|

市場調查報告書

商品編碼

1404559

電磁相容性測試設備和測試服務:市場佔有率分析、行業趨勢和統計、2024-2029 年成長預測Electromagnetic Compatibility Test Equipment And Testing Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

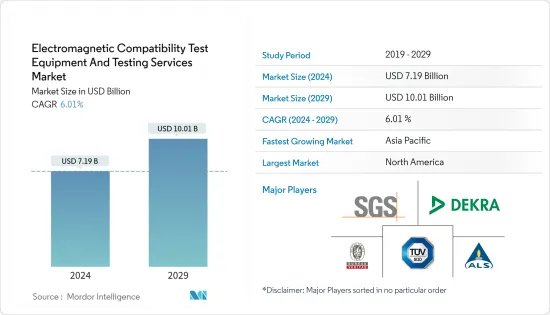

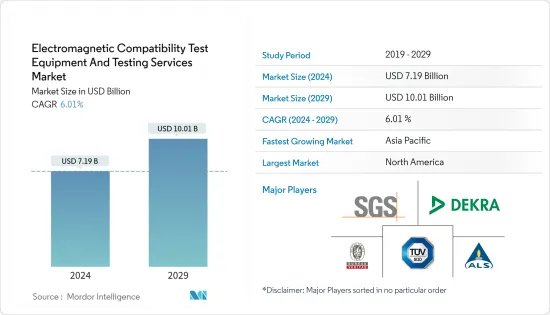

電磁相容性測試設備和測試服務市場規模預計2024年為71.9億美元,2029年達到100.1億美元,預測期內(2024-2029年)複合年成長率為6.01,預計將成長%。

主要亮點

- 由於電子設備在各個最終用戶行業中的使用不斷增加,電磁相容性 (EMC) 已成為一項重要服務。電磁相容性 (EMC) 有助於最大限度地降低設備的輻射或傳導發射干擾附近其他電子產品的可能性。

- 電磁相容性測試設備和服務測量電子設備在其電磁環境中、靠近其他電子設備以及存在可能干擾其預期操作的電磁干擾的情況下按預期運行的能力。

- 因此,電磁相容性(EMC)測試已成為電子設備設計和製造流程中至關重要的一步。包括 FCC、FDA 和 ISO 在內的各種監管機構已針對電子設備可能排放的排放制定了具體限制/框架。這些法規透過確保設備不會干擾其他設備或按預期運行,為任何使用電氣/電子設備的人提供更高的安全性和可靠性。

- 為了符合市場要求並避免代價高昂的召回,消費品、醫療設備、工業機械、鐵路、汽車、航太和軍事設備等行業的製造商必須確保電磁干擾不會干擾其產品的功能。哪有這回事。由於法律規範的持續出現,這些製造商也面臨著維持品質、同時降低成本和加快上市時間的壓力。

- 世界人口和經濟成長以及快速都市化預計將在未來幾年增加能源需求。聯合國(UN)估計,世界人口將從2017年的76億增加到2050年的98億。預計這將增加所使用的電氣和電子設備的數量,並在所研究的市場中創造商機。

- 近年來,汽車業的電動進程不斷加快。電動車包含許多會發出高頻/電磁干擾的電子元件,會對車輛性能和駕駛體驗產生負面影響。隨著半導體開關頻率的增加以及高電壓和電流導致的排放增加,汽車電動將帶來新的 EMC 挑戰。考慮到這些趨勢,市場上有多家供應商提供創新的解決方案。例如,2022年11月,AVL和汽車測試系統著名供應商羅德與施瓦茨公司將在現實駕駛條件下對電力傳動系統進行電磁相容性資料分析,以簡化和加快開發過程。宣布推出創新解決方案自動化

- 然而,與電磁相容性測試設備和服務相關的高價格是阻礙所研究市場成長的主要因素之一。此外,EMC考試平均持續時間較長也是限制研究市場成長的主要因素之一。

- COVID-19 大流行對所研究市場的成長產生了重大影響。隨著疫情的爆發,對電子設備的需求迅速擴大,給包括EMC測試產業在內的整個產業價值鏈帶來了巨大壓力。由於隨著大流行的爆發而勢頭強勁的數位化趨勢預計將進一步成長,因此所研究的市場預計在預測期內也將出現類似的成長。

電磁相容性測試設備及測試服務市場趨勢

消費性電子領域預計將推動市場成長

- 在數位化、智慧家庭和物聯網 (IoT)連網型設備等趨勢的推動下,大多數垂直行業中電子產品的密度正在增加。為了從電磁相容性 (EMC) 角度確保產品質量,監管機構不斷制定有關設計和製造的規則和指令。

- 此外,根據思科年度網際網路報告,到2023年,連網設備和連線數量將從2018年的184億增加到近300億。此外,到 2023 年,物聯網設備將佔所有連網裝置的 50%(147 億),高於 2018 年的 33%(61 億)。此外,愛立信預計,2019年至2027年,全球5G用戶數預計將快速成長,從超過1,200萬增加到超過40億。這些因素的結合預計將顯著擴大家電產業的規模。

- 製造商在進入市場之前必須通過認證符合最新的EMC指令、地區和行業級法規和標準。例如,為了防止 EMC 問題,英國政府制定了嚴格的法律,強制所有電子產品進口商和製造商確保其產品符合電磁相容要求。這些發展預計將推動消費性電子領域對 EMC 測試設備和服務的需求。因此,此類行業法規預計將推動所研究市場的成長。

- 中國是著名的消費性電子產品生產國,尤其是博朗產品類型。中國擁有廣泛的電子製造生態系統和供應鏈。例如,根據中國國家統計局的數據,2022年5月中國將生產約3,700萬台電腦,高於2022年4月的3,266萬台。該地區強大的消費電子產品製造能力為研究市場的成長提供了有利可圖的機會。

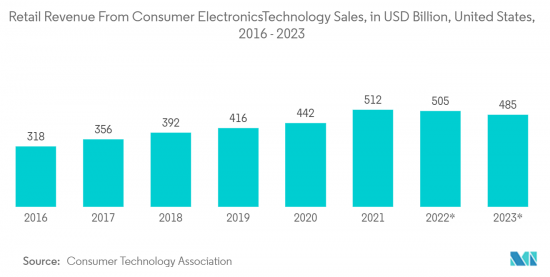

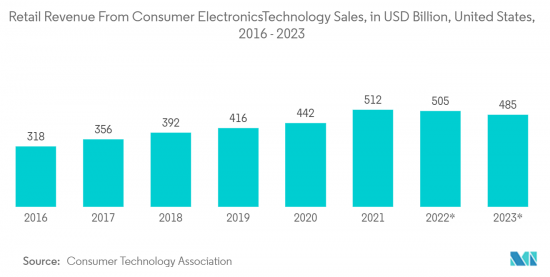

- 同樣,根據消費者技術協會(CTA)的數據,2023年美國消費電子和科技產品的零售收入預計將達到4,850億美元。儘管與 2022 年的數字相比有所下降,但預計在預測期內將穩定成長,尤其是在美國等已開發國家,這些國家有關產品品質的法律更加嚴格,導致預測期內消費者的需求更高。電子產品預計將增加。

北美預計將佔據主要市場佔有率

- 由於有利於開拓和引進最新技術的經濟和社會條件,包括政府支持政策、意識提升以及研發基礎設施的發展,北美是 EMC 測試市場參與者的強大地區。隨著智慧型手機、平板電腦、電腦、暖通空調系統、洗衣機和電視的普及,該地區的消費性電子產業正在蓬勃發展。

- 美國因其強大的汽車、航太、消費性電子和醫療保健產業而成為電磁相容性測試設備和測試服務的重要市場。近年來,隨著電子元件/設備在所有主要最終用戶領域的日益普及,對 EMC 測試設備/服務的需求預計在預測期內將進一步成長。

- 此外,美國對電磁波的規定也很嚴格。例如,在美國,聯邦通訊委員會 (FCC) 監管所有商業電磁輻射源。 FCC 的 Title 47 第 15 部分法規對多種來源的排放設定了限制,包括使用微處理器的辦公設備、電腦和電腦周邊設備、電子遊戲、銷售點終端等,幾乎包括所有產品。

- 北美地區多家電磁相容性測試設備和測試服務供應商的存在也推動了該地區研究市場的成長。例如,美國華盛頓實驗室有限公司的測試站點已在馬裡蘭州哥倫比亞市的 FCC 設備授權分部註冊,並符合 ANSI C63.4-2003。

- 此外,北美汽車產業正穩步向自動駕駛汽車邁進。這些車輛配備了多個電子單元,這使得電磁相容性測試對於確保車輛無錯誤運作的作用變得更加重要。因此,所有這些趨勢預計將補充預測期內北美研究市場的成長。

電磁相容性測試設備及測試服務業概況

由於眾多區域和全球參與者的存在,全球電氣測試設備市場預計將得到整合。儘管如此,市場參與企業正積極參與聯盟、新產品開拓和市場拓展等競爭性策略舉措,以鞏固其在全球電磁測試設備和測試服務市場的地位。

2023 年 4 月,Emitec 是一家專門從事汽車行業產品認證應用測試的公司,在法國蒙蒂尼布勒托訥開設了最先進的車輛測試中心。 Emitec 的新型 EMC 暗房配備了羅德與施瓦茨的全面 EMC 測試系統,包括 R&S BBA130、R&S BBA150、R&S BBL200 寬頻放大器、R&S SMB100B 射頻訊號產生器、功率計和 R&S ESW44 測試接收機。

2023 年 2 月,ISRO 的 Chandrayaan-3 登陸器在班加羅爾的 UR Rao 衛星中心成功進行了 EMI/EMC 測試。 ISRO的測試程序包括發射器相容性、所有射頻系統的天線極化、著陸後任務階段的著陸器和探測車相容性測試,以及在軌道和動力下降任務階段的獨立自動相容性測試。這確保了著陸器的任務準備狀態。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估宏觀趨勢對產業的影響

第5章市場動態

- 市場促進因素

- 無線寬頻基礎設施的成長和 5G 行動網路的發展

- 政府對各行業電磁干擾(EMI)的嚴格規定

- 市場抑制因素

- 與電磁相容性(EMC) 測試設備相關的高成本

第6章市場區隔

- 按類型

- 測驗設備

- EMI測試接收機

- 訊號產生器

- 放大器

- 頻譜分析儀

- 其他測試設備

- 按服務

- 測驗設備

- 按最終用戶產業

- 車

- 消費性電子產品

- 資訊科技/通訊

- 航太/國防

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Rohde & Schwarz GmbH & Co. KG

- HV Technologies, Inc.

- ETS-Lindgren Inc.

- Keysight Technologies Inc.

- SGS SA

- Bureau Veritas SA

- Intertek Group PLC

- Dekra Certification GmbH

- ALS Limited

- TUV SUD

第8章投資分析

第9章 市場機會及未來趨勢

The Electromagnetic Compatibility Test Equipment And Testing Services Market size is estimated at USD 7.19 billion in 2024, and is expected to reach USD 10.01 billion by 2029, growing at a CAGR of 6.01% during the forecast period (2024-2029).

Key Highlights

- The increasing usage of electronic devices across various end-user industries makes electromagnetic compatibility (EMC) an essential service, as it helps minimize the possibility that radiated or conducted emissions produced by a device interfere with other electronic products in its vicinity.

- Electromagnetic Compatibility testing equipment and services analyze the ability of electronic devices to operate as anticipated in their electromagnetic environment when in proximity to other electronic devices or in the presence of electromagnetic disturbances that can interfere with their intended operation.

- Hence, electromagnetic compatibility (EMC) testing is a crucial step in electronic device design and manufacturing processes. Various regulatory bodies, including the FCC, FDA, and ISO, have set specific limits/frameworks on the emissions that can be released from an electronic device. These regulations provide improved safety and reliability for anyone using electrical/electronic equipment by assuring the device does not interfere with other equipment or fail to operate as intended.

- To comply with market requirements and avoid costly recalls, manufacturers in industries such as consumer products, medical devices, industrial machinery, railway, automotive, aerospace, and military equipment must ensure that electromagnetic disturbances do not interfere with the function of their products. These manufacturers are also under pressure to maintain quality while reducing costs and time to market owing to the growing presence of related regulatory frameworks.

- Growth in the world's population and economy and rapid urbanization are expected to increase energy demand over the coming years. The United Nations (UN) estimates that the world's population will grow from 7.6 billion in 2017 to 9.8 billion by 2050. This is anticipated to drive the number of electrical/electronic devices in use, thereby creating opportunities in the studied market.

- In recent years, the electrification trend has been gaining traction in the automotive industry. As electric vehicles incorporate many electronic components that emit radio-frequency/electromagnetic interference, they have the potential to negatively impact the vehicle's performance and driving experience. Hence, the electrification of vehicles leads to new EMC challenges because of higher switching frequencies of semiconductors and higher emissions due to high voltages and currents. Considering such trends, there are several vendors offering innovative solutions in the market. For instance, in November 2022, to ease and speed up the development process, AVL and Rohde & Schwarz, two of the prominent providers of automotive test systems, presented an innovative solution for automated electromagnetic compatibility data analysis of an electric drivetrain under real driving conditions.

- However, a higher price tag associated with electromagnetic compatibility test equipment and services is among the major factors challenging the studied market's growth. Furthermore, a higher average time period of EMC testing is also among the key restraining factors for the studied market's growth.

- The global outbreak of COVID-19 had a major impact on the growth of the studied market. At the onset of the pandemic, the demand for electronic devices witnessed rapid growth, which put immense pressure on the entire value chain of the industry, including the EMC testing industry. As the digitization trend, which received a boost due to the outbreak of the pandemic, is anticipated to grow further, the studied market is also anticipated to witness similar growth during the forecast period.

Electromagnetic Compatibility Test Equipment And Testing Services Market Trends

The Consumer Electronics Segment is Expected to Drive the Market's Growth

- The density of electronics-based products is increasing in most verticals due to trends such as digitization, smart homes, and connected devices for the Internet of Things (IoT). To ensure the quality of the product from an electromagnetic compatibility (EMC) standpoint, regulatory bodies have enforced constantly evolving rules and directions on designing and manufacturing.

- Moreover, according to Cisco's Annual Internet Report, by 2023, there will be close to 30 billion network-connected devices and connections, up from 18.4 billion in 2018. Additionally, by 2023, IoT devices will make up 50% (14.7 billion) of all networked devices, up from 33% (6.1 billion) in 2018. Further, according to Ericsson, 5G subscriptions are expected to skyrocket globally between 2019 and 2027, rising from over 12 million to over 4 billion. Combined, these factors are anticipated to expand the consumer electronics industry's size significantly.

- Manufacturers must comply with the latest EMC directives and regional and industry-level regulations and standards through certification before market entry. For instance, to pree of EMC problems, the UK government has adopted stringent laws, forcing all importers and manufacturers of electronic goods to ensure that their products are electromagnetically compatible. Such initiations are anticipated to drive the need for EMC test equipment and services in the consumer electronics segment. Hence, such industry regulations are anticipated to drive the growth of the studied market.

- China is a prominent consumer electronics producer, especially in the brown goods product category. It features an extensive electronics manufacturing ecosystem and supply chain. For instance, according to the National Bureau of Statistics of China, in May 2022, around 37 million computers were produced in China, an increase from 32.66 million computers in April 2022. The region's robust consumer electronics manufacturing capabilities offer lucrative opportunities for the growth of the studied market.

- Similarly, according to the Consumer Technology Association (CTA), the retail sales revenue of consumer electronic/technology products in the United States is anticipated to be valued at USD 485 billion in 2023. Although this is a decline compared to the figures of 2022, stable growth is still anticipated during the forecast period, which in turn will drive the demand for EMC testing of consumer electronic products during the forecast period as several countries, especially developed ones such as the United States have stringent laws pertaining to product quality.

North America is Expected to Hold a Major Market Share

- North America is a prominent region for the EMC testing market players due to favorable economic and social conditions for developing and adopting modern technologies, including supportive government policies, higher consumer awareness, and developed infrastructure for research and development. The region's consumer electronics industry thrives due to the widespread use of smartphones, tablets, personal computers, HVAC systems, washing machines, and television sets.

- The United States is one of the significant markets for Electromagnetic Compatibility Test Equipment and Testing Services owing to the presence of strong automotive, aerospace, consumer electronics, and healthcare industries. As the adoption of electronic components/devices has increased across all the major end-user sectors in recent years, the demand for EMC test equipment/services is anticipated to grow further during the forecast period.

- Furthermore, the country has stringent regulations pertaining to electromagnetic radiation. For instance, in the United States, the Federal Communications Commission (FCC) regulates all commercial sources of electromagnetic radiation. The Title 47, Part 15 regulation of FCC specifies limits on the radiation from various radiation sources, which include virtually every product that employs a microprocessor, including office equipment, computers and computer peripherals, electronic games, and point-of-sale terminals.

- The North American region has the presence of several electromagnetic compatibility test equipment and testing services providers, which also facilitates the studied market's growth in the region. For instance, Washington Laboratories Ltd's test sites in the United States are listed by the FCC's Equipment Authorizations Branch in Columbia, Maryland, and conform to ANSI C63.4-2003.

- Furthermore, the North American automotive industry is progressing steadily toward autonomous vehicles. As these vehicles are loaded with multiple electronic units, the role of electromagnetic compatibility testing becomes even more important to ensure the error-free working of the automobile. Hence, all such trends together are anticipated to supplement the studied market's growth in North America during the forecast period.

Electromagnetic Compatibility Test Equipment And Testing Services Industry Overview

With the presence of numerous regional and global players, the global electrical test equipment market is expected to be consolidated. Nevertheless, market participants are actively engaging in competitive strategic initiatives, including partnerships, new product development, and market expansion, to strengthen their positions in the global electromagnetic test equipment and test services market.

In April 2023, Emitech, a company specializing in applied testing for product qualification in the automotive sector, inaugurated its state-of-the-art vehicle test center in Montigny-le-Bretonneux, France. Emitech's new EMC chamber is equipped with a comprehensive EMC test system from Rohde & Schwarz, featuring R&S BBA130, R&S BBA150, and R&S BBL200 broadband amplifiers, as well as R&S SMB100B RF signal generators and power meters, along with R&S ESW44 test receivers.

In February 2023, ISRO's Chandrayaan-3 lander successfully underwent EMI/EMC testing at the U R Rao Satellite Centre in Bengaluru. ISRO's testing procedures encompassed Launcher compatibility, Antenna Polarization for all RF systems, Lander & Rover compatibility tests for the post-landing mission phase, and Standalone auto compatibility tests for orbital and powered descent mission phases, ensuring the lander's readiness for its mission.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of impact of Macro Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Wireless Broadband Infrastructure and Development of 5g Mobile Network

- 5.1.2 Stringent Government Regulations Against Electromagnetic Interference(EMI) Across the Industries

- 5.2 Market Restraints

- 5.2.1 High Cost Affiliated With the Electromagnetic Compatibility (EMC) Test Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Test Equipment

- 6.1.1.1 EMI Test Receiver

- 6.1.1.2 Signal Generator

- 6.1.1.3 Amplifiers

- 6.1.1.4 Spectrum Analyzer

- 6.1.1.5 Other Test Equipments

- 6.1.2 Services

- 6.1.1 Test Equipment

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 IT and Telecom

- 6.2.4 Aerospace and Defense

- 6.2.5 Healthcare

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rohde & Schwarz GmbH & Co. KG

- 7.1.2 HV Technologies, Inc.

- 7.1.3 ETS-Lindgren Inc.

- 7.1.4 Keysight Technologies Inc.

- 7.1.5 SGS S.A.

- 7.1.6 Bureau Veritas S.A.

- 7.1.7 Intertek Group PLC

- 7.1.8 Dekra Certification GmbH

- 7.1.9 ALS Limited

- 7.1.10 TUV SUD