|

市場調查報告書

商品編碼

1435207

抗菌紡織品:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Antimicrobial Textile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

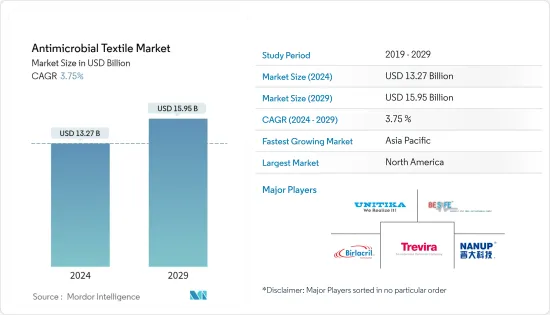

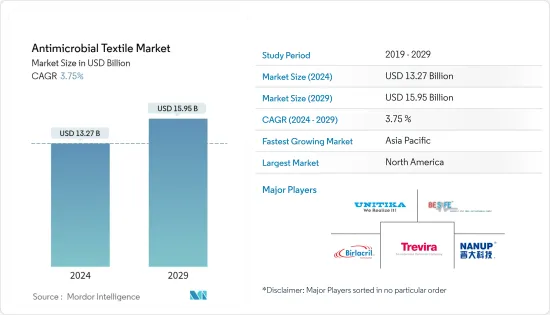

抗菌紡織品市場規模預計2024年為132.7億美元,預計到2029年將達到159.5億美元,在預測期內(2024-2029年)複合年成長率為3.75%成長。

2020年,由於COVID-19的感染疾病,對微生物纖維的需求增加。從那時起,世界各地對各種應用的衛生和防護紡織品的需求不斷增加。

主要亮點

- 醫療保健行業需求的成長和運動服裝應用的增加等因素正在推動市場成長。

- 然而,嚴格的環境法規正在阻礙市場成長。

- 無毒性和生物相容性產品的開發是預測期內市場成長的機會。

- 北美主導了全球市場,其中美國的消費量最高。

抗菌紡織品市場趨勢

醫用紡織品的應用不斷增加

- 抗生素用於殺死微生物或抑制其生長。抗菌紡織品是在纖維表面或內部塗布抗菌劑的紡織品。

- 在紡絲或擠出過程中將抗菌劑引入纖維中,與染料或顏料結合,或作為整理過程應用。您選擇的方法取決於多種因素,包括織物的最終用途、製造商的能力和您的預算。

- 醫療保健產業在抗菌紡織品的使用方面處於領先地位。這些纖維用於製造醫用窗簾、床單、枕頭套、床墊套和床單以及幫助檢查基材上微生物生長的醫院罩衣。

- 在美國,一座計劃價值50億美元的新醫院於2022年第四季在內華達州開工。根據美國醫院協會統計,截至2022年,全美總合6129家醫院。

- 此外,由於新型冠狀病毒感染疾病(COVID-19)的爆發,中國政府建造了多家醫院來容納不斷增加的患者人數。一座包含國際腫瘤中心的新醫療大樓計劃於 2023 年在中國西部竣工。

- 不同國家的此類新計劃預計將在預測期內增加工作人員和患者對抗菌紡織品的需求。

亞太地區將成為成長最快的地區

- 預計亞太地區將成為預測期內抗菌紡織品成長最快的市場。由於公眾健康意識的提高,中國、印度和日本等國家對抗菌紡織品的需求和使用正在擴大預測期內抗菌紡織品市場的範圍。

- 最大的抗菌紡織品生產商位於亞太地區。生產抗菌紡織品的一些領先公司包括 Unitika Trading、Birlacryl、Zindananotech(廈門)、Surgicotfab Textiles Pvt. Ltd 和 Sanitized AG。

- 2022 年 8 月,一家擁有 2,600 個床位的私立醫院在印度法裡達巴德開業,配備了最尖端科技,包括集中式全自動技術。

- 此外,2022 年 9 月,菲律賓武裝部隊 (AFP) 開始在奎松盧塞納建造一座新的三層醫院。該醫院將擁有25張床位,提供住院、門診病人、急診服務和附加服務。

- 由於該地區的這些趨勢,預計該地區對抗菌紡織品的需求在預測期內將會增加。

抗菌紡織業概況

全球抗菌紡織品市場高度分散,一些公司佔據了較小的市場佔有率。部分企業包括(排名不分先後)Birlacril、金達奈米科技(廈門)、Surgicotfab Textiles Pvt Ltd.、Trevira GmbH、UNITIKA LTD等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 醫療保健產業的需求不斷成長

- 擴大用途到運動服

- 其他司機

- 抑制因素

- 嚴格的環境法規

- 其他限制因素

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 類型

- 季銨鹽

- 三氯生

- 環糊精

- 幾丁聚醣

- 其他

- 目的

- 醫用紡織產品

- 服飾

- 家用紡織品

- 產業用紡織品

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Birlacril

- Herculite

- Jinda Nano Tech(Xiamen)Co.,Ltd

- LifeThreads

- Microban International

- Milliken Pivots Textile Manufacturing

- Sanitized AG

- Sinterama SpA

- Surgicotfab Textiles Pvt Ltd.

- Trevira GmbH

- UNITIKA LTD.

第7章 市場機會及未來趨勢

- 開發無毒且生物相容性產品

- 其他機會

The Antimicrobial Textile Market size is estimated at USD 13.27 billion in 2024, and is expected to reach USD 15.95 billion by 2029, growing at a CAGR of 3.75% during the forecast period (2024-2029).

In the year 2020, due to the breakdown of Covid-19, the demand for microbial textiles increased. Since then, the demand for hygienic and protective textiles is increasing for various applications all over the globe.

Key Highlights

- Factors such as growing demand from the healthcare industry and increasing application in sportswear are driving market growth.

- However, stringent environmental regulations are hindering the market growth.

- The development of non-toxic and bio-compatible products will act as an opportunity for the growth of the market during the forecast period.

- North America dominated the market across the globe with the largest consumption from the United States.

Antimicrobial Textiles Market Trends

Increasing Application in Medical Textiles

- Antimicrobial agents are used to kill microorganisms or to inhibit their growth. Antimicrobial fibers are textiles to which antimicrobial agents have been applied, either at the surface or within the fibers.

- Antimicrobial agents are introduced to the fiber during spinning or extrusion, combined with dyes or pigments, or applied as a finishing process. The chosen method is determined by a variety of factors including the final use of the fabric, the capability of the manufacturer, and the budget.

- The healthcare industry leads in the usage of antimicrobial textiles. These textiles are used in making medical curtains, bed sheets, and pillow coverings, mattress covers and linens, hospital gowns which help to check microbe's growth on the substrate.

- In the United States, in the fourth quarter of 2022, a new hospital construction started with a project value of USD 5,000 million in Nevada. As of 2022, according to the American Hospital Association, there are a total of 6,129 hospitals in the country.

- Further, due to the outbreak of Covid-19, in China the government built various hospitals to cater to growing number of patients. A new medical building which comprises of International Oncology Center is set to be completed in 2023 in West China.

- Such new proejcts across various countries will increase the demand for antimircobial textiles for the staff and patients over the forecast period.

Asia-Pacific Region to be the Fastest Growing Region

- The Asia-Pacific region is expected to be the fastest-growing market for antimicrobial textiles during the forecast period. In countries like China, India, and Japan because of growing public health awareness, the demand and utilization of antimicrobial textiles has been increasing the scope of the Antimicrobial Textile Market during the forecast period.

- The largest producers of antimicrobial textiles are located in the Asia-Pacific region. Some of the leading companies in the production of antimicrobial textiles are Unitika Trading Co. Ltd, Birlacril, Jinda Nano Tech (Xiamen) Co., Ltd, Surgicotfab Textiles Pvt.Ltd, and Sanitized AG among others.

- In August 2022, in Faridabad, India, a 2,600-bed private hospital was inaugurated which is equipped with cutting-edge technology, including a centralized fully-automated technology.

- Further, in September 2022, the Armed Forces of the Philippines (AFP) started the construction of a new three-storey hospital building in Lucena, Quezon. This hospital will feature 25 beds and offers in-patient, outpatient, emergency, and additional services.

- Such trends in the region will increase the demand for anitmicrobial textiles in the region over the forecast period.

Antimicrobial Textiles Industry Overview

The global antimicrobial textiles market is highly fragmented with players accounting for a marginal share of the market. A few companies include (not in any particular order) Birlacril, Jinda Nano Tech (Xiamen) Co., Ltd, Surgicotfab Textiles Pvt Ltd., Trevira GmbH, and UNITIKA LTD among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Healthcare Industry

- 4.1.2 Increasing Application in Sportswear

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulatuions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Quaternary Ammonium

- 5.1.2 Triclosan

- 5.1.3 Cyclodextrin

- 5.1.4 Chitosan

- 5.1.5 Others

- 5.2 Application

- 5.2.1 Medical Textiles

- 5.2.2 Apparel

- 5.2.3 Home Textiles

- 5.2.4 Industrial Textiles

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Birlacril

- 6.4.2 Herculite

- 6.4.3 Jinda Nano Tech(Xiamen) Co.,Ltd

- 6.4.4 LifeThreads

- 6.4.5 Microban International

- 6.4.6 Milliken Pivots Textile Manufacturing

- 6.4.7 Sanitized AG

- 6.4.8 Sinterama S.p.A.

- 6.4.9 Surgicotfab Textiles Pvt Ltd.

- 6.4.10 Trevira GmbH

- 6.4.11 UNITIKA LTD.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Non-Toxic and Bio-Compatible Products

- 7.2 Other Opportunities