|

市場調查報告書

商品編碼

1435887

對話系統:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Conversational Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

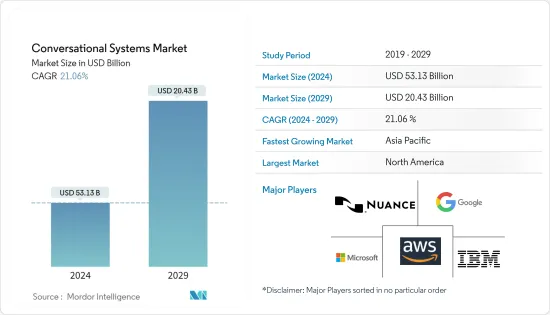

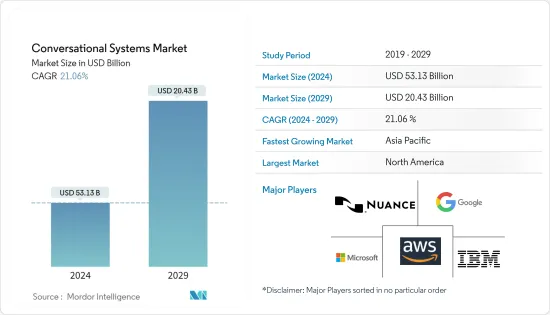

對話系統市場規模預計到 2024 年為 531.3 億美元,預計到 2029 年將達到 204.3 億美元,預測期內(2024-2029 年)複合年成長率為 21.06%。

對話系統是智慧機器解決方案,可以理解語言並與客戶進行口頭或書面對話。這些系統旨在透過鼓勵互動來改善客戶體驗。

主要亮點

- 企業中大量資料的可用性和資料相關複雜性的增加預計將增加對會話系統解決方案的市場需求。此外,對模仿人腦的人工智慧(AI)系統的需求是推動產業發展的關鍵參數之一。

- 深度神經網路、機器學習和其他人工智慧技術的進步正在增加對話系統的使用。聊天機器人等對話系統用於跨多個最終用戶領域的各種應用程式。消費者的主要應用之一是作為個人助理的對話系統。它幫助消費者執行各種任務。例如,Apple 的 Siri 為連網家庭和汽車提供了直覺的介面。

- 組織可以透過對話軟體平台簡化和重新構想業務流程,並透過情勢感知智慧系統減少和自動化業務工作流程。這些平台使用戶和系統能夠進行有意義的互動並共同努力實現業務目標。

- 此外,人工智慧(AI)功能與對話系統的集合成為全球對話系統市場提供了巨大的成長機會。預計有多種因素會阻礙市場擴張,包括缺乏對開發技術的了解以及對這些系統部署平台的依賴。此外,虛擬助理和聊天機器人缺乏準確性預計將限制市場成長。

- 然而,COVID-19感染疾病推動了對話系統市場的發展。對清晰度的需求不斷增加,促使消費者詢問量大幅增加,給客服中心帶來了額外的壓力。因此,對話解決方案在客服中心的使用預計將加速。這些工具允許用戶透過基於語音或文字的參與平台獲取訊息,從而在冠狀病毒爆發期間增加這些新通訊管道的使用。

對話系統市場趨勢

更多地使用基於人工智慧的客戶服務解決方案推動市場成長

- 由人工智慧 (AI) 提供支援的客戶支援服務可以幫助組織提高忠誠度、線上客戶經驗、主動幫助、品牌聲譽,甚至收益。自然語言處理(NLP)和對話交換工具的進步將推動市場成長。

- 各種客服中心都專注於客服中心系統,因為它們可以使用人工智慧來自動化支援語音的應用程式和訊息,以實現人機互動。此外,這些系統能夠理解客戶用不同語言的意圖,並相應地回應查詢。世界各地的許多人正在使用基於人工智慧的解決方案(例如通訊平台和基於語音的助理)來與企業建立聯繫。因此,基於人工智慧語音的通訊平台正在迅速取代傳統的行動和網路應用程式,成為新的互動式媒介。

- 這一成長可歸因於對人工智慧驅動的客戶支援服務的需求激增。考慮到自動化服務預計將在預測期內顯著增加,為使用者提供完成常規任務所需的功能。

- 企業將受益於人工智慧提供的主動客戶支援服務,這將有助於提高忠誠度、線上客戶經驗、服務協助、品牌聲譽甚至產生收入等各個方面。自然語言處理(包括 NLP 和對話交換工具)的進步預計將刺激市場成長。因此,NLP 工具的普及預計會增加,由於網路服務和雲端基礎的應用程式的使用增加,從而帶來市場成長機會。

亞太地區預計將成為成長最快的市場

- 亞太地區成長的主要驅動力是技術供應商的大量存在以及在關鍵產業中擴大使用先進技術支援的機器人解決方案。該地區的這些公司專注於開發創新解決方案,以保持競爭激烈的市場形勢。

- 該地區正在快速工業化,增加了相關市場對聊天機器人的需求。中國、印度、印尼、越南、馬來西亞、菲律賓、台灣和泰國等新興經濟體零售和電子商務行業的成長推動了零售商和電子商務企業主對聊天機器人的高需求和廣泛採用。

- 亞太地區對話系統市場在 COVID-19感染疾病期間經歷了穩定成長。由於該地區 COVID- 感染疾病病例的增加以及該地區主要經濟體政府宣布的封鎖,各種組織正在實施聊天機器人。偏遠地點的數量增加。

- 由於技術需求不斷成長,該地區出現了提供更好客戶體驗的大中型企業。 2022 年 6 月,全球 CPaaS 供應商之一 Tanla 和全球最大的企業對話式 AI 軟體平台和解決方案公司之一 Kore.ai 宣布,將擴大在亞洲四個國家(印度、印尼、越南、菲律賓、阿拉伯聯合大公國宣布簽訂合約。此次合作使企業和品牌能夠使用基於高級對話人工智慧 (AI) 的自然語言處理 (NLP) 系統,為關鍵相關利益者的客戶、合作夥伴和員工改善數位體驗,代表著向前邁出的重要一步。

對話系統行業概況

對話系統市場高度分散,主要參與者包括 IBM 公司、微軟公司、Google LLC (Alphabet Inc.)、Amazon Web Services, Inc. 和 Nuance Communications Inc.。市場參與者正在採取合作夥伴關係等策略。收購旨在增強產品並獲得永續的競爭優勢。

2023 年 7 月,IBM watsonx 將能夠滿足企業業務需求,透過 watsonx,客戶和合作夥伴可以專門針對不同的企業用例部署模型,或開發自己的模型。迄今為止,該平台已由來自電信業者到銀行等各行各業的 150 多名用戶參與測試和技術預覽計畫。

2022 年 12 月,全球最大的端到端數位 CX 解決方案客戶經驗(CX) 技術和服務創新者之一 TTEC Holdings, Inc. 宣布,TTEC 數位公司 VoiceFoundry 將併入 Amazon Web Services (AWS). 對話式人工智慧(AI) 能力。該獎項凸顯了 VoiceFoundry 創建高品質、高效能聊天機器人、虛擬助理和互動式語音應答 (IVR) 系統的能力。

2022 年 10 月,IBM 發佈了三個新庫,旨在説明 IBM 生態系統中的合作夥伴、客戶和開發人員更輕鬆、更快速、更經濟高效地構建和銷售 AI 驅動的產品,從而擴展了其嵌入式 AI 軟體產品群組。 該 AI 庫現已正式發佈,由 IBM 研究開發,旨在為整個行業的獨立軟體供應商 (ISV) 提供一種易於擴展的方式來構建自然語言處理、文本轉語音和文本轉語音功能。 集成到任何混合多雲應用程式中。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭公司之間的敵意強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 在客戶服務中更多地使用基於人工智慧的解決方案

- 市場課題

- 與對話平台相關的準確性問題

第6章市場區隔

- 依醫療器材類型

- 單一模式

- 多模態

- 依類型

- 語音協助

- 文字輔助

- 其他類型

- 依配置

- 本地

- 雲

- 依公司規模

- 中小企業

- 主要企業

- 最終用戶產業

- 資訊科技和通訊

- BFSI

- 政府

- 零售

- 能源和電力

- 其他最終用戶部門(教育機構、旅遊/旅遊、交通/物流)

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭訊息

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- Google LLC(Alphabet Inc.)

- Amazon Web Services, Inc.

- Nuance Communications Inc.

- Drift.com, Inc.

- Oracle Corporation

- SAP SE

- Boost.ai

- Inbenta Technologies Inc.

第8章投資分析

第9章市場的未來

The Conversational Systems Market size is estimated at USD 53.13 billion in 2024, and is expected to reach USD 20.43 billion by 2029, growing at a CAGR of 21.06% during the forecast period (2024-2029).

Conversational systems are intelligent machine solutions that understand language and conduct verbal or written customer conversations. These systems are aimed at improving the customer experience by boosting interaction.

Key Highlights

- The availability of large amounts of data and increasing data-related complexities in enterprises are expected to drive the market demand for conversational system solutions. Further, the requirement of artificial intelligence (AI)-enabled systems to mimic human brains is one of the crucial parameters responsible for the development of the industry.

- The usage of conversational systems is increasing because of deep neural networks, machine learning, and other advancements in AI technologies. Conversational systems like chatbots are used for various applications across several end-user verticals. One primary consumer-facing application is a conversational system as a personal assistant. It helps consumers accomplish various tasks; for instance, Apple's Siri offers an intuitive interface for connected homes or cars.

- An organization can simplify and reimagine business processes through conversational software platforms and reduce and automate business workflows through context-aware intelligence systems. These platforms enable users and systems to have meaningful interactions and work in tandem to meet business objectives.

- Furthermore, integrating artificial intelligence (AI) capabilities with conversational systems provides significant opportunities for growth in the global conversational systems market. Various factors, such as a lack of understanding of developing technologies and these systems' dependency on deployment platforms, are projected to hinder market expansion. Additionally, a lack of accuracy in virtual assistants and chatbots is expected to limit the market growth.

- However, the COVID-19 pandemic boosted the conversational systems market. The growing need for clarification significantly increased consumer calls, imposing further strain on contact centers. As a result, the use of conversational solutions in contact centers is projected to accelerate. These tools enable users to obtain information via voice or text-based engagement platforms, resulting in increased usage of these novel communication channels during the coronavirus epidemic.

Conversational Systems Market Trends

Rising Usage of AI-based Solutions for Customer Services Drives the Market Growth

- Artificial intelligence (AI)-powered customer support services assist organizations in increasing loyalty, online customer experience, preventive assistance, brand reputation, and even revenue growth. Natural language processing (NLP) and dialog-exchanging tool advances will drive market growth.

- Various contact centers are emphasizing conversational systems because they enable contact centers to AI automate speech-enabled apps and messages for interactions between computers and humans. Additionally, these systems understand client intent in various languages and reply to their inquiries accordingly. Many people throughout the globe use AI-based solutions like messaging platforms and speech-based assistants to connect with businesses. As a result, AI speech-based, and messaging platforms are quickly supplanting traditional mobile and web apps as the new interactive medium for interactions.

- The increase can be attributed to a surge in demand for AI powered customer support services. In view of the fact that, by providing users with a much required facility to complete their usual tasks, automation services are expected to increase significantly over the forecast period.

- Businesses benefit from the proactive customer support services provided by AI that help improve various aspects, such as loyalty, online customer experience, service assistance, brand reputation and even revenue generation. The market growth is anticipated to be stimulated by growing advances in natural language processing, which includesNLP and dialogexchanging tools. As a result, the uptake of NLP tools is forecast to increase and thus lead to growth opportunities on the market due to increased use of Web services and cloud based applications.

Asia Pacific is Expected to be the Fastest Growing Market

- The primary driver for the growth of the Asia-Pacific geographic segment is the significant presence of technology providers and the increasing usage of advanced technology-enabled bot solutions across major industries. These players in the region are focusing on developing innovative solutions to stay in the competitive market landscape.

- The region is witnessing rapid industrialization, raising the need for chatbots in the market under consideration. The growing retail and e-commerce sector in emerging economies, including China, India, Indonesia, Vietnam, Malaysia, the Philippines, Taiwan, and Thailand, has accelerated the high demand for and widespread adoption of chatbots by retailers and e-commerce business owners.

- The Asian-Pacific conversational systems market during the COVID-19 pandemic experienced steady growth. Due to increased COVID-19-infected patients in the region and the lockdown announced by the government of significant economies in the area, the deployments of chatbots by various organizations to handle the patients' queries related to their medication and consultation with doctors online from a remote location increased.

- Owing to the increased technological need, the region is witnessing the emergence of medium and large enterprises to help provide a better customer experience. In June 2022, Tanla, one of the global CPaaS suppliers, and Kore.ai, one of the world's largest enterprise conversational AI software platform and solutions firms, announced an agreement in four Asian countries India, Indonesia, Vietnam, the Philippines, and UAE. This collaboration represents a significant step forward in providing enterprises and brands with the ability to improve the digital experiences of their key stakeholder's customers, partners, and employees, using a advanced conversational artificial intelligence (AI) based natural language processing (NLP) system.

Conversational Systems Industry Overview

The conversational systems market is highly fragmented with the presence of major players like IBM Corporation, Microsoft Corporation, Google LLC (Alphabet Inc.), Amazon Web Services, Inc., and Nuance Communications Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their offerings and gain sustainable competitive advantage.

In July 2023, IBM watsonx is available to help meet enterprises' AI for business needs, Watsonx allows clients and partners to specialize and deploy models for various enterprise use cases or build their own. To date, the platform has been shaped by more than 150 users across industries - from telco to banking participating in the beta and tech preview program

In December 2022, TTEC Holdings, Inc., one of the largest global customer experience (CX) technology and services innovators for end-to-end digital CX solutions, announced that VoiceFoundry, a TTEC Digital company, has earned the Amazon Web Services (AWS) Conversational Artificial Intelligence (AI) Competency. This award highlights VoiceFoundry's competence in creating high-quality, high-performance chatbots, virtual assistants, and interactive voice response (IVR) systems.

In October 2022, IBM expanded its embeddable AI software portfolio by releasing three new libraries designed to let IBM Ecosystem partners, customers, and developers build and market their AI-powered products more easily, rapidly, and cost-effectively. The AI libraries, now generally available, were developed in IBM Research and were designed to provide independent software vendors (ISVs) across industries with an easily scalable way to build natural language processing, speech-to-text, and text-to-speech capabilities into applications across any hybrid, multi-cloud environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Usage of AI-based Solutions for Customer Services

- 5.2 Market Challenges

- 5.2.1 Accuracy Problems Related to Conversational Platforms

6 MARKET SEGMENTATION

- 6.1 By Modality Type

- 6.1.1 Uni-Modal

- 6.1.2 Multi-Modal

- 6.2 By Type

- 6.2.1 Voice Assisted

- 6.2.2 Text Assisted

- 6.2.3 Other Types

- 6.3 By Deployment

- 6.3.1 On-Premise

- 6.3.2 Cloud

- 6.4 By Enterprise Size

- 6.4.1 Small & Medium Enterprises

- 6.4.2 Large Enterprises

- 6.5 By End-user Verticals

- 6.5.1 IT & Telecommunication

- 6.5.2 BFSI

- 6.5.3 Government

- 6.5.4 Retail

- 6.5.5 Energy & Power

- 6.5.6 Other End-User Verticals (Educational Institutions, Travel & Tourism, Transportation & Logistics)

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia Pacific

- 6.6.4 Latin America

- 6.6.5 Middle East and Africa

7 COMPETITIVE INTELLIGENCE

- 7.1 Company Profiles*

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Google LLC (Alphabet Inc.)

- 7.1.4 Amazon Web Services, Inc.

- 7.1.5 Nuance Communications Inc.

- 7.1.6 Drift.com, Inc.

- 7.1.7 Oracle Corporation

- 7.1.8 SAP SE

- 7.1.9 Boost.ai

- 7.1.10 Inbenta Technologies Inc.