|

市場調查報告書

商品編碼

1333811

數位全息市場規模和份額分析 - 增長趨勢和預測(2023-2028)Digital Holography Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

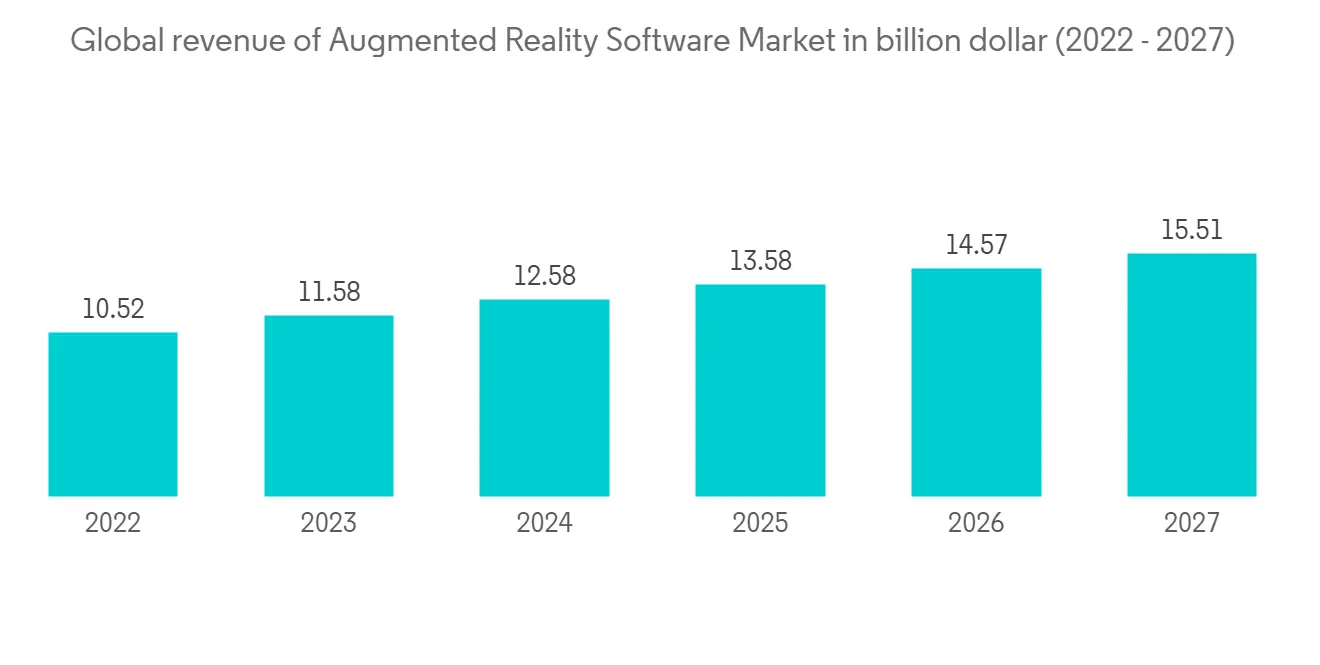

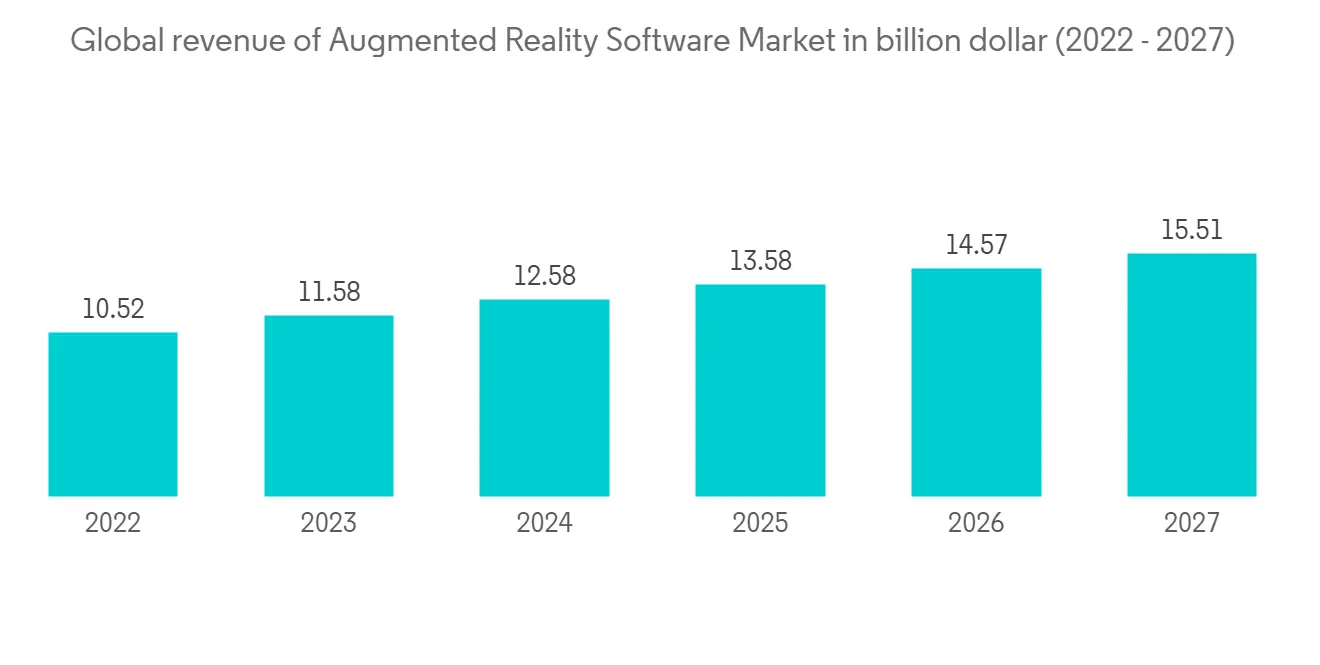

數位全息市場規模預計將從2023年的49.2億美元增長到2028年的106.9億美元,預測期內(2023-2028年)複合年增長率為16.79%。

數位全息術需要兩個波來生成全息圖並同時記錄定量相位和幅度圖像。這一新穎的想法可實現快速 3D 成像,並已在多個應用場景中得到驗證。每個行業,包括房地產、醫療保健、教育和零售,都在轉向 3D 世界,以更準確地了解其商業模式。

主要亮點

- 零售商可以採用自助服務亭,顧客可以在其中觸摸全息產品,從而帶來全新的參與度,並最終確保無摩擦的購物體驗,從而獲得更大的視野,並可能帶來銷售。在賓夕法尼亞州,Coen Markets 開設了兩家收銀店。Grabango 應用程序允許客戶無需前往收銀台即可付款。

- 全息成像技術將促進生物醫學研究、醫療保健、生命科學以及醫學教育和培訓。為了更好地為醫學生做好準備,劍橋大學酒店管理學院 (CHU) 及其教育學院引入了混合現實。借助由 CUH 和大學教育學院與科技公司 GigXR 合作開發的應用程序,使用 Microsoft HoloLens 混合現實耳機的學生將能夠與多層、醫學上準確的全息患者進行互動。可以實時看到彼此。

- 由於物鏡和專門的數位圖像處理設備的成本,從 2D 到 3D 全息的適應成本很高。此外,處理全息圖的計算成本很高,限制了該技術的應用範圍。

- 在新冠肺炎 (COVID-19) 疫情期間,社會隔離、遠程就業和在線教育使企業意識到需要採用現代方法。這增加了許多行業對 AR 和 VR 為用戶提供沉浸式體驗的需求。針對遊戲愛好者,VividQ 和 Dispelix 設計了可用於 AR 耳機和智能眼鏡的全息技術。遊戲玩家可以參與沈浸式增強現實體驗,其中數位內容顯示在真實環境中,並允許輕鬆舒適的交互。

數位全息市場趨勢

數位全息顯示佔據主要市場份額

- 通過使用數位標牌,您可以有效地吸引顧客的興趣。全息顯示技術增強營銷效果,讓用戶不受頭戴設備的束縛,享受內容。

- 根據Queppelin的研究,美國有5740萬活躍VR用戶,AR-VR市場預計將達到1.5萬億美元。虛擬現實等沉浸式技術預計將對醫療保健行業產生重大影響。

- 2022 年 6 月,Looking Glass 推出了世界上最大的全息顯示器。65 英寸、8K 分辨率的屏幕比以前的 3D 全息顯示器大五倍,並且不需要特殊設備即可查看圖像。這種新的顯示屏是“群組可觀看”的,這使其與一些一次只能由一個人觀看的競爭產品區分開來。

- 2022 年 10 月,總部位於印度的智能家居鏡子公司 PORTL 宣布計劃在商店、會議室、教室和其他可以發揮作用的地方設計櫥櫃大小的全息顯示器。這些 PORTL EPIC 設備的用途之一是在消費者做出購買決定之前進行全身視頻聊天、產品查看和評估。

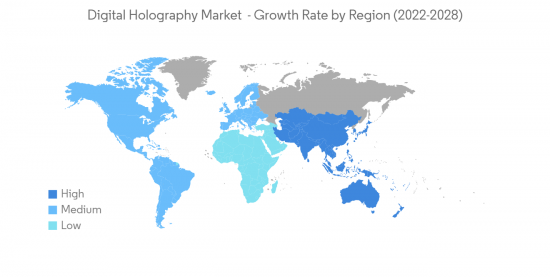

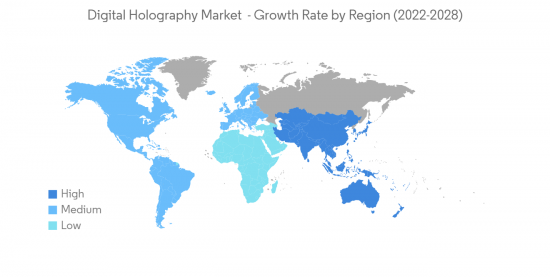

亞太地區實現顯著增長

- 亞太地區正在經歷數位技術採用速度最快的地區。隨著越來越多的國家建設智慧城市,虛擬世界將變得越來越重要。房地產、醫療保健、教育和零售等行業都在轉向 3D 世界,以更清晰、更準確地了解其商業模式。例如,總部位於新加坡的 Vigeo Technologies 構建了新加坡城市的數位孿生,為消費者提供無縫的 3D 體驗。日本 CAD 中心使用尖端軟件創建了類似的大阪和東京 3D 地圖,以創造身臨其境的體驗。

- 2022 年 1 月,日本的一家 7-11 商店安裝了浮動全息顯示屏,無需身體接觸即可工作,使現場購物更加安全。使用這款 Digi POS,觸摸屏界面似乎漂浮在顧客面前,但後面排隊的人根本看不到任何東西。

- 2022 年 12 月,鞋履製造商 Bata 推出了 3D OOH 廣告牌。這種創新的3D戶外廣告方式吸引了人們對該公司銷售的各種運動鞋的關注。該廣告牌利用變形圖像內容生成來提供具有視覺吸引力的三維內容。

數位全息行業概況

數位全息市場高度分散,由幾個大型競爭對手組成,其產品組合具有可比性,並且存在被替代的危險。為了保持競爭力並擴大客戶群和市場份額,供應商定期投資研發以改進其產品線、將更多產品線投入使用並擴展其產品線。

2022 年 11 月,真人大小的全息通信解決方案提供商 Proto 與人工智能對話視頻平台製造商 StoryFile 合作,創建了Walmart創始人 Sam Walton 的全息圖。數位複製為這張全息圖最終將在Walmart博物館展出,向參觀者講述Walmart的早期歷史、公司的核心價值觀、沃爾頓的商業規則等等。

2023年2月,領先的全息公司Looking Glass獲得了Accenture的投資。通過此次合作,Accenture將加速從 2D 到 3D 的轉變。Look Glass 構建了一個端到端全息平台,其中包含一系列顯示器,可以實時顯示 3D 材料,而無需耳機或頭部跟蹤。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查假設

- 調查範圍

第二章研究方法論

第三章執行摘要

第四章市場動態

- 市場概況

- 市場驅動力

- 市場製約因素

- 行業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對行業的影響

第五章市場細分

- 提供

- 硬件(分光鏡、CCD相機、激光器等)

- 軟件

- 應用

- 數位全息顯示

- 數位全息顯微鏡

- 全息臨場感

- 按終端用戶行業

- 醫療保健

- 航空航天與國防

- 商業的

- 教育

- 自動化

- 其他終端用戶行業

- 區域

- 北美

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 亞太其他地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合酋長國

- 沙特阿拉伯

- 其他中東和非洲

- 北美

第六章 競爭格局

- 投資分析

- 公司簡介

- RealView Imaging Ltd

- Lyncee TEC SA

- Phase Holographic Imaging AB

- Eon Reality

- Geola Digital Uab

- MetroLaser Inc.

- Leia Inc.

- Intelligent Imaging Innovations

- Light Logics Holography and Optics

- Mit Media Lab

- Jasper Display Corporation

- Holmarc Opto-Mechatronics Pvt. Ltd

第七章市場機會與未來趨勢

The Digital Holography Market size is expected to grow from USD 4.92 billion in 2023 to USD 10.69 billion by 2028, at a CAGR of 16.79% during the forecast period (2023-2028).

Two waves are required to produce a hologram and simultaneously record quantitative phase and amplitude images in digital holography. Several application scenarios have demonstrated how this novel idea enables quick 3D imaging. Every industry, including real estate, healthcare, education, and retail, turns to the 3D world to get a more precise and accurate picture of their business models.

Key Highlights

- Retailers can incorporate self-service kiosks where customers may engage with a holographic product, bringing an entirely new level of engagement that could ultimately result in greater sales to ensure a frictionless shopping experience. In Pennsylvania, Coen Markets opened two checkout-fee stores; with the aid of the Grabango app, customers may make payments without going through a checkout process.

- Holographic imaging technology boosts biomedical research, healthcare, life sciences, and medical education and training. To better prepare medical students, Cambridge University Hospitals (CHU) and the university's education faculty have introduced mixed reality. Students using Microsoft HoloLens mixed reality headsets can see each other in real-time while engaging with a multi-layered, medically accurate holographic patient thanks to an app that CUH and the university's faculty of education developed in collaboration with tech company GigXR.

- Adopting 3D holography from 2D involves significant expense due to the high cost of objective lenses and specialized digital imaging equipment requirements. Due to the higher computing costs associated with processing holograms, the approach also has a limited range of applications.

- Businesses became aware of the necessity of adopting the newest approaches during COVID-19 due to social estrangement, remote employment, and online education. This increased the need for AR and VR in numerous industries to provide users with a real-life experience. For gaming lovers, VividQ and Dispelix designed a holographic tech that can be used with AR headsets or smart glasses. Gamers can take part in immersive augmented reality experiences where digital content is displayed in the real environment for easy and comfortable interaction.

Digital Holography Market Trends

Digital Holographic Displays to Hold the Significant Market Share

- Customers' interest can be effectively drawn in by using digital signage. Holographic display technology will increase marketing effectiveness and let users enjoy content without headgear restrictions.

- According to a survey by Queppelin, there are 57.4 million active VR users in the US, and the AR-VR market is projected to reach USD 1.5 trillion. Immersive technology, such as virtual reality, is expected to impact the healthcare sector significantly.

- In June 2022, Looking Glass introduced the world's largest holographic display. The 65-inch, 8K-resolution screen is five times bigger than any previous 3D holo display and requires no special equipment to see the visuals. The new display is "group viewable," distinguishing it from several competing products that one person can only view at a time.

- In October 2022, an India-based startup PORTL, an Intelligent Home Mirror, announced plans to design cabinet-sized holographic displays in places that might be useful, like stores, meeting rooms, or even classrooms. One application for these PORTL EPIC devices is full-body video chatting, product browsing, and evaluation before a consumer decides to purchase.

Asia-Pacific to Witness Significant Growth

- The adoption of digital technology has been the fastest in Asia-Pacific. The metaverse will become increasingly important as more nations build smart cities. Every industry, including real estate, healthcare, education, and retail, is turning to the 3D world to get a clearer and more accurate picture of their business models. For instance, Vizzio Technologies, based in Singapore, built a digital twin of the city of Singapore to give consumers a seamless 3D experience. A similar 3D map of Osaka and Tokyo was produced by the CAD Center in Japan, utilizing cutting-edge software to create immersive experiences.

- In January 2022, to make in-person buying safer, 7-Eleven Stores in Japan installed floating holographic displays that function without any physical contact. With the use of this Digi POS, a touchscreen interface will appear to be floating in midair in front of a customer while those in line behind them see nothing at all.

- In December 2022, footwear company Bata unveiled 3D OOH Billboards. This novel method of 3D outdoor advertising draws attention to the range of sneakers the company sells. The billboard makes use of an anamorphic image content generation method to provide content that appears in three dimensions and is visually appealing.

Digital Holography Industry Overview

Due to comparable portfolio offerings and the danger of alternatives, the digital holography market is highly fragmented and comprises multiple sizeable competitors. To maintain their competitive edge and grow their customer base and market share, the vendors regularly invest in R&D to improve their product lines, bring more product lines into practical applications, and expand their product lines.

In November 2022, Sam Walton, the founder of Walmart, was digitally recreated as a hologram by Proto, a provider of life-sized holographic communications solutions, in collaboration with StoryFile, the maker of an AI-powered conversational video platform. The hologram will eventually be on display in The Walmart Museum to inform visitors about the early history of Walmart, the company's core values, Walton's rules of business, and more.

In February 2023, the leading holographic company, Looking Glass, received funding from Accenture. Accenture will speed up the transition from 2D to 3D through this partnership. Looking Glass has built an end-to-end holographic platform with a selection of monitors that can display material in real-time 3D without the need for headsets or head-tracking.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Offering

- 5.1.1 Hardware (Beam Splitter, CCD Camera, Laser, and Others)

- 5.1.2 Software

- 5.2 Application

- 5.2.1 Digital Holographic Displays

- 5.2.2 Digital Holographic Microscopy

- 5.2.3 Holographic Telepresence

- 5.3 End-user Vertical

- 5.3.1 Medical

- 5.3.2 Aerospace and Defense

- 5.3.3 Commercial

- 5.3.4 Education

- 5.3.5 Automation

- 5.3.6 Other End-user Verticals

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Investment Analysis

- 6.2 Company Profiles

- 6.2.1 RealView Imaging Ltd

- 6.2.2 Lyncee TEC SA

- 6.2.3 Phase Holographic Imaging AB

- 6.2.4 Eon Reality

- 6.2.5 Geola Digital Uab

- 6.2.6 MetroLaser Inc.

- 6.2.7 Leia Inc.

- 6.2.8 Intelligent Imaging Innovations

- 6.2.9 Light Logics Holography and Optics

- 6.2.10 Mit Media Lab

- 6.2.11 Jasper Display Corporation

- 6.2.12 Holmarc Opto-Mechatronics Pvt. Ltd