|

市場調查報告書

商品編碼

1406122

窄頻物聯網 -市場佔有率分析、產業趨勢與統計、2024 年至 2029 年成長預測Narrowband IoT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

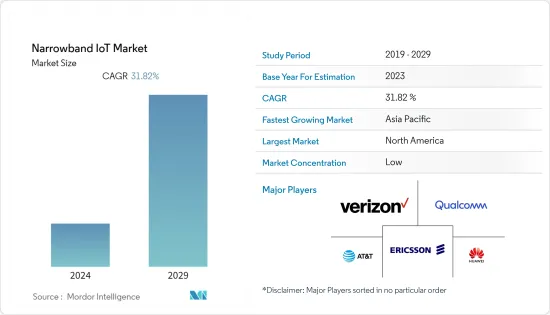

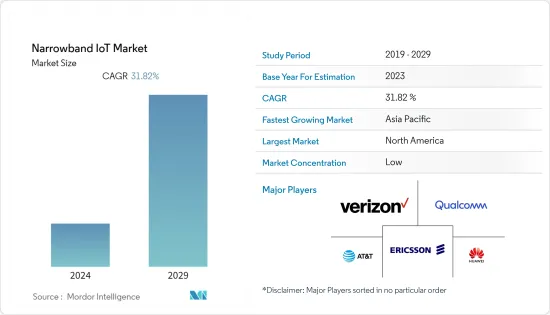

上年度窄頻物聯網市場規模為45.5億美元,預計未來五年將達240.6億美元,複合年成長率為31.82%。

NB-IoT 是一項相對較新的技術,仍處於普及的早期階段。然而,預計它在未來幾年將變得更加普及。

主要亮點

- NB-IoT(窄頻物聯網)是一種基於標準的低功耗廣域通訊(LPWA) 技術,旨在支援各種創新的物聯網產品和服務。 NB-IoT 大大提高了系統容量、頻譜效率和用戶設備功耗,尤其是在深度覆蓋方面。

- NB-IoT 是由 3GPP 開發的無線通訊技術標準,3GPP 是負責所有重要行動通訊標準的全球標準機構,包括 LTE 等 4G 標準和 5G NR 等 5G 標準。 NB-IoT 模組在訊號處理過程中的低功耗有助於實現 10 年的電池壽命。

- 所有主要行動裝置、晶片組和模組製造商都支援 NB-IoT,並且可以與 2G、3G 和 4G 行動網路共存。此外,您還可以受益於行動網路的所有安全和隱私特性,例如使用者身分機密性、實體身分驗證、機密性、資料以及對行動裝置識別的支援。

- 特別是,NB-IoT 用於需要低資料速率、長電池壽命和廣域覆蓋的智慧城市、智慧農業和資產追蹤應用。 NB-IoT 可連接大量設備(通常為數百到數百萬),非常適合需要大規模連接的物聯網應用。

- 由於運動、健身、個人護理和診斷等醫療保健設備的需求快速成長,預計穿戴式裝置市場也將佔據很大一部分市場。可支配收入水準的提高和對健身益處的了解不斷增加,鼓勵年輕人使用運動和健身手環,而已開發國家醫療保健手環的使用也在增加。

- NB-IoT 技術應用的快速擴展導致開發 NB-IoT 設備和部署相關服務的技術公司和通訊服務供應商不斷增加,預計將在預測期內加速市場成長。巨量資料分析、人工智慧 (AI) 和機器學習 (ML) 的進步將使企業能夠透過物聯網網路監控和監控活動來研究可用的大量資料。

- 汽車製造商正在透過引入新技術來應對乘客安全問題,這無疑可以提供更安全、更方便且更具成本效益的交通。因此,NB-IoT 能夠準確追蹤車輛、識別和避免嚴重交通堵塞,並有助於高效的交通管理,從而使其在汽車行業的應用不斷增加。

- 此外,NB-IoT網路可以到達地下深處和封閉位置,使物聯網設備能夠部署在室內和地下。然而,即將缺乏標準化和負擔得起的網路定價模式以及足夠的網路覆蓋範圍來支援顯著擴大的物聯網部署,這限制了行業的成長。

窄頻物聯網市場趨勢

智慧城市可望推動市場發展

- 行動行動通訊業者在行動物聯網網路解決方案(例如NB-IoT)方面的進步是專門為滿足智慧城市的需求而設計的,從而連接永續提供各種服務的智慧城市資產。使用此類技術的經濟性將帶來價值的提高圍繞網路和組件標準化的鏈。

- 此外,在人口稠密的都市區,蜂巢式網路可以管理來自大量物聯網設備的流量,而對網路容量的負面影響很小。例如,窄頻物聯網技術可以應用於每平方公里1萬戶、數萬個物聯網設備的密集城市環境,對網路容量影響很小,可以處理大量物聯網設備。

- 政府對智慧城市發展的措施可能會促進研究市場的成長。例如,2022年11月,智慧城市組織智慧城市理事會在英國開始運作。智慧城市理事會及其相關的全球影響力計畫「Everybody」將政府、企業、學術界、慈善機構和慈善組織聚集在一起,共同應對當今城市和社區面臨的主要挑戰和機遇,目的是採取行動並發揮影響力。人、安全、美麗、永續性、彈性、公平和包容性是英國地方和基礎設施「智慧」擴展的一部分。

- 此外,據印度住宅和城市事務部稱,這些智慧城市最近已收到 6,452 個計劃的競標,總成本達 1,84,998 千萬印度盧比。授予 5,809 項工程,總造價 1,56,571 千萬印度盧比,完成 3,131 項工程,總造價 53,175 千萬印度盧比。同期,中央政府向各邦和中央直轄區提供了 2,723.5 億盧比用於智慧城市計劃。

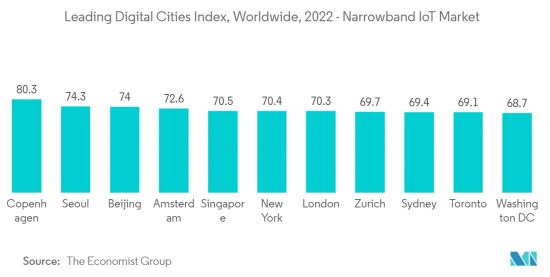

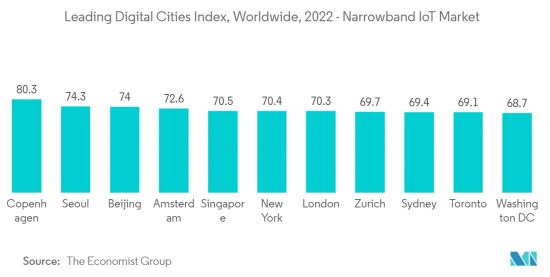

- 根據經濟學人集團統計,哥本哈根在2022年全球數位城市排名中以80.3分位居第一。首爾、北京、阿姆斯特丹和新加坡躋身最佳數位城市前五名。隨著智慧城市計畫的實施,物聯網和連網型設備的成長趨勢預計將在預測期內持續下去。由物聯網驅動的連接連網型設備(例如智慧電錶、智慧家庭、智慧照明和智慧交通)的日益普及可能會推動所研究市場的成長。

- 到 2030 年,沙烏地阿拉伯希望成為世界上最宜居的大都市,吸引最聰明的頭腦和人才。沙烏地阿拉伯已在285個城市投資5000億美元建設智慧城市。該國也正在建設NEOM City,這是一個全長200公里的未來城市,將充分利用人工智慧和物最尖端科技。

北美佔據主要市場佔有率

- 北美是幾家主要設備製造商和網路服務供應商的所在地,專注於工業和商業應用的測試和商業部署解決方案,為該行業創造了巨大的需求。此外,網際網路普及的上升、高速網際網路基礎設施網路的持續部署、智慧城市計劃的不斷增加以及可支配收入水平的上升,特別是在美國、加拿大、巴西和該地區其他國家,正在推動市場發展成長顯著,預計將佔據較大市場佔有率。

- 美國和加拿大都是新興經濟體,可以在研發方面投入大量資金。各產業重點領域的數位化不斷提高、技術不斷進步以及智慧連網型設備的普及不斷提高,正在推動北美窄頻物聯網市場的成長。連網型設備和相關網路基礎設施的使用不斷增加,以及網路、硬體和軟體供應商之間的協作不斷加強,是推動北美物聯網市場擴張的關鍵因素。

- 據思科稱,預計到 2022 年,美國和加拿大的人均設備和連接數量將達到最高。此外,工業界對物聯網設備的認知度明顯高於其他地區。 Mendix的研究顯示,78%的美國製造業工人歡迎數位化,十分之八的製造業工人有興趣學習新的數位技能。物聯網設備的增加可能會推動研究市場的需求。

- 2022 年 9 月,美國標準與技術研究院 (NIST) 發布了美國物聯網設備安全建議草案。由於物聯網經常因駭客攻擊和資料外洩而帶來網路安全風險,因此 NIST 的核心基準提供了建議的安全功能,製造商應將這些功能內建到物聯網設備中,並且消費者應在購物時檢查其設備的包裝盒和線上描述。重點強調了閱讀文字的指南。

- AT&T 等公司推出了窄頻物聯網網路來滿足客戶業務,提供智慧照明解決方案等各種物聯網產品。未來20年,全國城市將投資約41兆美元來發展智慧城市、智慧型能源和其他連網型,包括智慧照明。據聯邦政府稱,氣候智慧建築計畫將支出增加五倍,從 2021 年的 2.51 億美元增加到 2030 年的每年 12 億美元。智慧建築支出的大幅增加可能為智慧照明廠商創造多個開發新產品以贏得市場佔有率的機會。

- 許多政府已經開始考慮長期目標的智慧照明計劃。加拿大蒙特利爾聖洛朗區發起了一項創建智慧照明系統的計劃。該市節省了 50% 的能源支出,降低了近 55% 的維護成本,並減少了光污染。 Saint Laurent 大約 90% 的路燈已更換為 LED 燈。更換工作是蒙特利爾市和聖洛朗市正在進行的多項資本投資的一部分。蒙特利爾市支付了約 1.1 億美元的計劃,將 19 個城市的 132,000 盞路燈更換為 LED 燈。智慧照明的這種成長預計將為所研究的市場創造成長機會。

窄頻物聯網產業概況

全球窄頻物聯網市場適度整合,存在一些主要參與者。公司不斷投資於策略合作夥伴關係和產品開拓,以佔領更多的市場佔有率。最近的市場開拓包括:

- 2022 年 9 月 - 衛星通訊業者Sateliot 宣布正在利用低地球軌道 (LEO) 衛星開發直接衛星間窄頻聯網 (NB-IoT) 連接。本週,該公司宣布與 Amazon Web Services (AWS) 合作,為 NB-IoT 服務開發完全虛擬的雲端原生 5G 核心。 Sateriot打算透過漫遊協定向行動電話營運商提供無縫覆蓋,而不是出售服務本身。

- 2022 年 9 月 - 紐西蘭物聯網連接供應商 Vodafone NZ 與全球 GPS 和物聯網資產追蹤硬體和軟體公司 Digital Matter 合作,為紐西蘭企業提供完整的物聯網資產追蹤解決方案。透過將 Digital Matter 的大量電池供電物聯網資產監控設備與白標資產追蹤軟體、一流的 LTE-M (Cat-M1)、NB-IoT 連接和內部技術支援相結合,沃達豐紐西蘭將我們建立了完全託管的端到端資產管理解決方案。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場抑制因素

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 成分

- 網路

- 模組

- 部署

- 獨立的

- 帶內

- 保護帶

- 設備類型

- 穿戴式的

- 追蹤器

- 智慧電錶

- 智慧照明

- 警報器和偵測器

- 其他

- 目的

- 智慧城市

- 運輸/物流

- 能源與公用事業

- 零售

- 農業

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東/非洲

- 北美洲

第6章 競爭形勢

- 公司簡介

- Huawei Technologies Co., Ltd

- Ericsson Corporation

- Qualcomm Technologies

- AT&T Inc

- Verizon Wireless

- Nokia Corporation

- Vodafone Group

- SEQUANS Communications

- Intel Corporation

- Intel Corporation

- Deutsche Telekom

- Twilio

- SEQUANS Communications

第7章 投資分析

第8章 市場機會及未來趨勢

Narrowband IoT Market was valued at USD 4.55 billion in the previous year and is expected to register a CAGR of 31.82%, reaching USD 24.06 billion by the next five years. As a relatively new technology, NB-IoT is still in the early phases of adoption. However, in the upcoming years, it is anticipated to increase quickly.

Key Highlights

- The NarrowBand-Internet of Things (NB-IoT) is a standards-based low-power wide area (LPWA) technology designed to support a variety of innovative IoT products and services. NB-IoT dramatically increases system capacity, spectrum efficiency, and user device power consumption, especially in deep coverage.

- NB-IoT is a wireless telecommunications technology standard created by 3GPP, the worldwide standards body responsible for all significant mobile telecommunications standards, including 4G standards like LTE and 5G standards like 5G NR. The NB-IoT modules' low power consumption during signal processing contributes to a ten-year battery life.

- All significant manufacturers of mobile devices, chipsets, and modules support NB-IoT, which can coexist alongside 2G, 3G, and 4G mobile networks. Additionally, it gains the advantages of all mobile networks' security and privacy characteristics, including support for user identity confidentiality, entity authentication, confidentiality, data integrity, and mobile equipment identification.

- In particular, NB-IoT is used in smart cities, smart agricultural, and asset-tracking applications that need low data rates, long battery life, and wide-area coverage. It is ideal for IoT applications that demand massive connectivity since it enables the connection of many devices, generally in hundreds or even millions.

- The wearables sector is also predicted to contribute a major portion of the market due to the fast expanding demand for sports, fitness, and healthcare gadgets for personal care and diagnostics. While the younger population is encouraged to use sports and fitness bands due to rising disposable income levels and increased knowledge of the benefits of physical fitness, the use of healthcare bands is rising in developed nations.

- As a result of the NB-IoT technology's fast-expanding uses, an increasing number of technology firms and telecommunications service providers are projected to develop NB-IoT devices and roll out related services, accelerating market growth throughout the projection period. Big data analytics, artificial intelligence (AI), and machine learning (ML) advancements would allow firms to study enormous volumes of data obtained by watching and monitoring activities via IoT networks.

- Automobile manufacturers are responding to passenger safety concerns by implementing new technology that will undoubtedly provide safer, more convenient, and cost-effective transportation. As a result, NB-IoT is increasingly being used in the automobile industry due to its ability to precisely track vehicles, identify and avoid major traffic jams, and contribute to efficient traffic management.

- Additionally, the capacity of the NB-IoT network to reach deep underground and enclosed locations would allow for the deployment of IoT devices indoors and underground. However, the impending lack of standardized and affordable network pricing models and sufficient network coverage to support the vastly expanded IoT deployments limits industry growth.

Narrowband IoT Market Trends

Smart Cities is Expected to Drive the Market

- Advancements in mobile IoT networks solutions such as Nb-IoT from mobile operators offer a scalable, secure, and standardized way to connect smart city assets that offer a wide variety of services sustainably as they are particularly designed to meet the needs of smart city, the economics of using such technology is leading to improvement in value chain standardizes around networks and components.

- Additionally, in densely populated urban areas, cellular networks can manage traffic from a sizable number of IoT devices with little negative influence on network capacity. For instance, narrow band-IoT technology can handle a huge number of enormous IoT devices with little impact on network capacity, even in a dense metropolitan environment with 10,000 households per km2 and tens of thousands of installed IoT devices.

- The government's initiatives towards developing smart cities would allow the studied market to grow. For instance, in November 2022, the Smart Cities Council, a smart cities organization, began operations in the United Kingdom. The Smart Cities Council and its associated global impact program, "Everyone," bring together government, business, academia, philanthropy, and charity to take action and have an impact on the key challenges and possibilities that cities and communities face today. People, safety, beauty, sustainability, resilience, equity, and inclusion will be included in expanding "smart" from place and infrastructure in the United Kingdom.

- Further, According to the Union Housing and Urban Affairs Ministry, these Smart Cities recently bid out 6,452 projects totaling INR 1,84,998 crore. Work orders have been issued for 5,809 projects totaling INR 1,56,571 crore, with 3,131 projects totaling INR 53,175 crore completed. During the same period, the Central government provided INR 27,235 crore to states and union territories for smart city projects.

- According to the Economist group, Copenhagen was the leading worldwide digital city in 2022, according to the index rating above, with a score of 80.3. Seoul, Beijing, Amsterdam, and Singapore completed the top five list of best digital cities. With smart city initiatives, the trend of an increasing number of IoT and connected devices is expected to continue over the forecast period. The growing adoption of connected devices that include smart meters, smart homes, smart lighting, and smart transportation, among others that use IoT to connect, is likely to propel the growth of the studied market.

- By 2030, Saudi Arabia wants to have the most livable metropolis in the world, one that can draw the brightest brains and most talented people. To construct smart cities, the Kingdom has already set up USD 500 billion to invest across 285 municipalities. The nation is also constructing NEOM City, a futuristic 200 km long city with a wealth of cutting-edge technology that utilizes AI and IoT to the maximum.

North America Holds Major Market Share

- North America is home to several significant device makers and network service providers who focus on testing and commercial deployment of solutions for industrial and commercial applications, creating a massive demand for the industry. Additionally, the market is anticipated to contribute a sizeable share due to rising internet penetration, the continued rollout of high-speed internet infrastructure networks, the rise in smart city initiatives, and rising levels of disposable income, especially in economies like the United States, Canada, Brazil, and other nations in the region.

- The United States and Canada have developed economies that enable them to invest heavily in R&D. Rising digitization throughout the industrial emphasis areas, steady technological advancements, and rising penetration of smart connected devices have all contributed to the growth of the North American Narrowband IoT market. The increased usage of connected devices and associated network infrastructure, as well as the increased collaboration of network, hardware, and software providers, are the primary drivers that assist in expanding the IoT market in the North American region.

- According to Cisco, the United States and Canada are expected to have the highest average per capita devices and connections by 2022. Moreover, awareness about IoT devices in industries is significantly higher in the region compared to others. According to a study by Mendix, 78% of US manufacturing workers welcome digitalization; eight in ten manufacturing workers are interested in learning new digital skills. Such a rise in IoT devices would drive the demand for the studied market.

- In September 2022, The National Institute of Standards and Technology (NIST) issued Draft Security Recommendations for IoT Devices in the United States. Because IoT regularly poses a cybersecurity risk through hacks and data breaches, the NIST's Core Baseline highlights recommended security features for manufacturers to incorporate into their IoT devices and guidelines for consumers to look for on a device's box or online description while shopping.

- Companies like AT&T had launched NarrowBand IoT Network to cater to customers' business needs, providing them with a range of IoT offerings, including smart lighting solutions. Over the next 20 years, the cities in the country are planning to invest about USD 41 trillion to develop smart cities, smart energy, and other connected technologies, including smart lighting. According to the federal government, the Climate Smart Buildings Initiative is planned to boost performance contract spending from USD 251 million in FY2021 to USD 1.2 billion per year by 2030, a fivefold increase. Such a massive rise in spending on smart buildings would create several opportunities for the smart lighting players to develop new products to capture the market share.

- Many governments initiated smart lighting schemes with long-term goals in mind. Saint-Laurent, a borough of Montreal, Canada, launched an initiative to create a smart lighting system. The city saved 50% on energy expenditures, nearly 55% on maintenance costs, and reduced light pollution. Around 90% of the streetlamps on Saint-Laurent's roads have been replaced with LEDs. This replacement work was completed as part of numerous capital investment initiatives that the Ville de Montreal and the Arrondissement de Saint-Laurent run. The City of Montreal paid about USD 110 million in a project to replace 132,000 street lighting in 19 municipalities with LEDs. Such a rise in smart lighting is expected to create opportunities for the studied market to grow.

Narrowband IoT Industry Overview

The Global Narrowband IoT Market is moderately consolidated, with the presence of a few major companies. The companies continuously invest in strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- September 2022 - Sateliot, a satellite communication operator, announced that it is developing direct-to-satellite narrowband IoT (NB-IoT) connectivity using Low Earth Orbiting (LEO) satellites. This week, the business announced a collaboration with Amazon Web Services (AWS) to develop a completely virtualized cloud-native 5G core for its NB-IoT service, which is slated to be commercially operational in the second half of 2023. Rather than selling the service itself, Sateliot intends to provide seamless coverage for cell operators through roaming agreements.

- September 2022 - Vodafone NZ, New Zealand's IoT connection provider, has worked with Digital Matter, a global player in GPS and IoT asset tracking hardware and software, to provide complete IoT asset tracking solutions for New Zealand businesses. Vodafone NZ has created a fully managed, end-to-end asset management solution by combining numerous battery-powered IoT asset monitoring devices from Digital Matter with white-label asset tracking software, best-in-class LTE-M (Cat-M1), NB-IoT connection, and in-house technical support.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain Analysis

- 4.5 Porters Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assestment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Component

- 5.1.1 Network

- 5.1.2 Module

- 5.2 Deployment

- 5.2.1 Standalone

- 5.2.2 In-band

- 5.2.3 Guard-band

- 5.3 Device Type

- 5.3.1 Wearables

- 5.3.2 Tracker

- 5.3.3 Smart Meter

- 5.3.4 Smart Lighting

- 5.3.5 Alarm & Detector

- 5.3.6 Others

- 5.4 Application

- 5.4.1 Smart Cities

- 5.4.2 Transportation & Logistics

- 5.4.3 Energy & Utilities

- 5.4.4 Retail

- 5.4.5 Agriculture

- 5.4.6 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of Latin America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Huawei Technologies Co., Ltd

- 6.1.2 Ericsson Corporation

- 6.1.3 Qualcomm Technologies

- 6.1.4 AT&T Inc

- 6.1.5 Verizon Wireless

- 6.1.6 Nokia Corporation

- 6.1.7 Vodafone Group

- 6.1.8 SEQUANS Communications

- 6.1.9 Intel Corporation

- 6.1.10 Intel Corporation

- 6.1.11 Deutsche Telekom

- 6.1.12 Twilio

- 6.1.13 SEQUANS Communications