|

市場調查報告書

商品編碼

1433907

化學機械拋光 (CMP):市場佔有率分析、行業趨勢和統計、成長預測(2024-2029 年)Chemical Mechanical Polishing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

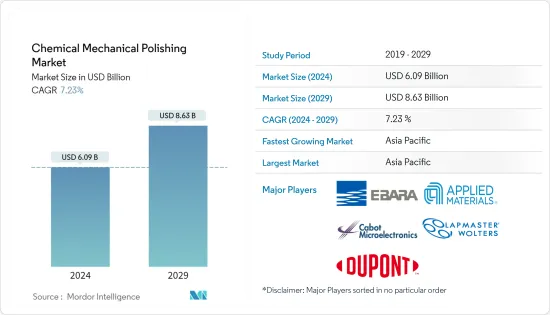

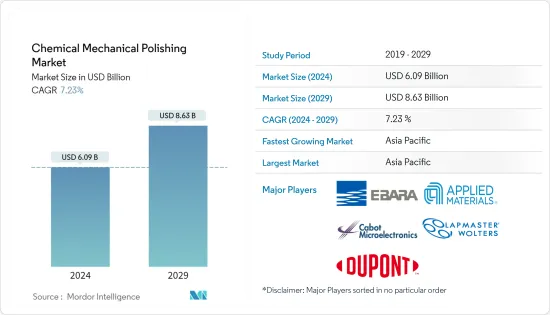

化學機械拋光(CMP)市場規模預計到2024年為60.9億美元,預計到2029年將達到86.3億美元,在預測期內(2024-2029年)持續成長,複合年成長率為7.23%。

化學機械拋光(CMP)是半導體晶圓製造過程中重要的製程技術步驟。該工藝利用化學漿料和機械運動來拋光或壓平晶圓的頂面,以形成生產更耐用、更堅固的半導體材料所需的完美平坦表面。傳統的拋光正在變得過時,供應商不再使用佔用大量土地空間、安裝成本很高且需要大量維護的不同機器,而是轉向單獨的組裝。我們期待著一種-用於切片、探測和拋光的停止解決方案。儘管此類解決方案目前在市場上不太常見,但預計它們將在預測期內成為下一代拋光系統。

主要亮點

- 對電子設備性能要求的不斷提高,催生了對更小、更堅固的半導體和電子設備的需求,從而導致對包括 CMP 在內的新製造材料和技術的需求增加。對電子產品不斷成長的需求正在推動電子封裝行業的成長,並提高客戶對新電子設備功能的期望。

- 預測期內推動 CMP 市場成長的其他決定因素包括晶圓平坦化對 CMP 的需求不斷成長、消費性電器產品的高需求以及電子機械系統 (MEMS) 的使用不斷增加。除此之外,由於 IC 製造、電子機械系統 (MEMS)、光學、化合物半導體和電腦硬碟製造等最終用途應用數量的不斷增加,預計對化學機械平坦化或拋光的需求也會增加。擴大。

化學機械拋光(CMP)市場趨勢

CMP耗材支出預計在預測期內增加

- 隨著半導體產業突破小型化的極限,重新開始進一步縮小規模將需要將新的獨特材料整合到更複雜的結構中。隨著需要整合到先進裝置結構中的材料總數的增加,材料相互作用的複雜性迅速增加,並且 CMP 材料變得難以區分。卓越的均勻性和低缺陷率對於任何具有生產價值的 CMP 製程都很重要,這些參數從根本上由 CMP墊片的機械和結構特性控制。

- CMP 耗材在先進半導體元件的製造中發揮關鍵作用,幫助客戶生產更小、更快、更複雜的裝置。例如,卡博特微電子公司是工業木材防腐行業高性能材料的領先供應商,該行業在管道營運商和先進半導體設備的製造中發揮關鍵作用。磨料等關鍵 CMP 上游材料在控制缺陷的同時實現更好的拋光性能發揮更重要的作用。二氧化矽和二氧化鈰領域正在取得新的進展,以轉向高純度膠體型磨料。

- 預計未來幾年 CMP 耗材將在該產業強勁成長。對於22nm和14nm,業界必須非常嚴格地控制漿料和墊片品質以控制缺陷。在沒有附聚物或有角顆粒的高級漿料中,漿料顆粒的型態變得非常重要。選擇性要求對於漿料來說可能具有挑戰性,因為墊片調節是提高選擇性和整體製程控制的關鍵點。此外,記憶體和邏輯領域的新應用將繼續為 CMP 耗材帶來機會。

亞太地區將經歷最快的成長

- 亞太地區是化學機械平整最全面的市場,台灣、日本和中國大陸是亞太地區的一些主要市場。亞太地區的市場主導地位歸因於該地區MEMS和NEMS等半導體IC製造外包的成長。

- 與世界其他地區相比,亞太地區提供了廣泛的市場成長機會。由於晶圓廠市場整合的增加,該地區市場對委託半導體組裝測試(OSAT)的需求龐大。

- 一些市場參與者正在加緊努力,抵禦持續不斷的垂直整合浪潮。在中國等國家,鼓勵半導體產業的政府政策日益為半導體材料產業的發展創造機會,並支撐了市場的成長。

- 例如,中華人民共和國國務院發布的政策框架將先進半導體製造解決方案作為整個半導體產業的技術重點。

化學機械拋光 (CMP) 產業概覽

化學機械拋光(CMP)市場競爭適中,由幾個主要企業組成。在過去的20年裡,市場已經獲得了競爭力。從市場佔有率來看,目前很少大公司佔據市場主導地位。市場上的許多公司正在透過開拓新市場和贏得新契約來增加其在市場上的影響力。

- 2018 年 11 月 - 卡博特微電子公司宣布已完成先前宣布的 KMG Chemicals, Inc. 的收購。收購完成後,KMG 成為卡博特微電子公司的完全子公司。

- 2018 年 11 月 - Applied Materials, Inc. 的創業投資部門 Applied Ventures LLC 宣布與紐約州經濟發展機構 Empire State Development (ESD) 建立新的合作夥伴關係,旨在加速紐約州北部的創新。宣布聯合投資舉措。該舉措的目標是投資紐約州北部眾多成熟和新興行業的有前途的Start-Ups,包括半導體、人工智慧、先進光學、自動駕駛汽車、生命科學、清潔能源等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進與市場約束因素介紹

- 市場促進因素

- 對半導體小型化的需求日益成長

- MEMS 和 NEMS 的使用不斷增加推動 CMP 市場成長

- 對半導體小型化的需求日益成長

- 市場限制因素

- 製造複雜性

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

第5章市場區隔

- 按類型

- 化學機械研磨設備

- 化學機械拋光耗材

- 泥

- PAD

- PAD調理劑

- 其他消耗品

- 按用途

- 化合物半導體

- 積體電路

- MEMS,NEMS

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭形勢

- 公司簡介

- Applied Materials, Inc.

- Cabot Microelectronics Corporation

- Ebara Corporation

- Lapmaster Wolters GmbH

- DuPont de Nemours, Inc.

- Fujimi Incorporated

- Revasum Inc.

- LAM Research Corporation

- Okamoto Corporation

- Strasbaugh Inc.

- Tokyo Seimitsu Co. Ltd.(Accretech Create Corp.)

第7章 投資分析

第8章 市場機會及未來趨勢

The Chemical Mechanical Polishing Market size is estimated at USD 6.09 billion in 2024, and is expected to reach USD 8.63 billion by 2029, growing at a CAGR of 7.23% during the forecast period (2024-2029).

Chemical Mechanical Polishing is an important process technology step in the semiconductor wafer fabrication process. In this process action, the top surface of the wafer is polished or planarized to produce a perfectly flat surface that is necessary to make more durable and more powerful semiconductor materials with the help of chemical slurry & mechanical movements. Traditional polishing is becoming old, and venders are anticipating one-stop solutions that could slice, probe, and polish in a separate assembly line, instead of using various machines that occupy a lot of land space and need high budget installation and heavy maintenance. Although such solutions are less common in the market currently, they are anticipated to be the next generation of polishing systems, over the forecast period.

Key Highlights

- Growing performance requirements of electronic devices are creating the need for smaller and more robust semiconductors and electronic devices which, in turn, is driving the demand for newer fabrication materials and techniques, including CMP. An increase in the demand for electronic products has pushed the electronic packaging industry and customer expectations have raised regarding the features of new electronic devices.

- The other determinants driving the growth of the CMP market during the forecast period are the growing need of CMP for wafer planarization, high demand for consumer electronic products, and increasing use of micro-electro-mechanical systems (MEMS). In addition to that, with an expanding number of end-use applications such as IC manufacturing, micro-electro-mechanical systems (MEMS), optics, compound semiconductors, and computer hard drive manufacturing, the demand for chemical mechanical planarization or polishing is expected to expand.

Chemical Mechanical Polishing Market Trends

CMP Consumable Spending is Expected to Increase over the Forecast Period

- As the semiconductor industry has driven the limits of miniaturization such that new and distinct materials will require to be integrated into more complex structures to resume further scaling. With an increment in the total number of materials that must be integrated into advanced device structures, the complexity of materials interactions grows rapidly and CMP materials are no distinct. Extraordinary uniformity and low defectivity are critical to any production-worthy CMP process, and those critical parameters are fundamentally controlled by the mechanical and structural properties of the CMP pad.

- CMP consumable plays a critical role in the production of advanced semiconductor devices, helping to enable the manufacture of smaller, faster and more complex devices for its customers. For example, Cabot Microelectronics Corporation is a leading provider of performance materials for pipeline operators and the industrial wood preservation industry playing a critical role in the production of advanced semiconductor devices. Key CMP upstream material like abrasive plays a more critical role to achieve better polishing performance while controlling defects. New development to move to high purity colloidal type abrasives are taking place in both silica and ceria segments.

- CMP consumables are expected to have a strong industry growth outlook over the next several years. For 22nm and 14nm, the industry needs to have extremely tight control over the slurries and pad quality to control defects. With no agglomerations and angular particles, in advanced slurries, the morphology of the slurry particles will be critical. Selectivity requirements will prove challenging to slurries as selectivity is increased and pads are tuned as a key point of the overall process control. In addition, new applications in both memory and logic will continue to drive the opportunities for CMP consumables going forward.

Asia-Pacific to Witness Fastest Growth

- Asia-Pacific is the most comprehensive market of chemical mechanical planarization with Taiwan, Japan, and China are some of the principal markets in Asia-Pacific. The market dominance of Asia-Pacific is owing to the growing outsourcing of semiconductor IC fabrication, such as MEMS and NEMS in the region.

- Asia-Pacific contributes a wide range of opportunities to the market's growth, compared to the rest parts of the world. The market in the region witnessed huge demand from the Outsourced Semiconductor Assembly and Test (OSAT), owing to progressing consolidation in the fab market.

- Several market players are strengthening to withstand the ongoing wave of vertical integration. In countries like China, the government policies that encourage the semiconductor industry are increasingly generating opportunities for the development of the semiconductor materials industry, which is, in turn, supporting the growth of the market.

- For example, the policy framework issued by the State Council of the People's Republic of China pointed to make advanced semiconductor manufacturing solutions, a technology-priority across the semiconductor industry.

Chemical Mechanical Polishing Industry Overview

The chemical mechanical polishing market is moderately competitive and consists of several major players. The market has gained a competitive edge over the past two decades. In terms of market share, few of the major players currently dominate the market. Many of the companies in the market are increasing their market presence by securing new contracts by tapping new markets.

- November 2018 - Cabot Microelectronics Corporation announced that it has completed its previously announced acquisition ofKMG Chemicals, Inc. As a result of the acquisition, KMG has become a wholly-owned subsidiary of Cabot Microelectronics.

- November 2018 -Applied Ventures, LLC, the venture capital arm ofApplied Materials, Inc., announced a new co-investment initiative withEmpire State Development(ESD), New York State's economic development organization, aimed at accelerating innovation in Upstate New York. The goal of the initiative is to invest in promising Upstate New York startups across a broad range of established and emerging industries including semiconductors, artificial intelligence, advanced optics, autonomous vehicles, life sciences, clean energy and more..

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Need for Miniaturization of Semiconductors

- 4.3.2 Increasing Use of MEMS & NEMS is Fueling the Growth of the CMP Market

- 4.3.3 Increasing Need for Miniaturization of Semiconductors

- 4.4 Market Restraints

- 4.4.1 Complexity Regarding Manufacturing

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 CMP Equipment

- 5.1.2 CMP Consumable

- 5.1.2.1 Slurry

- 5.1.2.2 PAD

- 5.1.2.3 PAD Conditioner

- 5.1.2.4 Other Consumable Types

- 5.2 By Application

- 5.2.1 Compound Semiconductors

- 5.2.2 Integrated Circuits

- 5.2.3 MEMS & NEMS

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Applied Materials, Inc.

- 6.1.2 Cabot Microelectronics Corporation

- 6.1.3 Ebara Corporation

- 6.1.4 Lapmaster Wolters GmbH

- 6.1.5 DuPont de Nemours, Inc.

- 6.1.6 Fujimi Incorporated

- 6.1.7 Revasum Inc.

- 6.1.8 LAM Research Corporation

- 6.1.9 Okamoto Corporation

- 6.1.10 Strasbaugh Inc.

- 6.1.11 Tokyo Seimitsu Co. Ltd. (Accretech Create Corp.)