|

市場調查報告書

商品編碼

1272702

硼市場 - 增長、趨勢和預測 (2023-2028)Boron Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,全球硼市場預計將以超過 3% 的複合年增長率增長。

COVID-19 對市場產生了負面影響,因為所有行業都停止了製造過程。封鎖、社會疏遠和貿易制裁對全球供應鍊網絡造成了巨大破壞。然而,預計 2021 年情況將有所改善,在預測期內使市場受益。

主要亮點

- 推動市場的主要因素是玻璃纖維在工業中的迅速採用。

- 另一方面,人們越來越擔心這種化合物的稀缺性阻礙了市場增長。

- 陶瓷行業不斷增長的需求有望為市場帶來新的機遇。

- 由於中國、印度和日本等國家的消費量增加,亞太地區是最大的市場,預計在預測期內將成為增長最快的市場。

硼市場趨勢

農業部門的需求增加

- 硼是農作物營養補充所必需的微量元素。它被稱為微量元素,因為與磷和硫等其他元素相比,它的需求量很小。由於人口增長和糧食需求增加,全球農業正在增長。

- 硼參與細胞分裂和發育,如芽和根尖的生長,這是植物的生長區域。它還用於花卉授粉期間的花粉管生長。因此,它是良好結實和果實發育的極其重要的成分。

- 據能源和自然資源部長稱,土耳其擁有世界上 62% 的硼儲量,約 11 億噸。美國和俄羅斯含有4000萬噸硼儲量。2021年,土耳其銷售硼產品260萬噸,其中出口250萬噸。

- 人工智能是農業領域的最新技術進步,有助於提高作物的整體質量和準確性。許多國家正在農業中實施人工智能以提高產量並幫助擴大市場。

- 例如,英國政府引入了旨在提高農作物生產力的人工智能 (AI)。到 2027 年,該國已將研發支出提高到 GDP 的 2.4%。此外,Cambridge還宣佈了一項耗資 5.32 億美元的項目,旨在鞏固英國作為不斷發展的農業科技行業創新者的地位。

- 歐洲和北美的技術採用提高了作物生產力。2022年6月,法國Idele(Institut d'Elevage)開發了在線數據庫應用程序 "CAP'2ER" ,將30組活動數據輸入程序並確定農業生態指標。

- 2022 年 11 月,AGCO公司推出了一款名為 "Geo-Bird" 的全新在線工具,幫助世界各地的農民規劃和優化自己的全球導航衛星系統 (GNSS) 機器製導線路。。

- 在農業中使用技術先進的設備引領了市場增長,並推動了該行業對硼產品的需求。例如,2021 年 9 月,聯邦農業和農民福利部長宣佈了 CISCO、Ninjacart、Jio Platforms Limited、ITC Limited 和 NCDEX e-markets Limited (NeML) 之間的五項諒解備忘錄 (MoU),以通過試點項目推進數字農業.) 在 2021-2025 年啟動數字農業任務。

- 數字農業使命 2021-2025 旨在支持和加速使用基於人工智能、區塊鏈、遙感和 GIS 技術等新技術的無人機和機器人的項目。

- 因此,預計在預測期內,農業對硼的需求將會增長。

亞太地區主導市場

- 由於中國、印度、日本等終端用戶行業的增長,預計亞太地區在預測期內將成為最大的硼市場。

- 由於中產階級家庭清潔意識的增強,預計亞太地區將擁有世界上最大的洗滌劑產業。中國和印度等國家是世界上最大的洗滌劑生產國之一。

- 硼酸和硼酸鹽等硼化合物可延長水泥的水化時間。因此,硼化合物被有效地用於建築行業。

- 到 2025 年的未來五年,中國將在重大建設項目上投資 1.43 萬億美元。根據國家發改委(NDRC)的數據,上海的計劃包括在未來三年投資 387 億美元,而廣州已簽署 16 個新的基礎設施項目,投資 80.9 億美元。

- 到 2022 年,印度將通過政府在基礎設施和經濟適用房方面的舉措(例如全民住房和智慧城市計劃)為建築業貢獻約 6400 億美元。

- 硼用於集成電路和電容器等半導體器件。它有助於形成一層金屬,保護設備免受腐蝕。它還用於 LCD 和 LED 電視屏幕。據JEITA(日本電子信息技術產業協會)統計,2022年11月,電子產業總產值達到70.9834億美元。2022 年 12 月,日本電子產品出口額達 83.9545 億美元。

- 在印度,電子市場需求不斷增長,市場規模迅速擴大。2022 年 12 月,印度電子產品出口收入為 166.7 億美元,而 2021 年同月為 109.9 億美元。印度和中國電子和消費電子市場的增長可能會推動亞太市場的進一步增長。

- 硼主要用於混凝土生產。它還可用於建築材料,例如鋼筋和絕緣材料。它對於水力壓裂也很重要,水力壓裂在創建天然氣開採點的同時提供液壓。

- 因此,由於亞太地區各國終端用戶行業的快速增長,預計在預測期內對硼的需求也將增加。

硼產業概況

全球硼市場本質上是部分整合的。主要公司包括 3M、Eti Maden、Rio Tinto、SB Boron Corporation、Orocobre Limited Pty Ltd。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查先決條件

- 本次調查範圍

第二章研究方法論

第三章執行摘要

第四章市場動態

- 促進者

- 玻璃纖維的快速傳播

- 其他促進者

- 抑製劑

- 對化合物稀有性的擔憂日益增加

- 其他制約因素

- 行業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 終端用戶行業

- 農業

- 運輸

- 建築/施工

- 肥皂

- 衛生保健

- 電子產品

- 其他最終用途行業

- 區域

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙特阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等

- 市場份額(%)**/排名分析

- 領先公司採用的策略

- 公司簡介

- 3M

- Aries Agro Limited

- Eti Maden

- Gujarat Boron Derivatives Pvt. Ltd

- Manufacturas los Andes SA

- Merck KGaA

- Orocobre Limited Pty Ltd

- Rio Tinto

- SB Boron Corporation

- WinField United

第七章市場機會與未來趨勢

- 陶瓷行業需求增長

- 其他商機

The global boron market is expected to register a CAGR of over 3% during the forecast period.

COVID-19 negatively impacted the market as all the industries halted their manufacturing processes. Lockdowns, social distances, and trade sanctions triggered massive disruptions to global supply chain networks. However, the condition is recovered in 2021, which is expected to benefit the market during the forecast period.

Key Highlights

- The primary factor driving the market studied is the rapidly growing adoption of fiberglass in industries.

- On the flip side, rising concerns regarding the compound's scarcity are hindering the market's growth.

- The growing demand from the ceramics industry shall create new opportunities in the market studied.

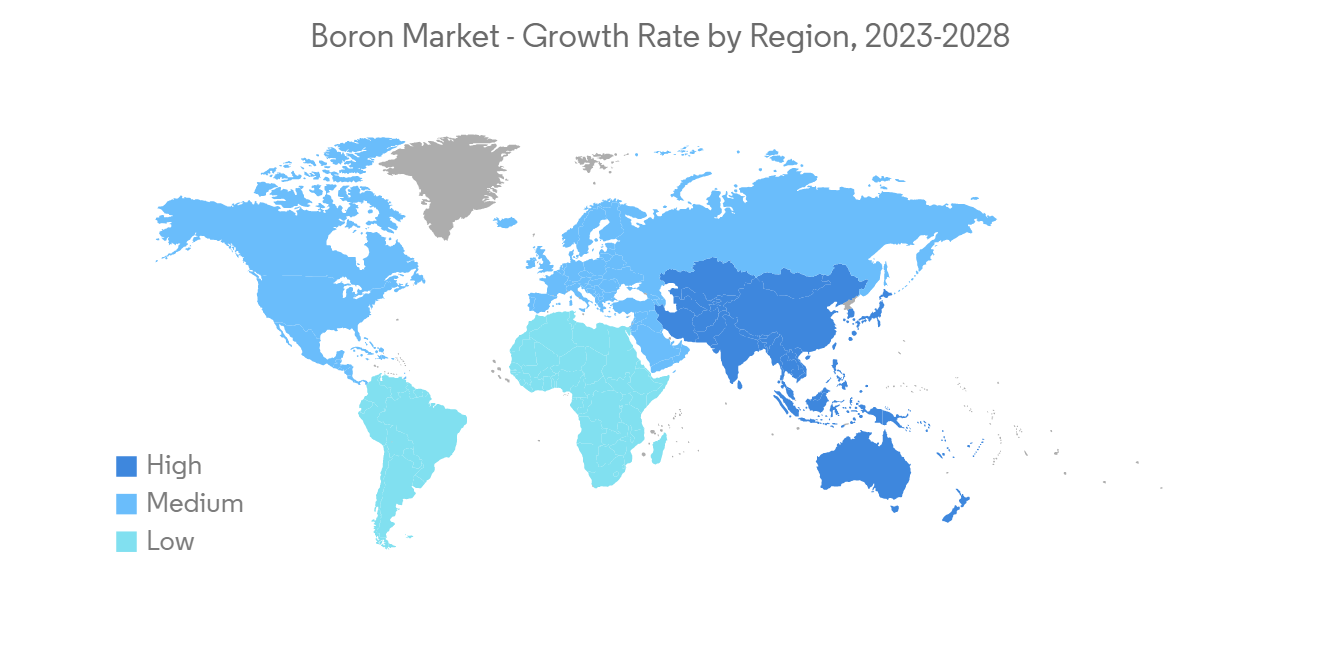

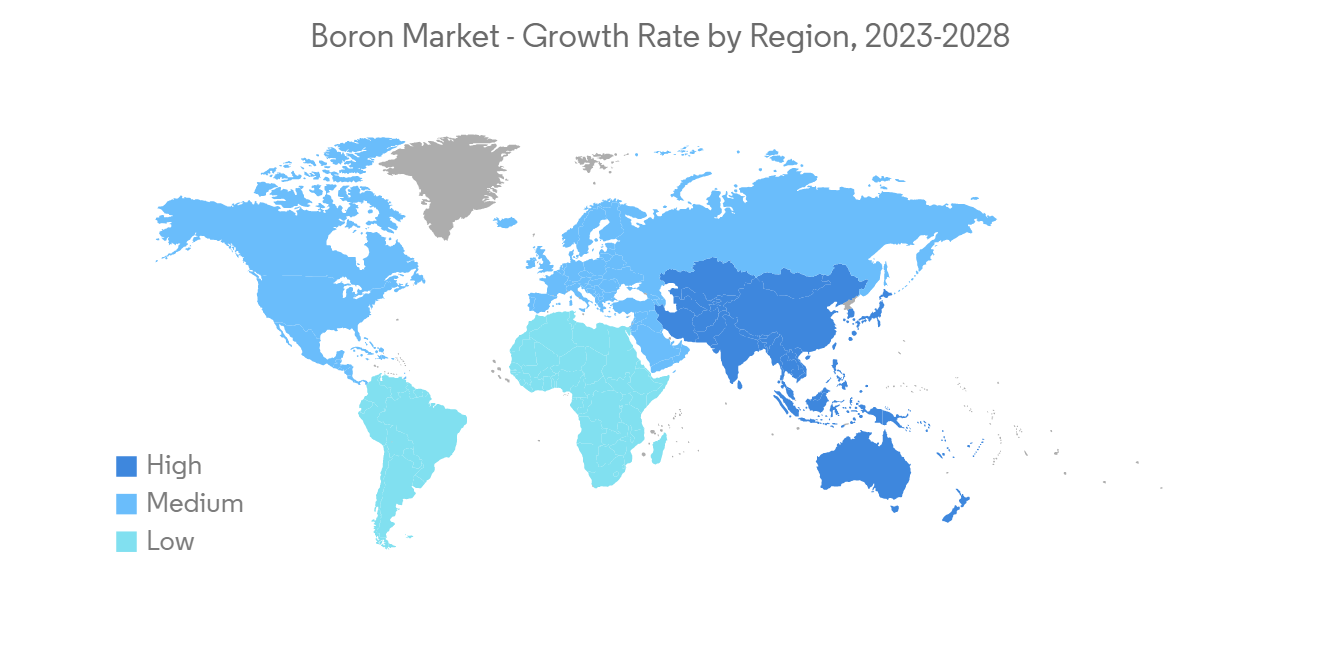

- The Asia-Pacific region represents the largest market and is expected to be the fastest-growing market over the forecast period owing to the increasing consumption from countries such as China, India, and Japan.

Boron Market Trends

Increasing Demand from the Agriculture Industry

- Boron is an essential micronutrient for crop nutrition. It is known as a trace element due to its requirement in small quantities compared to other elements, such as phosphorus and sulfur. The agriculture industry is growing globally, owing to the population increase and increasing demand for food.

- Boron is associated with cell division and development in the growth regions of the plant, such as the growth of the shoot and root tips. It is also used for pollen tube growth during flower pollination. It is, therefore, crucial for a good seed set and fruit development.

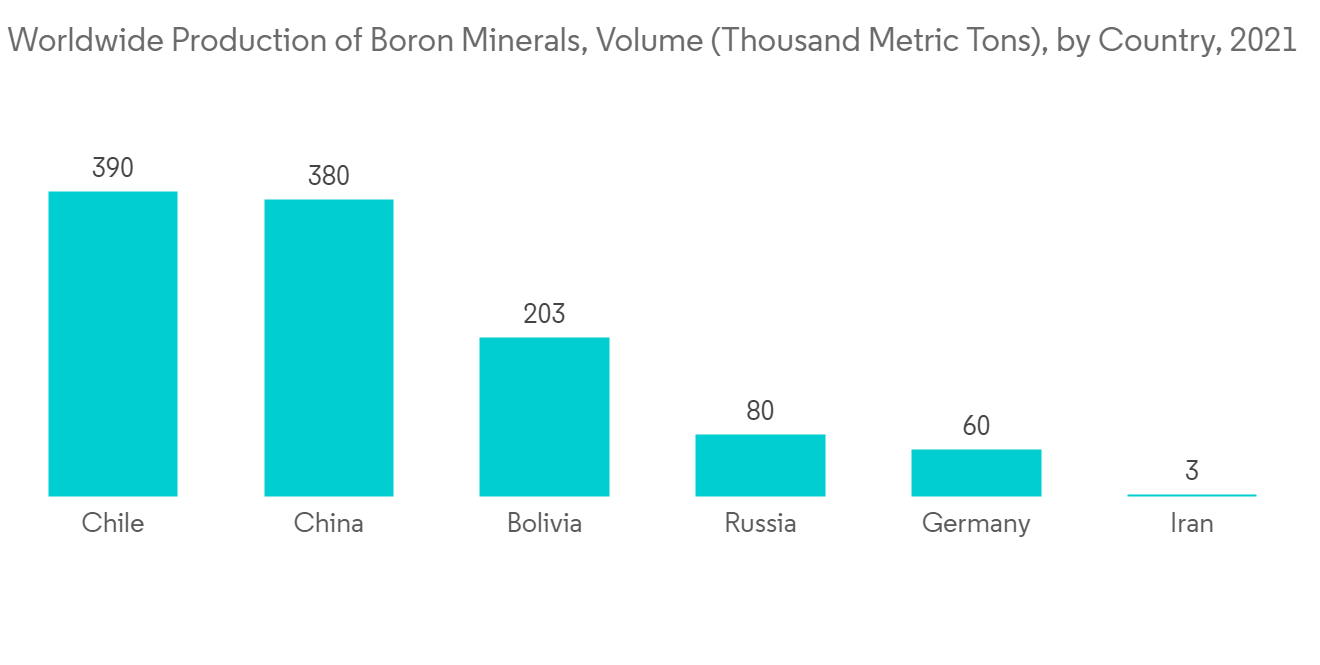

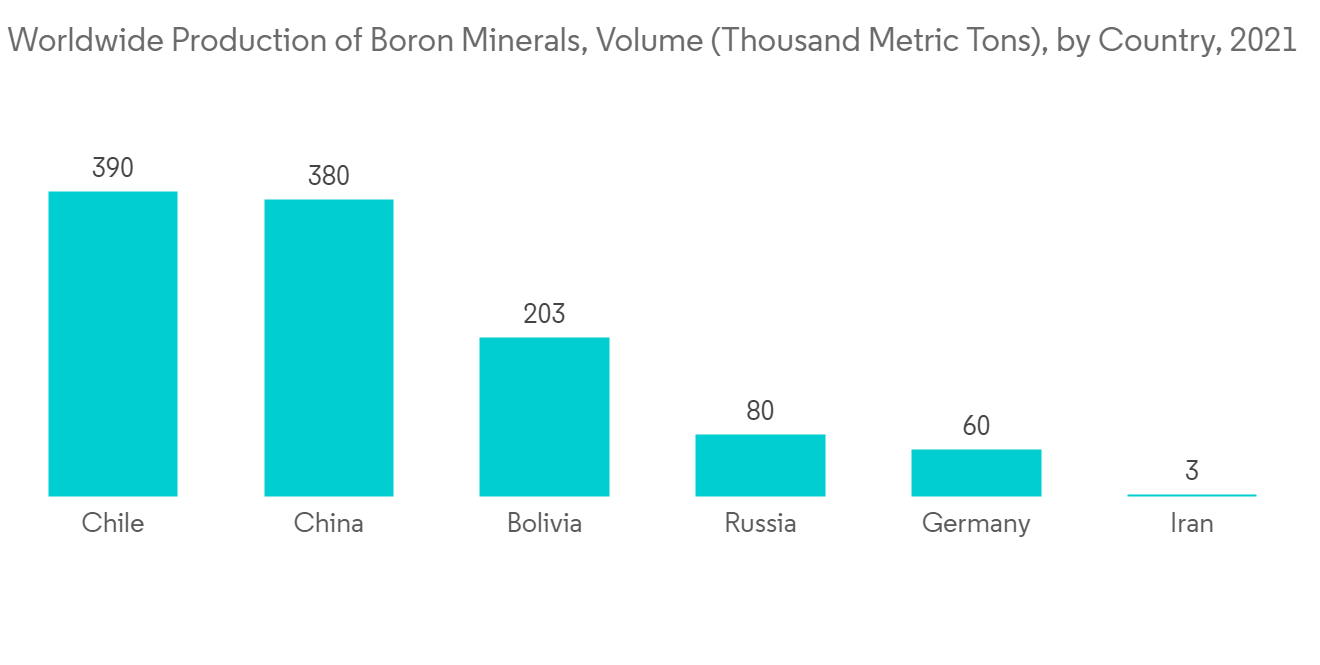

- According to the Energy and Natural Resources Minister, Turkey holds 62% of all boron reserves worldwide, approximately 1.1 billion metric tons. The United States and Russia include 40 million metric tons of boron reserves. In 2021, Turkey sold 2.6 million tons of boron products, of which 2.5 million tons were exported.

- Artificial Intelligence is the latest technological advancement in the agriculture industry that helps improve the overall harvest quality and accuracy. Many countries are adopting AI in agriculture, boosting production and helping market growth.

- For instance, the United Kingdom government put their artificial intelligence (AI) aimed at escalating crop productivity. The country boosted its R&D spending to 2.4% of the GDP by 2027. Furthermore, a new USD 532 million project is announced in Cambridge, which seeks to cement Britain's position as an innovator in the growing agri-tech industry.

- The technology adoption in Europe and North America increased crop productivity. In June 2022, Idele (Institut d'Elevage), France, developed a data-based online application called CAP'2ER, with thirty sets of activity data entered into the program to determine agroecological indicators.

- In November 2022, AGCO Corporation launched a brand-new online tool called Geo-Bird to help worldwide farmers independently plan and optimize their global navigation satellite system (GNSS) machine guidance lines.

- Using technologically advanced devices in agriculture led the market to grow and boosted the boron product demand in the industry. For instance, in September 2021, the Union Minister of Agriculture & Farmers Welfare launched the initiation of the Digital Agriculture Mission 2021-2025 while signing five memoranda of understanding (MoUs) with CISCO, Ninjacart, Jio Platforms Limited, ITC Limited, and NCDEX e-markets Limited (NeML), to forward digital agriculture through pilot projects.

- The Digital Agriculture Mission 2021-2025 aims to support and accelerate projects based on new technologies, like AI, blockchain, remote sensing, and GIS technology, and using drones and robots.

- Therefore, the demand for boron is expected to grow in the agriculture industry during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to be the largest market for boron during the forecast period owing to the growing end-user industries in China, India, and Japan, among others.

- Asia-Pacific is expected to include the largest detergent industry globally, owing to the increased awareness regarding cleanliness among middle-class families. Countries such as China and India are the top detergent producers globally.

- Boron compounds such as boric acid and borates extend the cement hydration period. Therefore, boron compounds are used effectively in the construction industry.

- China is investing USD 1.43 trillion in significant construction projects in the next five years till 2025. According to National Development and Reform Commission (NDRC), the Shanghai plan includes an investment of USD 38.7 billion in the next three years, whereas Guangzhou signed 16 new infrastructure projects with an investment of USD 8.09 billion.

- In 2022, India contributed about USD 640 billion to the construction industry due to government initiatives in infrastructure development and affordable housing, such as housing to all, smart city plans, and others.

- Boron is used in semiconductor devices such as integrated circuits and capacitors. It helps form layers of metal that protect devices against corrosion. It is used in LCD and LED TV screens. According to JEITA (Japan Electronics and Information Technology Industries Association), in November 2022, the total production of the electronics industry reached USD 7,098.34 million. In December 2022, Japan exported electronics worth USD 8,395.45 million.

- In India, the electronics market witnessed a growth in demand, with market size increasing rapidly. India's electronic goods exports fetched USD 16.67 billion in December 2022, compared to USD 10.99 billion in the same month of 2021. The growing electronics and appliances market in India and China may push further Asian-Pacific market growth.

- Boron is used primarily for concrete production. It is also helpful in construction materials for steel reinforcement and insulation. Additionally, they are essential in hydraulic fracturing to provide fluid pressure while creating natural gas extraction sites.

- Hence, with the rapidly growing end-user industries in countries of the Asia-Pacific region, the demand for boron is also expected to increase over the forecast period.

Boron Industry Overview

The global boron market is partially consolidated in nature. The major companies are 3M, Eti Maden, Rio Tinto, SB Boron Corporation, and Orocobre Limited Pty Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Growing Adoption of Fiberglass

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Rising Concerns Regarding the Scarcity of the Compound

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 End-user Industry

- 5.1.1 Agriculture

- 5.1.2 Transportation

- 5.1.3 Building and Construction

- 5.1.4 Detergents

- 5.1.5 Healthcare

- 5.1.6 Electronics

- 5.1.7 Other End-use Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Aries Agro Limited

- 6.4.3 Eti Maden

- 6.4.4 Gujarat Boron Derivatives Pvt. Ltd

- 6.4.5 Manufacturas los Andes SA

- 6.4.6 Merck KGaA

- 6.4.7 Orocobre Limited Pty Ltd

- 6.4.8 Rio Tinto

- 6.4.9 SB Boron Corporation

- 6.4.10 WinField United

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand from Ceramics Industry

- 7.2 Other Opportunities