|

市場調查報告書

商品編碼

1433943

過氧乙酸:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Peracetic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

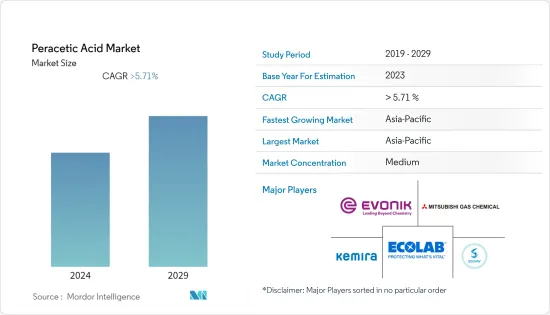

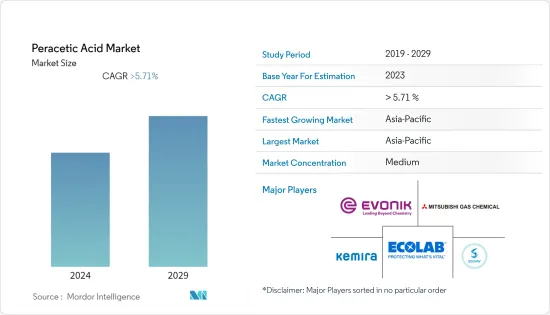

預計2024年過氧乙酸市場規模為36萬噸,預計2029年將達到48萬噸,在預測期(2024-2029年)複合年成長率為5.71%。

冠狀病毒感染疾病(COVID-19)大流行對市場產生了負面影響。這是因為製造設施和工廠因封鎖和限制措施而關閉。供應鏈和運輸中斷造成了進一步的市場瓶頸。然而,隨著所研究市場的需求復甦,該產業在 2021 年出現復甦。

主要亮點

- 短期內,水處理產業需求的成長以及各產業消毒劑使用的增加是推動所研究市場成長的一些因素。

- 另一方面,高成本和負面健康影響預計將阻礙市場成長。

- 然而,過氧乙酸在無菌包裝中的使用不斷增加預計將成為市場的機會。

- 亞太地區主導全球市場,中國、印度和日本等國家是最大的消費國。

過氧乙酸市場趨勢

主導市場的消毒應用

- 過氧乙酸 (PAA) 在食品工業、水處理以及紙漿工業中用作防止生物膜形成的消毒劑和清洗劑。

- 過氧乙酸是一種廣譜除生物劑,可用於許多工業部門,因此用於維持衛生標準。即使在低濃度和溫度下,也能有效對抗所有類型的微生物,包括細菌、真菌、孢子和病毒。

- 其穿過細胞膜的能力有助於賦予其優異且快速的抗菌效果。一旦PAA進入細胞,酵素系統就會被不可逆地破壞,導致微生物的滅亡。

- PAA 用於對食品和飲料產品進行消毒。例如,根據美國人口普查局的數據,2022年美國食品飲料零售商的年銷售額約為9,470億美元,較2021年成長7.65%。由於食品和飲料產品的成長,預計對過乙酸的需求將會增加。

- PAA 用於設備、表面、儲存槽、管道和寶特瓶的消毒,以保護內部材料在生產鏈中免受微生物侵襲。它也用於紡織產品的消毒和醫療設備的水處理。

- 過乙酸作為消毒劑的另一個重要用途是壓艙水。壓艙水用於控制船舶縱傾、橫傾、吃水、穩定性和應力,每年船舶排放數十億噸壓艙水。國際海事組織要求船舶只能在一定的排放標準內排放壓艙水。為了滿足這些標準,可以在壓艙水使用過乙酸。

- 在動物保健行業,PAA 用於對錶面進行消毒,以預防牲畜疾病。透過機械噴霧器或清洗噴灑,對系統進行消毒並消除 baPAA 的生長。它主要用作食品、飲料和水處理行業的消毒劑。世界人口的快速成長和都市化的加速正在增加對加工食品的需求。已開發國家70%以上的食品是加工食品。這些產品通常包裝在需要消毒的塑膠容器中。這可能會增加食品和飲料行業對 PAA 等消毒劑的需求。

- 此外,一些國家為了實現永續發展目標和保護環境,制定了更嚴格的污水處理法規和條例。在北美,美國環保署 (EPA) 根據《污水指南》制定了國家污水排放標準。這些標準已涵蓋國家污染物排放消除系統(NPDES)。

- 在歐盟,所有成員國都必須遵守關於都市廢水處理的理事會指令 91/271/EEC 中規定的污水處理指令。如果國家不遵守這些規定,可能會受到訴訟和罰款。

- 因此,上述因素可能會增加預測期內各行業對消毒劑的需求。

亞太地區主導市場

- 預計亞太地區將在預測期內主導過氧乙酸市場。在中國、印度和日本等國家,由於製藥、食品、飲料和化學工業的需求增加,對過氧乙酸的需求增加。

- 在亞太地區,中國是GDP最大的經濟體。 2021年,中國實際GDP成長8.4%,主要得益於疫情後消費支出的復甦。此外,國際貨幣基金組織(IMF)預計2022年GDP將成長3.0%,而IMF預測2023年GDP將成長約5.2%。

- 在食品和飲料行業,過氧乙酸被用作食品加工助劑,用於抗菌干預,而不會給最終產品添加氣味、顏色或風味。也用於動物設施的消毒和消毒。

- 中國是最大的食品和飲料消費國之一,鑑於人口成長和對健康美味加工食品的需求不斷增加,食品加工業不斷擴大。這個國家受歡迎的食品包括烘焙產品、飲料和其他營養食品。例如,工業信部資料顯示,2023年第一季與前一年同期比較飲料產量年增6%,達4,435萬噸。

- 此外,根據中國輕工業聯合會的數據,年銷售額超過280萬美元的主要食品製造企業報告稱,2022年收益將超過1.53兆美元。與2021年相比,總收益與前一年同期比較增500億美元。 5.6%,顯示食品業強勁成長。

- 根據印度造紙製造商協會(IPMA)預測,2021-2022年印度的紙張和紙板出口將激增80%左右,達到1396.3億印度盧比(約16.9217億美元)的歷史新高。此外,根據製漿造紙研究所(CPPRI)的報告,印度約有 861 家造紙廠,其中 526 家正在運作,2020-21 年總裝置容量超過 2,500 萬噸。因此,預計在預測期內該國對過氧乙酸的需求將會增加。

- 日本的食品加工業生產各種各樣的食品,從傳統食品到嬰兒和老年人的加工食品。由於食品和飲料產品消費量的增加,預計該國的食品加工業在未來幾年將成長。該國的食品和飲料行業是由包裝食品不斷成長的需求所推動的。

- 日本是繼美國和中國之後的世界第三大包裝食品市場。根據 Euromonitor 的數據,到 2025 年,日本加工食品市場的零售額預計將達到 2,045 億美元,成長 3.6%(70 億美元)。這種成長可歸因於所研究市場的需求不斷增加。

- 所有這些因素都可能增加對過乙酸的需求,從而導致預測期內的市場成長。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 水處理產業需求不斷成長

- 擴大作為殺菌劑在各行業中使用

- 抑制因素

- 高成本和負面健康影響

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 目的

- 殺菌劑

- 氧化劑

- 殺菌劑

- 其他用途

- 最終用戶產業

- 食品和飲料

- 水處理

- 紙漿/造紙製造

- 醫療保健(包括藥品)

- 化學

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 墨西哥

- 加拿大

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲等

- 中東/非洲

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ACURO ORGANICS LIMITED

- Aditya Birla Chemicals

- Airedale Chemical Company Limited

- Biosan

- Christeyns

- Diversey, Inc

- Ecolab

- Enviro Tech Chemical Services Inc.(arxada Ag)

- Evonik Industries AG

- Hydrite Chemical

- Kemira

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Solvay

- Stockmeier Group

第7章:市場機會以及機會與趨勢

The Peracetic Acid Market size is estimated at 0.36 Million tons in 2024, and is expected to reach 0.48 Million tons by 2029, growing at a CAGR of 5.71% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, growing demand from the water treatment industry and increasing usage as a disinfectant across various industries are some of the factors driving the growth of the market studied.

- On the flip side, high costs and adverse effects on health are expected to hinder the growth of the market.

- However, the increase in peracetic acid use in aseptic packaging is expected to act as an opportunity for the market.

- The Asia-Pacific region dominated the market worldwide, with countries like China, India, and Japan being the biggest consumers.

Peracetic Acid Market Trends

Disinfectant Application to Dominate the Market

- Peracetic acid (PAA) is used as a disinfectant and cleanser in the food industry, in water treatment, and to prevent biofilm formation in the pulp industries.

- To maintain hygiene standards, peracetic acid is used as it is a broad-spectrum biocide and can be used in many industrial fields. It is effective against all types of microorganisms like bacteria, fungi, spores, and viruses, even at low concentrations and temperatures.

- Its capability to penetrate through the cell membrane helps it impart excellent and rapid antimicrobial effects. When PAA enters the cell, it irreversibly disrupts the enzyme system, which leads to microorganism destruction.

- PAA is used to disinfect food and beverage products. For instance, according to the US Census Bureau, in 2022, annual sales of retail food and beverage stores in the United States amounted to approximately USD 947 billion, which showed an increase of 7.65% compared with 2021. Therefore, an increase in the sales of food and beverage products is expected to create an upside demand for peracetic acid.

- PAA is applied to disinfect equipment, surfaces, tanks, pipes, and plastic bottles to protect the inside material from microorganism attacks along the production chain. It is also used to disinfect water treatment in textiles and medical devices.

- Another important use of peracetic acid as a disinfectant is in ballast water treatment. Ballast water is used to control ship trim, list, draught, stability, or stresses, and billions of tons of ballast water are discharged by ships every year. The International Maritime Organization requires ships to discharge ballast water only within specific discharge standards. To meet these standards, peracetic acid can be used in ballast water.

- In the animal health industry, PAA is used to disinfect surfaces to avoid livestock diseases. It is sprayed by mechanical sprayers or pressure washers to sanitize the system and eliminate the growth of baPAA is majorly used as a disinfectant in the food and beverage and water treatment industry. A rapidly growing population and greater urbanization globally have boosted processed food demand. More than 70% of food in developed countries is processed food. These products are generally packed in plastic containers which need disinfection. This is likely to boost disinfectants like PAA demand from the food and beverage industry.

- Further, several countries have made their wastewater treatment rules and regulations more stringent to meet the sustainable development goal and protect the environment. In North America, under the effluent guidelines, the Environmental Protection Agency (EPA) develops national standards for wastewater discharge. These standards are incorporated into the National Pollutant Discharge Elimination System (NPDES).

- In the European Union, it is mandatory for all member countries to follow the wastewater treatment directive mentioned in The Council Directive 91/271/EEC for urban wastewater treatment. If countries fail to comply with these regulations, they can receive court action and fines.

- Hence, the aforementioned factors are likely to increase disinfectant demand from various industries during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for peracetic acid during the forecast period. In countries like China, India, and Japan, the demand for peracetic acid increased due to the increasing demand from the pharmaceutical, food, beverage, and chemical industries.

- In the Asia-Pacific region, China is the largest economy in terms of GDP. China's real GDP grew by 8.4% in 2021, primarily driven by consumer spending rebound post-pandemic. Furthermore, in 2022, as per the International Monetary Fund (IMF), the country's GDP is accounted to grow by 3.0%, whereas, in 2023, the IMF has forecasted that the GDP will grow by about 5.2%.

- In the food and beverage industry, peracetic acid is used as a food processing aid for antimicrobial intervention without adding odors, colors, or flavors to the end product. It is also used to sanitize and disinfect animal facilities.

- China is one of the largest consumers of food and beverages, with the food processing industry continuing to expand in view of the growing population and rising demand for healthy and tasty packaged foods. Some of the popular food products in the country include bakery products, beverages, and other nutritious food items, among others. For instance, according to the data from the Ministry of Industry and Information Technology, the country witnessed its beverage production increase 6 percent year-on-year, reaching 44.35 million tons during Q1 2023.

- Furthermore, according to the China National Light Industry Council, major food manufacturing companies with an annual turnover of over USD 2.8 million reported revenues of over USD 1.53 trillion in 2022. Compared to 2021, the total revenue registered a year-on-year growth of 5.6 percent, indicating strong growth in the food industry.

- According to Indian Paper Manufacturers Association (IPMA), exports of paper and paperboard from India jumped to around 80% in 2021-22, touching a record value of INR 13,963 crore (~USD 1,692.17 million). In addition, as per the report of the Pulp & Paper Research Institute (CPPRI), there are about 861 paper mills in India, out of which 526 are operational, with a total installed capacity of over 25 million tons in 2020-21. Thus, the demand for peracetic acid is expected to be high in the country during the forecast period.

- The Japanese food processing industry produces a wide range of foods, from traditional to processed food, for infants and elderly people. The food processing industry in the country is estimated to grow in the coming years, owing to the higher consumption of food and beverage products. The food and beverage industry in the country is driven by the rising demand for packaged food.

- Japan is the third-largest package food market in the world after the United States and China. According to Euromonitor, it is estimated that by 2025, the retail sales in the packaged food market in Japan are expected to reach USD 204.5 billion, a growth of 3.6% or USD 7 billion. This growth is attributed to the increase in the demand for the market studied.

- All such factors are likely to increase the demand for peracetic acid, which as a result, leads to its market growth over the forecasting period.

Peracetic Acid Industry Overview

The peracetic acid market is partially consolidated in nature. The major players in this market (not in any particular order) include Solvay, Evonik Industries AG, Ecolab, Kemira, and Mitsubisho Gas Chemical Company Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand From Water Treatment Industry

- 4.1.2 Increasing Usage as A Disinfectant Across Various Industries

- 4.2 Restraints

- 4.2.1 High Cost and Adverse Effect on Health

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Disinfectant

- 5.1.2 Oxidizer

- 5.1.3 Sterilant

- 5.1.4 Other Applications

- 5.2 End-user Industry

- 5.2.1 Food and Beverage

- 5.2.2 Water Treatment

- 5.2.3 Pulp and Paper

- 5.2.4 Healthcare (incl. Pharmaceutical)

- 5.2.5 Chemical

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Mexico

- 5.3.2.3 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACURO ORGANICS LIMITED

- 6.4.2 Aditya Birla Chemicals

- 6.4.3 Airedale Chemical Company Limited

- 6.4.4 Biosan

- 6.4.5 Christeyns

- 6.4.6 Diversey, Inc

- 6.4.7 Ecolab

- 6.4.8 Enviro Tech Chemical Services Inc. (arxada Ag)

- 6.4.9 Evonik Industries AG

- 6.4.10 Hydrite Chemical

- 6.4.11 Kemira

- 6.4.12 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 6.4.13 Solvay

- 6.4.14 Stockmeier Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Usage In Aseptic Packaging Applications