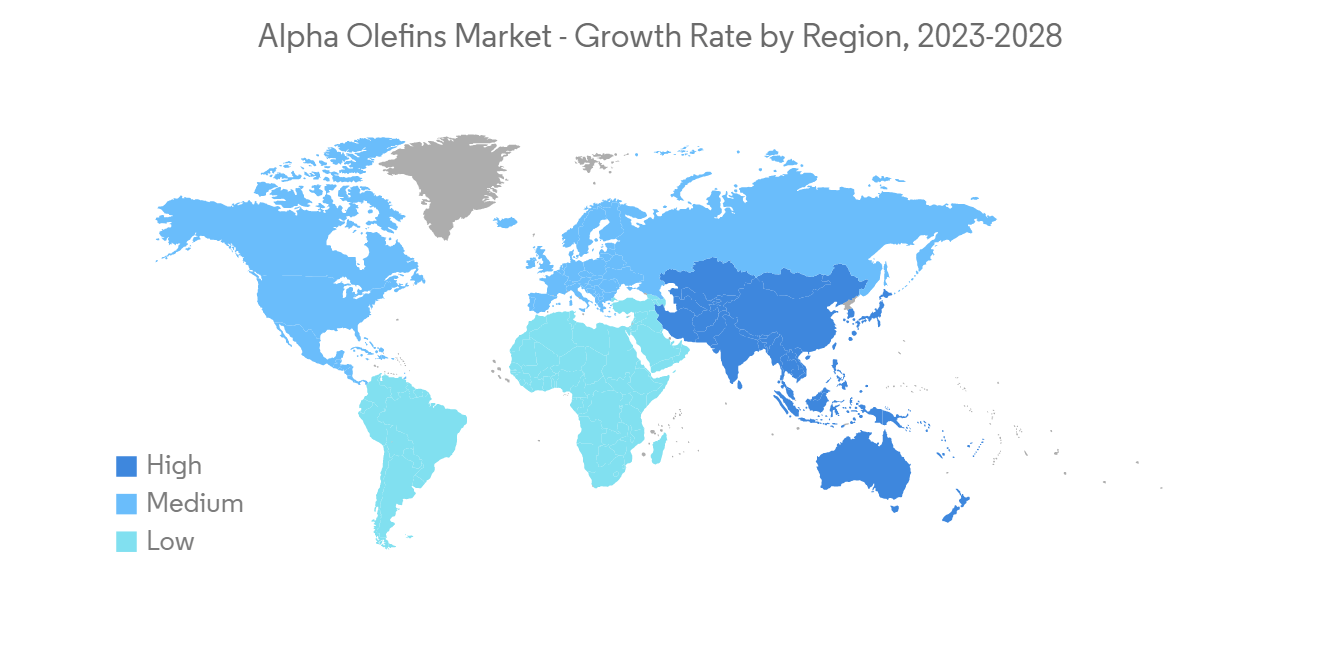

- 此外,用於開發各種來源的Alpha-烯烴的研發投資不斷增加,預計將在未來幾年成為市場機遇。 亞太地區主導著全球市場,中國、印度和日本等國家的消費量最大。

α-烯烴市場趨勢

表面活性劑用量增加

- 表面活性劑包含在各種洗滌劑中,但其中陰離子表面活性劑因其良好的發泡性能而受到特別重視。 許多陰離子表面活性劑用於洗滌劑中,但目前最常用的是十二烷基苯磺酸鹽和乙氧基化十二烷基硫酸鈉。

- Alpha-烯烴磺酸是陰離子表面活性劑,多年來一直有效地用於洗衣和個人護理產品,但逐漸被其他低成本產品所取代。

- Alpha-烯烴磺酸鹽在清潔劑中的主要優勢是它們能夠在稀產品、硬水和低溫下形成穩定的泡沫。 此外,它具有良好的去污力,可用於洗滌劑和化妝品,可快速生物降解,與皮膚具有良好的相容性,並且高度溶於水。 因此它適用於液體或粉末洗滌劑和個人衛生用品,尤其是洗碗機、洗衣粉、汽車清潔劑或沐浴露。

- 個人護理中最常用的Alpha-烯烴磺酸鹽是 C14-16 烯烴磺酸鈉,可用作洗滌劑、潤濕劑和乳化劑。 如果配製得當,C14-16 烯烴磺酸鈉可帶來諸如粘度、消費者可接受的發泡曲線和快速閃光泡沫等優點,以形成一致的泡沫。

- 洗滌劑和肥皂中含有的表面活性劑會與水混合併粘附在衣物等洗滌表面上的污垢上。 這降低了表面張力並允許從表面去除污垢。

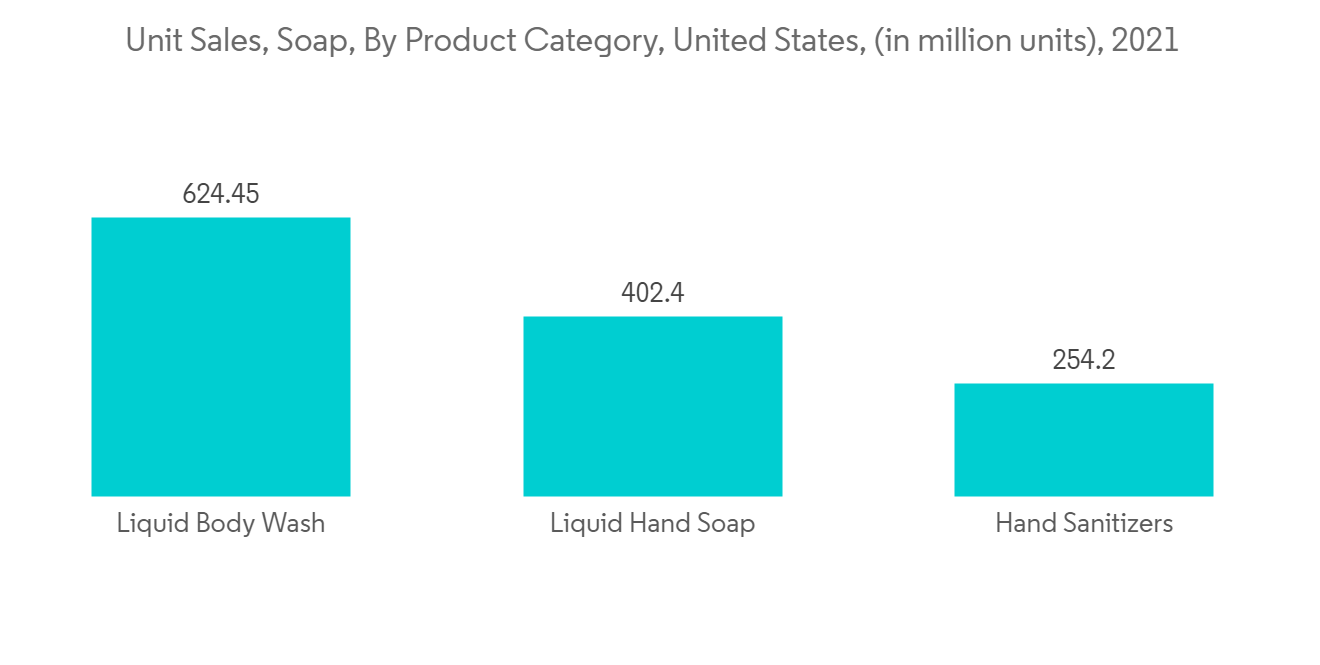

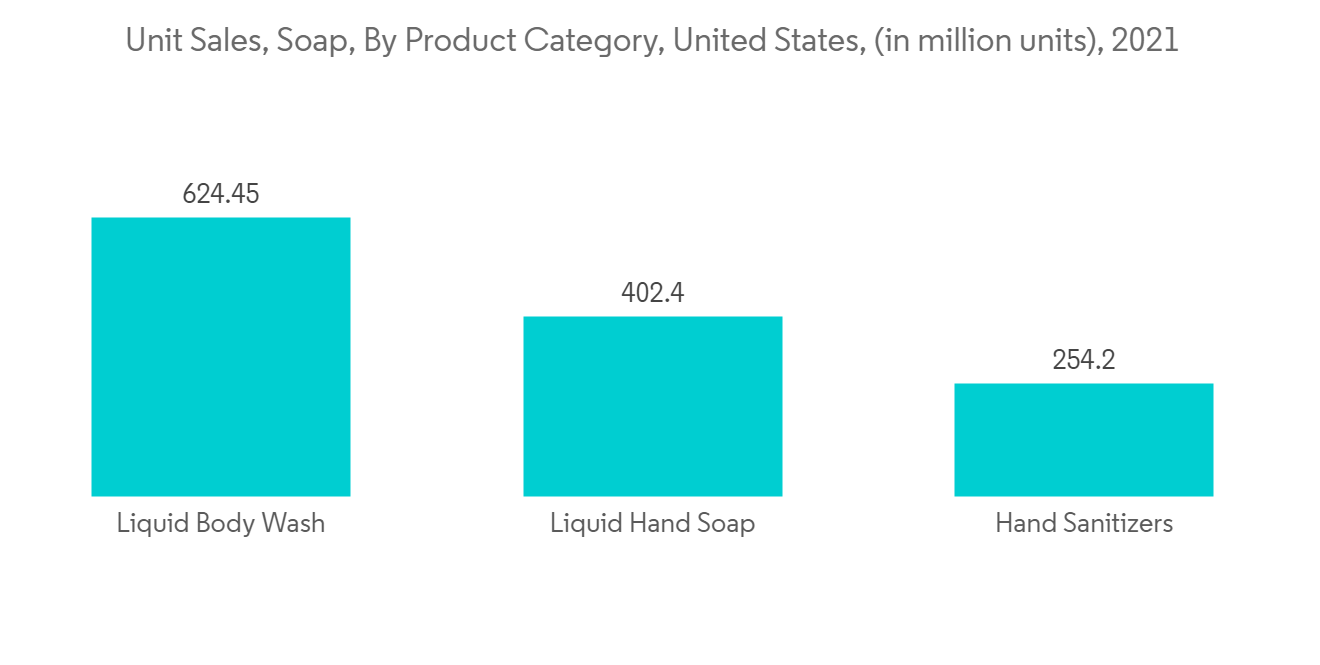

- 2021 年,沐浴露是美國銷量最高的肥皂產品。 2021年,美國液體沐浴露品類的多渠道銷量將達到約6.24億件。 洗手液和洗手液緊隨其後,2021年銷量分別約為4.02億和2.54億支。 因此,預計市場在預測期內將穩步增長。 由於這些因素,預計市場將在預測期內增長。

亞太地區主導市場

- 預計亞太地區將成為Alpha-烯烴消費的主導市場。 中國、日本、韓國、印度和東南亞國家等國家對Alpha-烯烴的需求增加。 中國還是潤滑油、油田化學品、增塑劑等產品的最大生產國,服務於全球市場。

- 在中國,由於 COVID-19 流行病導致衛生意識提高,肥皂和洗滌劑的消費量急劇增加。 預計這種消費將在未來幾年推動對Alpha烯烴的需求。

- α 烯烴主要用於生產線性低密度聚乙烯 (LLDPE) 和高密度聚乙烯 (HDPE) 等聚乙烯,並用於從包裝到管道的各種應用。

- 根據印度包裝工業協會 (PIAI) 的數據,包裝工業目前是印度第五大經濟部門。 印度以每年 22-25% 的速度增長,已成為包裝行業的首選中心。 預計這將增加對聚乙烯的需求,進而增加市場對Alpha-烯烴的需求。

- 此外,中國擁有世界上最大的紙漿和造紙工業之一。 中國是世界三大造紙國之一。 例如,2022年9月,中國轉化紙和紙板產量將在1160萬噸左右,預計將增加對Alpha-烯烴的需求。

- 因此,由於上述原因,亞太地區有望在預測期內主導所研究的市場。

α-烯烴行業概覽

α 烯烴市場因其性質而部分整合。 市場參與者包括 Chevron Phillips Chemical Company LLC、INEOS、SABIC、Sasol、Shell plc。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第 1 章介紹

- 調查先決條件

- 本次調查的範圍

第 2 章研究方法論

第 3 章執行摘要

第 4 章市場動態

- 促進因素

- 造紙和紙漿行業的需求不斷擴大

- 其他司機

- 抑制因素

- 聚乙烯的不可生物降解特性

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 類型

- 1-己烯

- 1-辛烯

- 1-丁烯

- 其他類型

- 用法

- 潤滑劑

- 油田化學品

- 增塑劑

- 聚烯烴共聚單體

- 表面活性劑

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 墨西哥

- 加拿大

- 其他北美地區

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第 6 章競爭格局

- 併購、合資企業、合作、合同

- 市場份額分析 (%)**/排名分析

- 主要公司採用的策略

- 公司簡介

- Chevron Phillips Chemical Company LLC

- Exxon Mobil Corporation

- Evonik Industries AG

- Idemitsu Kosan Co., Ltd.

- INEOS

- Kemipex

- LANXESS

- Qatar Chemical Company Ltd

- Shell plc

- SABIC

- Sasol

第 7 章市場機會與未來趨勢

- 增加研發投資以開發各種來源的alpha烯烴

簡介目錄

Product Code: 69487

The global alpha olefins market is projected to register a CAGR of more than 5% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The major factor driving the market is the growing demand from the paper and pulp industries. On the flip side, stringent environmental regulations due to the non-biodegradable nature of polyethylene are hindering the growth of the alpha olefins market.

- Further, growing R&D Investments for the development of alpha olefins from various sources are expected to act as a market opportunity in the coming years. The Asia-Pacific region dominates the global market, with the largest consumption from countries such as China, India, and Japan.

Alpha Olefins Market Trends

Increasing Usage in Surfactants Application

- Surfactants are present in a wide range of cleaning products, and one of the usual groups is anionic surfactants, which are particularly valued for their foaming ability. Many anionic surfactants are used in detergents, although the most commonly used today are the salts of dodecylbenzene sulfonic acid and ethoxylated sodium lauryl sulfate.

- Alpha olefin sulfonate is an anionic surfactant that has been used efficaciously for many years in laundry and personal care products but was gradually substituted by other low-cost products.

- The chief benefit of alpha olefin sulfonate in cleaning products is that it can form stable foams in diluted products, hard water, and at low temperatures. In addition, it has good cleaning properties, is useful in both detergents and cosmetics, has fast biodegradability, has good compatibility with the skin, and is highly soluble in water. Therefore, it is suitable for liquid or powder detergents and personal hygiene products, especially for dishwashers, laundry detergents, automotive cleaners, or bath gels.

- The most common alpha olefin sulfonate used in personal care is sodium C14-16 olefin sulfonate, which functions as a detergent, wetting agent, and emulsifier. When properly formulated, sodium C14-16 olefin sulfonate imparts viscosity, a consumer-acceptable foaming profile, and quick flash foam to produce a stable lather, among other benefits.

- The surfactants included in detergents and soaps mix with water and attach themselves to the dirt on clothes and other cleaning surfaces. This helps reduce surface tension and remove dirt from the concerned surface.

- In 2021, liquid body wash had the highest unit sales among soap products in the United States. In 2021, the liquid body wash category generated around 624 million units in multi-outlet sales in the United States. Also, it was followed by liquid hand soap and hand sanitizer, which sold about 402 million units and 254 million units, respectively, in 2021. This is expected to help the market grow steadily during the forecast period. Owing to all the abovementioned factors, the market is expected to grow during the forecast period.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to be the dominant market in alpha olefins consumption. In countries like China, Japan, South Korea, India, and Southeast Asian nations, the demand for alpha olefins is increasing. China is also the largest producer of lubricants, oil field chemicals, plasticizers, etc., catering to the market worldwide.

- The consumption of soap and detergent witnessed a sharp increase in the country, owing to the hygiene awareness due to the COVID-19 pandemic. This consumption is expected to propel the demand for alpha olefins in the coming years.

- Alpha olefins are mostly used to manufacture polyethylene, such as linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE), which are used in various applications ranging from packaging to pipes.

- According to the Packaging Industry Association of India (PIAI), the packaging industry is currently the fifth-largest economic sector in India. It is growing at a rate of 22-25% per year, making India a preferred hub for the packaging industry. This is expected to increase the demand for polyethylene, in turn, increasing the demand for alpha olefins in the market.

- Further, China has one of the world's largest pulp and paper industries. China is one of the top three producers of paper in the world. For instance, in September 2022, China's processed paper and cardboard manufacturing volume was roughly 11.6 million metric tonnes, which is expected to increase the demand for alpha olefins.

- Hence, due to the above-mentioned reasons, Asia-Pacific is anticipated to dominate the market studied during the forecast period.

Alpha Olefins Industry Overview

The alpha-olefin market is partially consolidated in nature. Some of the major players in the market include Chevron Phillips Chemical Company LLC, INEOS, SABIC, Sasol, and Shell plc, among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Paper and Pulp Industries

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Non-biodegradable Nature of Polyethylene

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 1-Hexene

- 5.1.2 1-Octene

- 5.1.3 1-Butene

- 5.1.4 Other Types

- 5.2 Appllication

- 5.2.1 Lubricants

- 5.2.2 Oil Field Chemicals

- 5.2.3 Plasticizers

- 5.2.4 Polyolefin Comonomers

- 5.2.5 Surfactants

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Mexico

- 5.3.2.3 Canada

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Merger and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chevron Phillips Chemical Company LLC

- 6.4.2 Exxon Mobil Corporation

- 6.4.3 Evonik Industries AG

- 6.4.4 Idemitsu Kosan Co., Ltd.

- 6.4.5 INEOS

- 6.4.6 Kemipex

- 6.4.7 LANXESS

- 6.4.8 Qatar Chemical Company Ltd

- 6.4.9 Shell plc

- 6.4.10 SABIC

- 6.4.11 Sasol

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing R&D Investments for the Development of Alpha Olefins from Various Sources

02-2729-4219

+886-2-2729-4219