|

市場調查報告書

商品編碼

1435839

電磁場模擬軟體:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Electromagnetic Simulation Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

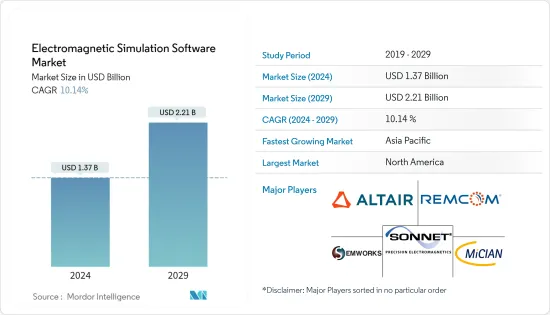

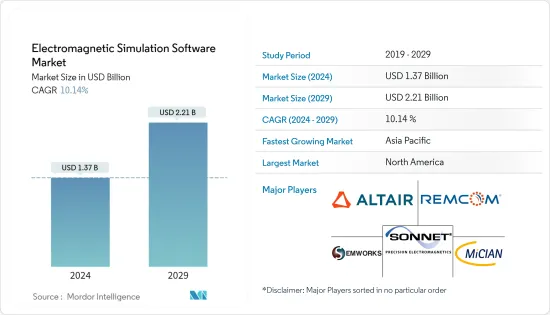

電磁場模擬軟體市場規模預計到 2024 年為 13.7 億美元,預計到 2029 年將達到 22.1 億美元,在預測期內(2024-2029 年)成長 10.14%。複合年成長率為

主導驅動的產品開發方法主要為多種課題提供有效的解決方案。模擬使工程團隊能夠在組件和系統層級的各種操作條件下快速評估設計的性能。該軟體還可以快速分析數十種初步設計方案,並對選定的少數產品進行上市前所需的嚴格測試。

主要亮點

- 技術進步和對自動化的日益依賴預計將迅速增加對耐用消費品、電子產品和高階技術產品的需求,從而推動市場。隨著網際網路在全球變得越來越普及,供應商尋求提高速度和連接性,從而促進了 5G 的發展。過去幾年,工業、商業、汽車和通訊系統對低成本、精確電磁場模擬軟體的需求也迅速成長。

- 此外,電網基礎設施正變得越來越數位化和互聯,確保關鍵數位通訊的可靠和安全。因此,智慧電網基礎設施至關重要,無論是變電站還是住宅環境。智慧電錶和系統控制可實現監控設備運作狀況、電網擁塞和穩定性所需的即時測量,是智慧電網不可或缺的一部分。電磁場模擬軟體主要用於分析智慧電錶主要部件的工頻磁場干擾。隨著智慧電錶的大規模引入,預計會有進一步的需求。

- 根據美國能源局預測,到2024年,美國對先進計量基礎設施(AMI)等智慧電網設備或系統的投資預計將達到64億美元。隨著一些國家大力投資智慧電網,全球市場預計在未來十年將繼續成長。

- 多輸入多輸出(MIMO)技術是天線的最新迭代。由於該技術具有廣泛的優勢,包括擴展通訊和 3D 波束成形,因此採用率預計將快速成長,特別是在北美和歐洲等先進通訊市場。

- 持續的 COVID-19感染疾病迫使所有行業的組織要么完全關閉製造業,要么允許所有員工在家工作。這促使多種目的使用網路的顯著增加,例如查看線上媒體內容、對其他任務的呼叫增加以及對現有網路造成壓力的幾個因素。因此,通訊業參與者尋找像 MIMO 這樣為消費者提供不間斷服務的解決方案已變得至關重要。

電磁場模擬軟體市場趨勢

通訊業預計將推動市場成長

- 隨著LTE的不斷引入以及無線連接技術領域的進步,例如通用封包服務(GPRS)、Wi-Fi和微波接入全球互通性(WiMax)在各個領域的應用,隨著使用的設備數量不斷增加,電磁模擬軟體用於執行高保真 3-D EM 模擬、分析幾何尺度變化、執行熱機械應力分析以及最佳化天線設計,這促使了其成長。

- 由於頻譜可用性以及部署下一代行動網路所需的大量時間和成本,成熟市場中的大多數行動網路營運商計劃在未來幾年內升級到 5G。領先的公司與技術供應商合作,加快流程並提高其在通訊市場的競爭力。

- 例如,2020 年 2 月,三星電子與美國 Cellular 合作開發 5G 和 4G LTE 網路解決方案。該協議允許為美國數百萬客戶提供行動服務的領先提供商美國 Cellular 購買三星商業性驗證的網路解決方案,包括5G 新無線電(NR) 技術,並將突破性的4G LTE 和5G 技術擴展到您的服務中。消費者和商業應用程式的客戶群正在不斷成長。

- 此外,電子公司正專注於新產品開發,例如 5G MIMO 微帶天線,並正在考慮各種結構,以滿足不同應用經常相互衝突的需求。例如,2020 年 2 月,Fractus Antennas 推出了一款只有米粒大小的新型多頻段 5G 和蜂巢式物聯網天線增強器。它提供全球連接並解決通用的尺寸課題,因為其尺寸僅為 7.0 毫米 x 3.0 毫米 x 1.0 毫米。單天線可覆蓋824 MHz至5 GHz的2G、3G、4G和5G頻寬。天線設計的進一步進步將大大推動模擬軟體市場的發展。

北美佔有很大的市場佔有率

- 北美被認為是全球行動通訊和 MIMO 技術最先進的市場之一。根據 GSMA 的數據,2019 年美國獨立行動用戶數量為 2.81 億,預計到 2025 年將成長至 2.97 億。

- 在美國,AT&T、Verizon、T-Mobile 和 Sprint 等主要營運商佔據了所有訂閱量的近 95%。隨著大多數公司大力投資 5G 技術,預計 MIMO 在預測期內該地區的採用率將大幅上升,從而推動市場發展。

- 有了這樣的發展,多輸入多輸出技術預計在預計的時期內將在北美地區顯示出突出的地位。 Baylin Technologies 的子公司 Galtronics USA 為北美一家主要通訊業者推出了 6 英尺、12 埠基地台(宏)天線。基地台天線支援所有北美中頻頻率,具有八個端口,並在現有 Cellular 850頻寬、LTE 700頻寬和新的 600 MHz頻寬上實現真正的 4x4 MIMO。

- 智慧型手機、平板電腦和人工智慧輔助電子產品在該地區正在經歷高速成長。預計這將影響該地區的市場成長。根據消費者科技協會(CTA)進行的美國消費者技術銷售和預測研究,2018年和2019年智慧型手機產生的收益分別為791億美元和775億美元。加拿大也是世界上最大的消費性電器產品生產國之一。

- 該地區的汽車產業預計將為市場帶來重大機會。隨著產業動態的變化,汽車製造商正在轉向電動車,以滿足下一代消費者的需求。

- 然而,由於 COVID-19感染疾病,美國汽車製造商面臨越來越大的關閉工廠的壓力。自從聯邦、州和地方政府開始鼓勵人們盡可能待在家裡以來。這導致了各個行業的供應鏈中斷。

電磁場模擬軟體產業概況

電磁模擬軟體市場由 Remcom Inc.、Altair Engineering Inc.、Mician GmbH、Sonnet Software, Inc. 和 ElectroMagneticWorks, Inc. 等幾家大型企業集中並主導。擁有重要市場佔有率的主要參與者正在專注於擴大海外客戶群。這些公司正在利用策略合作舉措來提高市場佔有率和盈利。然而,隨著技術進步和產品創新,中小企業正在透過贏得新合約和開拓新市場來增加其市場佔有率。市場的一些主要發展是:

- 2023 年 1 月 - Remcom 宣布發布 XFdtd 3D 電磁模擬軟體。這為XFdtd的原理圖編輯器添加了分析工具,讓使用者可以輕鬆調整元件值以滿足設計目標並了解電路行為,進一步擴展了軟體的工具集。實現綜合匹配網路設計。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代產品的威脅

- 競爭公司之間的敵意強度

- 評估感染疾病-19 對電磁場模擬軟體市場的影響

第5章市場動態

- 市場促進因素

- 提高求解器工具的使用率來處理大量組件形狀和尺寸

- 射頻模組、MMIC、RFIC 設計的應用不斷增加

- 市場限制因素

- 模擬器所需的計算密集型處理的複雜性

第6章 電磁仿真方法

- 積分或微分方程求解器

- 矩量法 (MOM)

- 多層次快速多極子方法(MLFMM)

- 時域有限差分 (FDTD)

- 有限元素法(FEM)

- 漸近法

- 物理光學(PO)

- 幾何光學 (GO)

- 均勻衍射理論(UTD)

- 其他數值方法

第 7 章. 相關用例與案例研究

第8章 主要應用領域

- 天線設計與分析

- 行動裝置

- 汽車雷達

- 生物醫學科學

- 無線電傳播

- 其他用途

第9章市場區隔

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第10章競爭形勢

- 公司簡介

- Remcom Inc.

- EMPIRE(IMST GmbH)

- Altair Engineering Inc.

- WIPL-D doo

- Mician GmbH

- Sonnet Software Inc.

- ElectroMagneticWorks Inc.

- COMSOL Inc.

- Keysight Technologies

- ANSYS Inc.

- Dassault Systmes SE

- Cadence Design Systems Inc.

- ESI Group

第11章比較分析

第12章投資分析

第13章市場的未來

The Electromagnetic Simulation Software Market size is estimated at USD 1.37 billion in 2024, and is expected to reach USD 2.21 billion by 2029, growing at a CAGR of 10.14% during the forecast period (2024-2029).

A simulation-driven approach toward product development primarily offers an effective solution to multiple challenges. The usage of simulation enables the engineering teams to quickly assess the performance of their designs under a wide range of operating conditions, at both the component and systems levels. This software can also rapidly analyze dozens of preliminary design choices and then subject a chosen few to the rigorous testing that must precede any market launch.

Key Highlights

- The rapidly rising demand for consumer durables, electronics goods, and high-end technology products owing to technological advancement and increased dependency on automation is expected to drive the market. The increasing penetration of the internet across the world has encouraged vendors to improve their speed and connectivity, which has led to the development of 5G. The demand for low-cost, accurate, electromagnetic simulation software has also grown rapidly during the past few years in the industrial, commercial, automotive, and communications systems.

- Moreover, the power grid infrastructure is increasingly becoming digitized and connected, ensuring the reliable and secure flow of critical digital communications. Thus, smart grid infrastructure, whether in a power substation or residential setting, is vital. Smart meters enabling the real-time measurements needed to monitor equipment health, grid congestion, and stability, and system control form an integral part of smart grids. The electromagnetic simulation software is primarily being used to analyze the interference of the power-frequency magnetic field from the key parts of these smart meters. It is expected to witness further demand owing to the large-scale deployment of these smart meters.

- According to the US Department of Energy, investment on smart grid devices or systems, such as advanced metering infrastructure (AMI), was expected to reach USD 6.4 billion by 2024 in the United States. As several countries have made substantial investments in smart grids, the global market is expected to continue to grow throughout the decade.

- The multiple-input and multiple-output (MIMO) technology is the most recent iteration of antennas. With a wide range of advantages, such as increased range and 3D beamforming, it is expected that this technology will rapidly expand the adoption rates of this technology, especially in the advanced telecommunication markets, like North America and Europe.

- The ongoing pandemic of COVID-19 has propelled the organizations in all the sectors to either stop their manufacturing completely or grant work from homes to all of their employees. This has significantly increased internet usage for multiple purposes, such as browsing online media content, increased calling among other works, and some of the factors that are putting a burden on the existing networks. Therefore, it has become imperative for the telecom industry players to look for solutions like MIMO to provide uninterrupted services to its consumers.

Electromagnetic Simulation Software Market Trends

Telecommunication Sector is Expected to Drive the Market Growth

- The ongoing deployment of LTE and advancements in the field of wireless connectivity technologies, such as general packet radio service (GPRS), Wi-Fi, and worldwide interoperability for microwave access (WiMax) in various fields have boosted the number of connected devices and has led to the growth of electromagnetic simulation software, as they are used to conduct high-fidelity 3-D EM simulations, analyze geometric-scale variations, perform thermomechanical stress analysis, and optimize antenna design.

- The majority of mobile network operators in mature markets are planning to upgrade into 5G in the next few years due to spectrum availability and the sheer time and costs involved in rolling out the next generation of mobile networks. Major players partner with the technology provider to speed up the process and be competitive in the telecom market.

- For instance, in February 2020, Samsung Electronics Co. Ltd collaborated with US Cellular for 5G and 4G LTE network solutions. Through the agreement US Cellular, a key provider of mobile services to millions of customers across the United States, can purchase Samsung's commercially-proven network solutions, including 5G New Radio (NR) technology, and will extend groundbreaking 4G LTE and 5G technology to its customers base, expanding in consumer and business applications.

- Moreover, electronic companies are focusing on new product development, such as 5G MIMO microstrip antenna, to consider a wide variety of structures to meet the often-conflicting needs for different applications. For instance, in February 2020, Fractus Antennas launched a new multi-band 5G and cellular IoT antenna booster as tiny as a rice grain. It provides global connectivity and solves the common challenge of size as it is of only 7.0 mm x 3.0 mm x 1.0 mm in size. A single antenna can cover 2G, 3G, 4G, and 5G frequency bands from 824 MHz to 5 GHz. More advancement in the antenna design will propel the simulation software market significantly.

North America to Hold a Significant Market Share

- North America is considered to be one of the most advanced markets for mobile communications and MIMO technology in the world. According to the GSMA, the number of unique mobile subscribers in the United States was 281 million in 2019 and is expected to increase by up to 297 million by 2025.

- In the United States, major players, such as AT&T, Verizon, T-Mobile, and Sprint, account for nearly 95% of all subscriptions. With most of the firms making significant investments in 5G technology, MIMO's usage is expected to witness a surged rate of adoption in this region during the forecast period, thereby driving the market.

- Owing to such developments, the multiple input multiple output technologies in the North American region are expected to showcase a prominent position in the foreseen period. Adding to the scenario, Galtronics USA, a subsidiary of Baylin Technologies, has introduced a six-foot, 12-Port base station (macro) antenna for major North American carriers. The base station antenna supports all of the North American mid-band frequencies on eight of its ports and true 4x4 MIMO on the existing Cellular 850 band, LTE 700 band, and the new 600 MHz band.

- Smartphones, tablets, and AI-assisted electronics are experiencing high growth in the region. This is expected to influence the growth of the market in the region. According to the US Consumer Technology Sales and Forecast study conducted by the Consumer Technology Association (CTA), the revenue generated by smartphones was valued at USD 79.1 billion and USD 77.5 billion in 2018 and 2019, respectively. Canada is also one of the largest producers of consumer electronics in the world.

- The region's automotive sector is expected to offer significant opportunities to the market. With changing dynamics in the industry, automotive manufacturers are moving toward electric vehicles to meet next-generation consumers' needs.

- However, automakers in the United States have faced increased pressure to shut down their factories owing to the COVID-19 pandemic. After the federal, state, and local governments started recommending people stay in their homes as much as possible. This has caused supply chain disruptions across various industries.

Electromagnetic Simulation Software Industry Overview

The electromagnetic simulation software market is concentrated and dominated by a few major players, like Remcom Inc., Altair Engineering Inc., Mician GmbH, Sonnet Software, Inc., and ElectroMagneticWorks, Inc. The major players, with a prominent share of the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies increase their market presence by securing new contracts and tapping new markets. Some of the key developments in the market are:

- January 2023 - Remcom announced the release of XFdtd 3D electromagnetic simulation software, which enables users to easily adjust component values in order to meet design objectives and understand circuit behavior, when adding an analysis tool into the schematic editor of XFdtd, further expands this software's toolset for comprehensive matching network designs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Electromagnetic Simulation Software Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Utilization of Solver Tools to Handle a Multitude of Component Shapes and Sizes

- 5.1.2 Increasing Applications in RF Module, MMIC, and RFIC Design

- 5.2 Market Restraints

- 5.2.1 Complexity Regarding Computationally-Intensive Processing Required by Simulators

6 METHODS OF ELECTROMAGNETIC SIMULATION

- 6.1 Integral or Differential Equation Solvers

- 6.1.1 Methods of Moments (MOM)

- 6.1.2 Multilevel Fast Multipole Method (MLFMM)

- 6.1.3 Finite Difference Time Domain (FDTD)

- 6.1.4 Finite Element Method (FEM)

- 6.2 Asymptotic Techniques

- 6.2.1 Physical Optics (PO)

- 6.2.2 Geometric Optics (GO)

- 6.2.3 Uniform Theory of Diffraction (UTD)

- 6.3 Other Numerical Methods

7 RELEVANT USE-CASES AND CASE STUDIES (Major use-cases and case studies, such as Surrogate Models for Antenna Placement on Large Platforms and Development of Wireless Sensors to Detect Lightning, will be discussed)

8 KEY APPLICATION AREAS (Qualitative Analysis pertaining to major applications such as 5G MIMO, Circuit co-simulation, among others, will be provided)

- 8.1 Antenna Design and Analysis

- 8.2 Mobile Device

- 8.3 Automotive Radar

- 8.4 Biomedical

- 8.5 Wireless Propagation

- 8.6 Other Applications

9 MARKET SEGMENTATION

- 9.1 Geography

- 9.1.1 North America

- 9.1.2 Europe

- 9.1.3 Asia-Pacific

- 9.1.4 Rest of the World

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 Remcom Inc.

- 10.1.2 EMPIRE (IMST GmbH)

- 10.1.3 Altair Engineering Inc.

- 10.1.4 WIPL-D d.o.o.

- 10.1.5 Mician GmbH

- 10.1.6 Sonnet Software Inc.

- 10.1.7 ElectroMagneticWorks Inc.

- 10.1.8 COMSOL Inc.

- 10.1.9 Keysight Technologies

- 10.1.10 ANSYS Inc.

- 10.1.11 Dassault Systmes SE

- 10.1.12 Cadence Design Systems Inc.

- 10.1.13 ESI Group