|

市場調查報告書

商品編碼

1445963

光學顯微鏡 - 市場佔有率分析、產業趨勢與統計、成長預測(2024 - 2029)Optical Microscopes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

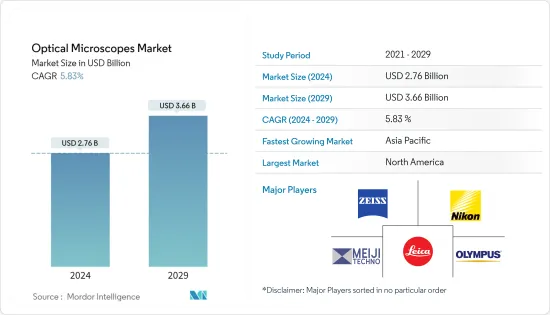

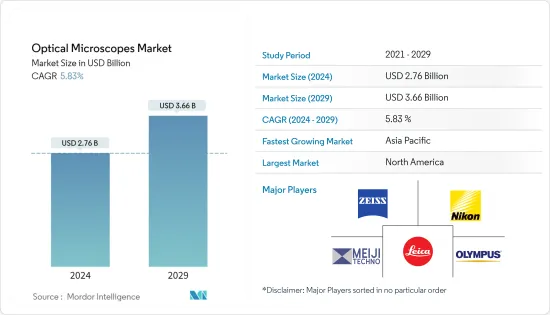

2024年光學顯微鏡市場規模估計為27.6億美元,預計2029年將達到36.6億美元,在預測期間(2024-2029年)CAGR為5.83%。

COVID-19 的爆發對光學顯微鏡市場產生了重大影響,因為光學顯微鏡被用於診斷 COVID-19 感染和疫苗開發過程。光學顯微鏡的進步有助於檢測和識別 COVID-19 病毒形態,促進了市場的成長。例如,根據 NCBI 2021 年 8 月發表的文章,該研究使用衍射無限螢光顯微鏡來分析 SARS-CoV-2 感染如何利用和重新利用初級氣道細胞的亞細胞結構。此外,在 COVID-19 疫苗開發中擴大採用顯微鏡技術預計將有助於大流行期間市場的成長。根據《Microscopy Australia 2020》上發表的文章,昆士蘭大學的設施透過向疫苗開發小組提供顯微鏡來支持 COVID-19 工作。南澳大利亞大學的光學顯微鏡和員工專業知識正在被用來開發方法和設備,並測試本地製造的個人防護裝備 (PPE) 的品質和有效性。在個人防護裝備開發中使用顯微鏡技術促進了大流行期間市場的成長。此外,由於 COVID-19 病毒突變株的出現促使研發活動增加,預計光學顯微鏡的使用將會增加,有助於未來市場的成長5年。

光學顯微鏡市場成長的主要因素包括光學顯微鏡的技術進步以及細胞生物學和生物技術研發資金的增加。光學顯微鏡用於許多研究領域,包括微生物學、微電子學、奈米物理學、生物技術、教育機構實驗室和藥物研究。它們也用於在診斷中心查看生物樣本以進行醫學診斷,從而促進最終用戶產業對光學顯微鏡不斷成長的需求。

根據美國衛生與公眾服務部2021 年的消息,美國國立衛生研究院和國立普通醫學科學研究所(NIGMS) 資助了「促進生物醫學研究企業中個人職業生涯的干涉措施研究」。透過本次資助公告,NIGMS旨在增強有效、高影響力、可擴展干預措施的證據基礎,並提高對促進生物醫學研究職業發展的因素的理解。因此,在預測期內增加生物技術職業機會預計將增加需求用於光學顯微鏡。

主要參與者採取的各種策略性舉措,包括合併、收購、合作、夥伴關係和產品發布,預計將有助於市場的成長。例如,2020 年 10 月,高木眼科儀器歐洲有限公司推出了 OM-6 手術顯微鏡。 OM-6 是最優秀的入門級手術顯微鏡,在入門級/緊湊型眼科手術顯微鏡中提供世界上第一個 LED 光源。此外,2020 年 5 月,Miltenyi Biotec 推出了 Ultra Microscope Blaze,這是世界上第一台全自動光片顯微鏡。新儀器使用戶能夠以亞細胞解析度對整個小鼠或多個樣本進行 3D 成像。

因此,在創新科學需求成長的推動下,全球光學顯微鏡市場預計將大幅擴張。然而,與電子顯微鏡相比,光學顯微鏡的局限性以及小規模製造商的低成本產品預計將在預測期內抑制光學顯微鏡市場。

光學顯微鏡市場趨勢

倒置顯微鏡領域預計將在光學顯微鏡市場中佔據最大的市場佔有率

由於最終用戶行業的使用量不斷增加,預計倒置顯微鏡在預測期內將在市場成長中佔據重要佔有率。倒置顯微鏡用於從下面觀察樣品。這在液體細胞培養的檢查過程中非常有用。病理領域的需求和先進技術選擇的增加預計將積極促進區隔市場的發展。

此外,倒置顯微鏡仍然是細胞即時成像的一種非常有用的技術。在倒置顯微鏡中,透過細胞培養容器的底部觀察活細胞。使用倒置顯微鏡有多種優勢可以滿足他們的需求。

此外,該領域正在進行許多研究,預計將促進該領域的創新。例如,2020 年 7 月發表在 Elsevier 上的一篇文章。研究人員開發了一種功能簡單的低成本倒置光學顯微鏡原型,其零件是使用 3D 列印技術製造的。諸如此類的創新預計將促進市場成長。

許多公司正在採取各種策略舉措,例如產品發布、合作、協作、併購和收購,以提高市場佔有率。例如,Nikon儀器於 2021 年 11 月增加了 AX RM 多光子共焦顯微鏡,這是一種倒置顯微鏡,可在生物體內高速獲取高解析度、大視野影像。

因此,預計上述因素將在預測期內推動所研究區隔市場的成長。

預計北美在預測期內將在市場中佔據重要佔有率

預計北美將在整個預測期內主導整個光學顯微鏡市場。這是由於該地區開展了大量的研發活動等因素。在北美地區,由於美國生命科學和材料科學應用市場需求大等因素,美國佔了最大的市場佔有率。此外,高GDP和不斷成長的投資可能會對未來幾年北美光學顯微鏡市場的成長產生積極影響。

例如,根據美國國立衛生研究院 2021 年 6 月的報告,2020 年各種研究、狀況和疾病類別 (RCDC) 的資金預算總額為 29 億美元,預計 2021 年將依估計值增加2022 年分別為32億美元和33 億美元。

此外,2021 年11 月,陳‧祖克柏計劃(CZI) 宣布提供近500 萬美元的資金,用於推進生物影像技術、增加這些工具的使用,並為北美國家的生物醫學研究人員提供能力建設。這包括加強生物學家和技術專家之間的合作,改進顯微鏡工具和擴大這些工具的使用範圍,以及支持增加培訓和社區建設,從而幫助推動所研究市場的成長。

此外,在生命科學領域,光學顯微鏡設備在識別和診斷引起人類、動物或植物疾病的微生物和病毒方面的使用正在增加,這將補充市場的成長。政府機構對研發活動的援助進一步加速了市場的成長。例如,2020 年 8 月,美國國立衛生研究院下屬的國家過敏和傳染病研究所 (NIAID) 授予了 11 項撥款,第一年總價值約為 1700 萬美元,用於建立新興疾病研究中心傳染病(CREID)。這將涉及對病毒和其他致病微生物的多學科研究。 NIAID 還打算在五年內提供約 8,200 萬美元來支援該網路。

因此,由於美國光學顯微鏡領域的研發不斷成長,並得到監管機構的支持,以及新技術先進技術的持續推出,預計光學顯微鏡市場在預測期內將出現利潤豐厚的成長。

光學顯微鏡產業概況

光學顯微鏡市場競爭適度,由幾個主要參與者組成。就市場佔有率而言,目前很少有主要參與者佔據市場主導地位。目前主導市場的一些公司包括 Carl Zeiss AG、Leica Microsystems、Meiji Techno、Nikon Instruments Inc.、Olympus Corporation、Labomed, Inc.、Oxford Instruments Asylum Research Inc.、Bruker 和 CAMECA。

額外的好處:

- Excel 格式的市場估算 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章:簡介

- 研究假設和市場定義

- 研究範圍

第 2 章:研究方法

第 3 章:執行摘要

第 4 章:市場動態

- 市場概況

- 市場促進因素

- 研究與開發經費不斷增加

- 光學顯微鏡領域的發展

- 市場限制

- 光學顯微鏡與電子顯微鏡相比的局限性

- 提供低成本產品的小型製造商

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代產品的威脅

- 競爭激烈程度

第 5 章:市場區隔

- 依產品分類

- 數位顯微鏡

- 體視顯微鏡

- 倒置顯微鏡

- 其他產品

- 依最終用戶

- 醫院和診所

- 學術及研究機構

- 診斷實驗室

- 其他最終用戶

- 地理

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 亞太其他地區

- 中東和非洲

- 海灣合作理事會

- 南非

- 中東和非洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第 6 章:競爭格局

- 公司簡介

- Carl Zeiss AG

- Danaher Corporation (Leica Microsystems)

- Meiji Techno

- Nikon Instruments Inc.

- Olympus Corporation

- Labomed, Inc.

- Bruker Corporation

- Hitachi High-tech Corporation

- AmScope

- Agilent Technologies

- Celestron

- Accu-scope Inc.

第 7 章:市場機會與未來趨勢

The Optical Microscopes Market size is estimated at USD 2.76 billion in 2024, and is expected to reach USD 3.66 billion by 2029, growing at a CAGR of 5.83% during the forecast period (2024-2029).

The outbreak of COVID-19 showed a significant impact on the optical microscopes market as they were used in the diagnosis of COVID-19 infection and vaccination development process. The advancement of optical microscopes helped in the detection and identification of COVID-19 virus morphology, contributing to the growth of the market. For instance, per the NCBI article published in August 2021, the study used diffraction-unlimited fluorescence microscopy to analyze how SARS-CoV-2 infection exploits and repurposes the subcellular architecture of primary airway cells. Also, the increasing adoption of microscopy in the COVID-19 vaccination development is expected to contribute to the growth of the market over the pandemic period. According to the article published in Microscopy Australia 2020, the University of Queensland's facility was supporting COVID-19 work by providing microscopy to the vaccine development group. Optical microscopy and staff expertise at the University of South Australia are being used to develop methodologies and equipment, and to test the quality and effectiveness of locally manufactured personal protective equipment (PPE). Such employment of microscopy in PPE development contributed to the growth of the market during the pandemic period. In addition, the use of optical microscopes is expected to be on the rise due to the emergence of a mutant strain of the COVID-19 virus leading to the rise in research and development activities, thereby contributing to the growth of the market over the coming five years.

The major factors attributing to the growth of the optical microscopes market include technological advancements in optical microscopes and increasing funding for research and development in cell biology and biotechnology. Optical microscopes are used in many research areas comprising microbiology, microelectronics, nanophysics, biotechnology, laboratories in educational institutes, and pharmaceutical research. They are also used to view biological samples for medical diagnosis in diagnostic centers, thereby contributing to the growing demand for optical microscopes in end-user industries.

According to the Department of Health and Human Services 2021, the National Institute of Health and National Institute of General Medical Sciences (NIGMS) funded 'Research on Interventions that Promote the Careers of Individuals in the Biomedical Research Enterprise". Through this funding announcement, NIGMS intends to enhance the evidence base for effective, high-impact, scalable interventions, and to improve understanding of the elements contributing to the advancement of individuals pursuing biomedical research careers. Thus, increasing biotechnology career opportunities over the forecast period is expected to increase the demand for optical microscopes.

Various strategic initiatives undertaken by the major players, including mergers, acquisitions, collaborations, partnerships, and product launches, are expected to contribute to the growth of the market. For instance, in October 2020, Takagi Ophthalmic Instruments Europe Ltd launched the OM-6 Operating Microscope. OM-6 is the most excellent entry-level operating microscope, offering the world's first LED light source in the entry-level/compact ophthalmic operating microscope. Also, in May 2020, Miltenyi Biotec launched the Ultra Microscope Blaze, the world's first fully automated light sheet microscope. The new instrument enables users to image an entire mouse or multiple samples at subcellular resolution in 3D.

Thus, the global optical microscope market is expected to expand at a substantial rate, driven by an increase in demand from innovation science. However, limitations of optical microscopes compared to the electron microscope and low-cost products by small-scale manufacturers are the reasons expected to restrain the optical microscopes market during the forecast period.

Optical Microscopes Market Trends

Inverted Microscopes Segment is Expected to Hold the Largest Market Share in the Optical Microscopes Market

Inverted Microscopes are expected to hold a significant share in the growth of the market during the forecast period owing to the increasing usage at the end-user industries. Inverted microscopes are used to view the sample from underneath. This is useful during the examination of liquid cell cultures. The demand from the pathological sector and the rise in advanced technology options are expected to positively aid in segment development.

Also, inverted microscopy remains a very useful technique for the live imaging of cells. In inverted microscopes, the living cells are observed through the bottom of a cell culture vessel. There are various advantages while using inverted microscopes that are responsible for their demand.

Additionally, many research studies are being conducted in the field that is expected to boost innovation in the segment. For instance, an article published in Elsevier in July 2020. The researchers developed a low-cost inverted optical microscope prototype with simple functioning, whose parts were manufactured using 3D printing techniques. Innovations such as these are expected to boost market growth.

Many companies are undertaking a variety of strategic initiatives like product launches, partnerships, collaborations, mergers, and acquisitions to boost their market share. For instance, in November 2021 Nikon instruments increased the AX R M multiphoton confocal microscope, a type of inverted microscopy that can acquire high-resolution, large field-of-view images, within living organisms at high speed.

Thus, the above-mentioned factors are expected to drive the growth of the studied segment during the forecast period.

North America is Expected to Hold Significant Share in the Market During the Forecast Period

North America is expected to dominate the overall optical microscopes market throughout the forecast period. This is due to factors such as strong research and development activities conducted in the region. In the North American region, the United States holds the largest market share due to the factors such as large demand from the country's life sciences and material sciences application market. Furthermore, high GDP and growing investment are likely to have a positive impact on the growth of the North American optical microscopes market in the coming years.

For instance, as per the June 2021 report National Institute of Health, the total budget of funding for various Research, Condition, and Disease Categories (RCDC) was USD 2.9 billion in 2020, and it is expected to increase in 2021 at an estimated value of USD 3.2 billion and USD 3.3 billion in 2022.

Also, in November 2021, Chan Zuckerberg Initiative (CZI) announced nearly USD 5 million in funding to advance bioimaging technologies, increase access to these tools, and build capacity for biomedical researchers in North American Countries. This includes increasing collaboration between biologists and technology experts, improving microscopy tools and expanding access to these tools, and supporting increased training and community building, thereby, helping in driving the growth of the studied market.

Moreover, in the life science segment, the use of optical microscopy devices in the identification and diagnosis of microorganisms and viruses causing diseases in humans, animals, or plants is increasing, which will complement the growth of the market. Aid from government agencies for research and development activities further accelerates the growth of the market. For instance, in August 2020, The National Institute of Allergy and Infectious Diseases (NIAID), part of the National Institutes of Health, awarded 11 grants with a total first-year value of approximately USD 17 million to establish the Centers for Research in Emerging Infectious Diseases (CREID). This will involve multidisciplinary investigations on viruses and other disease-causing microorganisms. NIAID also intends to provide approximately USD 82 million over five years to support the network.

Thus, owing to the growing R&D in the field of optical microscopy in the United States, supported by the regulatory authority, and the continuous launch of new technologically advanced techniques, the optical microscopes market is expected to witness lucrative growth over the forecast period.

Optical Microscopes Industry Overview

The optical microscopes market is moderately competitive and consists of several major players. In terms of market share, few of the major players are currently dominating the market. Some of the companies that are currently dominating the market are Carl Zeiss AG, Leica Microsystems, Meiji Techno, Nikon Instruments Inc., Olympus Corporation, Labomed, Inc., Oxford Instruments Asylum Research Inc., Bruker, and CAMECA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Funding for Research and Development

- 4.2.2 Development in the Field of Optical Microscopy

- 4.3 Market Restraints

- 4.3.1 Limitation of Optical Microscope Compared to Electron Microscope

- 4.3.2 Small-scale Manufactures offering Low-cost Products

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size By Value - USD million)

- 5.1 By Product

- 5.1.1 Digital Microscopes

- 5.1.2 Stereo Microscope

- 5.1.3 Inverted Microscopes

- 5.1.4 Other Products

- 5.2 By End User

- 5.2.1 Hospitals and Clinics

- 5.2.2 Academic and Research Institutes

- 5.2.3 Diagnostics Laboratories

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Carl Zeiss AG

- 6.1.2 Danaher Corporation (Leica Microsystems)

- 6.1.3 Meiji Techno

- 6.1.4 Nikon Instruments Inc.

- 6.1.5 Olympus Corporation

- 6.1.6 Labomed, Inc.

- 6.1.7 Bruker Corporation

- 6.1.8 Hitachi High-tech Corporation

- 6.1.9 AmScope

- 6.1.10 Agilent Technologies

- 6.1.11 Celestron

- 6.1.12 Accu-scope Inc.