|

市場調查報告書

商品編碼

1405351

智慧汽車 -市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Smart Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

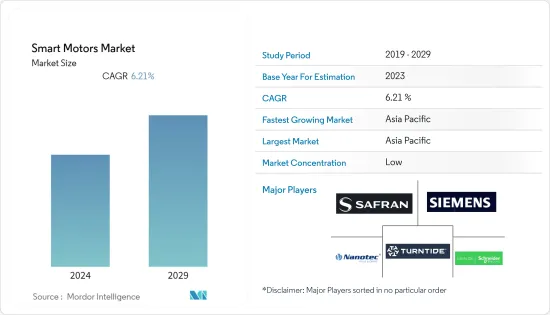

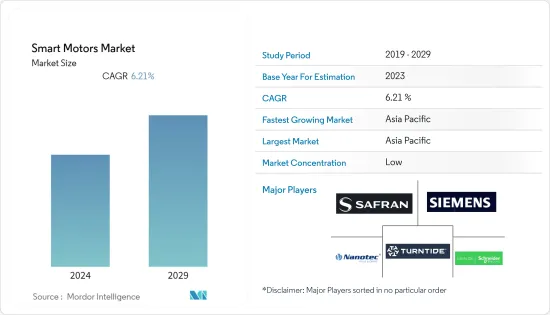

上一年智慧馬達市場規模為27.59億美元,預計在預測期內將達到38.34億美元,複合年成長率為6.21%。

馬達可以與智慧型馬達控制和先進的通訊功能相結合,以提高性能和運行效率。智慧馬達可實現預測性機器診斷,從而最佳化流程並減少停機時間。與傳統電動馬達相比,這些電動馬達具有更高的能源效率、性能、可靠性和維護能力,使其成為商業和工業應用的理想選擇。

主要亮點

- 全球對透過提高能源效率來節省能源成本的興趣日益濃厚,正在推動智慧馬達在各種能源集中產業中的採用,包括工業製造、汽車、消費性電子產品、石油和天然氣、航太和國防以及採礦。支持你。此外,歐盟(EU)和美國環保署(EPA)等監管機構對碳排放的嚴格監管是預測期內推動智慧馬達市場需求的關鍵因素之一。

- 例如,根據美國環境資訊署 (EIA) 的數據,全球工業能源消費量預計將從 2020 年的 241.10 兆英國熱單位增加到 2050 年的 361.4 兆英國熱單位。此外,到2021年,工業部門將占美國終端能源消耗總量的35%和能源消耗總量的33%。根據 IEA 的數據,到 2022 年,工業部門將佔全球能源消耗的 37%(166 EJ)。

- 先進的控制能力是工業領域使用的先進機器人和自動化解決方案所需的關鍵功能,隨著各產業向自動化產業轉型,對智慧馬達的需求將會不斷增加。除了機器人和自動化設備等因素和解決方案有助於提高生產效率和產能,同時減少生產時間外,勞動力短缺、人事費用上升以及對節能解決方案的需求也是促成因素。其他因素,是推動產業選擇這些解決方案的關鍵因素。

- COVID-19大流行對市場的影響是巨大的,包括多個國家政府實施的遏制措施,對工業部門的成長產生了重大影響。結果,所研究的市場經歷了放緩,尤其是在早期階段。然而,隨著主要終端用戶產業滿載恢復營運,智慧馬達的需求預計將在後疫情時期成長。

智慧馬達市場趨勢

石油和天然氣領域佔主要市場佔有率

- 在當前市場情勢下,油氣產業面臨經營績效、營業成本(TCO)、能源效率以及上下游流程安全等多重問題。透過不僅生產石油和天然氣,而且在其營運中使用石油和天然氣,石油和天然氣產業可以顯著減少其影響。

- 隨著傳統碳氫化合物能源的枯竭,在更脆弱和具有挑戰性的環境中生產能源變得越來越複雜。由於強調能源效率,石油和天然氣產業正在以前所未有的速度採用智慧馬達系統。石油和天然氣產業致力於確保石油和天然氣的可用性,同時以具成本效益的方式解決能源安全和環境問題。

- 石油和天然氣公司正在使用運動控制系統來改進流程,其中許多系統都採用智慧馬達。此外,石油和氣體純化使用低壓運動控制中心進行集中控制。這增加了所研究領域對智慧馬達的需求。

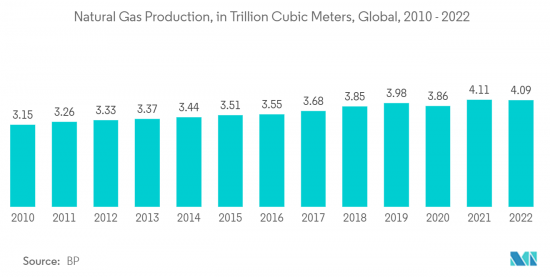

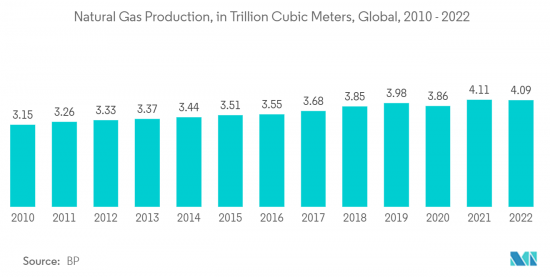

- 根據英國石油公司(BP)預測,2022年全球天然氣產量將達到約4.9兆立方米,2021年將達到4.1兆立方米。沙烏地阿美也表示,2022年原油產量為1,150萬桶/日,高於2021年的922萬桶/日。

- 此外,根據OPEC的預測,2022年全球原油需求(包括生質燃料)預計將達到9,957萬桶/日,2023年將增至1,0189萬桶/日。預測期內石油和天然氣需求的增加可能會促進智慧馬達的普及。此外,預計石油和天然氣生產活動的增加將顯著推動所研究市場的成長。

亞太地區預計將佔據主要市場佔有率

- 亞太地區是研究市場最重要的市場之一。由於該地區各個最終用戶行業擴大採用自動化,該地區為所研究的市場供應商提供了巨大的成長潛力。該地區的能源挑戰也增加了低壓電氣設備的採用,激勵許多公司開發節能且緊湊的電氣設備和裝置,進一步推動智慧馬達的成長。

- 此外,「印度製造」計畫等措施使印度成為世界地圖上的製造地,並使印度經濟得到全球認可。印度製造宣傳活動正在支援印度多個新推出的工業機器人。特別是,印度的工業自動化領域正在透過將製造的數位和物理方面相結合來實現最佳性能而發生革命性的變化。此外,對實現零廢棄物生產和縮短時間的關注正在加速市場成長。

- 工業 4.0 帶來的製造業大規模轉變以及物聯網的接受,透過技術推進生產以實現更大的產能和產量,正在推動市場對智慧馬達的需求。其他推動優勢,例如最小化維護要求和改進的過程控制,也推動了採用。

- 中國政府啟動了一項五年計劃,到 2022 年在中國工業領域擴大智慧製造和機器人流程自動化 (RPA)。成立了由16個國家資助的工業板組,以快速推動製造業走向未來並推廣電動馬達的使用。此外,透過加強機器人、人工智慧(AI)和雲端資料技術的研究能力,中國正致力於開發提供更大自主權並支援工業領域進一步成長的技術。

- 我國長期以來專注於發展高階製造業、電力工程、油氣產業,推廣使用國產中低壓變頻器。例如,中國政府雄心勃勃的「中國製造2025」舉措部分受到德國工業4.0的啟發,旨在提高中國製造業的競爭。

- 此外,在過去的幾十年裡,中國經歷了令人矚目的成長,特別是在工業領域,並被廣泛認為是世界製造中心。許多擁有各種製造和製程設備的行業的存在正在推動該地區對智慧馬達的需求。此外,最近透過更多採用自動化和其他先進技術來實現區域產業轉型的努力推動了所研究的市場需求。

智慧馬達產業概況

智慧型馬達市場高度分散,主要參與者包括 Safran Electrical &Power、Siemens AG、Natec Electronic GmbH &Co.KG、Turntide Technologies Inc. 和 Schneider Electric SE。市場參與企業正在採取聯盟和收購等策略來加強其產品陣容並獲得永續的競爭優勢。

2023年6月,賽峰電氣與電力公司宣佈在法國尼奧爾和英國皮特斯通安裝4條專用ENGINeUS電動馬達的自動化生產線。從 2026 年開始,這款大批量生產型號每年將生產 1,000 台引擎,以滿足蓬勃發展的電動和混合動力航空市場的需求。

2023年2月,日本電產株式會社宣布擬以150億日圓(約105.4億美元)現金收購義大利工具機公司PAMA。這將是日本電產株式會社在2021年進軍工具機業務企業合併。日本電產株式會社將先前專注於國內市場的工具機銷售管道擴展到海外市場,將其定位為繼電動車(EV)驅動系統之後的成長支柱。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 評估主要宏觀經濟趨勢的影響

第5章市場動態

- 市場促進因素

- 在提高設備效率的同時減少資本投資變得越來越重要

- 更好地整合 IIoT 服務,以實現預測性維護、更好的機器控制等服務

- 市場抑制因素

- 採用率低

- 與替代 VFD 解決方案相關的高轉換成本

第6章市場區隔

- 按成分

- 變速驅動器

- 引擎

- 按用途

- 工業的

- 商業的

- 車

- 航太/國防

- 油和氣

- 金屬/礦業

- 用水和污水

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Safran Electrical & Power

- Siemens AG

- Nanotec Electronic GmbH & Co. KG

- Turntide Technologies Inc.

- Schneider Electric SE

- Fuji Electric Co. Ltd

- Nidec Motion Control(Nidec Corporation)

- Moog Inc.

- Dunkermotoren GmbH(Ametek Inc.)

- Shanghai Moons'Electric Co. Ltd

第8章投資分析

第9章市場的未來

The smart motors market was valued at USD 2.759 billion the previous year and is expected to register a CAGR of 6.21%, reaching USD 3.834 billion over the forecast period. Motors can be combined with intelligent motor controls and advanced communication capabilities to improve performance and operational efficiencies. Smart motors allow predictive machine diagnosis, thus, resulting in reduced downtime through process optimization. These motors provide energy efficiency, improved performance, reliability, and maintenance capabilities compared to traditional electric motors, making them an ideal choice for commercial and industrial applications.

Key Highlights

- The rising global concern about saving energy costs by improving energy efficiency has been driving the adoption of smart motors in various high energy-intensive industries such as industrial manufacturing, automotive, consumer electronics, oil & gas, aerospace & defense, and mining, among others. Furthermore, growing stringent regulations regarding carbon emissions by regulatory agencies such as the European Union and the US Environmental Protection Agency (EPA) are among the key factors projected to fuel the market demand for smart motors during the forecast period.

- For instance, according to the United States Environmental Information Agency (EIA), global industrial energy consumption is estimated to grow from 241.10 quadrillion British thermal units in 2020 to 361.4 quadrillion British thermal units by 2050. Moreover, in 2021, the industrial sector accounted for 35% of total US end-use energy consumption and 33% of total US energy consumption. According to IEA, the industrial sector accounted for 37% (166 EJ) of global energy use in 2022.

- As advanced control features are crucial features required in advanced robotics and automation solutions used in the industrial sector, the demand for smart motors is increasing, with industries across various sectors transitioning to automated industries. Apart from the factors and solutions such as robotics and automated equipment help industries drive production efficiency and capacity while reducing production time, labor shortage, rising labor cost, and the growing demand for energy-efficient solutions are other major factors encouraging the industries to opt for such solutions.

- A notable impact of the global outbreak of COVID-19 was observed on the market as various containment measures taken by governments across multiple countries, such as the implementation of lockdown, significantly impacted the growth of the industrial sector. As a result, a slowdown was witnessed in the studied market, especially during the initial phase. However, with significant end-user industries resuming operations at total capacity, the demand for smart motors is anticipated to grow in the post-covid period.

Smart Motors Market Trends

Oil and Gas Segment Holds Major Market Share

- In the current market scenario, oil and gas industries face multiple issues related to business performance, the total cost of operation (TCO), energy efficiency, and safety in upstream and downstream processes. In addition to producing oil and gas, the industry also uses oil and gas in its operations, and this can significantly reduce the industry's impact.

- As traditional hydrocarbon energy resources are depleted, energy production from ever more sensitive and difficult environments is becoming increasingly complex. Smart motor systems are observing an unprecedented adoption rate by the oil and gas industry as it focuses efforts on energy efficiency. The industry strives to ensure the availability of oil and gas while addressing energy security and environmental concerns cost-effectively.

- Oil and gas companies use motion control systems to improve their processes, and many of these systems employ smart motors. Further, low voltage-motion control centers are being used in the oil and gas refineries for centralized control. This augments the demand for smart motors in the studied segment.

- According to BP (British Petroleum) company, global natural gas production amounted to approximately 4.09 trillion cubic meters and 4.10 trillion cubic meters in 2022 and 2021. Further, according to Aramco, its crude oil production volume of 11.5 million barrels per day in 2022 increased from 9.22 million barrels per day in 2021.

- Furthermore, according to OPEC, the global demand for crude oil (including biofuels) in 2022 amounted to 99.57 million barrels per day, and it is projected to increase to 101.89 million barrels per day in 2023. The rising demand for oil and gas during the forecast period would boost the penetration of smart motors. Further, the increase in oil and gas production activities is anticipated to drive the growth of the studied market significantly.

Asia Pacific is Expected to Hold Significant Market Share

- Asia-Pacific is one of the most significant markets for the market studied. The region offers massive growth potential to the studied market vendors, owing to the growing adoption of automation across the various end-user industries in the region. The energy concern in the region is also increasing the adoption of low-voltage electrical equipment and motivating many firms to develop energy-efficient and compact electrical equipment and devices, further driving the smart motor growth.

- Further, initiatives like the 'Make in India' program places India on the world map as a manufacturing hub and give global recognition to the Indian economy. The Make in India campaign has bolstered multiple new launches in industrial robots in the country. Notably, India's industrial automation sector has been revolutionized by the combination of digital and physical aspects of manufacturing to deliver optimum performance. Further, the focus on achieving zero waste production and a shorter time to acquire the market has augmented the growth of the market.

- The massive shifts in manufacturing due to Industry 4.0 and the acceptance of IoT to advance production, with technologies to achieve greater production capacity and output, have propelled the demand for smart motors in the market. Also, the additional drive benefits, such as minimized maintenance requirements and improved process control, fuels adoption.

- The Chinese government launched a five-year plan to increase smart manufacturing and robotic process automation (RPA) in the country's industrial sector in 2022. A group of sixteen state-funded industry committees was formed to rapidly push the manufacturing industry into the future, driving the usage of electric motors. Furthermore, by strengthening robotics, artificial intelligence (AI), and cloud data technology research capabilities, the country focuses on developing technologies that can provide it greater autonomy and help the industrial sector grow further.

- Over the years, China has been focusing on high-end manufacturing industries, power utilities, and oil & gas industries, boosting the usage of both low and medium-voltage drives in the country. For instance, the Chinese government's ambitious 'Made in China 2025' initiative, partially inspired by Germany for Industry 4.0, aims to boost the country's competitiveness in the manufacturing sector.

- Furthermore, during the past few decades, China has witnessed remarkable growth, especially in the industrial segment, and is widely regarded as the global manufacturing hub. The presence of many industries wherein a wide variety of manufacturing/process equipment is used drives the demand for smart motors in the region. Furthermore, recent initiatives to transform the local industry through a higher adoption of automation and other advanced technologies will drive the studied market demand.

Smart Motors Industry Overview

The smart motors market is highly fragmented, with the presence of major players like Safran Electrical & Power, Siemens AG, Nanotec Electronic GmbH & Co. KG, Turntide Technologies Inc., and Schneider Electric SE. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In June 2023, Safran Electrical & Power announced the installation of four automation production lines specifically for its ENGINeUS electric motors at its sites in Niort, France, and Pitstone, and Great Britain. This high-volume production model will enable 1,000 motors to be manufactured per year from 2026 to serve the booming electric and hybrid aviation markets.

In February 2023, Nidec Corporation announced its intention to acquire the Italian machine tool company PAMA for JPY 15 billion (~USD 10.54 billion) in cash. As the company enters the machine tool business in 2021, this is the first time Nidec has initiated an overseas corporate merger and acquisition (M&A). Nidec intends to expand its previously domestic-focused machine tool sales channel into international markets, positioning it as a growth pillar after electric vehicle (EV) drive systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 An Assessment of the Impact of Key Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Emphasis on Reducing Capex With Gaining Effectiveness of the Equipment

- 5.1.2 Growing Integration of IIoT Services for Enabling Services Such as Predictive Maintenance, Superior Machine Control

- 5.2 Market Restraints

- 5.2.1 Low Rate of Implementation

- 5.2.2 High Switching Cost Along with Alternate VFD Solutions

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Variable Speed Drive

- 6.1.2 Motor

- 6.2 By Application

- 6.2.1 Industrial

- 6.2.2 Commercial

- 6.2.3 Automotive

- 6.2.4 Aerospace and Defense

- 6.2.5 Oil and Gas

- 6.2.6 Metal and Mining

- 6.2.7 Water and Wastewater

- 6.2.8 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Safran Electrical & Power

- 7.1.2 Siemens AG

- 7.1.3 Nanotec Electronic GmbH & Co. KG

- 7.1.4 Turntide Technologies Inc.

- 7.1.5 Schneider Electric SE

- 7.1.6 Fuji Electric Co. Ltd

- 7.1.7 Nidec Motion Control (Nidec Corporation)

- 7.1.8 Moog Inc.

- 7.1.9 Dunkermotoren GmbH (Ametek Inc.)

- 7.1.10 Shanghai Moons' Electric Co. Ltd