|

市場調查報告書

商品編碼

1434487

大麻測試(產品測試):全球市場佔有率分析、行業趨勢和統計、成長趨勢預測(2024-2029)Global Cannabis Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

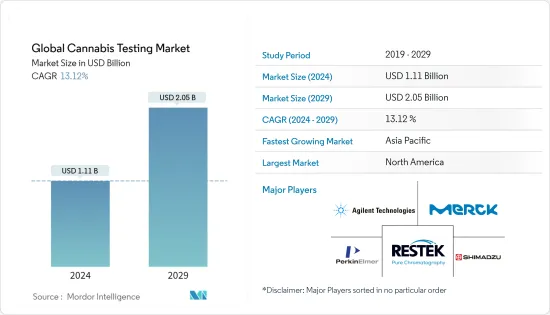

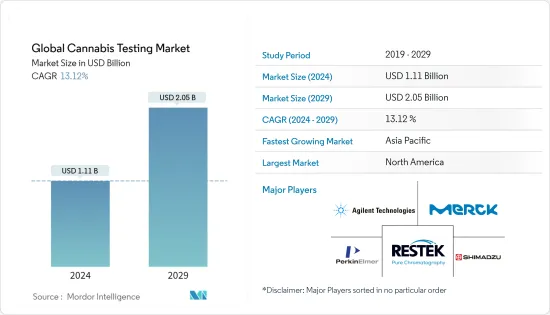

2024年全球大麻測試市場規模預計為11.1億美元,預計到2029年將達到20.5億美元,在預測期內(2024-2029年)成長13.12%,以複合年成長率成長。

COVID-19對該行業的影響仍在調查中。另一方面,由於新型冠狀病毒感染疾病(COVID-19)導致的封鎖,世界各地關閉了非必要的實驗室和測試設施,大麻測試設備和服務的銷售額略有下降。不過,也有一些正面的消息。 2020 年 4 月,兩家以色列公司 Eibna 和 CannaSoul 聯手申請了用於感染疾病COVID-19 的大麻萜烯配方專利。這些公司正在研究大麻萜烯製劑的有效性,該製劑用於治療各種發炎疾病,包括由 COVID-19 引起的細胞激素感染疾病症候群。該領域合作和研究的增加可能會產生對大麻測試服務以分離新化合物的需求。

推動市場成長的主要因素是醫用大麻使用的核准不斷增加。大麻用於醫療目的的合法使用正在穩步增加,但各國根據其使用、分銷、種植和消費的醫學適應症而有所不同。此外,越來越多的研究支持將大麻用於醫療目的,一些研究表明大麻是對抗鴉片類藥物流行的潛在手段。北美、歐洲和南美洲多個國家的政府機構已根據嚴格的標準,完全或以某種形式有限地使醫用大麻的使用合法化。世界上大約有 40 個國家允許透過處方箋合法使用大麻或作為阿育吠陀藥物有限使用。自 2018 年美國農業法案通過以來,已有支持使用大麻產品的法律。該法案允許廣泛種植大麻,但僅限於一項試點計劃,以衡量市場對大麻衍生產品的興趣。該法案明確授權大麻衍生產品跨州轉移用於商業或其他目的。此外,只要大麻衍生產品以合法方式生產,其銷售、運輸或擁有就不受限制。 2021年2月,美國立法者表示,他們正在計劃制定新的立法,以廢除聯邦對大麻的禁令,大麻在許多州已經在一定程度上合法化。這些努力可能會對大麻檢測設備的需求產生正面影響。隨著基於大麻的產品變得更加法律規章並受到立法的約束,預計在研究期間對測試設備的需求將會增加。

大麻萃取物也用於治療許多神經病變和精神疾病。隨著這些疾病發病率的增加以及大麻使用和產量的增加,預計大麻測試市場在預測期內也會成長。據歐洲腦理事會稱,截至 2022 年,全球將報告約 600 例神經病變病例,使精神障礙成為全球疾病和殘疾的主要原因。憂鬱症是最常見的精神障礙。全球範圍內,超過 2.64 億各年齡層的人患有憂鬱症。患有憂鬱症的女性多於男性。此外,大麻測試實驗室對軟體服務的認知和採用的提高也是推動市場發展的因素。

各個主要市場相關人員最近採取的大麻測試措施可能會進一步加速市場成長。例如,2022 年 9 月,2021 年推出的第三方大麻和大麻測試機構 Method Testing Labs 在佛羅裡達州布蘭登開設了一家位於佛羅裡達州的實驗室。預計此類活動將進一步推動市場成長。

然而,大麻檢測設備的高成本是市場成長的主要障礙。

大麻測試市場趨勢

分析儀器領域主導市場

COVID-19 對分析儀器的影響是正面的。總體而言,COVID-19感染疾病大流行顯著增加了分析儀器的產量,並增加了對分析儀器的需求。此外,大麻萃取物也用於醫學研究,因此在大流行期間對這些設備的需求持續存在。最後,美國許多地區都賦予大麻藥局「基本業務」的稱號。因此,這些發展預計將對市場開拓產生正面影響。

應測試大麻萃取物的重金屬、效力、農藥、萜烯成分、殘留溶劑、水分、微生物和真菌生長以及黴菌毒素/黃麴毒素。測試可確保您的產品安全,同時產生收益和投資收益。 HPLC、氣相層析法、液相層析法等儀器被廣泛使用。 2021 年 6 月發表在《色譜雜誌 A》上的報導“使用液相層析法和超臨界流體層析進行大麻素效力測試:我們在哪裡,我們需要什麼”的文章中,紫外線檢測和高效液相層析被指示。超臨界流體層析(SFC)對於大麻產品的準確效力測試非常有價值。

層析法技術廣泛用於減少污染物。這些產品具有成本效益,同時可以有效去除大麻和大麻萃取物中的殺菌劑、殺蟲劑、除草劑、增效劑和重金屬等污染物。層析法也可用於降低大麻萃取物中四氫大麻酚 (THC) 的含量。這些用於從大麻萃取物中分離大麻素,例如大麻二酚 (CBD)、THC、大麻酚 (CBN) 和大麻醇 (CBG)。許多公司,例如 Sorbent Technologies Inc.,提供自己的基於層析法的測試和提取產品。本公司銷售吸附劑、薄層層析法( TLC)板、快速管柱、快速層析法系統、快速蛋白液相層析法(FPLC)管柱、高效液相層析(HPLC)管柱、氣相層析法(GC)管柱等。層析法產品。 、凝膠過濾、固相萃取 (SPE) 管柱和針筒篩檢程式。許多其他公司也提供各種產品,包括 Aurum Labs、WATERS 和 CannaSafe Inc。領先企業的出現預計將推動市場成長,因為它會帶來更好的產品可用性。

此外,主要市場參與者在預測期內支持市場的成長。 2021 年 3 月,PerkinElmer 推出了業界首款經過認證的標準物質 (CRM) 試劑和耗材套件,以簡化大麻農藥測試工作流程。此類產品將有助於促進使用分析儀器對大麻產品進行分析,並可能在預測期內進一步促進該領域的成長。

北美主導市場,預計在預測期內也是如此

預計北美將在整個預測期內主導整個市場。市場的成長得益於慢性病的高盛行率、有利的立法以及大公司在該地區的存在等因素。

根據加拿大政府2022年4月發表的報導,加拿大目前有超過9萬40歲以上的人患有帕金森氏症。根據美國國家神經病變和中風研究所2022年7月更新的帕金森氏症資料,美國約有50萬人被診斷出患有帕金森氏症,但一些專家由於未確診或誤診疾病的問題,估計更多人患有帕金森氏症。超過一百萬美國人患有帕金森氏症但沒有報告。從大麻中提取的 CBD 產品用於治療帕金森氏症等一些神經系統疾病的症狀。如此高的發病率預計將對市場成長產生積極影響。

加拿大是世界上最早將大麻生產和使用合法化的國家之一。 2019年10月,該公司修訂了法律,制定了三類新大麻的合法生產和銷售規則,包括食用大麻、大麻萃取物和大麻外用藥。這些產品需要先進的精製和測試設備從大麻植物中提取。因此,像加拿大這樣的監管變化預計將對市場開拓產生積極影響。

此外,領先公司之間不斷增加的合作和研究活動也是預計推動市場成長的一些因素。由於其支持性醫療政策和龐大的患者人數,美國預計將在該地區佔據最大佔有率。 2022 年 8 月,SC Labs 將更名為 Agricor、Botanacor 和 Can-Lab,成為 SC Labs 名下的一家公司,在加州、密西根州、奧勒岡和科羅拉多提供無縫大麻測試服務。我們還在全國範圍內提供大麻測試能力。預計此類行動將在預測期內推動市場成長。

大麻測試產業概述

大麻測試市場適度整合,由幾家大公司組成。目前主導市場的公司包括安捷倫科技公司、島津科學儀器公司、默克公司、Restek公司、珀金埃爾默公司、丹納赫公司、Accelerated Technology Laboratories Inc.、Steep Hill Halent Laboratories Inc.、Digipath Inc.和Pharmlabs。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 用於各種醫療目的的大麻合法化

- 人們越來越認知到大麻用於治療神經系統疾病

- 市場限制因素

- 分析設備高成本

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模:金額)

- 按產品、軟體/服務

- 分析設備

- 分光裝置

- 消耗品

- 大麻測試軟體和服務

- 按類型

- 效力測試

- 萜烯分析

- 殘留溶劑篩檢

- 重金屬測試

- 黴菌毒素測試

- 其他類型

- 按最終用戶

- 研究機構

- 大麻藥品製造商和藥房

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東/非洲

- GCC

- 南非

- 其他中東和非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭形勢

- 公司簡介

- Agilent Technologies Inc.

- Shimadzu Scientific Instruments

- Merck KGaA(Sigma Aldrich)

- Restek Corporation

- PerkinElmer Inc.

- Danaher Corporation

- Accelerated Technology Laboratories Inc.

- Steep Hill Halent Laboratories Inc.

- Digipath Inc.

- Pharmlabs LLC

- Sartorius AG

- AB Sciex Pte. Ltd

第7章 市場機會及未來趨勢

The Global Cannabis Testing Market size is estimated at USD 1.11 billion in 2024, and is expected to reach USD 2.05 billion by 2029, growing at a CAGR of 13.12% during the forecast period (2024-2029).

The impact of COVID-19 on this industry is still being studied. On one hand, due to the shutdown of non-essential labs and testing facilities across the world in response to COVID-19-induced lockdowns, sales of cannabis testing equipment and services were a bit low. However, there has been positive news too. In April 2020, two Israel-based companies, Eybna and CannaSoul, collaborated to work on a patented cannabis terpene formulation for treating COVID-19. The companies are examining the efficacy of the cannabis terpene formulation, which is being used to treat a diverse range of inflammatory conditions, including the cytokine storm syndrome caused by COVID-19. Collaborations and increased research in this segment are likely to create demand for cannabis testing services to isolate novel compounds.

The major factor attributing to the growth of the market is the increasing approval for the use of medical cannabis. The legal usage of cannabis for medical purposes is steadily growing but varies across countries based on the possession, distribution, cultivation, and medical indications for its consumption. In addition, there is an increasing volume of research supporting the use of marijuana for medical purposes, while some studies demonstrated it to be a potential means of fighting the opioid epidemic. Government bodies of several countries across North America, Europe, and South America have legalized the use of medicinal marijuana completely or for limited usage in certain forms on a strict basis. Globally, there are about 40 countries that allow the legal use of marijuana that is distributed through prescription or limited use in ayurvedic medicines. The use of hemp-based products has seen favorable legislation since the passage of the United States Farm Bill in 2018. The bill allowed the broad-based cultivation of hemp while restricting it to pilot programs for studying market interest in hemp-derived products. The bill explicitly allowed the transfer of hemp-derived products across state lines for commercial or other purposes. Additionally, it puts no restrictions on the sale, transport, or possession of hemp-derived products, so long as those items are produced in a manner consistent with the law. In February 2021, lawmakers in the United States stated that they were planning new legislation that would end the federal prohibition on marijuana, which has been legalized to some degree by many states. These initiatives are likely to impact the demand for cannabis testing equipment in a positive manner. As cannabis-based products find increased legislation and come under the ambit of law, the demand for testing equipment is expected to increase during the study period.

Cannabis extracts are also used to treat many neurological and mental disorders. As the incidence of these disorders increases, along with the increase in use and production of cannabis, the cannabis testing market is also expected to grow during the forecast period. According to the European Brain Council, as of 2022, approximately 600 neurological disorders reported around the world, placing mental disorders among the leading causes of ill-health and disability globally. Depression is the most common mental disorder. Globally, more than 264 million people of all ages suffer from depression. More women are affected by depression than men. Furthermore, growing awareness and adoption of software services in labs testing cannabis are other factors boosting the market.

The recent initiatives in cannabis testing by various key market players are likely to add to the market growth. For instance, in September 2022, Method Testing Labs, a third-party cannabis and hemp testing facility launched in 2021, opened a Florida-based lab located in Brandon, Florida. Such activities are expected to add to the market growth.

However, the high cost involved in cannabis testing instruments is a major drawback of the market growth.

Cannabis Testing Market Trends

The Analytical Instruments Segment is Dominating the Market

The COVID-19 impact on analytical instruments has been positive. In general, due to the COVID-19 pandemic, there has been an increase in demand for analytical instruments as the production of equipment has increased significantly. Additionally, since cannabis extracts are being used for medical research, there has been sustained demand for these equipment even during the pandemic. Finally, many regions in the United States tagged cannabis dispensaries with the title of 'essential business'. Thus, these developments are expected to positively affect the market development.

Cannabis extracts need to be tested for heavy metals, potency, pesticides, terpene profile, residual solvents, moisture, microbial and fungal growth, and mycotoxins/aflatoxin. Testing makes sure that the products are safe, while concurrently generating revenues and a return on investment. Instruments like HPLC, gas chromatography, and liquid chromatography are used extensively. An article titled 'Potency testing of cannabinoids by liquid and supercritical fluid chromatography: Where we are, what we need' published in the Journal of Chromatography A in June 2021 indicated that potency testing by high-performance liquid chromatography (HPLC) with UV detection and supercritical fluid chromatography (SFC) has been highly beneficial in the accurate potency testing of cannabis products..

Chromatography techniques are used extensively for contaminant reduction. They can be cost-effective while efficiently removing contaminants like fungicides, pesticides, herbicides, synergists, and heavy metals from cannabis and hemp extracts. Chromatography can also be used for reducing tetrahydrocannabinol (THC) content in cannabis extracts. They are used to separate cannabinoids like Cannabidiol (CBD), THC, Cannabinol (CBN), Cannabigerol (CBG), etc., from cannabis extracts. Many companies like Sorbent Technologies Inc. offer exclusive chromatography-based testing and extraction products. The company manufactures dedicated chromatographic products like Adsorbents, Thin-layer chromatography (TLC) Plates, Flash Cartridges, Flash Chromatographic Systems, Fast protein liquid chromatography (FPLC) Columns, High-performance liquid chromatography (HPLC) Columns, Gas Chromatography (GC) Columns, Gel Filtration, Solid Phase Extraction (SPE) Cartridges, and Syringe Filters. Many other companies like Aurum Labs, WATERS, and CannaSafe Inc., among others, offer diversified products too. The presence of major companies is expected to boost the market growth as it leads to greater product availability.

Also, the key market players are aiding in the market growth over the forecast period. In March 2021, PerkinElmer launched industry-first Certified reference material (CRM) reagent and consumable kit to streamline cannabis pesticide testing workflows. Such products aid in the easier analysis of the cannabis products using the analyzing instruments, which is likely to add to the segmental growth over the forecast period.

North America Dominates the Market and is Expected to do the Same in the Forecast Period

North America is expected to dominate the overall market throughout the forecast period. The market growth is due to factors such as the high prevalence of chronic diseases in the region, favorable legislation, and the presence of large companies.

According to the article by the Government of Canada released in April 2022, over 90,000 people in Canada over the age of 40 years were living with Parkinson's disease as of date. As per the National Institute of Neurological Disorders and Stroke data on Parkinson's disease updated in July 2022, around 500,000 people in the United States were reported to be diagnosed with Parkinson's, however, some experts estimate that over 1 million Americans have Parkinson's disease and are unreported due to undiagnosed or misdiagnosis problems. Cannabis-derived CBD products are used to treat some symptoms of neurological disorders like Parkinson's. Such high incidence rates are expected to have a positive effect on market growth.

Canada was one of the first countries in the world to legalize the production and use of cannabis. In October 2019, it updated its laws to establish rules for the legal production and sale of three new classes of cannabis, which included edible cannabis, cannabis extracts, and cannabis topicals. These products need advanced purification and testing equipment for their extraction from cannabis sativa plants. Thus, regulatory changes like the one in Canada are expected to have a positive effect on the market development.

Furthermore, collaborations between major companies and an increase in the number of research efforts are some of the factors expected to drive the market growth. In this region, the United States is expected to have the maximum share due to supportive healthcare policies and the high number of patients. In August 2022, SC Labs rebranded Agricor, Botanacor, and Can-Lab to become one company under the SC Labs name, which offers seamless testing services for cannabis across California, Michigan, Oregon, and Colorado, as well as hemp testing capabilities nationwide. Such actions are expected to boost the market growth over the forecast period.

Cannabis Testing Industry Overview

The cannabis testing market is moderately consolidated and consists of some major players. Some of the companies currently dominating the market are Agilent Technologies Inc., Shimadzu Scientific Instruments, Merck KGaA, Restek Corporation, PerkinElmer Inc., Danaher Corporation, Accelerated Technology Laboratories Inc., Steep Hill Halent Laboratories Inc., Digipath Inc., and Pharmlabs LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Legalization of Cannabis for Various Medical Purposes

- 4.2.2 Increasing Awareness regarding Cannabis for Treating Neurological Diseases

- 4.3 Market Restraints

- 4.3.1 High Cost of Analytical Instruments

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - in USD Millions)

- 5.1 By Product and Software/Service

- 5.1.1 Analytical Instruments

- 5.1.2 Spectroscopy Instruments

- 5.1.3 Consumables

- 5.1.4 Cannabis Testing Software and Services

- 5.2 By Type

- 5.2.1 Potency Testing

- 5.2.2 Terpene Profiling

- 5.2.3 Residual Solvent Screening

- 5.2.4 Heavy Metal Testing

- 5.2.5 Mycotoxin Testing

- 5.2.6 Other Types

- 5.3 By End User

- 5.3.1 Laboratories

- 5.3.2 Cannabis Drug Manufacturers and Dispensaries

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Agilent Technologies Inc.

- 6.1.2 Shimadzu Scientific Instruments

- 6.1.3 Merck KGaA (Sigma Aldrich)

- 6.1.4 Restek Corporation

- 6.1.5 PerkinElmer Inc.

- 6.1.6 Danaher Corporation

- 6.1.7 Accelerated Technology Laboratories Inc.

- 6.1.8 Steep Hill Halent Laboratories Inc.

- 6.1.9 Digipath Inc.

- 6.1.10 Pharmlabs LLC

- 6.1.11 Sartorius AG

- 6.1.12 AB Sciex Pte. Ltd

![大麻檢測市場:趨勢、機遇和競爭分析 [2023-2028]](/sample/img/cover/42/1272714.png)