|

市場調查報告書

商品編碼

1273386

鋰化合物市場 - 增長、趨勢、COVID-19 影響和預測 (2023-2028)Lithium Compounds Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

在預測期內,鋰化合物市場預計將以超過 8% 的複合年增長率增長。

主要亮點

- COVID-19 大流行對鋰化合物市場產生了重大影響。 全球約束影響了汽車、建築、陶瓷和玻璃行業。 儘管如此,製藥業務的需求有所增加,並且在大流行期間市場繼續增長。 但是,從 2021 年開始,每個行業都增加了產量,預計市場將在整個預測期內跟進。

- 電池使用量的增加,尤其是在電動汽車中的使用,以及陶瓷和玻璃行業不斷增長的需求正在推動鋰化合物市場向前發展。 相反,這些化合物的高成本及其被其他替代品的替代預計會阻礙市場增長。

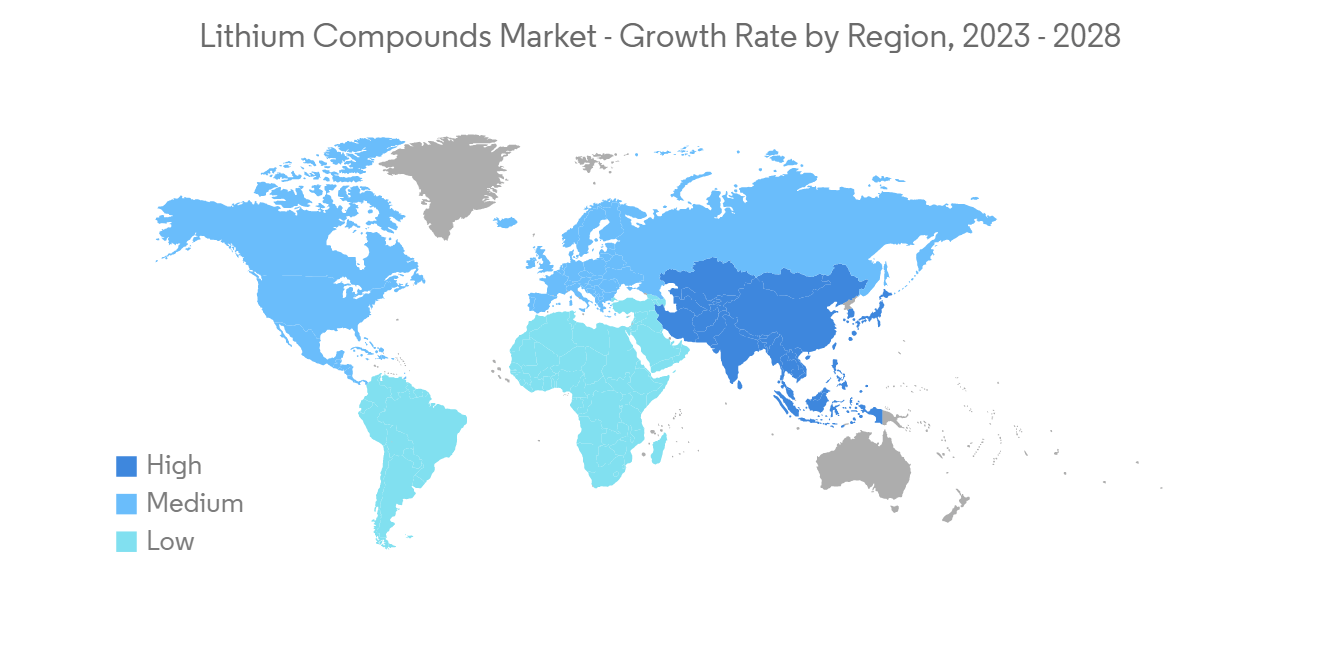

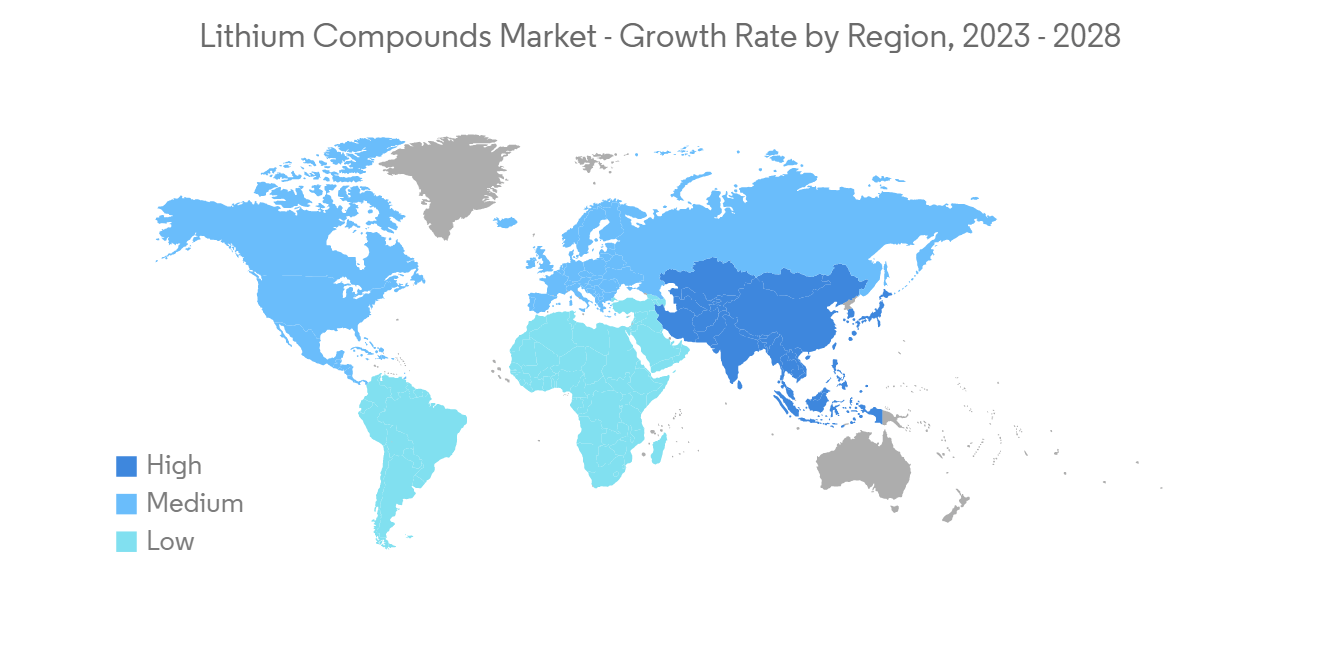

- 不過,對電動汽車不斷增長的需求似乎為市場研究提供了契機。 由於建築和汽車行業的大量支出,亞太地區是最大的鋰化合物市場,並且在預測期內仍將佔據主導地位。

鋰化合物市場趨勢

電池需求擴大

- 鋰化合物廣泛用於鋰離子二次電池技術,用於儲能和保存。 鋰離子二次電池用於手機、照相機、筆記本電腦、動力設備和汽車等設備。

- 鋰離子電池在內燃機汽車和電動汽車中都發揮著重要作用。 鋰離子電池具有能量密度高、自放電率低、循環壽命長、維護成本低、充電快、重量輕等優點,成為汽車領域的首選。 對鎳鎘電池的需求也很高,目前用於一些混合動力電動汽車。 與往年相比,印度、東南亞和韓國的混合動力汽車銷量和需求均呈現合理增長。

- 根據經濟分析局 (BEA) 的數據,2022 年第三季度美國電氣設備、設備和組件製造業的增加值約為 738 億美元,比去年同期增長約 8%去年同期。 前三季度增加值總額接近2200億美元。

- 此外,美國計算機和電子製造業的總產值在 2022 年前三個季度達到約 1.3 萬億美元。 與 2021 年同期(1.2 萬億美元)相比,2022 年增長 7%。

- 另一方面,國際能源署 (IEA) 在其 2022 年 9 月的電動汽車展望中宣布,儘管供應鏈受限且 COVID-19 疫情仍在持續,但報告銷量的電動汽車數量創歷史新高。 電動汽車銷量較2020年翻了一番,達到660萬輛,道路上行駛的電動汽車總數為1650萬輛。

- 新興市場中電動汽車數量的增加和電子設備使用的增加正在推動對二次電池的需求,這可能會在未來幾年推動鋰電池市場的發展。

亞太地區主導市場

- 在中國、印度、日本和韓國,電子、汽車、陶瓷和玻璃領域都高度發達,多年來持續投資發展電池技術領域。,亞太有望主導整個鋰化合物市場。

- 在過去幾年中,由於政府禁止使用內燃機並對內燃機車輛徵收重稅,中國和印度增加了電動和混合動力汽車的產量。

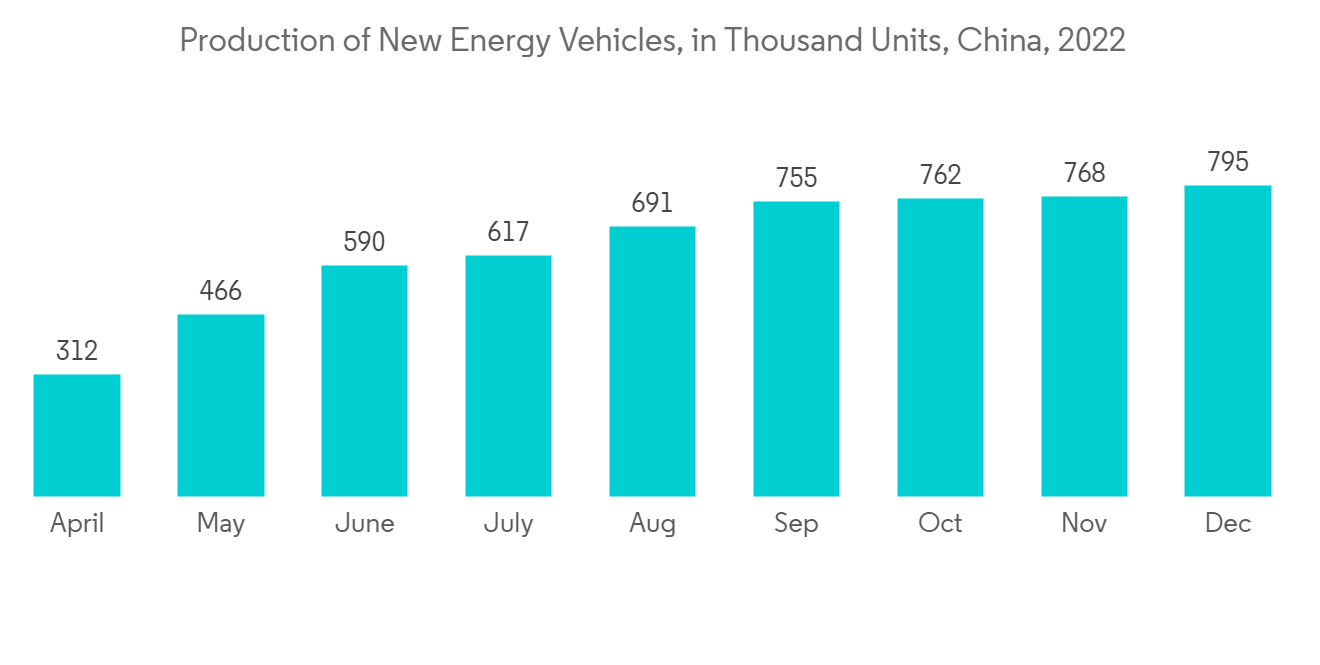

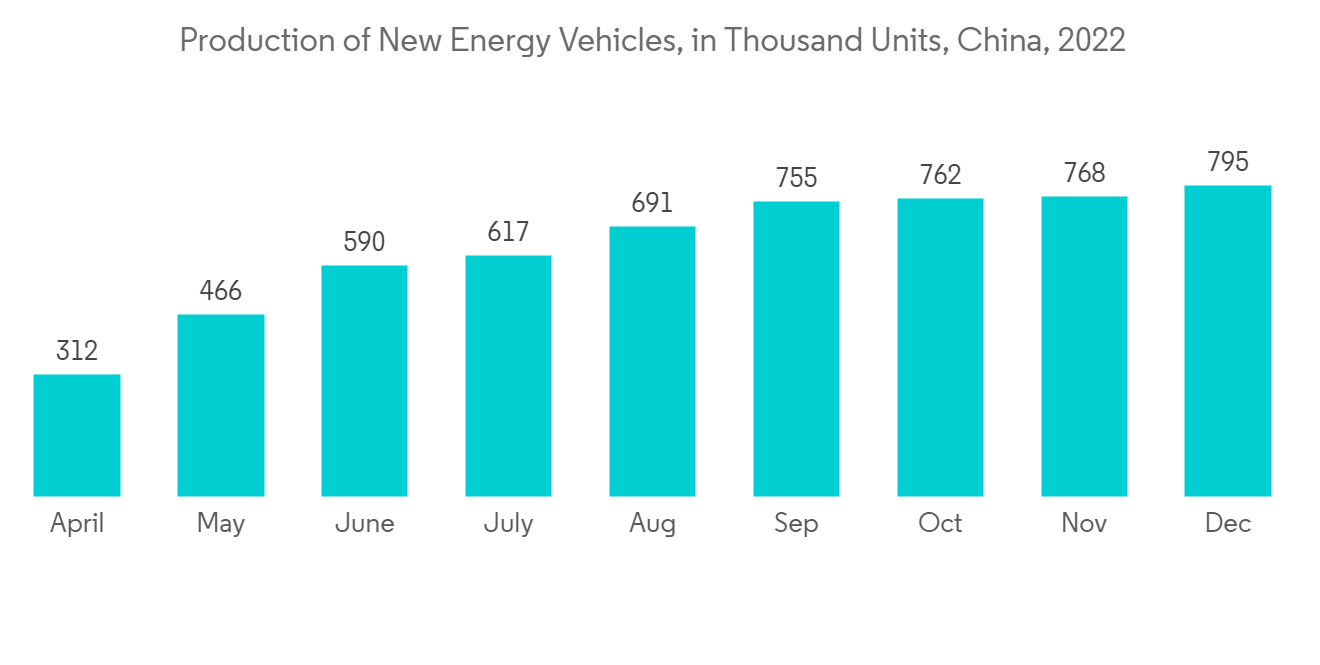

- 中國是最大的電動汽車生產國和消費國,約佔全球市場的一半。 根據中國汽車工業協會(CAAM)的數據,2022 年中國新能源汽車(NEV)的總產量約為 700 萬輛。 與2021年的產量(354萬台)相比,更是實現了近97%的驚人增長。

- 過去幾年,即使在印度,人們的注意力也一直集中在該國的電動汽車市場上。 CEEW 能源金融中心的一項研究發現,到 2030 年,印度的電動汽車機會將達到 2060 億美元,需要 1800 億美元投資於該國的汽車製造和充電基礎設施。

- 根據 IQVIA 的預測,中國是世界第二大藥品消費國,從 2021 年開始的五年內,該市場的銷量將增長 8%,而支出將增長 19%,增速低於往常。重點可能是致力於擴大獲得尖端藥物的機會。

- 根據印度品牌資產基金會 (IBEF) 的建議,到 2030 年,印度的製藥業預計也將達到 1300 億美元。 該國是世界上最大的疫苗生產國,到 2021 年將佔所有疫苗的 60%,成為世界第三大製藥國。

- 根據印度化學和化肥部發布的統計數據,2022-23 年(至 2022 年 7 月)關鍵化學品的產量將比去年同期的 41.15 乳酸(4115 萬噸)增長 5.73%。達43.51內酯(4351萬噸)。

- 對高效電池的需求不斷增長,這要求鋰化合物的先進技術得到改進。 該地區節能設備的持續增長以及製藥和化學工業的崛起預計將在未來幾年推動鋰化合物市場。

鋰化合物產業概況

鋰化合物市場具有部分整合的性質,少數大公司控制著市場的很大一部分。 主要公司包括 FMC Corporation、SQM SA、Lithium Americas Corp.、Albemarle Corporation 和 Neometals Ltd。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 主持人

- 陶瓷和玻璃行業的需求增加

- 電池應用的擴展

- 約束因素

- 新替代品的進入

- 其他抑製劑

- 工業價值鏈分析

- 波特的五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第 5 章市場細分

- 化合物

- 氮化鋰

- 金屬鋰

- 碳酸鋰

- 氫氧化鋰

- 氯化鋰

- 丁基鋰

- 其他化合物

- 申請

- 陶瓷/玻璃

- 潤滑劑

- 醫藥

- 電池

- 化學品

- 冶金

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 其他歐洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等。

- 市場份額 (%)/排名分析

- 主要公司採用的策略

- 公司簡介

- Albemarle Corporation

- Allkem Limited

- China Lithium Products Technology Co., Ltd.

- FMC Corporation

- Lithium Americas Corp.

- Neometals Ltd

- Shanghai China Lithium Industrial Co. Ltd

- Sichuan Tianqi Lithium Chemicals Inc.

- SQM SA

第七章市場機會與未來趨勢

- 對電動汽車的需求不斷擴大

- 其他機會

簡介目錄

Product Code: 69425

The lithium compounds market is expected to register a CAGR of over 8% during the forecast period.

Key Highlights

- The COVID-19 pandemic substantially impacted the lithium compounds market. Global constraints affected the automobile, building, and ceramic and glass industries. Despite this, the pharmaceutical business saw an increase in demand, keeping the market growing during the pandemic. However, the industries have increased production since 2021, and the market is expected to follow suit throughout the projection period.

- The increased use of batteries, particularly in electric cars, as well as rising demand from the ceramics and glass industries, are propelling the lithium compounds market forward. On the contrary, the high costs of compounds and their replacement by other substitutes are expected to hinder the market growth.

- Nonetheless, the increasing demand for electric vehicles in the market is likely to act as an opportunity for market study. Asia-Pacific represents the largest market for lithium compounds due to massive spending in the construction and automobile industry and will continue to dominate during the forecast period.

Lithium Compounds Market Trends

Growing Demand for Batteries

- Lithium compounds have been widely used in lithium-ion rechargeable battery technology to preserve and save energy. Lithium-ion batteries are used in devices such as mobile phones, cameras, laptop computers, power equipment, and vehicles.

- Lithium-ion batteries play an important part in vehicles, both combustion and electric. Because of their qualities like high energy density, low self-discharge rate, long life cycle, cheap maintenance, fast charging, and low weight, lithium-ion batteries are preferred in the automotive sector. The demand for Ni-Cd batteries is also high, as they are currently used in some hybrid electric vehicles. The sales of and demand for hybrid vehicles in India, Southeast Asia, and South Korea have witnessed decent growth compared to the previous years.

- According to the Bureau of Economic Analysis (BEA), the value added by manufacturing electrical appliances, equipment, and components in the United States in the third quarter of 2022 was around USD 73.8 billion, an increase of approximately 8% over the same time the previous year. The total value added in the first three quarters was close to USD 220 billion.

- Furthermore, the gross output of computer and electronic products manufacturing in the United States was approximately USD 1,300 billion in the first three quarters of 2022. 2022 saw a 7% gain when compared to the same period in 2021 (USD 1,200 billion).

- Meanwhile, the International Energy Agency (IEA) reported in its 'September 2022 Electric Vehicles Outlook' that despite supply chain constraints and the ongoing Covid-19 pandemic, electric car sales reached a record high in 2021. Sales nearly doubled to 6.6 million in comparison to 2020, bringing the total number of electric vehicles on the road to 16.5 million.

- The rising number of electric vehicles and the increasing usage of electronic equipment in developing countries is driving the demand for rechargeable batteries, which may drive the market for lithium batteries through the coming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the overall lithium compounds market, owing to the highly developed electronics, automotive, ceramics, and glass sectors in China, India, Japan, and Korea, coupled with the continuous investments in the region to advance the battery technology sector through the years.

- Due to government prohibitions on internal combustion engines and hefty levies on internal combustion vehicles in China, the manufacture of electric and hybrid vehicles increased in China and India over the past several years.

- China has been the highest producer as well as consumer of electric vehicles, covering approximately half the market all around the globe. According to the China Association of Automobile Manufacturers (CAAM), the total production of new energy vehicles (NEVs) in China in 2022 was about 7 million units. This was a whooping increase of close to 97% when compared with the production of vehicles in the year 2021 (3.54 million units).

- India has also been focusing on the electric vehicles market for the country for the past few years. A study by CEEW Centre for Energy Finance recognized a USD 206 billion opportunity for electric vehicles in India by2030, which will necessitate a USD 180 billion investment in vehicle manufacturing and charging infrastructure in the country.

- According to IQVIA's projections, China, the second-largest pharmaceutical spending nation in the world, will increase segment volume by 8% over five years since 2021, while spending will rise by 19%, a slower rate than in prior years but still with an emphasis on extending access to cutting-edge medications.

- Indian pharmaceutical industry is also expected to reach USD 130 billion by 2030, as India Brand Equity Foundation (IBEF) suggested. The country is the largest producer of vaccines worldwide, accounting for ~60% of the total vaccines as of 2021, and ranks third globally for pharmaceutical production by volume.

- According to the statistics presented by the Ministry of Chemicals and Fertilizers, India, major chemicals production climbed by 5.73% to 43.51 lakh tons (4.351 million tons) in 2022-23 (up to July 2022) compared to 41.15 lakh tons (4.115 million tons) in the previous year's similar period.

- The growing need for high-efficiency batteries necessitates advanced technological improvements in lithium compounds. Continuous growth in energy-saving devices, along with the increasing pharmaceuticals and chemicals industry in the region is expected to drive the market for lithium compounds through the coming years.

Lithium Compounds Industry Overview

The lithium compounds market is partially consolidated in nature, with a few major players dominating a significant portion of the market. Some of the major companies are FMC Corporation, SQM SA, Lithium Americas Corp., Albemarle Corporation, and Neometals Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Ceramics and Glass Industry

- 4.1.2 Growing Applications for Batteries

- 4.2 Restraints

- 4.2.1 Entry of New Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Compounds

- 5.1.1 Lithium Nitride

- 5.1.2 Lithium Metal

- 5.1.3 Lithium Carbonate

- 5.1.4 Lithium Hydroxide

- 5.1.5 Lithium Chloride

- 5.1.6 Butyllithium

- 5.1.7 Other Compounds

- 5.2 Application

- 5.2.1 Ceramics and Glass

- 5.2.2 Lubricants

- 5.2.3 Pharmaceuticals

- 5.2.4 Batteries

- 5.2.5 Chemicals

- 5.2.6 Metallurgy

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Albemarle Corporation

- 6.4.2 Allkem Limited

- 6.4.3 China Lithium Products Technology Co., Ltd.

- 6.4.4 FMC Corporation

- 6.4.5 Lithium Americas Corp.

- 6.4.6 Neometals Ltd

- 6.4.7 Shanghai China Lithium Industrial Co. Ltd

- 6.4.8 Sichuan Tianqi Lithium Chemicals Inc.

- 6.4.9 SQM SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Electric Vehicles

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219