|

市場調查報告書

商品編碼

1435800

烷基多醣苷(APG):市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Alkyl Polyglycoside (APG) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

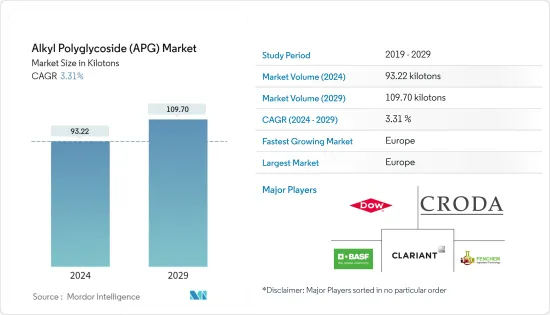

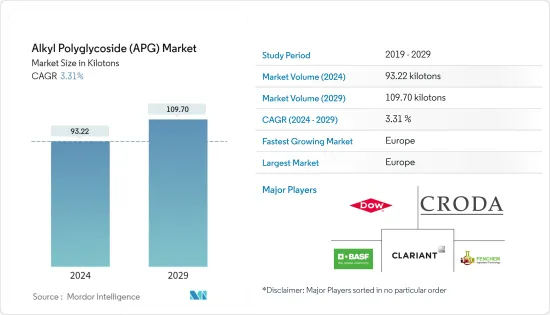

烷基多糖苷(APG)市場規模預計到2024年為93,220千噸,預計到2029年將達到109,700千噸,在預測期內(2024-2029年)市場規模將增加至3.31千噸。複合年增率為% 。

COVID-19感染疾病對烷基多醣體 (APG) 產業造成了影響。由於全球封鎖和各國政府實施的嚴格監管,大多數生產基地被關閉,造成毀滅性打擊。儘管如此,業務自 2021 年以來已經復甦,預計未來幾年將大幅成長。

主要亮點

- 推動市場的主要因素是家庭護理和個人保健產品需求的激增以及人們對傳統表面活性劑相關健康危害的認知不斷增強。

- 相反,替代品的可用性預計會阻礙所研究市場的成長。

- 擴大採用天然食品成分預計將為所研究的市場提供機會。

- 歐洲是最大的市場,預計將成為預測期內成長最快的地區。這是由於德國、英國和法國等國的消費增加。

烷基多醣苷(APG)市場趨勢

主導市場的居家護理產品應用

- 烷基多醣糖苷(APG)基界面活性劑以其高度生物分解性、環境友善和易水解的特性而廣為人知。這些有利的特性導致多種家庭護理產品應用中對烷基多醣苷 (APG) 的需求不斷成長。

- 人口成長、都市化、生活水準的變化和人均收入的增加正在對清潔劑、肥皂和織物柔軟劑等家庭護理產品的需求產生重大影響。

- 在歐洲和北美的已開發地區,自動洗衣機廣泛普及洗衣任務。家用清潔劑在家庭護理產品應用中的烷基多醣苷(APG)市場中佔有很大佔有率。

- 此外,人們越來越意識到提高洗衣業務的有效性和效率,導致對居家護理產品的需求激增。烷基多醣苷(APG)表面活性劑等非離子界面活性劑是製造清潔劑的主要原料,因此全球對清潔劑的需求預計將增加並推動市場成長。

- 根據國際貿易中心統計,德國是最大的肥皂和有機界面活性劑產品出口國,2022年出口額大幅成長至約14,542,764,000美元。這種成長意味著國際市場對這些產品的需求增加。這是由於作為表面活性劑生產中的關鍵成分的脂肪酸的需求不斷增加。 2022年,美國出口額為1,123,962,000美元,中國出口額為1,046,966,000美元,印尼出口額為871,438,000美元,法國出口額為750,356,000美元。

- 清潔劑產業在美國擁有大量的消費者支出,每年達數十億美元。品牌忠誠度是美國消費者的標誌,汰漬等知名品牌作為美國銷售量最大的清潔劑品牌之一,享有強大的市場影響力。此外,美國還擁有廣泛的製造基礎設施,擁有約 2,356 個肥皂、清洗產品和廁所配方生產設施。

- 因此,由於上述因素,家庭護理產品對烷基多醣苷(APG)的需求預計在預測期內將大幅增加。

考慮歐洲是否會壟斷市場

- 個人護理和化妝品行業的成長,尤其是在歐洲主要國家,加上消費者對使用天然家庭護理產品的偏好,正在推動歐洲烷基多醣苷(APG)的消費。

- 德國是歐洲最大的個人護理和化妝品市場,其次是法國和英國。由於其便利的位置和大眾市場美容品牌的廣泛選擇,藥局是德國美容和個人護理行業最大的分銷管道。此外,預計該地區製造業的顯著成長將推動對該產品的需求。

- 消費者對天然產品在居家照護應用中重要性的認知不斷提高,可能會擴大市場規模。據觀察,一些公司正在不斷努力減少對羥基苯甲酸酯、鄰苯二甲酸鹽和鋁鹽等潛在有害化學物質的使用,並從其產品中生產可再生資源。

- 該行業受到 REACH、CEFIC 和 ECHA 等地區主管機構關於無機表面活性劑環境危害的嚴格監管。考慮到該產品的毒性相對較低,並且符合當地執法機構的規定,因此積極採用這種生物基表面活性劑。

- 法國擁有龐大的化妝品和護膚市場,並獲得歐萊雅集團、寶潔公司、聯合利華公司、拉爾夫勞倫公司、露華濃公司、Christian Louboutin SA 和 Carolina Herrera 等公司的支持。根據法國美容企業聯合會(FEBEA)預測,2022年法國出口總銷售額的近85%將主要由香水、護膚品類和彩妝產品佔據,其中香水行業在2022年將成長30.2%。 。這是同一年。

- 此外,根據Brand Finance發布的2022年化妝品50強排名,這個法國化妝品品牌被公認為2022年全球化妝品行業最有價值的品牌之一。歐萊雅已成為最有價值的法國化妝品品牌,品牌價值更高。超過110億美元。嬌蘭和蘭蔻佔據第二和第三位,品牌價值分別為61.3億美元和45.85億美元。

- 上述因素預計將在預測期內增加該地區對烷基多醣苷(APG)的需求。

烷基多醣苷(APG)產業概況

烷基多醣苷 (APG) 市場已部分整合,少數大型企業控制了很大一部分。主要企業包括巴斯夫股份公司(BASF SE)、科萊恩 (Clariant)、禾大國際 (Croda International PLC)、FENCHEM 和陶氏化學 (Dow)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 家庭和個人保健產品的需求快速成長

- 提高人們對傳統界面活性劑造成的健康危害的認知

- 其他司機

- 抑制因素

- 替代品的可用性

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:基於數量)

- 依產品

- 脂醇類

- 砂糖

- 玉米粉

- 植物油

- 其他

- 按用途

- 個人護理/化妝品

- 居家護理產品

- 工業清潔劑

- 農業化學品

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率分析(%)/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- Actylis

- Clariant

- Croda International PLC

- Dow

- FENCHEM

- Kao Corporation

- LG Household & Healthcare Ltd

- Shanghai Chenhua International Trade Co., Ltd.

- Shanghai Fine Chemical Co., Ltd.

- Spec-Chem Industry Inc.

第7章 市場機會及未來趨勢

The Alkyl Polyglycoside Market size is estimated at 93.22 kilotons in 2024, and is expected to reach 109.70 kilotons by 2029, growing at a CAGR of 3.31% during the forecast period (2024-2029).

The COVID-19 pandemic harmed the alkyl polyglycoside sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business is recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- The major factors driving the market are a surge in demand for home care and personal care products and growing awareness of health hazards associated with conventional surfactants.

- Conversely, the availability of substitutes is expected to hinder the studied market's growth.

- A surge in the adoption of natural food ingredients is expected to act as an opportunity for the market studied.

- Europe represents the largest market and is expected to be the fastest-growing region over the forecast period. It is due to increased consumption from countries such as Germany, the United Kingdom, and France.

Alkyl Polyglycoside (APG) Market Trends

Home Care Products Application to Dominate the Market

- Alkyl polyglycoside surfactants are widely known for their high biodegradability, eco-friendly nature, and easy hydrolyzed ability. Such favorable properties contribute to the growing demand for alkyl polyglycoside in several home care product applications.

- Population growth, urbanization, changing living standards, and rising per capita income significantly affect the demand for home care products, such as laundry detergents, soaps, and fabric conditioners.

- In developed regions, like Europe and North America, automated washing machines are widely prevalent and used for laundry operations. Household detergents hold a major share in the home care products applications of the alkyl polyglycoside market.

- Moreover, people are becoming more conscious about increasing the efficacy and efficiency of laundry operations, which, in turn, is surging the demand for home care products. As non-ionic surfactants, like alkyl polyglycoside surfactants, are the primary raw materials used in the production of detergents, the growing demand for laundry detergents worldwide is expected to boost the market growth.

- According to the International Trade Centre, Germany is the largest exporter of soap and organic surface-active products, witnessing a substantial increase in export value of around USD 14,542,764 thousand in 2022. This growth signifies a growing demand for these products in international markets, translating to increased demand for fatty acids as key components in producing surfactants. The United States of America exported USD 1,123,962 thousand, China USD 1,046,966 thousand, Indonesia USD 871,438 thousand, and France USD 750,356 thousand in 2022.

- The laundry detergent sector holds substantial consumer spending in the United States, reaching billions annually. Brand loyalty is a prominent feature among American consumers, with established brands like Tide enjoying a strong market presence as one of the largest-selling laundry detergent brands in the country. Moreover, the United States boasts an extensive manufacturing infrastructure, with approximately 2,356 soap, cleaning compounds, and toilet preparation manufacturing facilities.

- Hence, owing to the abovementioned factors, the demand for alkyl polyglycoside from home care products is expected to increase considerably over the forecast period.

Europe to Dominate the Market Studied

- The growth of the personal care and cosmetic industry, particularly in major European countries, coupled with consumer preferences toward using natural home care products, is driving the consumption of alkyl polyglycoside in Europe.

- Germany represents Europe's largest personal care and cosmetic market, followed by France and the United Kingdom. Due to their convenient location and wide selection of mass-market beauty brands, Drug stores are the largest distribution channel in Germany's beauty and personal care industry. Moreover, the significant growth of the manufacturing sector in the region is expected to aid the demand for the product.

- Growing consumer awareness of the importance of naturally derived products in home care applications will likely boost the market size. Several players are observed to continuously strive to manufacture product-derived renewable sources by decreasing the use of potentially harmful chemicals, such as parabens, phthalates, and aluminum salts.

- The industry is regulated by stringent regulations by regional authorities, such as REACH, CEFIC, and ECHA, regarding the environmental hazards of inorganic surfactants. The robust adoption of this bio-based surfactant considering the product's relatively low toxicity, further complies with the regulations of the regional enforcement authorities.

- France is a home for a large cosmetics and skincare market, with support from players like the L'Oreal Group, Procter & Gamble, Unilever PLC, Ralph Lauren Corporation, Revlon Inc., Christian Louboutin SA, and Carolina Herrera, among others. According to the French Federation for Beauty Companies (FEBEA), nearly 85% of total export sales in France is mainly driven by the perfume, skincare categories, and make-up in 2022, in which the perfumery segment depicted a growth of 30.2% in the same year.

- Furthermore, according to the Cosmetics 50 2022 ranking given by Brand Finance, French cosmetics brands were recognized among the most valued brands in the global cosmetics sector in 2022. L'Oreal emerged as the most valued French cosmetics brand, with a brand value of more than USD 11 billion. Guerlain and Lancome occupied the second and third place, with brand value standing at USD 6,130 million and USD 4,585 million, respectively.

- Due to the factors above, the demand for alkyl polyglycoside is expected to increase in the region during the forecast period.

Alkyl Polyglycoside (APG) Industry Overview

The alkyl polyglycoside (APG) market is partially consolidated, with a few major players dominating a significant portion. Some major companies are BASF SE, Clariant, Croda International PLC, FENCHEM, and Dow.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surge in Demand for Home Care and Personal Care Products

- 4.1.2 Growing Awareness Toward Health Hazards Associated with Conventional Surfactants

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Product

- 5.1.1 Fatty Alcohol

- 5.1.2 Sugar

- 5.1.3 Cornstarch

- 5.1.4 Vegetable Oil

- 5.1.5 Other Products

- 5.2 By Application

- 5.2.1 Personal Care and Cosmetics

- 5.2.2 Home Care Products

- 5.2.3 Industrial Cleaners

- 5.2.4 Agricultural Chemicals

- 5.2.5 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Actylis

- 6.4.3 Clariant

- 6.4.4 Croda International PLC

- 6.4.5 Dow

- 6.4.6 FENCHEM

- 6.4.7 Kao Corporation

- 6.4.8 LG Household & Healthcare Ltd

- 6.4.9 Shanghai Chenhua International Trade Co., Ltd.

- 6.4.10 Shanghai Fine Chemical Co., Ltd.

- 6.4.11 Spec-Chem Industry Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Surge in Adoption of Natural Food Ingredients

- 7.2 Other Opportunities