|

市場調查報告書

商品編碼

1435213

丙烯酸表面塗料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Acrylic Surface Coating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

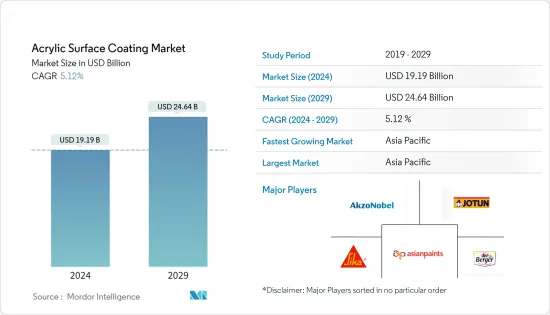

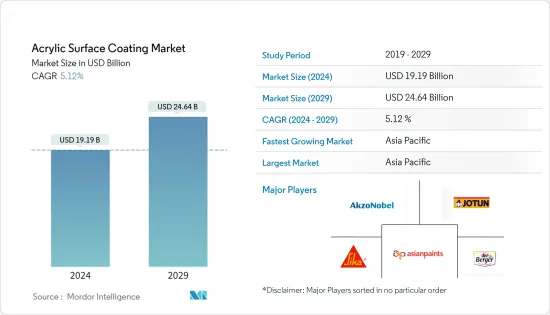

丙烯酸表面塗料市場規模預計到2024年為191.9億美元,預計到2029年將達到246.4億美元,在預測期內(2024-2029年)成長5.12%,複合年成長率成長。

建築塗料應用的增加預計將推動市場成長。另一方面,全球汽車生產放緩預計將阻礙市場成長。

主要亮點

- 由於建設產業需求的增加,丙烯酸表面塗料市場預計在預測期內將成長。

- 亞太地區主導全球市場,主要消費國為中國、印度和日本。

壓克力表面塗料市場趨勢

建築業的需求不斷成長

- 丙烯酸表面塗料廣泛應用於建築和施工,因為它們惰性,並且在暴露於室外條件下時具有良好的保色性。丙烯酸有型態,包括乳化(乳膠)、清漆、瓷漆和粉末。

- 丙烯酸類聚合物的主要成分是丙烯酸和甲基丙烯酸,聚合物結構難以吸收紫外線。與油基塗料、醇酸樹脂和環氧樹脂相比,它具有更強的耐候性和抗氧化性,因此在建築和施工中的應用越來越多。

- 南非政府制定了《2050年國家基礎建設計畫》,旨在2050年發展能源、交通、數位通訊和水務等基礎設施。到2040年,基礎建設投資將達到3,300億美元。

- 此外,美國人口普查局編制的額外統計數據顯示,2022 年美國年度新建建築面積將為 16,575.90 億美元,而 2021 年為 14,998.22 億美元。美國,2022 年美國住宅建築年價值為 8,491.64 億美元,而 2021 年為 7,406.45 億美元。 2022 年,該國年度非住宅建築價值將為 8,084.27 億美元,而 2021 年為 7,591.77 億美元,市場消費下降。

- 據加拿大建築協會稱,建築業是加拿大最大的雇主之一,為國家的經濟成功做出了重大貢獻。該產業每年產值約 1,410 億美元,佔該國國內生產總值(GDP) 的 7.5%。

- 建設產業在丙烯酸表面塗料的使用方面處於領先地位,其中中國、德國、美國、印度和日本在市場上發揮主要作用。

亞太地區主導市場

- 預計亞太地區在預測期內將主導丙烯酸表面塗料市場。建築業的成長增加了中國、印度和日本等國家對丙烯酸表面塗料的需求。

- 最大的丙烯酸表面塗料生產商位於亞太地區。製造丙烯酸表面塗料的一些領先公司包括亞洲塗料公司、伯傑塗料印度有限公司、阿克蘇諾貝爾公司、佐敦公司和西卡公司。

- 中國的「十四五」規劃重點在於能源、交通、水利系統和都市化領域的新型基礎設施計劃。據計算,「十四五」期間(2021-2025年)新基建投資總額預計將達到約27兆元(4.2兆美元)。

- 中國的都市化位居世界前列。 2022年中國的都市化64.7%,這項都市更新政策旨在發展更綠色、更有效率的城市,因為政府的目標是改善中國城市的居住條件。

- 印度龐大的建築業可望成為全球第三大建築市場。印度政府實施的智慧城市計劃、全民住宅等多項政策預計將為印度建設產業提供動力。

- 印度統計與計畫實施部的數據顯示,2022年第四季建築業佔GDP的比重達372.6億美元,高於2022年第三季329.5億美元的GDP比重。

- 除紙張塗料外,丙烯酸表面塗料還用作油漆、紡織品和皮革飾面、地板拋光劑和航太應用中的保護塗料。

- 上述因素和政府支持將有助於預測期內丙烯酸表面塗料市場需求的增加。

壓克力表面塗料產業概況

全球丙烯酸表面塗料市場部分分散,主要參與者只佔該行業的一小部分。市場上的主要企業包括亞洲塗料、Berger Paints India Limited、Akzo Nobel NV、Jotun、Sika AG 等(排名不分先後)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 擴大建築塗料的應用

- 汽車產業應用快速拓展

- 其他司機

- 抑制因素

- 與低VOC相關的嚴格環境法規

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 目的

- 水性的

- 溶劑型

- 粉底

- 其他用途

- 最終用戶產業

- 建築/施工

- 住宅

- 非住宅

- 車

- 航太

- 其他最終用戶產業

- 建築/施工

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Akzo Nobel NV

- Arkema Group

- Asian Paints

- BASF SE

- Berger Paints India Limited

- Dow

- Jotun

- PPG Industries Inc.

- Sika AG

- Solvay

- The Sherwin-Williams Company

第7章 市場機會及未來趨勢

- 生物基壓克力型塗料的開發

- 其他機會

The Acrylic Surface Coating Market size is estimated at USD 19.19 billion in 2024, and is expected to reach USD 24.64 billion by 2029, growing at a CAGR of 5.12% during the forecast period (2024-2029).

Increasing applications in architectural coatings are expected to drive the market growth. On the flip side, the slowdown in global automotive production is expected to hinder the growth of the market.

Key Highlights

- The acrylic surface coating market is expected to grow during the forecast period, owing to the increasing demand from the building and construction setor.

- The Asia-Pacific region dominates the global market, with the major consumption being registered in China, India, and Japan.

Acrylic Surface Coating Market Trends

Growing Demand from the Building and Construction Sector

- Acrylic surface coatings are widely used in the building and construction sector because of their inertness and excellent color retention when exposed to outdoor conditions. Acrylics are available in various forms, such as emulsions (latex), lacquers, enamels, and powders.

- The chief component of acrylic polymers is acrylic and methacrylic acid which provide a polymer structure with a little tendency to absorb UV light. It increases its resistance to weathering and oxidation than oil-based paints, alkyds, or epoxies, so its application increased in the buildings & construction sector.

- The South African government devised a 'National Infrastructure Plan 2050' to deliver infrastructure development across energy, transport, digital communications, and water by 2050. USD 0.33 trillion will be invested through 2040 in infrastructure development.

- Further, as per further statistics generated by the US Census Bureau, the annual value for new construction in the United States accounted for USD 1,657,590 million in 2022, compared to USD 1,499,822 million in 2021. Moreover, the annual value of residential construction in the United States was valued at USD 849,164 million in 2022, compared to USD 740,645 million in 2021. The country's annual non-residential construction value was USD 808,427 million in 2022, compared to USD 759,177 million in 2021. It is thereby decreasing the consumption of the market studied in the short term.

- According to the Canadian Construction Association, the construction sector is one of Canada's largest employers and a major contributor to the country's economic success. The industry generates about USD 141 billion annually and contributes 7.5% of the country's Gross Domestic Product (GDP).

- The building & construction industry leads in using acrylic surface coatings, with China, Germany, the United States, India, and Japan playing a major role in the market.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for acrylic surface coatings during the forecast period. The demand for acrylic surface coatings is increasing in countries like China, India, and Japan because of the growing building and construction sector.

- The largest producers of acrylic surface coatings are located in the Asia-Pacific region. Some leading companies producing acrylic surface coatings are Asian Paints, Berger Paints India Limited, Akzo Nobel NV, Jotun, and Sika AG.

- China's 14th Five-Year Plan focuses on new infrastructure projects in energy, transportation, water systems, and urbanization. According to estimates, overall investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) will reach roughly CNY 27 trillion (USD 4.2 trillion).

- China's urbanization rate is among the highest in the world. While China's urbanization rate reached 64.7% in 2022, this urban renewal policy aims to develop greener and more efficient cities as the government seeks to improve China's urban living conditions.

- India's huge construction sector is expected to become the world's third-largest construction market. Various policies implemented by the Indian government, such as the Smart Cities project, Housing for All, etc., are expected to bring impetus to the Indian construction industry.

- As per the Ministry of Statistics and Programme Implementation of India, the construction sector contributed a GDP share amounting to USD 37.26 billion in Q4 2022, higher than the GDP share of USD 32.95 billion in Q3 2022.

- Acrylic surface coatings are used as protective coatings in aerospace applications other than paints, fabric and leather finishes, floor polishes, and paper coatings.

- The above factors and government support contribute to the increasing demand for the acrylic surface coatings market during the forecast period.

Acrylic Surface Coating Industry Overview

The global acrylic surface coating market is partially fragmented, with the major players accounting for a marginal portion of the industry. Some major companies operating in the market are Asian Paints, Berger Paints India Limited, Akzo Nobel NV, Jotun, and Sika AG, among others (not in particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in Architectural Coatings

- 4.1.2 Rapidly Growing Application in the Automotive Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Related to Lower VOC

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Water-borne

- 5.1.2 Solvent-borne

- 5.1.3 Powder-based

- 5.1.4 Other Applications

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.1.1 Residential

- 5.2.1.2 Non-residential

- 5.2.2 Automotive

- 5.2.3 Aerospace

- 5.2.4 Other End-user Industries

- 5.2.1 Building and Construction

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Akzo Nobel NV

- 6.4.3 Arkema Group

- 6.4.4 Asian Paints

- 6.4.5 BASF SE

- 6.4.6 Berger Paints India Limited

- 6.4.7 Dow

- 6.4.8 Jotun

- 6.4.9 PPG Industries Inc.

- 6.4.10 Sika AG

- 6.4.11 Solvay

- 6.4.12 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based Acrylic Coatings

- 7.2 Other Opportunities