|

市場調查報告書

商品編碼

1435205

橡膠添加劑:市場佔有率分析、產業趨勢、成長預測(2024-2029)Rubber Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

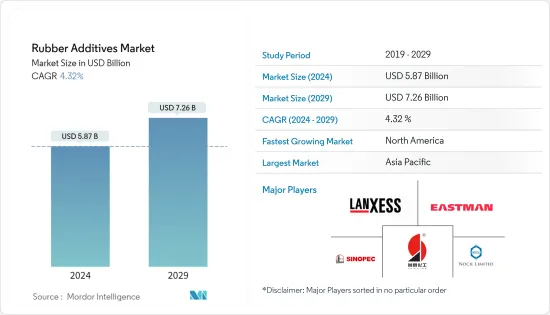

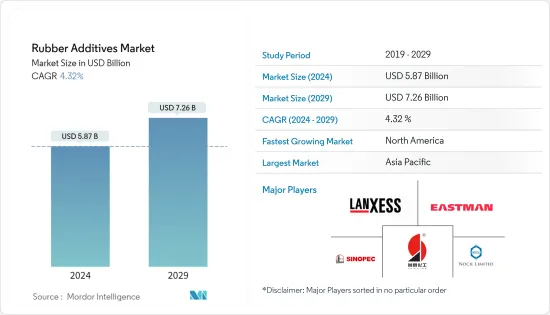

橡膠添加劑市場規模預計到 2024 年為 58.7 億美元,預計到 2029 年將達到 72.6 億美元,在預測期內(2024-2029 年)成長 4.32%。複合年成長率為

由於汽車製造和供應鏈陷入停滯,COVID-19感染疾病影響了橡膠添加劑市場。世界各地實施封鎖導致運輸延誤並擾亂進出口活動。不過,隨著限制措施逐步解除,該產業已恢復良好。電動車銷量的成長和電子設備需求的擴大推動了過去兩年市場的復甦。

主要亮點

- 橡膠和輪胎行業的成長以及建設產業非輪胎行業需求的增加是推動所研究市場需求的關鍵因素。

- 另一方面,與其處置相關的環境問題預計將阻礙市場成長。

- 開發新的添加劑來生產高性能橡膠,提高最終產品的耐用性可能是未來的機會。

- 亞太地區主導著橡膠添加劑市場,其中印度、中國和日本推動了消費。

橡膠助劑市場趨勢

主導市場的輪胎細分市場

- 研究期間,輪胎產業佔據橡膠助劑市場的最大佔有率。天然橡膠主要與順丁橡膠、苯乙烯-丁二烯橡膠等合成橡膠配合用於製造輪胎。

- 由於高品質輪胎製造技術的進步,輪胎市場持續成長。設備自動化和巨量資料的廣泛採用正在推動市場成長。此外,為了生產經濟高效且高品質的輪胎,一些製造商使用自動化的一步式輪胎製造流程。

- 根據美國輪胎製造商協會 (USTMA) 的數據,2021 年美國輪胎總出貨量為 3.352 億條,而 2022 年為 3.421 億條。

- 中國是全球最大的輪胎生產國和消費國。我國有各領域大、中、小型輪胎生產企業300多家。中國的輪胎工業無論金額或產量均位居世界第一。根據中國橡膠工業協會輪胎產業統計,2021年排名前38的會員企業總合生產輪胎5,2922萬條,與前一年同期比較成長11.28%。

- 此外,法國領先輪胎製造商米其林表示,自2022年起,卡車和客車輪胎市場的新車裝備持續表現良好,歐洲和北美訂單飽和。在北美,由於新排放氣體標準預計將於 2024 年生效,汽車輪胎的購買量支撐了需求。

- 考慮到上述所有事實和因素,預計在預測期內輪胎應用中橡膠添加劑的使用和需求將會增加。

亞太地區主導市場

- 預計亞太地區將在整個預測期內佔據主導地位。隨著中國、印度和韓國等國家加速在汽車應用中的使用以及增加其在電氣和電子應用中的使用,該地區橡膠添加劑的消費量將會增加。

- 橡膠助劑廣泛應用於橡膠及相關製品的加工。汽車產業輪胎製造對橡膠的需求不斷成長,推動了橡膠添加劑市場的發展。國內汽車工業的復甦和其他橡膠工業的恢復預計將在不久的將來推動所研究的市場。

- 中國是世界上最大的天然橡膠消費國,佔全球消費量的37%,但缺乏合適的土地,只能生產國內所需量的一小部分。因此,中國政府開始鼓勵中國企業投資橡膠生產。因此,它有潛力成為該國的橡膠添加劑,因為它可用於天然橡膠和合成橡膠的加工。

- 自2005年以來,中國已成為全球最大的輪胎生產國和消費國。儘管輪胎生產和消費經歷了非常健康的成長,但近年來,特別是近兩年,輪胎市場對於在該國經營的國內外企業來說非常艱難。然而,隨著汽車生產和各種最終用戶產業中橡膠添加劑的使用不斷擴大,預計預測期內的消費量將增加。

- 國際汽車製造組織(OICA)的數據顯示,儘管全球經濟不確定性,但中國汽車產量2021年成長7%,2022年成長3%。

- 此外,該協會表示,印度、澳洲和韓國的汽車產量到2022年將分別成長24%、13%和9%。

- 國家統計局數據顯示,2022年我國電子資訊製造業穩定成長,生產、投資均呈現強勁擴張態勢。根據工業信部統計,同期,規模以上付加與前一年同期比較% ,成長率高於全部工業4個百分點。這增加了電線的使用。

- 印度的電子工業是世界上成長最快的工業之一。近日,電子和資訊技術部發布了印度電子製造業願景文件第二卷,指出電子製造業預計到2025-26年將達到3000億美元。

- 所有上述因素都可能推動亞太地區橡膠添加劑市場在預測期內的成長。

橡膠助劑產業概況

全球橡膠助劑市場本質上是部分一體化的,前五家企業佔了市場總量的40%以上。領先的公司也專注於研發活動,為產品開發開發創新技術,進行併購以增加市場佔有率,並提高其在市場上的有效性和專業化程度。我們正在最佳化我們的供應鏈。研究市場的主要企業包括中國三信化學控股有限公司、萊茵化學(朗盛)、酵母化學公司、中國石油化學股份有限公司(中石化)、NOCIL LIMITED等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 輪胎橡膠工業的成長

- 建設產業對非輪胎領域的需求不斷擴大

- 其他司機

- 抑制因素

- 橡膠助劑的環境限制

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 類型

- 活化劑

- 硫化抑制劑

- 塑化劑

- 其他類型

- 目的

- 胎

- 輸送帶

- 電纜

- 其他用途

- 填料

- 碳黑

- 碳酸鈣

- 二氧化矽

- 其他填料

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- Behn Meyer

- China Petrochemical Corporation(SINOPEC)

- China Sunsine Chemical Holdings Limited

- Eastman Chemical Company

- Emery Oleochemicals

- Kemai Chemical Co. Ltd

- MLPC International(Arkema Group)

- NOCIL LIMITED

- PUKHRAJ ZINCOLET

- Rhein Chemie(Lanxess)

- Sumitomo Chemical Co. Ltd

- Thomas Swan & Co. Ltd

第7章 市場機會及未來趨勢

- 電動車需求增加

- 生物基橡膠助劑的開發

The Rubber Additives Market size is estimated at USD 5.87 billion in 2024, and is expected to reach USD 7.26 billion by 2029, growing at a CAGR of 4.32% during the forecast period (2024-2029).

The COVID-19 pandemic affected the rubber additives market as automotive manufacturing and supply chains were halted. The introduction of lockdowns across the world caused transportation delays and hindered import-export activities. However, the sector is recovering well since restrictions were gradually lifted. An increase in electric vehicle sales and growing demand for electronic appliances have led the market recovery over the last two years.

Key Highlights

- The growing rubber and tire industry along with increasing demand from the non-tire segment of the construction industry are the key attributes driving the demand for the market studied.

- On the flipside, environmental concerns related to its disposal are expected to hinder the growth of the market.

- The development of new additives to produce high-performance rubbers that increase the durability of the end product is likely to act as an opportunity in the future.

- Asia-Pacific region dominated the market for rubber additives with India, China, Japan driving the consumption.

Rubber Additives Market Trends

Tire Segment to Dominate the Market

- The tire industry accounts for the largest share of the rubber additives market during the study period. Natural rubber in combination with synthetic rubbers like butadiene rubber or styrene butadiene rubber is majorly used in tire manufacturing.

- The tire market continues to grow due to technological advances in manufacturing high-quality tires. Increasing device automation and big data adoption is boosting the market growth. Additionally, for cost-effective and high-quality tire production, some manufacturers are using an automated, one-step tire manufacturing process.

- According to the United States Tire Manufacturers Association (USTMA), total U.S. tire shipments of 342.1 million units in 2022, compared to 335.2 million units in 2021.

- China is the world's largest tire producer and consumer. There are more than 300 large, medium, and small tire manufacturers in all segments of China. China's tire industry is the largest in the world in terms of value and volume. According to China Rubber Industry Association's Tire Industry, the top 38 member companies produced a total of 529.22 million tires in 2021, an increase of 11.28% from previous year.

- Furthermore, according to the French tire manufacturing giant Michelin, in original equipment, the truck and bus tire market continued to perform well in Europe and North America against a backdrop of saturated order books since 2022. In North America, demand was supported by purchases of vehicles in anticipation of a new emissions standard coming into force in 2024.

- Considering all the above facts and factors, the usage and demand of rubber additives for tire applications are expected to grow in the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate through the forecast period. With the accelerating usage of rubber additives in automotive and increasing application in electrical and electronucs applications in countries such as China, India, and South Korea, the consumption of rubber additives is growing in the region.

- Rubber additives are widely used in the processing of rubber and its allied products. The growing demand for rubber in tire manufacturing in the automotive sector has been driving the market for rubber additives. The recovering automotive industry and resuming of other rubber-based industries in the country are expected to drive the market studied in the near future.

- China is the world's largest consumer of natural rubber, accounting for 37% of global consumption, but lacks suitable land to produce only a fraction of what it needs domestically. As a result, the Chinese government began encouraging Chinese companies to invest in rubber production. Thus, there is a potential for rubber additives in the country as they are used both to process natural and synthetic rubber.

- Since 2005, China has been the world's largest tire producer and consumer. Although tire production and consumption have enjoyed a very healthy growth, the last few years, especially the last two years, the market has been very tough for domestic and foreign companies operating in the country. However, as the automotive production and usage of rubber additives in different end-user industies constinues to expand, the consumption is projected to increase during the forecast period.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), despite the global economic unceratinities prevailing, the country's motor vehicle production registered an increase of 7% in 2021 and 3% in 2022.

- In addition, according to the association, motor vehicle production in India, Australia, and South Korea registered annual increases of 24%, 13%, and 9%, respectively, in 2022.

- According to the National Statistics Bureau, China's electronic information manufacturing sector recorded steady growth in 2022, signaling strong expansion in terms of production and investment. According to the Ministry of Industry and Information Technology, the added value of large companies in this sector increased by 7.6% year-on-year in this period, making the industry 4% higher than all industries. This is boosting the usage of electric cables.

- The Indian electronics industry is one of the fastest growing industries in the world. Recently, the Ministry of Electronics and Information Technology released Volume 2 of its vision document on electronics manufacturing in India, stating that the electronics manufacturing industry is anticipated to reach USD 300 billion by 2025-26.

- All factors above are likely to fuel the growth of rubber additives market in Asia-Pacific over the forecasted time frame.

Rubber Additives Industry Overview

The global rubber additives market is partially consolidated in nature, with top 5 players together accounting for more than 40% of the total market. Major players are also focusing on R&D activities, developing innovative techniques for the development of the product, engaging in mergers and acquisitions in order to increase their market share and optimizing supply chain to increase its efficacy and specialization in the market. The key players in the market studied include China Sunsine Chemical Holdings Limited, Rhein Chemie (LANXESS), Eastman Chemical Company, China Petrochemical Corporation (Sinopec), and NOCIL LIMITED, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growth in the Tire and Rubber Industry

- 4.1.2 Growing Demand from the Non-Tire Segment in the Construction Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Constraints Pertaining to Rubber Chemicals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Activators

- 5.1.2 Vulcanization Inhibitors

- 5.1.3 Plasticizers

- 5.1.4 Other Types

- 5.2 Application

- 5.2.1 Tires

- 5.2.2 Conveyor Belts

- 5.2.3 Electric Cables

- 5.2.4 Other Applications

- 5.3 Fillers

- 5.3.1 Carbon Black

- 5.3.2 Calcium Carbonate

- 5.3.3 Silica

- 5.3.4 Other Fillers

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Behn Meyer

- 6.4.3 China Petrochemical Corporation (SINOPEC)

- 6.4.4 China Sunsine Chemical Holdings Limited

- 6.4.5 Eastman Chemical Company

- 6.4.6 Emery Oleochemicals

- 6.4.7 Kemai Chemical Co. Ltd

- 6.4.8 MLPC International (Arkema Group)

- 6.4.9 NOCIL LIMITED

- 6.4.10 PUKHRAJ ZINCOLET

- 6.4.11 Rhein Chemie (Lanxess)

- 6.4.12 Sumitomo Chemical Co. Ltd

- 6.4.13 Thomas Swan & Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand From Electric Vehicles

- 7.2 Development of Bio-based Rubber Additives