|

市場調查報告書

商品編碼

1433934

託管測試服務:市場佔有率分析、行業趨勢和成長預測(2024-2029)Managed Testing Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

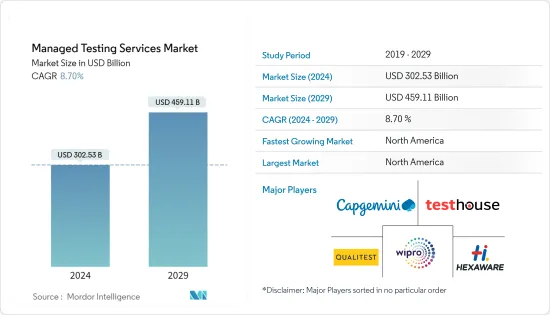

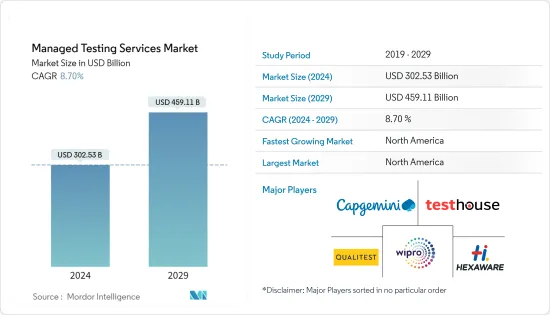

託管測試服務市場規模預計到 2024 年為 3,025.3 億美元,預計到 2029 年將達到 4,591.1 億美元,在預測期內(2024-2029 年)成長 8.70%,複合年成長率成長。

隨著客戶期望企業在所有管道上提供個人化內容和一致的體驗,品質保證和測試變得越來越重要。隨著公司的擴張,擁有足夠成熟和強大的業務應用程式來支援多個業務部門變得更加重要和困難。這將有助於託管測試服務的成長。

主要亮點

- 託管測試服務 (MTS) 涵蓋測試項目的所有部分,包括整個測試計劃。在工作開始之前,服務供應商和客戶討論計劃行動計劃。當測試很複雜並且需要相關人員協調時,託管測試非常有用。完成所有這些都需要客戶必須獲得的專業知識和資源。組織更喜歡託管測試,因為它提供可預測性、彈性和成本節約。同時考慮您的所有測試許可證、活動、聯絡人和服務可以更輕鬆地預測和追蹤計劃。這縮短了計劃進度並使成本計算更加容易。

- 然而,市場面臨的主要挑戰是需要更多熟練工人。需要專業知識來了解客戶的要求並應用適當的測試方法。這意味著企業的培訓成本增加。因此,新興的 IT 供應商和分銷商正在進行收購和合作,以虛擬環境取代實體伺服器。這降低了大約 15% 的成本,同時保持了 95% 的運作。

- 託管服務減少停機時間和重複工作,並提供客製化的附加價值服務,例如應用程式測試、服務目錄開發和專家諮詢。市場的成長得到了管理許多監控工具和基礎設施層的各種團隊的支持。例如,BMC 最近推出了 BMC Helix ITSM,這是一個集中式、雲端原生、可觀察性主導的AIOps 整合系統。該系統提供對來自IT基礎設施、應用程式效能、網路效能和雲端監控工具的資料的完整可見性。個人和團隊儀表板也根據每個使用者的需求量身定做。

- 自動化、物聯網、區塊鏈和雲端運算等雲端基礎的技術的使用越來越多,以及透過專注於核心能力來提高業務效率,推動了市場成長。自始至終提供安全的自訂IT 解決方案和應用程式託管的託管服務預計也將推動市場成長。此外,冠狀病毒感染疾病(COVID-19)大流行的出現擾亂了業務運作和供應鏈。業務營運和遠端工作解決方案的突然變化要求員工在公司擁有的設備上存取各種業務應用程式。在 COVID-19感染疾病期間和之後,組織開始更多地依賴託管服務。

- 此外,透過託管服務,我們將管理任務委託給第三方,以幫助業務更順利地運作。隨著雲端基礎的技術的引入和普及,託管服務誕生了。託管服務可協助公司提高業務效率並降低成本。將管理功能外包給雲端和託管服務供應商的趨勢預計將在預測期內推動市場成長。

- 由於感染疾病病毒肺炎 (COVID-19) 大流行,該公司開始專注於在家工作。近年來,使用雲端服務的公司數量不斷增加。企業希望確保即使政府實施封鎖以阻止冠狀病毒傳播,他們也能繼續運作。大多數公司已經在與託管雲端服務供應商續約,因為他們預計向企業雲端的遷移將變得更加普遍,並且在某些情況下會獲得動力。此外,作為加速數位轉型努力的一部分,企業和組織非常重視採用機器學習等新興技術。

託管測試服務市場趨勢

醫療保健實現最大成長

- 醫療保健經營模式正在發生重大轉變,轉向以患者為先、注重預防和更好的護理的系統。隨著對互通性、法律規章遵從性以及最終用戶技術(行動、不同作業系統)合規性的需求不斷增加,測試醫療保健應用程式現在需要大量的技術技能、大量的時間和大量的資金。例如,總部位於印度的 Cigniti 為醫院、製藥公司、醫療保健服務、臨床實驗室、診斷中心和第三方組織提供協助。 - 當事人管理者 (TPA)、付款人、醫療設備製造商、醫療保健獨立軟體供應商 (ISV) 和研究組織測試醫療保健和生命科學軟體。

- 總部位於新澤西州的 Citius Tech 為醫療保健企業提供多種類型的測試。其中包括企業範圍的醫療保健工作流程的功能測試,例如 IHE 和 HITSP。醫療圖像測試使用專為醫療圖像設計的 MESA、DVTK 和 Mirth 等測試自動化工具。他們正在尋找有關醫療產業安全性和框架的有意義的用途、HIPAA、FDA、VA 要求等。互通性測試:使用業界標準測試工具測試是否符合互通性標準,例如 HL7、FHIR、DICOM、NCPDP、CCD/CDA 等。

- 微軟也表示,其用於醫療保健和生命科學的雲端技術正在改進。例如,Azure 健康數據服務和 Microsoft 醫療保健雲端的更新現在可供所有人使用。透過最近收購 Nuance Communications,微軟處於獨特的地位,可以幫助組織透過使用可信任人工智慧解決最緊迫的問題來幫助更多的人。這將改變每個人醫療保健的未來。

- 此外,醫療產業在過去兩年經歷了快速的數位轉型。去年,微軟雲端發布了軟體,幫助醫療保健行業解決臨床醫生倦怠等問題,為患者提供更個人化的護理,並在不同的系統之間共用醫療資料。一切變得簡單。

- Microsoft 繼續執行我們的醫療保健策略,以提高病人參與和臨床醫生體驗,提高臨床和業務洞察力,並使護理團隊更輕鬆地協作。 Microsoft 醫療保健雲端使用整個公司的尖端解決方案來創建強大、整合且完整的雲端服務。

北美主導市場。 IT 和通訊產業預計將佔據重要市場佔有率

- 北美是成長最快、最大的市場,許多跨國公司正在該地區擴大業務。

- 由於IT基礎設施形勢的變化,北美市場正在不斷擴大,尤其是中小企業 (SME) 越來越關注外包網路安全解決方案。例如,美國新興的 IT 用品製造商和分銷商之一的 KPaul Properties LLC 與富士通合作,以虛擬環境取代實體伺服器。這使公司的成本降低了大約 15%,同時實現了 95% 的運轉率。

- 各種技術的高採用率、BYOD政策的採用率不斷提高(讓業務營運更加舒適可控)、通訊內部資料量快速成長對高階安全的需求、IT和安全由於需求的不斷增加,託管服務的重要市場。

- 近年來,通訊業持續成長,因為電信業者面臨持續的壓力,需要以低成本提供創新服務,以便在競爭激烈的市場中留住客戶。託管服務已成為通訊業者應對複雜競爭環境的通用需求。

- 此外,出於經濟原因,大多數通訊業者預計將以軟體取代網路硬體。推動 SDN 和 NFV 需求的關鍵因素包括更快的上市時間、更低的資本和營運成本以及創造新的收益來源。所有這些因素預計將推動市場成長。這些措施正在增加對託管網路服務的需求。

- 北美的許多 SD-WAN 託管服務供應商透過提供廣泛的保全服務脫穎而出。例如,Cato Networks 提供具有 NGFW、安全 Web 閘道、進階威脅防禦、雲端和行動存取防護以及託管威脅偵測和回應的雲端原生平台。 Colt 提供具有 DDoS 保護的第 7 層防火牆或第 3/4 層狀態防火牆,CenturyLink 提供其自我調整網路安全套件的保全服務。例如,2022 年 2 月,Verizon Business 宣布將 VMware 涵蓋 Verizon 託管 WAN 服務的全球託管軟體定義廣域網路 (SD-WAN) 服務組合。

託管測試服務產業概述

託管測試服務市場本質上是分散的。市場上有許多大大小小的公司提供測試和品質保證服務。該市場由提供多種服務的公司(如凱捷)和僅提供測試的公司(如 Qualitest)主導。

2023 年 1 月:全球技術諮詢和解決方案公司 Hexaware Technologies 宣佈在印度諾伊達開設 ServiceNow 體驗中心和創新實驗室。該中心旨在為企業客戶提供 Hexaware ServiceNow 解決方案套件的實踐體驗,以及展示創新解決方案、推動先導計畫和存取概念驗證的場所。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 價值鏈/供應鏈分析

- 波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- PESTLE分析

第5章市場區隔

- 交付模型類型

- 陸上

- 離岸

- 組織規模

- 中小企業

- 主要企業

- 按最終用戶產業

- 衛生保健

- BFSI

- 通訊/IT

- 零售

- 政府機關

- 其他最終用戶(按行業)

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東/非洲

第6章 競爭形勢

- 供應商市場佔有率

- 併購

- 公司簡介

- Capgemini SE

- Cognizant

- Hexaware Technologies

- Testhouse Ltd.

- Wipro Limited

- Infosys Limited

- TATA Consultancy Services Limited

- QualiTest

- International Business Machines Corporation(IBM)

- Accenture Plc

第7章 市場機會及未來趨勢

The Managed Testing Services Market size is estimated at USD 302.53 billion in 2024, and is expected to reach USD 459.11 billion by 2029, growing at a CAGR of 8.70% during the forecast period (2024-2029).

Customers expect businesses to deliver personalized content and a consistent experience across all channels, so the emphasis on quality assurance and testing is increasing. As companies expand, it becomes more important and difficult to have business applications supporting multiple business units with sufficient maturity and robustness. This contributes to the growth of managed testing services.

Key Highlights

- Managed Testing Service (MTS) covers all parts of a testing project, including the whole testing process. Before beginning work, the service provider and customer discuss the project's action plan. Managed testing is useful when testing is complicated and needs to be coordinated by more than one party. All of this necessitates the expertise and resources that customers need to gain. Organizations prefer managed testing because it provides predictability, flexibility, and lower costs. Projects become easier to forecast and track when all testing licenses, activities, points of contact, and services are considered simultaneously. This shortens the project's timeline and makes it easier to calculate its costs.

- However, a significant challenge for the market is the need for more skilled labor. Understanding customer requirements and applying the appropriate testing method necessitated specialized knowledge. This implies an increase in training costs for the companies. For this reason, emerging manufacturers and distributors of IT supplies are performing acquisitions and forming partnerships to replace a physical server with a virtualized environment. This reduced costs by approximately 15% while maintaining 95% uptime.

- Managed services reduce downtime and duplication and offer customized value-added services like application testing, service catalog development, and expert consulting. Market growth is helped by different teams managing many monitoring tools and infrastructure layers. For instance, BMC recently launched the "BMC Helix ITSM," a centralized, cloud-native, observability-driven, and AIOps-integrated system. This system provides complete visibility into data from IT infrastructure, application performance, network performance, and cloud monitoring tools. Individual and team dashboards are also tailored to the needs of each user.

- Market growth is driven by the increased use of cloud-based technologies like automation, IoT, blockchain, and cloud computing, as well as operational efficiency improvement by focusing more on core competencies. Also, managed services, which offer secure, custom IT solutions and applications hosting from start to finish, are expected to drive market growth. Moreover, the emergence of the COVID-19 pandemic disrupted business operations and the supply chain. As a result of the abrupt change in business operations and remote working solutions, employees needed access to various work applications on company-owned devices. During and after the COVID-19 pandemic, organizations began to rely more on managed services.

- Also, managed services involve giving management tasks to a third party so business operations can run more smoothly. The introduction of cloud-based technologies and their proliferation have resulted in managed services. Managed services help businesses improve operational efficiency and lower operating expenses. The growing preference for outsourcing management functions to the cloud and managed service providers is expected to drive market growth over the forecast period.

- Because of the COVID-19 pandemic, businesses put a lot of emphasis on working from home. The number of companies using cloud services has grown in the last few years. This is because companies wanted to ensure they could keep doing business even when governments put lockdowns in place to stop the spread of the coronavirus. Most companies have already renewed their contracts with managed cloud service providers because they expect enterprise cloud migration to become more common and, in some cases, gain momentum. Furthermore, as part of their efforts to encourage digital transformation, businesses and organizations strongly emphasized adopting the latest technologies, such as machine learning.

Managed Testing Services Market Trends

Healthcare to Witness the Highest Growth

- The business model for health care is going through a big change toward a system that puts the patient first and focuses on prevention and better care.With the growing need for interoperability, regulatory compliance, and end-user technology (mobile, different OS) compliance, testing healthcare apps now takes a lot of technical skill, a lot of time, and a lot of money.For example, Cigniti, which is based in India, helps hospitals, pharmaceutical companies, healthcare services, clinical labs, diagnostic centers, third-party administrators (TPAs), payers, medical equipment manufacturers, healthcare independent software vendors (ISVs), and research organizations test their healthcare and life sciences software.

- Citius Tech, based in New Jersey, provides several types of testing for the healthcare business. Some of them are functional testing tests of healthcare workflows across the enterprise, such as IHE and HITSP. Medical Imaging Testing uses test automation tools like MESA, DVTK, and Mirth that are made for medical imaging.They are looking for things like Meaningful Use, HIPAA, FDA, and VA requirements for security and frameworks in the health care industry.Interoperability Testing: Testing conformance to interoperability standards such as HL7, FHIR, DICOM, NCPDP, and CCD/CDA using industry-standard testing tools

- Microsoft Corp. also said that cloud technologies for healthcare and life sciences are getting better. For example, Azure Health Data Services and updates to Microsoft Cloud for Healthcare are now available to everyone.With the recent purchase of Nuance Communications, Microsoft is in a unique position to help organizations help more people by using trusted AI to solve the most pressing problems. This will change the future of healthcare for everyone.

- Furthermore, the health industry has undergone a rapid digital transformation over the last two years. Microsoft Cloud released software for healthcare last year to help the industry deal with problems like clinician burnout, giving patients more personalized care, and making it easier for health data to be shared between different systems.

- Microsoft keeps delivering on its healthcare strategy, which helps improve patient engagement and clinician experiences, improves clinical and operational insights, and makes it easier for health teams to work together. Microsoft Cloud for Healthcare uses cutting-edge solutions from all over the company to make a strong, integrated, and complete cloud service.

North America to Dominate the Market. IT and Telecom Sector Expected to Hold a Significant Market Share

- North America is the fastest-growing and largest market since many global companies are expanding their footprint in this region.

- The North American market is expanding due to the changing IT infrastructure landscape, particularly in small and medium-sized enterprises (SMEs), which are increasingly focusing on outsourcing cybersecurity solutions. For instance, KPaul Properties LLC, one of the United States' emerging manufacturers and distributors of IT supplies, partnered with Fujitsu to replace a physical server with a virtualized environment. This reduced the company's costs by about 15% while providing 95% uptime.

- Due to the high rate of various technological adoptions, increased rate of adoption of the BYOD policy (to make business operations much more comfortable and controllable), and increased need for high-end security due to rapidly growing data volumes in organizations, the IT and telecom sector is a significant market for managed services.

- The telecom industry has seen growth in recent years, as telecommunication companies face constant pressure to deliver innovative services at lower costs to retain customers in a competitive market. Managed services have become a common demand for operators to address a complex and competitive environment.

- Furthermore, due to their compelling economic case, most telecom carriers are expected to replace their network hardware with software. Significant factors driving demand for SDN and NFV include shorter time-to-market, lower CAPEX and OPEX, and the creation of new revenue streams. All of these factors are expected to drive the market's growth. Such initiatives are increasing the demand for managed network services.

- Many SD-WAN-managed service providers in North America distinguish themselves by providing a wide range of security services. For instance, Cato Networks provides a cloud-native platform with NGFW, Secure Web Gateway, Advanced Threat Prevention, Cloud and Mobile Access Protection, and Managed Threat Detection and Response. Colt offers a Layer 7 firewall or a Layer 3/4 stateful firewall with DDoS protection, and CenturyLink offers an Adaptive Network Security suite of security services. For instance, in February 2022, Verizon Business announced the inclusion of VMware to Verizon's Managed WAN Service's global managed Software-Defined Wide Area Network (SD-WAN) service portfolio.

Managed Testing Services Industry Overview

The managed testing services market is fragmented in nature. There are a lot of different companies in the market, both big and small, that offer testing and quality assurance services.The market is led by companies that offer more than one service, like Capgemini, and companies that only offer testing, like Qualitest.

January 2023: Hexaware Technologies, a global technology consulting and solutions firm, announced the opening of a ServiceNow Experience Center and Innovation Lab in Noida, India. The center is intended to provide enterprise customers with hands-on experience with Hexaware's ServiceNow Solution Suite and a venue for demonstrating innovative solutions, driving pilot projects, and accessing proofs of concept.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adopting artificial intelligence (AI) and cloud management is eventually helping organizations meet various functional business requirements while driving business process optimization.

- 4.2.2 The growing preference for outsourcing management functions to cloud service providers and managed service providers is expected to drive market growth.

- 4.3 Market Restraints

- 4.3.1 The market's need for more skilled labor is a significant challenge. Understanding customer requirements and selecting the best testing method required specialized knowledge.

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Type of Delivery Model

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Size of Organization

- 5.2.1 Small & Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 End-user Vertical

- 5.3.1 Healthcare

- 5.3.2 BFSI

- 5.3.3 Telecom and IT

- 5.3.4 Retail

- 5.3.5 Government

- 5.3.6 Other End-user Verticals

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Capgemini SE

- 6.3.2 Cognizant

- 6.3.3 Hexaware Technologies

- 6.3.4 Testhouse Ltd.

- 6.3.5 Wipro Limited

- 6.3.6 Infosys Limited

- 6.3.7 TATA Consultancy Services Limited

- 6.3.8 QualiTest

- 6.3.9 International Business Machines Corporation (IBM)

- 6.3.10 Accenture Plc