|

市場調查報告書

商品編碼

1273416

非磁性輪椅市場增長、趨勢和預測 (2023-2028)Nonmagnetic Wheelchair Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

在預測期內,非磁性輪椅市場的調查結果預計將以 6.1% 左右的複合年增長率增長。

主要亮點

- COVID-19 大流行對非磁性輪椅市場產生了重大影響。 例如,在 2022 年 12 月發表在 MedRxiv 上的一篇論文中,大流行病對殘疾人的影響尤為嚴重,因為他們既往情況復雜。 基本服務和支持的中斷,以及原有的健康狀況,在某些情況下會使殘疾人面臨多種疾病的風險。 因此,患者大多被留在家中,對大流行期間非磁性輪椅的銷售產生了負面影響。 2021 年 1 月發表在《脊髓醫學》上的一篇論文發現,在大流行期間使用全手動輪椅的胸脊髓損傷患者的身體活動水平低於大流行之前。 因此,COVID-19 對非磁性輪椅市場產生了重大影響。 然而,由於醫院重新開放和 COVID-19 病例減少,預計所研究的市場將在預測期內從 COVID-19 的影響中恢復過來。

- 受傷和神經肌肉疾病數量的增加以及老年人口的增加等因素可能會推動市場增長。 例如,根據聯合國發布的WPP 2022報告,全球老年人口正在快速增長。 北亞和西亞、撒哈拉以南非洲、大洋洲(不包括澳大利亞和新西蘭)、中亞和南亞的老年人口預計將以每年 3% 以上的速度增長。 預計 65 歲及以上人口占全球人口的比例將從 2022 年的 10% 上升到 2050 年的 16%。 隨著老年人口的增加,行動不便的問題會增加,非磁性輪椅的採用會增加。

- 此外,使人衰弱的神經系統疾病、類風濕性關節炎和骨關節炎的患病率不斷上升,導致步態受損的人口比例不斷增加。 例如,根據 2022 年 11 月 WA 關節炎更新,關節炎影響 360 萬澳大利亞人(七分之一),每年造成 140 億美元的損失。 隨著關節炎並發症的增加,利用非磁性輪椅的潛力正在增加,推動了非磁性輪椅市場的增長。 此外,全球範圍內越來越多的輪椅捐贈也在推動無磁輪椅市場的增長。 例如,從 2021 年 5 月到 2022 年 4 月,耶穌基督教會捐贈或交付了 18,569 輛輪椅,以幫助 32 個國家/地區。

- 由於老年人口增加、神經系統疾病增加、輪椅捐贈等,預計受調查市場在預測期內將出現顯著的市場增長。 然而,新興市場和欠發達地區的設施短缺可能會在預測期內抑制市場增長。

非磁性輪椅的市場趨勢

在預測期內,非磁性輪椅市場在醫院領域可能會顯著增長

- 由於行動不便的人增加、輪椅捐贈增加以及致殘運動損傷激增等因素,醫院部門的市場研究可能會顯著增長。 例如,根據美國國家安全委員會 (NSC) 的數據,到 2021 年,運動器材將在美國造成約 409,000 起傷害,是體育和娛樂領域中最多的。 根據同一消息來源,2021 年美國報告了 222,086 起橄欖球受傷、259,779 起籃球受傷和 144,895 起橄欖球受傷。 運動損傷的高發率直接影響了住院人數的增加,最終推動了全球對無磁輪椅需求的增長。

- 此外,個人和機構向醫院捐贈的輪椅預計將在預測期內推動該細分市場的增長。 例如,2021 年 5 月,一名青少年向印度 Vasai Covid 醫院捐贈了價值 6,500 印度盧比(78.61 美元)的輪椅。 同樣,2022 年 10 月,耶穌基督後期聖徒教會將與盧旺達生物醫學中心和全國殘疾人委員會 (NCPD) 合作,在盧旺達基加利結束為期四天的輪椅運送和培訓活動。底部。

- 因此,由於傷害事件增加、神經系統疾病增加、輪椅捐贈等,預計醫院部門在預測期內將出現顯著增長。

預計在預測期內北美將佔很大份額

- 由於容易患骨質疏鬆症和類風濕性關節炎等行動障礙的老年人口增加、受傷病例增加以及輪椅捐贈和產品發布激增,預計在預測期內北美將佔據整個市場的很大份額。將 例如,2022 年 9 月發表在 Springer 上的一項研究表明,加拿大高中的碰撞運動中總傷害和腦震蕩的發生率更高。 考慮到該人群中所有嚴重傷害的 33% 是四項運動造成的,這一點尤其值得注意。 因此,運動損傷將增加輪椅的使用並推動市場增長。

- 此外,政府為減輕昂貴設備的負擔而採取的支持措施以及報銷政策的擴大導致了個人移動設備的大量使用。 例如,根據 2021 年白宮情況說明書的一份報告,美國國際開發署 (USAID) 與 ATscale 之間的合作夥伴全球輔助技術合作將為 5 億人提供輪椅、眼鏡、假肢和助聽器到 2030 年。我們計劃提供改變生活的支持產品,例如: 該合作夥伴關係預計將使超過 10 億使用輔助技術和小工具的人受益。

- 此外,北美製造商可以獲得新技術,這使他們能夠在短時間內開發出技術先進的設備,這是市場增長的一個主要因素。 例如,2021 年 10 月,美國精密手動康復輪椅和座椅市場參與者 Ki Mobility 被符合人體工程學的輔助設備和麵向患者的設備的製造商和供應商 Etac AB 收購。 通過此次收購,Etac AB 現在可以為需要專業康復輪椅、座椅和兒科輔助設備的人、家庭和治療師提供範圍更廣的產品。

- 因此,由於傷害事件增加、產品發布增加以及政府舉措,預計北美在預測期內將佔據所研究市場的很大份額。

無磁輪椅行業概況

非磁性輪椅市場競爭激烈,由許多主要參與者組成。 廣東順德捷永五金、Comfort Orthopedic、Axis Medical、PRO ACTIV Reha-Technik、Besco Medical、Melrose Wheelchair、Karma Medical、Devilbiss Healthcare、Giraldin G&C 等公司在市場上佔有重要的市場份額。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

內容

第一章介紹

- 調查假設和市場定義

- 本次調查的範圍

第二章研究方法論

第 3 章執行摘要

第四章市場動態

- 市場概覽

- 市場驅動力

- 受傷和神經肌肉骨骼疾病的發生率增加

- 老年人口增加

- 市場製約因素

- 發展中和欠發達地區缺乏設施

- 產業吸引力 - 波特五力分析

- 新進入者的威脅

- 買方/消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第 5 章市場細分

- 按類型

- 小於 100 公斤

- 100kg以上150kg以下

- 150公斤或以上

- 最終用戶

- 醫院

- 骨科中心

- 其他最終用戶

- 按地區

- 北美

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 意大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 澳大利亞

- 韓國

- 其他亞太地區

- 中東和非洲

- 海灣合作委員會

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章競爭格局

- 公司簡介

- Guangdong Shunde JIEYANG HARDWARE Co. Ltd

- Comfort Orthopedic Co. Ltd

- Access Medical Wheelchairs

- PRO ACTIV Reha-Technik

- Besco Medical

- Melrose Wheelchair

- Karma Medical

- DeVilbiss Healthcare

- Giraldin G&C

- MRIequip.com

- Z&Z Medical Inc.

- Varay Laborix

第7章 市場機會與將來動向

簡介目錄

Product Code: 67798

The nonmagnetic wheelchair market studied was anticipated to grow with a CAGR of nearly 6.1% during the forecast period.

Key Highlights

- The COVID-19 pandemic had a significant impact on the nonmagnetic wheelchair market. For instance, as per the article published in December 2022 in MedRxiv, the pandemic disproportionately impacted physically disabled people because of the convoluted preexisting conditions. The interruption of vital services and support and preexisting health ailments, in some cases, have left the physically disabled in danger of acquiring several diseases. Hence, the patients were mostly left in households, which adversely impacted the sale of nonmagnetic wheelchairs during the pandemic. An article published in January 2021 in the journal of Spinal Cord Medicine stated that individuals with thoracic spinal cord injuries who used a manual wheelchair full-time during the pandemic had lower levels of physical activity than before the pandemic. Hence, COVID-19 had a significant impact on the nonmagnetic wheelchair market. However, with the resumption of hospitals and decreasing cases of COVID-19, the studied market is expected to recover from the impact of COVID-19 over the forecast period.

- Factors such as an increase in injuries, neuromuscular diseases, and a rise in the geriatric population are likely to drive the growth of the market. For instance, according to the WPP 2022 report published by the United Nations, the global geriatric population is increasing rapidly around the world. The older population is projected to grow at rates above 3% per year in Northern Africa and Western Asia, sub-Saharan Africa, Oceania (excluding Australia and New Zealand), and Central and Southern Asia. The share of the global population aged 65 years or above is projected to rise from 10% in 2022 to 16% in 2050. As the geriatric population rises, the disabilities associated with mobility increase, and the adoption of nonmagnetic wheelchairs rises.

- Moreover, the increasing prevalence of debilitating neurological diseases, rheumatoid arthritis, and osteoarthritis has been contributing to the increased percentage of the population with a disability to walk. For instance, as per the Arthritis WA November 2022 update, arthritis affects 3.6 million Australians (or 1 in 7) and costs USD 14 billion per year. As the arthritis complication increases, the likelihood of utilizing nonmagnetic wheelchairs rises, driving the growth of the nonmagnetic wheelchair market. Moreover, the increase in wheelchair donations worldwide also boosts the growth of the nonmagnetic wheelchair market. For instance, the Church of Jesus Christ donated or delivered 18,569 wheelchairs in support of 32 countries from May 2021 to April 2022.

- Due to the increase in the geriatric population, the rise in neurological diseases, and wheelchair donations, the studied market is expected to witness significant market growth over the forecast period. However, the lack of facilities in developing and under-developed regions are likely to restrain the growth of the market over the forecast period.

Nonmagnetic Wheelchair Market Trends

Hospital Segment is Likely to Witness a Significant Growth in the Nonmagnetic Wheelchair Market Over the Forecast Period

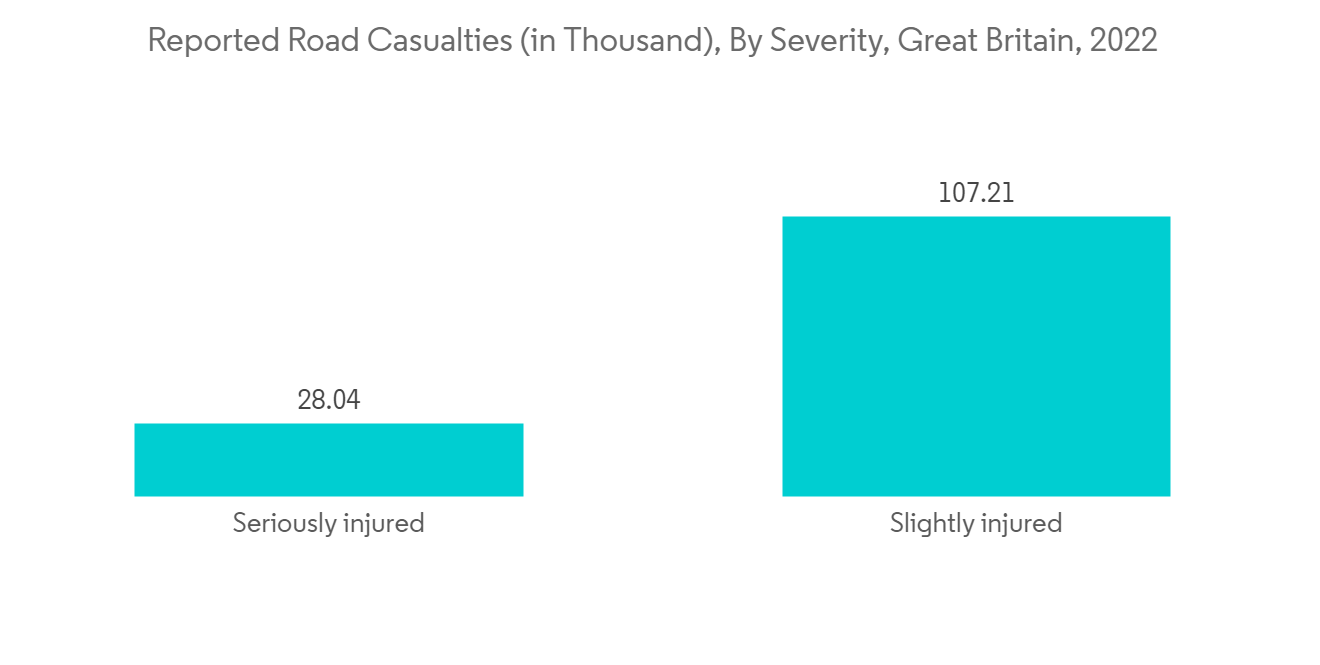

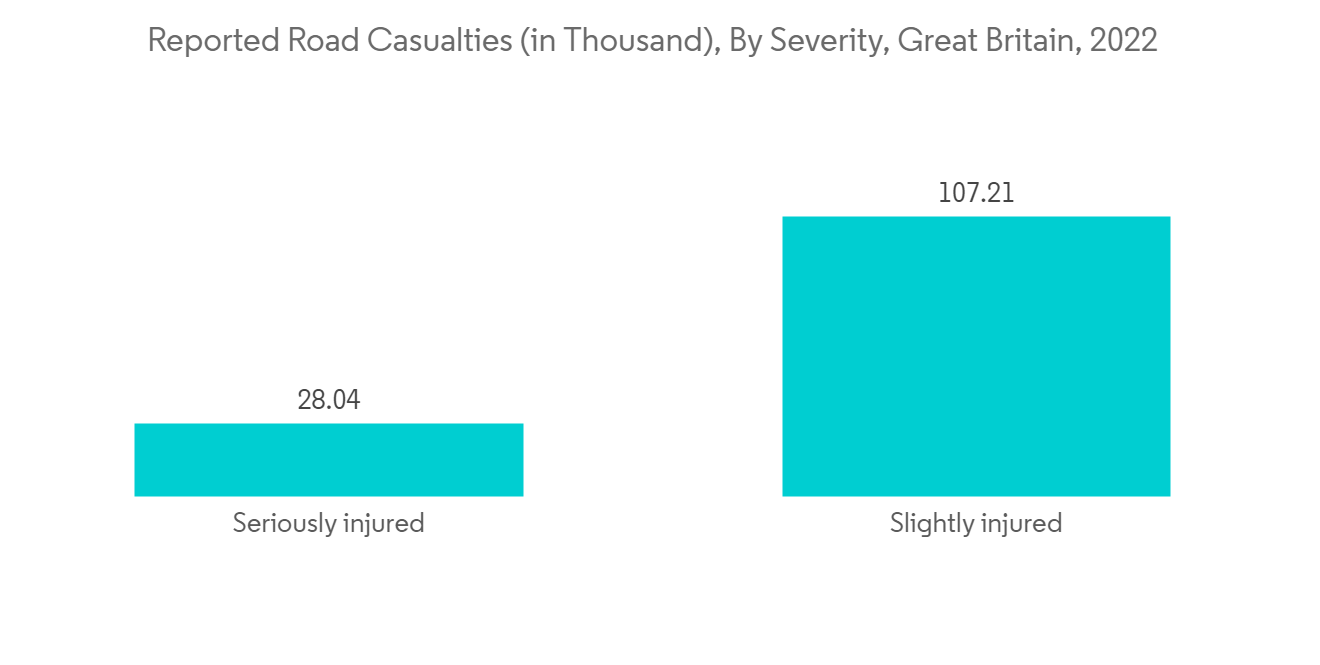

- The hospital segment is likely to witness significant growth in the market studied owing to the factors such as an increase in mobility issue cases, a rise in wheelchair donations, and a surge in sports injury cases that lead to disability. For instance, according to the National Safety Council (NSC), in 2021, exercise equipment accounted for about 409,000 injuries in the United States, the most in any category of sports and recreation. As per the same source, 222,086 cases of football injuries, 259,779 cases of basketball injuries, and 144,895 cases of soccer injuries were reported in 2021 in the United States. The high incidence of sports injuries is directly having an impact on the rise in hospital admissions, eventually boosting the growth in demand for non-magnetic wheelchairs worldwide.

- Furthermore, individual and group donations of wheelchairs to hospitals are likely to boost the growth of the segment over the forecast period. For instance, in May 2021, a teenager donated a wheelchair worth INR 6,500 (USD 78.61) to Vasai Covid hospital in India. Similarly, in October 2022, in collaboration with the Rwanda Biomedical Center and National Council of People with Disability (NCPD), the Church of Jesus Christ of Latter-day Saints closed a 4-day wheelchair delivery and training event in Kigali, Rwanda.

- Therefore, due to the increase in injury cases, the rise in neurological diseases, and wheelchair donations, the hospital segment is expected to witness significant growth over the forecast period.

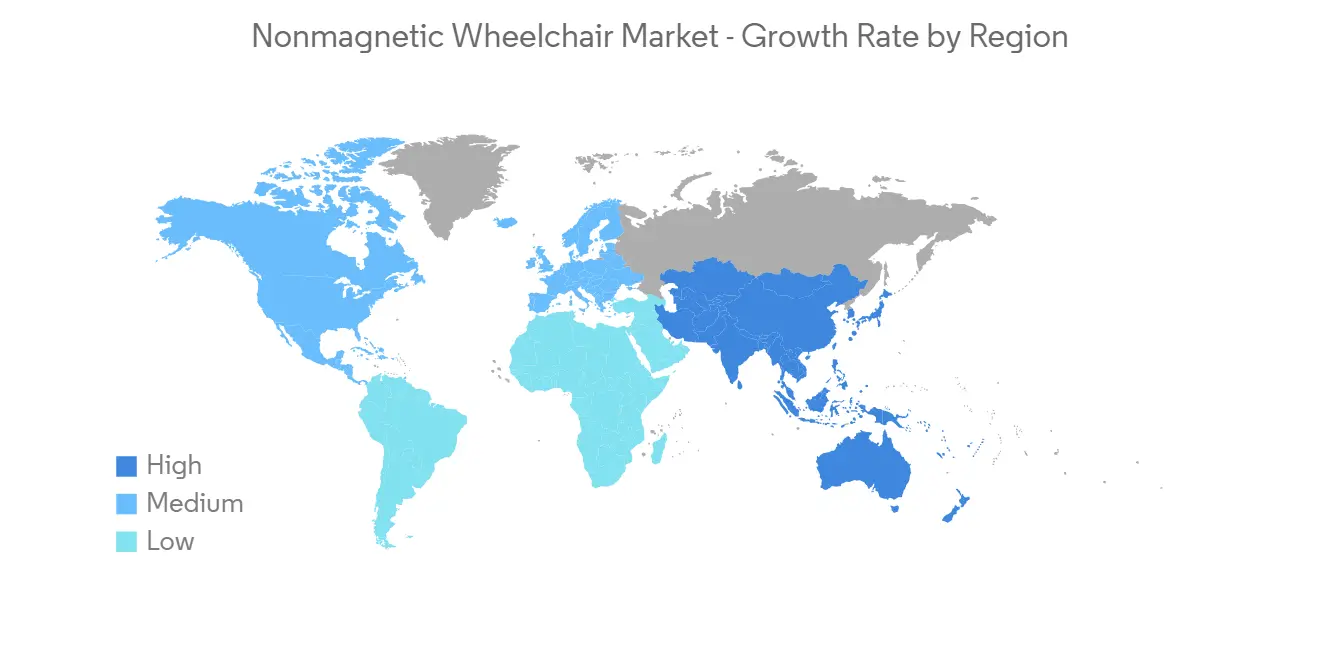

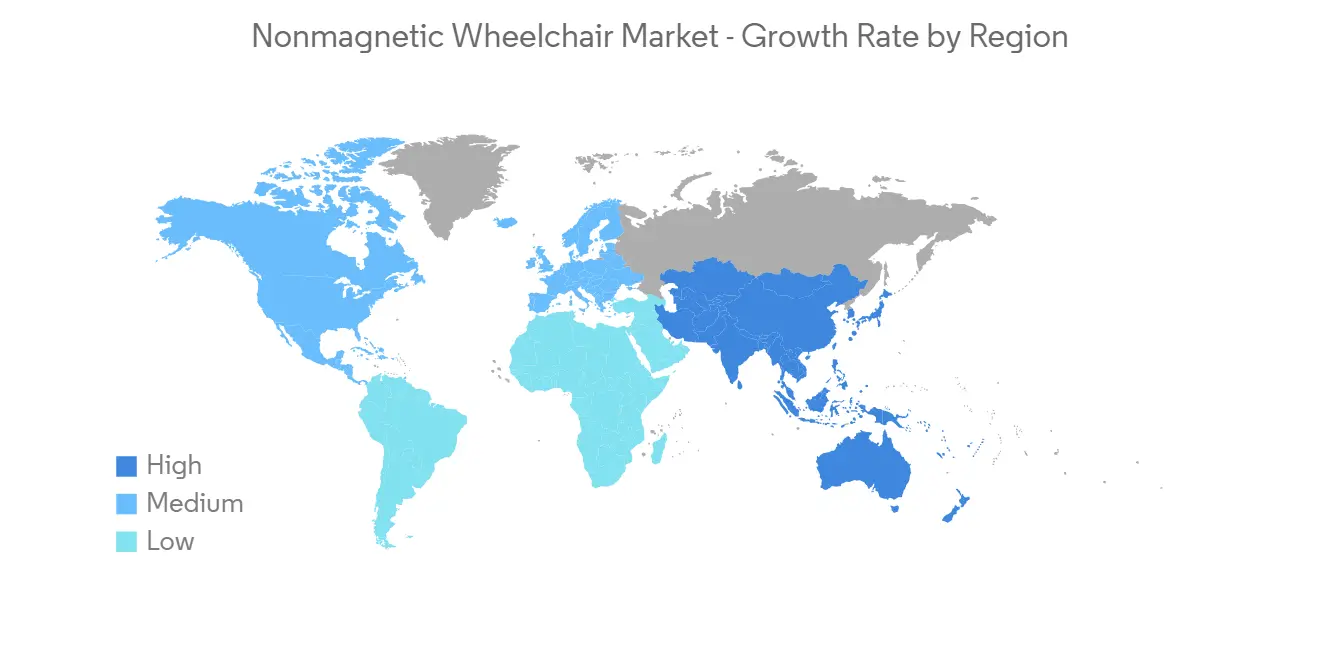

North America Anticipated to Hold a Significant Market Share Over the Forecast Period

- North America is expected to hold a significant market share in the overall market throughout the forecast period due to the increasing geriatric population who are more prone to mobility disorders (such as osteoporosis, rheumatoid arthritis, etc.), a rise in injury cases, and a surge in wheelchair donations and product launches. For instance, a study published in September 2022 in Springer demonstrated the high rates of all injuries and concussions in collision sports in Canadian high schools. This is particularly noteworthy when it is considered that four sports contribute 33% of all serious injuries to this population. Hence, sports injury cases raise the chance of utilization of wheelchairs, thereby driving the growth of the market.

- Furthermore, the supportive government initiatives that reduce the burden of the high cost of the devices, combined with growing reimbursement policies, have resulted in a high-volume usage of personal mobility devices. For instance, according to the report from the Whitehouse factsheet in 2021, the Global Cooperation for Assistive Technology, a partnership between United States Agency for International Development (USAID) and ATscale, planned to provide assistive products that can change their lives, such as wheelchairs, eyeglasses, prosthetic devices, or hearing aids to 500 million people by 2030. More than a billion people who use assistive technology or gadgets are expected to benefit from this partnership.

- Moreover, manufacturers in North America have access to novel technology, which enables the development of technologically advanced devices in a short span, which is a major factor in the growth of the market. For instance, in October 2021, Ki Mobility, a market player in sophisticated manual rehab wheelchairs and seating in the United States, was acquired by Etac AB, a creator and supplier of ergonomic assistive devices and patient handling equipment. With the acquisition, Etac AB offered a far wider range of products to people, families, and therapists that require specialized manual rehab wheelchairs, seating, and pediatric assistive devices.

- Thus, due to the increase in injury cases, the rise in product launches, and government initiatives, North America is expected to hold a significant market share in the market studied over the forecast period.

Nonmagnetic Wheelchair Industry Overview

The nonmagnetic wheelchair market is highly competitive and consists of a number of major players. Companies like Guangdong Shunde Jaeyong Hardware, Comfort Orthopedic, Axis Medical, PRO ACTIV Reha-Technik, Besco Medical, Melrose Wheelchair, Karma Medical, DeVilbiss Healthcare, Giraldin G&C, among others, hold substantial market share in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Injury and Neuromusculoskeletal Disorders

- 4.2.2 Increasing Geriatric Population

- 4.3 Market Restraints

- 4.3.1 Lack of Facilities in Developing and Under-Developed Regions

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type

- 5.1.1 Below 100 kg

- 5.1.2 100 kg to 150 kg

- 5.1.3 Above 150 kg

- 5.2 By End-User

- 5.2.1 Hospitals

- 5.2.2 Orthopedic Centers

- 5.2.3 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Guangdong Shunde JIEYANG HARDWARE Co. Ltd

- 6.1.2 Comfort Orthopedic Co. Ltd

- 6.1.3 Access Medical Wheelchairs

- 6.1.4 PRO ACTIV Reha-Technik

- 6.1.5 Besco Medical

- 6.1.6 Melrose Wheelchair

- 6.1.7 Karma Medical

- 6.1.8 DeVilbiss Healthcare

- 6.1.9 Giraldin G&C

- 6.1.10 MRIequip.com

- 6.1.11 Z&Z Medical Inc.

- 6.1.12 Varay Laborix

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219