|

市場調查報告書

商品編碼

1406097

雙相不銹鋼-2024年至2029年市場佔有率分析、產業趨勢與統計、成長預測Duplex Stainless Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

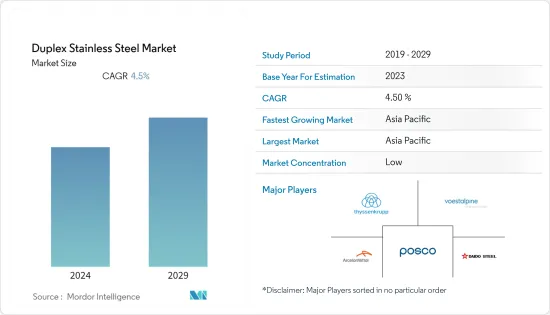

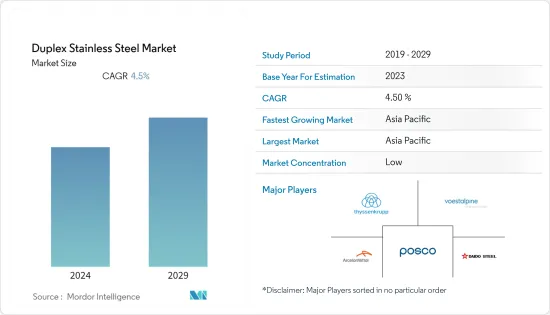

預計2024年全球雙相不銹鋼市場規模為23億美元,2029年將達28億美元,預測期內(2024-2029年)複合年成長率為4.5%。

主要亮點

- 從中期來看,耐腐蝕應用的增加以及石油和天然氣行業需求的增加等因素預計將推動市場成長。

- 另一方面,雙相不銹鋼在高溫下的有限使用預計將抑制雙相不銹鋼市場的成長。

- 新油田設施對雙相不銹鋼的需求不斷成長預計將為該行業提供成長機會。

- 預計亞太地區將主導市場,印度和中國等國家的消費量最高。

雙相不銹鋼市場趨勢

建設產業需求增加

- 雙相不銹鋼主要用於建設產業。它被用作建築設計材料,因為它具有比碳鋼更高的強度和比奧氏體不銹鋼更高的耐腐蝕等獨特性能。

- 雙相不銹鋼最常見的建築和施工應用是大型人行橋,例如新加坡的螺旋橋、聖地牙哥的港灣大道橋和卡達的新盧賽爾人行橋。

- 其他用途包括容易腐蝕地區的欄桿,例如加那利群島和紐約的四自由公園。高強度拉桿和星形輪用於玻璃帷幕牆的薄壁結構支撐。

- 基礎設施的快速發展預計將在未來幾年推動雙相不銹鋼的需求。

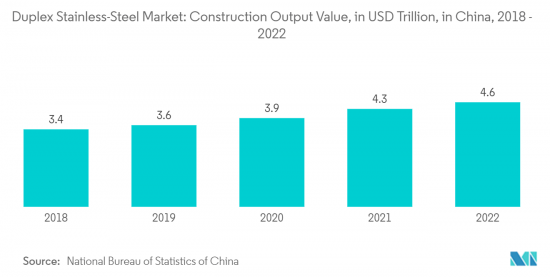

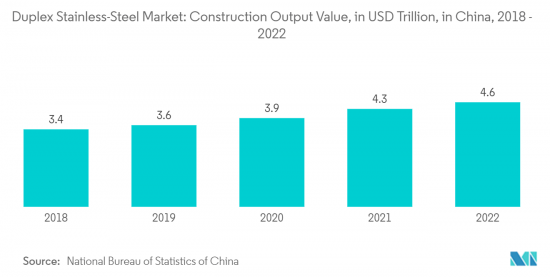

- 中國是世界上最大的建築市場之一。 2022年,中國建設產業產值達到約4.6兆美元。中國政府主要關注中小城市的基礎建設。北京已為建設計劃提供了6.8兆元人民幣(1兆美元)的政府資金。

- 北京市2021-2025年發展計畫總合包括102個計劃。中國政府已經開闢了一條全長1,629公里、全長3,000多公尺的路線,穿越地震多發地區和冰川,從西南部的四川省到西藏首府拉薩。該計劃將投資3,198億元人民幣(506億美元)。建設活動預計將於年終開始,並於 2025 年完成。

- 據中國水利部稱,2022年水利基礎建設計劃投資額為7,036億元人民幣(980億美元),較2021年成長63.95%。 2022年,動工計劃1.9萬多個,其中重大計劃31個。

- 印度政府正專注於發展全國基礎設施,以促進經濟成長。政府的目標是建造100個智慧城市。根據世界銀行的報告,印度未來15年必須投資8,400億美元用於城市基礎設施,以滿足快速成長的城市人口的需求。

- 為了加強該國的基礎設施部門,印度政府已在 2022 年撥款 100,000 億印度盧比(1,305.7 億美元)。其中包括向印度國家公路管理局 (NHAI) 提供的 13,401.5 億印度盧比(172.4 億美元)、向道路運輸和公路部提供的 6,000 億印度盧比(77.2 億美元)以及向住宅和城市事務部提供的7,654.9億印度盧比. 印度盧比(98.5 億美元)的預算已分配。

- 總體而言,全球此類基礎設施的開拓預計將在未來幾年推動市場。

亞太地區主導市場

- 由於快速建設和持續投資,亞太地區預計將主導全球市場。

- 中國擁有龐大的建築業。過去兩年,基礎設施、商業和住宅領域的快速發展,帶動了建築業的數量和金額。

- 目前,中國有許多機場建設計劃處於開發和規劃階段。這些計劃包括北京首都國際機場、成都雙流國際機場、廣州白雲國際機場等。政府推出了一項大規模建設計畫,將在未來 10 年內將 2.5 億人遷入新開發的特大城市。

- 印度的工商業基礎設施已成為高成長產業之一。印度政府正在製定放寬規則等舉措,吸引外國直接投資流入建築業,以促進該國的整體發展。

- 2022年10月,日本國際協力機構(JICA)宣布有意更參與印度私部門所進行的計劃。未來幾年,日本發展援助機構希望將全球對私部門計劃的投資增加到 150 億美元,主要關注印度的舉措。

- 印度化工產品銷售額居世界第六位,對全球化工業貢獻3%。據印度品牌股權基金會(IBEF)稱,在2022-2023年聯邦預算中,政府已向化學和石化部撥款20.9億印度盧比(2743萬美元)。到2025年,化學品需求預計將以每年9%的速度成長。這一趨勢預計將增加化學工業的製造能力,並增加化學加工廠製造對雙相不銹鋼的需求。

- 由於上述因素,預計亞太市場在預測期內將大幅擴張。

雙相不銹鋼產業概況

全球雙相不銹鋼市場較為分散,眾多企業相互競爭。主要公司包括蒂森克虜伯股份公司、奧鋼聯股份公司、安賽樂米塔爾股份公司、浦項製鐵及大同特殊鋼公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 增加耐腐蝕應用

- 石油和天然氣產業需求增加

- 抑制因素

- 耐熱性有限

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 類型

- 精益雙相不銹鋼

- 雙相不銹鋼

- 超級雙相不銹鋼

- 最終用戶產業

- 油和氣

- 建造

- 紙漿

- 化學處理

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AK Steel Holding(Cleveland-Cliffs Inc.)

- ArcelorMittal SA

- Daido Steel Co. Ltd

- Jindal Stainless Ltd.

- Nippon Yakin Kogyo Co. Ltd

- Outokumpu

- POSCO

- SAIL

- Sandvik AB

- SeAH Steel Corporation

- Thyssenkrupp AG

- Voestalpine AG

第7章 市場機會及未來趨勢

- 新油田設施對雙相不銹鋼的需求不斷成長

簡介目錄

Product Code: 69446

The global duplex stainless steel market has been estimated to be valued at USD 2.3 billion in 2024, and it is expected to reach a value of USD 2.8 billion by 2029, registering a CAGR of 4.5% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as increasing applications for corrosion resistance and rising demand from the oil and gas industry are expected to drive the growth of the market.

- On the other hand, the limited use of duplex stainless steel at higher temperatures is expected to restrain the growth of the duplex stainless steel market.

- The rising demand for duplex stainless steel in new oilfield facilities is expected to offer growth opportunities to the industry.

- The Asia-Pacific region is expected to dominate the market, with the largest consumption being recorded by countries like India and China.

Duplex Stainless Steel Market Trends

Rising Demand from the Construction Industry

- Duplex stainless steel finds major applications in the construction industry. It is used as a construction design material because of its unique characteristics, such as higher strength than carbon steel and higher corrosive resistance compared to austenitic stainless steel.

- The most common building and construction applications for duplexes are spectacular pedestrian bridges, like the Helix Bridge in Singapore, San Diego's Harbor Drive Bridge, and the new Lusail Pedestrian Bridges in Qatar.

- Other applications include handrails in corrosive locations, like the Canary Islands and the Four Freedoms Park in New York. High-strength tension bars and spiders are used in low-profile wall structural supports for glass curtains.

- The rapid development of infrastructure is expected to drive the demand for duplex stainless steel in the coming years.

- China is one of the largest construction markets in the world. The Chinese construction industry's output value amounted to around USD 4.6 trillion in 2022. The Chinese government mainly focuses on improving the infrastructure in small and medium-sized cities. The local body of Beijing has made CNY 6.8 trillion (USD 1 trillion) of government funds available for construction projects.

- A total of 102 mega-projects have been included in Beijing's 2021-2025 development plan. The Chinese government initiated a 1,629-kilometer line from Sichuan province in the southwest to the Tibetan capital, Lhasa, covering more than 3,000 meters through earthquake-prone terrain and glaciers. This project involves a planned investment of CNY 319.8 billion (USD 50.6 billion). Construction activities started at the end of 2020, and the line is expected to be completed by 2025.

- According to China's Ministry of Water Resources, CNY 703.6 billion (USD 98 billion) was invested in water-conservancy infrastructural projects in 2022, recording an increase of 63.95% compared to 2021. The construction of more than 19,000 water-conservancy projects began in 2022, of which 31 were considered to be major projects.

- The Government of India strongly focuses on infrastructural development across the country to boost economic growth. The government is aiming to build 100 smart cities. According to the World Bank's report, India has to invest USD 840 billion in urban infrastructure over the next 15 years in order to meet the requirements of its fast-growing urban population.

- In order to enhance the country's infrastructural sector, the Indian government allocated INR 10 lakh crore (USD 130.57 billion) in 2022. These investments included the allocated budget of INR 134,015 crore (USD 17.24 billion) for the National Highways Authority of India (NHAI), an outlay of INR 60,000 crore (USD 7.72 billion) for the Ministry of Road Transport and Highways, and INR 76,549 crore (USD 9.85 billion) for the Ministry of Housing and Urban Affairs.

- Overall, all such developments in infrastructure across the world are expected to drive the market in the coming years.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the global market, owing to rapid construction and continuous investments across the region.

- China hosts a vast construction sector. Rapid developments in the infrastructural, commercial, and residential sectors over the past two years have boosted the construction sector in terms of volume and value.

- Currently, China accounts for numerous airport construction projects in the development and planning stages. These projects include Beijing Capital International Airport, Chengdu Shuangliu International Airport, and Guangzhou Baiyun International Airport. The government rolled out massive construction plans to shift 250 million people to the newly developed mega-cities over the next ten years.

- Industrial and commercial infrastructure in India has emerged as one of the high-growth sectors. The Indian government has been formulating initiatives like easing the rules to attract FDI inflow in the construction sector to expedite development across the nation.

- In October 2022, the Japan International Cooperation Agency (JICA) announced its intention to participate in more projects conducted by India's private sector. In the coming years, Japan's development agency hopes to increase its global investments in private-sector projects to USD 15 billion, mainly concentrating on Indian initiatives.

- India ranks sixth in the world in the sales of chemicals, and it contributes 3% to the global chemical industry. According to the Indian Brand Equity Foundation (IBEF), under the Union Budget 2022-2023, the government allocated INR 209 crore (USD 27.43 million) to the Department of Chemicals and Petrochemicals. The demand for chemicals is expected to expand by 9% per annum by 2025. This trend is expected to boost the manufacturing capabilities of the chemical industry and the demand for duplex stainless steel for manufacturing chemical processing plants.

- All the above-mentioned factors are expected to significantly boost the market in the Asia-Pacific region during the forecast period.

Duplex Stainless Steel Industry Overview

The global duplex stainless steel market is fragmented, with many players competing against one another. Some of the major companies are Thyssenkrupp AG, Voestalpine AG, ArcelorMittal SA, POSCO, and Daido Steel Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications for Corrosion Resistance

- 4.1.2 Growing Demand from the Oil and Gas Industries

- 4.2 Restraints

- 4.2.1 Limited Heat Resistance

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Lean Duplex Stainless Steel

- 5.1.2 Duplex Stainless Steel

- 5.1.3 Super Duplex Stainless Steel

- 5.2 End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Construction

- 5.2.3 Paper and Pulp

- 5.2.4 Chemical Processing

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AK Steel Holding (Cleveland-Cliffs Inc.)

- 6.4.2 ArcelorMittal S.A.

- 6.4.3 Daido Steel Co. Ltd

- 6.4.4 Jindal Stainless Ltd.

- 6.4.5 Nippon Yakin Kogyo Co. Ltd

- 6.4.6 Outokumpu

- 6.4.7 POSCO

- 6.4.8 SAIL

- 6.4.9 Sandvik AB

- 6.4.10 SeAH Steel Corporation

- 6.4.11 Thyssenkrupp AG

- 6.4.12 Voestalpine AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Duplex Stainless Steel in New Oilfield Facilities

02-2729-4219

+886-2-2729-4219