|

市場調查報告書

商品編碼

1273313

電氣絕緣材料市場 - COVID-19 的增長、趨勢、影響和預測 (2023-2028)Electrical Insulation Material Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計在預測期內,全球電氣絕緣材料市場的複合年增長率將超過 6%。

由於影響大多數行業的全球限制,COVID-19 大流行對電絕緣材料市場產生了重大影響。 但2021年後,行業加速發展,對電絕緣材料的需求增加。 因此,預計市場在預測期內將保持類似的軌跡。

主要亮點

- 在預測期內,加強電氣設備的安全措施推動了電氣絕緣材料市場的增長。 此外,將電力傳輸和分配到世界各地的需求正在推動市場的增長。

- 相反,電絕緣材料的高成本是阻礙市場增長的主要因素。 此外,預計全球電絕緣材料市場將面臨嚴峻形勢。

- 新興國家/地區發電活動的增加以及電動汽車對電氣絕緣材料的需求增加可能會為所研究的市場帶來機遇。

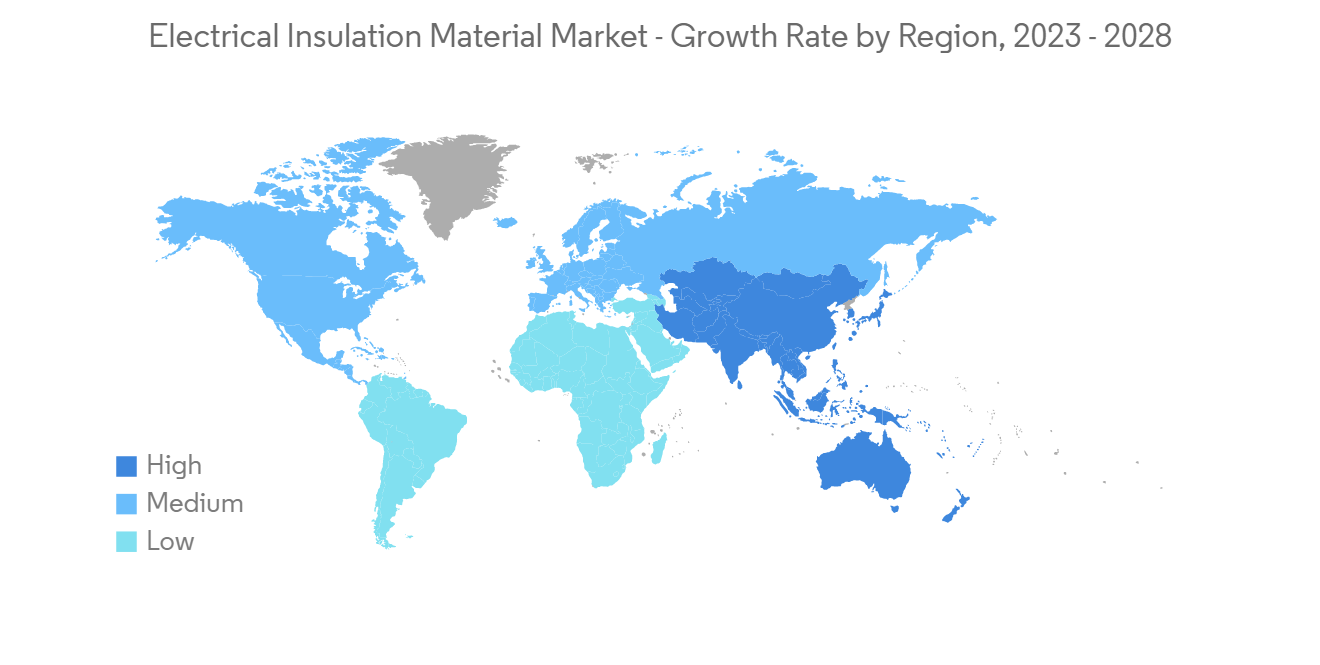

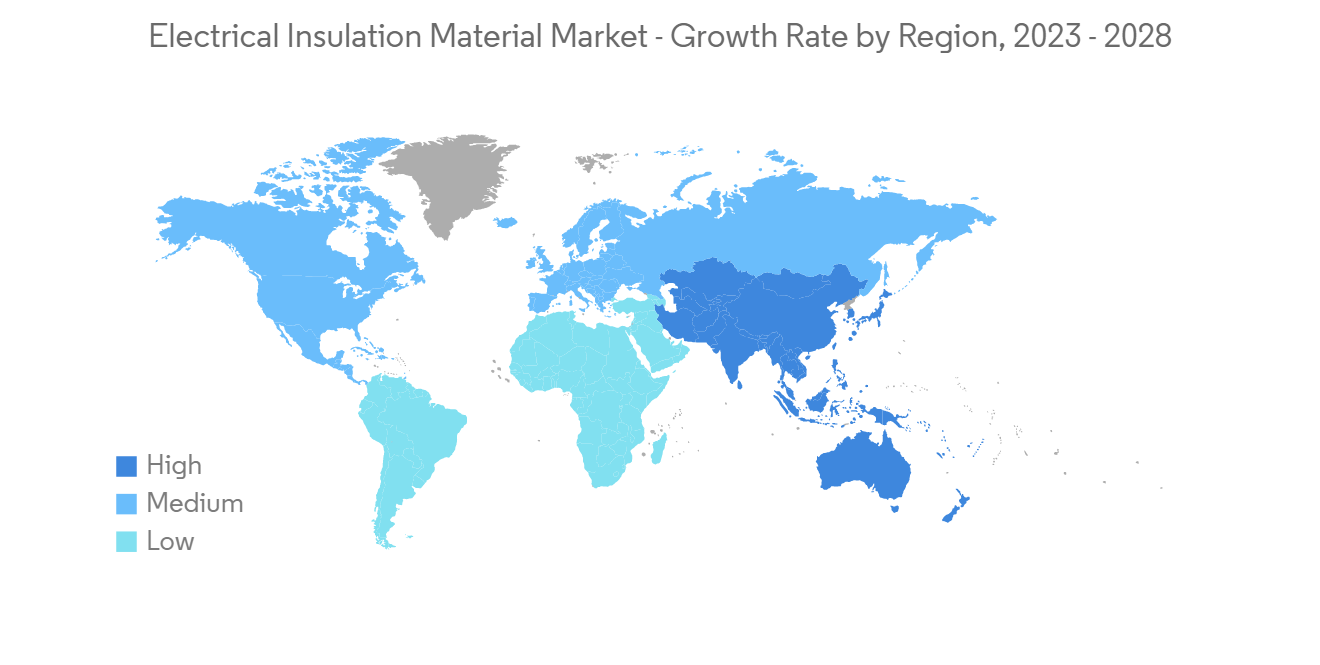

- 由於新興經濟體電力行業的先進改進和快速工業化,亞太地區在電氣絕緣材料市場佔據主導地位。 同時,預計亞太地區在預測期內仍將保持最高複合年增長率。

電絕緣材料的市場趨勢

傳輸和電纜應用主導市場

- 電絕緣材料不導電。 電絕緣材料應用於輸電和電纜線路、發電機、旋轉電機、傳動裝置、變壓器等。

- 輸電線路將電力從發電廠輸送到各個地方。 發電機、變壓器和旋轉機械是發電行業的一部分。 絕緣材料允許電力通過電力線和電纜而不會受到干擾或浪費能源。

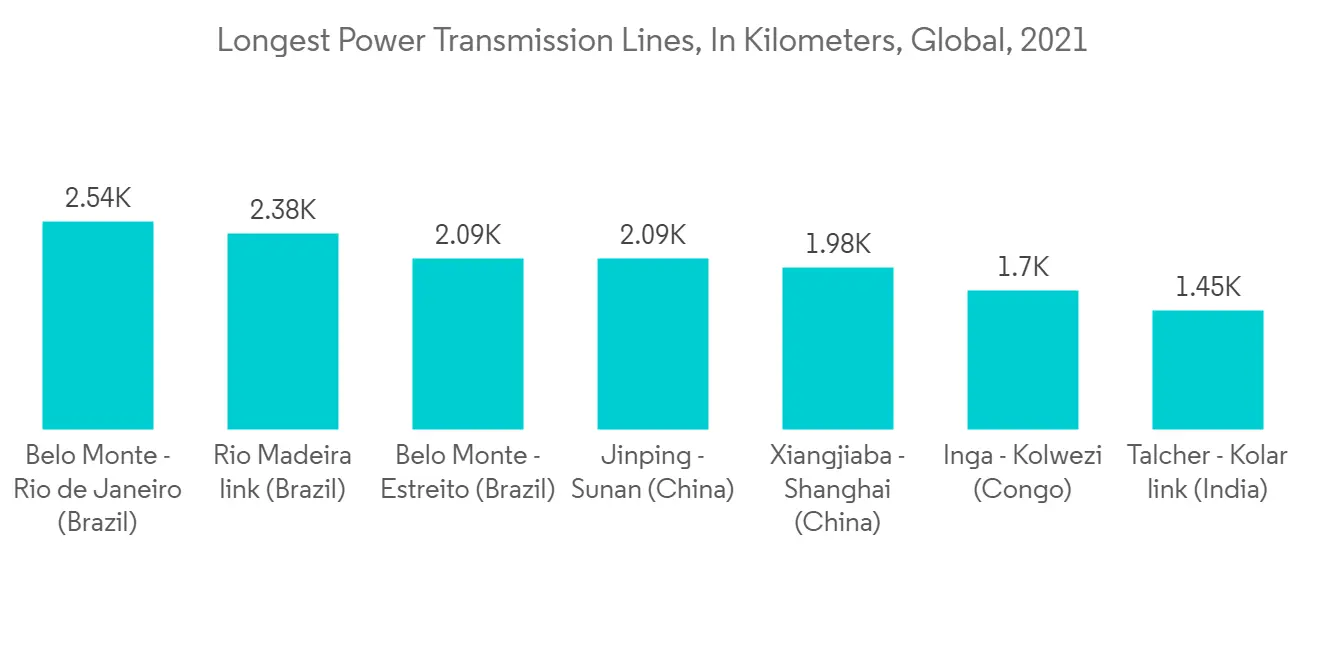

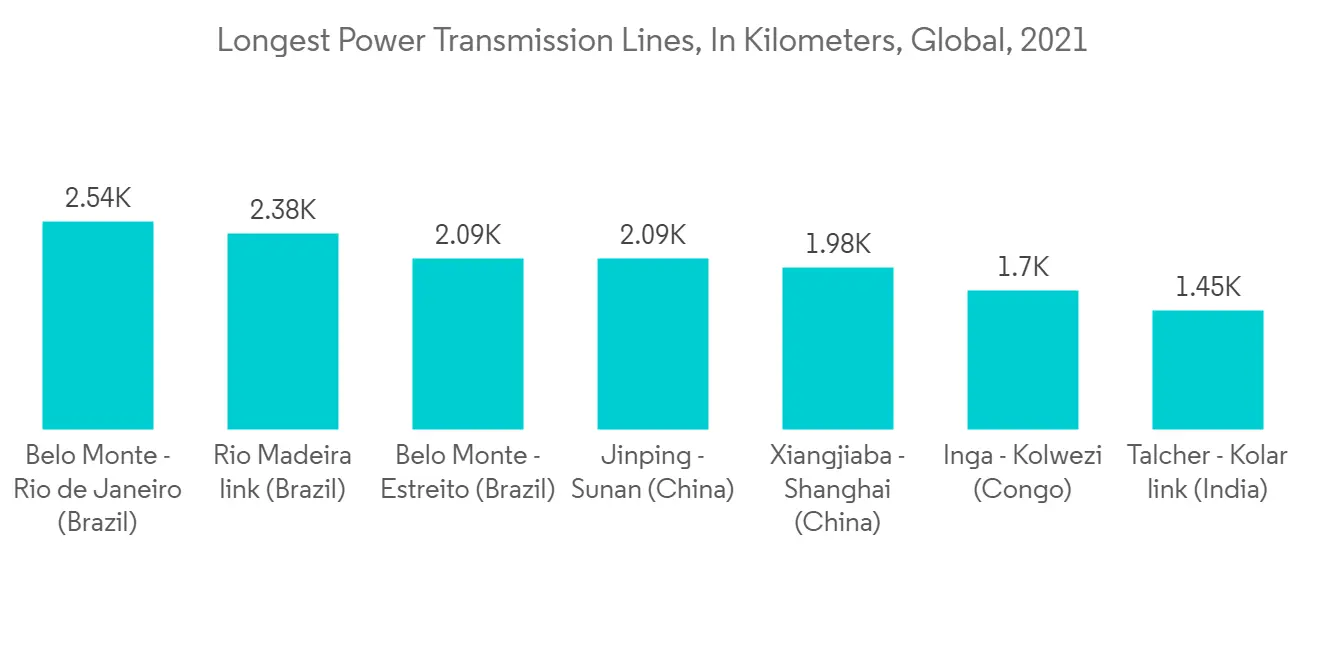

- 根據 Power Technology 的數據,到 2021 年,巴西將擁有世界上最長的三個輸電線路。 2543公裡長的貝洛蒙特-裡約熱內盧輸電線路位居首位,其次是裡約馬德拉輸電線路和貝洛蒙特-埃斯特裡托輸電線路。

- 據美國能源部估計,到 2021 年美國將擁有大約 200 英裡的輸電線。 年內竣工總長度中,230KV及以下工程佔近52%。

- 電壓高達 230KV 的項目跑了大約 101 英裡。 其餘 92 英裡由電壓在 230-345KV 之間的項目覆蓋。

- 許多項目正在進行中,以鋪設電力線以將電力從一個地方安全地輸送到另一個地方。 例如,PacifiCorp 的愛達荷州東南部項目將於 2022 年 4 月完工,旨在用新的輸電線路替換老化的輸電線路,以滿足該地區不斷增長的電力需求。 該項目需要對電氣系統進行多階段擴展,從愛達荷州弗斯附近的戈森變電站到愛達荷州雷克斯堡的雷克斯堡變電站。

- 上述電力傳輸電纜的擴建和新建項目大大增加了對電絕緣材料的需求。

亞太地區主導市場

- 由於電力行業高度發達以及中國和印度在能源服務領域的快速工業化,預計亞太地區將主導全球市場。

- 隨著家庭收入的增加和各種用途的電力消耗增加,該地區的電力需求預計會增加。 絕緣材料用於將電能轉換為機械能的旋轉電機,使電能在零件內部良好傳導,而無需通過材料。

- 到 2021 年,中國的兩條電力線將躋身世界最長延伸電力線前五名之列。 首先是 2,090 公裡的錦屏-蘇南輸電線路,為世界第四大輸電線路,其次是 1,980 公裡的向家壩-上海輸電線路。

- 根據印度政府電力部的數據,截至 2023 年 1 月,它將擁有 4,63,758 公裡的輸電線路和 11,56,105 MVA 的變電站容量,使其成為世界領先的大型同步電站之一互連電網。

- 此外,國土交通省在其報告中表示,2021 財年日本 50 家初級建築公司收到的電力線施工訂單金額約為 2583.6 億日元(約合 23.5 億美元)。說。 但是,與上一年相比下降了 6.6%。

- 電動汽車業務也需要電絕緣材料。 電絕緣材料是調節電流並保護敏感元件的非導電材料。 採用這些新技術更安全,因為它們有足夠的電流保護、防止火災並確保電能保持在正確的路徑上並且不會與其他組件相互作用並且可能發生短路。

- 絕緣體還可以保護 EV 車載充電器、直流/直流轉換器、電力電子控制器、直流充電站和電池管理系統。 根據中國汽車工業協會的數據,2022 年新能源汽車銷量比 2021 年增長 93.4%。 2021年全年新能源汽車總銷量僅為350萬輛左右,但到2022年底達到約680萬輛。 日本電動汽車產銷量如此增長,無疑會增加市場需求。

- 因此,預計未來幾年,工業用電量的增加和電動汽車生產中材料利用率的增加將推動亞太地區的電氣絕緣材料市場。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 輸配電系統的需求不斷擴大

- 其他司機

- 阻礙因素

- 電絕緣材料成本高

- 其他限制

- 工業價值鏈分析

- 波特的五力分析

- 供應商的議價能力

- 消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 類型

- 玻璃絕緣體

- 瓷絕緣體

- 聚合物絕緣體

- 電壓

- 低電壓

- 中壓

- 高壓

- 用法

- 變壓器和套管

- 電纜和傳輸線

- 旋轉機

- 電湧保護器斷路器

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)/排名分析

- 主要公司採用的策略

- 公司簡介

- ABB

- BASF

- Bharat Heavy Electricals Limited

- General Electric

- Huntsman

- Knauf Insulation Group

- Krempel GmbH

- NGK Insulators

- Owens Corning

- Siemens

- Toshiba

- Von Roll

第七章市場機會與未來趨勢

- 新興國家/地區的發電活動有所增加

- 電動汽車對電氣絕緣材料的需求不斷擴大

- 其他商業機會

The market for electrical insulation material is expected to register at a CAGR of more than 6% globally during the forecast period.

The COVID-19 pandemic significantly influenced the market for electrical insulation materials, owing to worldwide limitations that affected most industries. However, the industries accelerated from 2021, thus increasing the demand for electrical insulation material. Therefore, the market will likely maintain a similar trajectory during the forecast period.

Key Highlights

- The increasing safety precautions in electrical equipment are increasing the growth of the electrical insulation materials market throughout the forecast period. Moreover, the need for electricity transmission and distribution to various places in different regions worldwide is driving market growth.

- On the contrary, the high costs of electrical insulation materials are a significant factor hampering the market growth. It is also expected to be challenging for the global electrical insulation materials market.

- The increasing power generation activities in developing countries and the growing demand for electrical insulation materials in electric vehicles will likely be an opportunity for the market studied.

- Asia-pacific dominated the market for electrical insulation materials owing to the highly improved power sectors and rapid industrialization in emerging economies. At the same time, Asia-pacific is also expected to register the highest CAGR during the forecast period.

Electrical Insulation Material Market Trends

Transmission and Cable Lines Application to Dominate the Market

- Electrical insulation materials don't allow electricity to pass through them. Electrical insulation materials are applied in transmission and cable lines, generators, electrical rotating machines, transmissions, and transformers.

- Transmission cables transport electricity from power production areas to various locations. Generators, transformers, and spinning machinery are part of the power generation industry. Insulation materials allow electricity to travel through transmission or cable lines without disruption or energy wastage.

- According to Power Technology, the top three most extended power transmission lines in the world as of 2021 were in Brazil. With a length of 2,543 km, the Belo Monte-Rio de Janeiro transmission line came in first, followed by the Rio Madeira transmission link and the Belo Monte-Estreito line.

- According to the US Department of Energy estimation, approximately 200 miles of electrical transmission lines will be covered in the United States in 2021. Projects with voltages of up to 230 KV accounted for nearly 52% of the total length completed that year.

- Projects with voltages of up to 230 KV traveled around 101 miles. The remaining 92 miles were covered by projects with voltages ranging from 230 to 345 KV.

- Many projects are underway to lay the transmission line for safe power transmission from one location to another. For example, PacifiCorp's Southeastern Idaho project, scheduled to be finished in April 2022, aimed to replace outdated transmission lines with newer ones to fulfill the region's rising demand for electrical power. The project required a multi-stage electrical system upgrade from Goshen Substation near Firth, Idaho, to Rexburg Substation in Rexburg, Idaho.

- The expansions, as mentioned above, in the transmission cables and the new projects substantially increased the demand for electrical insulation materials.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the global market owing to the highly developed power sector, and rapid industrialization witnessed in China and India in the energy services sector recently.

- The region's electricity demand is expected to rise as household incomes increase and power consumption in various applications rises. Rotating electric machines that convert electrical energy into mechanical energy use insulation materials for better electricity transmission inside the machine parts without passing through materials.

- Two of China's power transmission lines are among the world's top five most extended transmission lines as of 2021. The first is the 2,090 km long Jinping-Sunan transmission line, ranked fourth worldwide, followed by the 1,980 km long Xiangjiaba-Shanghai transmission line.

- According to the Ministry of Power, Government of India, the country became one of the world's most extensive synchronous interconnected electricity grids with 4,63,758 circuit km of transmission line and 11,56,105 MVA of transformation capacity as of January 2023.

- The Ministry of Land, Infrastructure, Transport, and Tourism also stated in its report that in the fiscal year 2021, the value of orders for the construction of electric power lines received by 50 primary constructors in Japan amounted to approximately JPY 258.36 billion (~USD 2.35 billion). It, however, represents a decrease of 6.6% compared to the previous year.

- Electric insulating materials are also necessary for the electric vehicles business. Electrical insulation comprises non-conductive materials that regulate the electricity flow and safeguard sensitive components. It enables the safer adoption of these new technologies since they are adequately protected from electrical currents, preventing fires and guaranteeing that the electric energy stays on the appropriate path and does not interact with other components, resulting in short-circuiting.

- In addition, insulators safeguard EV onboard chargers, DC/DC converters, power electronics controllers, DC charging stations, and the battery management system. According to the Chinese Association of Automobile Manufacturers, sales of New Energy Vehicles surged by 93.4% in 2022 over 2021. Overall sales of new energy vehicles were roughly 6.8 million by the end of 2022, compared to only about 3.5 million sales for the entire year in 2021. This growth in EV production and sales in the country will undoubtedly raise market demand.

- Therefore, the increasing electricity usage in industries and the usage of the increasing material in EV production are expected to drive the market for electrical insulation material through the years to come in the Asia-Pacific region.

Electrical Insulation Material Industry Overview

The electrical insulation material market is fragmented, with many players competing. Some major companies (not in particular order) are General Electric, Owens Corning, ABB, Siemens, and Huntsman.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Transmission and Distribution Systems

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Costs of Electrical Insulation Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Glass Insulator

- 5.1.2 Porcelain Insulator

- 5.1.3 Polymer Insulator

- 5.2 Voltage

- 5.2.1 Low Voltage

- 5.2.2 Medium Voltage

- 5.2.3 High Voltage

- 5.3 Application

- 5.3.1 Transformers and Bushings

- 5.3.2 Cables and Transmission Lines

- 5.3.3 Rotating Machines

- 5.3.4 Surge Protector and Circuit Breaker

- 5.3.5 Others

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ABB

- 6.4.2 BASF

- 6.4.3 Bharat Heavy Electricals Limited

- 6.4.4 General Electric

- 6.4.5 Huntsman

- 6.4.6 Knauf Insulation Group

- 6.4.7 Krempel GmbH

- 6.4.8 NGK Insulators

- 6.4.9 Owens Corning

- 6.4.10 Siemens

- 6.4.11 Toshiba

- 6.4.12 Von Roll

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Power Generation Activities in Developing Countries

- 7.2 Growing Demand for Electrical Insulation Materials in Electric Vehicles

- 7.3 Other Opportunities