|

市場調查報告書

商品編碼

1273507

四氫夫喃 (THF) 市場 - 增長、趨勢和預測 (2023-2028)Tetrahydrofuran (THF) Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

四氫夫喃 (THF) 市場預計在預測期內以 6% 的複合年增長率註冊。

主要亮點

- COVID-19 在 2020 年對市場產生了負面影響。與冠狀病毒相關的大規模檢疫對聚合物、紡織品、油漆和塗料行業產生了不利影響。製藥行業是那段時間唯一受益的行業。儘管如此,四氫夫喃市場最近開始增長,預計在預測期內將以同樣的軌跡擴張。

- 從中期來看,紡織行業對氨綸的需求增加以及對聚氯乙烯製造業的需求增加將是推動市場的主要因素。另一方面,相近替代品的可用性和 THF 的危險特性(高度易燃且對健康有害)阻礙了市場擴張。

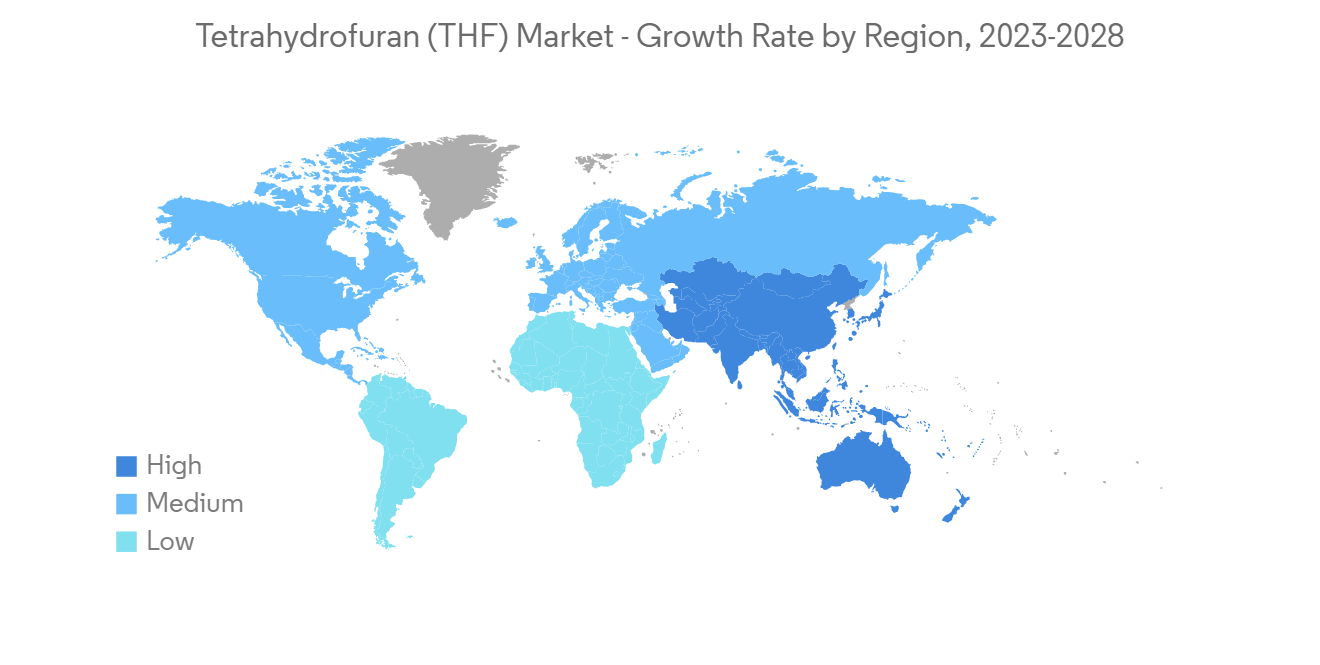

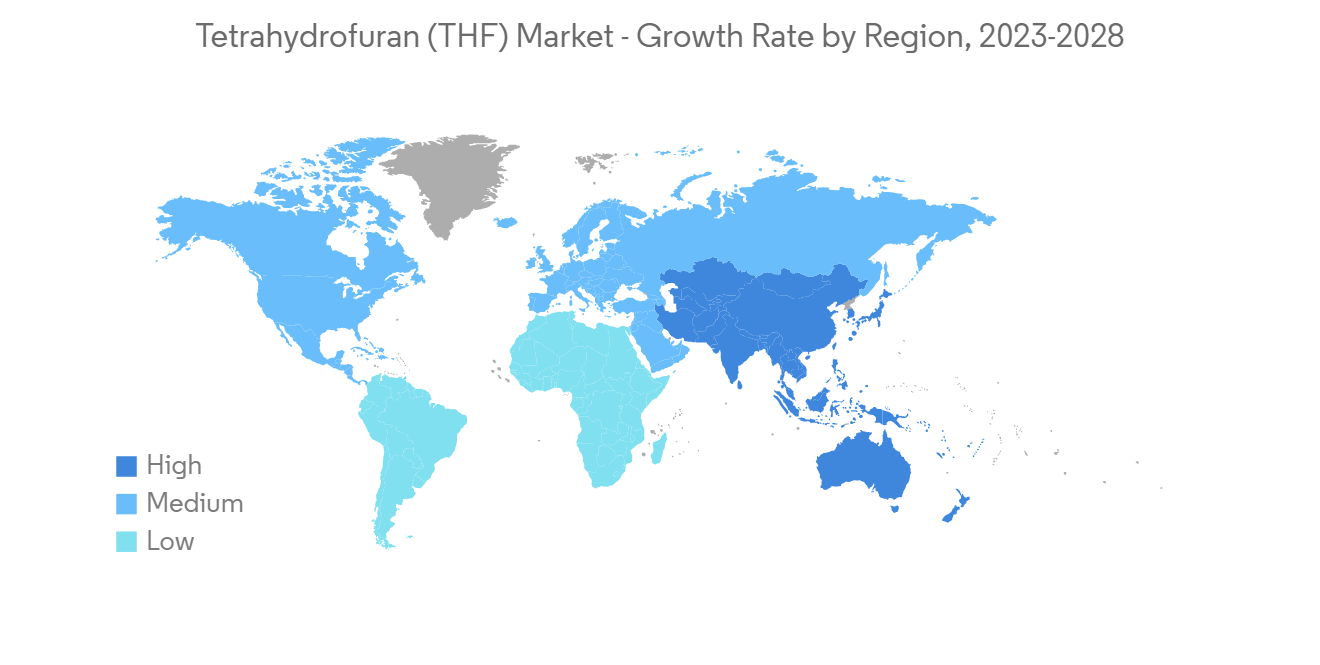

- 生物基四氫夫喃的最新創新很可能為所研究的市場提供機會。預計亞太地區將主導全球市場,其中中國、印度和日本等國家的消費量最高。

四氫夫喃 (THF) 市場趨勢

油漆和塗料行業的需求增加

- 由於其獨特的性能,四氫夫喃 (THF) 被用於油漆和塗料行業的各種應用。常用作化學工業中各種合成的溶劑、反應介質和起始原料,如粘合劑、特種油漆、塗料、纖維製備、某些活性物質的提取、某些化合物的重結晶等。

- 它提供均勻的膜厚和快速乾燥,形成具有高固體含量和實用工作粘度的溶液,提供良好的粘度和流變控制,從而減少塗抹。

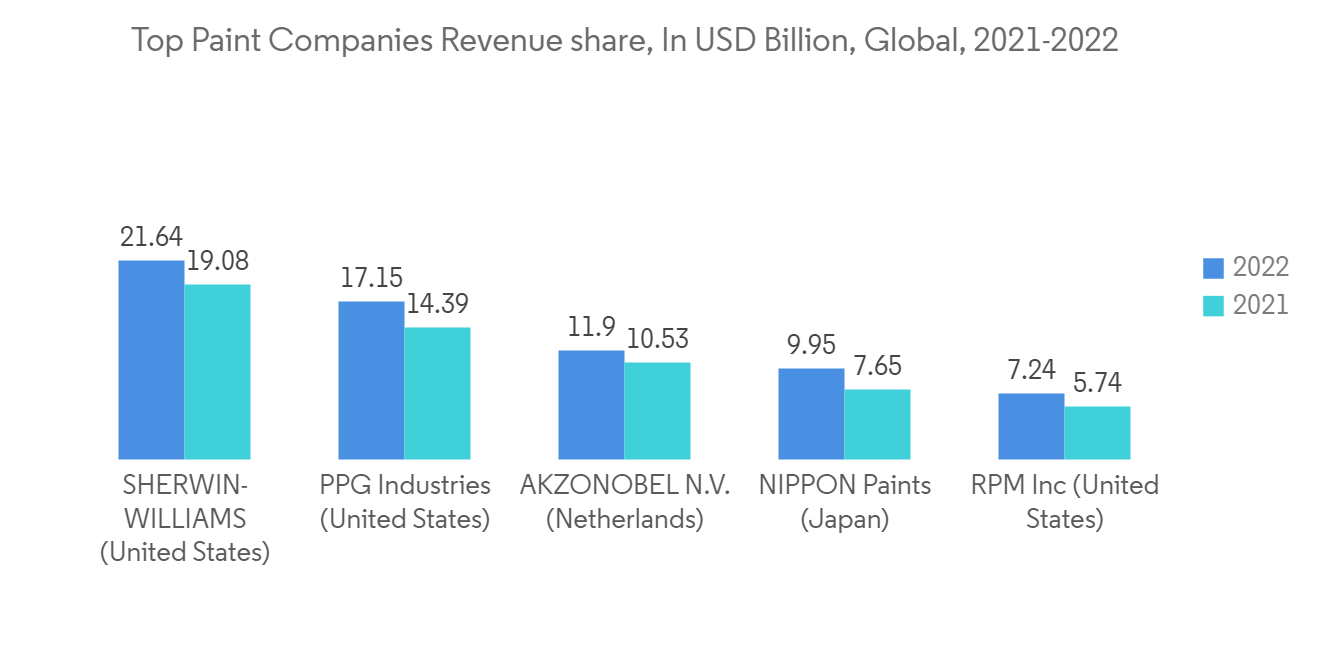

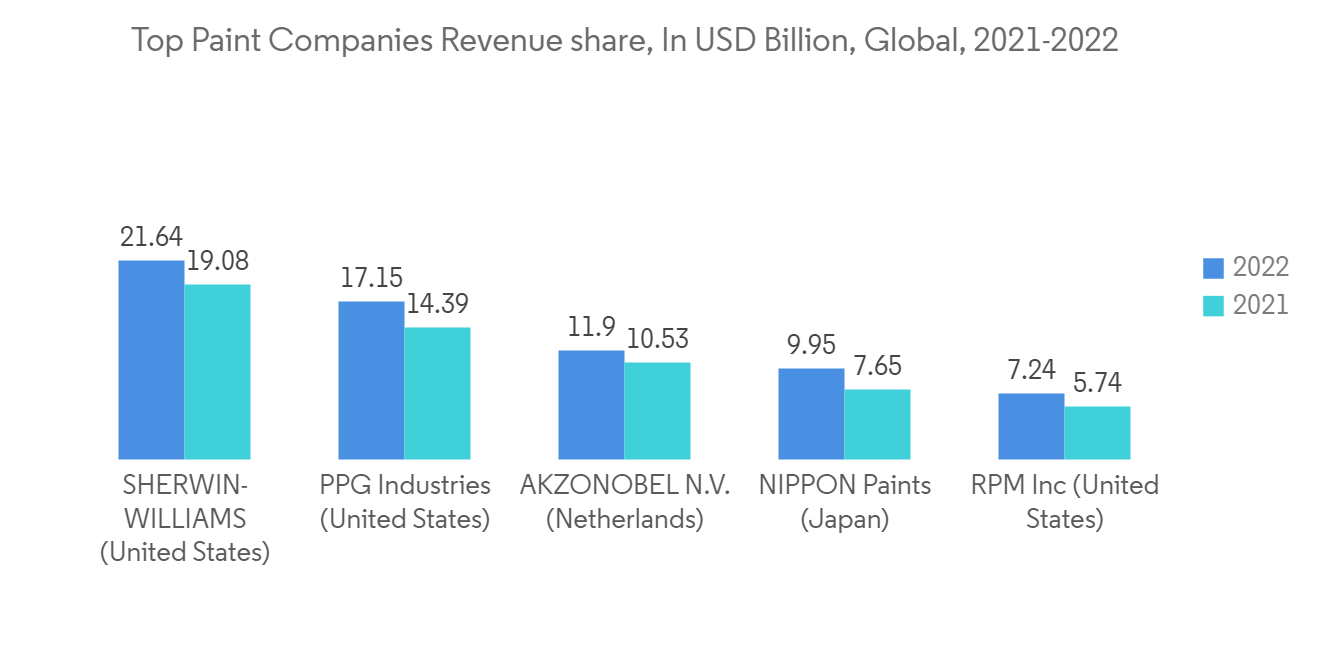

- 根據Worlds Paint and Coatings Industry Association (WPCIA) 的數據,2022 年全球油漆和塗料的銷售額約為 1800 億美元。到 2027 年,油漆和塗料行業預計將實現 3% 左右的複合年增長率 (CAGR)。根據該協會的年度報告,2022年北美市場價值339.2億美元,而歐洲市場價值423.7億美元。這些個別地區的增長歸因於加拿大、德國和美國國內裝修項目的增加。

- 在許多行業中,油漆和塗料的消耗量正在迅速增長。塗料廣泛用於汽車、建築和製造業。例如,全球建築施工市場從 2019 年的 6.6 萬億美元增長到 2022 年的 8.4 萬億美元。同樣,全球運輸製造市場將從 2019 年的 6 萬億美元增長到 2022 年的 7.8 萬億美元。

- 裝飾漆和塗料廣泛應用於建築和建築,而防護漆和塗料則與汽車、大家電和工業設備行業密切相關。因此,終端用戶行業的增長預計將在預測期內推動油漆和塗料市場。

- 這些因素將增加各行業的投資,增加全球對油漆和塗料的需求,這將對四氫夫喃市場產生積極影響。

亞太地區主導市場

- 由於中國、印度和日本等國家的需求不斷增加,預計亞太地區在預測期內將主導四氫夫喃市場。未來對油漆和塗料的需求預計將受到發展中國家工業和基礎設施建設增加的推動,尤其是中國、印度和新興經濟體。

- 到 2022 年,亞太地區油漆和塗料行業的產值將達到 630 億美元。中國目前主導該地區的市場,複合年增長率 (CAGR) 為 5.8%。2022年,中國市場將增長5.7%。按照目前趨勢,2022年中國油漆塗料總銷售額將超過450億美元。在東亞,該國擁有最大的市場份額,達到 78%。

- 四氫夫喃在製藥工業中用於生產止咳藥、利福黴素和黃體酮等激素類藥物,並用作格氏合成過程中的反應介質。印度製藥業佔全球供應量的20%,產量位居第三。四氫夫喃市場預計將受到需求增長和製藥業務擴張的推動。

- IQVIA 是一家服務於健康信息技術和臨床研究聯合行業的美國跨國公司,它預測中國作為世界第二大醫藥消費國,在未來五年內該細分市場的數量將增長 8%。預計支出增長 19%,儘管速度比以前慢,但重點是擴大創新藥物的可及性。

- 據印度政府稱,到2030年,印度醫藥行業的市場規模預計將達到1300億美元。此外,印度已向200多個國家提供藥品,並將繼續這樣做。到2021年,它將成為全球最大的疫苗生產商,佔疫苗總產量的60%,以及第三大製藥商。

- 在印度,人均收入的增加、有利的人口結構以及對品牌產品偏好的改變推動了對紡織業的需求,從而推動了研究市場的發展。據印度品牌資產基金會 (IBEF) 估計,到 2025 年,印度的紡織業產值將達到 2200 億美元左右。

- 在此背景下,政府支持、全球投資和業務擴張正在推動亞太地區對四氫夫喃的需求不斷增長。

四氫夫喃 (THF) 行業概況

全球四氫夫喃市場部分分散,大型企業佔據的市場份額很小。一些公司包括 Ashland、BASF SE、Mitsubishi Chemical Corporation、DCC 和 Banner Chemicals Limited。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查先決條件

- 本次調查範圍

第二章研究方法論

第三章執行摘要

第四章市場動態

- 促進者

- 紡織行業對氨綸的需求不斷增長

- 對 PVC 製造的需求不斷增長

- 阻礙因素

- 接近替代品的可用性

- THF 危害(高度易燃,危害健康)

- 行業價值鏈分析

- 五力分析(波特五力分析)

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章市場細分(基於價值的市場規模)

- 用法

- 聚四亞甲基醚二醇(PTMEG)

- 溶劑

- 其他用途

- 終端用戶行業

- 高分子材料

- 纖維

- 藥物

- 油漆/塗料

- 其他終端用戶行業

- 區域

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 意大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東/非洲

- 沙特阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第六章競爭格局

- 併購、合資、合作、合同等

- 市場份額(%)**/排名分析

- 領先公司採用的策略

- 公司簡介

- Ashland

- Banner Chemicals Limited

- BASF SE

- BHAGWATI CHEMICALS

- DCC

- Hefei TNJ Chemical Industry Co.,Ltd.

- Henan GP Chemicals Co., Ltd

- Mitsubishi Chemical Corporation

- NASIT PHARMACHEM

- REE ATHARVA LIFESCIENCE PVT. LTD

- Riddhi Siddhi Industries

- Shenyang East Chemical Science-Tech Co., Ltd.

- Sipchem Company

第七章市場機會與未來趨勢

- 生物基四氫夫喃(THF)開發技術創新

- 其他商機

簡介目錄

Product Code: 69066

The tetrahydrofuran (THF) market is projected to register a CAGR of 6% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. The coronavirus-related mass quarantines negatively affected the polymer, textile, paints, and coatings industries. The pharmaceutical business was the only one to have a beneficial impact during that time. Nonetheless, the THF market has started to grow in the recent past and is predicted to expand with the same trajectory over the forecast years.

- In the medium term, growing demand for spandex from the textile industry and increasing demand for polyvinyl chloride manufacturing are the major factors driving the market. On the other hand, the availability of close replacements and THF's hazardous characteristics (very flammable and health hazards) are impeding the market's expansion.

- The recent innovations in bio-based THF will likely act as an opportunity for the market studied. The Asia-Pacific region is expected to dominate the market across the world, with the largest consumption from countries such as China, India, and Japan.

Tetrahydrofuran (THF) Market Trends

Increasing Demand from the Paints and Coatings Industry

- Tetrahydrofuran (THF) serves a variety of purposes in the paints and coatings industry due to its unique properties. It is commonly used as a solvent, reaction medium, and starting material for various syntheses in the chemical industry, for example, for preparing adhesives, special paints, coatings, and fibers, and in the extraction of specific active substances, for the recrystallization of certain compounds.

- It provides uniform coating thickness and rapid drying, forms a solution with high solids and practical working viscosities, and provides good viscosity and rheology control, which in turn helps reduce smearing.

- According to Worlds Paint and Coatings Industry Association (WPCIA), global sales of paints and coatings were around USD 180 billion in 2022. By 2027, the paints and coatings industry is predicted to have a compound annual growth rate (CAGR) of around 3%. The annual report by the association also stated that in 2022, the North American market was worth USD 33.92 billion, while the European market was worth USD 42.37 billion. The expansion of these individual regions is ascribed to an uptick in domestic remodeling projects in Canada, Germany, and the United States.

- There is a rapid growth in the consumption of paints and coatings in many industries. Paints and coatings are widely used in the automotive, construction, and manufacturing industries. For instance, the global buildings construction market increased from USD 6.6 trillion in 2019 to USD 8.4 trillion in 2022. Similarly, the global transportation manufacturing market is increased from USD 6 trillion in 2019 to USD 7.8 trillion in 2022.

- Decorative paints and coatings are widely used in buildings and construction whereas protective paints and coatings are linked closely to the automotive, major appliance, and industrial equipment industries. Therefore, growth in end-user industries is expected to drive the paints and coatings market during the forecast period..

- Owing to all these factors, the rising investments in different industries will increase the demand for paints and coatings from all around the world and thus positively influence the market of tetrahydrofuran

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for tetrahydrofuran during the forecast period due to an increase in demand from countries like China, India, and Japan. The future demand for paints and coatings is expected to be driven by rising industrial and infrastructure construction in developing countries, particularly China, India, and ASEAN countries.

- In 2022, the Asia-Pacific paints and coatings industry was worth USD 63 billion. China now dominates the region's market, which is growing at a compound annual growth rate (CAGR) of 5.8%. In 2022, the Chinese market grew by 5.7%. According to current trends, China's total paints and coatings sales exceeded USD 45 billion in 2022. In East Asia, the country had the largest market share at 78%.

- Tetrahydrofuran is used in the pharmaceutical industry to make cough serum, rifamycin, progesterone, and other hormone medicines, as well as a reaction medium in the Grignard synthesis process. India's pharmaceutical business accounts for 20% of global supply by volume and ranks third in terms of production volume. The market for tetrahydrofuran is likely to be driven by rising demand and the expansion of pharmaceutical businesses.

- According to the estimations by IQVIA, a US multinational company serving the combined industries of health information technology and clinical research, China, the world's second-largest pharmaceutical spending country, will increase the volume of the segment by 8% over five years while spending will increase by 19%, a slower rate than in previous years but still at a focus on extending access to innovative drugs.

- According to the Government of India, the Indian pharmaceutical sector market will be worth USD 130 billion by 2030. Furthermore, India has supplied pharmaceutical products to over 200 countries and will continue to do so in the future. As of 2021, the country was the world's largest producer of vaccines, accounting for 60% of overall vaccine production, and ranked third in pharmaceutical manufacturing by volume.

- In India, the rising per capita income, favorable demographics, and a shift in preference for branded products boost the demand for the textile industry, thus, boosting the market studied. According to the India Brand Equity Foundation (IBEF), the textile industry in India is estimated to reach about USD 220 billion by 2025.

- The aforementioned causes, together with government backing and global investments and expansions in the region, are driving growing demand for tetrahydrofuran in Asia-Pacific.

Tetrahydrofuran (THF) Industry Overview

The global tetrahydrofuran market is partially fragmented, with major players accounting for a marginal share of the market. A few companies include Ashland, BASF SE, Mitsubishi Chemical Corporation, DCC, and Banner Chemicals Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Spandex from the Textile Industry

- 4.1.2 Increasing Demand for PVC Manufacturing

- 4.2 Restraints

- 4.2.1 Availability of Close Substitutes

- 4.2.2 Hazardous Nature (Highly Flammable and Health Hazard) of THF

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Polytetramethylene Ether Glycol (PTMEG)

- 5.1.2 Solvent

- 5.1.3 Other Applications

- 5.2 End-User Industry

- 5.2.1 Polymer

- 5.2.2 Textile

- 5.2.3 Pharmaceutical

- 5.2.4 Paints and Coatings

- 5.2.5 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ashland

- 6.4.2 Banner Chemicals Limited

- 6.4.3 BASF SE

- 6.4.4 BHAGWATI CHEMICALS

- 6.4.5 DCC

- 6.4.6 Hefei TNJ Chemical Industry Co.,Ltd.

- 6.4.7 Henan GP Chemicals Co., Ltd

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 NASIT PHARMACHEM

- 6.4.10 REE ATHARVA LIFESCIENCE PVT. LTD

- 6.4.11 Riddhi Siddhi Industries

- 6.4.12 Shenyang East Chemical Science-Tech Co., Ltd.

- 6.4.13 Sipchem Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Development of Bio-based Tetrahydrofuran (THF)

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219

![四氫[口夫]喃(THF)的全球市場:2016年~2032年](/sample/img/cover/42/1291081.png)

![四氫[口夫]喃(THF)的全球市場](/sample/img/cover/42/1212627.png)