|

市場調查報告書

商品編碼

1406093

肼:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Hydrazine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

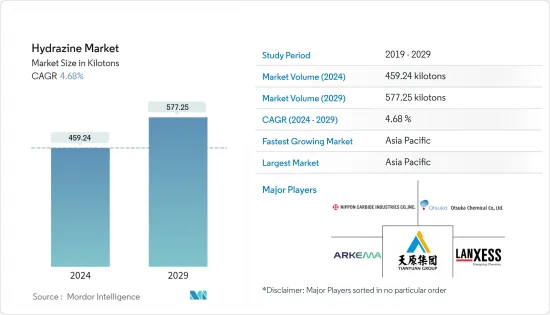

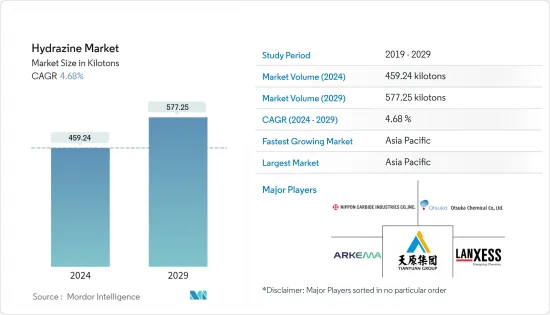

聯氨市場規模預計到2024年為459.24 Kt,預計到2029年將達到577.25 Kt,在預測期內(2024-2029年)複合年成長率為4.68%。

COVID-19 大流行對市場產生了負面影響,生產和運輸放緩,農化行業和其他行業由於遏制措施和經濟中斷而被迫推遲生產。目前市場正從疫情中恢復。預計2022年市場將達到疫情前水準並持續穩定成長。

主要亮點

- 推動市場的主要因素是農化和製藥業需求的增加。

- 另一方面,肼的高毒性(例如,它會導致皮膚燒燙傷、眼睛損傷等)阻礙了市場成長。

- 在燃料電池中使用肼作為氫的替代品預計將為市場成長提供各種機會。

- 亞太地區主導全球市場,其中中國和印度等國家的消費量最高。

聯氨市場趨勢

製藥業的需求不斷增加

- 肼在多種藥物應用中用作前驅物。例如,硫酸肼用於治療癌症和治療與惡病質相關的虛弱。

- 此外,異煙肼是一種用於治療結核病的抗生素,是用肼製備的。根據世界衛生組織 (WHO) 的數據,六個亞洲國家的結核病患者人數最多:印度 (27%)、中國 (9%)、印尼 (8%)、菲律賓 (6%) 和巴基斯坦 (6%)。 %).),孟加拉國(4%)。

- 目前,全球製藥業受到技術創新及其對世界人口健康的正面影響的推動。該行業在過去幾年中取得了可觀的成長。

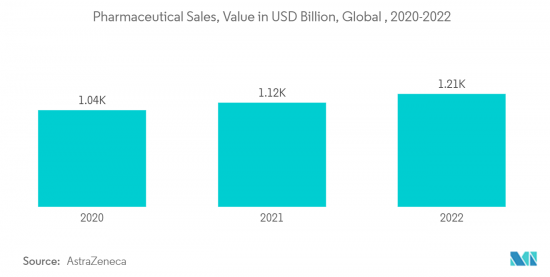

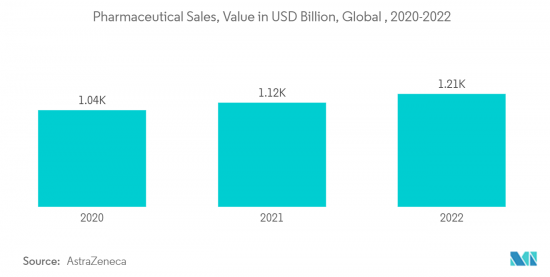

- 根據Astra Zeneca,2022年全球藥品銷售額為12,140億美元,與前一年同期比較增8.4%。

- 美國、中國、印度和德國是世界上最大的製藥工業國。根據藥物成分公約(CPHI),美國仍是全球最大的藥品市場,佔全球藥品支出的41%。

- 美國是大型製藥、生物製藥和藥物開發公司的所在地,也是技術創新中心。多年的研發投資已為該行業開發治療方法和疫苗做好了準備。此外,據Astra Zeneca稱,到 2022 年,美國將佔全球藥品銷售額的 49.8%。

- 因此,由於上述因素,預計市場在預測期內將大幅成長。

亞太地區主導市場

- 由於製藥和農化行業的擴張,預計亞太地區在預測期內將成為肼的最大市場。

- 中國的醫藥工業也是世界上最大的工業之一。該國生產學名藥、治療藥物、原料藥和中藥。

- 中國政府實施「健康中國2030」策略,大力開拓醫療健康產業,目標是到2030年將市場規模增加到2.4兆美元。

- 此外,2023年8月,中國國務院發布了旨在改善外商投資營商環境的24條指導意見,重點關注中國醫療保健和生物製藥行業的發展。

- 此外,印度的製藥業也在顯著成長。根據印度投資局報告,預計2024年印度醫藥產業市場規模將達650億美元,到2030年進一步達到1,300億美元。因此,該地區的 PVP 市場預計將會成長。

- 此外,肼也被用作許多農藥的前體,包括化學肥料、殺蟲劑、荷爾蒙和植物生長調節劑(PGR),可保護植物和土壤、提高產量、維持和改善植物生長過程。

- 根據印度化學和化學肥料部預計,2022年印度農藥產量將達29.9萬噸,較2021年增加17%以上。因此,在預測期內促進了市場成長。

- 因此,上述因素顯示亞太地區市場農化和製藥業的成長將對預測期內的研究市場產生正面影響。

聯氨行業概況

聯氨市場較為分散。調查市場主要企業(排名不分先後)包括朗盛、日本碳化物工業株式會社、大塚化學、阿科瑪、宜賓天元集團等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 農藥需求增加

- 擴大在製藥業的應用

- 其他司機

- 抑制因素

- 肼的高毒性

- 其他阻礙因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 類型

- 水合肼

- 硝酸肼

- 硫酸肼

- 其他類型(如碳酸肼)

- 目的

- 緩蝕劑

- 霹靂

- 火箭燃料

- 醫藥原料

- 農藥前驅

- 發泡

- 其他用途(發泡、推進劑等)

- 最終用戶產業

- 藥品

- 農藥

- 工業的

- 其他最終用戶產業(例如水處理)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ACURO ORGANICS LIMITED

- Arkema

- Arrow Fine Chemicals

- BroadPharm

- Innova Corporate

- LANXESS

- MERU CHEM PVT.LTD.

- NIPPON CARBIDE INDUSTRIES CO. INC.

- Otsuka Chemical Co.,Ltd

- Tokyo Chemical Industry Co., Ltd.

- Yibin Tianyuan Group

第7章 市場機會及未來趨勢

- 肼作為燃料電池中氫的替代品

- 其他機會

The Hydrazine Market size is estimated at 459.24 kilotons in 2024, and is expected to reach 577.25 kilotons by 2029, growing at a CAGR of 4.68% during the forecast period (2024-2029).

The market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility, wherein agrochemical and other industries were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

Key Highlights

- The major factor driving the market studied is the increasing demand from the agrochemical and pharmaceutical sectors.

- On the flip side, the highly toxic nature of hydrazine (such as it can cause skin burns, eye damage, etc.) is hindering the growth of the market.

- The use of hydrazine as an alternative to hydrogen in fuel cells is expected to offer various opportunities for the growth of the market.

- Asia-Pacific dominates the market across the world, with the largest consumption from countries such as China and India.

Hydrazine Market Trends

Increasing Demand from Pharmaceutical Sector

- Hydrazine is used as a precursor in several pharmaceutical applications. For example, hydrazine sulfate is used in the treatment of cancer and as a treatment for body wasting associated with cachexia disease.

- Further, Isoniazid, an antibiotic for the treatment of Tuberculosis, is prepared using hydrazine. According to the World Health Organization (WHO), the greatest number of Tuberculosis patients was found in six Asian countries, namely, India (27%), China (9%), Indonesia (8%), the Philippines (6%), Pakistan (6%), and Bangladesh (4%).

- The global pharmaceutical industry is currently driven by innovations and positive implications for the global population's health. The industry has been witnessing decent growth over the past several years.

- According to AstraZeneca, the global pharmaceutical sales in 2022 were USD 1,214 billion, representing a growth of 8.4% compared to the previous year.

- The United States, China, India, and Germany are the largest pharmaceutical industries in the world. CPHI (Convention on Pharmaceutical Ingredients) states that the United States remains the world's largest pharmaceutical market, accounting for 41% of global pharmaceutical spending.

- The United States is home to large pharmaceutical and biopharmaceutical companies, drug developers, and a center of innovation. Owing to years of investment in research and development, the industry is prepared to develop therapeutics and vaccines. Further, according to AstraZeneca, in 2022, the United States had 49.8% of global pharmaceutical sales.

- Therefore, owing to the above-mentioned factors, the market is expected to grow significantly during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to account for the largest market for hydrazine during the forecast period owing to expanding pharmaceuticals and agrochemical industries.

- The pharmaceutical industry in China is also one of the largest in the world. The country produces generics, therapeutic medicines, active pharmaceutical ingredients, and traditional Chinese medicine.

- The government in China has implemented the "Healthy China 2030" initiative for developing the healthcare industry, which aims for the market to reach a value of USD 2.4 trillion by 2030.

- Furthermore, in August 2023, China's State Council released a 24-point list of guidelines aiming to improve the business environment for foreign investment which focuses on advancing Chinese healthcare and biopharma sectors.

- Further, in India, the pharmaceutical sector is also growing significantly. According to a report by Invest India, the pharmaceutical industry in India is anticipated to reach a market value of USD 65 billion by the year 2024, with further growth projected to reach USD 130 billion by 2030. Therefore, the PVP market is expected to rise in the region.

- Moreover, hydrazine is used as a precursor to many agrochemicals, involving fertilizers, pesticides, hormones, and plant growth regulators (PGR) that enable plant and soil protection, improve yield, and maintain and improve the growth process of plants.

- According to the Ministry of Chemicals and fertilizers (India), the pesticide production volume in 2022 accounted for 299 thousand metric tons in India, reflecting an increase of more than 17% compared to 2021. Thus boosting the market growth during the forecast period.

- Therefore, the above-mentioned factors indicate a positive influence of the growing agrochemical and pharmaceutical industry in the Asia-Pacific market on the studied market over the forecast period.

Hydrazine Industry Overview

The hydrazine market is fragmented in nature. The major players in the studied market (not in any particular order) include LANXESS, NIPPON CARBIDE INDUSTRIES CO. INC., Otsuka Chemical Co.,Ltd., Arkema, and Yibin Tianyuan Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Agrochemicals

- 4.1.2 Growing Applications in Pharmaceutical Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Highly Toxic Nature of Hydrazine

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Hydrazine Hydrate

- 5.1.2 Hydrazine Nitrate

- 5.1.3 Hydrazine Sulfate

- 5.1.4 Other Types (Hydrazine Carbonate, etc.)

- 5.2 Application

- 5.2.1 Corrosion Inhibitor

- 5.2.2 Explosives

- 5.2.3 Rocket Fuel

- 5.2.4 Medicinal Ingredients

- 5.2.5 Precursor to Pesticides

- 5.2.6 Blowing Agent

- 5.2.7 Other Applications (Foaming Agent, Propellants, etc.)

- 5.3 End-user Industry

- 5.3.1 Pharmaceuticals

- 5.3.2 Agrochemicals

- 5.3.3 Industrial

- 5.3.4 Other End-user Industries (Water Treatment, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACURO ORGANICS LIMITED

- 6.4.2 Arkema

- 6.4.3 Arrow Fine Chemicals

- 6.4.4 BroadPharm

- 6.4.5 Innova Corporate

- 6.4.6 LANXESS

- 6.4.7 MERU CHEM PVT.LTD.

- 6.4.8 NIPPON CARBIDE INDUSTRIES CO. INC.

- 6.4.9 Otsuka Chemical Co.,Ltd

- 6.4.10 Tokyo Chemical Industry Co., Ltd.

- 6.4.11 Yibin Tianyuan Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Hydrazine as an Alternative to Hydrogen in Fuel Cells

- 7.2 Other Opportunities