|

市場調查報告書

商品編碼

1273475

特種酶市場——增長、趨勢和預測 (2023-2028)Specialty Enzymes Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

未來五年,特種酶市場預計將以 7.6% 的複合年增長率增長。

酶是存在於所有生物體(包括人類)中的蛋白質,可作為催化劑。另一方面,酶是生命活動所必需的物質,有助於許多複雜多樣的物質代謝活動。消費者健康意識的提高導致功能性食品消費量的增加,預計這將在預測期內對酶的需求產生積極影響。2021 年 3 月,International Flavors & Fragrances Inc. 宣佈推出 Enovera 3001 酶,這是其烘焙行業配料系列的最新成員。這種新的酶提供了一種標籤友好的配方,可以在不影響質地或味道的情況下強化烘焙麵團。在過去的十年中,食品的天然風味和味道以及獨特的食品增加了對酶的需求,從而導致市場擴大。它用於各種應用,包括果汁澄清、釀造發芽、奶酪製作、嬰兒食品預消化和肉類嫩化。此外,即將到來的人口激增、食品質量的提高、消費者對營養需求意識的提高等預計將對市場擴張產生有利影響。

由於日本對加工食品的需求不斷增加以及酶在加工食品行業的廣泛應用,該市場正在經歷快速增長。此外,日本食品技術的創新以及人們對酶可用於生產更高質量產品的認識不斷提高,進一步推動了市場的發展。例如,DSM推出了專門針對無麩質應用的全新烘焙酶系列,可改善麵包的柔軟度和濕潤度。這些酶還用於其他應用,例如玉米餅、黑麥麵包和白麵包。印度食品、飲料和製藥行業的快速增長正在支持這種擴張,隨著時間的推移,對食品酶的需求預計將超過對工業酶的需求。這些企業中的大多數專門從事食品酶的營銷或配方。此外,由於健康意識的提高和對積極生活方式的偏好,運動營養行業在過去幾年中發展迅速。

特種酶的市場趨勢

對加工食品的需求不斷增長

受消費者生活方式變化和方便食品消費的強烈影響,加工食品行業在過去幾年中顯示出顯著的市場增長。城市化、不斷壯大的中產階級、更多的職業女性以及不斷增加的可支配收入等因素正在增加世界發達地區和發展中地區對加工食品和包裝食品的需求。因此,對食品包裝和加工解決方案的需求不斷增長。因此,食品添加劑被廣泛應用於加工食品和方便食品中,以保持加工食品的新鮮度、安全性、味道、外觀和質地。

對即食食品、飲料、零食和冷凍晚餐等方便食品和加工食品的需求不斷增長,是推動食品添加劑市場擴張的關鍵因素之一。顧客既想要各種口味又想要營養豐富的膳食選擇。為了增加顧客的興趣,市場上銷售了幾種富含鈣、纖維和蛋白質的加工食品,據說對糖尿病患者有益。這些產品具有功能特性,例如不含麩質、膽固醇、轉基因生物、鹽等。由於其低成本和高生產率,微生物來源是食品和飲料中使用的酶的主要來源。食品酶的消化率、靈活性和密封特性有望推動市場擴張。對奶酪、酸奶、蛋糕、餅乾和麵包等烘焙和乳製品的需求非常高。特別是,麵包店使用全國最多的酶。因此,由於食品零售鏈的擴張和便利,對加工食品不斷增長的需求一直導致對酶應用的需求不斷增長。

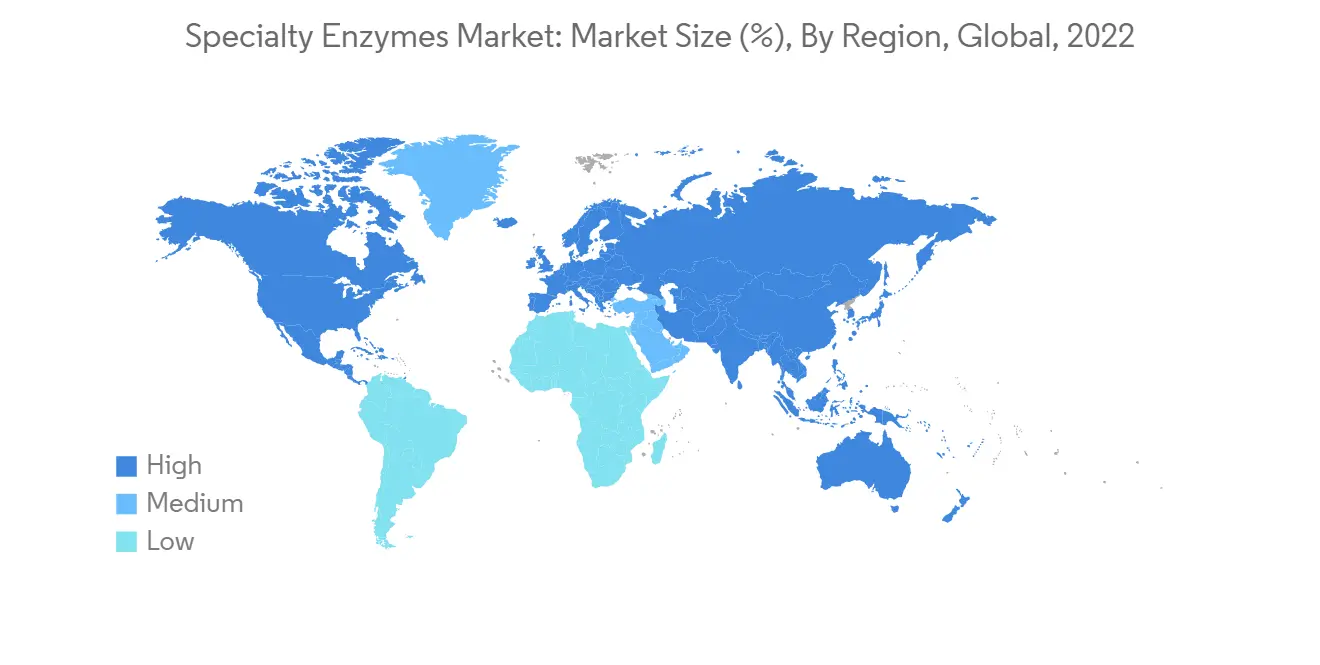

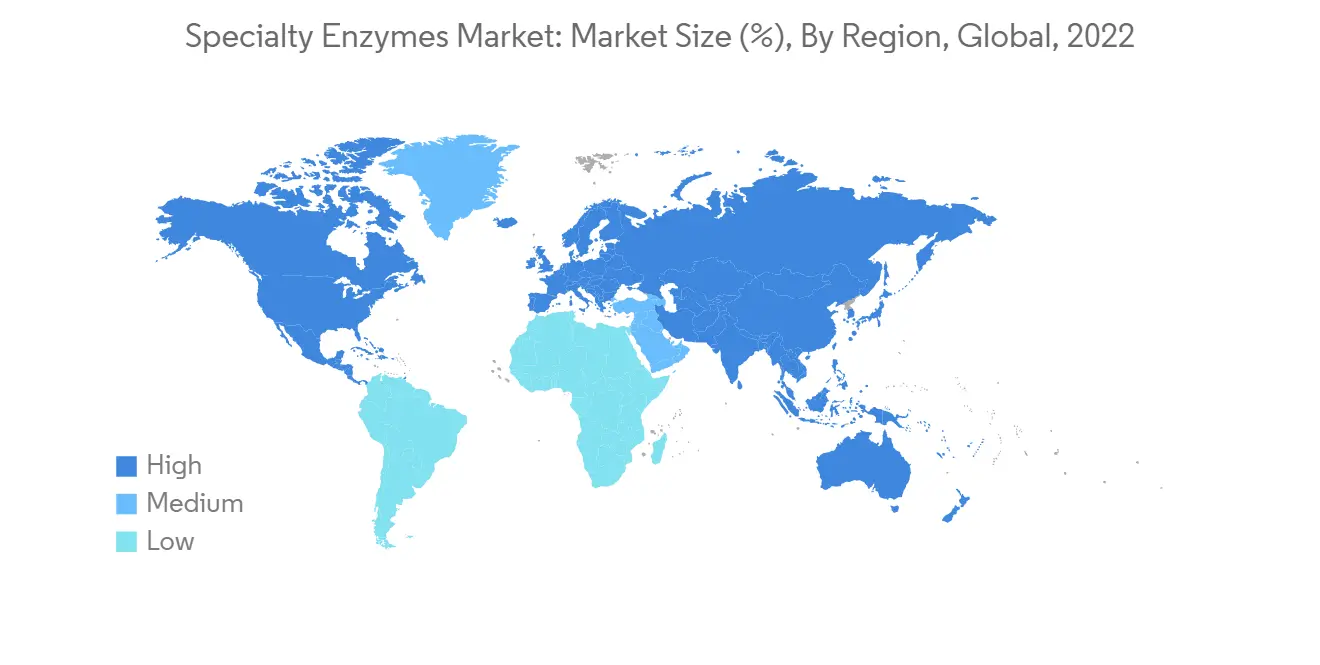

北美市場領先

北美是特種酶的最大市場,其主要應用領域是食品和飼料行業。我們在全球特種酶市場佔有很大份額。這個市場是由加工食品消費增加、奢侈品消費增加以及消費者對產品中使用的天然成分的偏好推動的。食品酶在市場上的新興應用,如蛋白質強化,預計將推動食品酶市場的增長,並為市場進入者創造有利可圖的機會。例如,2021 年 6 月,International Flavors & Fragrances, Inc. 在美國推出了 Nurica,這是一種天然利用牛奶中存在的乳糖的乳製品酶。這種酶有助於自然產生高產量的益生元低聚半乳糖 (GOS) 纖維,有助於控制乳糖不耐症和優化膳食纖維攝入量 推動美國對碳水化合物的需求 造成這種情況的主要因素之一被認為是不斷增長的需求用於膳食纖維和功能性食品。

北美市場的快速擴張與消費者對天然飲食的偏好增加有關。由於消費者越來越意識到有機添加劑是安全和有營養的,因此該地區對食品酶的需求正在增長。據有機貿易協會稱,2021 年美國有機食品的銷售額約為 575 億美元。對不含化學添加劑的優質加工食品的需求不斷增加,導致酶在各種食品系統中的使用增加。該地區的市場擴張是由主要參與者增加對新解決方案(例如更精確的酶)的投資推動的。此外,該地區的食品技術創新、廣泛的研發投資以及人們對酶可用於生產更高質量產品的認識不斷提高,都在進一步推動市場發展。

特種酶產業概況

特種酶市場分散,全球和區域頂級企業與本地企業激烈競爭市場份額。Kerry Group、Novozymes、Chr.Hansen、DuPont是特種酶市場的主要參與者。這些公司專注於業務擴張,採用併購、業務擴張和新產品創新等戰略。合作夥伴關係是公司青睞的下一個戰略,以增加其市場佔有率和開發創新產品。嘉裡集團計劃開發生產特種酶的新技術。Connell Brothers 專注於擴大其在市場上的分銷。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 本次調查範圍

第二章研究方法論

第三章執行摘要

- 市場概況

第四章市場動態

- 市場驅動力

- 市場製約因素

- 波特五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第五章市場細分

- 按來源

- 植物

- 動物

- 微生物

- 按類型

- 碳水化合物降解酶

- 蛋白酶

- 脂肪酶

- 其他類型

- 按用途

- 飲食

- 藥品

- 動物營養

- 其他用途

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 其他北美

- 歐洲

- 西班牙

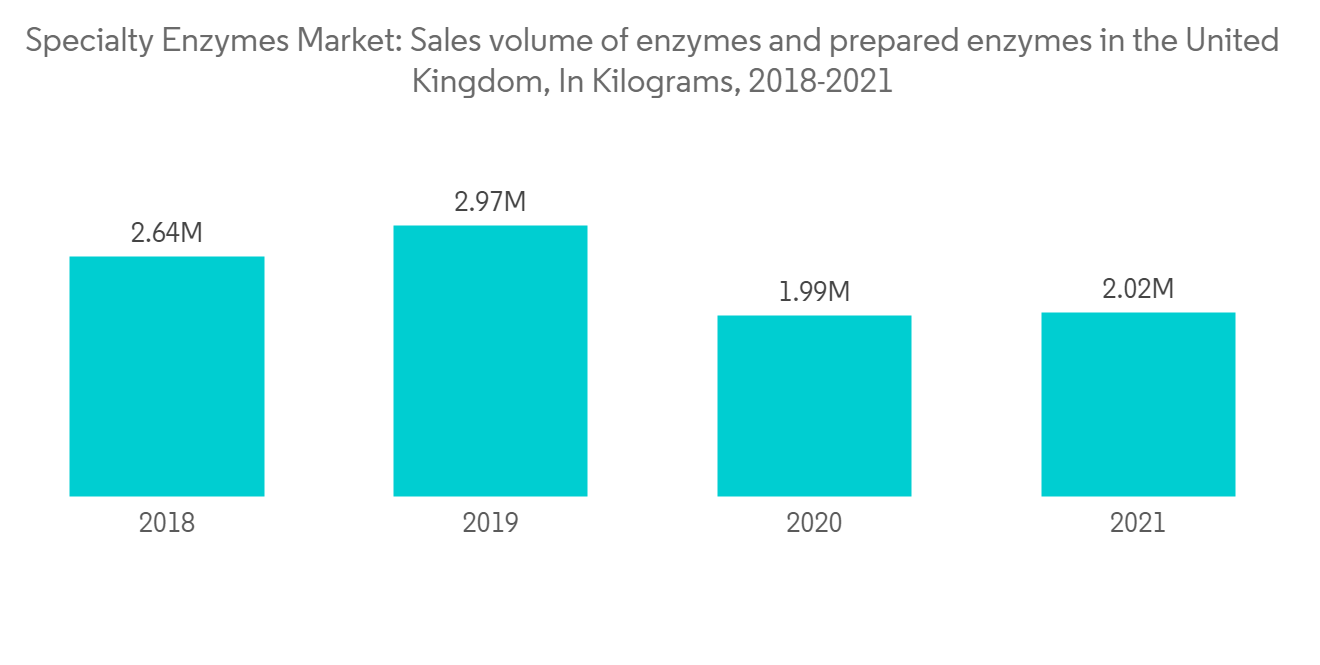

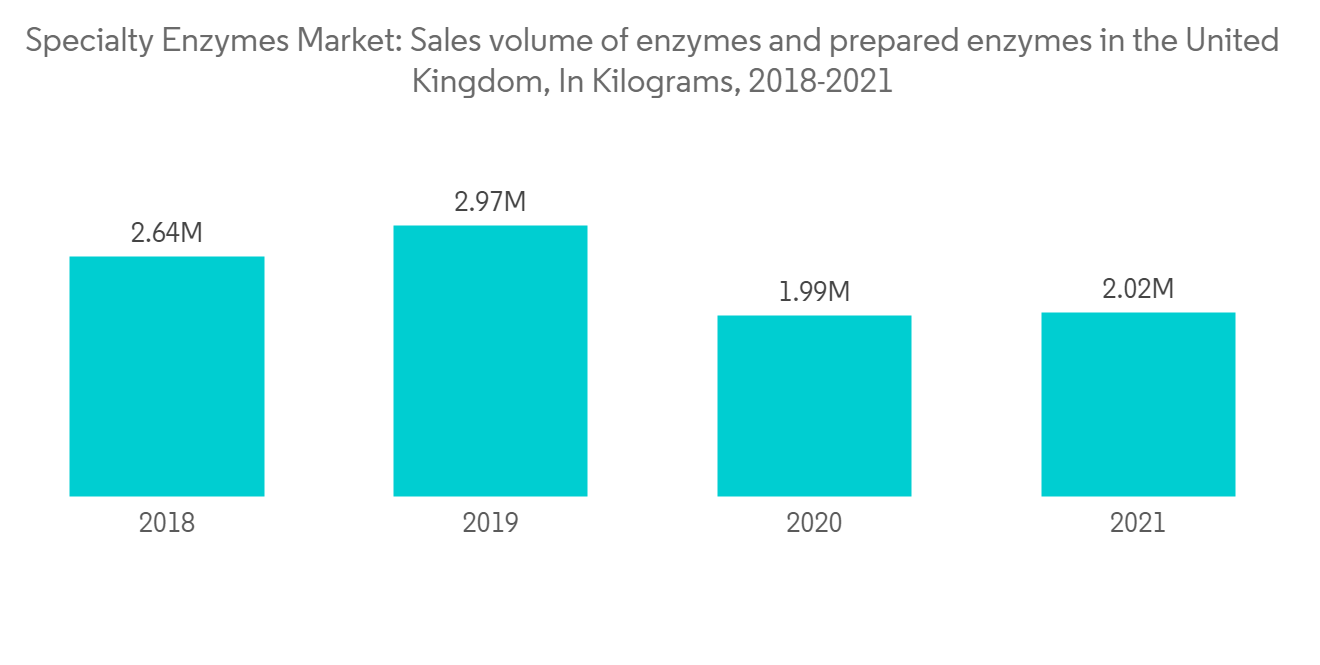

- 英國

- 德國

- 法國

- 意大利

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東/非洲

- 南非共和國

- 阿拉伯聯合酋長國

- 其他中東和非洲

- 北美

第六章競爭格局

- 最常採用的策略

- 市場份額分析

- 公司簡介

- Novozymes

- Kerry Inc.

- Chr. Hansen Holding A/S

- DuPont de Nemours, Inc.

- Associate British Foods PLC

- Specialty Enzymes & Probiotics

- Koninklijke DSM N.V.

- International Flavors & Fragrances

- Mitsubishi Chemical Corporation

- Amano Enzymes

- AST Enzymes

第七章市場機會與未來趨勢

The Specialty Enzymes market is projected to witness a CAGR of 7.6% over the next five years.

Enzymes are proteins that exist in the body of all living organisms, including humans, that function as catalysts. On the other hand, enzymes are necessary substances for vital activities and help many of the complex and diverse activities in substance metabolism. Growing consumer health consciousness has increased consumption of functional food products, which is predicted to have a favorable impact on the demand for enzymes over the forecast period. In March 2021, International Flavors & Fragrances Inc. announced the launch of Enovera 3001 enzyme as the newest addition to its ingredients for the bakery industry range. The new enzyme offers a label-friendly formulation for strengthening the bakery dough without compromising on its texture and taste. Over the past 10 years, the demand for enzymes has increased due to the natural flavor and taste of food items as well as unique food products, which has led to market expansion. The product is used for a variety of purposes, including the clarity of fruit juice, brewing germination, making cheese, pre-digesting infant food, and tenderizing meat. Additionally, the imminent population boom, increased food quality, and greater consumer awareness of nutritional requirements are all expected to have a beneficial impact on market growth.

The market is witnessing rapid growth due to the increasing demand for processed food in the country and the wide applications of enzymes in the processed food industry. Moreover, innovation in food technology in the country and increasing awareness about better-quality products being manufactured by utilizing enzymes are further driving the market. For instance, DSM launched a new range of baking enzymes, specifically formulated for gluten-free applications, that improve the softness and moistness of bread. These enzymes are also used in further applications, such as corn tortillas, rye bread, and white bread. The rapid growth of India's food, beverage, and pharmaceutical industries has supported this expansion, and the demand for food enzymes is eventually expected to surpass the demand for industrial enzymes. The majority of these businesses either specialize in marketing or formulations of food enzymes. Moreover, the sports nutrition industry has been expanding at a rapid pace for the past few years due to increased health awareness and a high preference for an active lifestyle.

Specialty Enzymes Market Trends

Increasing Demand for Processed Food

The processed foods segment has witnessed a significant rise in the market in recent years, owing to changes in the lifestyle patterns of consumers and a strong influence on the consumption of convenience foods. The demand for processed and packaged foods is rising in both developed and developing regions of the world due to factors such as urbanization, a growing middle-class population, an increase in the number of working women, and an increase in disposable income. As a result, there is a greater need for food packaging and processing solutions. Food additives are therefore widely employed in processed and convenience food products to maintain the freshness, safety, taste, appearance, and texture of processed foods.

The increased demand for convenience and processed foods such as ready-to-eat foods, ready-to-drink beverages, snacks, frozen dinners, and others is one of the key drivers fueling the expansion of the food additives market. Customers want both a diversity of flavors and nutritious eating choices. To increase customer interest, several processed foods that are high in calcium, fiber, and protein and are regarded as healthy for diabetics are being sold. These products have features that are functional, such as being devoid of gluten, cholesterol, GMOs, and salt, among others. Due to their low cost and great production, microbial sources are the primary source of enzymes used in food and beverages. The digestive, softening, and anti-staling properties of food enzymes are anticipated to propel market expansion. The demand for bakery and dairy goods such as cheese, yogurt, cakes, biscuits, and bread is extremely high. Notably, the bakery uses the most enzymes in the entire nation. Thus, the rise in demand for processed foods has always contributed to the rise in demand for enzyme application due to the expansion and convenience of food retail chains.

North America Leading the Market

North America is the largest market for specialty enzymes with its major applications in the food and feed industries. It accounts for a prominent share of the global specialty enzyme market. The market is driven by the increased consumption of processed food products, increased expenditure on premium quality products, and consumer preference for the natural ingredients used in the products. New food enzyme applications in markets such as protein fortification are expected to prompt growth in the food enzymes market and create lucrative opportunities for industry participants. For instance, in June 2021, International Flavors & Fragrances, Inc., launched Nurica, a dairy enzyme that naturally harnesses the lactose present in milk in the United States. The enzyme helps in naturally generating a higher yield of prebiotic galactooligosaccharides (GOS) fibers that help in managing lactose intolerance and optimizing fiber intake one of the main factors driving the demand for carbs in the United States is likely to be the rising desire for dietary fibers and functional foods.

The market's rapid expansion in North America is linked to the expanding trend of consumers choosing naturally derived meals. The demand for food enzymes in the region is developing as a result of the growing consumer perception that organic additives are secure and nutritious. According to the Organic Trade Association, in 2021, organic food sales in the United States amounted to about USD 57.5 billion. The use of enzymes in various food systems has increased in response to the rising demand for premium processed meals free of chemical additives. Market expansion in the region is being fueled by major players' increased investments in novel solutions, like more precise enzymes. Furthermore, innovation in food technology in the region, extensive R&D investment, and the growing awareness about better-quality products being manufactured by utilizing enzymes, are further driving the market.

Specialty Enzymes Industry Overview

The Specialty Enzymes Market is fragmented, with top global and regional players competing fiercely with local companies to gain market shares. Kerry Group, Novozymes, Chr. Hansen, and DuPont are some of the major players in the specialty enzymes market. These companies majorly focus on expanding their businesses and undertaking strategies, such as mergers and acquisitions, expansions, and novel product innovations. Partnerships are the next strategy preferred by companies in order to strengthen their market presence and develop innovative products. Kerry Group has planned to develop new technologies for specialty enzyme production. Connell Brothers is focusing on increasing distribution in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Overview

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Source

- 5.1.1 Plant

- 5.1.2 Animal

- 5.1.3 Microbial

- 5.2 By Type

- 5.2.1 Carbohydrases

- 5.2.2 Proteases

- 5.2.3 Lipases

- 5.2.4 Other Types

- 5.3 By Application

- 5.3.1 Food & Beverage

- 5.3.2 Pharmaceutical

- 5.3.3 Animal Nutrition

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 Germany

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Novozymes

- 6.3.2 Kerry Inc.

- 6.3.3 Chr. Hansen Holding A/S

- 6.3.4 DuPont de Nemours, Inc.

- 6.3.5 Associate British Foods PLC

- 6.3.6 Specialty Enzymes & Probiotics

- 6.3.7 Koninklijke DSM N.V.

- 6.3.8 International Flavors & Fragrances

- 6.3.9 Mitsubishi Chemical Corporation

- 6.3.10 Amano Enzymes

- 6.3.11 AST Enzymes