|

市場調查報告書

商品編碼

1435861

低 GWP 冷媒:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029 年)Low GWP Refrigerant - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

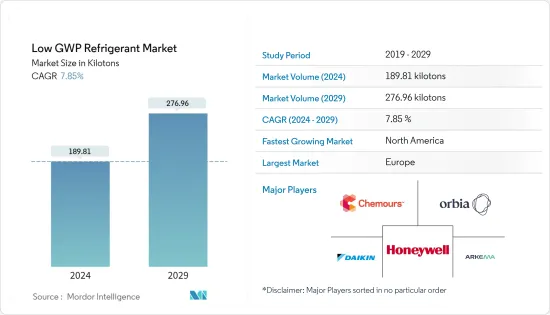

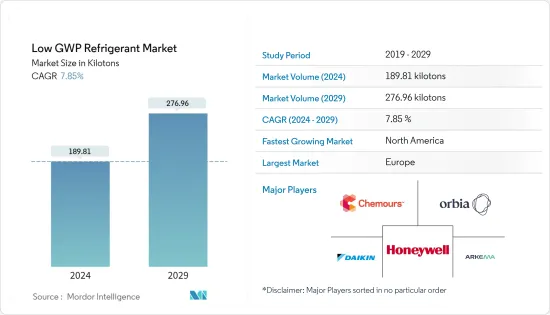

低GWP冷媒市場規模預計到2024年為189,810噸,預計2029年將達到276,960噸,在預測期內(2024-2029年)複合年成長率為7.85%。

低 GWP 冷媒市場受到冠狀病毒感染疾病(COVID-19) 大流行的負面影響。然而,由於製藥、住宅和商業等應用的增加,市場在 2021 年顯著復甦。

主要亮點

- 低環境影響和嚴格的法規可能是中期內低 GWP 冷媒市場成長的主要驅動力。

- 然而,由於高易燃性和其他有毒特性,低 GWP 冷媒市場的成長預計將受到限制。

- 儘管如此,推廣低全球升溫潛能值冷媒的發展可能很快就會為全球市場創造利潤豐厚的成長機會。

- 歐洲是最大的市場,最大的消費國包括德國和英國。

低GWP冷媒市場趨勢

商務用冷凍佔據市場主導地位

- 空調和冷凍應用對全球暖化潛值 (GWP) 較低的冷媒解決方案的需求不斷增加。這些低 GWP 冷媒會增加能源消耗,帶來安全風險,並且需要對設備進行重大改造。

- 此外,與HFC和CFC相比,它們主要用於將服務設備的能源消耗和碳排放減少50%。

- 空調和冷凍應用對全球暖化潛值 (GWP) 較低的冷媒解決方案的需求不斷增加。這些低 GWP 冷媒會增加能源消耗,帶來安全風險,並且需要對設備進行重大改造。

- 使用低 GWP 冷媒對於涉及食品安全等多種應用的商務用冷凍領域。醫藥業倉儲、商務用空調。

- 日本空調冷凍協會2022年6月發布的資料顯示,2021年全球商務用空調需求大幅成長,達1,488萬台。同年,北美以737萬台的總合位居榜首,超過了前一年的成績。

- 海爾智家預計,2022年亞洲空調零售量預計將達到1.323億台,2024年將達到1.474億台。

- 此外,根據OEA(印度)的數據,2022年空調批發價格指數達到119.4。

- 隨著對冷凍食品的需求不斷增長和獲利率低的競爭市場,大多數食品加工商、分銷商和零售商正在從人工操作的過時設施轉向商業製冷設備被廣泛採用的高層冷凍倉庫。

- 此外,跨國公司零售食品鏈的擴張和國際貿易的成長(由於貿易自由化)正在增加對低溫運輸流程的需求。這促使世界各地對商務用冷凍的需求增加。

德國將主導歐洲市場

- 德國經濟是歐洲第一大經濟體,世界第五大經濟體。德國擁有強大的製造業,尤其是機械和汽車領域。這使得該國能夠在國際貿易中保持競爭力並吸引外國投資。

- 日本空調冷凍工業協會2022年6月發布的資料顯示,2021年德國商務用空調銷售量大幅成長,需求量達5萬台。與去年相比,需求激增顯著增加。

- 德國食品和飲料業是其最大的工業部門。食品加工是國內食品和飲料行業的主要活動之一,對冷藏產生了巨大的需求。該國食品和飲料出口業務超過726億歐元(約796億美元)。

- 國內加工的主要食品包括肉類和香腸製品、乳製品、烘焙點心和糖果零食。大多數這些產品需要冷藏來延長保存期限,從而產生了進一步的冷藏需求。

- 根據聯邦食品和農業部(BMEL)的數據,2022年德國人均肉類消費量77.5公斤。

- 德國是世界上最大的軟性飲料消費國之一,人均軟性飲料消費量超過120公升。含咖啡館的飲料目前是德國市場上最活躍的。這增加了雪碧、芬達、Delta、Mesomix 和可口可樂等公司的銷售。保持這些冷飲冷藏的需要顯著增加了冷藏需求。

- 此外,隨著更好的低溫設備的使用和冷凍食品需求的增加,預計未來幾年國內低GWP冷凍市場將出現更快的成長。

- 然而,食品加工售後市場的需求龐大,汽車產業對冷媒的需求預計在未來幾年將會增加。

低GWP冷媒產業概述

低全球升溫潛勢值冷媒市場本質上是部分整合的,公司在研究市場中只佔很小的佔有率。市場主要企業包括(排名不分先後)霍尼韋爾國際公司、科慕公司、奧比亞、阿科瑪和大金工業有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對環境影響低

- 嚴格規定

- 其他司機

- 抑制因素

- 較高的可燃性和其他毒性

- 其他限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章市場區隔

- 類型

- 無機物

- 烴

- 碳氟化合物和氟烯烴(HFC 和 HFO)

- 應用

- 商務用冷凍庫

- 工業冷凍設備

- 家用冰箱

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他

- 南美洲

- 巴西

- 阿根廷

- 其他

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業採取的策略

- 公司簡介

- A-Gas

- Arkema

- DAIKIN INDUSTRIES, LTD.

- Danfoss

- engas Australasia

- GTS SPA

- HARP International

- Honeywell International Inc

- Linde

- Messer Group

- Orbia

- Tazzetti SpA

- The Chemours Company

第7章市場機會與未來趨勢

The Low GWP Refrigerant Market size is estimated at 189.81 kilotons in 2024, and is expected to reach 276.96 kilotons by 2029, growing at a CAGR of 7.85% during the forecast period (2024-2029).

The low GWP refrigerant market was negatively impacted by the COVID-19 pandemic. However, the market recovered significantly in 2021, owing to rising applications in pharmaceuticals, residential, commercial, and others.

Key Highlights

- The low environmental impact and stringent regulations are likely to be the main driver of the low GWP refrigerant market's growth over the medium term.

- However, the higher flammability and other toxicity characteristics are expected to limit the growth of the low GWP refrigerant market.

- Nevertheless, developments for promoting low GWP refrigerants are likely to create lucrative growth opportunities for the global market soon.

- Europe represents the largest market,with the largest consumption coming from countries such as Germany,United Kingdom, etc.

Low GWP Refrigerant Market Trends

Commercial Refrigeration to Dominate the Market

- Low global warming potential (GWP) refrigerant solutions have been in greater demand for air conditioning and refrigeration applications. These low-GWP refrigerants increase energy consumption, introduces safety risks, and require significant equipment modifications.

- Moreover, these are primarily used to reduce service equipment energy consumption and carbon emissions by 50% compared to HFCs and CFCs.

- Low global warming potential (GWP) refrigerant solutions have been in greater demand for air conditioning and refrigeration applications. These low-GWP refrigerants increase energy consumption, introduces safety risks, and require significant equipment modifications.

- The usage of low GWP refrigerants is increasing, especially in the commercial refrigeration segment that includes varied applications, including food safety in dairy, meat, fisheries, and other food industries that rely on efficient cold chain networks (commercial freezers and refrigerators), cold chain preservation in the pharmaceutical industry, commercial air conditioners.

- Based on data published by the Air Conditioning and Refrigeration Association of Japan in June 2022, the worldwide demand for commercial air conditioners experienced a significant increase in 2021, reaching 14.88 million units. The North America region took the lead with a total of 7.37 million units in the same year, surpassing previous years figures.

- According to The Haier Smart Home, Asia's air-conditioners retail unit volume has reached 132.3 million units in 2022 and is estimated to reach 147.4 million units by 2024.

- Furthermore, according to OEA (India), the wholesale price index of air conditioners reached 119.4 in 2022.

- With the increasing demand for frozen food products and a highly competitive market with low margins, most food processors, distributors, and retailers are shifting from manually operated obsolete facilities to the high bay deep-freeze warehouses, where commercial refrigeration are widely employed.

- Moreover, the expansion of retail food chains by the multinational companies and the growth in international trade (due to trade liberalization) have led to an increase in the demand for the cold chain processes. This, in turn, is augmenting the demand for commercial refrigeration across the world.

Germany to Dominate the Europe Market

- The German economy is the largest in Europe and the fifth-largest in the world. Germany has a strong manufacturing sector, particularly in the areas of machinery and automotive. This has helped the country maintain a competitive edge in international trade and attract foreign investment.

- Based on the data published by the Association of Air Conditioning and Refrigeration Industry in Japan in June 2022, the sales of commercial air conditioning units in Germany experienced a significant increase in 2021, with the demand reaching 50 thousand units. This surge in demand marked a notable rise compared to previous years.

- The German food and beverage industry is the largest industry sector. Food processing is one of the major activities in the domestic food and beverage industry, which creates a significant need for refrigeration. The country's food and beverage export business exceeds more than EUR 72.6 billion (~USD 79.6 billion).

- Some of the major foods processed in the country include meat and sausage products, dairy products, baked goods, and confectionery. Most of these products need cold storage in order to increase their shelf life, further creating a demand for refrigeration.

- According to The Federal Ministry of Food and Agriculture( BMEL), Germany's per capita consumption of meat has reached 77.5 kilograms in 2022.

- Germany is one of the world's largest consumers of soft drinks with more than 120 liters of per-capita consumption. Caffeine-oriented drinks are the most dynamic in the present German market. This has given a boost to the sales of companies, such as Sprite, Fanta, Delta, Mezzo Mix, and Coca-Cola. The need for cold storage of these cold drinks has created a significant demand for refrigeration.

- Furthermore, with the use of better cryogenic equipment and the increased demand for frozen foods, the low GWP refrigeration market is poised to witness an increasing growth rate in the coming years in the country.

- However, there is significant demand from the food processing aftermarket, which is expected to increase the demand for refrigerants from the automotive industry in the coming years.

Low GWP Refrigerant Industry Overview

The low GWP refrigerants market is partially consolidated in nature, with players accounting for a marginal share of the market studied. A few major companies in the market (not in particular order) include Honeywell International Inc., The Chemours Company, Orbia, Arkema, and DAIKIN INDUSTRIES, Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Low Environmental Impact

- 4.1.2 Stringent Regulations

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Higher Flammability and Other Toxicity Characteristics

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Inorganics

- 5.1.2 Hydrocarbons

- 5.1.3 Fluorocarbons and Fluoro-olefins (HFCs and HFOs)

- 5.2 Application

- 5.2.1 Commercial Refrigeration

- 5.2.2 Industrial Refrigeration

- 5.2.3 Domestic Refrigeration

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A-Gas

- 6.4.2 Arkema

- 6.4.3 DAIKIN INDUSTRIES, LTD.

- 6.4.4 Danfoss

- 6.4.5 engas Australasia

- 6.4.6 GTS SPA

- 6.4.7 HARP International

- 6.4.8 Honeywell International Inc

- 6.4.9 Linde

- 6.4.10 Messer Group

- 6.4.11 Orbia

- 6.4.12 Tazzetti S.p.A

- 6.4.13 The Chemours Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Developments for Promoting Low GWP Refrigerants

- 7.2 Other Opportunities