|

市場調查報告書

商品編碼

1435821

汽車襯套:市場佔有率分析、產業趨勢、成長預測(2024-2029)Automotive Bushing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

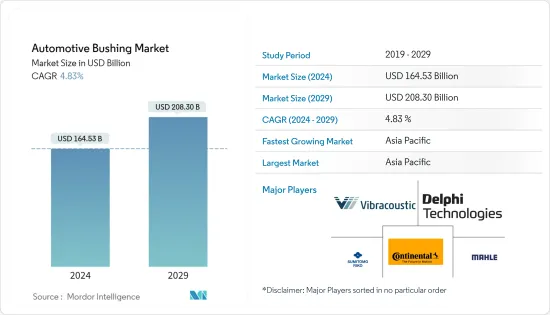

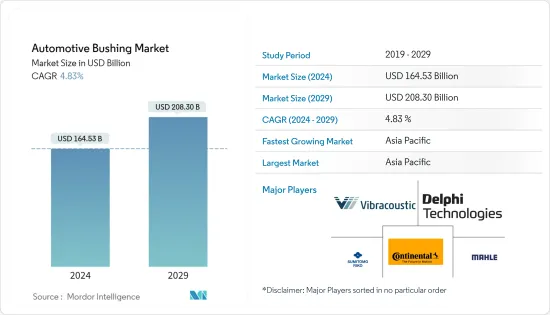

汽車襯套市場規模預計2024年為1645.3億美元,預計到2029年將達到2083億美元,在預測期內(2024-2029年)複合年成長率為4.83%成長。

主要亮點

- 冠狀病毒感染疾病(COVID-19)大流行對汽車襯套市場產生了重大影響。疫情給汽車產業帶來了很大的衝擊。受疫情影響,不少汽車製造商被迫停產。這導致汽車襯套的需求下降。

- 疫情也擾亂了汽車供應鏈。這使得汽車製造商很難獲得製造襯套所需的材料。疫情造成的經濟放緩也導致新車需求下降。這對汽車襯套的需求產生了連鎖反應。然而,隨著情況恢復正常,汽車產量大幅增加,帶動了隔年的市場。

- 隨著車輛標準的提高,車輛必須具有最低程度的噪音、聲振粗糙度和振動。最終用戶對噪音和空氣污染的日益關注以及要求汽車製造商盡量減少車輛噪音污染的嚴格政府標準是汽車襯套市場的主要成長動力。

- 隨著人們收入水準的提高,他們會花額外的錢購買新車和豪華車。預計全球汽車銷售量在預測期內將增加。隨著汽車銷量的增加,作為汽車各部件必不可少的材料的襯套市場預計將擴大。

汽車襯套市場趨勢

更高的舒適度和更安靜的汽車推動市場

- 不斷提高的舒適度和更安靜的汽車正在推動汽車襯套市場的發展。襯套用於懸吊系統中以吸收衝擊和振動。這提供了更平穩的行駛並降低了噪音。例如,2023年3月,大陸集團宣布推出新的Busch電動車產品線。新的 Busch 產品線旨在降低電動車的 NVH,電動車比汽油車更容易產生噪音和振動。

- 襯套用於引擎支架,將引擎與車輛的其他部分隔離。這可以減少噪音和振動並提高引擎性能。

- 襯套用於變速箱安裝座,以將變速箱與車輛的其他部分隔離。這可以減少噪音和振動並提高傳輸性能。

- 隨著對更舒適、更安靜的汽車的需求增加,對襯套的需求預計也會增加。這是因為襯套在降低噪音和振動方面發揮著重要作用。

- 輕型車輛越來越受歡迎,這增加了對襯套的需求。由鋁或複合材料等輕質材料製成的襯套越來越受歡迎,因為它們可以在不犧牲性能的情況下減輕重量。

- 電動車和自動駕駛汽車等新技術正在增加對新型套管的需求。電動車需要能夠承受馬達高扭矩的襯套,自動駕駛汽車需要能夠提供精確控制的襯套。

- 隨著越來越多的駕駛者選擇更換磨損或損壞的襯套,汽車襯套售後市場正在不斷成長。這增加了售後供應商對襯套的需求。

- 總體而言,汽車襯套市場預計在未來幾年將繼續成長。市場預計將受益於對舒適和安靜汽車的需求不斷成長、新技術的發展和售後市場的成長。

亞太地區獲得主要市場佔有率

- 亞太地區在汽車襯套市場中佔有主要市場佔有率。亞太地區的汽車工業正在快速成長,這增加了對汽車襯套的需求。

- 例如,預計2022年包括中東在內的亞太地區銷量約為3,750萬輛小客車,其中中國銷量超過2,360萬輛。相較之下,預計2021年亞太地區小客車銷量約3,457萬輛。

- 亞太地區對豪華車的需求不斷增加,這些汽車通常比經濟型汽車需要更多的襯套。

- 電動車和自動駕駛汽車等新技術的發展正在增加對新型套管的需求。這些車輛比汽油車輛更容易產生噪音和振動,因此必須使用專用這些車輛設計的襯套。

- 亞太汽車產業面臨越來越大的提高安全性的壓力,襯套在安全系統中發揮著重要作用。襯套用於各種安全關鍵應用,例如懸吊和轉向系統。隨著安全問題的增加,安全系統中對套管的需求也預計會增加。

- 中國、日本和印度這些國家是世界上一些最大的汽車製造商的所在地,對豪華車和新技術的需求也在快速成長。因此,預計這些國家在未來幾年仍將是汽車襯套的主要市場。

- 總體而言,亞太地區汽車襯套市場預計在未來幾年將繼續成長。市場預計將受益於豪華車需求的增加、新技術的發展以及安全問題的增加。

汽車襯套產業概況

汽車襯套市場高度分散,因為市場上有許多地區和國際參與者。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 汽車產量增加

- 重視車輛舒適性和降低 NVH

- 市場限制因素

- 經濟波動和不確定性

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 車型

- 小客車

- 商用車

- 應用程式類型

- 懸吊系統襯套

- 引擎懸置襯套

- 底盤襯套

- 傳動軸套

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 阿拉伯聯合大公國

- 其他

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Delphi Technologies

- Continental AG

- Sumitomo Riko

- Vibracoustic

- Boge rubber and plastics

- Hyundai Polytech India Pvt. Ltd.

- Cooper Standard Holdings Ltd.

- Dupont

- Mahle

- Tenneco

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 69757

The Automotive Bushing Market size is estimated at USD 164.53 billion in 2024, and is expected to reach USD 208.30 billion by 2029, growing at a CAGR of 4.83% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic had a significant impact on the automotive bushing market. The pandemic caused a number of disruptions to the automotive industry. Many automotive manufacturers were forced to shut down production due to the pandemic. This led to a decrease in demand for automotive bushings.

- The pandemic also caused disruptions to the automotive supply chain. This made it difficult for automotive manufacturers to obtain the materials they needed to produce bushings. Economic slowdown: The economic slowdown caused by the pandemic also led to a decrease in demand for new vehicles. This had a knock-on effect on the demand for automotive bushings. But as the situation got back to normal and the production of vehicles increased significantly, it drove the market in the coming year.

- With the growing standards of vehicles, it is essential for a vehicle to have minimum levels of noise, harshness, and vibrations. The increased concern about noise and air pollution amongst the end users and strict government norms for automobile manufacturers to ensure that their vehicle produces minimum levels of noise pollution have been the major growth drivers in the automotive bushing market.

- With the increase in income levels of the people, they are spending their excess money on buying new and luxurious vehicles. It is expected during the forecast period that the sales of automobiles all around the world will grow. With an increase in sales of automobiles, the market for bushing will also increase as it is an essential material in various parts of an automobile.

Automotive Bushing Market Trends

Rise in Comfort Levels and Silent Cars Driving the Market

- The rise in comfort levels and silent cars is driving the automotive bushing market. Bushings are used in the suspension system to absorb shocks and vibrations. This helps to provide a smoother ride and reduce noise. For instance, in March 2023, Continental AG announced that it had launched a new line of bushings for electric vehicles. The new line of bushings is designed to reduce NVH in electric vehicles, which are more prone to noise and vibration than gasoline-powered vehicles.

- Bushings are used in engine mounts to isolate the engine from the rest of the vehicle. This helps to reduce noise and vibration, and it also helps to improve the performance of the engine.

- Bushings are used in transmission mounts to isolate the transmission from the rest of the vehicle. This helps to reduce noise and vibration, and it also helps to improve the performance of the transmission.

- As the demand for more comfortable and silent cars increases, the demand for bushings is also expected to increase. This is because bushings play an important role in reducing noise and vibration.

- Lightweight vehicles are becoming increasingly popular, and this is driving the demand for bushings. Bushings made from lightweight materials, such as aluminum and composites, are becoming more popular as they offer weight savings without compromising performance.

- New technologies, such as electric vehicles and autonomous vehicles, are driving the demand for new bushings. Electric vehicles require bushings that can handle the high torque of electric motors, and autonomous vehicles require bushings that can provide precise control.

- The aftermarket for automotive bushings is growing as more and more motorists are choosing to replace worn or damaged bushings. This is driving the demand for bushings from aftermarket suppliers.

- Overall, the automotive bushing market is expected to continue to grow in the coming years. The market is expected to benefit from the increasing demand for comfortable and silent cars, the development of new technologies, and the growth of the aftermarket.

Asia Pacific Captures Major Market Share

- Asia-Pacific captures the major market share in the automotive bushing market. The growing automotive industry in Asia Pacific: The automotive industry in Asia Pacific is growing rapidly, and this is driving the demand for automotive bushings.

- For instance, in 2022, it was estimated that about 37.5 million passenger cars were sold within the Asia-Pacific region, including the Middle East, of which over 23.6 million were sold in China. Comparatively, it was also estimated that approximately 34.57 million passenger cars will be sold in the Asia-Pacific region in 2021.

- The increasing demand for premium vehicles: The demand for premium vehicles is increasing in Asia-Pacific, and these vehicles typically require a greater number of bushings than economy vehicles.

- The development of new technologies, such as electric vehicles and autonomous vehicles, is driving the demand for new bushings. These vehicles are more prone to noise and vibration than gasoline-powered vehicles, which requires the use of bushings that are specifically designed for these vehicles.

- The automotive industry in the Asia-Pacific is under increasing pressure to improve safety, and bushings play an important role in safety systems. Bushings are used in a variety of safety-critical applications, such as suspension and steering systems. As the focus on safety continues to increase, the demand for bushings in safety systems is also expected to increase.

- China, Japan, and India These countries are home to some of the largest automotive manufacturers in the world, and they are also seeing rapid growth in the demand for premium vehicles and new technologies. As a result, these countries are expected to continue to be major markets for automotive bushings in the coming years.

- The use of lightweight materials in vehicles is increasing, and this is driving the demand for automotive bushings. Lightweight materials can help to reduce noise, but they can also make vehicles more prone to noise. Automotive bushings can be used to mitigate the noise from lightweight materials. Active noise cancellation is a technology that can be used to reduce noise. This technology is becoming increasingly popular in vehicles, and it is expected to drive the demand for automotive bushings.

- Overall, the automotive bushing market in the Asia-Pacific is expected to continue to grow in the coming years. The market is expected to benefit from the increasing demand for premium vehicles, the development of new technologies, and the increasing focus on safety.

Automotive Bushing Industry Overview

The automotive bushing market is highly fragmented due to the presence of many regional and international players in the market. The major players in the market are Continental AG, Vibracoustic, Mahle, Delphi Technologies, Sumitomo Riko, Etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Vehicle Production

- 4.1.2 Emphasis on Vehicle Comfort and NVH Reduction

- 4.2 Market Restraints

- 4.2.1 Economic Fluctuations And Uncertainties

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 Application Type

- 5.2.1 Suspension System Bushings

- 5.2.2 Engine Mount Bushings

- 5.2.3 Chassis Bushings

- 5.2.4 Transmission Bushings

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

- 6.2 Company Profiles*

- 6.2.1 Delphi Technologies

- 6.2.2 Continental AG

- 6.2.3 Sumitomo Riko

- 6.2.4 Vibracoustic

- 6.2.5 Boge rubber and plastics

- 6.2.6 Hyundai Polytech India Pvt. Ltd.

- 6.2.7 Cooper Standard Holdings Ltd.

- 6.2.8 Dupont

- 6.2.9 Mahle

- 6.2.10 Tenneco

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Electric and Hybrid Vehicles

- 7.2 Sustainability and Environmental Considerations

02-2729-4219

+886-2-2729-4219