|

市場調查報告書

商品編碼

1273478

胸骨閉合系統市場——增長、趨勢、COVID-19 影響和預測 (2023-2028)Sternal Closure Systems Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

在預測期內,胸骨閉合系統市場預計將以約 5.3% 的複合年增長率增長。

由於嚴格的封鎖規定和大流行初期胸骨閉合產品的短缺,COVID-19 對胸骨閉合系統市場的增長產生了重大影響。 醫療保健提供者也對 COVID-19 患者不堪重負,獲得基本護理的機會有限,心髒病學中心的臨時關閉大大減少了胸骨手術。 根據 2021 年 3 月發布的 BMC 研究,一項全球研究發現,心臟手術在大流行期間下降了 50% 至 75%,到 2020 年,專用心臟手術室和重症監護病房床位下降了 50%。確認下降。 因此,對心臟手術的重大影響也對胸骨閉合系統產生了顯著影響,影響了市場的增長。 此外,由於大流行後放鬆管製而恢復擇期手術

隨著世界人口老齡化的增加,心臟直視手術的增加是市場增長的主要驅動力。 例如,2022 年 6 月發表的一篇 NIH 論文指出,全世界每年有超過 200 萬人接受心臟直視手術以治療各種心臟問題。 如此大量的心臟直視手術預計將推動對胸骨閉合系統的需求,並有助於預測期內的市場增長,因為它們在心臟直視手術中被廣泛用於重新連接胸骨。 此外,根據世衛組織2022年10月發布的一份報告,全球60歲及以上人口的比例預計到2030年將增至14億,到2050年將達到21億。 因此,預計在預測期內,增加易患心血管疾病且經常需要心臟直視手術的老年人口將有助於市場增長。

此外,預計產品批准的增加也將有助於市場增長。 例如,2021 年 10 月,Able Medical Devices 宣布了 Valkyrie 胸椎固定係統,用於穩定胸壁骨折,包括正常和不良骨骼患者胸骨切開術後的胸骨固定和胸骨重建手術。獲得了 510(k) 批准藥物管理。

這樣,心臟直視手術的增加、老年人口的增加以及新產品的積極開發有望促進市場的增長。 然而,替代手術的日益普及預計將抑制預測期內的市場增長。

胸骨閉合系統的市場趨勢

在預測期內,電線部分預計將佔據很大的市場份額。

由於其易於使用、速度快、並發症發生率相對較低以及線材成本低,使用線材閉合胸骨已成為一種標準程序。 常見的閉合方法使用間斷線或八字形線來固定由正中胸骨切開術產生的一半胸骨。 然而,使用任何佈線方法,胸骨的兩半可能會在生理負荷下移動或稍微分開。 這些最小的運動不會對大多數胸骨健康的患者造成問題,除非胸骨切開術存在技術缺陷。 它還可以通過促進早期癒傷組織形成來促進更快的骨骼癒合。

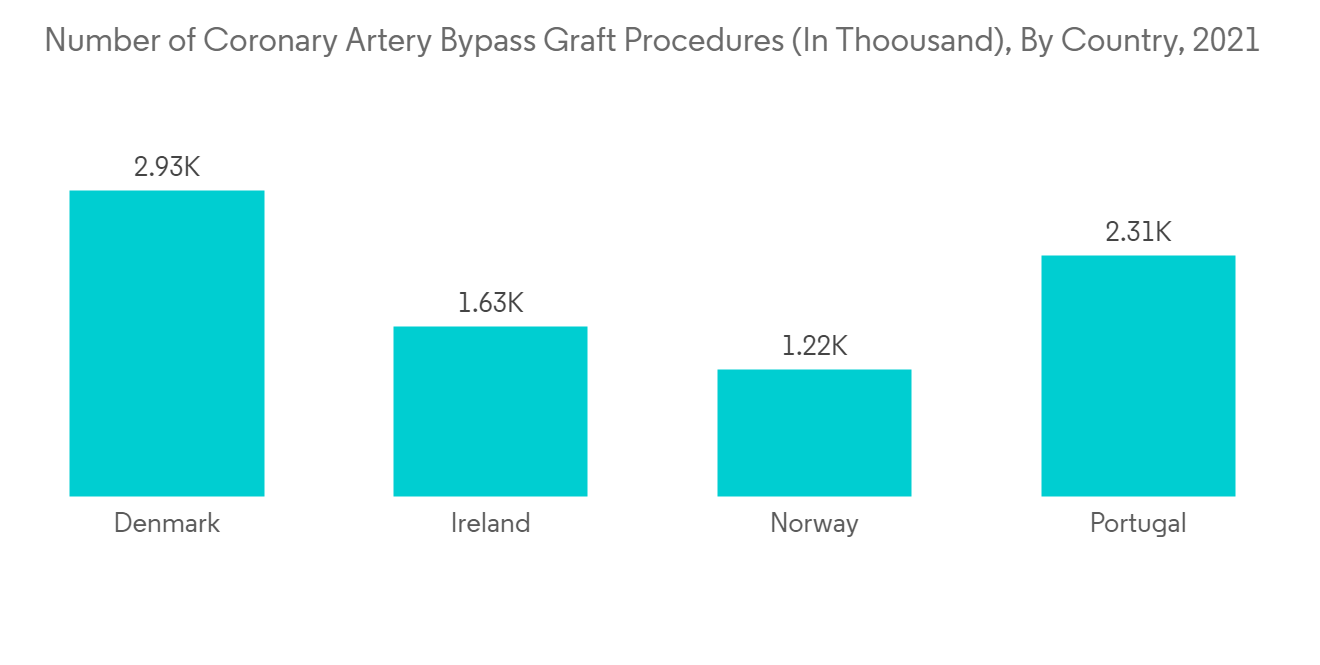

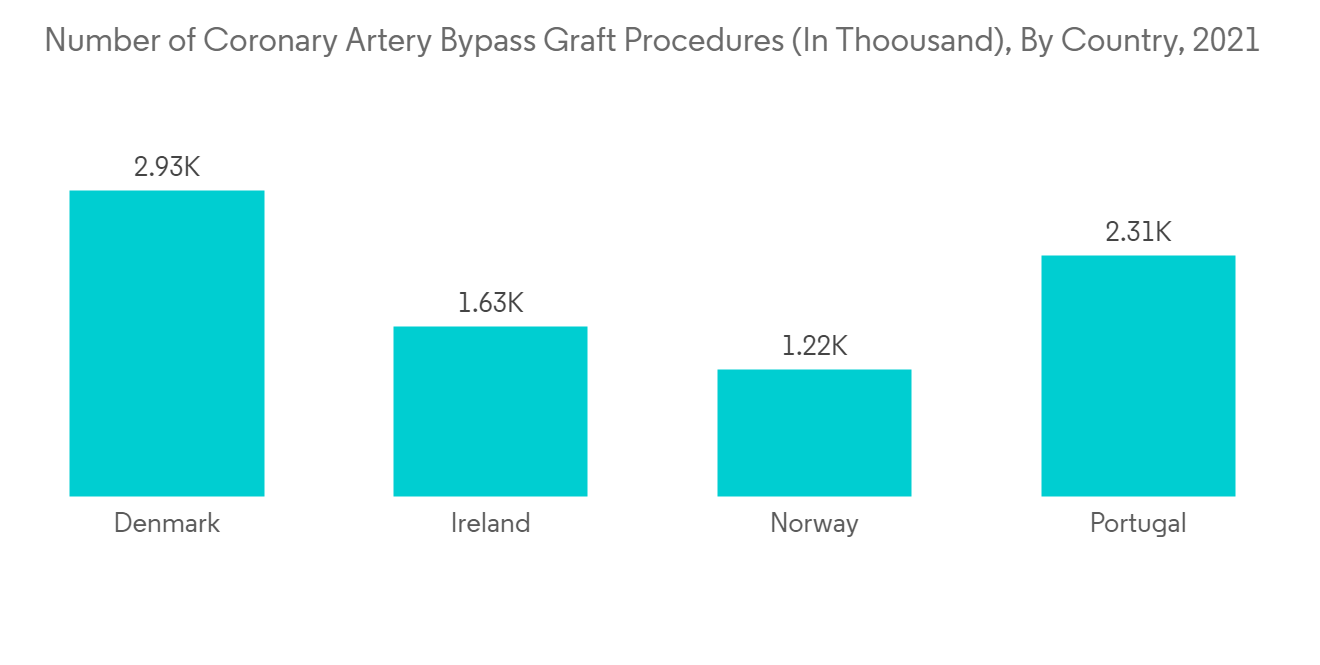

推動該細分市場增長的因素包括心臟手術的增加、老年人口的增加以及主要市場參與者增加產品開發。 例如,2022 年 8 月發表的一篇 NCBI 文章指出,全世界每年大約進行 400,000 例冠狀動脈搭橋手術。 同樣,根據 NCBI 於 2022 年 8 月發表的一篇文章,德國將在 2021 年登記約 29,947 例孤立的冠狀動脈搭橋手術、36,714 例孤立的心臟瓣膜手術和 750 例輔助裝置植入手術。我是。 因此,越來越多的心臟手術,其中胸骨閉合線通常用於外科手術,也有望促進研究部分的增長。

另一方面,由於胸骨閉合手術效率高,胸骨閉合鋼絲的採用率不斷提高,預計將有助於市場增長。 例如,根據 NCBI 於 2022 年 5 月發表的一項研究,不銹鋼環紮鋼絲仍然是最著名和使用最廣泛的胸骨切開術。 因此,預計在預測期內,增加胸骨閉合中線材產品的利用率將推動該部門的增長。

因此,上述因素正在推動預測期內市場的增長。

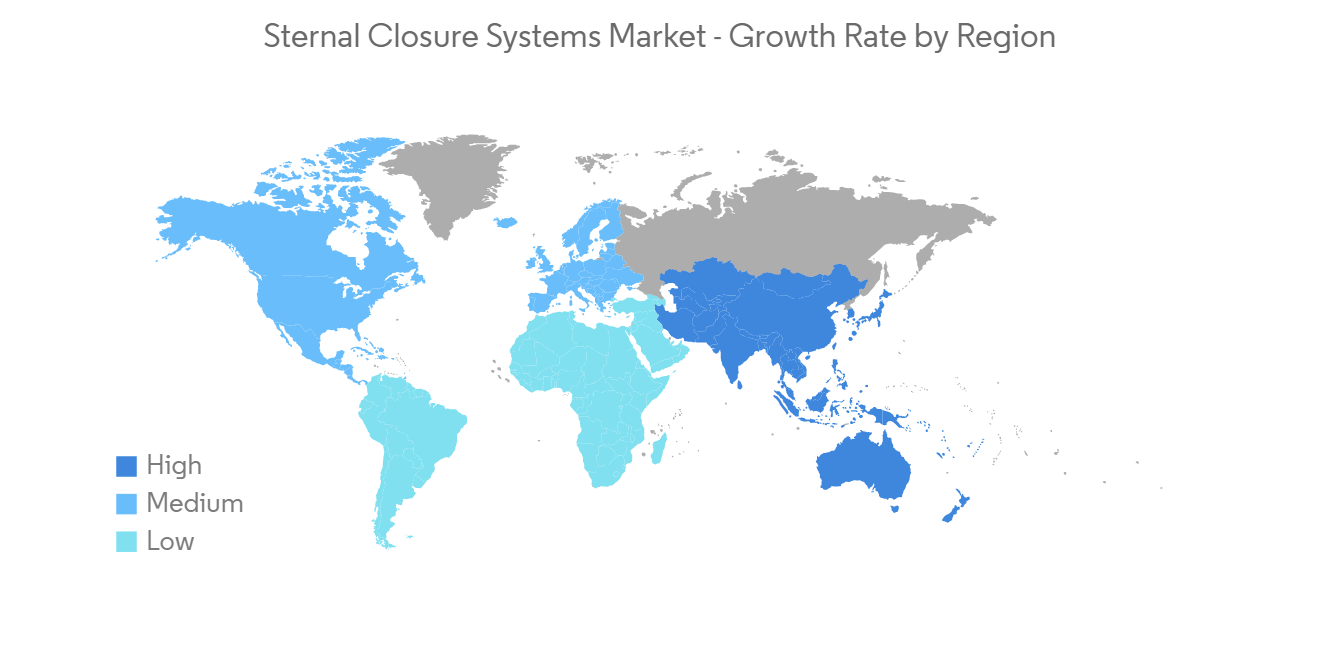

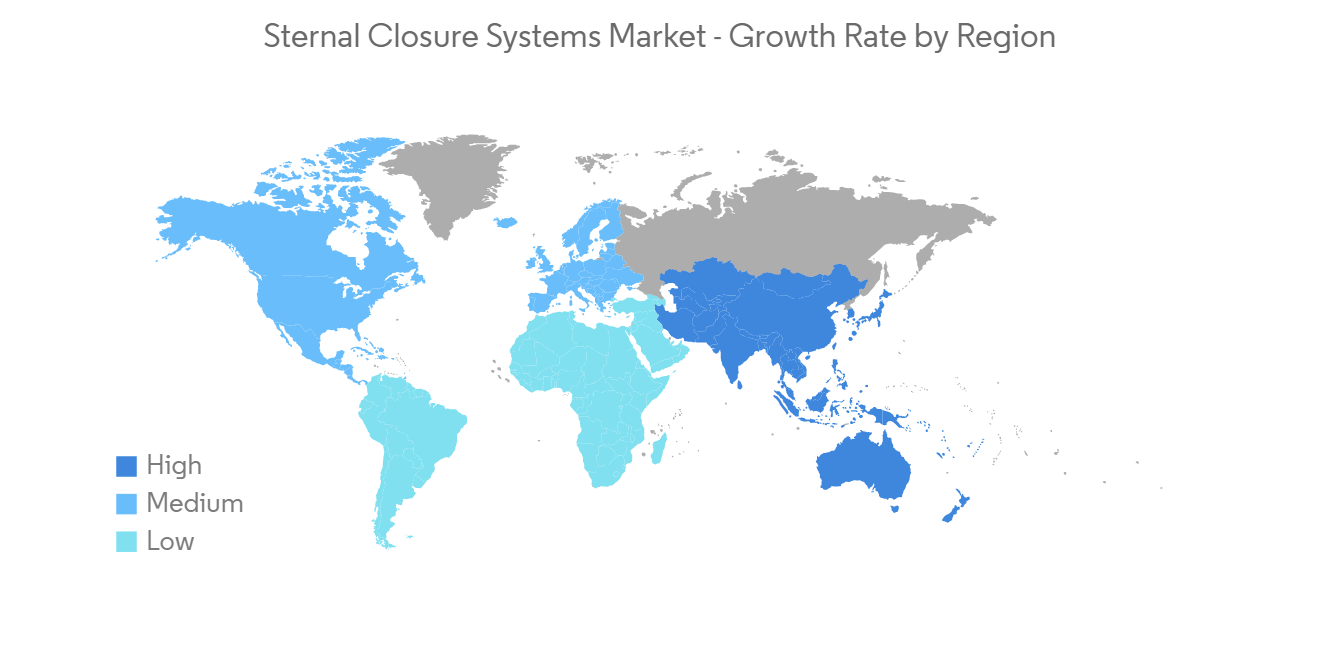

預計在預測期內,北美將佔據很大的市場份額。

預計在整個預測期內,北美將佔整個市場的很大份額。 預計有助於該地區市場增長的因素包括心臟直視手術和冠狀動脈旁路移植手術數量的增加、老年人口的增加和先進的醫療基礎設施。

例如,根據底特律醫療中心 2022 年公佈的數據,美國每年約有 50 萬人接受心臟直視手術。 此外,根據新澤西州衛生部2022年8月公佈的數據,2021年新澤西州進行了17291例心臟直視手術。 同樣,2021 年 5 月發表在 NCBI 論文中的一篇論文報告稱,加拿大每年約有 15,000 人接受冠狀動脈旁路移植術。 此外,北美國家易患心髒病和需要心臟手術的老年人口不斷增加,預計也將推動對胸骨閉合系統的需求並推動市場增長。 例如,根據加拿大統計局的數據,加拿大的老年人口將從 2021 年的 2,232,871 人增長到 2022 年的 2,308,041 人。 同樣,根據 UCAM 2022 年發布的數據,墨西哥總人口中約有 12% 的人年齡在 60 歲以上。 因此,預計該地區老年人口的增加將在預測期內推動市場增長。

因此,由於上述因素,心臟手術的增加、老年人口的增加以及主要市場參與者在北美地區的存在預計將佔胸骨閉合系統市場的主要份額本研究的預測期將是

胸骨閉合系統行業概覽

胸骨閉合系統市場與幾家大型企業的競爭適中。 目前主導市場的公司包括 Johnson & Johnson、Zimmer Biomet Holdings、KLS Martin Group、Acumed, LLC (Colson Medical, LLC)、A&E Medical、Idear S.R.L、Praesidia SRL、Kinamed Incorporated 等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 患有衰弱性傷口的患者增加

- 心臟直視手術增加,老年人口增加

- 支架切開術技術的技術進步

- 市場製約因素

- 與胸骨閉合相關的手術風險

- 波特的五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第 5 章市場細分

- 按產品分類

- 電線

- 板材和螺絲

- 骨水泥

- 其他

- 通過方法

- 中線切除術

- 半胸切開術

- 雙側胸骨切開術

- 按材料

- 不銹鋼

- 聚醚醚酮

- 鈦

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章競爭格局

- 公司簡介

- Johnson & Johnson

- Zimmer Biomet Holdings(A&E Medical)

- KLS Martin Group

- Acumed, LLC(Colson Medical, LLC)

- Idear S.R.L

- Praesidia SRL

- Kinamed Incorporated

- Jace Medical

- B Braun SE

- Orthofix Holdings Inc

- Abyrx Inc

第7章 市場機會與將來動向

The sternal closure systems market is projected to grow with a CAGR of nearly 5.3% over the forecast period.

COVID-19 significantly impacted the growth of the sternal closure systems market due to the strict lockdown regulations and poor supply of sternal closure products during the initial stages of the pandemic. Also, healthcare providers were occupied with COVID-19 patients, access was restricted to only essential care, and the temporary shutdown of cardiology centers significantly curtailed sternal procedures. According to the BMC study published in March 2021, a worldwide survey identified cardiac surgery reduced by 50% to 75% during the pandemic, with a 50% reduction in dedicated cardiac theater rooms and Intensive care unit beds in 2020. Thus, the significant impact on cardiac surgeries also had a notable impact on the sternal closure system, affecting the market's growth. Moreover, owing to the resumption of elective surgeries after the relaxations of regulations in the post-pandemic period

The major factor attributed to the market growth is the increasing number of open-heart surgeries, along with the rising geriatric population worldwide. For instance, the NIH article published in June 2022 mentioned that more than 2 million people worldwide have open-heart surgery each year to treat various heart problems. Such a high volume of open heart surgeries is expected to drive the demand for sternal closure systems as they are widely used in open heart surgeries to rejoin the sternum, thereby contributing to market growth over the forecast period. Moreover, according to the WHO report published in October 2022, the share of the population in the world aged 60 years and over will increase to 1.4 billion by 2030 and reach 2.1 billion by 2050. Thus, the increasing geriatric population, more susceptible to developing cardiovascular diseases and often requiring open heart surgeries, is expected to contribute to the market growth over the forecast period.

Furthermore, rising product approvals are also expected to contribute to the market's growth. For instance, in October 2021, Able Medical Devices received 510(k) clearance from the United States Food and Drug Administration for its Valkyrie Thoracic Fixation System, which is used for chest wall fracture stabilization, including sternal fixation after sternotomy and sternal reconstructive surgical procedures for patients with normal and poor bone.

Thus, the increasing number of open heart surgeries, the rising geriatric population, and increasing product developments are expected to contribute to the market's growth. However, the gaining popularity of alternative procedures is expected to restrain the market's growth over the forecast period.

Sternal Closure Systems Market Trends

Wires Segment is Expected to Hold a Significant Share in the Market Over the Forecast Period.

Sternal closure with wires has become the standard because of the ease of use, speed of use, relatively low complication rate, and low cost of wires. Common closure methods use either interrupted or figure-of-eight wires to secure the sternal halves created during the median sternotomy. All wiring techniques, however, allow some movement and separation of sternal halves under physiologic loads. These minimal movements do not cause problems in most patients with healthy sternums unless the sternotomy is technically faulty. They may even promote faster bone healing by stimulating early callus formation.

The factors propelling the segment growth are increasing heart surgeries, the geriatric population, and the rising product developments by various key market players. For instance, the NCBI article published in August 2022 mentioned that almost 400,000 coronary artery bypass grafting surgeries are performed each year across the world. Similarly, according to the article published by NCBI in August 2022, approximately 29,947 isolated coronary artery bypass grafting procedures, 36,714 isolated heart valve procedures, and 750 assist device implantations were registered in Germany in 2021. Thus, the rising number of heart surgeries, among which the sternal closure wires are highly used in surgical procedures, are also expected to contribute to the growth of the studied segment.

On the other hand, the rising adoption of sternal closure wires due to their high efficiency in sternal closure procedures is expected to contribute to the market's growth. For instance, according to the NCBI study published in May 2022, stainless steel cerclage wires remain the most well-known and widely utilized sternal fixation technique. Hence, the growing utilization of wire products in the sternal closure is expected to drive segment growth over the forecast period.

Thus, the factors above are boosting the market segment's growth over the forecast period.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period.

North America is expected to hold the major share of the overall market, throughout the forecast period. The factors that are expected to contribute to the growth of the market in this region are the rising number of open-heart and coronary artery bypass grafting surgeries, the increasing geriatric population along with the advanced healthcare infrastructure.

For instance, as per the data published by Detroit Medical Center in 2022, approximately 500,000 people undergo open-heart surgery each year in the United States. Also, the data published by the New Jersey Department of Health in August 2022, there were 17,291 open heart surgeries in New Jersey in 2021. Similarly, the article published in NCBI article in May 2021 reported that about 15,000 people in Canada undergo coronary artery bypass grafting surgery each year. Furthermore, the rising geriatric population among the North American countries who are prone to cardiac disorders and in need of cardiac surgeries is also expected to drive the demand for sternal closure systems, thereby fueling the market growth. For instance, according to Statistics Canada, the senior population in Canada reached 2,308,041 in 2022, from 2,232,871 in 2021. Likewise, the UCAM data published in 2022, around 12% of the total Mexican population is over 60 years and older. Thus, the growing geriatric population in the region is expected to boost market growth over the forecast period.

Therefore, owing to the above-mentioned factors, the rising cardiac surgeries, the increasing geriatric population along with the presence of key market players in the North American region are expected to occupy a major share of the sternal closure system market during the forecast period of the study.

Sternal Closure Systems Industry Overview

The Sternal Closure Systems market is moderately competitive and has several major players. Some companies currently dominating the market are Johnson & Johnson, Zimmer Biomet Holdings, KLS Martin Group, Acumed, LLC (Colson Medical, LLC), A&E Medical, Idear S.R.L, Praesidia SRL, Kinamed Incorporated, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Patients with Debilitating Wounds

- 4.2.2 Increasing Open Cardiac Surgeries and Geriatric Population

- 4.2.3 Technological Advancements in Sternotomy Techniques

- 4.3 Market Restraints

- 4.3.1 Procedural Risks Associated With Sternal Closure

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Wires

- 5.1.2 Plates and Screws

- 5.1.3 Bone Cement

- 5.1.4 Others

- 5.2 By Procedure

- 5.2.1 Median Sternotomy

- 5.2.2 Hemisternotomy

- 5.2.3 Bilateral Thoracosternotomy

- 5.3 By Material

- 5.3.1 Stainless Steel

- 5.3.2 Polyether Ether Ketone

- 5.3.3 Titanium

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Johnson & Johnson

- 6.1.2 Zimmer Biomet Holdings (A&E Medical)

- 6.1.3 KLS Martin Group

- 6.1.4 Acumed, LLC (Colson Medical, LLC)

- 6.1.5 Figure 8 Surgical

- 6.1.6 Idear S.R.L

- 6.1.7 Praesidia SRL

- 6.1.8 Kinamed Incorporated

- 6.1.9 Jace Medical

- 6.1.10 B Braun SE

- 6.1.11 Orthofix Holdings Inc

- 6.1.12 Abyrx Inc