|

市場調查報告書

商品編碼

1406129

汽車廢熱回收系統:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Automotive Exhaust Heat Recovery System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

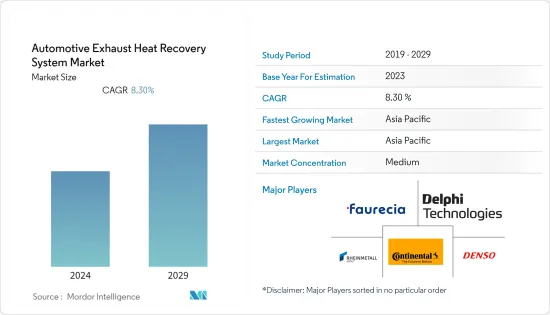

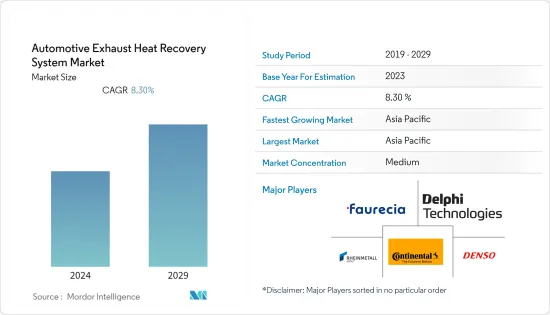

目前汽車廢熱回收系統市場規模估計為237億美元。

預計預測期內複合年成長率為 8.3%,到預測期結束時將達到 354 億美元。

汽車廢熱回收系統市場是汽車產業快速發展的領域。它的重點是利用和利用車輛排氣系統產生的廢熱,以提高整體效率、減少排放氣體並提高燃油效率。由於環境問題、嚴格的排放法規以及對提高燃油效率的持續追求,該技術受到了極大的關注和重視。

隨著排放法規的收緊迫使汽車製造商最佳化燃燒並減少有害排放氣體,全球範圍內擴大採用廢熱回收系統。此外,高溫合金和陶瓷等先進材料的開發正在提高這些零件的效率和耐用性。

汽車廢熱回收系統市場的另一個主要促進因素是小客車和商用車的銷售。小客車銷量從 2021 年的 5,640 萬美元成長到 2022 年的 5,740 萬美元,推動了汽車廢熱回收系統市場的成長。

汽車廢熱回收系統市場趨勢

嚴格的廢氣法規推動市場成長

2023 年 4 月,美國環保署 (EPA) 公佈了標準更新,旨在進一步減少輕型和中型車輛有害空氣污染物的排放。該提案以 EPA 2023 年至 2026 年小客車和輕型卡車聯邦溫室氣體排放標準為基礎。它利用清潔汽車技術的進步,為美國人提供各種好處。這包括減少氣候污染、改善公共衛生以及透過減少燃料和維護成本來節省成本。

提案的標準預計將要求汽車製造商進一步最佳化燃燒並大幅減少排放氣體。為了滿足這些嚴格的標準,汽車製造商擴大轉向廢熱回收系統(EHRS)。這是一項有效的技術,可以回收廢熱以提高引擎整體效率並最終減少排放氣體。

作為這些標準的一部分,重點是提高燃油效率。 EHRS 透過回收和利用廢熱來完成有用功並降低車輛燃油消費量,在實現更好的燃油效率方面發揮重要作用。

亞太地區預計成長最快

2022年,亞太地區將佔全球汽車銷售的大部分,達到58%,反映出汽車產業快速技術創新帶來的需求大幅成長。

亞太地區人口占全球近60%,預計在預測期內該地區的汽車需求量最高。該地區的政府法規也變得更加嚴格。例如,印度政府制定了BS-VI標準來控制車輛排放的污染物。這是因為廢熱回收系統不僅降低了汽車排放污染物的比例,而且還提高了汽車的燃油效率。隨著當地污染水平的上升,人們的環保意識越來越強,並擔心他們購買的汽車的排放氣體。

中國排放法規的快速發展和收緊,迫使製造商進一步永續地減少顆粒物和氮氧化物排放,以符合現行的中國 6a 排放法規。因此,公路和非公路領域的商用車需要採取額外的廢氣再循環措施。

汽車廢熱回收系統產業概況

汽車廢熱回收系統是一個分散且競爭激烈的市場,由於市場上存在多個製造商,並且採取了密集的研發活動、新產品開發和收購等各種策略。

- 2022年8月,博世收購了兩台SLM500機組,並為其進軍積層製造領域提供了重大推動力。這項策略性投資將增強博世採用3D列印技術的能力,進一步推動汽車產業的發展。

- 2023年1月,通用汽車宣布將投資9.18億美元在美國的四家工廠增加V8汽油引擎的產量。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場抑制因素

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 科技

- 廢氣再循環(EGR)

- 渦輪增壓器

- 車輛類型

- 小客車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 其他地區

- 巴西

- 阿拉伯聯合大公國

- 其他

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Delphi Technologies

- Valeo Service

- Denso

- Faurecia

- Mahle

- Rheinmetall Automotive

- Mitsubishi Electric

- Calsonic Kansai

- Continental AG

- Borgwarner

第7章 市場機會及未來趨勢

The Automotive Exhaust Heat Recovery market is estimated to be valued at USD 23.7 billion in the current year. It is expected to reach USD 35.4 billion by the end of the forecast period, registering a CAGR of 8.3% during the forecast period.

The Automotive exhaust heat recovery market is a rapidly evolving sector within the automotive industry. It focuses on harnessing and utilizing waste heat generated by a vehicle's exhaust system to enhance overall efficiency, reduce emissions, and improve fuel economy. This technology gained significant attention and importance due to environmental concerns, stricter emission regulations, and the continuous quest for improved fuel efficiency.

The adoption of exhaust heat recovery systems is on the rise globally as stricter emission standards push automakers to optimize combustion and reduce harmful emissions. Furthermore, the development of advanced materials, like heat-resistant alloys and ceramics, is enhancing the efficiency and durability of these components. Also, governments and regulatory bodies incentivize automakers through credits for adopting fuel-saving technologies, including exhaust heat recovery systems.

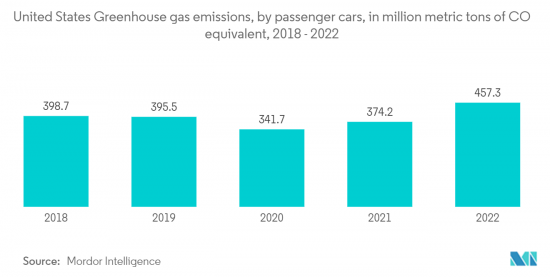

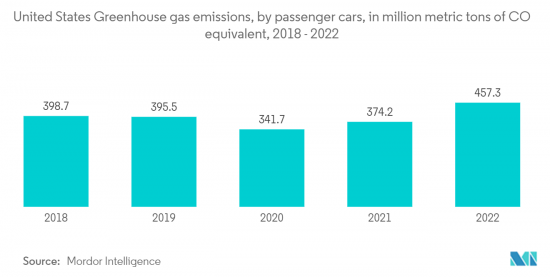

Another major driver for the Automotive Exhaust Heat recovery systems market is the sales of passenger cars and commercial vehicles. The increase in passenger car sales from USD 56.4 million in 2021 to USD 57.4 million in 2022 is contributing to the growth of the automotive exhaust heat recovery market.

Automotive Exhaust Heat Recovery System Market Trends

Strict Emission Regulations Driving the Market Growth

In April 2023, the Environmental Protection Agency (EPA) revealed updated standards aimed at further decreasing harmful air pollutant emissions from light-duty and medium-duty vehicles, with the initial implementation set for model year 2027. This proposal is built upon EPA's previous federal greenhouse gas emissions standards for passenger cars and light trucks covering model years 2023 through 2026. It harnesses the advancements in clean car technology to deliver a range of benefits to the American population. It includes reduced climate pollution, enhanced public health, and cost savings for drivers due to reduced fuel and maintenance expenses.

The proposed standards are expected to require automakers to further optimize combustion and reduce emissions significantly. To meet these stringent standards, automakers may increasingly turn to exhaust heat recovery systems (EHRS). It is an effective technology to recover waste heat and improve overall engine efficiency, ultimately leading to lower emissions.

As part of these standards, there is an emphasis on improving fuel economy. EHRS can play a crucial role in achieving better fuel efficiency by capturing and utilizing exhaust heat to perform useful work, thus reducing the fuel consumption of vehicles.

Asia-Pacific is Expected to be the fastest growing region

In 2022, Asia-Pacific accounted for the majority of global vehicle sales at 58%, reflecting a significant surge in demand owing to rapid technological innovations in the automotive industry.

Asia-Pacific accounts for almost 60 % of the world's population, and the demand for vehicles is expected to be the highest in the region for the forecasted period. Also, government regulations are becoming strict in the region. For example, BS-VI standards are enforced by Govt. of India to regulate the expelled pollutants from motor vehicles. With the addition of environmental norms, exhaust heat recovery systems will be more in demand as these systems not only reduce the percentage of pollutants coming out from the vehicles but also increase the fuel efficiency of the vehicle. With the growing pollution levels in the region, people are becoming more aware of the environment and more concerned about the emissions from the cars they purchase.

The rapidly progressing and tightening of exhaust emission standards in China is forcing manufacturers to achieve a further sustained reduction in particulate and nitrogen oxide emissions in order to comply with the current Chinese 6a emissions standard. Additional exhaust-gas recirculation measures are thus mandatory for commercial vehicles in the on and off-highway sector.

Automotive Exhaust Heat Recovery System Industry Overview

Key exhaust heat recovery system participants are Continental AG, Delphi Technologies, Denso, Faurecia, Rheinmetall Automotive, and others. The automotive exhaust heat recovery system is a fragmented and competitive market due to the presence of several manufacturers in the market, owing to various strategies such as focused research and development activities, new product developments, acquisitions, etc. For instance,

- In August 2022, Bosch acquired two SLM500s, a move that significantly boosted its expansion into the additive manufacturing sector. This strategic investment further propels the automotive industry by strengthening Bosch's capabilities in adopting 3D printing technologies.

- In January 2023, General Motors announced a substantial investment of USD 918 million across four US plants to bolster the production of V8 gasoline engines.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Exhaust Gas Recirculation (EGR)

- 5.1.2 Turbocharger

- 5.2 Vehicle Type

- 5.2.1 Passenger Car

- 5.2.2 Commercial Vehicle

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Delphi Technologies

- 6.2.2 Valeo Service

- 6.2.3 Denso

- 6.2.4 Faurecia

- 6.2.5 Mahle

- 6.2.6 Rheinmetall Automotive

- 6.2.7 Mitsubishi Electric

- 6.2.8 Calsonic Kansai

- 6.2.9 Continental AG

- 6.2.10 Borgwarner