|

市場調查報告書

商品編碼

1435235

工業齒輪箱:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Industrial Gearbox - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

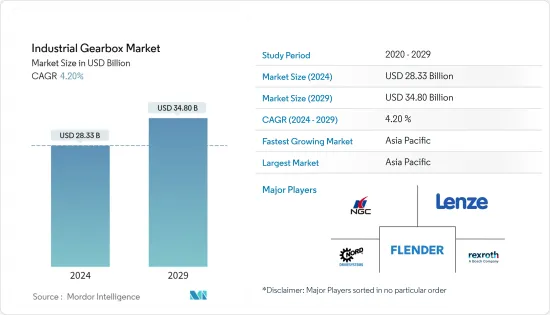

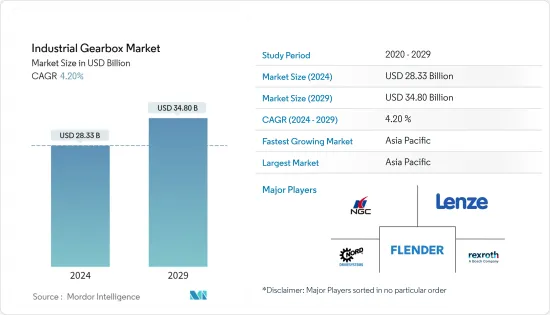

工業齒輪箱市場規模預計2024年為283.3億美元,預計到2029年將達到348億美元,在預測期內(2024-2029年)成長4.20%,以複合年成長率成長。

工業齒輪箱市場規模預計將從2023年的271.9億美元成長到2028年的334億美元,預測期內複合年成長率為4.20%。

主要亮點

- 從中期來看,製造業、鋼鐵、食品和飲料等各個工業領域擴大採用工業自動化等因素預計將在預測期內推動市場發展。

- 另一方面,經濟和工業活動放緩預計將對工業齒輪箱市場產生負面影響並抑制市場成長。

- 儘管如此,對節能齒輪箱的需求激增預計將在未來幾年為全球工業齒輪箱市場創造巨大機會。

工業齒輪箱市場趨勢

螺旋變速器類型細分市場佔據主導地位

- 在螺旋變速器中,斜齒輪齒是與齒輪面對角地切割的。當兩個齒開始嚙合時,從齒的一端逐漸開始接觸並保持接觸,直到齒輪完全嚙合時旋轉。實現平穩運轉和高推力輸出。此齒輪最常用於汽車變速箱並產生很大的推力。

- 螺旋變速器的特點包括非常高的輸出扭力、安靜的運作和較長的使用壽命。螺旋變速器是業界製造的效率最高的變速箱,運作效率高達 98%,僅次於行星齒輪變速器。由於其高效率和高推力產生能力,螺旋變速器應用於化肥、汽車、鋼鐵、軋延、電力和港口工業等主要行業以及紡織、塑膠和食品等製造業。

- 螺旋變速器用於中型和重型工業應用的汽車變速箱,因為它們可以處理高速和高負載。模組化設計和構造提供了許多工程和性能優勢,包括零件和子組件的高度相容性。這提供了顯著的生產經濟性,同時保持了組件完整性的最高標準。

- 汽車產量的進一步增加增加了對螺旋齒輪的需求。根據國際汽車製造商組織的數據,2022 年全球汽車產量約 8,500 萬輛。與前一年相比,這一數字大幅成長,增幅超過6%。

- 因此,基於上述因素,螺旋變速器類型預計將在預測期內主導市場。

亞太地區主導市場

- 由於製造業、電力業等各種應用對變速箱的需求不斷增加,預計亞太地區將在 2022 年佔據工業變速箱市場的主要佔有率。印度、中國、日本、韓國和澳洲等國家是該地區的主要貢獻者。

- 中國已成為全球製造業成長不可或缺的一部分。該國是鋼鐵、化工、電力和水泥行業的領導者,也是石化和精製行業的主要企業之一。

- 此外,中國也是全球最大的粗鋼生產國和出口國,產量佔全球一半以上。 2022年全國粗鋼產量約101795.9萬噸。中國的「一帶一路」計劃彌合了地區基礎設施差距,預計將提振鋼鐵需求。

- 此外,合資夥伴阿美公司、北方工業集團和盤錦新城工業集團計劃於2023年3月在中國東北地區開始建造大型煉油化工綜合體。因此,煉油廠和石化業務的擴張以及即將建造的燃煤發電廠預計將在預測期內增加能源領域工業齒輪箱的安裝量。

- 以裝置容量計算,印度也是全球第四大陸上風電市場,截至2022年風力發電容量達41.93吉瓦。該國風電市場的成長得益於兩個基本因素:不斷成長的能源需求和政府目標。印度目前也正在尋求利用尚未開發的風力發電潛力來擴大其綠色能源組合。因此,如果真正的潛力得以實現,風電領域對工業齒輪箱的需求預計在未來幾年將會增加。

- 同樣,日本是世界上最大的液化天然氣進口國之一,其次是中國和韓國。隨著天然氣基礎設施的發展和清潔能源的進步,該國有興趣發展液化天然氣基礎設施以增加全球液化天然氣需求。齒輪箱用於安裝在LNG接收站的渦輪機,齒輪箱安裝在液化天然氣處理終端的高速泵浦驅動器、螺旋槳驅動器或壓縮機驅動器中。

- 因此,基於上述因素,亞太地區預計將在預測期內主導工業齒輪箱市場。

工業齒輪箱產業概況

工業齒輪箱市場正在慢慢整合。市場主要企業包括(排名不分先後)南京高精度驅動設備製造集團、Lenze SE、Flender Ltd、Getriebebau NORD GmbH &Co. KG、Bosch Rexroth AG。

目錄

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

年表

第1章簡介

- 調查範圍

- 合作公寓市場 合作公寓市場

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 工業自動化在各工業領域的採用率不斷提高

- 全球汽車銷售成長

- 經濟和工業活動停滯

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 蝸輪箱

- 螺旋變速器

- 錐齒輪-斜螺旋變速器

- 行星齒輪變速器

- 原廠變速箱

- 生產

- -電力產業

- 鋼鐵工業

- 採礦業

- 污水處理業

- 製造業

- 其他用途

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Nanjing High Accurate Drive Equipment Manufacturing Group Co. Ltd

- Lenze SE

- Flender Ltd.

- Getriebebau NORD GmbH & Co. KG

- Bosch Rexroth AG

- Zollern GmbH & Co. KG

- INGECO GEARS Pvt Ltd.

- Sew-Eurodrive GmbH & Co KG

- Essential Power Transmission Pvt Ltd.

- Bonfiglioli Drives Co. Ltd.

- Kngear

- Elecon Engineering Company Limited

第7章 市場機會及未來趨勢

- 節能齒輪箱的需求快速成長

The Industrial Gearbox Market size is estimated at USD 28.33 billion in 2024, and is expected to reach USD 34.80 billion by 2029, growing at a CAGR of 4.20% during the forecast period (2024-2029).

The Industrial Gearbox Market size is expected to grow from USD 27.19 billion in 2023 to USD 33.40 billion by 2028, registering a CAGR of 4.20% during the forecast period.

Key Highlights

- Over the medium term, factors such as the growing adoption of industrial automation across various industrial sectors, like manufacturing, steel, and food and beverages, are expected to drive the market during the forecast period.

- On the other hand, the slowdown in economic and industrial activities is expected to negatively impact the industrial gearbox market, thus restraining market growth.

- Nevertheless, soaring demand for energy-efficient gearboxes is expected to create immense opportunities for the global industrial gearbox market in the coming years.

Industrial Gearbox Market Trends

Helical Gearbox Type Segment to Dominate the Market

- In a helical gearbox, the teeth on a helical gear are cut at an angle to the face of the gear. When two teeth start to engage, the contact gradually begins at one end of the tooth and maintains contact as the gear rotates in full engagement. It offers the capacity to conduct a smooth operation and high thrust outputs. It is the most used gear in automobile transmissions, generating large amounts of thrust.

- Defining features of helical gearboxes include extremely high output torques, silent operation, and long service life. Helical Gearboxes are the most efficient gearboxes manufactured in the industry and work at 98% efficiency, after Planetary Gearboxes. Due to their high efficiency and high thrust generating capabilities, helical gearboxes are utilized in major industries, like fertilizer, automobiles, steel, rolling mills, power and port industries, and manufacturing sectors, such as textile, plastics, and food.

- Helical Gearbox is used in automobile transmissions in medium and heavy-duty industrial applications, as it can handle high speeds and loads. Modular design and construction offer many engineering and performance benefits, including a high degree of interchangeability of parts and sub-assemblies. This, in turn, provides considerable economies of production while maintaining the highest standard of component integrity.

- Further increasing automobile production is driving the demand for helical gears. According to the International Organization of Motor Vehicle Manufacturers, in 2022, around 85 million motor vehicles were produced worldwide. This represents a significant increase of more than 6% compared to the previous year.

- Therefore, based on the above factors, the helical gearbox type segment is expected to dominate the market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region accounted for a significant share of the industrial gearbox market in 2022, owing to the increasing demand for gearboxes in various applications like the manufacturing sector, power industry, etc. Countries such as India, China, Japan, Korea, and Australia, are the key contributing nations in the region.

- China has been an essential factor in the growth of the manufacturing sector worldwide. The country is the leader in the steel, chemical, power, and cement industries and is one of the top players in the petrochemical and refining industries.

- Moreover, China has been the biggest crude steel producer and exporter, accounting for more than half of global production. In 2022 the country's crude steel production was around 1017.959 million tonnes. China's One Belt One Road project to bridge the infrastructure gap in the region is expected to boost the steel demand.

- Furthermore, In March 2023, Aramco and NORINCO Group and Panjin Xincheng Industrial Group, joint venture partners, planned to begin construction of a significant integrated refinery and petrochemical complex in northeast China. Hence, with the expansion of refineries and petrochemical businesses and the upcoming coal-fired plants, the country is expected to witness an increase in industrial gearbox installations in the energy sector during the forecast period.

- Also, India was the world's fourth-largest onshore wind market by installations, with 41.93 GW of wind capacity as of 2022. The wind power market in the country has been growing by two fundamental drivers: rising energy demand and governmental targets. Also, India is presently trying to expand its green energy portfolio by harnessing the unexploited offshore wind energy potential. Hence, once the true potential is realized, the demand for industrial gearboxes in the wind power sector is expected to increase in the upcoming years.

- Similarly, Japan is one of the largest LNG importers worldwide, followed by China and South Korea. With the developed gas infrastructure and progression toward cleaner energy, the country is interested in developing the LNG infrastructure to enhance the global LNG demand. The gearbox is used in turbines fitted in LNG terminals, or the gearbox is installed in high-speed pump drives, propellor drives, or compressor drives in LNG processing terminals.

- Therefore, based on the above-mentioned factors, Asia-Pacific is expected to dominate the industrial gearbox market during the forecast period.

Industrial Gearbox Industry Overview

The industrial gearbox market is moderately consolidated. Some of the major players in market (not in particular order) include Nanjing High Accurate Drive Equipment Manufacturing Group Co. Ltd, Lenze SE, Flender Ltd, Getriebebau NORD GmbH & Co. KG, and Bosch Rexroth AG., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Industrial Automation across Various Industrial Sectors

- 4.5.1.2 Rising Sales for Automobiles across the World

- 4.5.2 Restraints

- 4.5.2.1 Slow Down in Economic and Industrial Activities

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Worm Gearbox

- 5.1.2 Helical Gearbox

- 5.1.3 Bevel Helical Gearbox

- 5.1.4 Planetary Gearbox

- 5.1.5 Other Types

- 5.2 Application

- 5.2.1 Power Industry

- 5.2.2 Steel Industry

- 5.2.3 Mines and Minerals Industry

- 5.2.4 Wastewater Treatment Industry

- 5.2.5 Manufacturing Industry

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nanjing High Accurate Drive Equipment Manufacturing Group Co. Ltd

- 6.3.2 Lenze SE

- 6.3.3 Flender Ltd.

- 6.3.4 Getriebebau NORD GmbH & Co. KG

- 6.3.5 Bosch Rexroth AG

- 6.3.6 Zollern GmbH & Co. KG

- 6.3.7 INGECO GEARS Pvt Ltd.

- 6.3.8 Sew-Eurodrive GmbH & Co KG

- 6.3.9 Essential Power Transmission Pvt Ltd.

- 6.3.10 Bonfiglioli Drives Co. Ltd.

- 6.3.11 Kngear

- 6.3.12 Elecon Engineering Company Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Soaring Demand for Energy Efficient Gearboxes