|

市場調查報告書

商品編碼

1435203

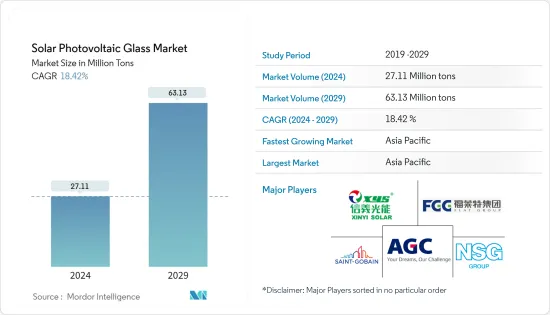

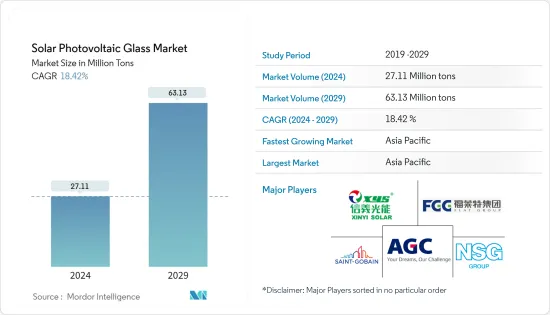

光伏玻璃:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Solar Photovoltaic Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計2024年太陽能玻璃市場規模為1528萬噸,預計2029年將達到3003萬噸,在預測期內(2024-2029年)複合年成長率為14.47%成長。

冠狀病毒感染疾病(COVID-19) 的爆發對多個行業產生了短期和長期影響,包括影響太陽能玻璃市場的製造業和建設業。該行業受到供應鏈中斷和化學品製造公司停產的廣泛影響。這是因為封鎖和勞動力短缺對市場產生了不利影響。

主要亮點

- 推動太陽能玻璃市場的主要因素是非住宅領域需求的增加和政府補貼計畫的增加。

- 太陽能玻璃安裝和維護的高資本成本預計將阻礙所研究市場的成長。

- 為了減少空氣污染而對生產綠色電力的需求不斷成長,為太陽能玻璃市場的成長提供了各種機會。

- 亞太地區主導太陽能玻璃市場,其中中國、日本和印度是主要消費國。

光伏(PV)玻璃市場趨勢

非住宅領域的需求增加

- 太陽能玻璃是一種將光能轉換為電能的技術。這種玻璃採用透明半導體光伏電池,也稱為太陽能電池。這些電池夾在兩塊玻璃之間,使它們能夠捕捉陽光並將其轉換為電能。

- 太陽能電池產生的電力可減少碳排放和溫室氣體排放,並確保節省能源成本。這些產品之間的太陽能效率和光傳輸方面的差異為建築設計提供了多種選擇。

- 光伏玻璃可以輕鬆整合到建築物和屋頂系統中,從而可以透過創造性的建築設計經濟地利用太陽能並產生可再生能源。

- 此外,由於印度工業活動的活性化,工業電力需求預計將增加。因此,屋頂太陽能光電安裝成為企業自力更生的強力選擇,印度屋頂太陽能光電市場可望擴大。例如,2022年第四季(Q4),印度屋頂太陽能裝機量較上季成長近51%,從320兆瓦增加到483兆瓦。這相當於與前一年同期比較成長 20%。工業部門約佔年內總裝置量的42%。因此,屋頂太陽能光電裝置的增加預計將為太陽能光電玻璃市場創造上行需求。

- 印度政府宣布投資 31.65 兆美元,根據智慧城市計畫建造 100 個城市。 100個智慧城市和500個城市有潛力吸引價值2兆盧比(約281.8億美元)的投資。該專案預計將於2019年至2023年完成,為光伏玻璃在非住宅領域的應用創造空間。

- 非住宅領域引領著光伏電池的使用,其中中國、英國、美國、印度、日本和馬來西亞在光伏玻璃市場中發揮重要作用。

- 由於所有這些因素,太陽能玻璃市場預計在預測期內穩定成長。

亞太地區主導市場

- 預計亞太地區將主導太陽能玻璃市場。在中國、印度和日本等新興國家,電力供應危機正在擴大該地區使用太陽能玻璃的內部發電範圍。

- 最大的太陽能玻璃生產商位於亞太地區。太陽能玻璃製造領域的領先公司包括晶科太陽能、三菱電機公司、Onyx Solar Group LLC、晶澳太陽能和Infini。

- 根據國際可再生能源機構(IRENA)預測,2022年印度太陽能發電容量將達到62.8吉瓦以上,較2021年成長21.5%。因此,由於太陽能發電容量的增加,預計太陽能發電的需求將會增加。國內太陽能發電玻璃市場。

- 太陽能電池產生的電力可減少碳排放和溫室氣體排放,並確保節省能源成本。

- 此外,日本正在尋求透過努力減少核能在其能源結構中的佔有率來擴大裝置容量,目標是到2030年將裝置容量增加到近108吉瓦。然而,在這些領域中,由於住宅太陽能普及較高,地面安裝領域預計將以最快的速度成長,從而為大型公用事業規模計劃創造了對大型中央逆變器的需求。

- 中國是全球最大的太陽能玻璃生產國。 2022年7月,中國工業與資訊化部透露,截至6月底,全國太陽能玻璃產能達到6.4萬噸/日,涵蓋38家企業的348條生產線。目前已運作生產線313條,總合5.9萬噸。

- 上述因素和政府支持正在推動預測期內太陽能光電玻璃市場需求的增加。

光伏玻璃產業概況

太陽能玻璃市場本質上是整合的。該市場的主要企業(排名不分先後)包括信義光能控股有限公司、福萊特玻璃Group Limited。株式會社、AGC株式會社、日本板硝子株式會社、聖戈班、入子集團新能源株式會社等

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 非住宅領域的需求增加

- 增加政府補貼制度

- 其他司機

- 抑制因素

- 安裝和維護資本成本高

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 類型

- 薄膜矽玻璃

- 碲化鎘薄膜玻璃

- 結晶太陽能電池玻璃

- 非晶質玻璃

- 其他類型

- 目的

- 住宅

- 非住宅

- 商業的

- 工業/設施

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Canadian Solar

- INFINI Co. Ltd

- JA SOLAR Technology Co.,Ltd.

- Jinko Solar

- KANEKA CORPORATION

- KYOCERA Corporation

- Mitsubishi Electric Corporation

- Onyx Solar Group LLC.

- SunPower Corporation

- Trina Solar

第7章 市場機會及未來趨勢

- 綠色電力生產需求不斷成長

- 一種採用薄膜技術的新型太陽能電池技術現已上市,該技術在太陽能電池上使用了窄的碲化鎘塗層。

The Solar Photovoltaic Glass Market size is estimated at 15.28 Million tons in 2024, and is expected to reach 30.03 Million tons by 2029, growing at a CAGR of 14.47% during the forecast period (2024-2029).

The COVID-19 outbreak brought several short-term and long-term consequences in various industries, such as manufacturing and construction affecting the solar photovoltaic glass market. The industry was widely impacted due to supply chain disruption and a halt in the production of chemical manufacturing companies. It is due to lockdown and workforce shortages, thus, adversely affecting the market.

Key Highlights

- Major factors driving the solar photovoltaic glass market are increasing the demand from non-residential sector and increasing number of subsidy schemes from government.

- High capital costs for installation and maintenance of photovoltaic glass is expected to hinder the growth of the market studied.

- The growing demand for producing green electricity to reduce air pollution is offering various opportunities for the growth of solar photovoltaic glass market.

- Asia-Pacific region dominated the market for solar photovoltaic glass with China, Japan, and India representing major countries for consumption.

Solar Photovoltaic (PV) Glass Market Trends

Increasing Demand from Non-Residential Sector

- Solar photovoltaic glass is a technology that enables the conversion of light into electricity. The glass is incorporated with transparent semiconductor-based photovoltaic cells, which are also known as solar cells. These cells are sandwiched between two sheets of glass, which enables them to capture these solar rays and convert them into electricity.

- The power generated from solar photovoltaic cells reduces carbon footprints and greenhouse gas emissions and also ensures energy cost savings. Variance in photovoltaic efficiency and light penetration among these products enables multiple options for architectural design.

- Solar photovoltaic glass can be easily integrated into buildings and rooftop systems, thereby creating renewable energy through the economical use of solar energy and creative architectural design.

- Moreover, due to the rise of industrial activity in India, industry power demand will increase. As a result, rooftop solar installations would provide a robust option for enterprises to become self-reliant, which is expected to increase the rooftop solar market in India. For instance, in the fourth quarter (Q4) of 2022, India's rooftop solar installations increased by almost 51% quarter-over-quarter, adding 483 MW compared to 320 MW. This represents a year-on-year growth of 20%. The industrial sector accounted for approximately 42% of all installations during the year. Therefore, increasing rooftop solar installations is expected to create an upside demand for the solar photovoltaic glass market.

- The Indian government has announced an investment worth USD 31,650 billion for the construction of 100 cities under the smart cities plan. 100 smart cities and 500 cities are likely to invite investments worth INR 2 trillion (~USD 28.18 billion). This is expected to complete between 2019 and 2023, creating scope for the application of solar photovoltaic glass in the non-residential sector.

- Non-residential sector leads in the utilization of solar photovoltaic cells, with China, the United Kingdom, the United States, India, Japan, and Malaysia playing a major role in the solar photovoltaic glass market.

- Due to all such factors, the market for solar photovoltaic glass is expected to have steady growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for solar photovoltaic glass market. In developing countries, such as China, India, and Japan, the crisis in the supply of electricity has resulted in increasing the scope for the self-production of electricity using solar photovoltaic glass in the region.

- The largest producers of solar photovoltaic glasses are located in the Asia-Pacific region. Some of the leading companies in the production of solar photovoltaic glasses are Jinko Solar, Mitsubishi Electric Corporation, Onyx Solar Group LLC, JA Solar Co. Ltd, and Infini Co. Ltd.

- According to the International Renewable Energy Agency (IRENA), solar photovoltaic energy capacity in India reached over 62.8 gigawatts in 2022, a 21.5% increase over 2021. As a result, an increase in the capacity of solar photovoltaic energy is expected to boost the solar photovoltaic glass market in the country.

- The power generated from solar photovoltaic cells reduces carbon footprints and greenhouse gas emissions and also ensures energy cost savings.

- Moreover, Japan is trying to expand its installed solar capacity due to efforts to reduce the share of nuclear in their energy mix and aims to expand installed solar capacity to nearly 108 GW by 2030. However, due to the high solar penetration rate in the residential sector, the ground-mounted segment is expected to grow at the fastest pace, creating a demand for larger, central inverters for large utility-scale projects.

- China is the world's largest solar PV glass manufacturer. In July 2022, China's Ministry of Industry and Information Technology revealed that the country's solar glass capacity reached 64,000 metric tons (MT) per day across 348 production lines from 38 companies at the end of June. Currently, 313 production lines with a combined capacity of 59,000 MT are operational.

- The aforementioned factors, coupled with government support, are contributing to the increasing demand for the solar photovoltaic glass market during the forecast period.

Solar Photovoltaic (PV) Glass Industry Overview

The solar photovoltaic glass market is consolidated in nature. The major players in this market (not in a particular order) include Xinyi Solar Holdings Limited, Flat Glass GroupCo. Ltd., AGC Inc., Nippon Sheet Glass Co. Ltd., Saint-Gobain, and Irico Group New Energy Company Limited among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Non-residential Sector

- 4.1.2 Increasing Number of Subsidy Schemes from Government

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Capital Costs for Installation and Maintenance

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Thin Film Silicon Glass

- 5.1.2 Cadmium Telluride Thin Film Glass

- 5.1.3 Crystalline Solar Glass

- 5.1.4 Amorphous Silicon Solar Glass

- 5.1.5 Other Types

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Non-residential

- 5.2.2.1 Commercial

- 5.2.2.2 Industrial/Institutional

- 5.2.2.3 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Canadian Solar

- 6.4.2 INFINI Co. Ltd

- 6.4.3 JA SOLAR Technology Co.,Ltd.

- 6.4.4 Jinko Solar

- 6.4.5 KANEKA CORPORATION

- 6.4.6 KYOCERA Corporation

- 6.4.7 Mitsubishi Electric Corporation

- 6.4.8 Onyx Solar Group LLC.

- 6.4.9 SunPower Corporation

- 6.4.10 Trina Solar

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Producing Green Electricity

- 7.2 New Models Of Solar Cells Made of Thin Film Technology that use Narrow Coatings of Cadmium Telluride in Solar Cells, which have Higher Efficiency and Lower Cost