|

市場調查報告書

商品編碼

1332469

5G 連接市場規模和份額分析 - 增長趨勢和預測(2023-2028)5G Connections Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

2023年5G連接市場規模預計為1066.4億美元,預計2028年將達到9903.3億美元,在預測期內(2023-2028年)複合年增長率為56.16%。

根據愛立信數據,全球 5G 用戶在 2022 年最後一個季度新增 1.36 億 5G 用戶,突破 10 億大關。 5G 的發展速度比移動一代的前身更快。 愛立信進一步聲稱,到2027年,全球約四分之三的人口將能夠使用5G。

主要亮點

- 光纖塔等穩健的基礎設施將加速 5G 在全球的擴張。 富含光纖的網絡基礎設施可以支持諸如更高速度、更低衰減、抗電磁干擾、小尺寸和幾乎無限的帶寬潛力等功能。 如果沒有光纖,5G 性能就會受到限制,因此運營商正在投資安裝這些光纖以進一步擴展。 AT&T 正在與私募股權公司 BlackRock Alternatives 合作開展一個名為 Gigapower 的項目,該項目將在美國提供批發光纖網絡。 最初,光纖網絡將安裝在 150 萬個客戶地點。

- 物聯網在各行各業的採用預計將推動 5G 的發展。 新興的智慧城市項目和智能交通系統(ITS)都是需要物聯網和5G融合的案例。 5G 與採礦業的自動駕駛汽車一起使用,為工人提供安全措施。 5G 的低延遲將幫助您做出快速、實時的決策。 這意味著可以在車輛上安裝攝像頭和傳感器,以提醒在礦井工作的工人潛在的碰撞和事故。

- 對使用大量數據提供可行見解的雲數據和應用程序的需求不斷增長,也需要 5G。 5G 的高速度和低延遲可以將無盡的數據流傳輸到中央雲服務器,使網絡邊緣的物聯網設備能夠做出高效的決策。 例如,使用 5G 服務可以輕鬆地將患者健康數據從移動的救護車傳輸到醫院。

- COVID-19 大流行是 5G 作為一項革命性技術的最關鍵時刻。 許多應用都基於5G與其他數字技術的結合進行了測試。 在COVID-19期間,5G一直是支持醫療診斷和治療的最有效工具,並且這一趨勢仍在持續。 例如,醫療保健行業從 5G 的使用中受益最多,因為它的高容量和低延遲能夠傳輸高分辨率視頻以進行處理和分析。 該工具有助於識別行為異常、經歷跌倒等事故或對自己或他人構成危險的患者。

- 引入 5G 技術成本高昂。 毫米波頻率的使用、廣泛的光纜安裝以及熟練勞動力的缺乏都會帶來高昂的成本。 5G技術部署的每一步對於大多數通信服務提供商(CSP)來說都是困難的。

5G 連接市場趨勢

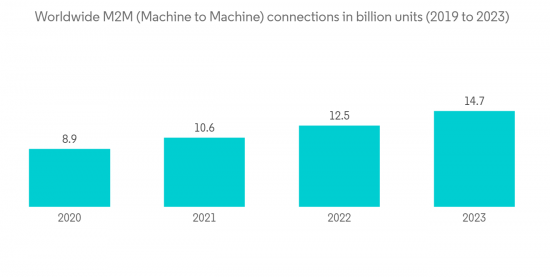

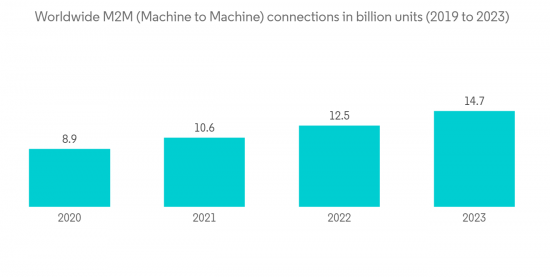

M2M 連接預計將大幅增長

- M2M 通常指硬件組件之間的點對點通信模式。 它使用有線或無線通信網絡,不需要人工干預。 主要目的是收集數據,通過網絡發送數據,並對觸發的事件採取行動。 智能電錶是使用全國性無線通信網絡向公用事業公司傳輸信息的示例之一。 5G 通過安全傳輸和不間斷的數據流提高了智能電錶功能的運營效率。

- 5G 將徹底改變連接方式,並實現與物聯網應用的 M2M 通信。 e-Sim 就是 M2M 的一種應用,它為工業物聯網設備和各種機器提供輕鬆的移動連接。 5G 提高了網絡容量,允許每平方公裡連接數百萬個傳感器和設備。 在歐盟,所有新車都必須具備緊急呼叫功能,並且電子SIM卡是在製造過程中以自動化流程焊接的。 汽車製造商還銷售連接計劃,為信息娛樂系統提供互聯網訪問並支持汽車軟件的更新。

- 2022 年 2 月,寶馬集團宣布推出一款具有雙 e-Sim 功能的汽車。 一張 SIM 卡用於電子通話、導航和交通信息服務,另一張 SIM 卡用於駕駛員個人信息和娛樂服務。

- 2022 年 10 月,Bharati Telekom 推出了 Always On 物聯網連接解決方□□案。 這種連接對於車輛跟蹤和在遠程位置工作的設備需要通用連接的其他應用非常有用。

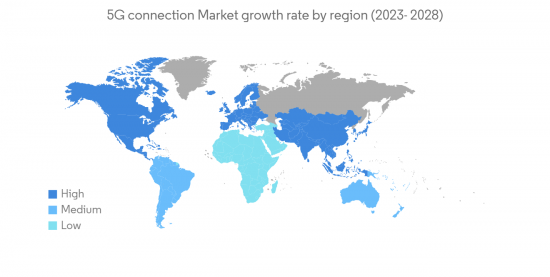

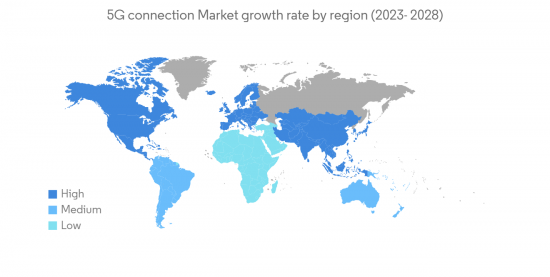

北美佔據主要市場份額

- 根據 GSMA 報告,預計到 2025 年,美國的 5G 採用率將位居全球第二。 5G 連接數將佔北美所有移動連接數的 64%,到 2025 年將達到 2.8 億。 隨著運營商加大中頻段頻譜的部署,美國和加拿大在 5G 普及方面將表現良好,預計到 2025 年,加拿大的總人口覆蓋率將達到 92%,美國的總人口覆蓋率將達到 100%。

- 此外,GSMA 表示 T-Mobile 是最大的 5G 提供商,到 2022 年第一季度,FWA 用戶數量將達到 90 萬,到 2025 年將達到約 700 萬用戶。我強調,我計劃 加拿大運營商也在探索5G FWA市場,特別是在農村地區。

- 所有頻段頻譜的可用性將支持該地區 5G 的發展,因為它將支持運營商提供更快的速度,同時覆蓋更多區域。我正在加速。 運營商可以在北美進行經濟高效的投資,以提高網絡質量。

- 2022 年 2 月,AT&T 與 Microsoft 合作開發 AT&T Private 5G Edge,它將 Azure 中的私有移動邊緣計算連接到 5G 網絡。 這將使企業能夠啟動並運行其私有邊緣網絡。 為了滿足客戶需求,AT&T Private 5G Edge 旨在成為一個集成平台,通過單一平台提供連接和嵌入式應用程序,同時利用 CBRS 或 AT&T 頻譜。

5G連接產業概覽

5G 連接市場競爭激烈,參與者眾多。 AT&T、Verizon、沃達豐和 T-Mobile 等市場領導者不斷創新,這使他們比其他小型企業更具競爭優勢。

2023 年 2 月,AT&T 與 Frontier 的光纖網絡簽署了一項協議,將業務擴展到沒有光纖連接的地區。 Frontier 的光纖基礎設施為 AT&T 的無線服務提供支持。 這些光纜提供更高的帶寬並且數據傳輸高度安全。 光纖的這些特性將有助於運營商吸引更多用戶使用5G服務。

2023 年 1 月,Verizon 與德勤合作,在威奇托由 20 家全球領先公司組成的生態系統中推進智能工廠的智能製造。 該智能工廠位於威奇托州立大學的創新校園,包括一條全面運營的生產線和用於創建和研究智能製造技術和策略的實踐實驗室。

2022 年 10 月,博世和 Cradlepoint 將使用 T-Mobile 的 5G 無線廣域網技術,促進美國首批智慧城市之一 Peachtree Corners 的實時停車和安全監控。我們開發了一種解決方案 這將使城市規劃者能夠根據城市周圍發生的情況數據,實時做出有關停車容量、基礎設施規劃、交通管理和安全保護的明智決策。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第一章簡介

- 研究假設和市場定義

- 調查範圍

第二章研究方法

第 3 章執行摘要

第 4 章市場動態

- 市場概覽

- 市場驅動因素

- 無線寬帶服務的需求不斷增長,需要更快、更高容量的網絡

- 市場製約因素

- 基礎設施建設成本高,部署初期覆蓋範圍相對狹窄

- 行業吸引力 - 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 新冠肺炎 (COVID-19) 對市場的影響

第五章市場細分

- 連接類型

- 移動寬帶

- 固定無線接入

- M2M 和物聯網

- 關鍵任務

- 地區

- 北美

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第 6 章競爭格局

- 公司簡介

- AT&T Inc.

- Verizon Communications Inc.

- Vodafone Group Plc

- T-Mobile US Inc.(Sprint Corporation)

- Telstra Corporation Ltd

- Telefonica SA

- China Telecommunications Corporation

- Deutsche Telekom

- IDEMIA

- Nippon Telegraph and Telephone

第7章 投資分析

第8章 今後的市場

The 5G Connections Market size is estimated at USD 106.64 billion in 2023, and is expected to reach USD 990.33 billion by 2028, growing at a CAGR of 56.16% during the forecast period (2023-2028).

According to Ericsson data, with the addition of 136 million 5G subscribers in the last quarter of 2022, Global 5G subscriptions reached the one billion milestone. 5G is expanding faster than its predecessors in the mobile generation. Ericsson further claims, by 2027, about three-quarters of the world's population will be able to access 5G.

Key Highlights

- Robust infrastructure like fiberizing the towers will accelerate the 5G expansion across the world. Fiber-rich network infrastructure can support features like increased speeds with lower attenuation, immunity to electromagnetic interference, small size, and virtually unlimited bandwidth potential. Without fiber optics, 5G will have limited performance, so Telcos are investing in laying these fibers for further expansion.AT&T partnered with the private equity company BlackRock Alternatives for a project called Gigapower to provide a wholesale fiber network across the U.S. Initially, the fiber network will be installed in 1.5 million customer locations.

- The adoption of IoT in various businesses will drive 5G. Emerging smart city projects or Intelligent Transport Systems (ITS) are cases that require the amalgamation of IoT and 5G. 5G is being used with autonomous vehicles in mining to provide safety measures for workers. The low latency of 5G helps in making quick real-time decisions. This means cameras or sensors can be mounted on vehicles to notify workers of potential collisions and accidents while they work in mines.

- Increasing demand for cloud data or applications that use massive amounts of data to provide actionable insights will also require 5G. The high speeds and low latency of 5G can stream endless waves of data to a central cloud server, where IoT devices on the network edge can make efficient decisions. For instance, streaming patient health data from a moving ambulance to a hospital will be easy with 5G services.

- The Covid-19 pandemic was the most important time for 5G as a revolutionary technology. Many applications were tested based on the integration of 5G in combination with other digital technologies. During COVID-19, 5G was the most effective tool for supporting medical diagnosis and treatment; the trend is still present today. For instance, The healthcare sector most benefited from using 5G since the network's high capacity and low latency enable the transmission of high-definition footage for processing and analytics. This tool will assist in identifying patients who are acting differently than usual, have experienced an incident like a fall, or are becoming a danger to themselves or others.

- Implementation of 5G technology involves high costs. Utilizing mm-Wave frequencies, rolling out large-scale fiber optic cables, and lacking skilled labor involves high cost. Every 5G technology implementation step are challenging for most Communication Service Providers (CSPs).

5G Connections Market Trends

M2M Connectivity Expected to Witness Significant Growth

- M2M often refers to a point-to-point communication pattern between hardware components. It may use wired or wireless communication networks without human intervention. The primary objective is to gather data, send it across the network, and take action in response to the events that are triggered. Smart Meters are one case that uses a national wireless communication network to send information to the utility company. 5G will bring operational efficiency improvements in smart meter functioning with an uninterrupted data stream that transmits safely.

- 5G revolutionizes connectivity and enables M2M communication with IoT applications. e-Sim is one such application of M2M that provides easy mobile connectivity to industrial IoT devices and all types of machines. Since 5G boosts network capability, it will connect with millions of sensors and devices per square kilometer. In the European Union, it is mandatory to have emergency call functionality in all new cars, and e-Sim is being soldered while manufacturing in an automated process. Car manufacturers are also selling connectivity plans which provide internet to the infotainment system and allow the cars to receive over-the-air software updates.

- In February 2022, BMW Group introduced cars embedded with dual e-Sim functionality. While one sim will be used for eCalls, navigation, or traffic information services, the other will be for a driver's private information and entertainment services.

- In October 2022, Bharati Telecom launched the Always On IoT connectivity solution, which allows an IoT device to remain connected to a mobile network from different Mobile Network Operators in the eSIM. The connectivity will be helpful in vehicle tracking or in cases where universal connectivity is required for equipment working in remote locations.

North America Accounts for Significant Market Share

- According to GSMA's report, the United States is expected to have the world's second-highest 5G adoption rate by 2025. The 5G connections will contribute 64% of all mobile connections in North America and will reach 280 million by 2025. The United States and Canada are expected to perform well in terms of 5G penetration as operators step up deployments of mid-band spectrum, taking overall population coverage to 92% in Canada and 100% in the US by 2025.

- Furthermore, GSMA highlighted that T-Mobile is the biggest provider of 5G, with 0.9 million FWA subscribers by the first quarter of 2022 and plans to achieve around 7 million subscribers by 2025. The 5G FWA market is also being investigated by Canadian operators, particularly in rural areas.

- Strong spectrum availability across all the bands is accelerating the growth of 5G in the region as it supports operators to deliver enhanced speed with more geographical coverage. Telcos can make cost-effective investments and improve network quality in North America.

- In February 2022, AT&T, in partnership with Microsoft, developed AT&T Private 5G Edge to connect Azure private mobile edge computing with the 5G network. This will encourage businesses to launch their private edge networks up and running. To fulfill client needs, AT&T Private 5G Edge is intended to be an integrated platform offering connectivity and embedded applications through a single platform while utilizing CBRS or AT&T spectrum.

5G Connections Industry Overview

The 5G Connectivity Market is highly competitive because of many players. Market leaders like AT&T, Verizon, Vodafone, T-Mobile, and more work constantly towards innovation which give with a competitive advantage over other smaller players.

In February 2023, AT&T signed an agreement with Frontier's fiber network to expand into areas where it doesn't have fiber connectivity. Frontier's fiber infrastructure will strengthen the wireless services for AT&T. These optical cables provide higher bandwidth and are very secure for transmitting data. These features of fiber optics will help the telecom operator to entice more users for its 5G services.

In January 2023, Verizon collaborated with Deloitte to promote smart manufacturing for the Smart Factory at the Wichita ecosystem of 20 leading global companies. This smart factory is located on the Innovation Campus at Wichita State University and includes a fully operational production line and experiential labs for creating and researching smart manufacturing technology and strategy.

In October 2022, Bosch and Cradlepoint developed a solution that will use T-mobile's 5G Wireless WAN technology to facilitate real-time parking and safety monitoring at Peachtree Corners, one of the nation's first smart cities. This will further help city planners to make real-time informed decisions on parking capacity, infrastructure planning, traffic management, and security safeguards based on data about events happening throughout the city.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Demand for Wireless Broadband Services Needing Faster, Higher-Capacity Networks

- 4.3 Market Restraints

- 4.3.1 High Infrastructure Setup Cost During the Initial Rollout Phase and Relatively Less Range of Coverage

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Connection Type

- 5.1.1 Mobile Broadband

- 5.1.2 Fixed Wireless Access

- 5.1.3 M2M and IoT

- 5.1.4 Mission-critical

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 AT&T Inc.

- 6.1.2 Verizon Communications Inc.

- 6.1.3 Vodafone Group Plc

- 6.1.4 T-Mobile US Inc. (Sprint Corporation)

- 6.1.5 Telstra Corporation Ltd

- 6.1.6 Telefonica SA

- 6.1.7 China Telecommunications Corporation

- 6.1.8 Deutsche Telekom

- 6.1.9 IDEMIA

- 6.1.10 Nippon Telegraph and Telephone