|

市場調查報告書

商品編碼

1273462

睡眠呼吸暫停植入物市場——增長、趨勢、COVID-19 影響和預測 (2023-2028)Sleep Apnea Implant Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,睡眠呼吸暫停植入物市場預計將以 10.5% 的複合年增長率增長。

COVID-19 對睡眠呼吸暫停植入物市場產生了重大影響,因為睡眠呼吸暫停患者在感染 COVID-19 後症狀惡化。 感染加速了呼吸道的炎症,導致睡眠時呼吸更加困難。 此類重大生活事件可能會干擾睡眠並影響市場增長。 例如,2022 年 2 月發表在 ERJ 上的一篇文章發現,睡眠呼吸暫停的患病率和嚴重程度在疾病恢復過程中增加,這表明 SARS-CoV-2 感染與 SARS-CoV-2 感染之間存在顯著相關性 然而,隨著限制的解除和 COVID-19 病例的減少,對睡眠呼吸暫停植入物的需求增加、技術的快速進步和睡眠障礙的增加預計將在未來幾年推動市場增長。

睡眠呼吸暫停植入物市場的增長可歸因於多種因素,例如睡眠障礙的增加和睡眠呼吸暫停植入物的技術進步。 例如,根據 Advisor 2023 更新,美國約有 7000 萬人患有睡眠障礙。 此外,研究表明睡眠呼吸暫停植入物的技術進步有望在預測期內促進市場增長。 例如,根據 2022 年 2 月發表在 PubMed 上的一篇論文,微型種植體輔助快速上顎擴大術 (MARPE) 擴大了鼻腔和口腔的尺寸並擴大了中面,降低了氣流阻力,從而提高了效果OSA治療,它已經幫助了一些患者。 此外,2022 年 2 月,LivaNova PLC 將其阻塞性睡眠呼吸暫停 (OSA) 治療設備植入患者體內,標誌著其首個設備研究豁免研究。 該公司的隨機對照試驗,使用靶向舌下神經刺激 (OSPREY) 治療阻塞性睡眠呼吸暫停,評估了 LivaNova aura6000 植入式舌下神經刺激器系統治療中度至重度 OSA 成年患者的安全性和有效性。我正在嘗試來證明它有效。

因此,由於睡眠呼吸暫停患者的數量不斷增加以及睡眠呼吸暫停植入物的技術進步激增,所研究的市場預計在預測期內會出現增長。 然而,預計睡眠呼吸暫停植入物的高成本將抑制預測期內的市場增長。

睡眠呼吸暫停植入物的市場趨勢

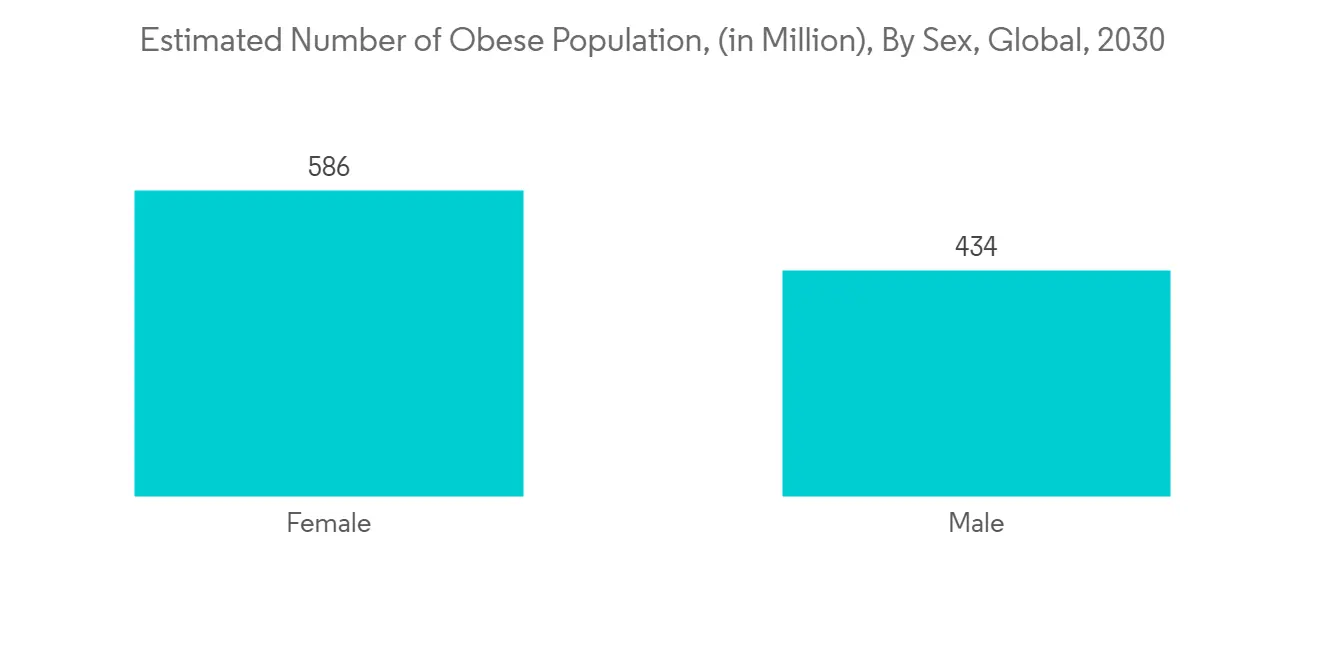

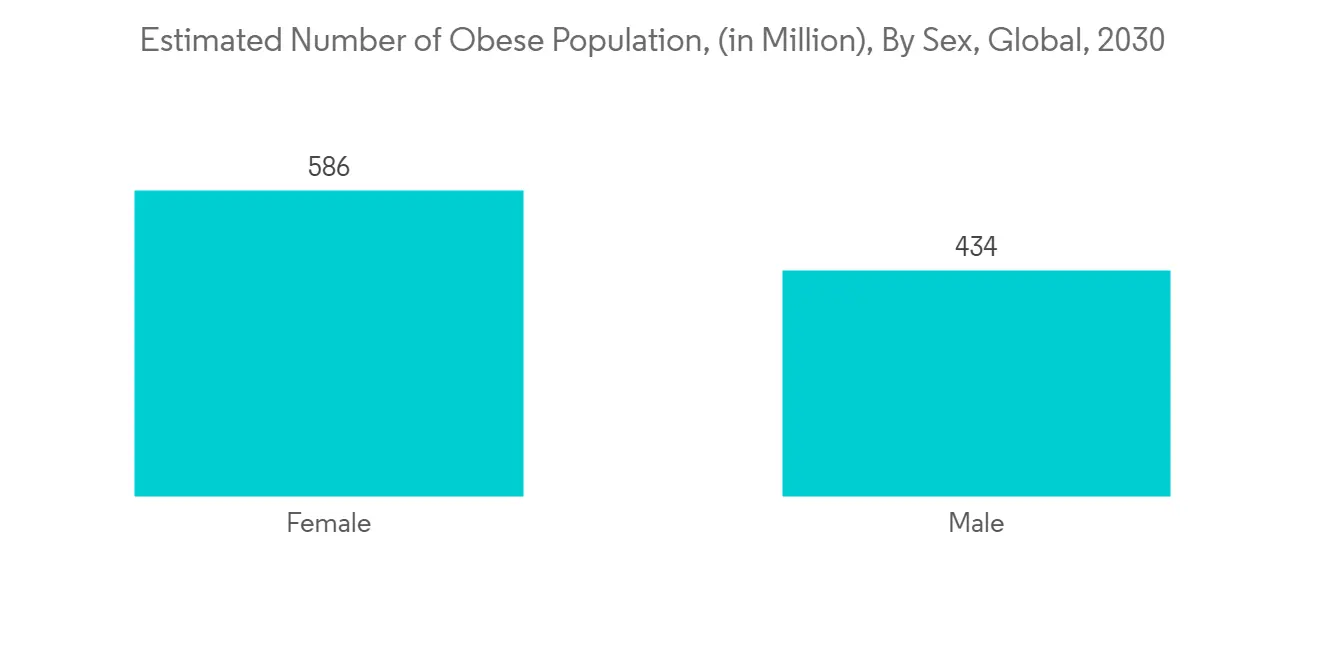

預計在預測期內,阻塞性睡眠呼吸暫停綜合徵將佔睡眠呼吸暫停植入物市場的很大份額

阻塞性睡眠呼吸暫停是一種呼吸在睡眠期間不斷停止和開始的疾病,會導致打鼾。 這種疾病通常發生在睡眠期間喉嚨肌肉間歇性放鬆,阻塞氣道時。 越來越多的患者對持續氣道正壓通氣 (CPAP) 設備無效,加上阻塞性睡眠呼吸暫停的患病率上升,導致睡眠呼吸暫停植入物的引入。 例如,根據 2023 年 1 月更新的 UptoDate 文章,基於每小時 5 次或更多事件/事件的全球估計表明,在 30 歲至 69 歲之間,全球有 9.36 億輕度至重度 OSA 患者和 4.25 億人全世界患有中度至重度 OSA 的人。 市場上流行的植入式設備包括 AIRLIFT、remedy System 和 Inspire Therapy。 有人指出,睡眠呼吸暫停綜合症與肥胖有關。 因此,肥胖病例的增加預計會增加 OSA 病例。 例如,根據 2022 年世界肥胖地圖集,預計到 2030 年將有 5.86 億女性和 4.34 億男性肥胖。 在肥胖人群中,上呼吸道的脂肪沉積會使氣道變窄並減少這些區域的肌肉活動,從而導致缺氧、呼吸暫停,並最終導致睡眠呼吸暫停。 因此,肥胖的增加將增加 OSA 的合併症,因此在預測期內使用植入物治療睡眠呼吸暫停可能會推動市場增長。

此外,阻塞性睡眠呼吸暫停領域正在進行的臨床研究和開發預計將在預測期內增加對研究標記物的需求。 例如,2021 年 6 月,Inspire Medical Systems, Inc. 正在讚助一項臨床研究,評估在植入和治療 Inspire 上呼吸道刺激 (UAS) 系統後認知和表達語言的客觀變化。 因此,此類研究證明了各種阻塞性睡眠呼吸暫停植入物的療效,預計將在預測期內促進市場增長。

因此,由於阻塞性睡眠呼吸暫停病例的增加和阻塞性睡眠呼吸暫停臨床研究的激增,預計該市場在預測期內將出現增長。

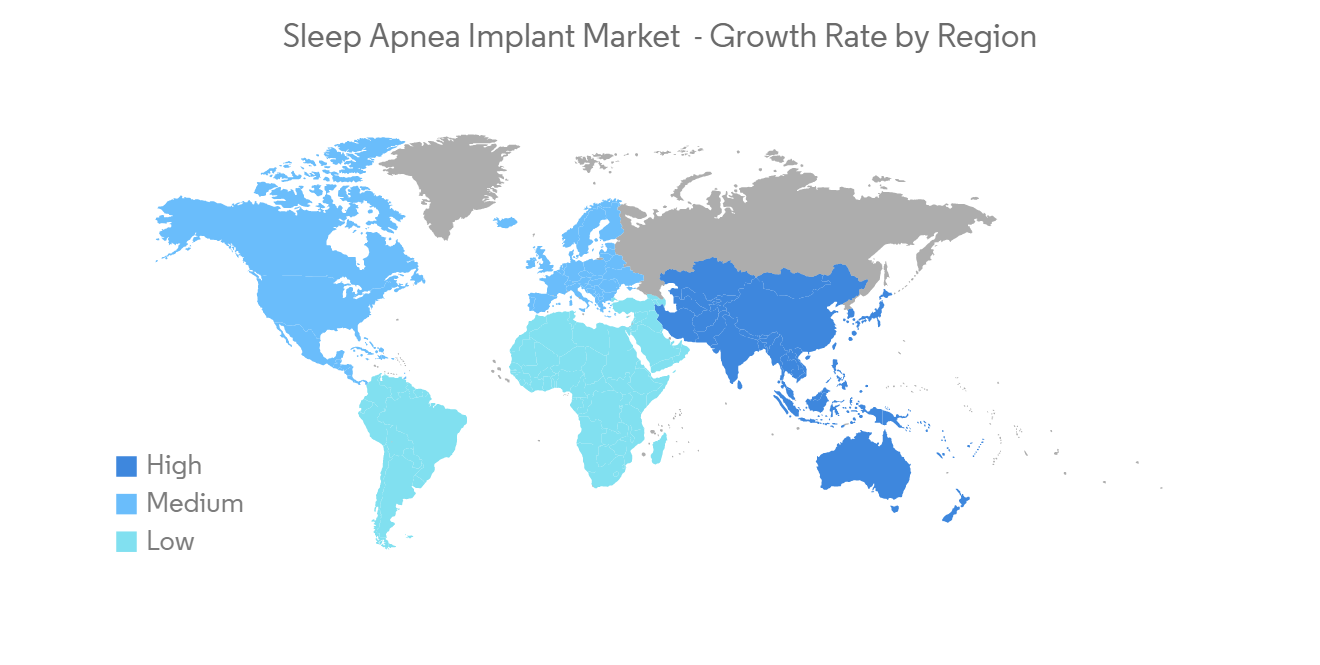

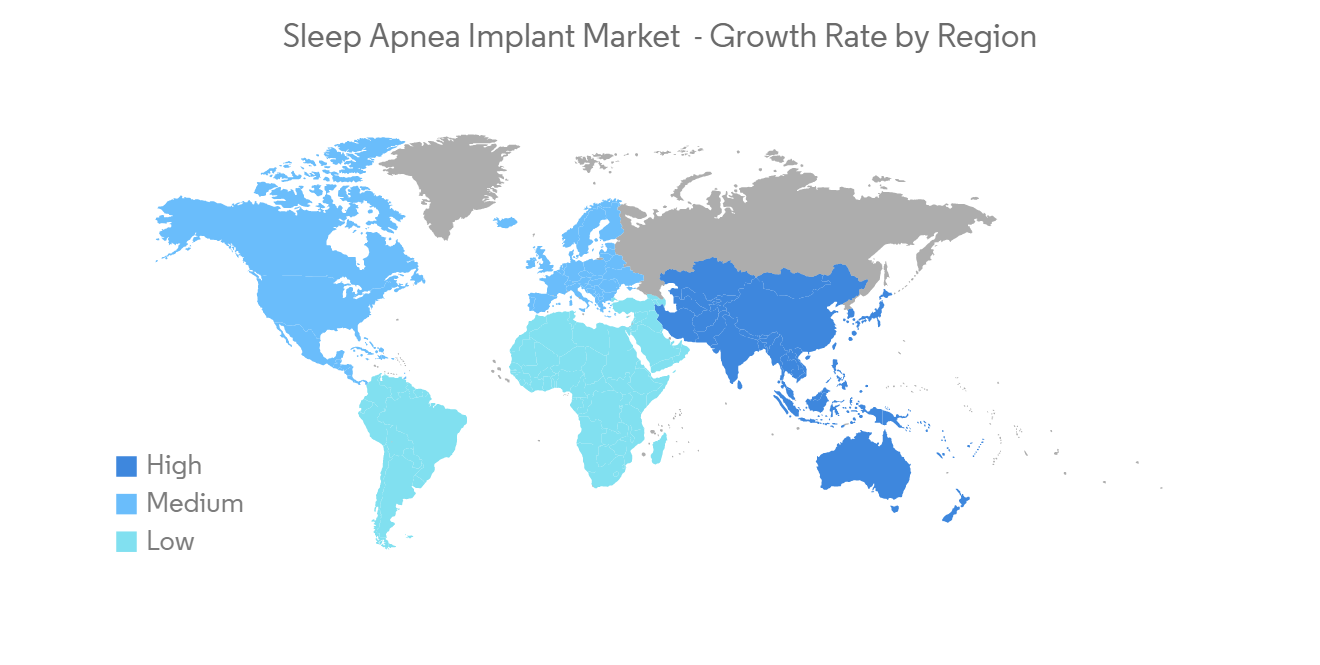

預計北美將佔很大份額,預計在預測期內也會如此

北美是全球睡眠呼吸暫停植入物市場的主要參與者,原因包括睡眠呼吸暫停綜合徵患病率上升、意識提高以及睡眠呼吸暫停植入物臨床研究激增等因素。預計將分一杯羹。 例如,根據 2022 年 3 月的一篇 PubMed 論文,研究人員進行的一項基於人口的調查發現,13.1% 的 45 歲及以上的加拿大女性(120 萬)和 21.9% 的加拿大男性(180 萬)處於患兒高風險OSA,而這種風險在中年和老年男性中比女性高 1.2-2 倍。

此外,2021 年 8 月,亞利桑那大學贊助了一項針對 50 歲及以上並被診斷患有中度或重度阻塞性睡眠呼吸暫停的成年人進行呼吸肌力量訓練的研究,以改善血壓和心率。一項臨床研究進行評估其對血管健康的影響。 此類研究提供了利用睡眠呼吸暫停植入物的重要性,並在預測期內推動了市場增長。

此外,許多政府研究機構正積極關注國內睡眠研究的持續發展,這將促進市場拓展。 例如,根據 NIH 2021 年 12 月的更新,2021 年 NIH 睡眠研究計劃基於研究人員、公眾、NIH 研討會參與者和項目工作人員的投入所確定的一組研究需求和機會。我'我在這裡。 該計劃強化了國家睡眠障礙研究中心的宗旨,並概述了建立在睡眠和晝夜節律研究人員近 30 年令人印象深刻的工作基礎上的願景。 五個戰略目標、研究重點和技術都展示了睡眠和晝夜節律科學如何增強醫學和改善公眾健康。 此外,九個關鍵觀點展示了在睡眠和晝夜節律研究的背景下拓寬生物醫學領域的潛力。

因此,由於睡眠呼吸暫停綜合徵病例的增加和睡眠呼吸暫停植入物臨床研究的增加,預計北美在預測期內將佔據研究市場的很大份額。

睡眠呼吸暫停植入物行業概覽

市場是整合的,由主要參與者組成。 市場參與者越來越關注開發創新產品,這正在推動市場增長。 目前主導市場的公司包括Medtronic、Respicardia Inc.、Inspire Medical Systems、Siesta Medical Inc.、LivaNova PLC 和 LinguaFlex。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查先決條件

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動因素

- 睡眠呼吸暫停設備的技術進步

- 增加睡眠障礙的負擔

- 市場製約因素

- 睡眠呼吸暫停植入物的高成本

- 波特的五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 按產品類型

- 舌下神經刺激器

- 腦神經刺激器

- 顎種植體

- 根據指示

- 阻塞性睡眠呼吸暫停綜合徵

- 中樞性睡眠呼吸暫停綜合徵

- 最終用戶

- 醫院

- 門診手術中心

- 醫務室

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章競爭格局

- 公司簡介

- Inspire Medical Systems

- LinguaFlex

- LivaNova PLC

- Medtronic

- ZOLL Medical Corporation

- Siesta Medical Inc.

- Nyxoah SA

第七章市場機會與未來趨勢

The sleep apnea implant market is expected to register a CAGR of 10.5% during the forecast period.

COVID-19 had a substantial impact on the sleep apnea implant market since patients with sleep apnea experienced worsening symptoms after affecting COVID-19. The infection promoted airway irritation, making sleep breathing more difficult. Such an important life event is likely to interrupt sleep and have an impact on market growth. For instance, as per the article published in February 2022 in ERJ journal, the researchers showed a significant correlation between increased prevalence and severity of sleep apnea during recovery from illness and the severity of SARS-CoV-2 infection. However, as the restrictions are lifted, and COVID-19 cases are reduced, the market is anticipated to witness growth in the coming years due to the increase in demand for sleep apnea implants, rapid technological advancements, and a rise in sleep disorders.

The growth of the sleep apnea implant market can be attributed to factors such as the rise in sleep disorders and technological advancements in sleep apnea implants. For instance, as per the Advisor 2023 update, about 70 million people in the United States suffer from sleep disorders. In addition, research studies demonstrating the technological advancements of sleep apnea implants are anticipated to boost market growth over the forecast period. For instance, as per the article published in February 2022 in PubMed, mini-implant assisted rapid palatal expansion (MARPE), which increased the size of the nasal and oral cavities and widens the midface, which helped in some patients with OSA therapy by reducing airflow resistance. Furthermore, in February 2022, LivaNova PLC marked its first investigational device exemption study, as the patient was implanted with the company's obstructive sleep apnea (OSA) treatment device. The company's randomized controlled study, "Treating Obstructive Sleep Apnea using Targeted Hypoglossal Neurostimulation" (OSPREY), seeks to demonstrate the safety and effectiveness of the LivaNova aura6000 System, an implantable hypoglossal neurostimulator intended to treat adult patients with moderate to severe OSA.

Thus, due to the rise in sleep apnea cases and the surge in technological advancements in sleep apnea implants, the studied market is anticipated to witness growth over the forecast period. However, the high cost of sleep apnea implants is likely to restrain the market growth over the forecast period.

Sleep Apnea Implant Market Trends

Obstructive Sleep Apnea Segment is Expected to Contribute Significant Share in the Sleep Apnea Implant Market Over the Forecast Period

Obstructive sleep apnea is a disorder in which breathing constantly stops and starts during sleep, leading to snoring. This disorder usually happens due to throat muscles intermittently relaxing and blocking the airway during sleep. A growing number of patients who are not cured by continuous positive airway pressure (CPAP) devices, coupled with the increasing prevalence of obstructive sleep apnea, are leading to the adoption of sleep apnea implants. For instance, as per the UptoDate article updated in January 2023, global estimates based on five or more events/episodes each hour imply that between the ages of 30 and 69, there are 936 million people worldwide with mild to severe OSA and 425 million people worldwide with moderate to severe OSA. Some of the popular implantable devices in the market are AIRLIFT, remede System, and Inspire Therapy. Sleep apnea is linked to the body mass index. Thus increase in obesity cases is expected to raise the cases of OSA. For instance, as per the World Obesity Atlas 2022, 586 million women and 434 million men are expected to be obese by 2030. In obese people, fat deposits in the upper respiratory tract narrow the airway; there is a decrease in muscle activity in this region, leading to hypoxic and apneic episodes, ultimately resulting in sleep apnea. Hence, an increase in obesity is likely to raise the complication of OSA and thereby likely to utilize sleep apnea implants, driving the market growth over the forecast period.

Furthermore, clinical studies and development conducted in the field of obstructive sleep apnea are anticipated to boost the demand for the studied marker over the forecast period. For instance, in June 2021, Inspire Medical Systems, Inc. sponsored a clinical study to evaluate objective change in cognition and expressive language after implant and therapy with Inspire Upper Airway Stimulation (UAS) System. Thus, such studies demonstrating the efficacy of different obstructive sleep apnea implants are anticipated to boost market growth over the forecast period.

Hence, due to the rise in obstructive sleep apnea cases and the surge in clinical studies in obstructive sleep apnea, the studied market is anticipated to witness growth over the forecast period.

North America is Expected to Hold a Significant Share and Expected to do Same Over the Forecast Period

North America is expected to hold a significant market share in the global sleep apnea implant market owing to factors such as the rising prevalence of sleep apnea in the region, increasing awareness, and a surge in clinical studies in sleep apnea implants. For instance, as per the article published in March 2022 in PubMed, the population-based study conducted by the researchers indicated that 13.1% of Canadian women (or 1.2 million) and 21.9% of Canadian men (or 1.8 million) aged above 45 were at high-risk for presenting OSA and that this risk was 1.2- to twofold higher for middle-aged and older men than women.

Furthermore, in August 2021, the University of Arizona sponsored a clinical study to evaluate the effects of respiratory strength training on blood pressure and cardiovascular health in adults who are 50 years of age and older and have been diagnosed with moderate or severe obstructive sleep apnea. Such research studies provide the importance of utilizing sleep apnea implants, which drive the market growth over the forecast period.

Additionally, many government research organizations are actively focused on the continuous development of sleep research across the country, which is likely to augment the market expansion. For instance, as per the December 2021 update by NIH, the 2021 NIH Sleep Research Plan was based on a set of research needs and opportunities identified with input from researchers, public representatives, NIH workshop participants, and programmatic staff. This plan outlines a vision that enhances the purpose of the National Center for Sleep Disorders Research and builds on sleep and circadian researchers' nearly three decades of remarkable achievement. The five strategic goals, research priorities, and techniques all showed how sleep and circadian sciences might enhance medicine and improve public health. Furthermore, the nine crucial prospects showed the potential to widen the biomedical sciences landscape in the context of sleep and circadian research.

Hence, due to the increase in sleep apnea cases and the rise in clinical studies in sleep apnea implants, North America is expected to hold a significant share of the studied market over the forecast period.

Sleep Apnea Implant Industry Overview

The market is consolidated and consists of major players. The increasing focus of market players for the development of innovative products are driving the growth of the market. Some of the companies which are currently dominating the market are Medtronic, Respicardia Inc., Inspire Medical Systems, Siesta Medical Inc., LivaNova PLC, and LinguaFlex.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Advancements in Sleep Apnea Devices

- 4.2.2 Rise in Burden of Sleep Disorders

- 4.3 Market Restraints

- 4.3.1 High Cost of Sleep Apnea Implants

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Hypoglossal Neurostimulation Devices

- 5.1.2 Phrenic Nerve Stimulator

- 5.1.3 Palatal Implants

- 5.2 By Indication Type

- 5.2.1 Obstructive Sleep Apnea

- 5.2.2 Central Sleep Apnea

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Office Based Clinics

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Inspire Medical Systems

- 6.1.2 LinguaFlex

- 6.1.3 LivaNova PLC

- 6.1.4 Medtronic

- 6.1.5 ZOLL Medical Corporation

- 6.1.6 Siesta Medical Inc.

- 6.1.7 Nyxoah SA