|

市場調查報告書

商品編碼

1438557

彈性凸版印刷:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Flexographic Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

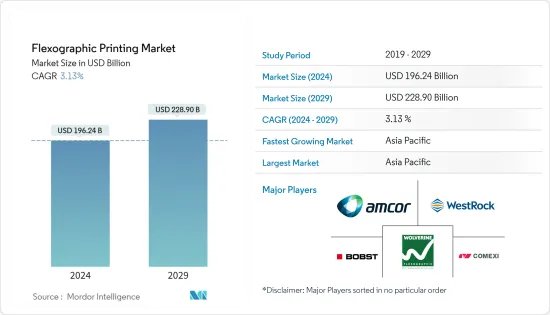

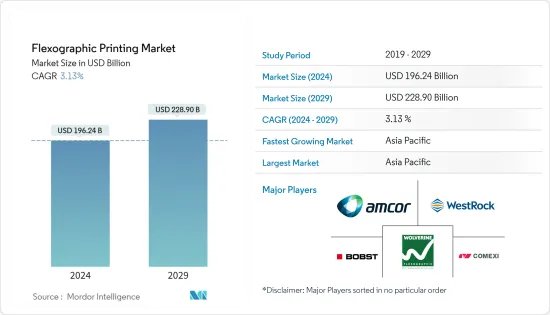

彈性凸版印刷市場規模預計到2024年為1,962.4億美元,預計2029年將達到2,289億美元,在預測期內(2024-2029年)年複合成長率為3.13%。

彈性凸版印刷市場在包裝行業受到廣泛關注,用於印刷標籤、紙箱和軟塑膠。食品、食品和飲料和其他包裝等行業的成長預計將推動彈性凸版印刷市場的發展。

主要亮點

- 彈性凸版印刷仍然是成長最快的印刷過程之一,並且不再僅用於印刷特殊物品。彈性凸版印刷可以在多種承印物上印刷,因此可用於印刷產品的範圍廣泛。食品包裝是一個重要的市場,因為彈性凸版印刷可以在無孔基材上印刷。

- 這種能力對於在塑膠袋上列印也很有用。此工藝非常適合出版包裝、壁紙、日曆、書籍、層壓利樂包裝、食品包裝等。被印製的材料(稱為基材)可以是紙張、卡片、聚合物、紡織品,甚至是金屬化薄膜(塗有一層薄金屬的聚合物)。

- 彈性凸版印刷印刷機能夠高速運行,不僅可以使用水性油墨,還可以使用油性油墨,使其適合在各種承印物和其他產品上使用,使其成為用途廣泛且易於操作的印刷機特別是對於可拉伸的可在某些塑膠薄膜上進行長時間印刷的印刷機的需求不斷成長,預計將推動彈性凸版印刷機的採用。

- 彈性凸版印刷是發展最快的印刷過程之一,不再僅用於印刷特殊物品。彈性凸版印刷可以在多種承印物上印刷,因此可用於印刷產品的範圍廣泛。食品包裝是一個重要的市場,因為彈性凸版印刷可以在無孔基材上印刷。

- 彈性凸版印刷為使用專色和冷燙、打孔、壓花和貼合加工等精加工工藝的客戶提供了關鍵優勢。隨著進展的繼續,這些付加流程可能會變得成本更低並成為主流。

- COVID-19 大流行帶動了電子商務產業的成長。在大流行封鎖期間,消費者轉向電子商務是包裝行業新趨勢的一部分。由於擔心冠狀病毒的傳播,人們待在家裡的時間越來越多,線上訂單以及商品和服務的交付增加。此外,俄羅斯和烏克蘭之間的戰爭正在影響整個包裝生態系統。

彈性凸版印刷市場趨勢

折疊紙盒預計將佔據較大佔有率

- 彈性凸版印刷乾燥快並且使用無毒油墨。這些因素也使得彈性凸版印刷易於用於印刷食品包裝。彈性凸版印刷主要用於牛奶盒、食品容器、食品和飲料容器、一次性杯子及容器等包裝。

- 可折疊紙盒重量輕,這導致全球客戶需求不斷增加。品質保證對於實體紙箱和最終包裝印刷至關重要。印刷公司正在轉向多站點營運,以適應這種成長並滿足需求。這種多站點操作提出了列印一致性的重要問題。

- 由於飲食習慣和生活方式的變化,消費者對包裝產品的需求不斷增加,可能會對食品包裝的折疊紙盒彈性凸版印刷市場產生重大影響。由於阻隔性、保存期限和消費者安全,人均可支配收入的增加和人口成長將推動產品需求。印刷用於各種包裝材料。可直接在塑膠、紙張、紙板和軟木上印刷。

- 儘管彈性凸版印刷多年來一直用於印刷折疊紙盒,但直到最近幾年,該公司才開始在該應用中使用中央廣告曝光率機。披薩紙盒是最初委託柔印製程處理的一個例子。同時,在寬幅輪轉印刷機上進行多種顏色印刷的能力使該工藝對其他商店紙板應用具有吸引力。

亞太地區預計主導彈性凸版印刷市場

- 該地區的電子商務產業正在蓬勃發展,是預測期內推動彈性凸版印刷機採用的關鍵因素之一。因為彈性凸版印刷在標籤和瓦楞紙印刷中起著至關重要的作用,被整個行業廣泛採用。例如,據印度投資局稱,到 2021 年,印度電子商務市場的商品總價值預計將超過 550 億美元。預計到2030年將達到3500億美元。

- 該地區物流業是包裝和印刷標籤的最大消費者之一,其成長預計將在預測期內推動市場成長。

- 此外,政府加強該地區製造業的舉措不斷增加,是預測期內增加彈性凸版印刷機採用的突出因素之一。

- 一些市場主要企業正在透過策略合作夥伴關係進入該地區,以擴大其市場足跡。預計此類合作夥伴關係將為該地區帶來新的創新產品,並在預測期內推動彈性凸版印刷的採用。

- 亞太地區在全球商業印刷市場中佔據主導地位,由於中國、印度、日本、印尼、泰國和越南等新興國家商業印刷消費的增加,預計未來幾年也將出現類似的成長。

彈性凸版印刷產業概述

彈性凸版印刷市場較為分散,存在多家公司。從市場佔有率來看,目前少數大公司佔據市場主導地位。這些擁有大量市場佔有率的領先公司正在尋求將基本客群擴展到其他國家。這些公司正在利用策略合作措施來擴大市場佔有率並提高盈利。

2022 年 10 月 - AV Flexologic 與博斯特合作,將博斯特的智慧 GPS 整合到 AV Flexologic 的全系列貼片機中。透過將這種先進的印刷機自動化技術與快速、準確的柔印製版機相結合,柔印產業將邁向更精簡、更最佳化的印刷流程。

2022 年 9 月 - Oasis Flower Plant for Plastic 是沙烏地阿拉伯領先的 PET 瓶胚和 HDPE 瓶蓋供應商,已達成協議購買一台 Comexi F2 MB彈性凸版印刷機。這家亞洲公司選擇依賴 Comexi 的知識和技術。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 降低印刷成本

- 技術進步和印刷品質提高

- 市場限制因素

- 新印刷技術的出現

第6章彈性凸版印刷設備市場展望

- 窄網

- 中型網路

- 單張饋紙

- 其他印刷設備

第7章市場區隔

- 目的

- 瓦楞紙箱

- 折疊式紙盒

- 軟包裝

- 標籤

- 印刷媒體

- 其他用途

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第8章 競爭形勢

- 公司簡介

- Amcor PLC

- Westrock Company

- Constantia Flexibles GmbH

- Sonoco Products Company

- Janoschka Holding GmbH

- InterFlex Group

- Pepin Manufacturing, Inc

- Siva Group

- Flexopack SA

- Southern Coating & Nameplate Inc.

- Wolverine Flexographic LLC(Crosson Holdings LLC)

- Bobst Group SA

- Edale UK Limited

- Heidelberger Druckmaschinen AG

- OMET

- MPS Systems BV

- Star Flex International

- Comexi

- Windmoeller & Hoelscher Corporation

- Orient Sogyo Co. Ltd.

第9章投資分析

第10章市場的未來

The Flexographic Printing Market size is estimated at USD 196.24 billion in 2024, and is expected to reach USD 228.90 billion by 2029, growing at a CAGR of 3.13% during the forecast period (2024-2029).

The market for flexographic printing has gained significant attention in the packaging industry, where it is used for printing labels, cartons, and flexible plastics. The growth of industries such as food, beverage, and other packaging, is anticipated to aid the market for flexographic printing.

Key Highlights

- Flexographic printing continues to be one of the fastest-growing print processes and is no longer reserved just for printing specialty items. The ability of flexography to print on a variety of substrates allows the process to be used for a wide range of printed products. Food packaging is an important market because of the ability of flexography to print on non-porous substrates.

- This ability makes it useful for printing on plastic bags, as well. The process is ideal for publishing packaging, wallpaper, calendars, books, laminated tetra paks, and food packaging. The material that receives the print, known as the substrate, can be paper, card, polymers, textiles, and even metalized films (polymers coated with a thin layer of metal).

- The increasing demand for a printing machine that can be used for a variety of substrates and other products with high versatility and ease of operation, particularly for rather long printing runs on all extensible plastic film, is expected to fuel the adoption of the flexographic printing machines, as flexographic printing machines can operate at high speeds and the have applicability on a different surface and water-based inks, as well as oil-based inks.

- Flexographic printing is one of the fastest-growing print processes and is no longer reserved for printing specialty items. The ability of flexography to print on a variety of substrates enables the process to be used for a wide range of printed products. Food packaging is a significant market because of the ability of flexography to print on non-porous substrates.

- Flexography provides principal benefits for customers using spot colors and finishing processes such as cold foiling, perforating, embossing, and laminating. Continued progress will likely decrease the costs of these value-added processes and make them extra mainstream.

- The outbreak of the COVID-19 pandemic resulted in growth in the e-commerce industry. Part of the packaging industry's new trends in the consumer's shift to e-commerce amidst the pandemic lockdowns. Online orders and delivery of goods and services were rising as people spent more time at home due to the fear of the coronavirus spreading. Furthermore, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

Flexographic Printing Market Trends

Folding Cartons Expected to Account for a Significant Share

- Flexographic printing is quick-drying and able to use non-toxic inks. These factors make flexographic printing accessible in the printing of food packaging for food packaging as well. It can primarily be used on packaging like milk cartons, food containers, beverage containers, and disposable cups and containers.

- To their lightweight nature, folding cartons are witnessing an increased customer demand globally. Quality assurance is essential for the physical carton and the final package print. Printers are looking at multi-site operations to address this growth and meet demand. In such a multi-site operation, a critical challenge comes into play: print consistency.

- The rising consumer demand for packaged products due to changing eating habits and lifestyles may significantly impact the market for flexographic printing of folding cartons in food packaging. Due to high barrier properties, shelf life, and consumer safety, a rise in per capita disposable income and a growing population will aid in product demand. Printing is used on a variety of packaging materials. Direct printing is possible on plastics, paper, board, and cork.

- Flexographic printing has been used to print folding cartons for many years, but it has only been in the last few years that the industry has begun to use central impression presses for this application. Pizza cartons are an example of the type of work that was originally relegated to the flexoprocess. The ability to print multi-colors in close registers on the wide web, on the other hand, has made the process more appealing to other point-of-purchase folding carton applications.

Asia Pacific Expected to Dominate the Flexographic Printing Market

- The e-commerce industry in the region is growing rapidly, which is one of the significant factors fueling the adoption of flexographic printing machines over the forecast period, as flexographic printing plays an essential role in the printing of labels and corrugated cardboard that are widely adopted across the industry. For instance, according to Invest India, the Indian e-commerce market is estimated to be worth over USD 55 billion in gross merchandise value in 2021. It is set to reach USD 350 billion by 2030.

- The growth of the logistics industry in the region, which is one of the biggest consumers of packaging and print labels, is expected to boost the market growth over the forecast period.

- Also, the growing initiatives by governments to boost the manufacturing industry in the region are one of the prominent factors that would increase the adoption of flexographic printing machines over the forecast period.

- Some of the prominent players in the market are entering the region through strategic partnerships in order to boost the market footprint. Such partnerships are expected to expose the region to new and innovative product offerings, fueling the adoption of flexographic printing machines over the forecast period.

- Asia Pacific is dominating the global commercial printing market and is expected to witness the similar growth over the coming years owing to the increasing consumption of commercial printing in emerging economies such as China, India, and Japan along with Indonesia, Thailand, and Vietnam.

Flexographic Printing Industry Overview

The flexographic printing market is moderately fragmented, with the presence of several companies. In terms of market share, few of the major players currently dominate the market. These major players with a significant share of the market are aiming to expand their customer base across other countries. These companies leverage strategic collaborative initiatives to augment their market share and increase profitability.

October 2022 - AV Flexologic and BOBST partnered to integrate BOBST smart GPS with the complete AV Flexologic mounting machine range. The flexo industry advances toward a leaner, waste-free, and optimized printing process by combining this advanced press automation technology with swift and accurate flexo plate mounters.

September 2022 - Oasis Flower Plant for Plastic, the leading provider of PET preforms and HDPE closures in Saudi Arabia, reached an agreement to acquire a Comexi F2 MB flexo press, as it primarily seeks printing projects to suit the demands of diverse customers, particularly those in the beverage sector. The Asian company has chosen to rely on Comexi's knowledge and technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Lesser Printing Cost

- 5.1.2 Technological Advancements and Improved Print Quality

- 5.2 Market Restraints

- 5.2.1 Advent of New Printing Technologies

6 FLEXOGRAPHIC PRINT EQUIPMENT MARKET LANDSCAPE

- 6.1 Narrow Web

- 6.2 Medium Web

- 6.3 Sheet Fed

- 6.4 Other Printing Equipment

7 MARKET SEGMENTATION

- 7.1 Application

- 7.1.1 Corrugated Boxes

- 7.1.2 Folding Carton

- 7.1.3 Flexible Packaging

- 7.1.4 Labels

- 7.1.5 Print Media

- 7.1.6 Other Applications

- 7.2 Geography

- 7.2.1 North America

- 7.2.1.1 United States

- 7.2.1.2 Canada

- 7.2.2 Europe

- 7.2.2.1 United Kingdom

- 7.2.2.2 Germany

- 7.2.2.3 France

- 7.2.2.4 Italy

- 7.2.2.5 Spain

- 7.2.2.6 Rest of Europe

- 7.2.3 Asia-Pacific

- 7.2.3.1 China

- 7.2.3.2 India

- 7.2.3.3 Japan

- 7.2.3.4 Rest of Asia-Pacific

- 7.2.4 Latin America

- 7.2.5 Middle East and Africa

- 7.2.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor PLC

- 8.1.2 Westrock Company

- 8.1.3 Constantia Flexibles GmbH

- 8.1.4 Sonoco Products Company

- 8.1.5 Janoschka Holding GmbH

- 8.1.6 InterFlex Group

- 8.1.7 Pepin Manufacturing, Inc

- 8.1.8 Siva Group

- 8.1.9 Flexopack SA

- 8.1.10 Southern Coating & Nameplate Inc.

- 8.1.11 Wolverine Flexographic LLC (Crosson Holdings LLC)

- 8.1.12 Bobst Group SA

- 8.1.13 Edale UK Limited

- 8.1.14 Heidelberger Druckmaschinen AG

- 8.1.15 OMET

- 8.1.16 MPS Systems BV

- 8.1.17 Star Flex International

- 8.1.18 Comexi

- 8.1.19 Windmoeller & Hoelscher Corporation

- 8.1.20 Orient Sogyo Co. Ltd.